Surbhi Jain

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Surbhi Jain

Bill Gross: Possibility of Deglobalization in the Economy

Gross warned about deglobalization in the global economy. Trade between nations, exacerbating immigration issues, and stagnant economic growth formed his belief.

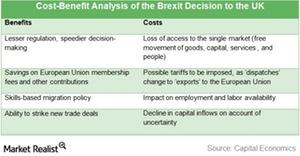

A Cost-Benefit Analysis of the Brexit Decision

To understand how the Brexit result stands to impact your portfolio or your willingness to invest in the United Kingdom, a cost-benefit analysis is pertinent.

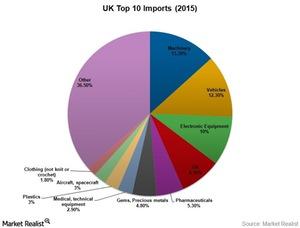

Will Brexit Weaken the UK’s Competitive Advantage over the US?

On Brexit, import restrictions and tariff quotas currently applicable to importers in the UK and foreign businesses that export to the UK are set to change.

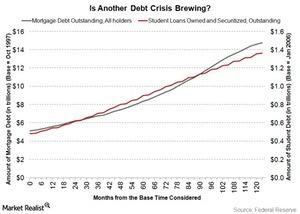

Is Student Debt the Next Bubble to Hit the US Economy?

Many are likening the current student debt situation in the United States to the mortgage debt situation that led to the 2009 financial meltdown in the US economy.

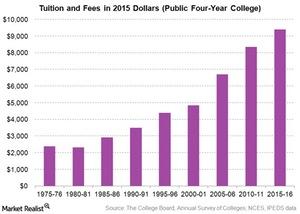

Why Is College Education So Expensive in the United States?

The rise in delinquencies on student loans in the United States (SPY) (IWM) (QQQ) can be partially attributed to the accelerated rise in college tuition and fees.

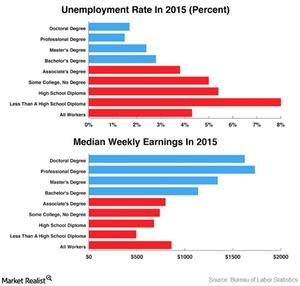

Why Student Debt May Not Affect the US Economy Like Sub-Prime

According to the White House Council of Economic Advisers, “Student debt is less likely to make a recession more severe or slow an expansion in the way that mortgage debt may have.”

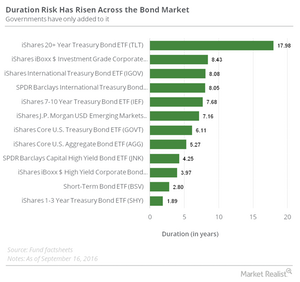

Investors Beware: Duration Risk Has Risen across the Bond Market

If you’re a bond (BSV) (AGG) investor or fund manager, fluctuation in interest rates is one of the key risk drivers for the returns you get from your portfolio.

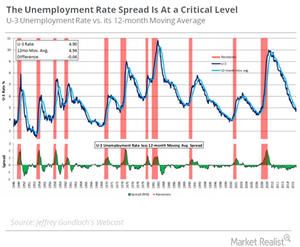

Gundlach Says This Chart Is ‘Early Warning Indicator’ of Recession

Jeffrey Gundlach seems quite bearish in his views about the US economy (IWM) (QQQ).

Ray Dalio: ‘Risks Are Asymmetric on the Downside’

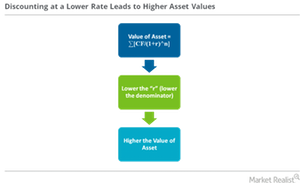

“Risks are asymmetric on the downside” On the economy, Ray Dalio stated that “the risks are asymmetric on the downside, because asset prices are comparatively high at the same time there’s not an ability to ease.” Courtesy of the current global monetary policy’s low interest rates, asset prices are artificially inflated—so much so that they’ve […]

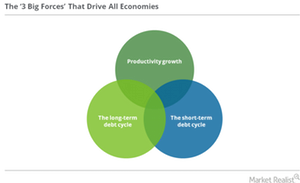

The ‘Three Big Forces’ That Drive All Economies

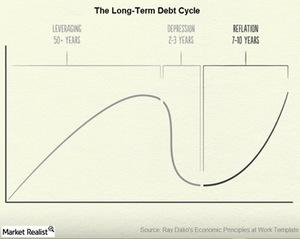

The “three big forces” Ray Dalio believes that “three big forces” drive all economies. These are: productivity growth the short-term debt cycle the long-term debt cycle An economy has to go through upturns and downturns Central bankers need to study the determinants of productivity for their economy. The determinants could include the costs of education, […]

Emerging Markets Have Been Leading Stock Returns in 2016

While developed markets have been caught in a lull, we’ve seen emerging markets grab the spotlight. Emerging markets have been leading stock market returns so far in 2016.

