Utilities Select Sector SPDR® ETF

Latest Utilities Select Sector SPDR® ETF News and Updates

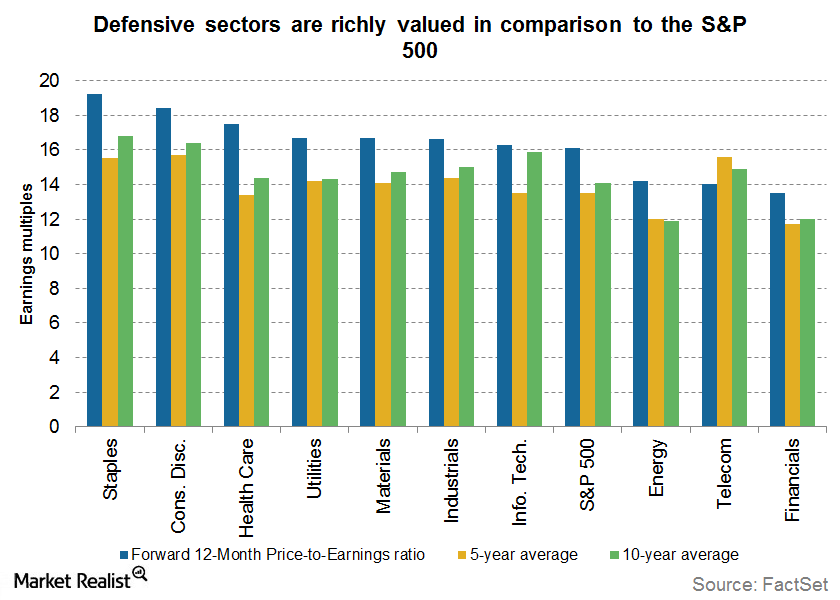

Investors Should Avoid Defensive Sectors If Rates Rise

Valuations are at the higher end of their historical range. Investors should avoid defensive sectors, which are highly sensitive to interest rate changes.

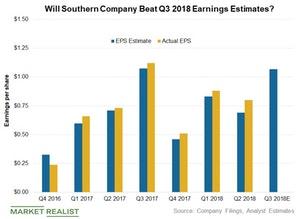

Will Southern Company Beat Its Q3 EPS Estimates?

Southern Company’s management has given an EPS guidance of $1.05 for the third quarter.

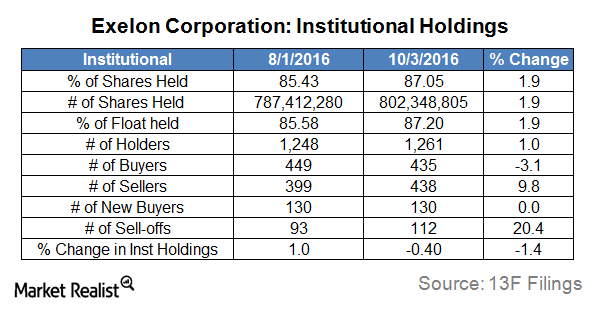

A Look at Institutional Investors’ Holdings in Exelon

In the past couple of months, institutions have increased their positions in Exelon by nearly 2%, from 85.6% to 87.2%, as of October 3, 2016.

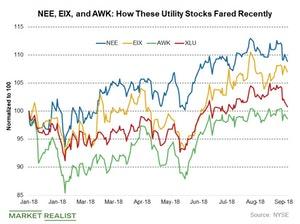

Highest Dividend Growth: Comparing NEE, EIX, and AWK

Utilities have been weak compared to the broader markets this year largely due to the strength in the Treasury yields.

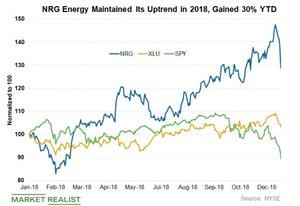

NRG Energy’s Valuation Compared to Its Peers

Currently, NRG Energy (NRG) stock is trading at a forward PE ratio of 8.5x based on its estimated EPS in 2019.

