David Meyer

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From David Meyer

July’s US Retail Sales Meet Estimates

On August 13, 2015, US retail sales came in at expected levels for July. The increase in the retail sector was broad-based.

Analyzing the BoJ’s Monetary Policy Enhancement Measures

The BoJ’s monetary policy was the most awaited macro event this week. It was the first major central bank to expand its easing program after the Brexit vote.

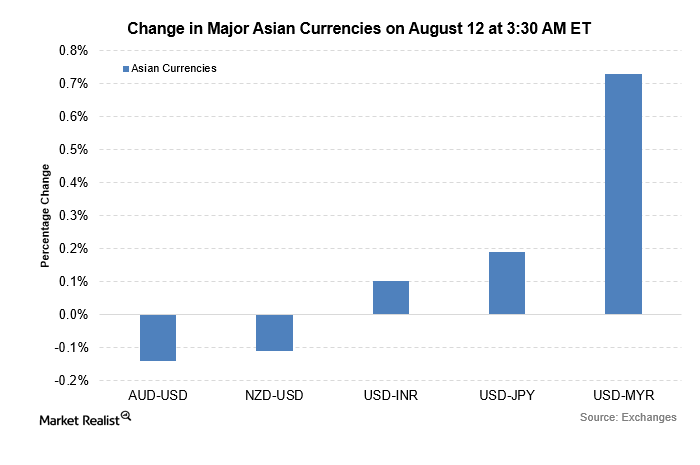

Notable Gainers and Losers among Major Currency Pairs

Major Asian currency pairs were trading on a negative bias against the US dollar on August 12, 2016. The US dollar broadly rose against the other currencies.

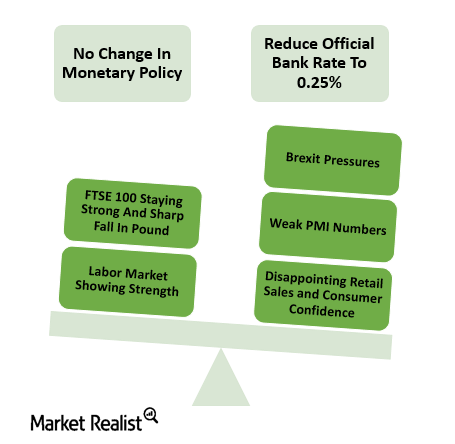

Why the Bank of England Decided to Keep Rates Unchanged

The Bank of England kept interest rates unchanged at 0.5%. The asset purchase program was also unchanged at 375 billion pounds.

Global Central Bank Leaders Meet to Calm Market Jitters

Central banks met in Basel during the Bank of International Settlement’s annual meeting. They discussed how to control the impact of Brexit on the global economy.

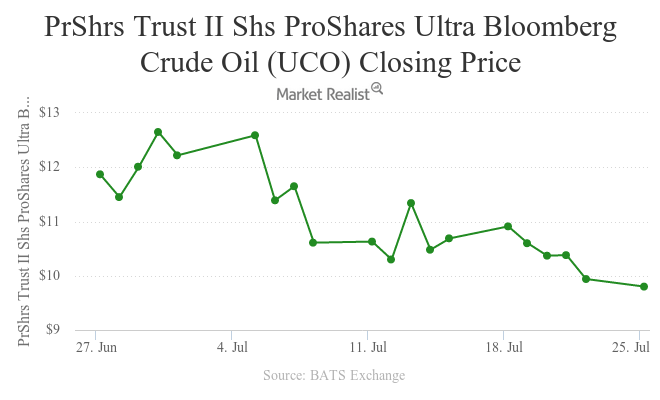

Sharp Fall in Crude Oil Price Dictate the Currencies Markets

Looking at the performance of the major commodity-driven currencies on July 25, the Nigerian naira was the biggest casualty.

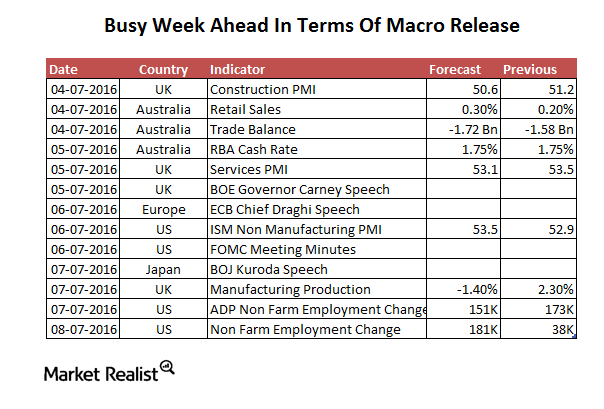

Why Employment Numbers Are this Week’s Center of Attention

Strong non-farm employment required to maintain any rate hike hopes Non-farm employment changes are one of the most important indicators the US Fed considers in deciding on monetary policy. May non-farm employment changes hit a multi-year low, which took away all probabilities of a June hike. Check out the following article for further detail on May’s […]

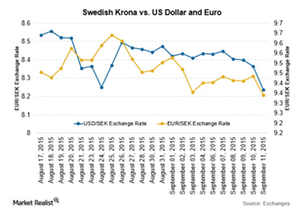

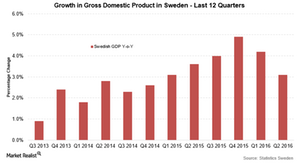

Swedish Krona Gains on Positive Growth Figures

The Swedish krona gained by more than 1.5% against the US dollar and 1.0% against the euro on September 11, 2015, as the economy grew at a faster rate than expected in 2Q15.