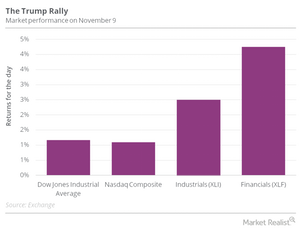

Gundlach: Invest in Industrials, Materials, Financial Sectors

“Industrials, materials, and financials are the sectors. . .you want to be invested in,” said Jeffrey Gundlach recently in a CNBC interview.

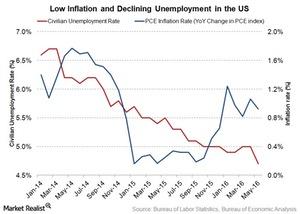

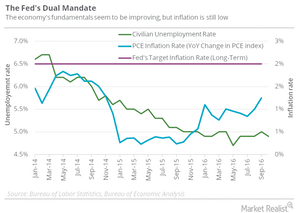

Paul Krugman to the Fed: Don’t Raise Rates

Inflation is moving up towards its target, but it still has a ways to go before it gets there. Paul Krugman believes raising rates could keep inflation from reaching that target.

Why Krugman Doesn’t Understand the Focus on Trade All of a Sudden

Trade has been a key focus with respect to the US elections lately.

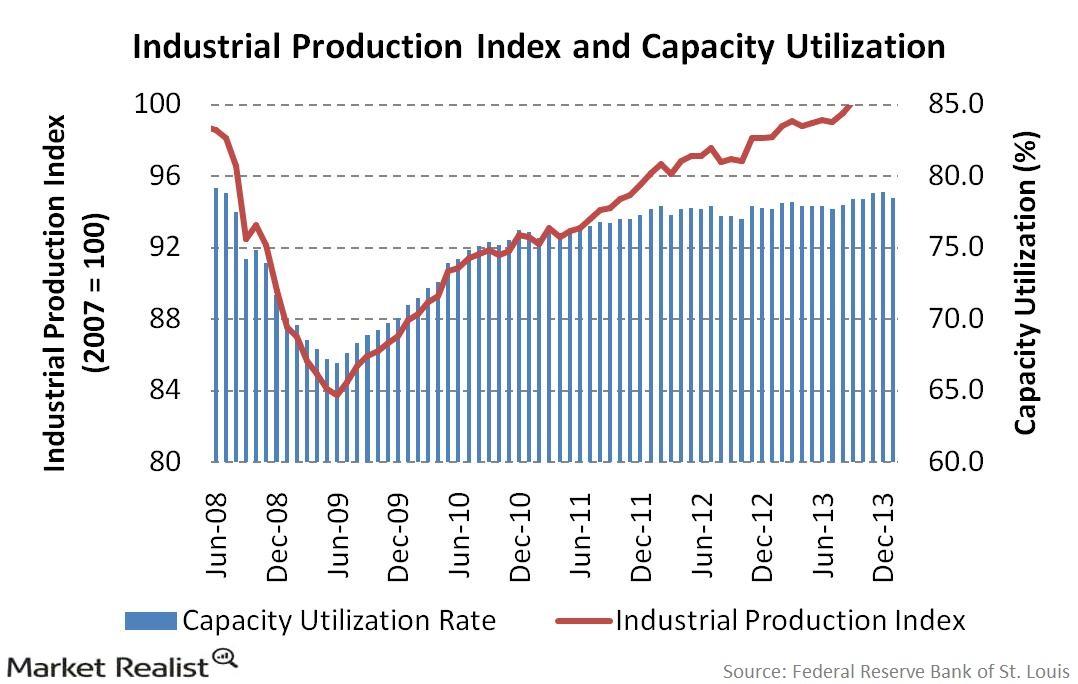

Why the bond market is affected by the Industrial Production Index

Although the industrial sector accounts for less than 20% of GDP, it creates much of the cyclical variability in the economy.Financials Why do investors continue to prefer floating-rate notes?

Last week’s Treasury auctions included $13 billion two-year Treasury FRNs auctioned on May 28. The FRNs were indexed to the May 19 13-week Treasury bill auction high rate,.

