Surbhi Jain

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Surbhi Jain

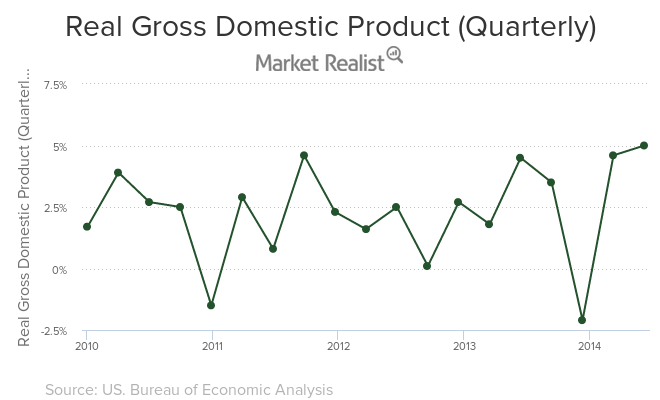

What 2 factors drive real GDP growth?

According to Jeffrey Lacker, two fundamental factors contribute to GDP growth in the long term—population growth and real GDP per worker.

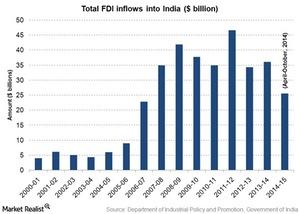

Make in India: A key campaign for India’s manufacturing sector

The Make in India campaign, introduced last September, is expected to create job opportunities for at least 100 million youths in India over time.

What are alternative investments?

Alternative investments seek to provide a hedge against various market risks by following hedge fund-like strategies.Healthcare Must-know: 3 key risks in stock market investing

Know the market and know your own appetite for risk before investing. You can’t eliminate market risk, also called systematic risk, through diversification. You can, however, hedge against market risk.Technology & Communications Why is the NASDAQ heavily weighted towards technology stocks?

The NASDAQ’s upstart image and all-electronic trading platform have attracted more technology-based companies. Many of these companies didn’t qualify to list on the NYSE when they originally went public.

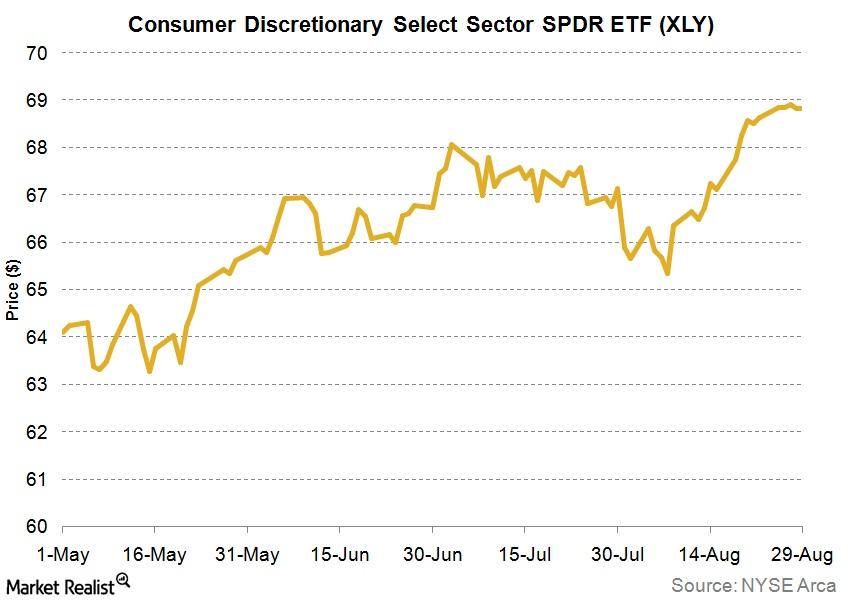

Why consumer confidence is an important economic indicator

Consumer confidence is an economic indicator. It measures how confident consumers are about the overall state of the economy. It also measures how confident people feel about their income’s stability. Their confidence impacts their economic decisions—like their spending activity.Healthcare Key differences between investment-grade and high-yield investments

Corporate debt is divided into investment-grade and high-yield on the basis of the credit risk associated with the issuer. Credit rating agencies issue ratings to corporations and debt issuance on the basis of associated credit risk.

