Albemarle Strengthens Its Leverage Position

At the end of 3Q17, Albemarle (ALB) reported debt of ~$1.8 billion, its lowest point since 2014.

Jan. 4 2018, Updated 5:00 p.m. ET

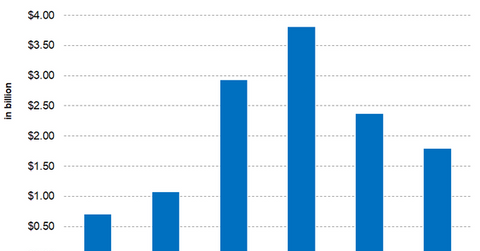

Albemarle’s debt trend

At the end of 3Q17, Albemarle (ALB) reported debt of ~$1.8 billion, its lowest point since 2014. This debt includes long-term debt and the current portion of the long-term debt.

From 2012 to 2016, ALB’s debt has grown from $700.0 million to ~$2.4 billion at the end of 2016, a CAGR[1. compound annual growth rate] of 35.6%. However, ALB’s debt has been on a declining trend since 2015 primarily due to the proceeds received from the divestitures.

Debt-to-equity ratio

Albemarle’s (ALB) decline in debt has improved its leverage position. In 2014, ALB’s debt-to-equity ratio stood at ~2.2x. With the repayment of its debt, ALB’s current debt-to-equity ratio stands at 0.46x, which is well below the industry average of 0.92x.

ALB’s peers FMC (FMC), W.R. Grace (GRA), and Chemours (CC) have debt-to-equity ratios of 0.80x, ~4.0x, and ~5.1x, respectively. ALB has the best debt-to-equity ratio among its peers.

Free cash flows

Albemarle (ALB) has been generating positive free cash flows in recent years. In the past five years, ALB’s free cash flow has shown an upward trend from $207.9 million in 2012 to $536.7 million in 2016, a CAGR of 26.0%.

Through December 26, 2017, Albemarle had free cash flow of -$113.0 million. In our view, ALB’s free cash flow needs to be stronger to pay off its debt. It appears that ALB’s priority is to pay the current portion of its long-term debt.

Albemarle’s free cash flow is being used for dividends and share repurchases. ALB bought back ~2.3 million shares from its $250.0 million accelerated share repurchase program in 2Q17.

Investors can indirectly hold ALB by investing in the Global X Lithium ETF (LIT). LIT invested 6.1% of its portfolio in Albemarle as of December 26, 2017.