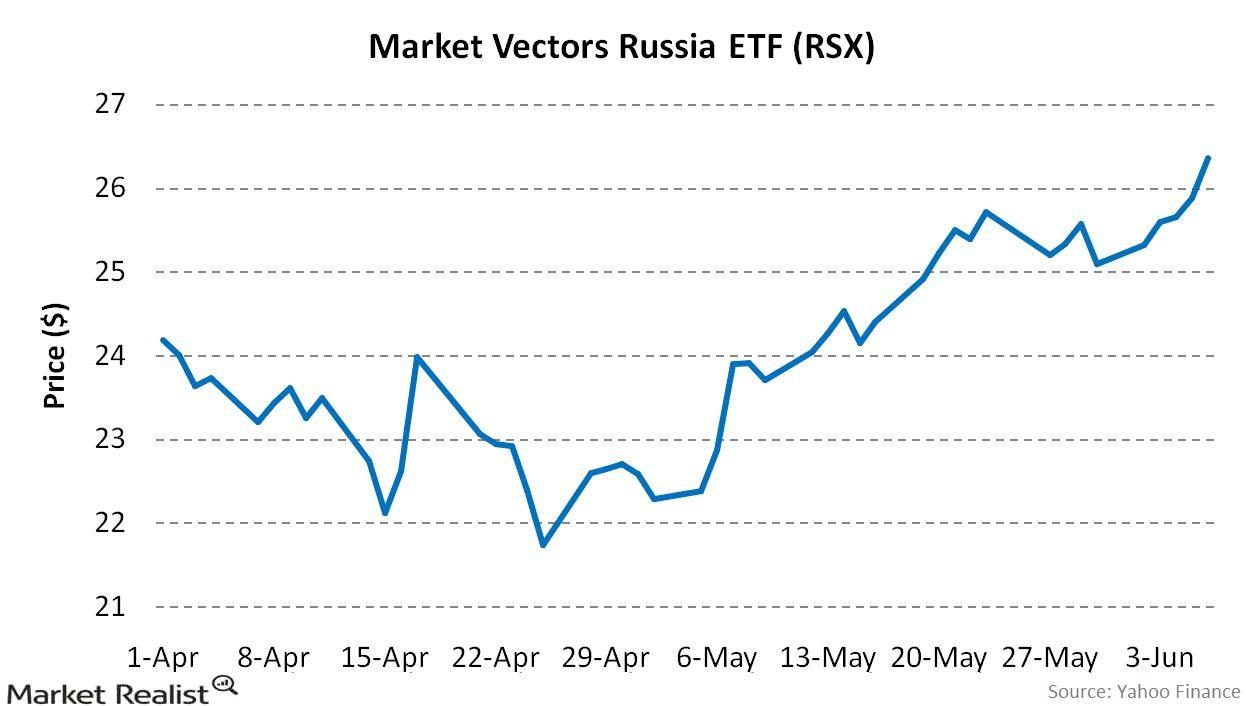

Overview: Why Eurasia is the center of world power

Investors continue to flock to secure their funds in exchange-traded funds (or ETFs) tracking Asian securities like the VanEck Vectors Russia ETF (RSX).Financials Must-know: Spain’s economy

Spain’s potential rating upgrade rests largely on its debt ratio being brought to a declining trend within the forecast period, which ends in 2015. According to an export performance Organization of Economic Co-operation and Development (or OECD) indicator, Spain has gained market share for the past 20 years.

