Kenneth Smith

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Kenneth Smith

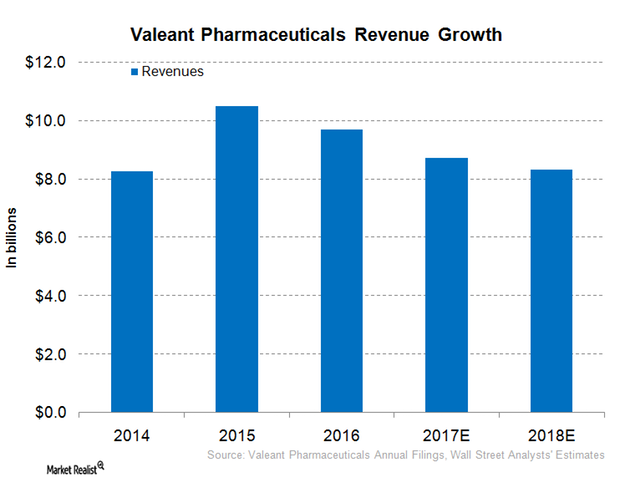

A Deeper Look at Valeant Pharmaceuticals’ Recent Financial Performance

In 3Q16, Valeant Pharmaceuticals (VRX) generated revenues of $2.4 billion, compared with $2.2 billion in 3Q17.

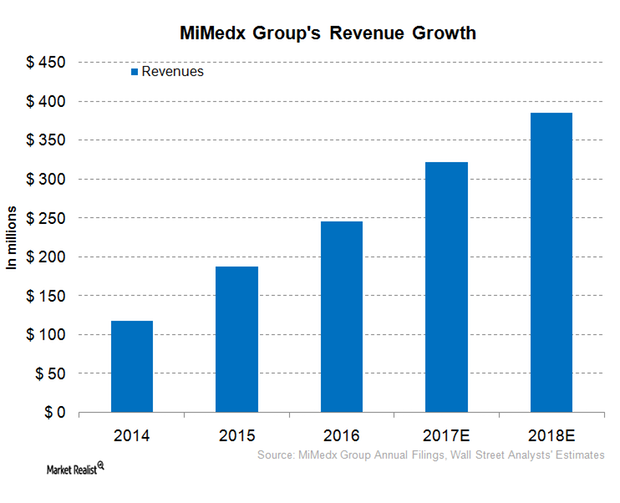

Understanding MiMedx Group’s Zealous Focus on Sales

MiMedx focuses on marketing efforts to increase revenues. The company has at its disposal a sales force of 320 professionals.

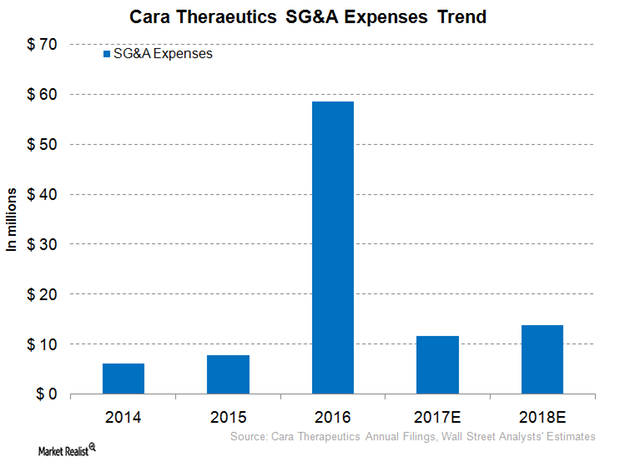

Comparing Cara Therapeutics’ Financial Performance

Financial performance In 3Q17, Cara Therapeutics (CARA) incurred $9.6 million in research and development expenses, compared with $9.1 million in 3Q16. This fall in expenses was due to a $3.1 million decrease in expenses for oral CR845’s Phase 2B clinical trial, and partially offset by increased expenses for its intravenous CR845 safety study. Meanwhile, the company’s general and administrative expenses rose from […]

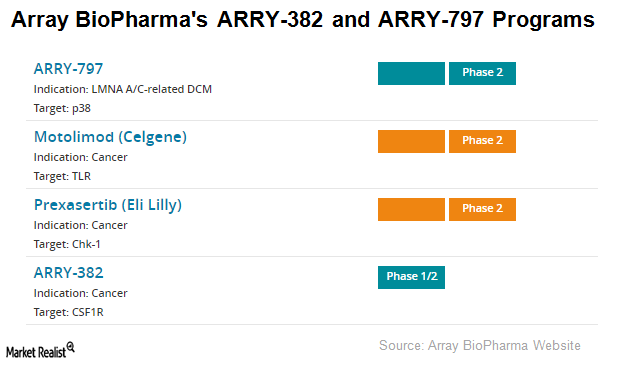

Array BioPharma’s ARRY-382 and ARRY-797

Array BioPharma (ARRY) completed its Phase 1b clinical trial of its investigational drug candidate ARRY-382 in combination with Merck’s (MRK) Keytruda for advanced tumor indications.

