Kenneth Smith

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Kenneth Smith

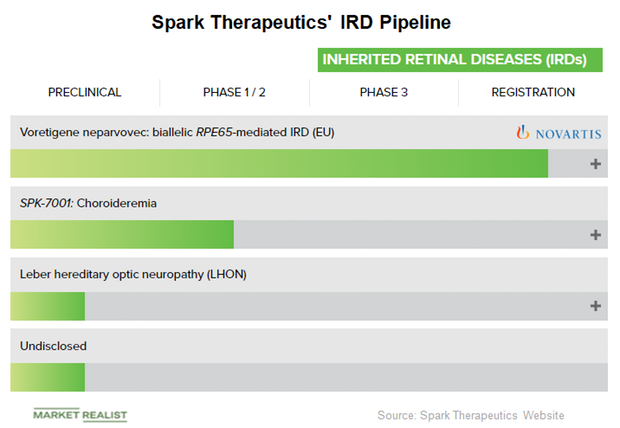

How Spark Therapeutics Is Positioned in 2018

Spark Therapeutics generated revenues of $25.18 million in the second quarter of 2018 compared to $1.48 million in Q2 2017.

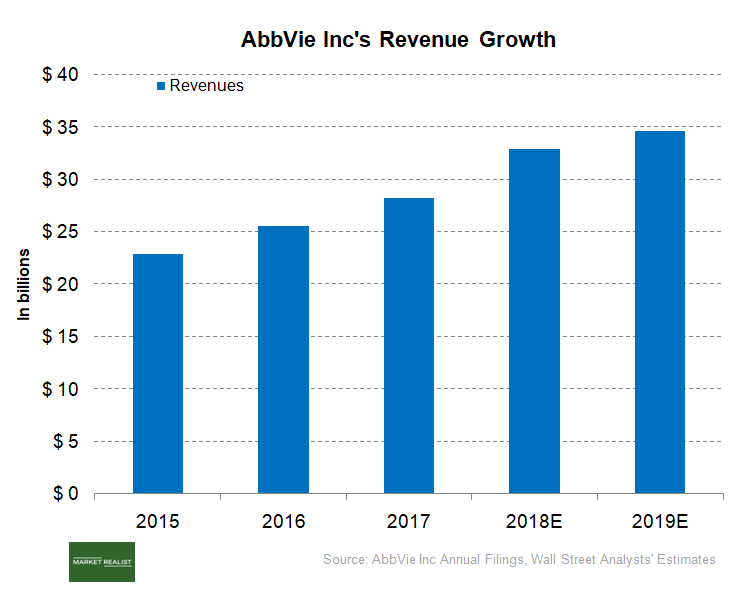

Analyzing AbbVie’s Financial Performance

AbbVie (ABBV) generated net revenue of $7.9 billion in 1Q18 compared to $6.5 billion in 1Q17.

What Spark Therapeutics’ Valuation Trend Indicates

Spark Therapeutics’ (ONCE) operating expenses decreased from $78.48 million in Q2 2017 to $59.78 million in Q2 2018.

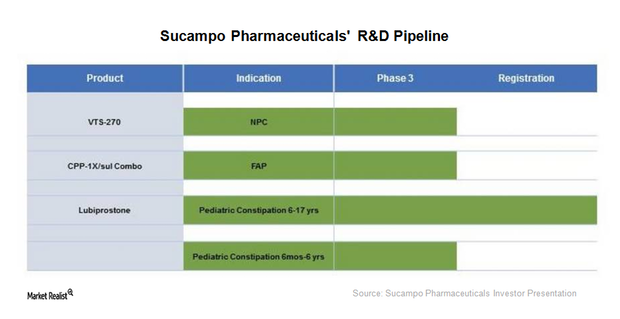

Sucampo Pharmaceuticals’ Research Pipeline in December 2017

Sucampo Pharmaceuticals (SCMP) recently completed a Phase 3 study for the alternate sprinkle formulation of Amitiza (lubiprostone) in adults with CIC (chronic idiopathic constipation).

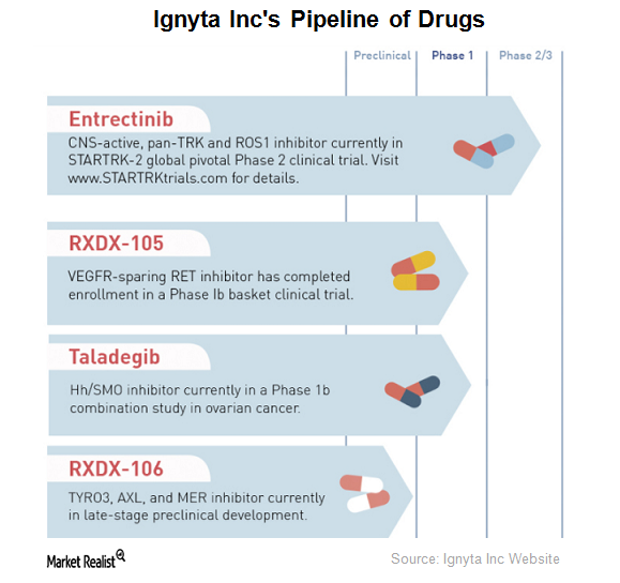

Ignyta’s Drug Pipeline

Ignyta (RXDX) has completed enrollment for a Phase 1 clinical trial of RXDX-105, an orally bioavailable small molecule tyrosine kinase inhibitor.

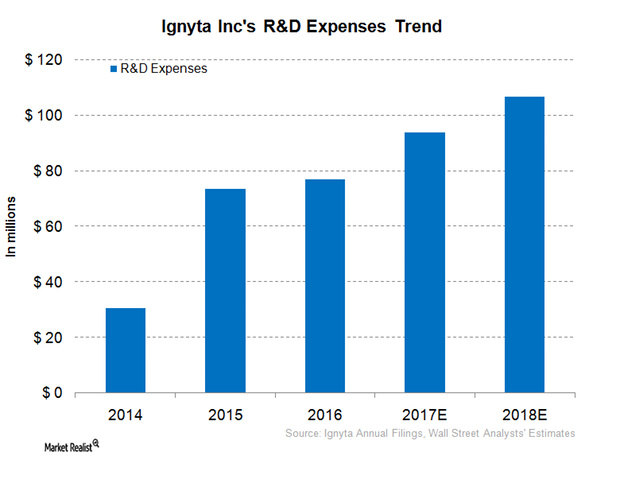

Inside Ignyta’s Financial Performance

Ignyta’s (RXDX) R&D (research and development) expenses increased from $16.6 million in 3Q16 to $21.7 million in 3Q17, a 30% rise.

