Sirisha Bhogaraju

Sirisha Bhogaraju joined Market Realist in October 2014. She has more than 12 years of experience in financial research. Sirisha has covered various sectors over the years, but she's most interested in consumer and retail stocks. She likes to see how macro trends and evolving customer choices impact companies.

Sirisha has a master’s degree in finance. She's also a music enthusiast and likes to read in her spare time.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sirisha Bhogaraju

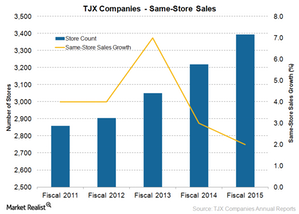

Gauging TJX Companies’ Same-Store Sales Growth

The growth in TJX Companies’ same-store sales slowed down in fiscal 2015, growing by 2.0% compared to 3.0% in fiscal 2014.

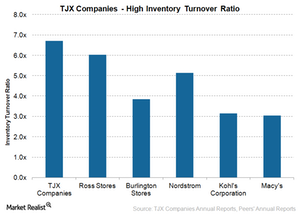

TJX Companies’ Best-in-Class Inventory Management

TJX Companies (TJX) has a very efficient internally developed inventory management system that helps the company ensure the proper flow of merchandise.

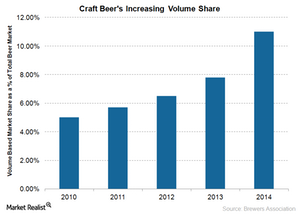

Craft Beer and Its Rising Popularity

Americans are moving toward craft beer due to better taste, innovation, and brewing techniques. Its market share increased to 11% in 2014 from 7.8% in 2013.

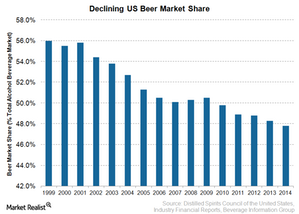

Why is Beer Losing Ground to Wine and Spirits?

The beer market share in terms of supplier revenues has fallen from 56.0% in 1999 to 47.8% in 2014. The decline is more evident in the light beer category.

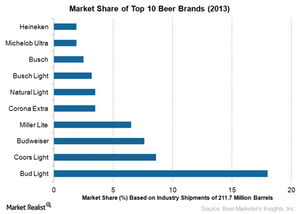

Beer Brands That Make a Difference in the US Market

Bud Light is the leader among major beer brands, with 18% share of the beer market based on the 2013 total beer industry shipments of 211.7 million barrels.

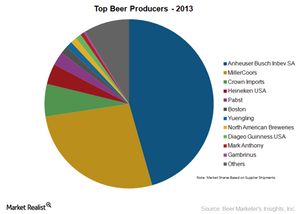

Competitive Forces: Who Rules the US Beer Industry?

Based on the US beer industry shipments of 211.7 million barrels, Anheuser-Busch InBev led the beer industry in 2013 with a 45.6% market share.

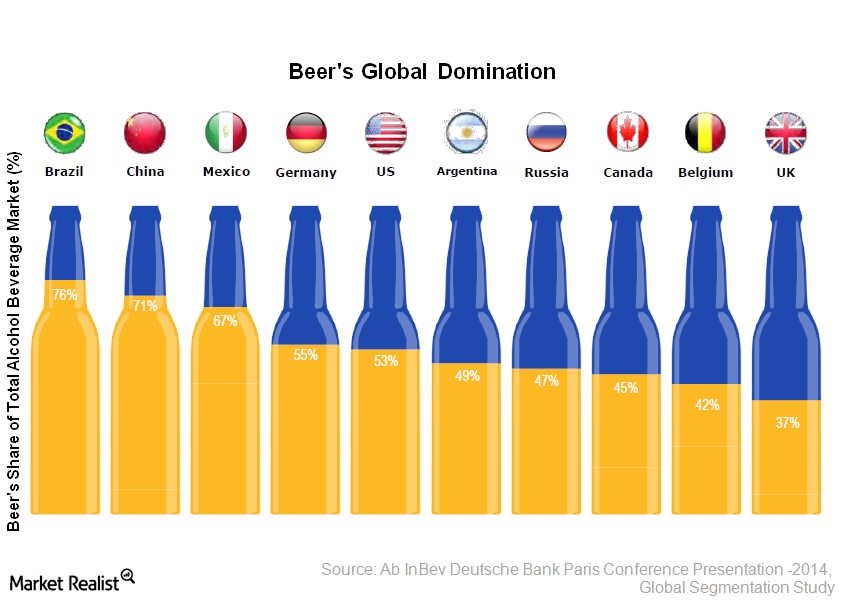

Beer Dominates Alcoholic Beverage Market

Beer is the dominant category in the alcoholic beverage industry with a 47.8% market share of the gross supplier revenue figures for 2014.

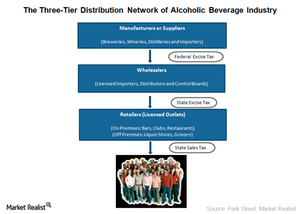

The Three-Tier Distribution of the US Alcoholic Beverage Industry

The three-tier distribution system ensures collection of taxes and prevents control of production, distribution, and selling by a single entity.