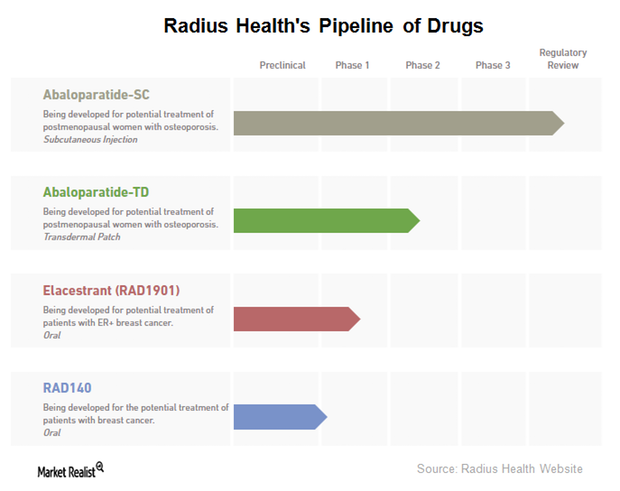

A Strong Pipeline of Drugs Bodes Well for Radius Health

The drug candidates in Radius Health’s (RDUS) pipeline include an investigational abaloparatide transdermal patch for possible use in treating women with postmenopausal osteoporosis.

What Led to Arrowhead Pharmaceuticals’ Revenue Surge in 2017?

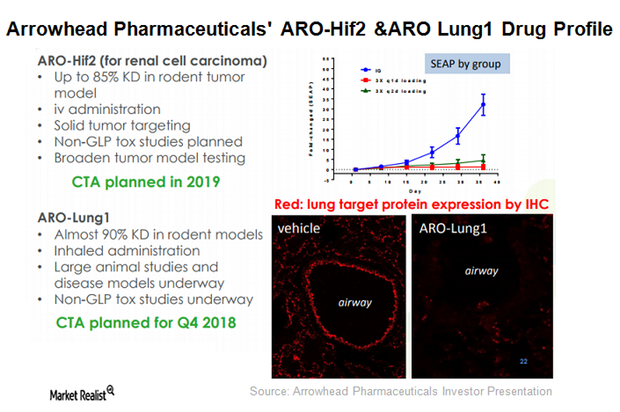

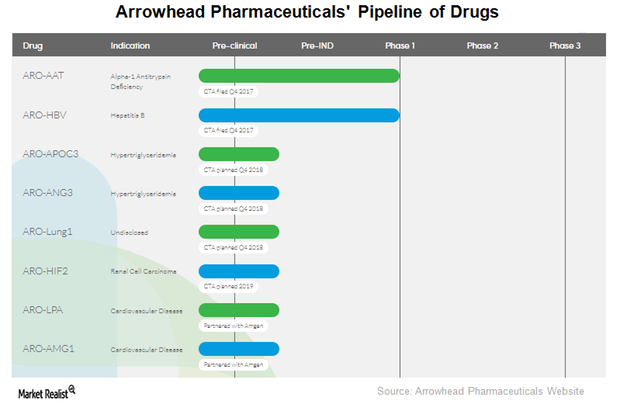

Arrowhead Pharmaceuticals’ therapeutic candidate ARO-LUNG1 is being developed for an undisclosed disease of the lung. This is the first candidate to utilize the company’s TRiM platform.

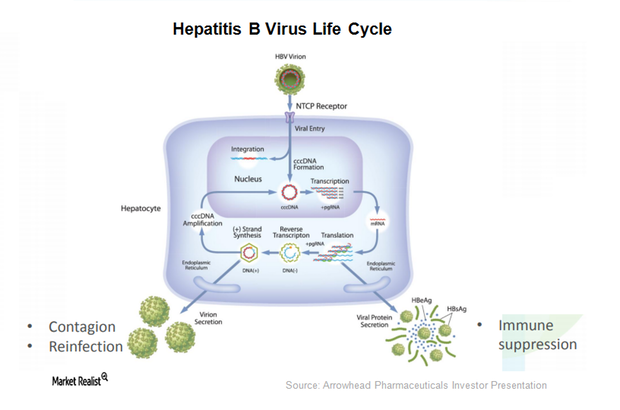

Arrowhead’s Candidates for Hepatitis B, Cardiovascular Diseases

ARO-HBV is Arrowhead Pharmaceuticals’ (ARWR) investigational drug candidate for treating chronic hepatitis B infection.