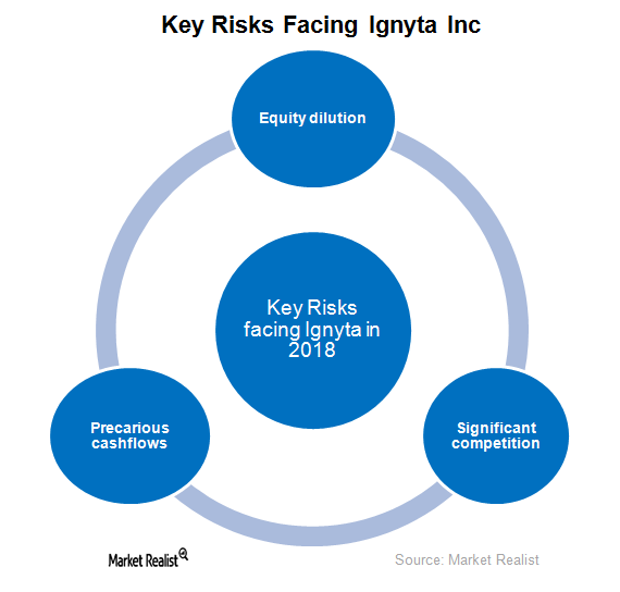

Ignyta and Its Key Risks in 2018

In October 2017, Ignyta (RXDX) raised $150 million by issuing 10 million shares of its common stock.

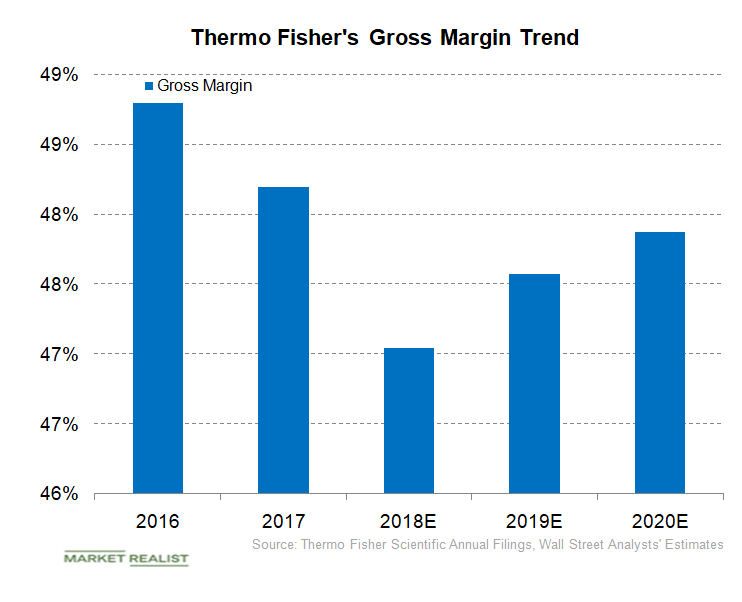

Thermo Fisher Scientific’s Gross Margin Trends

In fiscal 2018 and fiscal 2019, Thermo Fisher Scientific (TMO) is expected to generate revenue of $24.08 billion and $25.19 billion, respectively, compared with revenue of $20.92 billion in fiscal 2017.

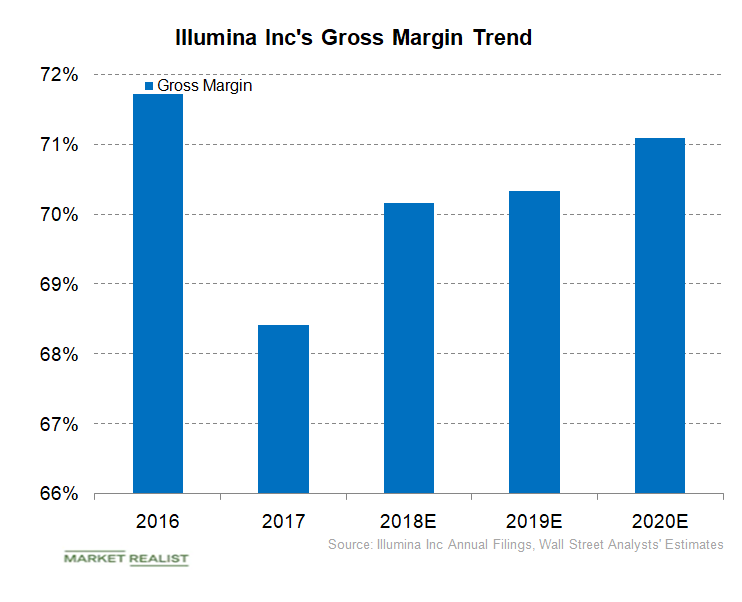

Understanding Illumina’s Gross Margin Trend

Illumina’s cost of product revenue increased from $173.0 million in the third quarter of 2017 to $184.0 million in the third quarter of 2018.

How Nektar Performed in the Third Quarter

Nektar Therapeutics generated total revenues of $27.76 million in the third quarter of 2018 as compared with $152.93 million in the third quarter of 2017.

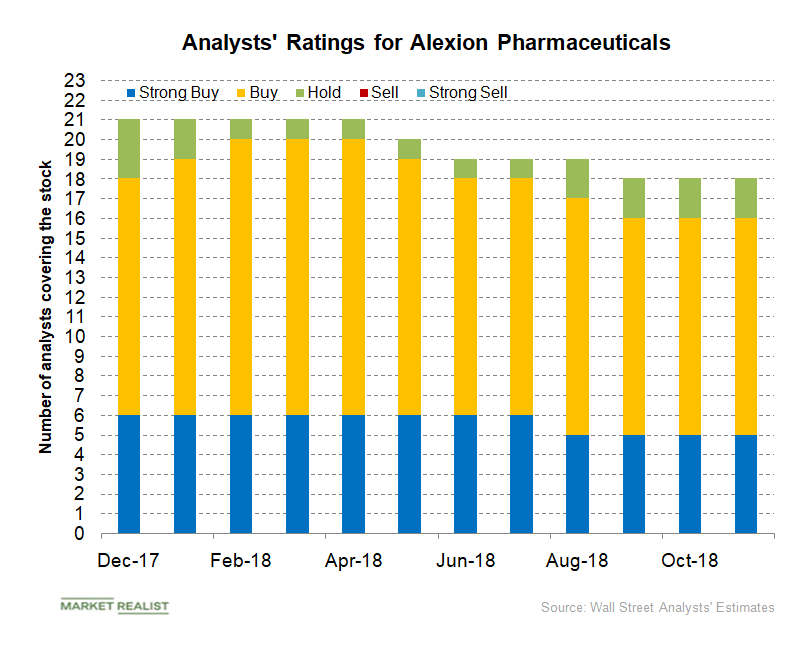

How Analysts View Alexion Stock

In November 2018, of the total 18 analysts covering Alexion Pharmaceuticals (ALXN), 16 analysts have given the stock a “buy” or higher rating, and two analysts have given it a “hold” rating.