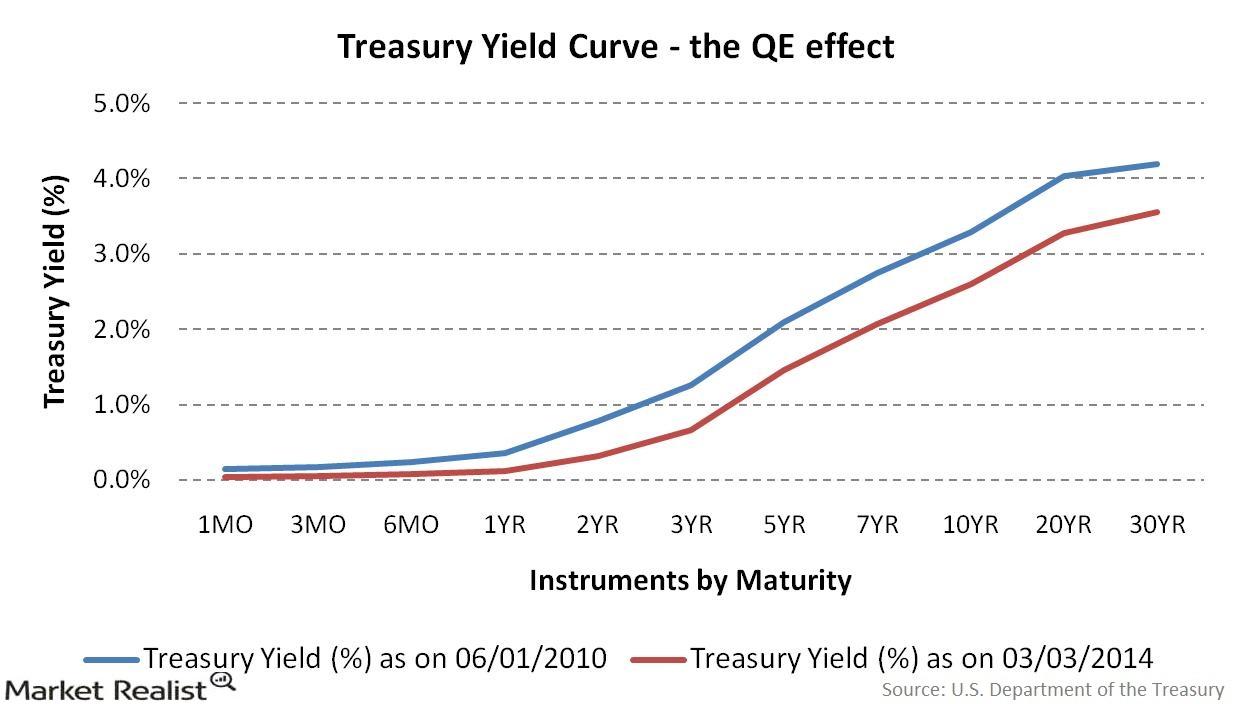

The Fed taper: How quantitative easing affects the yield curve

QE is an unconventional form of monetary easing—the Fed’s way of putting in more money into circulation in the economy.