Overview: The four major components used for calculating the GDP

While calculating the GDP estimate, the Bureau first takes into account the sum of an individual’s personal consumption expenditures, that is, durable goods, non-durable goods, and services.Energy & Utilities Why the Bureau of Labor and Statistics jobs report is important

The employment situation is the primary monthly indicator of aggregate economic activity because it encompasses all major sectors of the economy.Industrials The ADP jobs report: A must-know guide for ETF investors

The ADP National Employment Report (also popularly known as “the ADP Jobs Report” or “ADP Employment Report”) is a monthly report summarizing the employment situation.Industrials Must-know: Do credit spreads only represent credit risk?

While credit spreads do give you a good picture of the credit risk of one bond compared to another, it’s not the only factor they represent.Financials The relationship between interest rates and credit spreads

Examining credit spreads gives investors an idea of how cheap (a wide credit spread) or expensive (a narrow credit spread) the market for a particular bond category or a particular bond is.

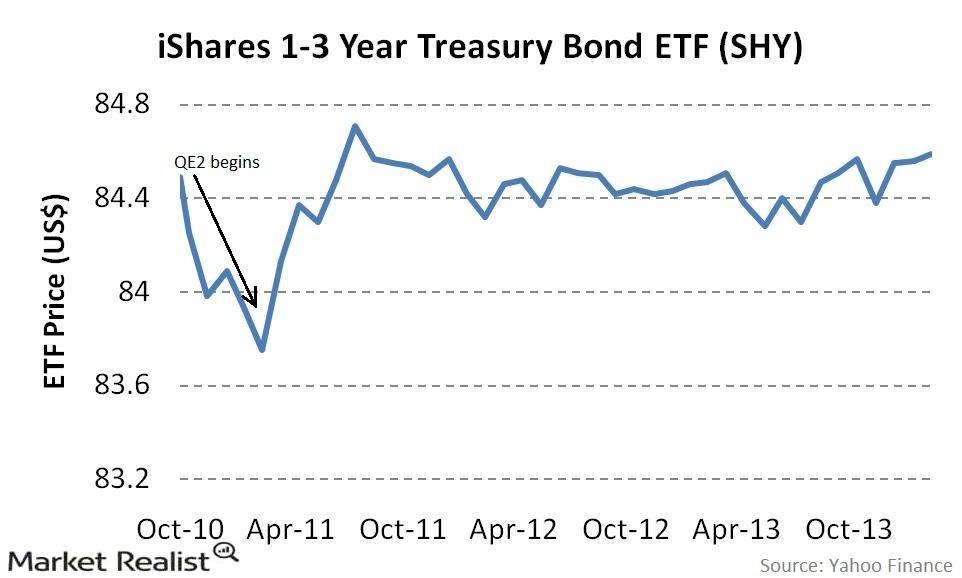

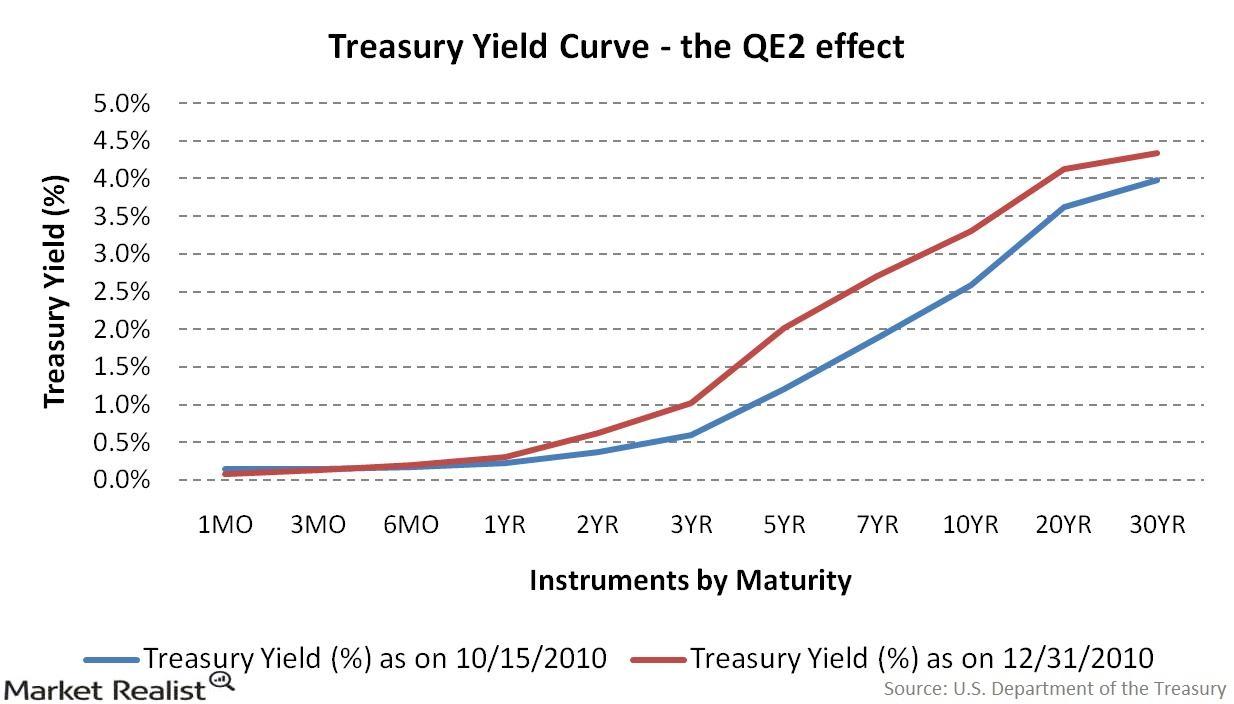

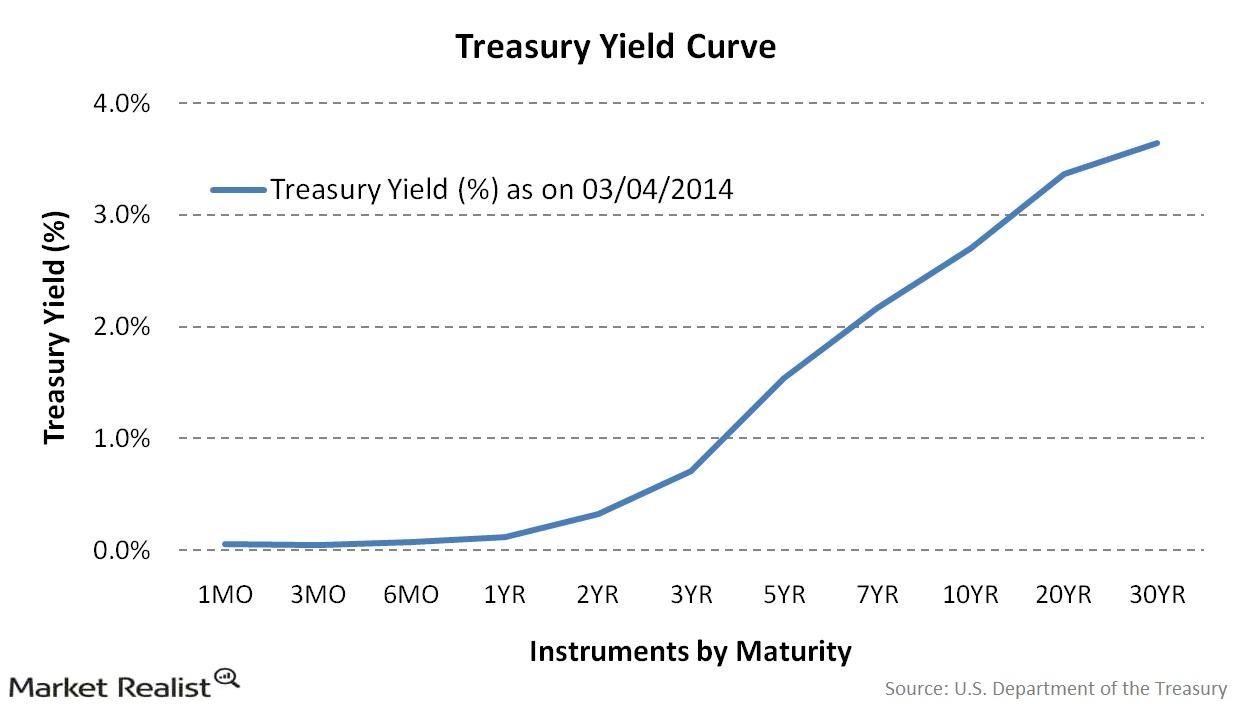

Must know: How the Fed’s monetary policy affects short-term yields

The Fed directly influences the short-term yields by either buying or selling short-term Treasuries or affecting the Fed funds rate.

How does the Fed’s monetary policy affect the yield curve?

When it comes to changes in the shape of the yield curve, there is no bigger factor driving these changes than the Federal Reserve.

The yield curve: An indicator of the monetary policy implications

Intelligent investors have an opportunity to earn profits and avoid losses, if they understand how the yield curve may move when the Fed acts.