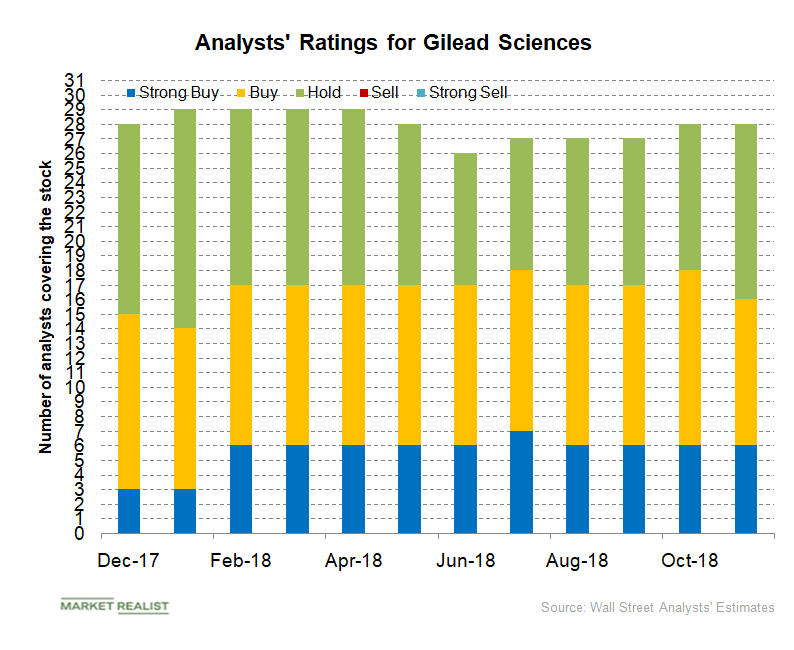

Gilead Sciences: Analysts’ Recommendations

In November, six analysts recommended a “strong buy,” ten recommended a “buy,” and 12 recommended a “hold” for Gilead Sciences.

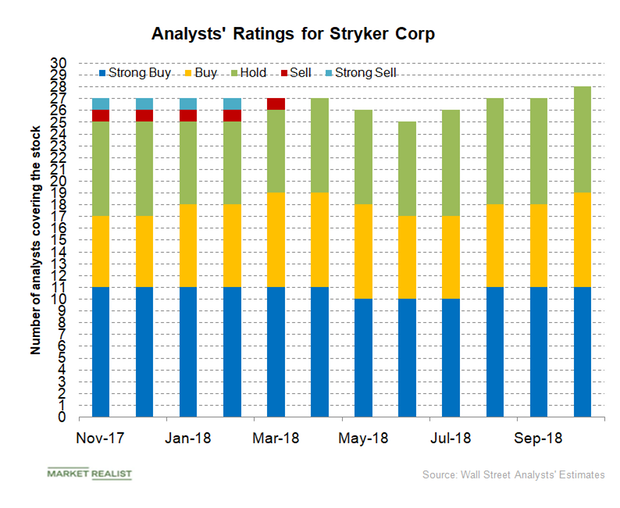

What Analysts Recommend for Stryker Stock

Of the total 28 analysts covering Stryker (SYK) in October 2018, 19 analysts have given the stock a “buy” or higher rating, and nine analysts have given Stryker a “hold” rating.

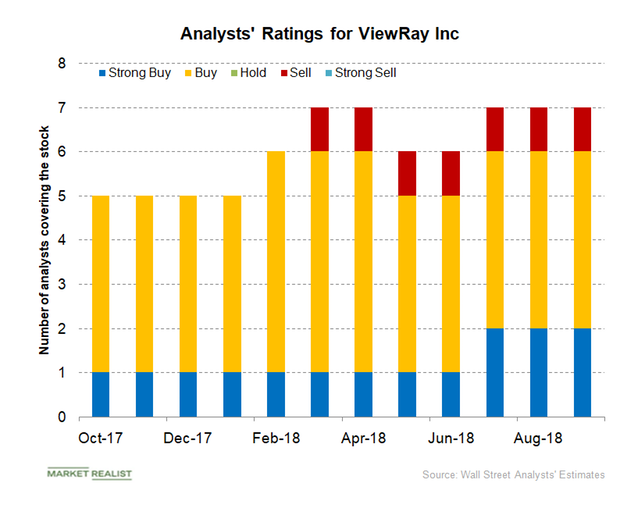

What ViewRay’s Valuation Trend Indicates

In September, of the seven analysts covering ViewRay (VRAY), six have given its stock “buy” or higher ratings, and one analyst has given it a “sell” rating.

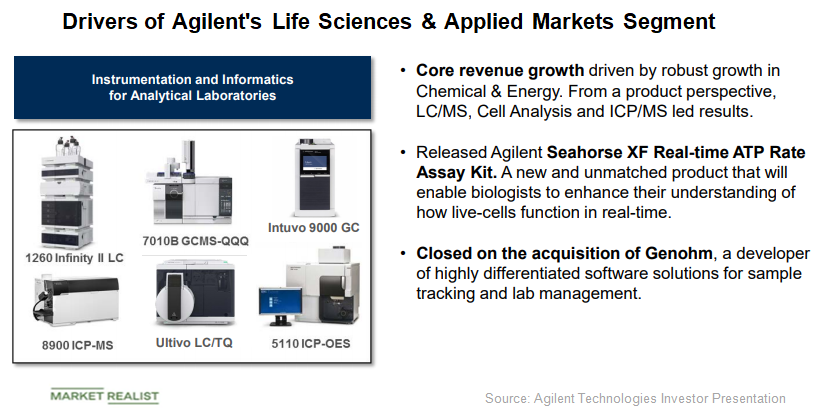

What’s Driving Agilent Technologies’ Segment Growth?

Agilent Technologies’ (A) Life Sciences and Applied Markets segment had revenues of $510 million in Q3 2017 compared to $540 million in Q3 2018.

Agilent Technologies: Its Acquisition Spree in 2018

Agilent Technologies (A) has been on an acquisition spree in 2018 with major acquisitions made until the third quarter.

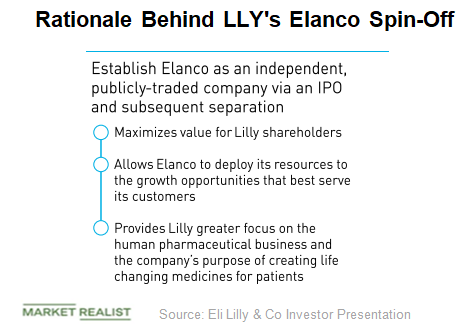

A Look at Eli Lilly’s Elanco Spin-Off

Eli Lilly (LLY) is expected to post revenues of $24.33 billion in fiscal 2018 and $24.8 billion in fiscal 2019.

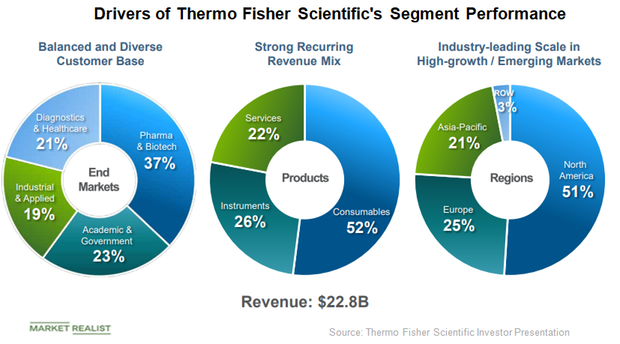

What’s Driving the Growth in Thermo Fisher Scientific’s Segments?