Taking a Closer Look at Arrowhead Pharmaceuticals’ TRIM Platform

Arrowhead Pharmaceuticals’ (ARWR) prior efforts were aimed at clinical programs that utilized the dynamic polyconjugate (or DPC), also called the EX1 delivery vehicle.

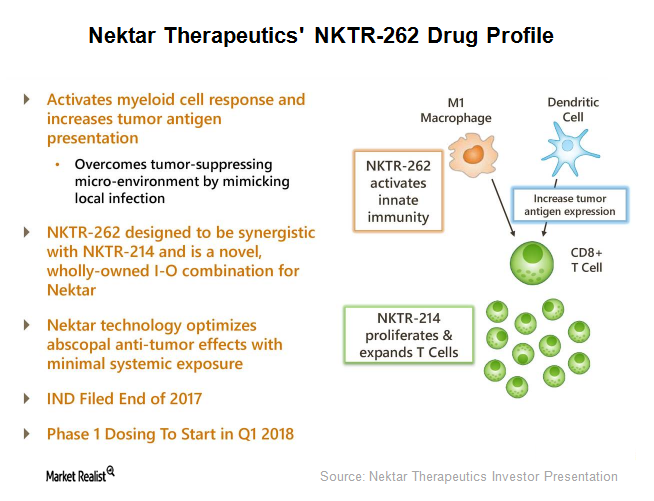

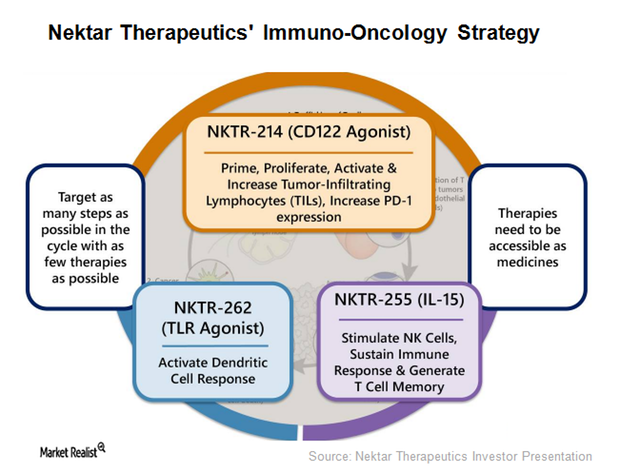

Nektar’s Deals: Daiichi Sankyo, Ophthotech, Bristol-Myers Squibb

Agreement with Daiichi Sankyo In May 2016, Nektar Therapeutics (NKTR) entered into a collaboration and licensing agreement with Daiichi Sankyo, under which Nektar granted exclusive commercialization rights for its product candidate, Onezeald, to Daiichi Sankyo in Europe. Onezeald is a long-acting topoisomerase-1 inhibitor in clinical development for treating adult patients with advanced breast cancer. Nektar […]

A Deeper Look at Nektar Therapeutics’ Licensing Agreements

License and collaboration agreements Nektar Therapeutics (NKTR) has entered into a number of licensing and collaboration agreements for research, development, and commercialization with various healthcare companies, including Eli Lilly (LLY), AstraZeneca (AZN), and Amgen (AMGN). Under these agreements, Nektar is entitled to receive license fees, milestone payments, royalties, and payments for manufacturing and supplying Nektar’s […]

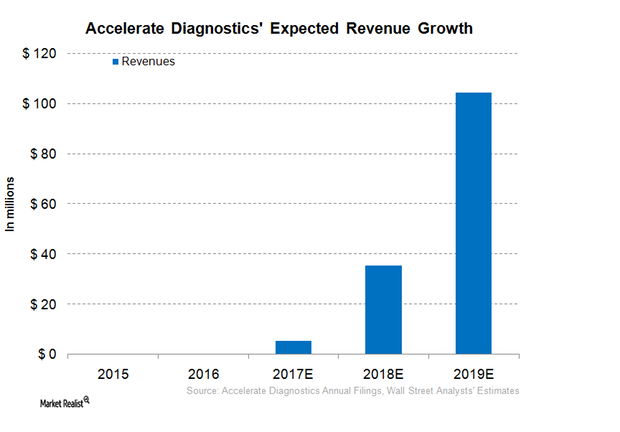

Does Accelerate Diagnostics’ Financial Performance Bode Well?