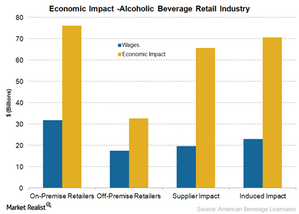

How Important Is the Alcoholic Beverage Industry to the Economy?

In an economic study, the American Beverage Licensees estimated the economic impact of the alcoholic beverage industry in 2014 to be more than $245 billion.

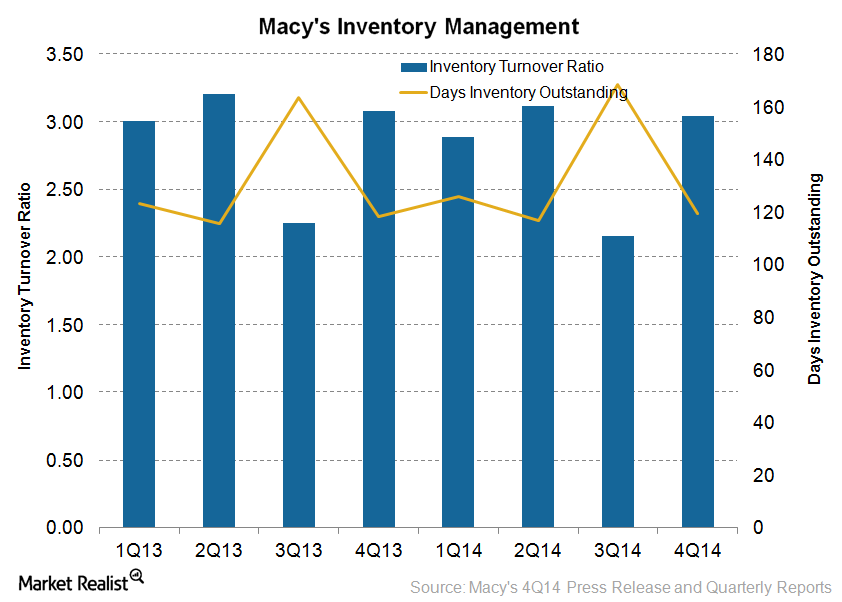

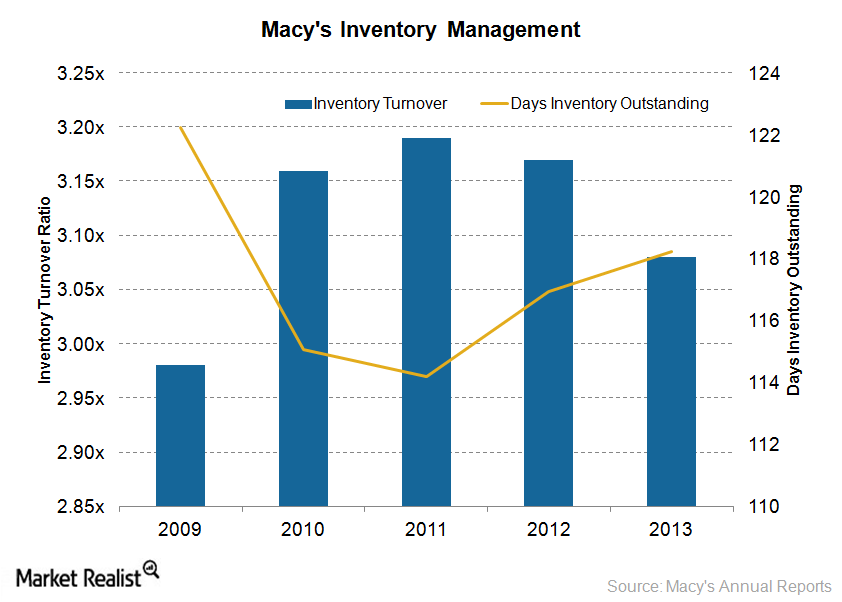

What Steps Has Macy’s Taken to Improve Inventory Management?

Department stores like Macy’s (M) are focusing on improving their inventory management so as to maintain the optimal level of inventory, bring down costs, and avoid stock-outs.