Thermo Fisher Scientific (TMO) operates in four business segments.

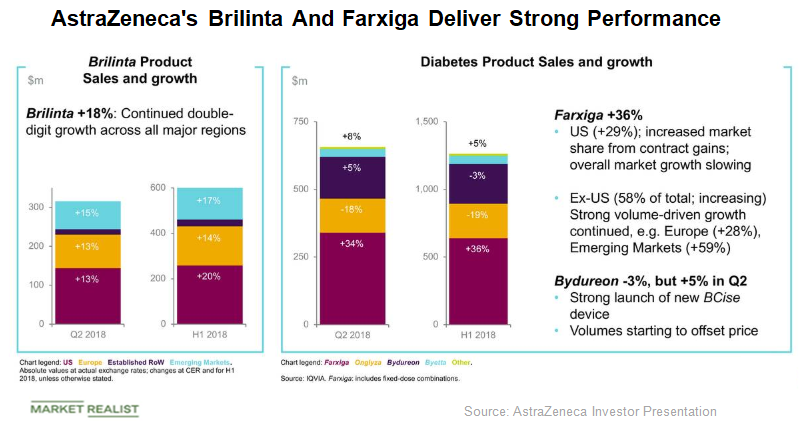

How Did AstraZeneca’s CVRM and Respiratory Products Perform?

Brilinta’s sales increased by 13.0% to $316.0 million, and Farxiga’s sales grew 34.0% to $340.0 million in the second quarter.

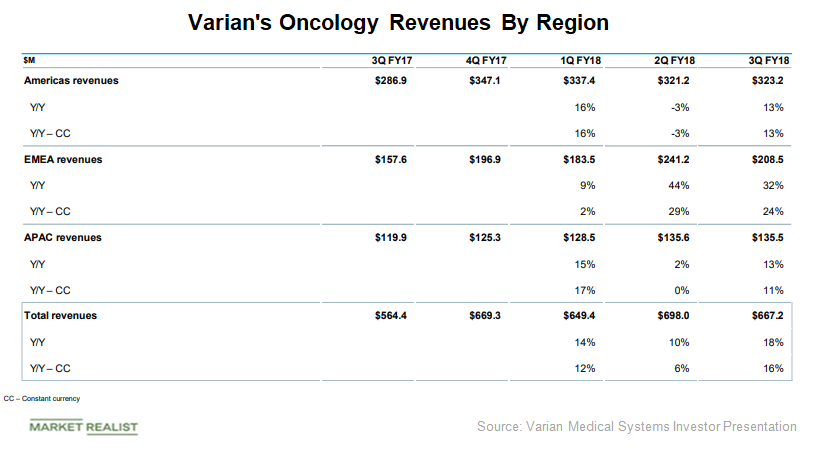

Understanding Varian Medical Systems’ Business Segments

Revenues from the Oncology Systems segment increased from $564.4 million in fiscal Q3 2017 to $667.2 million in fiscal Q3 2018.

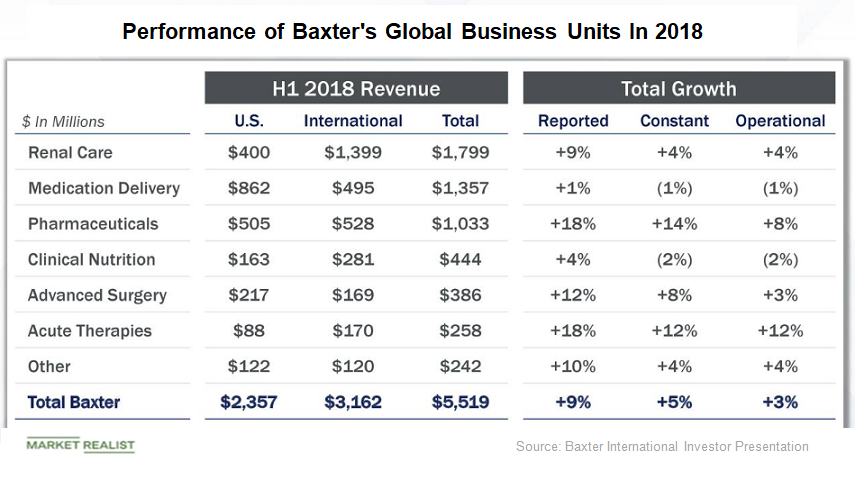

Baxter’s Global Business Units Continue to Deliver

Baxter International’s (BAX) global business units delivered strong performances in the second quarter.

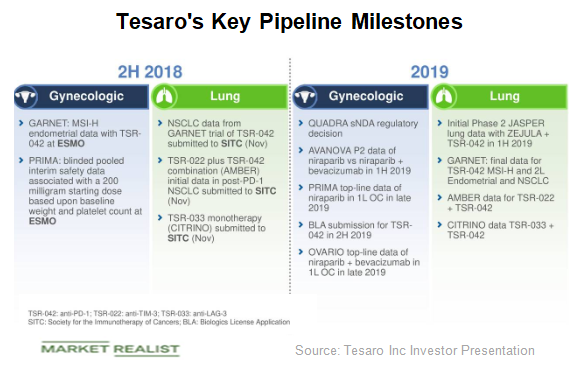

Here’s What Tesaro’s Valuation Trend Indicates

Tesaro stock has been on a downward trajectory for the past 52 weeks. From a high of $135 on September 5, 2017, it has corrected to $27 in August.

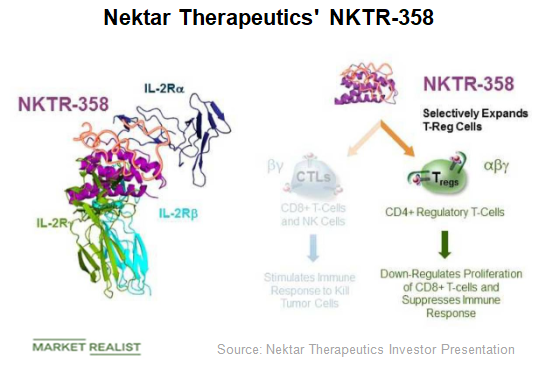

What Does Nektar Therapeutics’ Valuation Trend Indicate?

Under its immunology program, Nektar Therapeutics (NKTR) is developing NKTR-358 in collaboration with Eli Lilly and Company (LLY).