Russian GDP Continues to Fall, Taiwan’s Export Orders Drop

The Russian economy fell by 0.6% on an annual basis in July—compared to Market expectations of a 1.0% decline and lower than a decline of 0.5% in June.

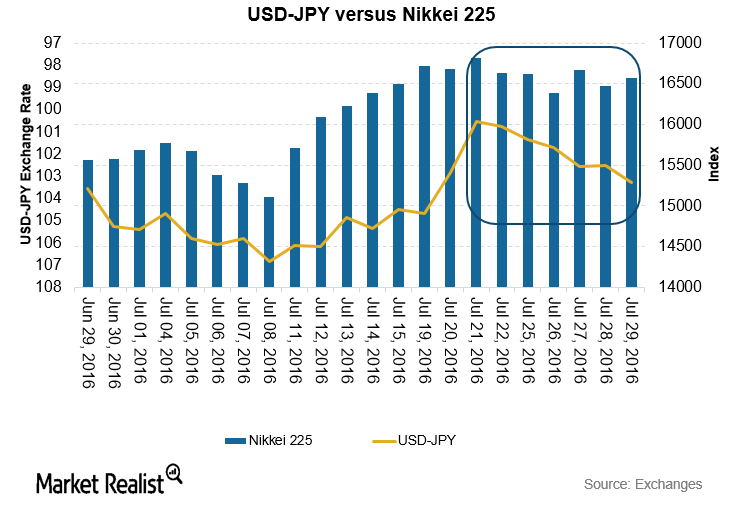

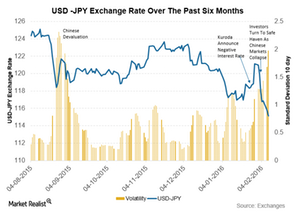

Why the High Volatility of the Japanese Yen in Recent Months?

The US dollar–Japanese yen currency pair has been one of the most volatile developed country currencies in the past six months. The Japanese yen saw heavy appreciation in August.

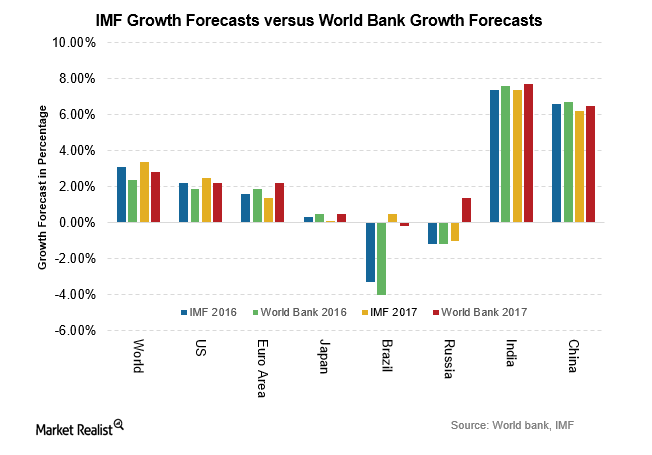

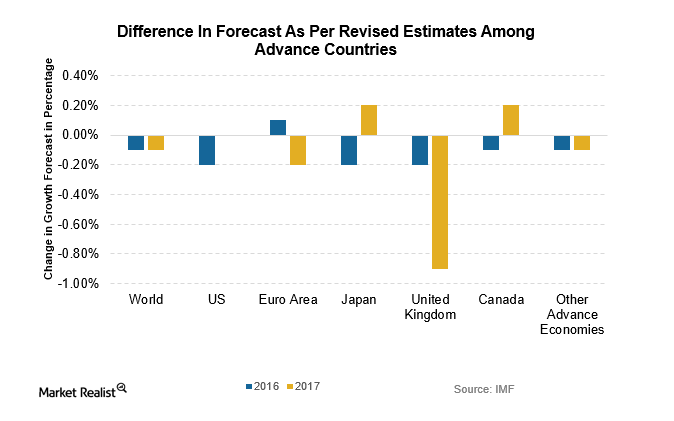

Outlook Projections: IMF Cuts Global Growth Forecasts

The IMF cut its global economic growth forecasts, according to the latest IMF World Economic Output Update dated July 19. The cut in forecasts was expected.

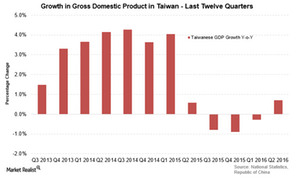

Taiwan’s Economy Expands, Bank Indonesia Keeps Rates Unchanged

Taiwan’s economy rose by 0.7% on an annual basis in 2Q16—compared to a contraction of 0.29% in the previous quarter and slightly above estimated forecasts.