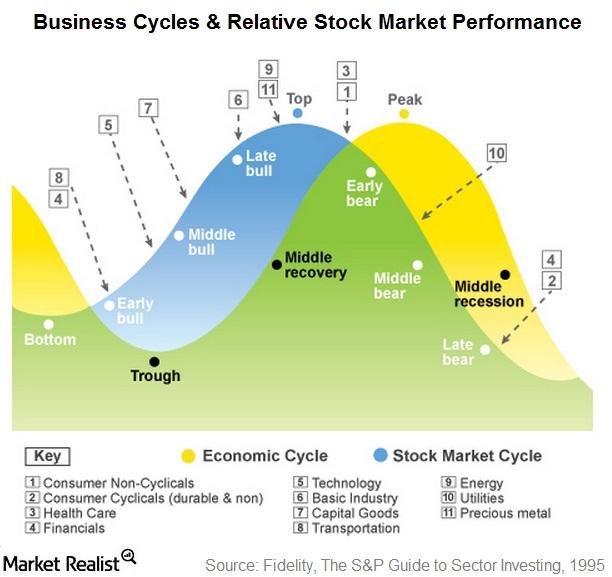

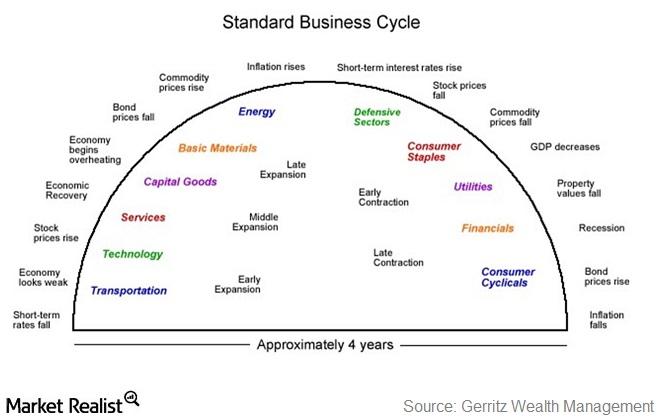

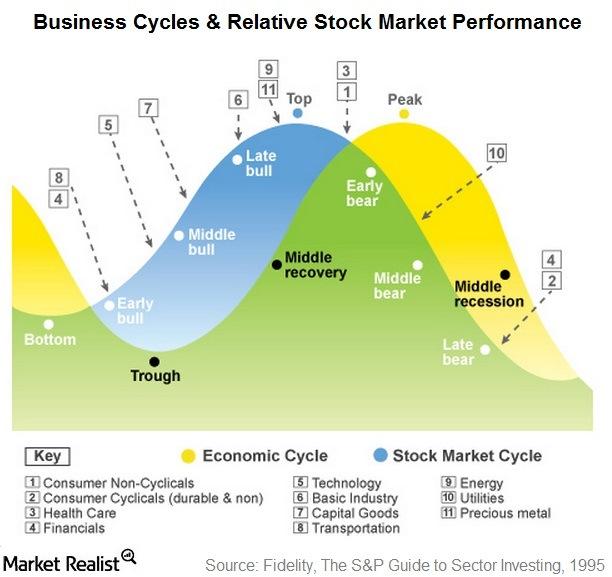

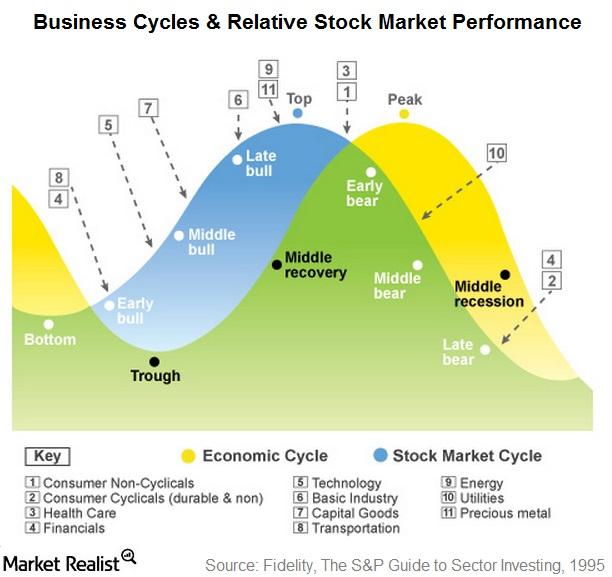

What Phase of the Business Cycle Are We In?

Studied in conjunction, stock market and economic conditions give clear indications of the business cycle phase we are in.

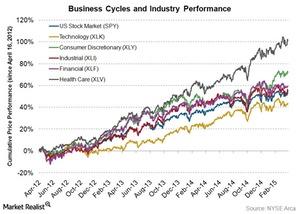

Business Cycle Investing? Here Are the Sectors You Should Look At

We’ve moved from a phase in the business cycle where defensive stocks do well to the phase where utilities outperform.

Positioning Your Portfolio According to the Business Cycle

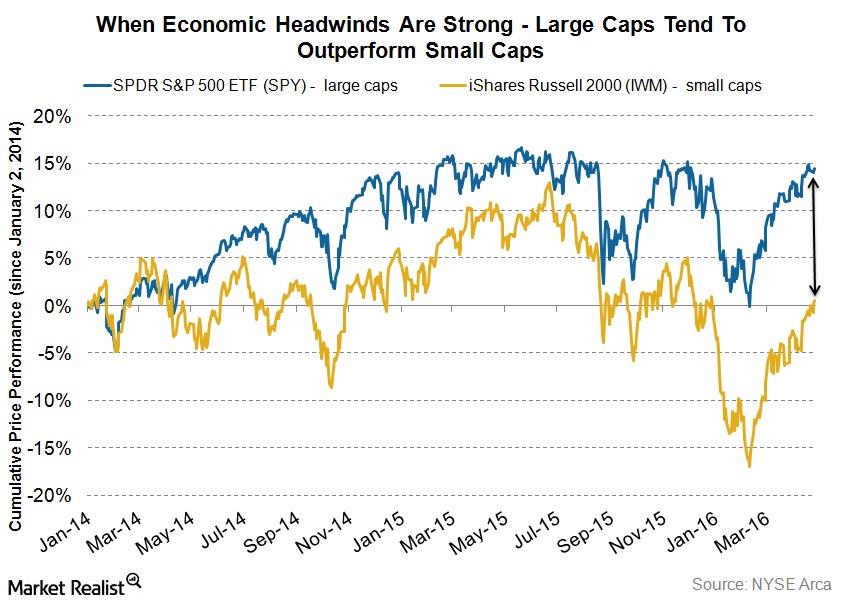

Style investing involves selecting a particular asset class that should outperform during a business cycle phase and positioning your portfolio accordingly.

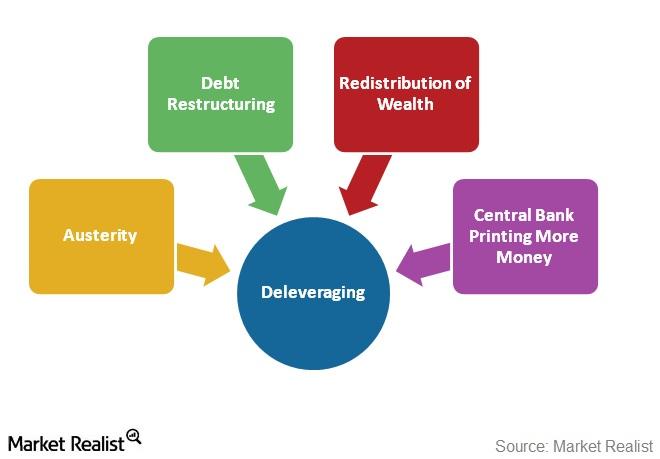

4 Ways an Economy Can Deleverage: Ray Dalio Explains

In his “Economic Principles at Work” template, Ray Dalio identifies four ways any world (ACWI)(VTI)(VEU) economy can deleverage. Find out why this matters.

