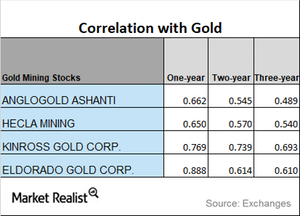

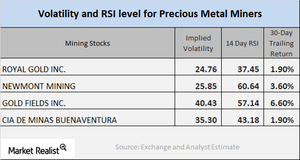

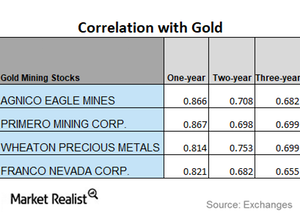

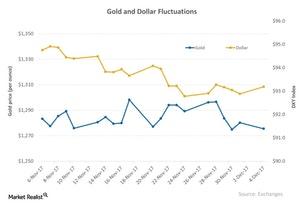

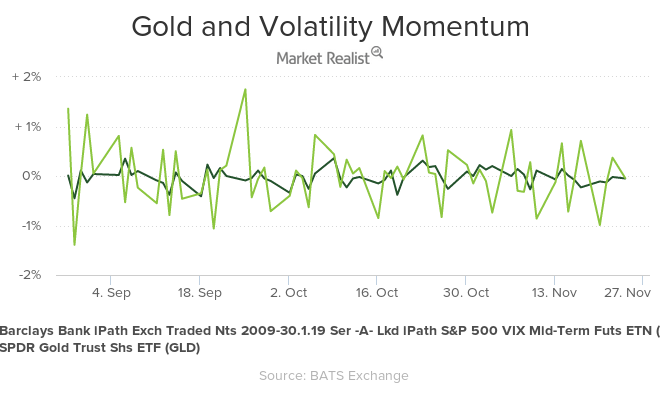

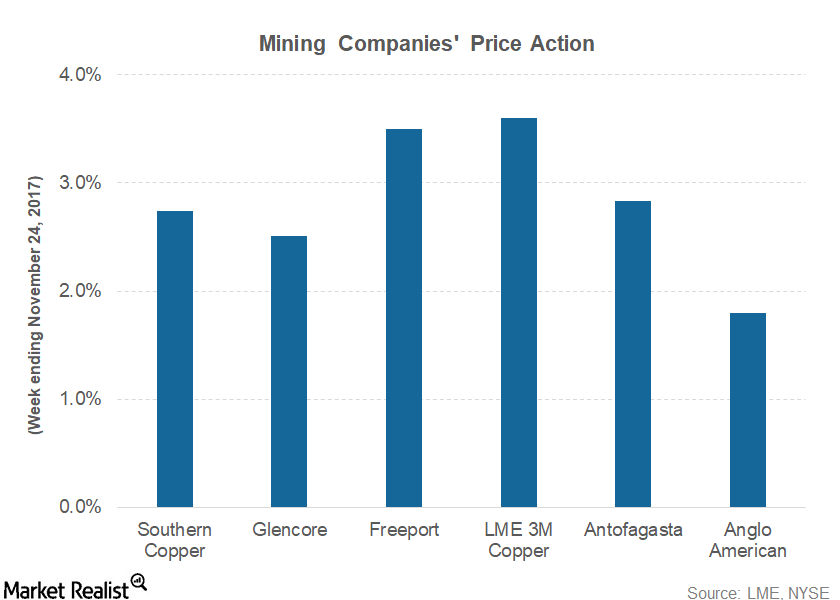

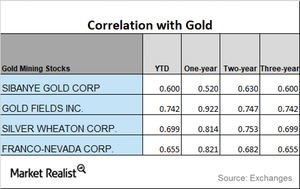

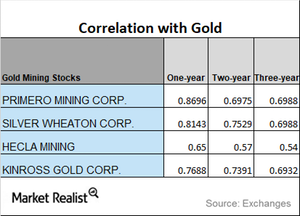

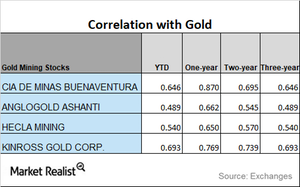

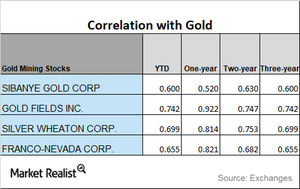

Correlation and Mining Stocks this Month

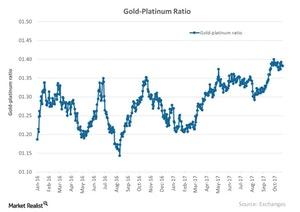

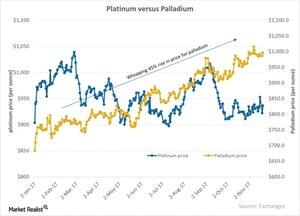

We’ll briefly analyze mining stocks’ correlation with gold. Gold is the most crucial of the precious metals, and mining stocks tend to increasingly take their price changes from gold.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.