Utilities Select Sector SPDR® ETF

Latest Utilities Select Sector SPDR® ETF News and Updates

A Look at Leaders and Laggards in the Utilities Sector Last Week

Utilities continued their upward march last week and outperformed broader markets.

NextEra Energy: Institutional Activity in Q4

The Vanguard Group was the largest institutional investor in NextEra Energy (NEE) at the end of the fourth quarter.

What FirstEnergy’s Chart Indicators Suggest

Utilities have been following a downtrend recently, plummeting more than 10% since early last week.

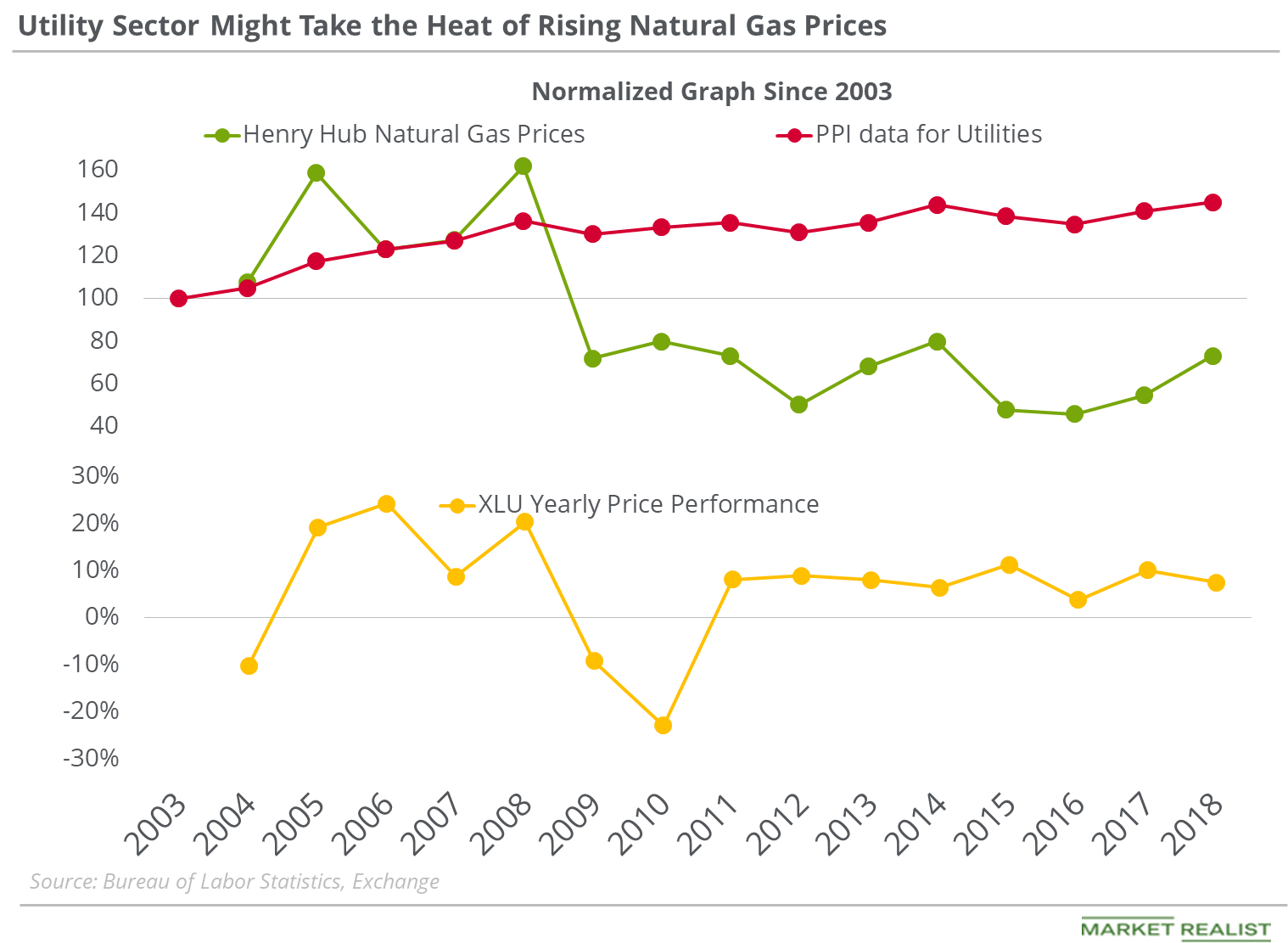

Utilities’ PPI Could Increase with Higher Natural Gas Prices

On March 3, 2016, natural gas active futures were at the lowest closing level in the last 17 years.

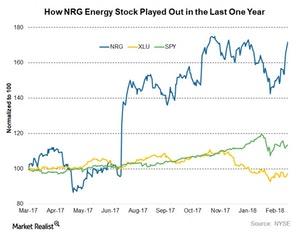

Elliott Management Exits NRG Energy in Q1: What’s Next?