Where Are We in the Long-Term Debt Cycle? Ray Dalio Weighs In

According to Ray Dalio, the Fed needs to study the long-term debt cycle in order to understand the huge downside risks that currently face the US economy.

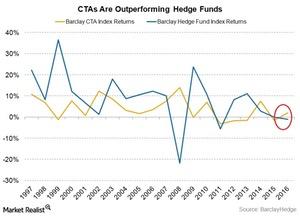

Why Commodity Trading Advisors Are Outperforming Hedge Funds

The Barclay CTA Index, which serves as a benchmark of the representative performance of CTAs (commodity trading advisors), has risen 2.0%, as of March 31.

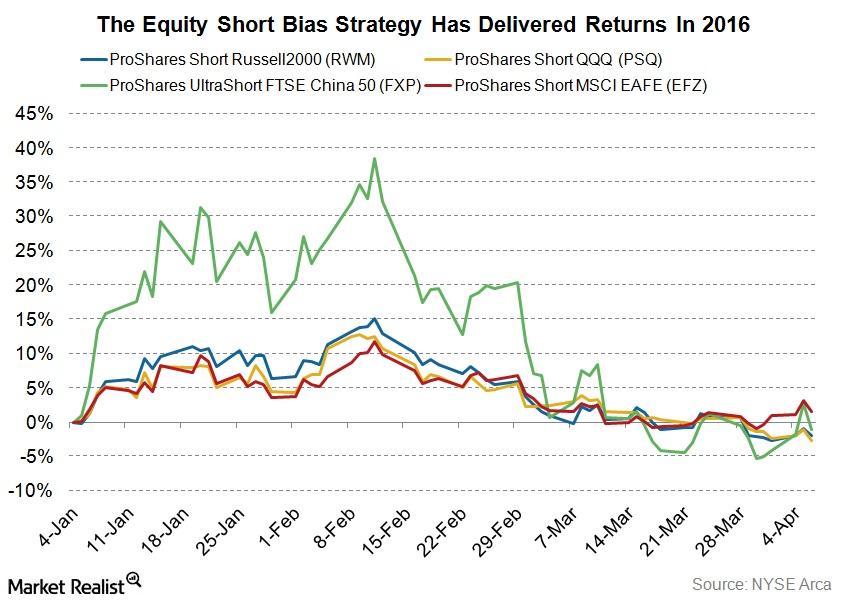

How Has the Equity Short Bias Hedge Fund Strategy Worked in 2016?

The equity short bias strategy has largely outperformed all other hedge fund strategies so far in 2016. The Barclay Equity Short Bias Index returned 9.0% in 1Q16.

Business Cycle Perspective: Has the Healthcare Sector Hit Bottom?

This year, the healthcare sector seems to be receding, and the utilities sector seems to be in good gear. This is a sign that the early bear phase is over.

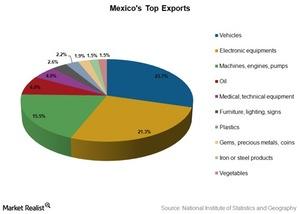

Consumerism Abroad to Drive Growth in Mexico

Mexico is known for its industrial base. In 2015, vehicles constituted about 23.7% of Mexican exports, followed by electronic equipment at 21.3% of exports.