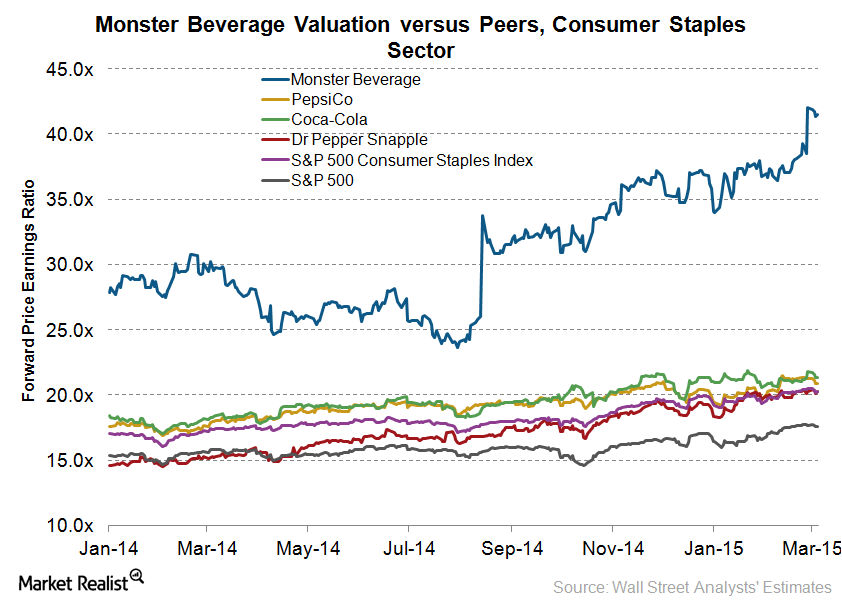

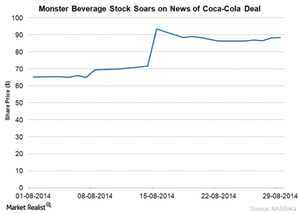

Monster Beverage’s stock outperforms peers

After transferring its non-energy drink brands to Coca-Cola, Monster Beverage can focus on its core energy business and expand its international presence.

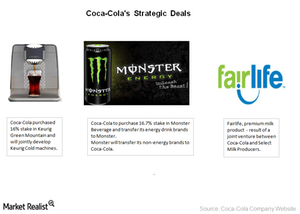

Monster Beverage and Coca-Cola: A landmark partnership

Under their strategic partnership, Coca-Cola will acquire 16.7% of Monster Beverage for $2.15 billion and transfer its energy business to Monster Beverage.

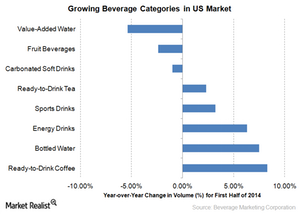

Dr Pepper Snapple pursues non-carbonated beverage growth

Keeping in view declining soda volumes, Dr Pepper Snapple is focusing on expanding its non-carbonated beverage line.

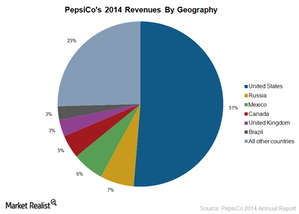

How PepsiCo is benefitting from complementary businesses

PepsiCo’s snack and beverage businesses are complementary in nature and derive a lot of synergies.

How PepsiCo’s focus on innovation is reaping rewards

PepsiCo’s focus on innovation includes Pepsi Spire 5.0 equipment, which allows consumers to create about 1,000 beverage combinations using a 32-inch touchscreen.

PepsiCo is a leader in the food and beverage spaces

PepsiCo (PEP) is the second largest non-alcoholic beverage maker and the market leader in the snack food space in the US.

Coca-Cola’s joint ventures set the stage for future growth

The company is focused on expanding its product portfolio through strategic deals. Coca-Cola’s joint ventures will set the stage for future growth.

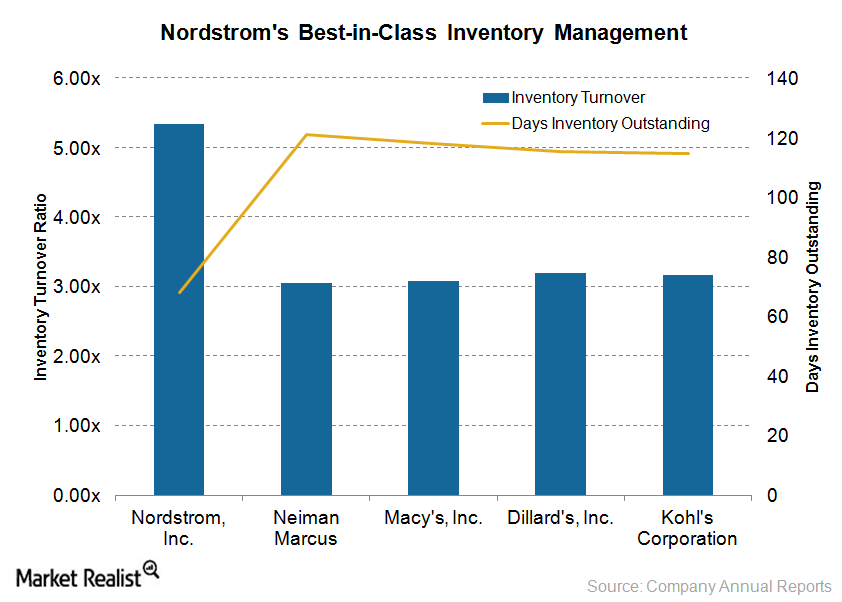

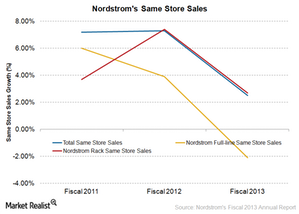

Nordstrom’s inventory management better than that of its peers

This article discusses Nordstrom’s inventory management in comparison to that of its industry peers.