Elliott Management, the activist shareholder whose involvement doubled NRG Energy (NRG) stock in the last year, has exited NRG.

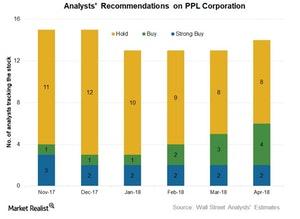

PPL: Analysts’ Views and Target Prices

PPL (PPL) stock offers an attractive potential upside of more than 13% in a year with a mean target price of $32.3. PPL stock is trading at $28.5.

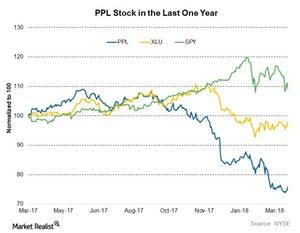

What PPL’s Current Valuation Means for the Stock

PPL Corporation (PPL) stock was particularly hit by the recent utilities turmoil. Its valuation fell significantly over the last few months.

How FirstEnergy Stock Ranks against Peers

FirstEnergy (FE) has been one of the top-performing stocks among the S&P 500 Utilities Index (XLU) this year.

NRG Energy’s Current Valuation

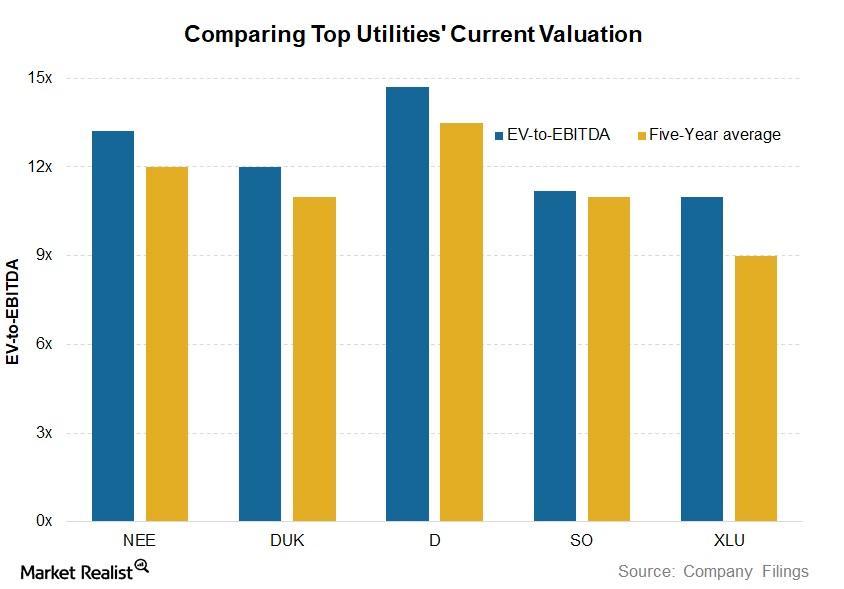

Currently, NRG Energy (NRG) stock is trading at an EV-to-EBITDA valuation of 12x—compared to its five-year historical valuation of around 11x.