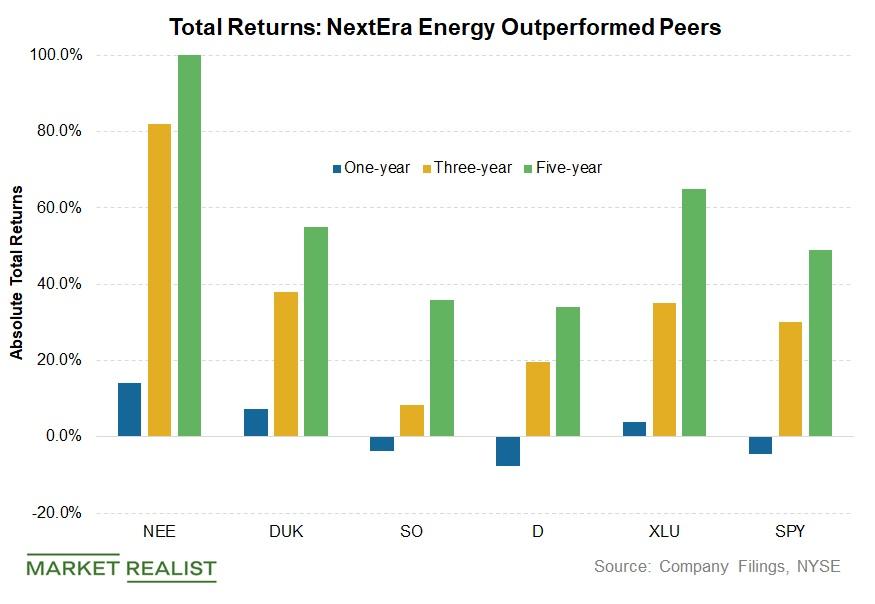

NEE, DUK, SO, and D: Comparing Top Utilities’ Total Returns

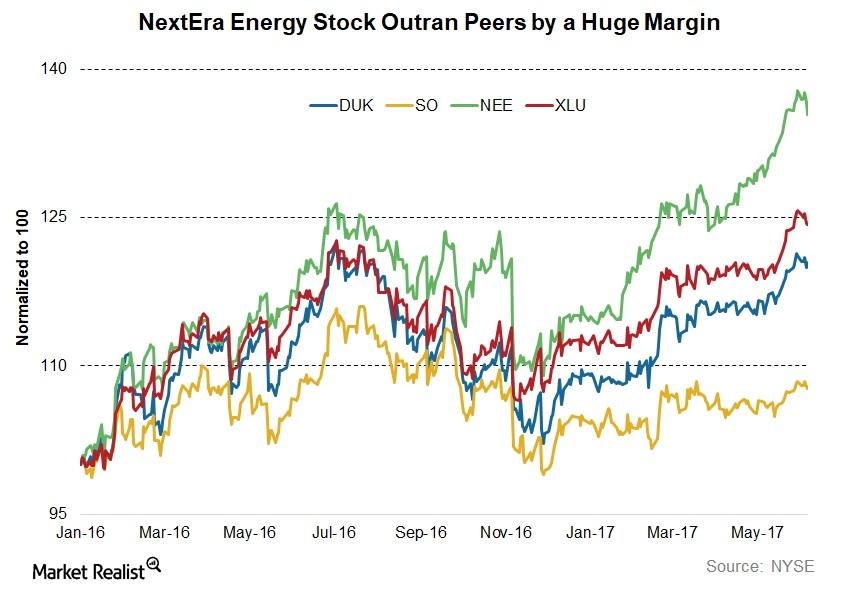

NextEra Energy (NEE) beat its peers in terms of returns in the last few years. NextEra Energy returned 14% in 2018.

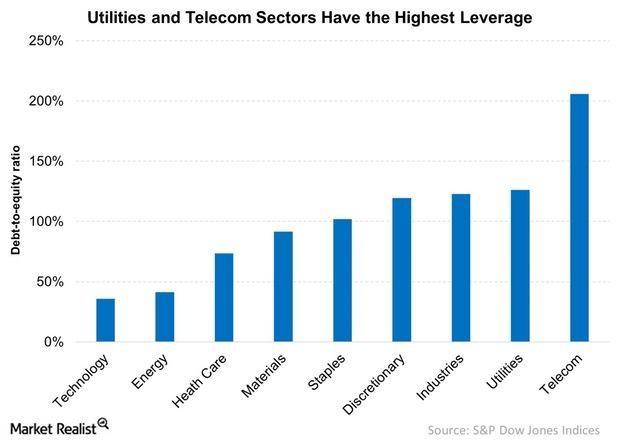

How a Rate Hike Could Affect High-Leverage Sectors

Industrials, utilities, and telecommunications have much higher leverage, as these sectors have massive capital needs.