Japanese Trade Surplus Rose in June, Imports Fell More than Exports

The trade surplus for Japan increased to 692.8 billion yen for June—compared to a deficit of 60.9 billion yen in the same month last year.

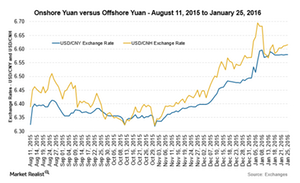

Spread Reducing between Onshore and Offshore Yuan

The spread between the offshore and onshore yuan creates arbitrage opportunities for traders as the value diverges between the two currencies.

Why Are Global Markets Range Bound?

The contrasting movement among the global markets was primarily due to caution ahead of the Bank of England’s monetary policy release on July 14.

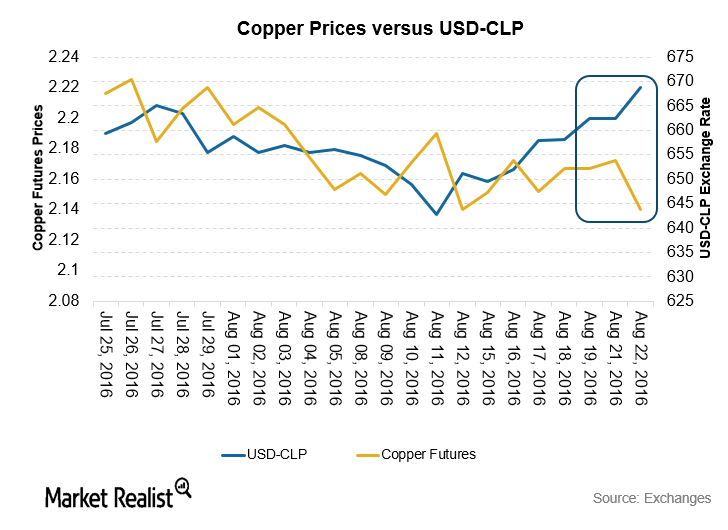

Why Are Falling Copper Prices Pressuring the Chilean Peso?

Copper futures prices fell by 1.5% on August 22, 2016. The Chilean peso has a high correlation to copper prices—copper is Chile’s major export.

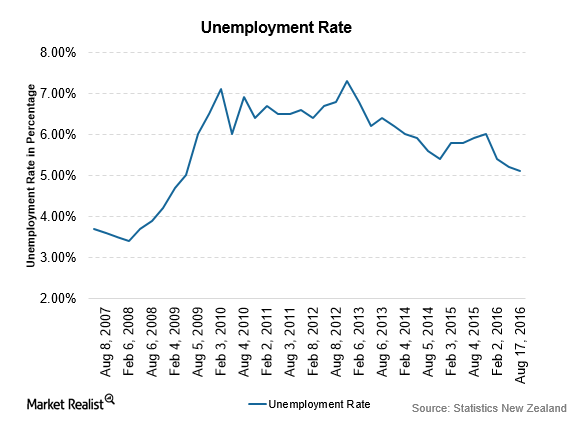

New Zealand Employment Reports Should Be Viewed with Caution

Given the two major changes brought about by Statistics New Zealand, markets should view this unemployment release as a benchmark for upcoming releases.

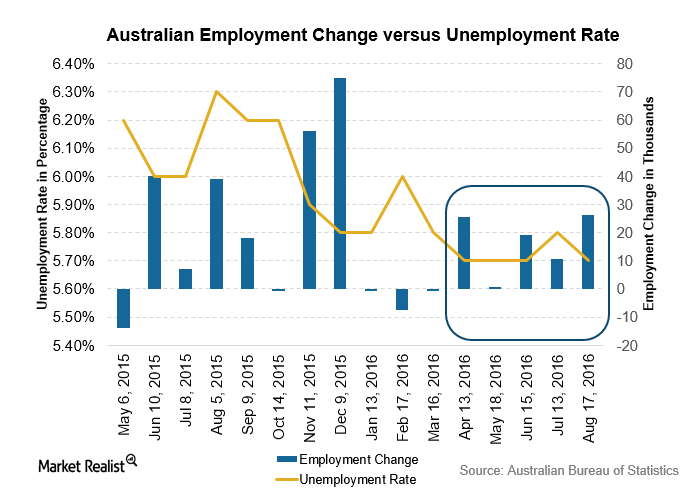

Australian Unemployment Fell: Is More Easing Needed?

The Australian Bureau of Statistics published the employment report for July on August 18, 2016. The unemployment rate fell by 0.1% to 5.7%.

RBA Minutes Exhibit Dovish Bias, Wholesale Prices Rise in India

The RBA released its minutes. Inflationary pressures were subdued—noted by a sluggish rise in consumer prices in Australia of 1% in 2Q16.

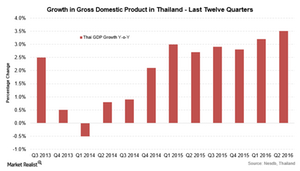

Thailand’s GDP Strengthens, Trade Surplus Narrows for Indonesia

Thailand’s economy rose by 3.5% on an annual basis in 2Q16. The GDP rose at the fastest pace since 1Q13. On a quarterly basis, its GDP grew by 0.8% in 2Q16.