The net sales of Accelerate Diagnostics (AXDX) increased from $24,000 in 3Q16 to $828,000 in 3Q17.

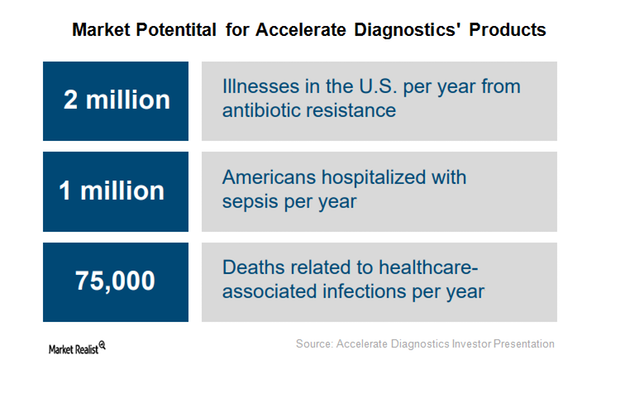

What’s the Potential Market for Accelerate Diagnostics’ Products?

Accelerate Diagnostics’ (AXDX) pheno system utilizes genotypic and phenotypic technology to identify infectious pathogens and perform antibiotic susceptibility tests.

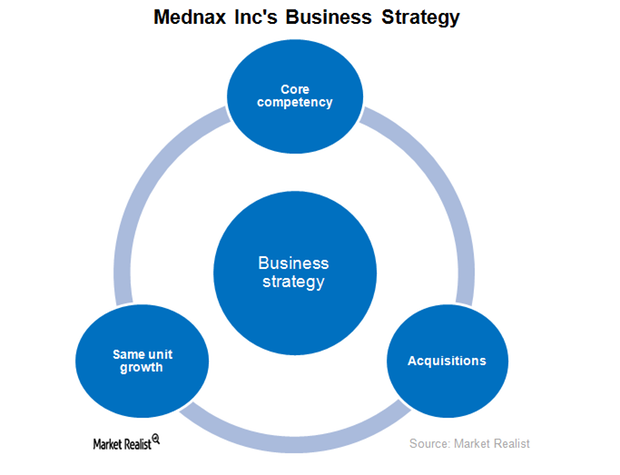

A Closer Look at Mednax’s Business Strategy

Mednax (MD) has a proven track record of expertise in the administration of physician services and a methodical approach to clinical data warehousing in fields such as research, education, and quality.

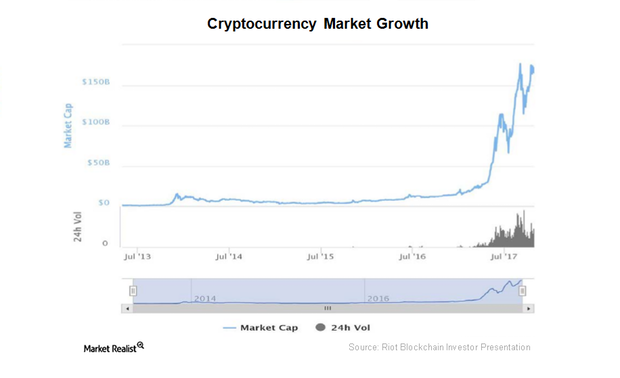

Taking a Look at Riot Blockchain’s Kairos Acquisition

Riot Blockchain stock has seen a strong upsurge in the past few days. It has risen from $4 to $25 in the past six months.

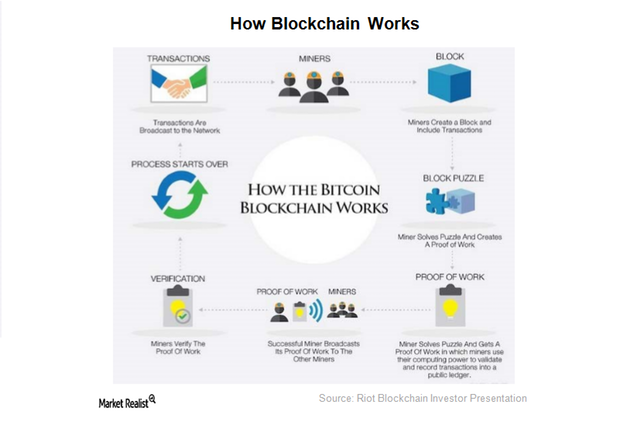

Riot Blockchain and Its New Business Model

From diagnostic equipment, Riot Blockchain pivoted to investing in companies that have exposure to digital currencies and the underlying blockchain technology.