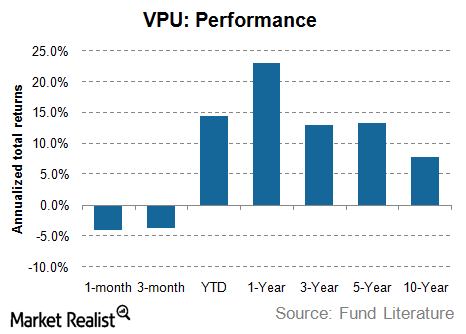

VPU Versus XLU: Which Utility ETF Is Better?

Utility ETFs have performed well in the last one year. The Vanguard Utilities Fund ETF (VPU) has been no exception to this.

Dimensional Fund Advisors’ Major Holdings in Q3

Dimensional Fund Advisors’ top buys are Apple (AAPL), AT&T (T), Microsoft (MSFT), L3Harris Technologies (LHX), and Verizon Communications (VZ).

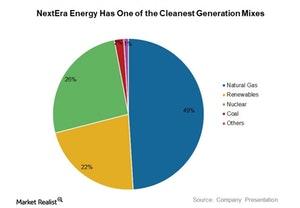

NEE Has One of the Cleanest Generation Mixes in the US

NextEra Energy (NEE) has one of the cleanest generation mixes among peers.

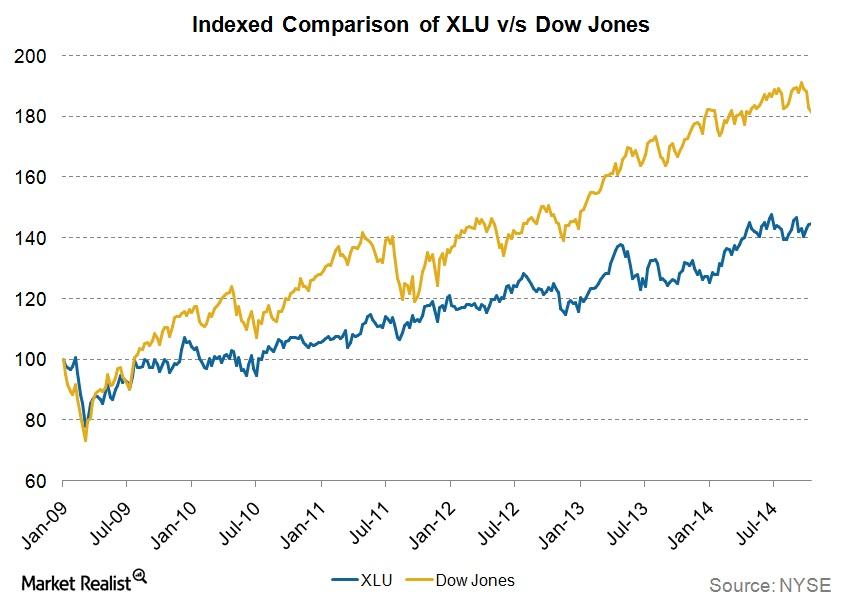

XLU: How US Utilities Are Currently Valued

So far, US utilities have had a decent run this year. The Utilities Select Sector SPDR ETF (XLU) has risen more than 14%.

Must-know: US power sector and its indicators

The power sector is the backbone of any economy. All of the other industries depend on it. In the U.S., the power utilities business is characterized by steady dividends and stable earnings.