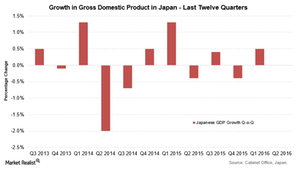

Japan’s Economy Exhibits Flat Growth, Abe Feels the Pressure

Japan’s economy showed no growth on a quarterly basis in 2Q16—compared to growth of 0.5% in the previous quarter and forecasts of a 0.2% expansion.

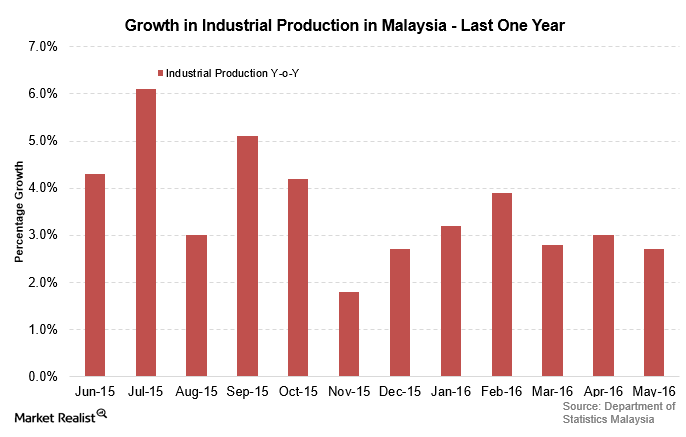

Malaysian GDP Grew Slower, Inflation Beat Expectations in India

The Malaysian economy grew by 4.0% on an annual basis in 2Q16—in line with estimated forecasts and against 4.2% growth recorded in 1Q16.

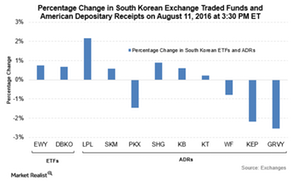

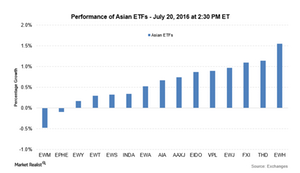

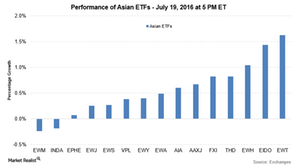

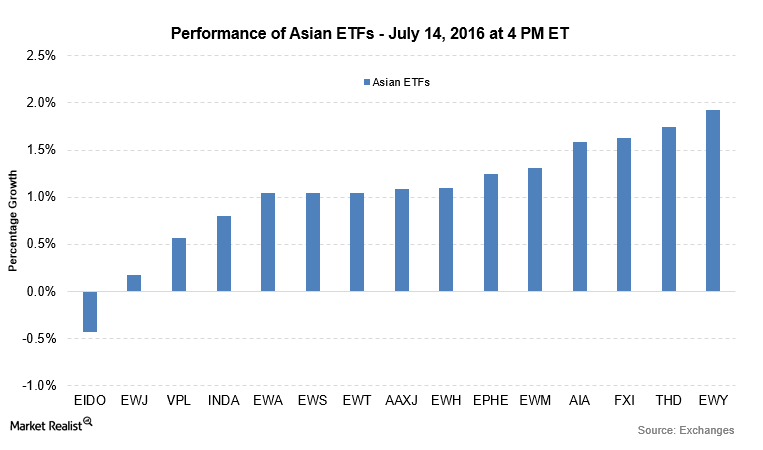

Bank of Korea Keeps Rates Unchanged, Asian ETFs Trade Positive

South Korea’s monetary policy committee kept the benchmark interest rate unchanged at a record low of 1.3%—in line with expectations.

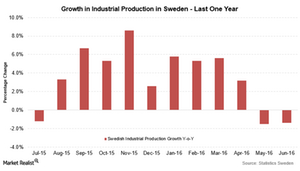

Why Did Swedish Industrial Production Fall?

Swedish industrial production fell by 1.4% in June on an annual basis—compared to a 1.5% drop in the previous month.

China’s Trade Surplus Expands, Australian Indices Still Rise

China’s trade surplus widened to $52.3 billion in July from $48.1 billion in the previous month. It’s expected to narrow to $47.6 billion.

Inflation Rises in Taiwan, Indonesian GDP Beat Expectations

The inflation rate in Taiwan rose by 1.2% in July on an annual basis—above expectations of 1.1% growth and last month’s rise of 0.91% in consumer prices.

Manufacturing PMI Releases across Asian Economies, China Struggles

The official manufacturing PMI for China, published by the National Bureau of Statistics of China, came in at 49.9 for July—slightly below June’s reading of 50.

Scandinavian Macroeconomic Data Are below Expectations

Sweden’s economy expanded by 3.1% on an annual basis in 2Q16—compared to 4.2% growth in the previous quarter and below expectations of 3.7% growth.