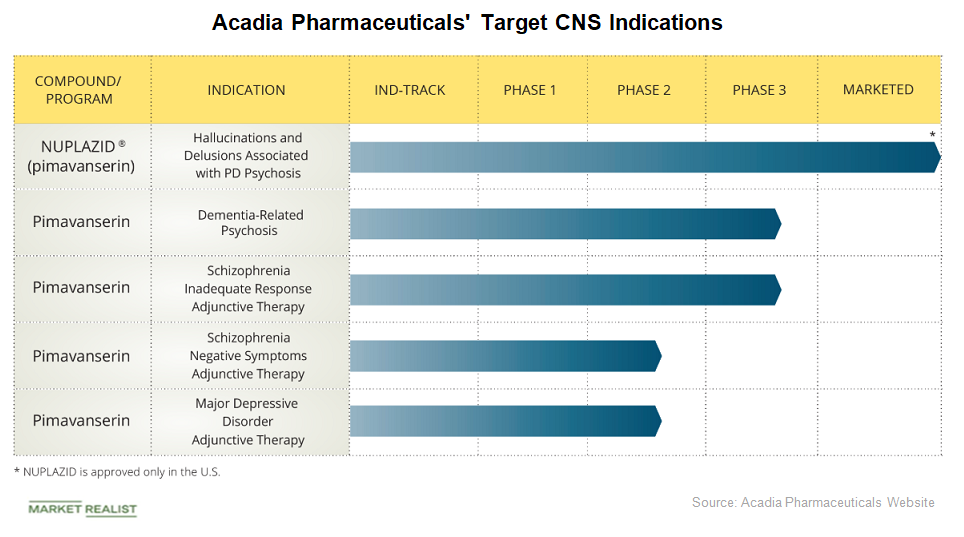

Exploring Acadia Pharmaceuticals’ Promising Research Pipeline

Acadia Pharmaceuticals’ Nuplazid is commercialized in the US market for the treatment of hallucinations and delusions related to Parkinson’s disease psychosis.

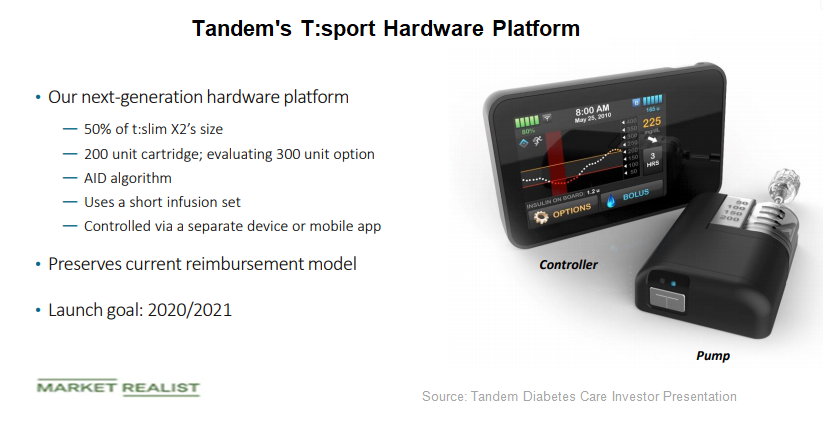

What to Expect from Tandem’s Product Pipeline

T:sport is Tandem’s next-generation hardware platform, which is expected to reduce the size of the t:slim pump by 50%.

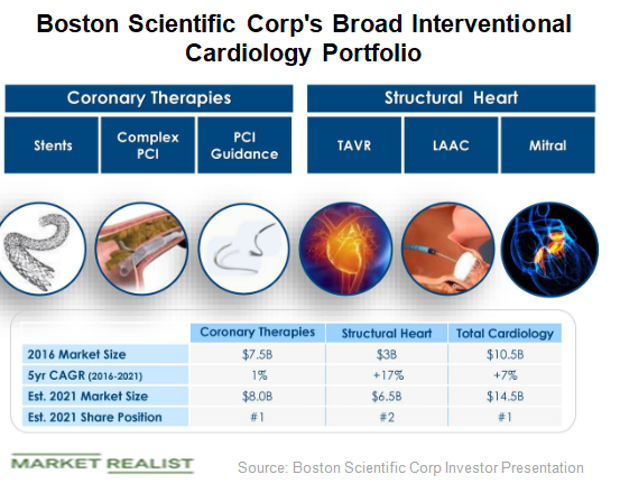

Boston Scientific’s Cardiovascular Segment: Q1 2018 Performance

Boston Scientific’s (BSX) Cardiovascular segment’s net sales increased from $851 million in Q1 2017 to $933 million in Q1 2018.

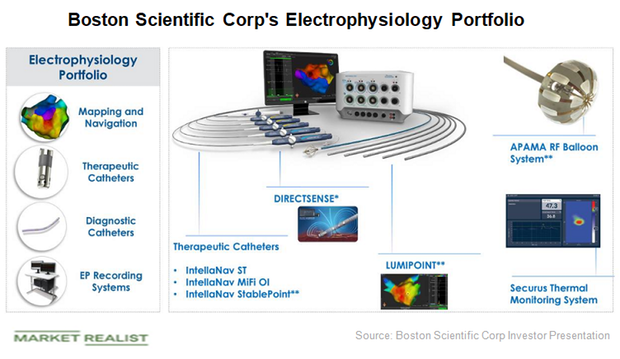

Boston Scientific’s Electrophysiology and Neuromodulation Areas

Worldwide revenues of Boston Scientific’s (BSX) electrophysiology business grew 20% from $64 million in Q1 2017 to $75 million in Q1 2018.

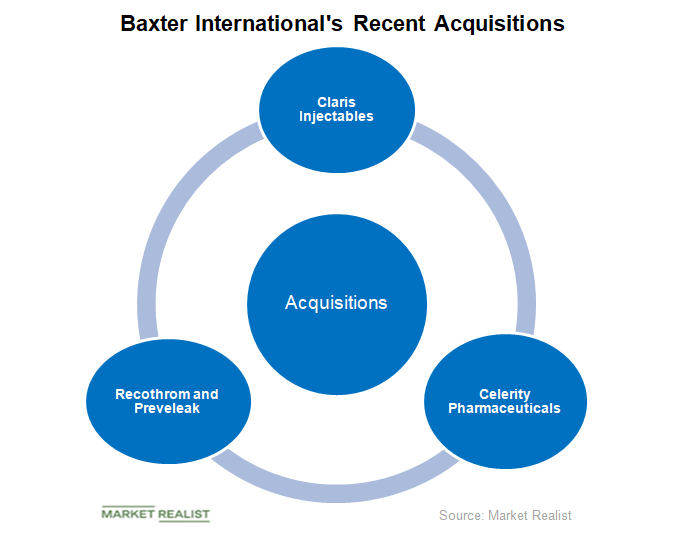

A Close Look at Baxter International’s Acquisitions

Sales from Baxter International’s (BAX) Acute Therapies rose 22%, from $106 million in Q1 2017 to $129 million in Q1 2018.