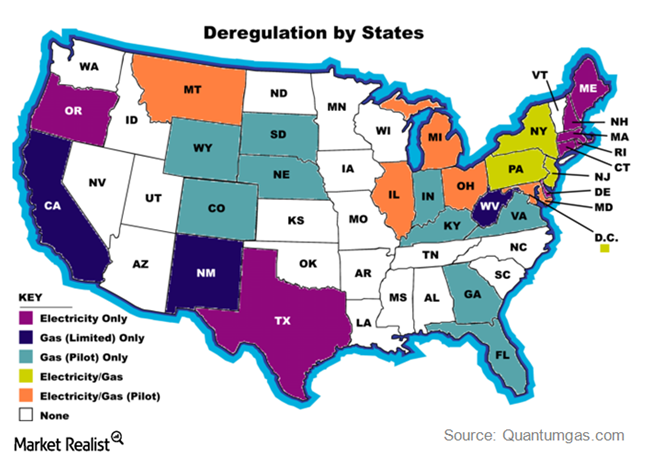

Breaking Down the Regulated and Deregulated US Electric Markets

The US electric utility industry is mostly regulated. The Public Utilities Regulatory Policies Act (or PURPA) was passed in 1978, beginning the deregulation of the utility industry.

Where Does NextEra Energy Really Stand in 2H17?

NextEra Energy is one of the fastest-growing utilities in the country. In this series, we’ll discuss its operational and financial metrics and see whether it’s attractive from a long-term investment perspective.

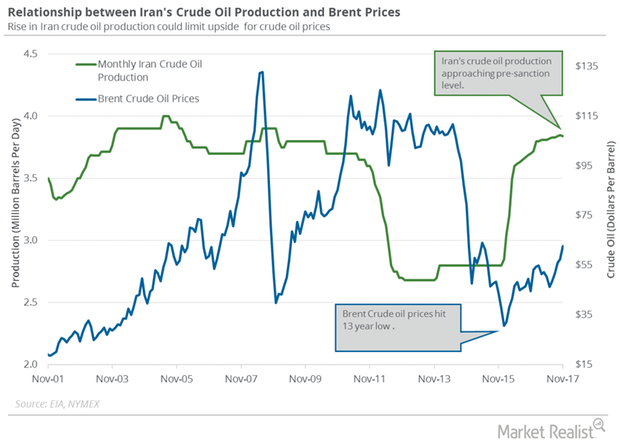

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

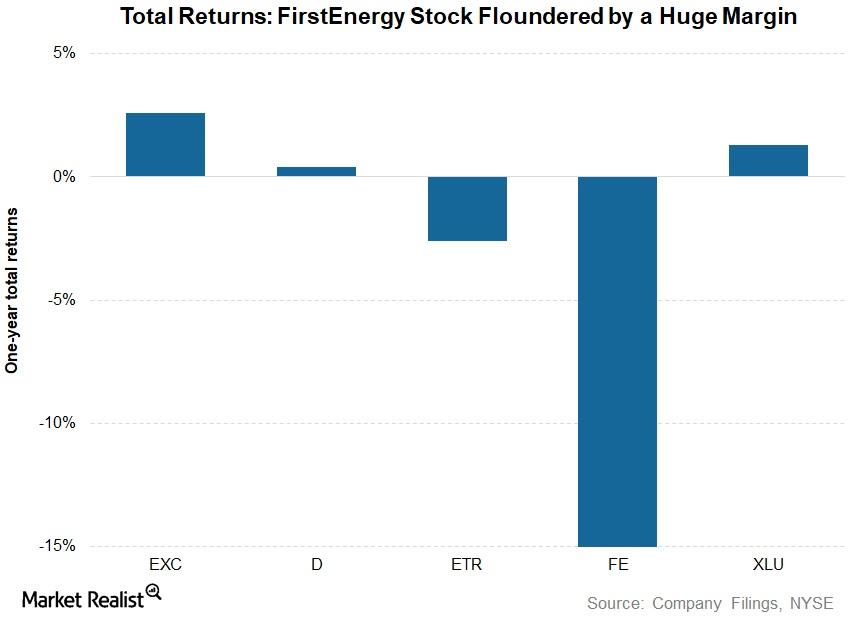

FE, D, EXC, or ETR: Which Utility Stock Stung Investors?

Exelon (EXC) stock has corrected nearly 2% in the last year. Including dividends, its returns have come in at ~3%.Energy & Utilities Why did the market punish Exelon?

Exelon Corporation’s (EXC) stock has been hammered in the last six years. In 2008, the stock was trading at ~$90 per share. Early this year, the stock was available at less than $27 per share.