EWA Rises despite Lower Growth in Export and Import Prices

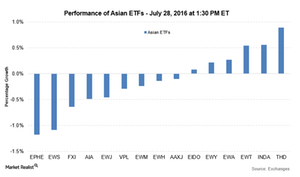

Recently, the trade surplus for Thailand increased as imports fell lower than exports in the Thai economy. THD rose by 0.81% at 1:30 PM EST on July 28.

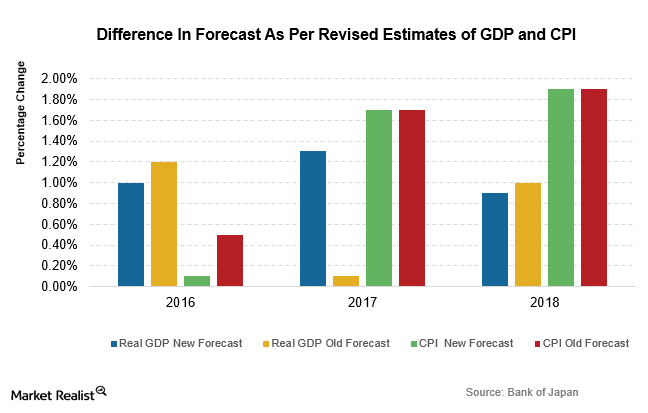

What Are the BoJ’s Projections for Economic Activity in Japan?

The Bank of Japan gave its economic outlook after the monetary policy meeting on July 29. The weak data are due to the slowdown in emerging economies.

Inflation Levels in Australia Exhibit a Sluggish Increase

Inflation levels in Australia rose by 1.0% in 2Q16—slightly below estimated forecasts of a 1.1% rise and softer than the previous quarter’s rise of 1.3%.

Why Did Singapore’s Industrial Production Fall?

Singapore’s industrial production fell on an annual basis by 0.3% in June—compared to a rise of 0.8% in the previous month and expectations of a 0.2% fall.

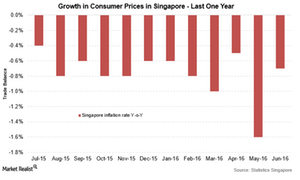

Inflation Levels Fall in Singapore, Malaysian Unemployment Rate Falls

The inflation rate in Singapore fell by 0.7% on an annual basis in June after a 1.6% drop in May and estimated forecasts of a contraction of 1.1%.

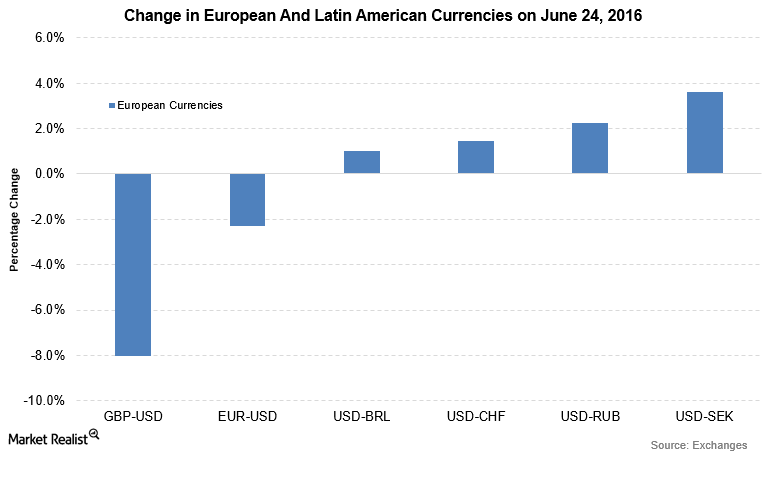

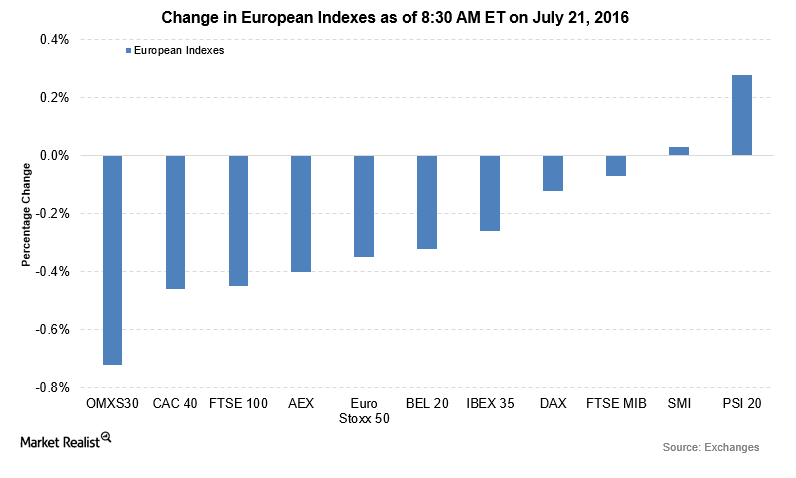

Monetary Policy Statement: Why the ECB Kept Rates Unchanged

The ECB decided to keep the key rates unchanged in the monetary policy review on July 21, 2016. The pound was the major loser among the currencies.

Inflation Levels in Malaysia Ease, Taiwanese Export Orders Drop

The inflation rate in Malaysia increased by 1.6% on an annual basis in June—compared to 2.0% in the previous month and below forecasts of 1.6%.