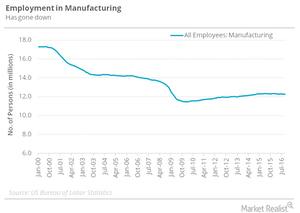

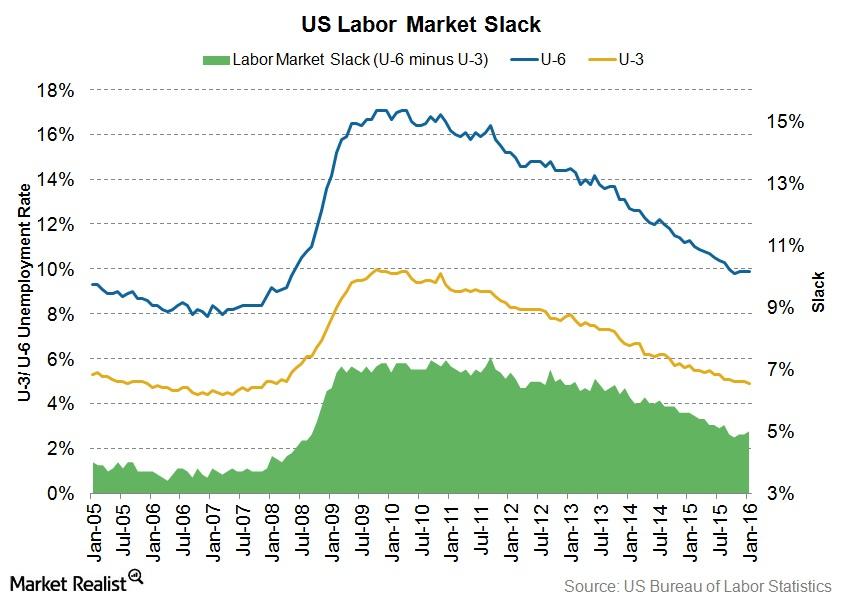

What Is Labor Market Slack?

The unemployment rate doesn’t help us gauge the extent of labor market slack. The actual employment gap that exists also consists of a slack component.

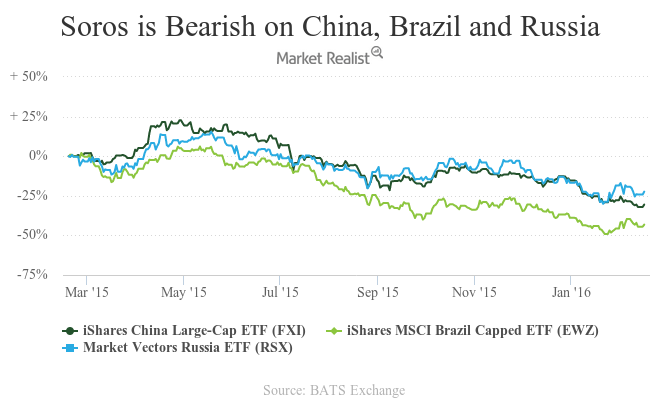

George Soros Is Shorting the S&P 500: Are You?

Soros Fund Management’s 13F filing for 4Q15 reveals that George Soros has been shorting the S&P 500. His top buys in the last quarter include puts on the PowerShares QQQ ETF (QQQ).

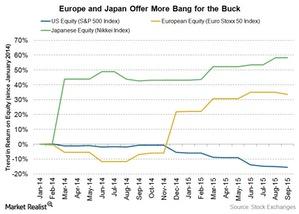

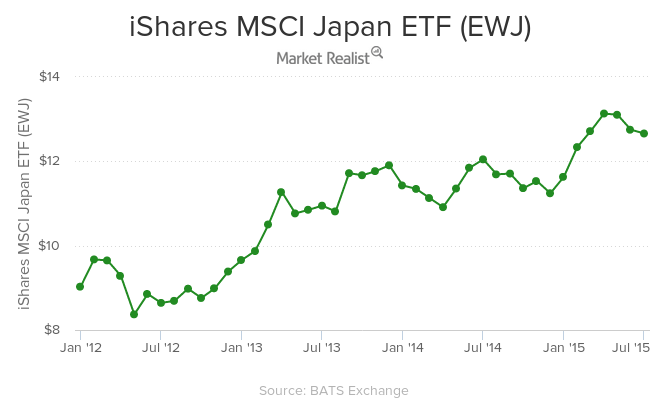

Japanese and European Equities Offer Relative Value

A Janus Capital (JNS) report for 2015 outlook by Bill Gross stated, “We like Japanese and European equities due to cheap valuations and monetary boosters.”

Ray Dalio’s Economic Principles: Why Is Japan Still Lagging?

Reviewing Ray Dalio’s economic principles template is helpful to understand the situation in Japan. It’s important to understand Japan’s challenges.

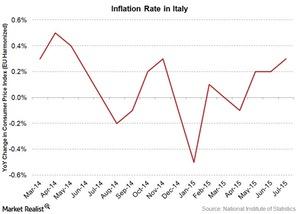

Italy’s Inflation Rate Rose to 0.3% in July, yet EWI Fell 0.88%

The ECB’s (European Central Bank) monetary stimulus package seems to be working well for most Eurozone economies, especially Italy.

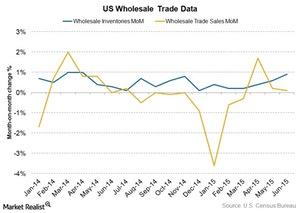

Indicators Suggest US Inventory Build-Up, SPY Falls 0.94%

August 11 saw the release of a number of key indicator around the world. Wholesale inventory data was the most eagerly awaited in the United States.

Which Parts of Japan’s Economy Most Need Reform Right Now?