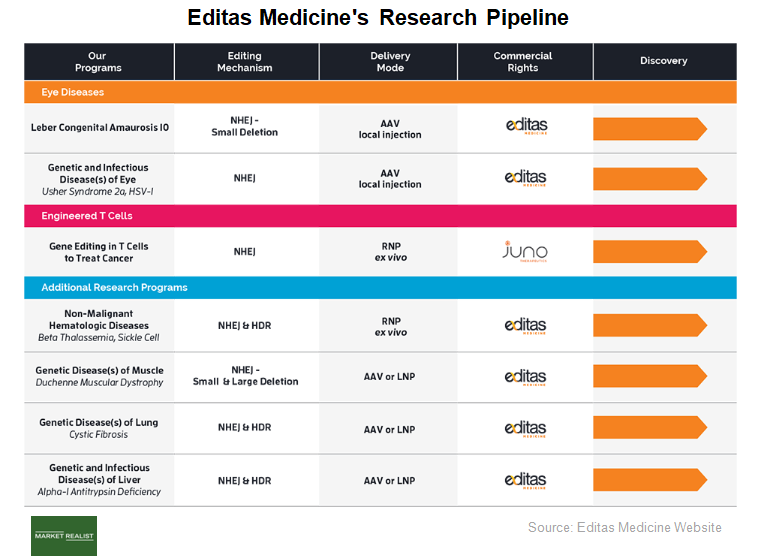

Exploring Editas Medicine’s Research Pipeline

Editas Medicine’s core capability in genome editing makes use of CRISPR technology to create molecules that can specifically edit DNA.

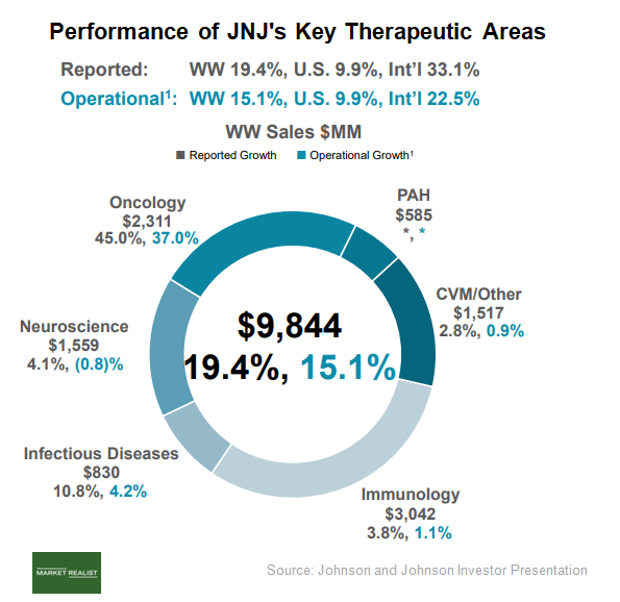

How Johnson & Johnson’s Key Therapeutic Products Have Performed

Between 1Q17 and 1Q18, Johnson & Johnson’s (JNJ) infectious disease product sales rose 10.8% from $749 million to $830 million.

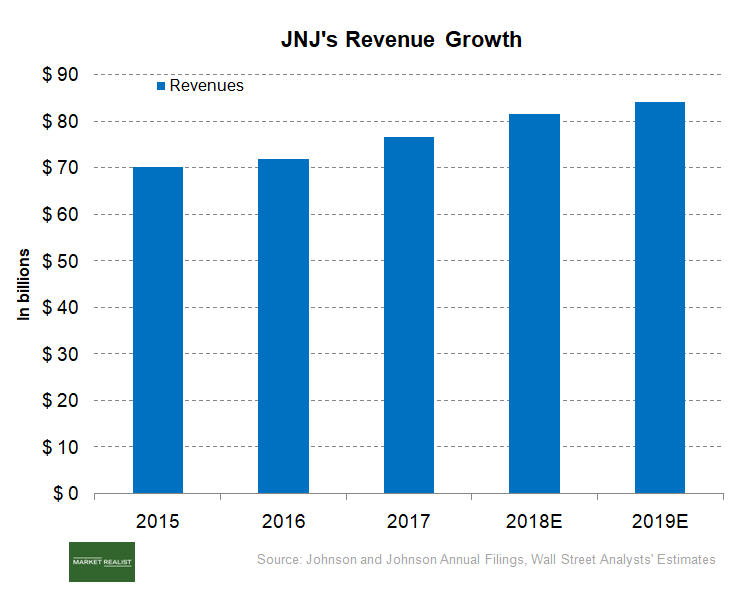

Johnson & Johnson’s Financial Performance

In 1Q18, Johnson & Johnson (JNJ) generated revenue of $20 billion, compared with $17.7 billion in 1Q17.

Analyzing Johnson & Johnson’s Geographic Performance

Johnson & Johnson (JNJ) derives revenue from four regions: the United States, Europe, the Western Hemisphere excluding the United States, and the Asia-Pacific region and Africa.

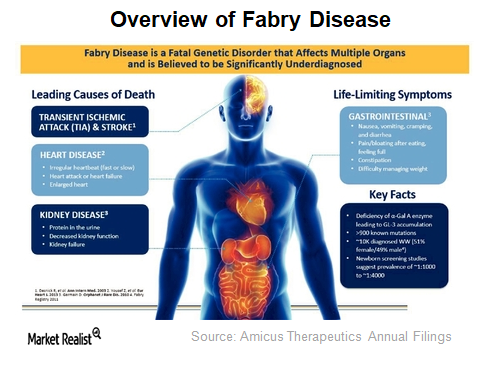

Analyzing the Market Potential for Amicus’s Galafold

According to Amicus Therapeutics, the annual incidence of the disease in newborn males is estimated to be between 1:40,000 and 1:60,000.

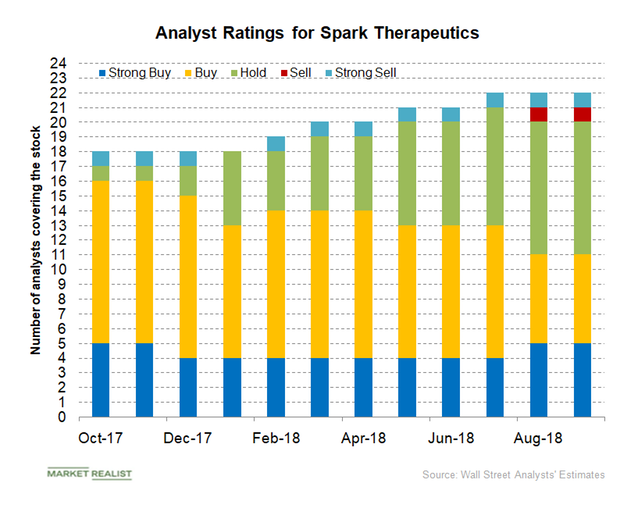

Analysts’ Ratings for Spark Therapeutics and Its Peers in April 2018

Of the 20 analysts covering Spark Therapeutics in April 2018, four have given the stock “strong buy” recommendations.