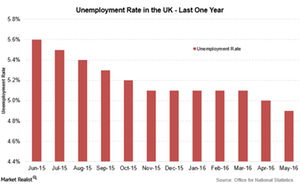

UK Unemployment Rate Improves, Brexit Concerns Remain

The unemployment rate in the United Kingdom reached 11-year low levels as the jobless rate fell to 4.9% for the period from March to May.

Why Were the United Kingdom’s Growth Forecasts Slashed?

Looking at the change in growth forecasts in advanced economies, the United Kingdom suffered the largest downward revision of estimates.

Australian Dollar Rises ahead of the RBA’s Minutes

The Australian dollar could gain more if the RBA doesn’t provide a strong hint of cutting interest rates. The central bank is concerned about economic growth.

Asian Markets Rise as Investors Focus on Chinese GDP Release

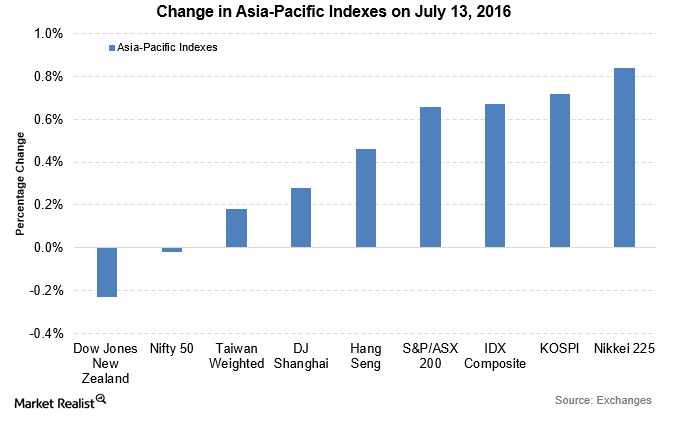

On a quarterly basis, the advance GDP for Singapore rose by 0.8%, marginally below estimated forecasts of 0.9%.

Central Bank of Malaysia Cuts Rates by 25 Basis Points

The Central Bank of Malaysia unexpectedly reduced the benchmark interest rate by 25 basis points to 3% on July 13—bringing the rates to two-year low levels.

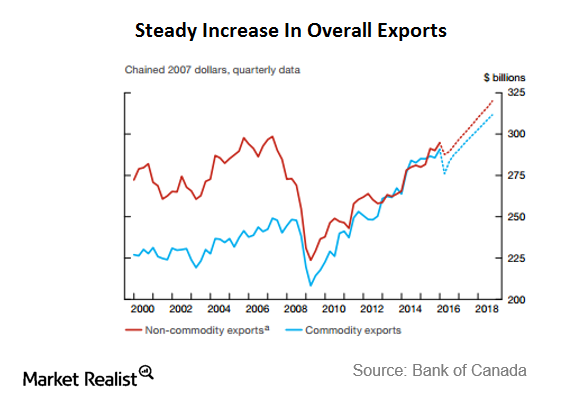

Major Takeaways from the Bank of Canada’s Monetary Policy

The Bank of Canada decided to keep the interest rates unchanged at 0.5% after the monetary policy meeting on July 13.

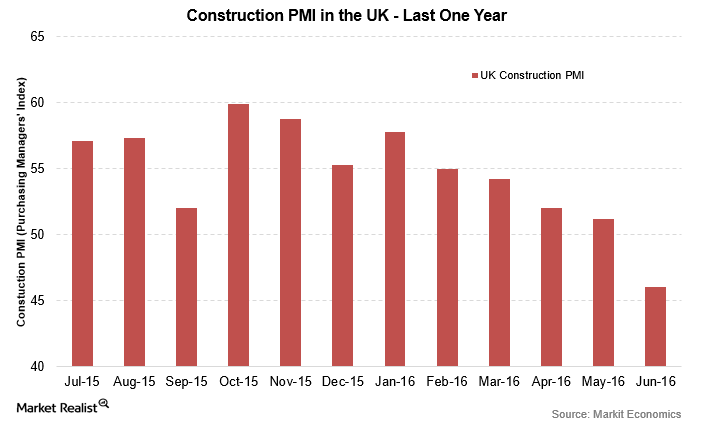

UK Construction PMI Contracts Due to Uncertain Brexit Implications

The United Kingdom’s construction PMI (purchasing managers’ index) came in at 46 for June—compared to 51.2 in the previous month.

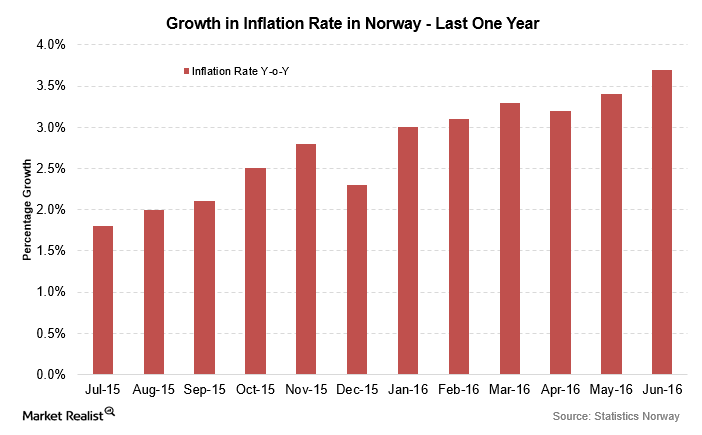

Scandinavian Indexes Rally as Inflation Rises in Norway and Denmark

The Scandinavian indexes were trading on a higher note towards the end of the day on July 11 following higher inflation numbers in Scandinavian countries.