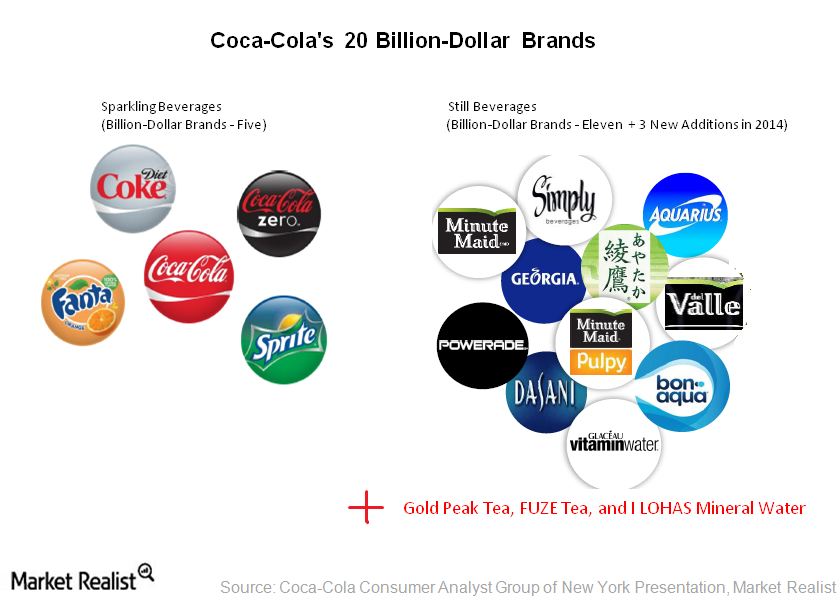

Coca-Cola’s still beverages brands meet growing demand

In 2014, Coca-Cola added three still beverage brands. Coca-Cola’s still beverages now include Gold Peak Tea, FUZE Tea, and I LOHAS mineral water.

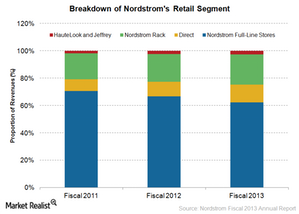

Understanding Nordstrom’s revenue streams

In fiscal 2013, the company’s Retail segment contributed 97% of Nordstrom’s revenues of $12.5 billion, while the Credit segment accounted for only 3%.

Nordstrom’s target customers

Nordstrom is an upscale department store that competes with other high-end stores. However, not all of Nordstrom’s target customers are high-end shoppers.

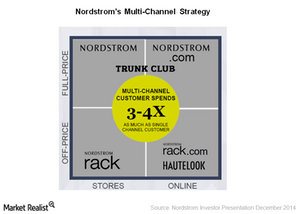

Nordstrom’s multichannel strategy, customer focus lead to success

Nordstrom’s multichannel strategy and best-in-class customer service have made the company famous.

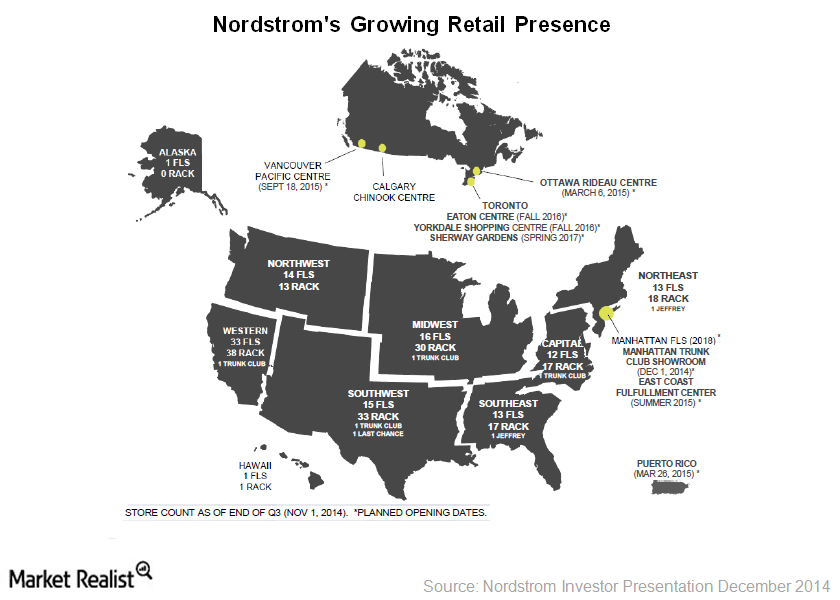

An overview of Nordstrom’s growth story

This article provides a brief overview of Nordstrom’s growth story.

Macy’s works on inventory management: Will it improve sales?

Macy’s is taking measures to improve inventory management, including its My Macy’s program that customizes merchandise according to local preferences.