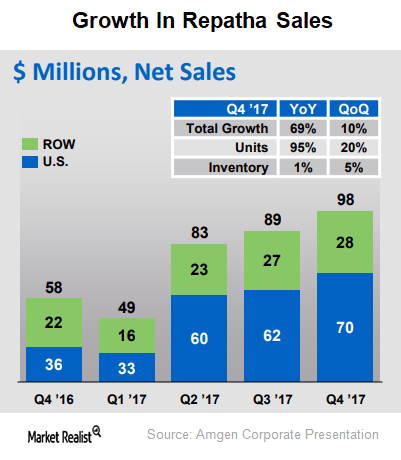

Exploring the Growth Trajectory of Amgen’s Repatha

Amgen (AMGN) is one of the world’s leading biotechnology companies, with a presence in ~100 countries.

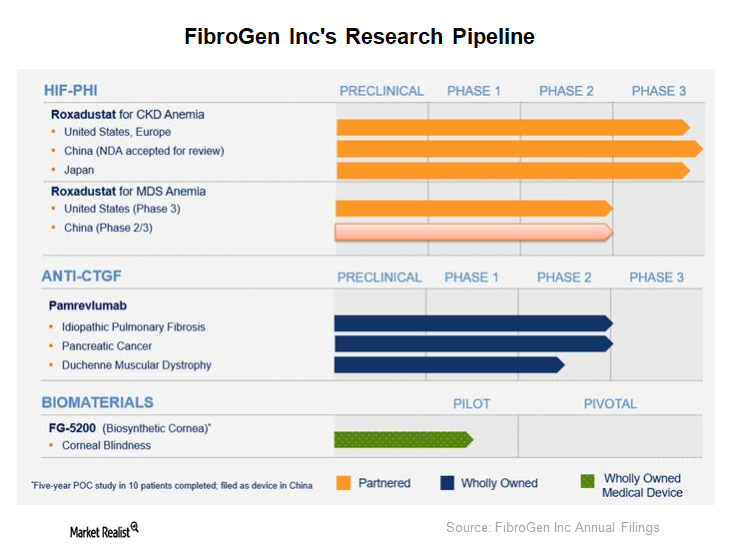

Understanding FibroGen’s Research Pipeline

Apart from Roxadustat, other products in FibroGen’s pipeline include Pamrevlumab (or FG-3019) and FG-5200.

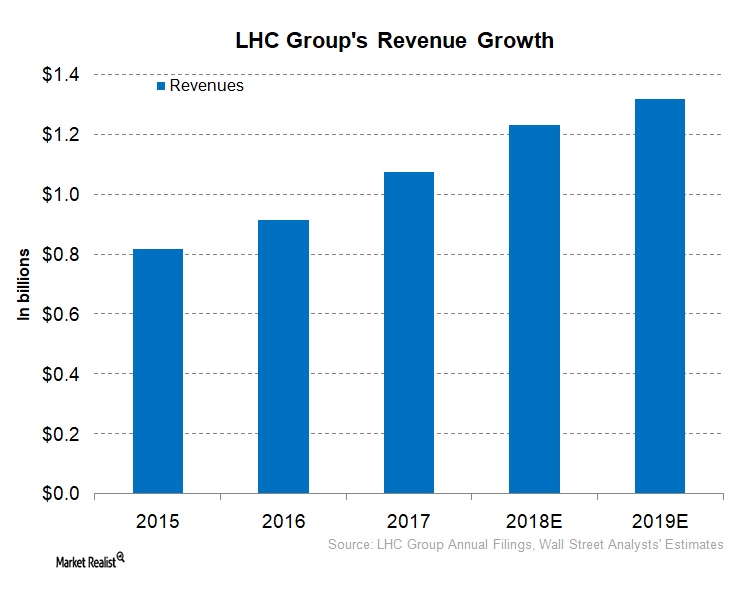

What’s LHC Group’s Business Strategy?

In 2018, LHC Group is expected to report revenue of $1.2 billion. What about its peers?

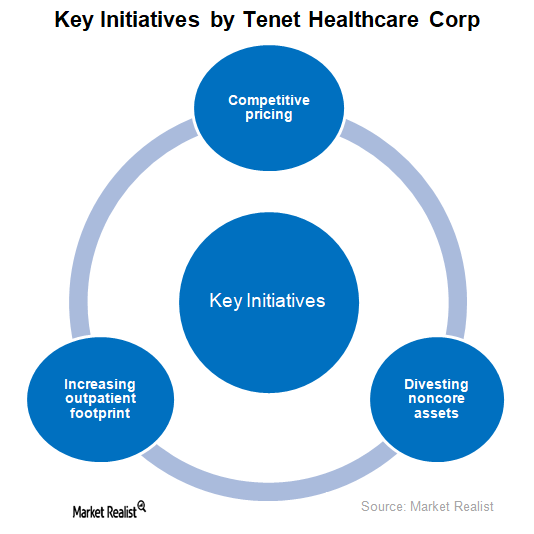

Understanding Tenet Healthcare’s Business Strategy

To better position itself and compete effectively in this evolving healthcare environment, Tenet Healthcare has taken a number of steps.

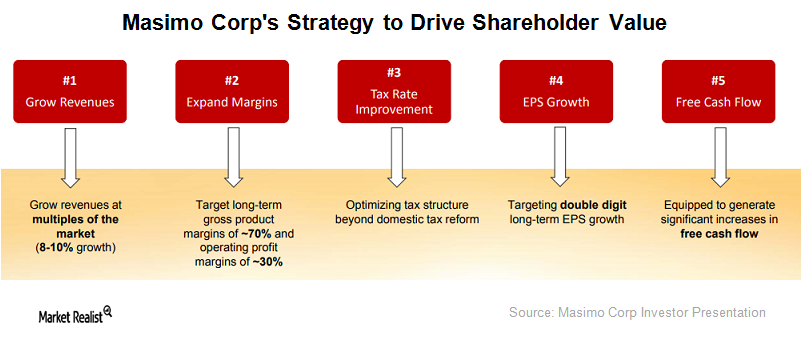

What’s Masimo’s Business Strategy?

Masimo’s future growth strategy is focused on international expansion opportunities in Europe, Asia, Asia-Pacific, the Middle East, and Latin America.

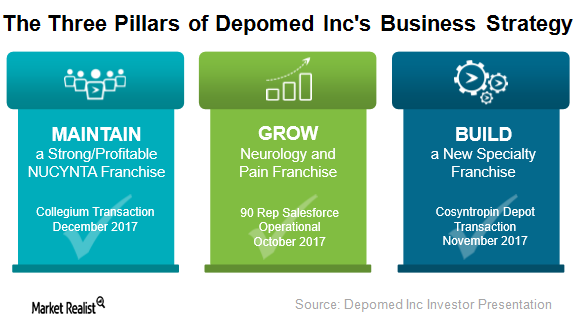

Behind Depomed’s Business Strategy

Depomed (DEPO) has adopted a three-pronged business strategy with three key elements: maintain, build, and grow.