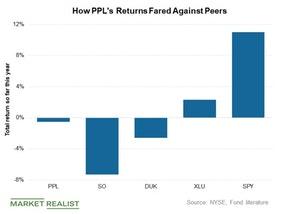

How PPL’s Returns Fared Compared to Its Peers in 2018

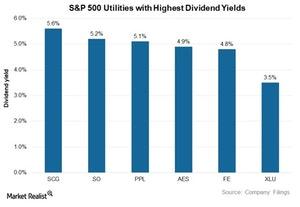

PPL (PPL), the top-yielding stock among the S&P 500 Utilities, has underperformed its peers in terms of total returns in 2018.

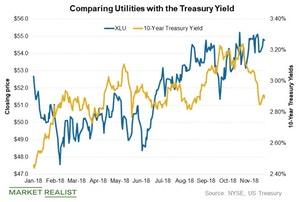

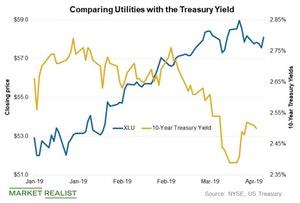

Comparing Utilities and Treasury Yields

The benchmark ten-year Treasury yield trended lower and changed from 2.68% to 2.66% last week.

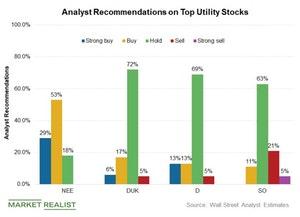

The Best Utility Stock out There: NEE, DUK, or SO?

Over the past few years, utility stocks have given enormous returns and have largely followed broader markets.

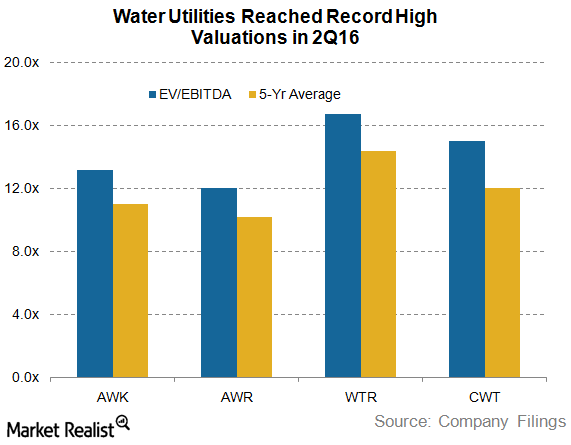

What Do Overvalued Water Utilities Indicate?

Given the sharp rally during the past six months, major water utilities are trading at huge premiums compared to their historical valuation multiples.

These 5 S&P 500 Utilities Offer Highest Dividend Yields

The Utilities Select Sector SPDR ETF (XLU), which tracks the S&P 500 Utilities Index, is currently trading at a dividend yield of 3.5%.

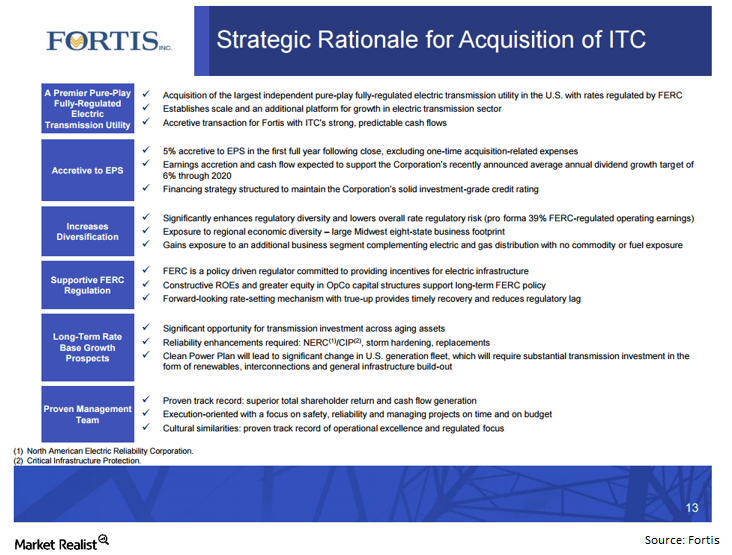

What’s the Rationale for the ITC-Fortis Merger?