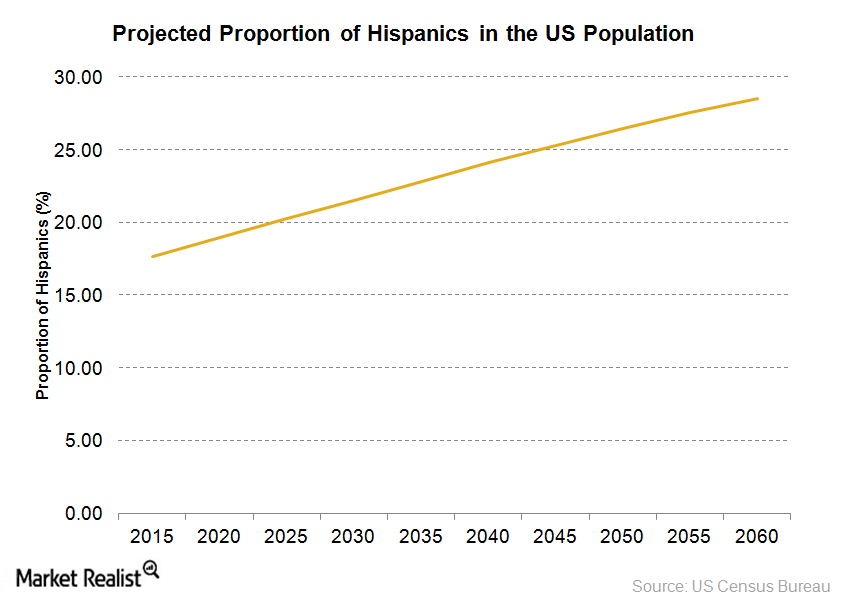

Macy’s target consumers: Do they make a difference?

Macy’s target consumers include Millennials. The company launched collections aimed at Millennials, including QMack, Maison Jules, and Bar III Carnaby.

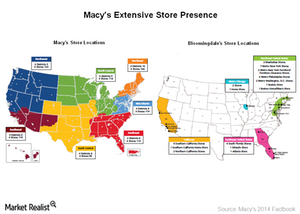

Macy’s: What does the largest department store look like?

Only two of the top 12 US retailers, Macy’s and Nordstrom, managed to witness a rise in market share over the period 2009–2014.

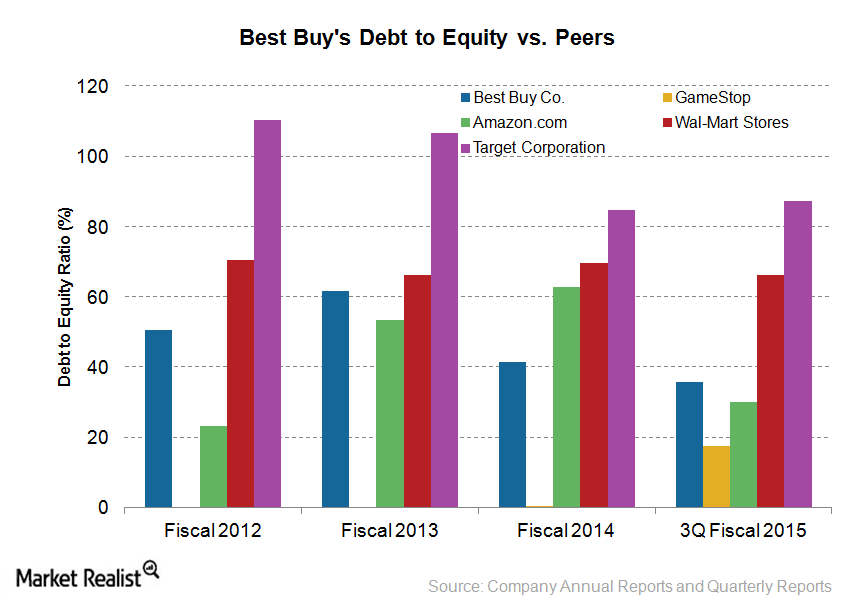

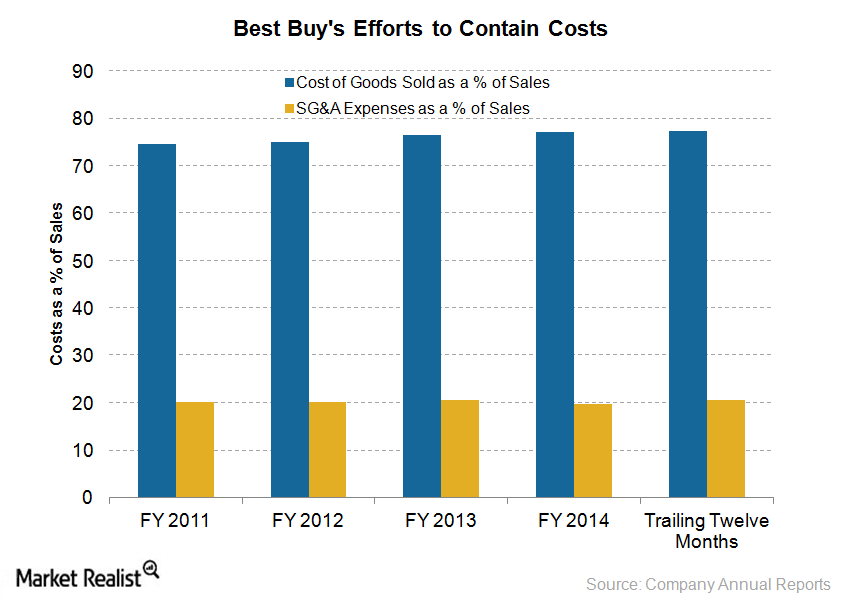

Assessing Best Buy’s debt profile

Gauging a company’s debt levels is crucial to understanding its financial health. Maintaining high debt levels in uncertain times can be damaging.