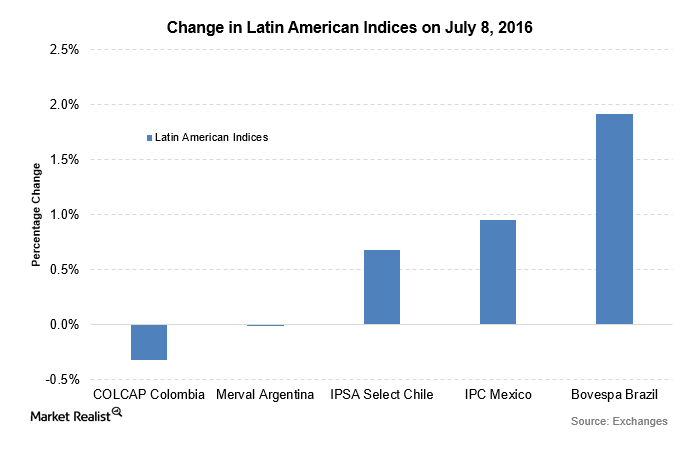

Latin American Markets Rise as Inflation Levels Ease in Brazil

Latin American markets were trading higher on July 9—taking cues from other emerging markets. Brazil’s inflation rate was released lower at 8.8% in June.

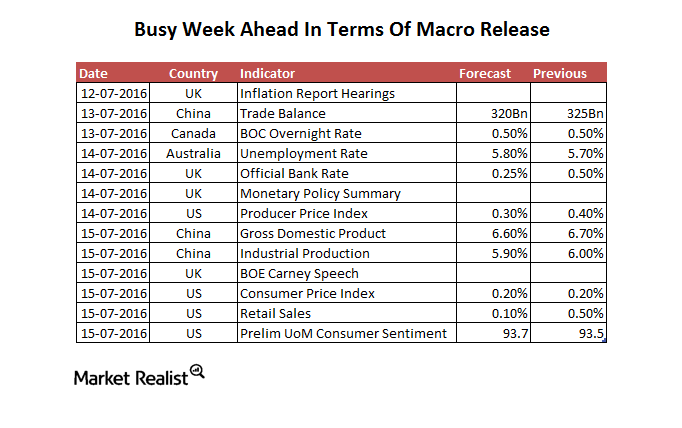

BOE Monetary Policy Will Be the Highlight This Week

The BOE is scheduled to release it monetary policy on July 14—the first after the United Kingdom decided to leave the European Union in a historic referendum.

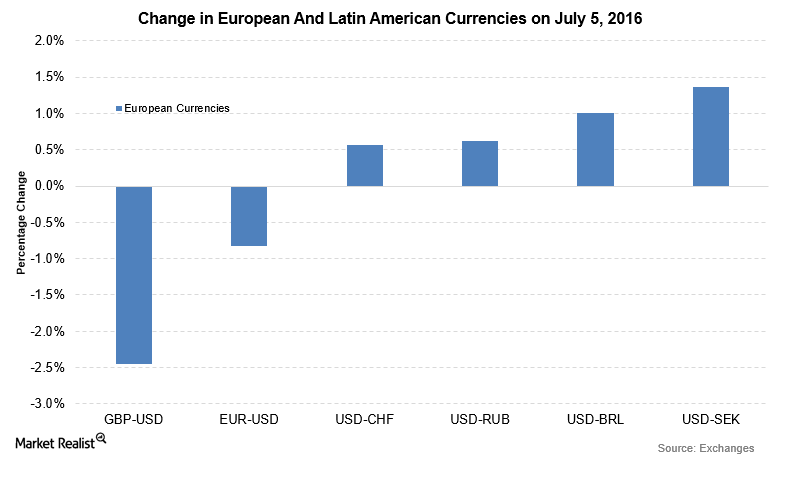

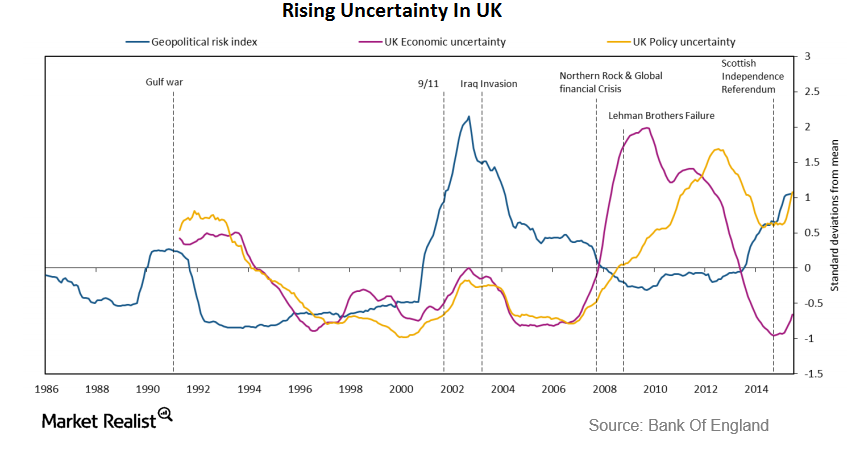

Why Did the Bank of England Relax Regulatory Requirements?