Fortis (FRTSF) is buying ITC (ITC) in the largest Canadian purchase of a US utility. Fortis intends to sell a 19% stake in order to help finance the transaction.Energy & Utilities Must-know: Is the utilities sector a bond market proxy?

It’s important to note that higher real yields, not rising inflation, are driving today’s higher nominal yields as investors are demanding more compensation for holding bondsEnergy & Utilities Must-know: Understanding Duke’s strategy

In recent years, Duke Energy (DUK) made its intent very clear. It concentrates on its regulated utilities—its core business—instead of other areas. The regulated utilities business is Duke’s strength.

NextEra Energy’s Earnings: Solid Growth in Q2

NextEra Energy’s adjusted earnings have risen 13% year-over-year. The company reported an EPS of $2.35, which beat analysts’ consensus estimates.

Dividend Faceoff: Southern Company vs Duke Energy

Dividend yields of Southern Company (SO) and Duke Energy (DUK) currently stand at multi-year lows because utility stocks had a solid run this year.

Bill Gross: Top Stock Picks with High Dividend Yields

On October 18, CNBC reported Bill Gross top picks. His top stock picks were Annaly Capital (NLY), Invesco (IVZ) and Allergan (AGN).

Get Real: Trump, Takeovers, and Top Stocks

In today’s Get Real market newsletter, we took a closer look at a potential Tesla takeover and at Trump’s part in US steel. Plus, a rebound for Boeing.

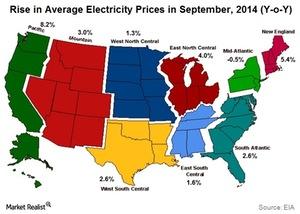

New England and the Pacific are great regions to produce power

The US is divided into nine divisions. The Pacific and New England divisions had the highest year-over-year, or YoY, growth in electricity prices in September 2014.

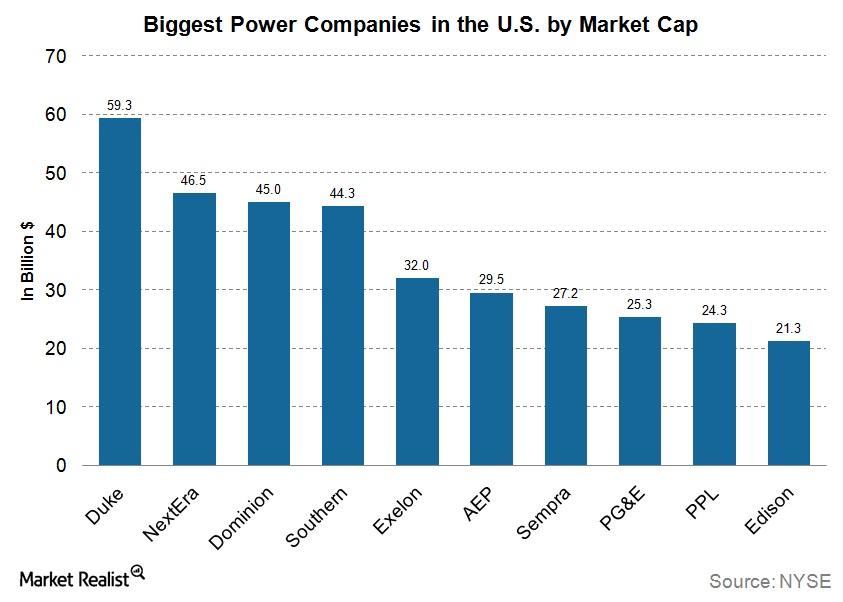

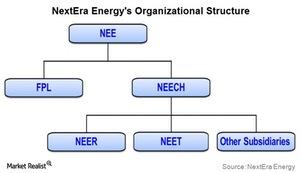

Utilities company overview: NextEra Energy

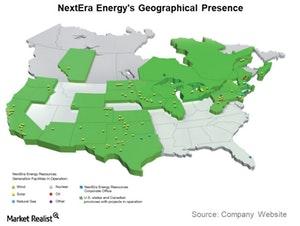

NextEra Energy (NEE) is the second-largest power company in the US after Duke Energy (DUK) in terms of market capitalization.