Focus on online sales: Best Buy goes head-to-head with Amazon

To address inventory issues associated with online sales at its distribution centers, Best Buy rolled out a ship-from-store strategy.

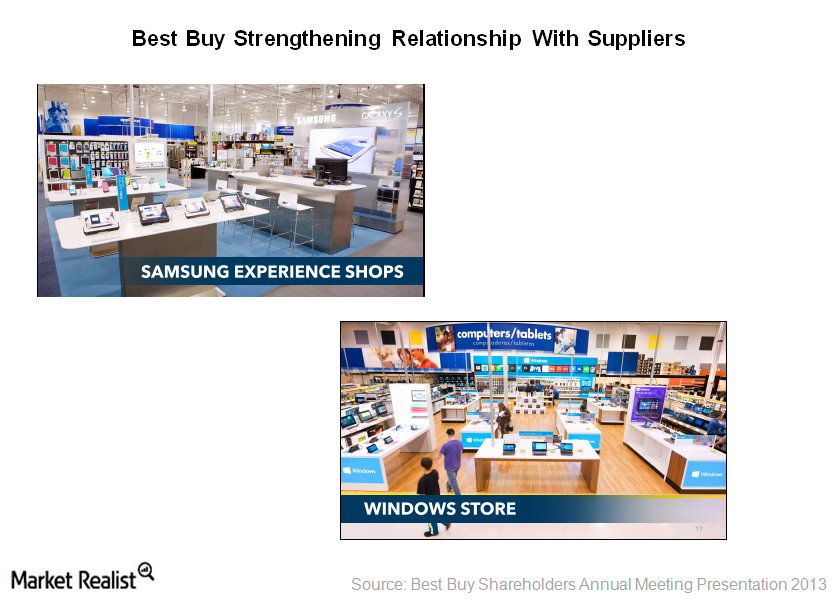

Best Buy joins forces with key suppliers

Best Buy is building strong relationships with key suppliers to mitigate the impact of heightened competition from suppliers’ retail stores.

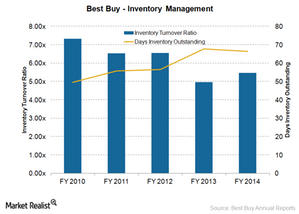

Best Buy attempts to optimize inventory levels

At Best Buy, returns, replacements, and damages account for nearly 10% of revenues and have cost the company over $400 million in losses each year.

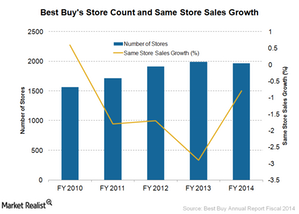

Best Buy sees better same-store sales in 3Q 2015

Best Buy’s growth rate in same-store sales had been negative since fiscal 2011. Efforts to optimize the shopping experience have changed that.

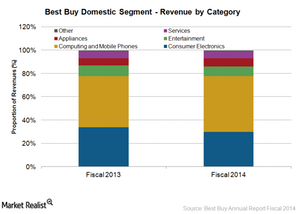

Understanding Best Buy’s revenue mix

The computing and mobile phone category is the largest of Best Buy’s revenue mix, accounting for 48% of the Domestic segment’s fiscal 2014 revenues.

Renew blue: Best Buy’s turnaround strategy

As part of its turnaround strategy, Best Buy is also revamping its stores and trying to encourage more robust store traffic.

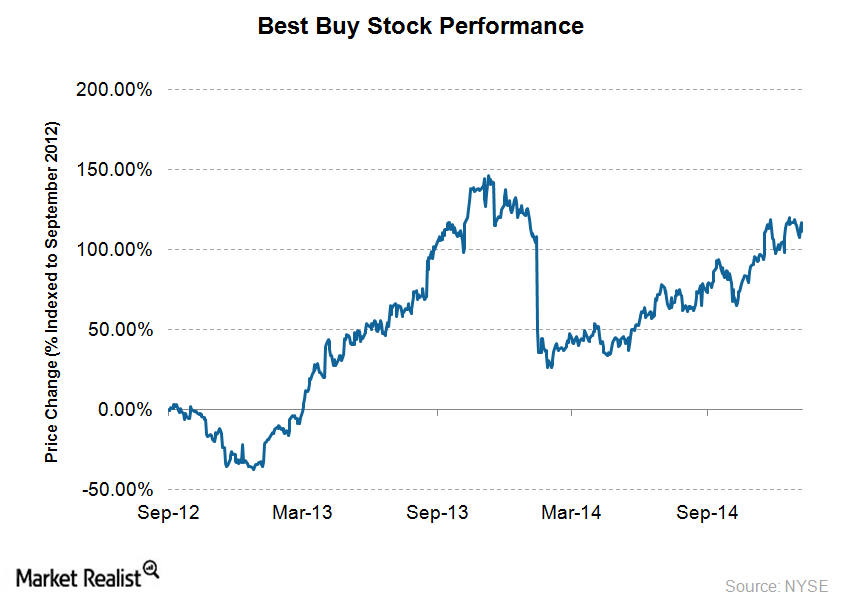

Best Buy CEO transforms the company for the better

Before being appointed Best Buy CEO, Hubert Joly was credited with turning around two other companies. Best Buy’s stock has appreciated by 111% since.