The BOE (Bank of England) released the Financial Stability Report on July 5, 2016. It warned multiple times about the repercussions of a Brexit.

Weak Data Puts Downward Pressure on European Indexes

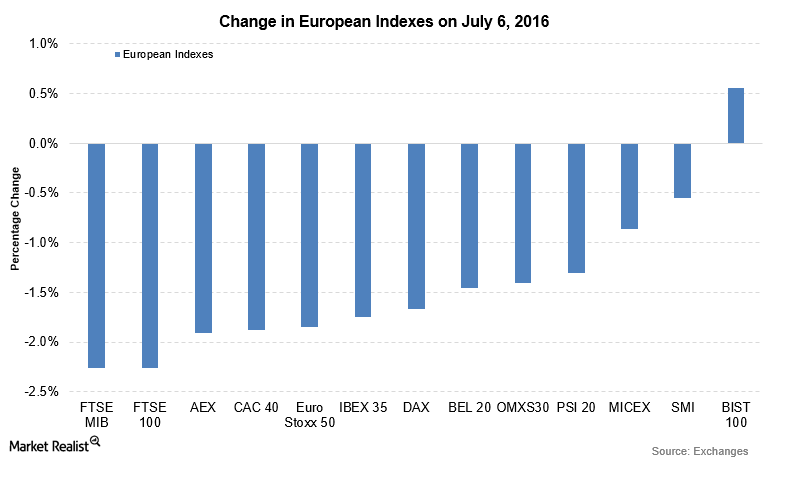

On July 6, major European indexes were trading lower for the second day. The fall in the indexes was led by the Italian FTSE MIB and the UK-based FTSE 100.

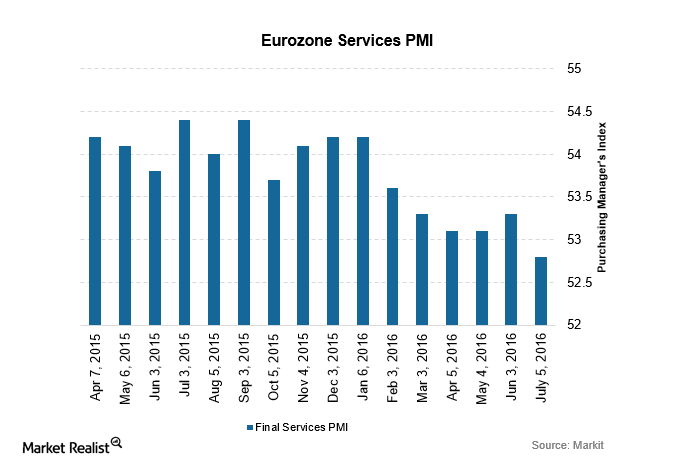

Contrasting Services PMI from the Eurozone and the UK

The composite PMI came out at 53.1—above the flash estimates of 52.8. The rise was primarily due to the rise in manufacturing production.

Asian Markets Rise as Australian Housing Data Disappoint

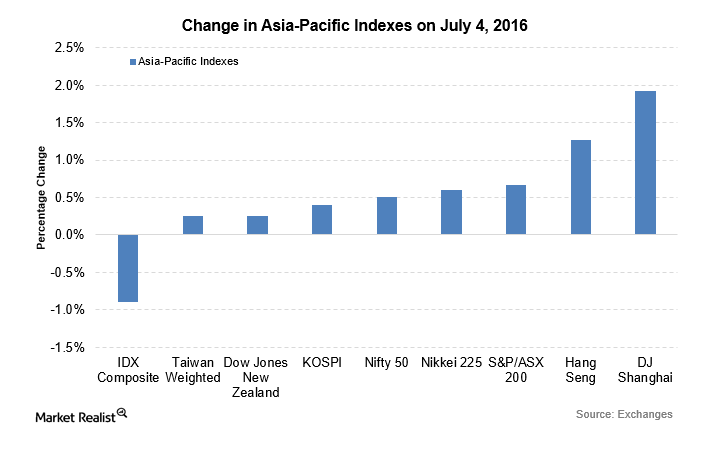

Key Asian indexes (AAXJ) were trading higher on July 4. This week, the major data release on the Asian front will be Australian monetary policy.

Pound Falls, BOE Summer Stimulus Hopes Rise after Carney’s Speech

On June 30, BOE (Bank of England) governor, Mark Carney, gave a speech signaling the BOE’s possible actions after the Brexit referendum on June 23.