Understanding Varian Medical Systems’ Business Segments

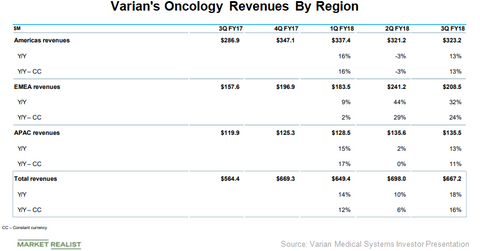

Revenues from the Oncology Systems segment increased from $564.4 million in fiscal Q3 2017 to $667.2 million in fiscal Q3 2018.

Aug. 22 2018, Updated 8:09 a.m. ET

Segment performance

Varian Medical Systems (VAR) operates in two business segments: Oncology Systems and Varian Particle Therapy (or VPT). The Oncology Systems segment includes conventional radiotherapy and advanced treatments for cancer such as fixed-field intensity-modulated radiation therapy (or IMRT), image-guided radiation therapy (or IGRT), volumetric modulated arc therapy (or VMAT), stereotactic radiotherapy and body radiotherapy, and software products. The VPT segment manufactures and commercializes products for delivering proton therapy for the treatment of cancer.

Revenues from the Oncology Systems segment, which contributes significantly to the company’s top line, increased from $564.4 million in the third quarter of fiscal 2017 to $667.2 million in the third quarter of fiscal 2018. Revenues from the VPT segment, on the other hand, decreased from $68.4 million in the third quarter of 2017 to $41.9 million in the third quarter of 2018.

Varian has been witnessing an increased portion of revenues from services and software licenses, which offer higher gross margins than hardware products.

Operating income from Oncology Systems increased from $104.3 million in the third quarter of 2017 to $125.6 million in the third quarter of 2018. On the other hand, the VPT segment incurred an operating loss of $10.1 million in the third quarter of 2018 compared to an operating loss of $12.4 million in the third quarter of 2017.

Geographic segments

Varian Medical Systems generates revenue from three geographic regions: the Americas (United States, Canada, and Latin America), EMEA[1. Europe, the Middle East, and Africa] (includes Europe, Russia, the Middle East, India, and Africa), and APAC[1. Asia-Pacific] (includes Australia and East and Southeast Asia).

In the next part, let’s look at Varian Medical Systems’ product and geographic performances.