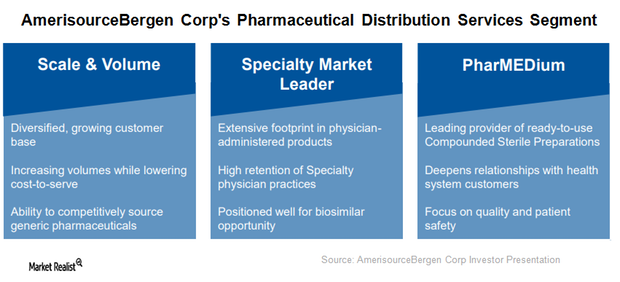

AmerisourceBergen’s Business Segments

AmerisourceBergen’s (ABC) operations are organized based on the products and services it provides to customers.

Analyzing Boston Scientific’s Business Segments

Boston Scientific (BSX) operates in three business segments that cater to seven different product categories.

The Geographic Segments of Integer Holdings Corporation

Integer Holdings Corporation provides custom battery packs to energy, military, and environmental markets for use in extreme environments.

Edwards Lifesciences’ Strong Product Portfolio Bodes Well

Edwards Lifesciences’ (EW) products can be categorized into three therapeutic areas: transcatheter heart valve, surgical heart valve, and critical care.

How Has Universal Health Services Fared Compared to Peers?

Between November 22 and February 21, Universal Health Services stock has risen 19% to reach $117.

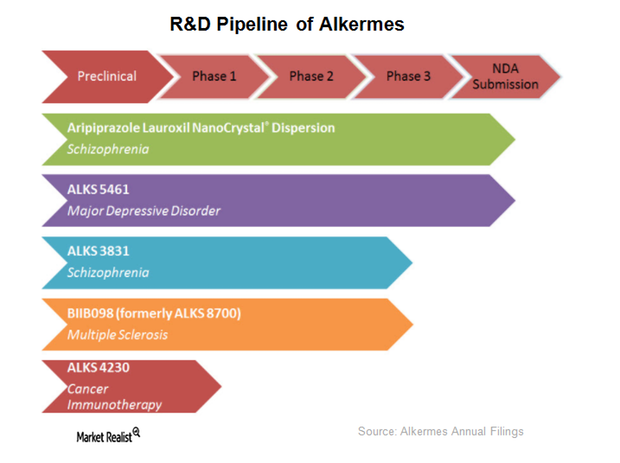

An Insight into Alkermes’ R&D Pipeline

Alkermes’ ALKS3831 is an investigational oral medicine is targeted for the treatment of schizophrenia.

A Look at Vanda Pharmaceuticals’ Product Portfolio

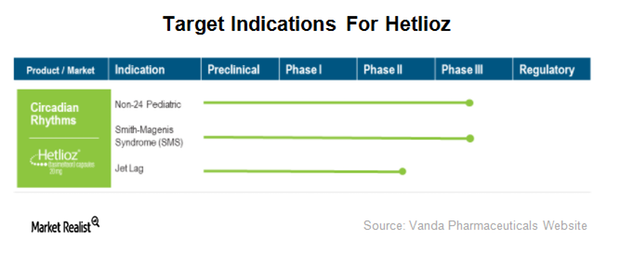

Vanda Pharmaceuticals’ (VNDA) Hetlioz was approved by the FDA in January 2014 for the treatment of Non-24-Hour Sleep Wake Disorder.

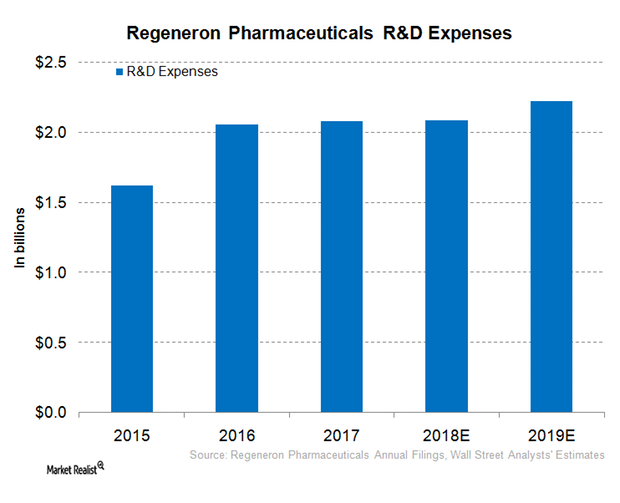

A Look at Regeneron Pharmaceuticals’ Product Pipeline

Regeneron Pharmaceuticals (REGN) currently has 15 products in clinical development.

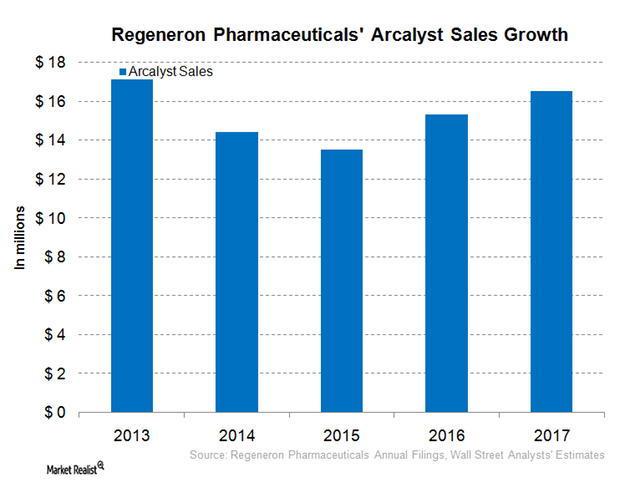

Regeneron Pharmaceuticals’ Kevzara, Arcalyst, and Zaltrap

In January 2017, Regeneron Pharmaceuticals’ (REGN) Kevzara was approved in Canada for the treatment of patients with active rheumatoid arthritis.

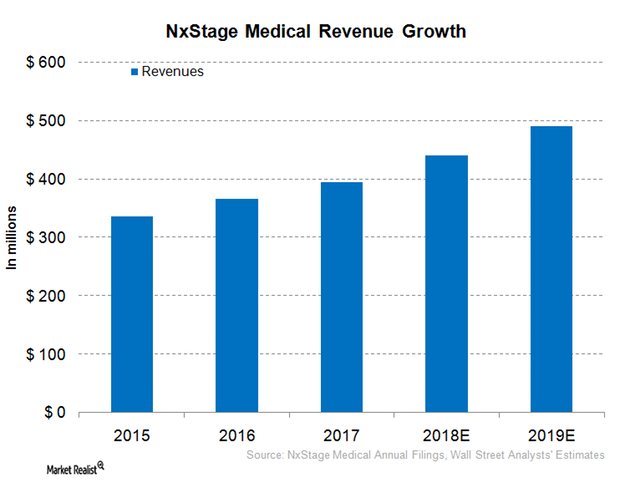

A Look at NxStage Medical’s Financial Performance

NxStage Medical (NXTM) generated revenue of $393.9 million in 2017 compared to $366.3 million in 2016.