Japan needs to work on reducing the regulatory, political, and social barriers that hinder productivity and profitability in its economy.

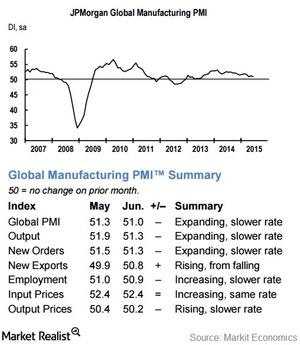

Markit Economics’ PMI Report: Global Manufacturing Slowed in June

The Markit PMI report serves as a business activity scorecard for the economy under survey. It provides insight into the private sector economy.

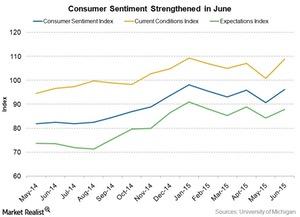

Consumer Sentiment Shines on Wall Street: Upbeat in June

In the US, consumer sentiment rose in June. The Consumer Discretionary Select Sector SPDR ETF (XLY) has gained about 1.22% over the past month.

What Stage of the Business Cycle Are We In Now?

Looking at the US economy for the last three years might help us understand which phase of the business cycle the US economy is in right now.

As US Economy Expands, Innovation Is Tide That Lifts All Boats

As the US economy expands, innovation seems to be the tide that is lifting all boats. Innovation is being driven by technology.

ETFs That Outperform in Late Stage, Recession, and Trough

Certain industries typically outperform at various phases of business cycles. This provides important clues to investors and helps them manage their portfolios.

Leading Indicators that Help Identify the Current Business Cycle

The business cycle, which reflects fluctuations of activity in an economy, can be a critical determinant of equity sector performance over the intermediate term.

An Investor’s Key Guide to Business Cycle Investing

For those investors who believe that a rising tide lifts all boats, as John F. Kennedy once said, understanding business cycle investing is a must.

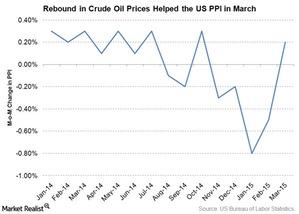

A Rebound in Crude Oil Prices Helped the PPI in March

On Tuesday, April 14, the U.S. Bureau of Labor Statistics released its PPI (Producer Price Index) figures for February. The PPI gained 0.2% in March.

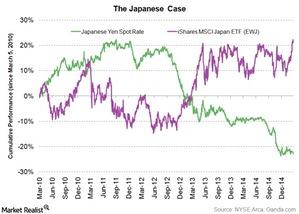

Currency war: Did it boost growth in Japan?

Japan is a classic case of how depreciating currency can boost economic growth. The stimulus package, launched in October 2010, worked over the short term.

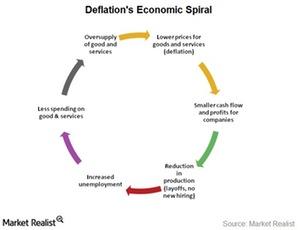

Currency warfare is a way to export deflation

When a country depreciates its currency, its major trading partners depreciate their own currencies. They do this to save their economies from entering into deflation.

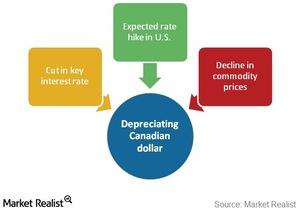

3 key factors affecting Canadian currency depreciation

The availability of easy money leads to currency depreciation, which benefits exporters, but is counterproductive for importers.

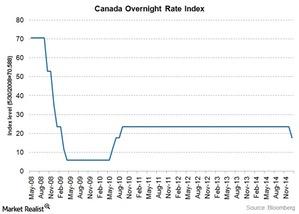

Economic essentials: The key interest rate and the prime rate

The key interest rate and the prime rate are central to the Canadian financial system. They key interest drives lending rates at the big banks.

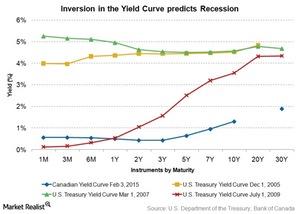

Could Canada’s inverted sovereign yield curve mean recession?

Canada’s inverted sovereign yield curve could be an indication of an upcoming recession. US yields exhibited similar curves prior to the 2008 recession.

Key challenges facing the Canadian economy

One of the challenges facing the Canadian economy is a lack diversification. More than 70% of the TSX Composite Index is made up of only three sectors.

Russia’s sovereign credit rating downgraded to junk

Russia’s sovereign credit rating now stands on par with countries such as Turkey and Indonesia. The oil price crisis isn’t helping matters.