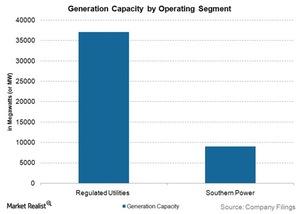

Regulated business is Southern Company’s strength

Southern Company manages its regulated utility business through the following four subsidiary companies: Alabama Power, Georgia Power, Gulf Power, and Mississippi Power. These subsidiaries have a combined power generation capacity of 37,000 megawatts (or MW).

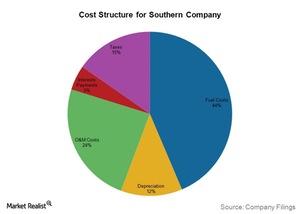

Cost structure sets Southern Company above its competitors

Fuel costs per kWh can be used to evaluate the efficiency of a power producer to produce electricity. Southern Company’s fuel cost per kWh is lower than its competitors’ in the regulated utility business.Energy & Utilities Must-know: Risks to AES Corporation’s business

Given the nature of its business, AES Corporation (AES) faces risks relating to currency fluctuations, fuel prices, interest rates, and a scattered business model.Energy & Utilities Must-know: Who owns Dominion?

Institutional investors hold most of Dominion Resources’ (D) outstanding shares. As of June 30, 2014, a total of 351.2 million shares were held by 1,069 institutions.Energy & Utilities Why electricity demand is linked to GDP

Electricity is the backbone of a nation’s progress. All of the industries need electricity to operate—directly or indirectly. When a business flourishes, the electricity consumption increases.Energy & Utilities Why net capacity additions are important

Capacity is defined as the potential power output that power plants can generate. Each power plant has a shelf life. After the shelf life, they’re replaced with new power plants.

A brief overview of Exelon’s power operations

Power generation is a significant segment for Exelon, generating more than 60% of its total revenue. The energy delivery business provides the other 40% of the company’s revenues.

NextEra Energy plays in regulated and unregulated utility markets

NextEra Energy is a Florida-based power company. Its subsidiaries are Florida Light & Power and NextEra Energy Resources.

Southern Company’s Dividends Compared to Its Peers

Southern Company (SO), the top regulated utility, declared a quarterly dividend of $0.62 per share last month. The ex-date for the dividends is Friday.

Where PG&E Stock Might Go amid Interest from Mayors

PG&E gained for the sixth straight day amid increased uncertainty. The stock has gained more than 80% during this period and closed at $8 on Tuesday.

How PG&E Stock Could Trade after a Terrible Week

Bankrupt utility PG&E lost more than 25% last week. The fall came after the bankruptcy court allowed a bondholder group to pitch their restructuring plan.

Why Utilities Could Keep Smashing in the Fourth Quarter

Despite valuation concerns, utility stocks seem relatively well placed at the moment, especially going into October, compared to broader markets.

PG&E Stock Fell 25% on Higher Risks from Tubbs Fire

PG&E (PCG) shares are trading more than 25% lower on Monday. A federal judge ruled that the utility must face victims of the Tubbs Fire.

Utilities Are Back in Focus as the Trade War Escalates

Investors turned to defensive utilities intensified yesterday after President Trump announced 10% tariffs on another $300.0 billion worth of Chinese goods.

Is Joe Biden’s Green New Deal Really Feasible?

Joe Biden has proposed a climate change framework that aims to zero down on carbon emissions and create millions of new jobs by 2050.

Why Utilities Underperformed the Broader Market Last Week

The defensives and utilities sector fell more than 2% last week while broader markets fell just 0.3%. Here’s why.

Top Utilities’ Stock Price Targets Get Bumped Up

Many top utility stocks’ price targets were changed last week.

Comparing Utility Stocks and Treasury Yields

The benchmark ten-year Treasury yields closed at 2.5% last week. Treasury yields and utility stocks usually trade inversely to each other.

XLU’s Chart Indicators and Short Interest

Currently, the Utilities Select Sector SPDR ETF (XLU) is trading at $58.2 after hitting an all-time high of $58.7 last week.