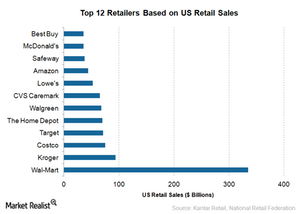

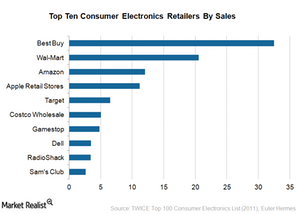

Best Buy: The largest consumer electronics retailer

Best Buy is the leading consumer electronics retailer in the US. Today, Best Buy has more than 1,900 stores and locations.

Why Monster Beverage extends its product line

Energy drinks witnessed impressive growth over the past five years. Monster Beverage and its peers—like Red Bull GmbH—are expanding their product lines to capture this growing demand.

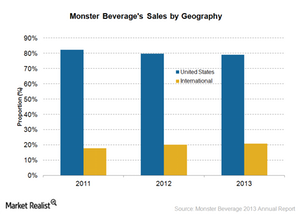

Why Monster Beverage’s international business is growing

Monster Beverage’s revenues from international regions increased over the years. Its international operations accounted for 21% of its 2013 revenues—up from 18% in 2011.

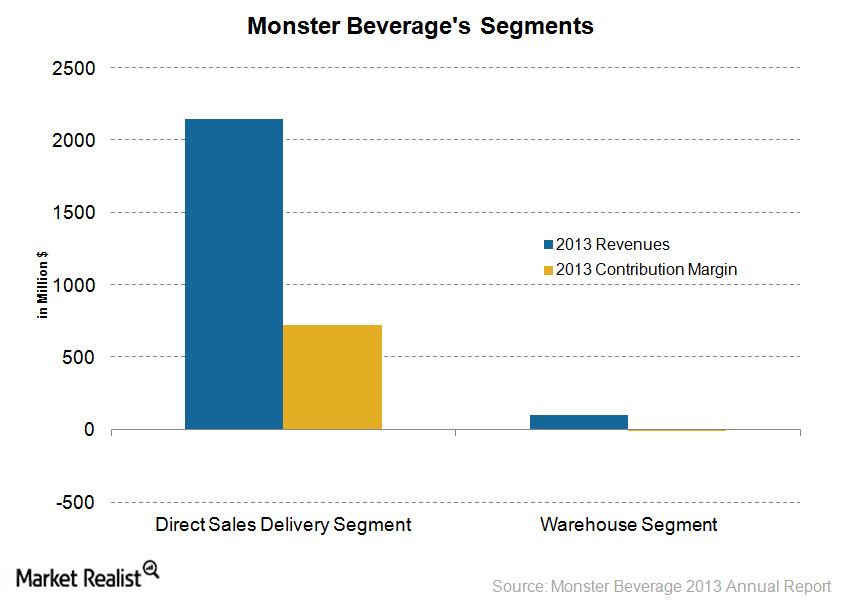

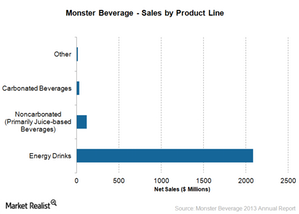

Analyzing Monster Beverage’s segments

Monster Beverage Corporation (MNST) conducts its business through two business segments—Direct Store Delivery, or DSD, and Warehouse. The DSD segment mainly sells energy drinks.

Monster Beverage’s bold marketing approach

Monster Beverage’s advertising and marketing efforts are associated with adventure sports and sports personalities. It sponsors extreme sporting events—like Motocross.

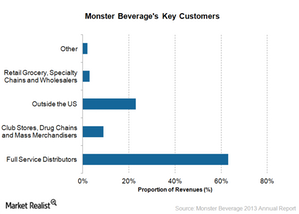

Monster Beverage’s distribution network

Coca-Cola purchased a 16.7% stake in Monster Beverage. Monster Beverage will be able to leverage Coca-Cola’s strong distribution network.

Monster Beverage’s extensive line of energy drinks

Monster Beverage Corporation (MNST) emerged as a leader in energy drinks. It has a 14% market share in the world’s energy drink market.

An overview of Monster Beverage Corporation

Monster Beverage Corporation (MNST) is based in California. It manufactures alternative beverages. It sold over 10 billion energy drinks in the past 12 years.

What are Dr Pepper Snapple’s growth strategies?

Dr Pepper Snapple plans to grow into new categories by leveraging its distribution agreements for third-party brands such as Vita Coco coconut water.

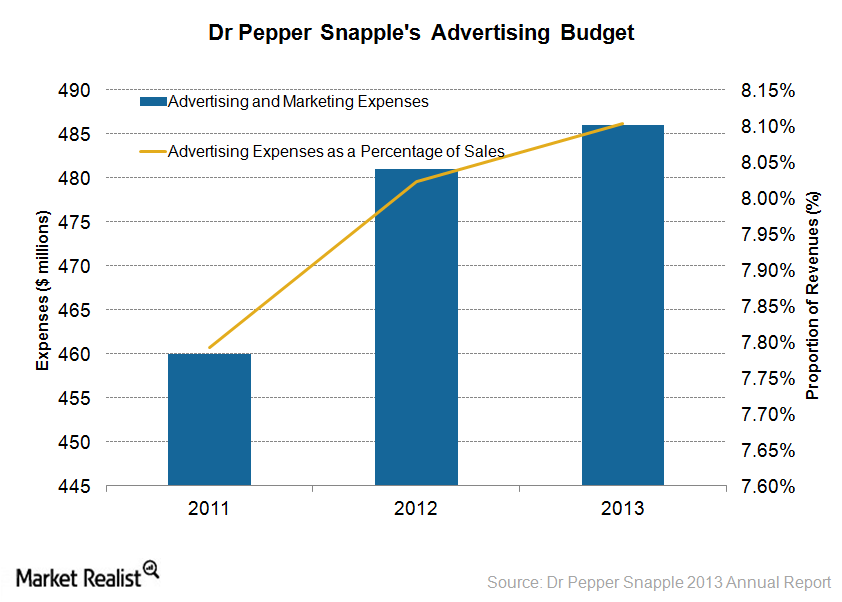

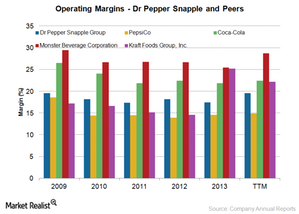

Dr Pepper Snapple makes efforts to improve profitability

Dr Pepper Snapple implemented its rapid continuous improvement (or RCI) in 2011 to simplify processes and address distribution and the availability gap.

What are Dr Pepper Snapple’s major risks?

Dr Pepper Snapple faces major risks like significant reliance on carbonated soft drinks, limited international growth, and excessive reliance on third-party distribution.

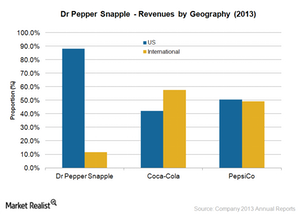

Why international expansion is vital for Dr Pepper Snapple

The carbonated soft drink volumes in North America have been continually declining. This makes it important for Dr Pepper Snapple to grow beyond its US operations.

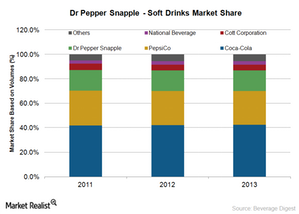

Dr Pepper Snapple is pitted against the soda behemoths

In 2013, Coca-Cola had 42.4% of the market share in the US carbonated soft drink category. PepsiCo had 27.7% and Dr Pepper Snapple 16.9% of the market share.

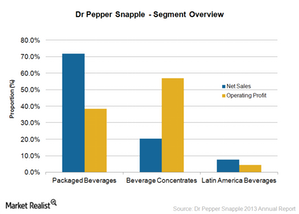

Understanding Dr Pepper Snapple’s revenue streams

Dr Pepper Snapple derives its revenues from the sale of carbonated soft drinks and noncarbonated beverages like ready-to-drink tea, juices, and mixers.

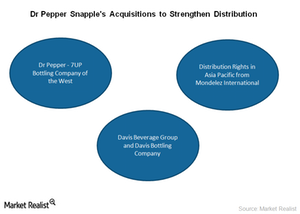

Dr Pepper Snapple strengthens its distribution network

Dr Pepper Snapple is continually strengthening its position as a major beverage company by acquiring regional bottling companies and distribution rights.

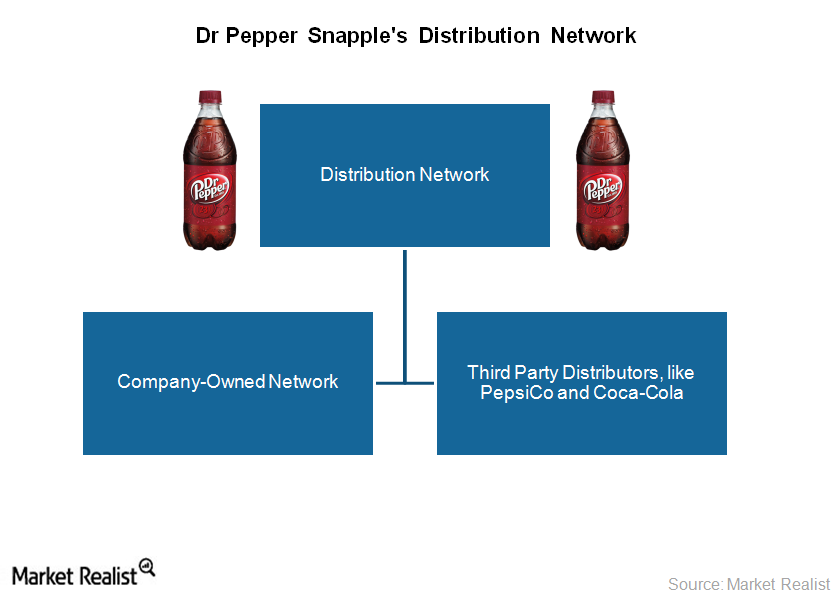

Understanding Dr Pepper Snapple’s route to market

Dr Pepper Snapple’ beverages reach consumers through the company’s own distribution network, third-party distributors, and direct delivery to customers’ warehouses.