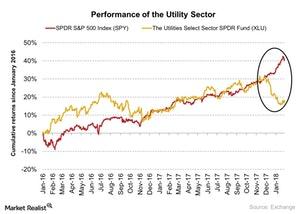

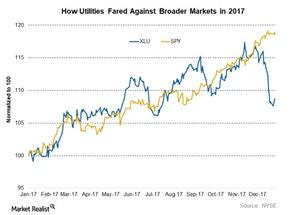

Why Utility Sector Had Inverse Correlation with S&P 500 in January

The Utilities Select Sector SPDR ETF (XLU), which tracks the performance of the utility sector, fell 3.2% in January 2018.

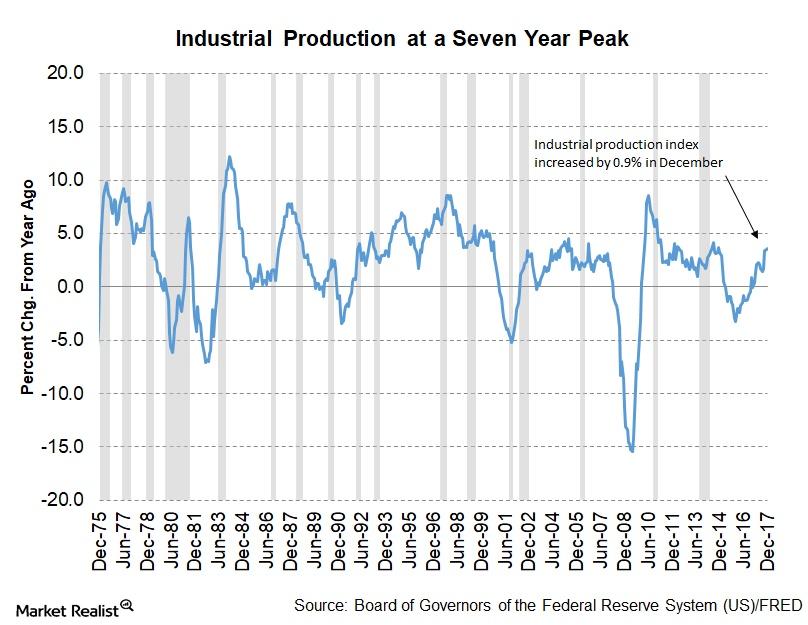

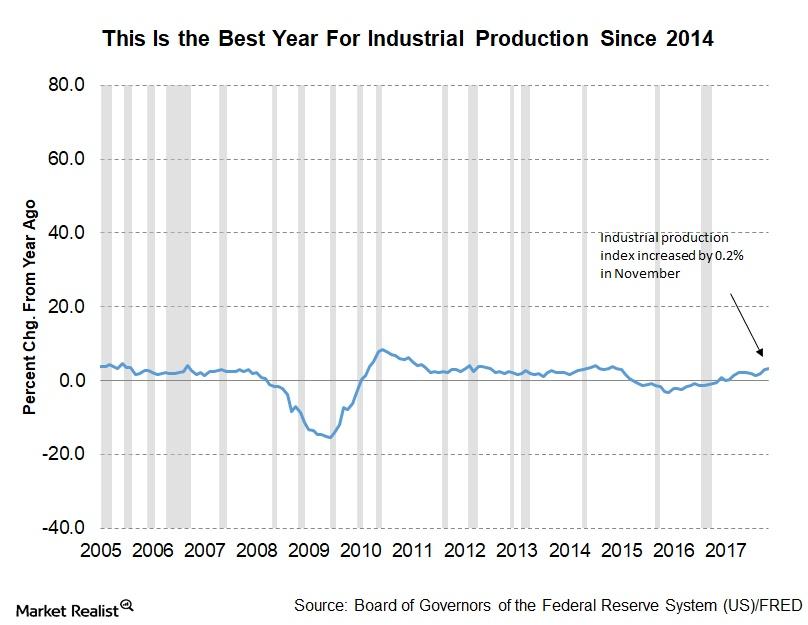

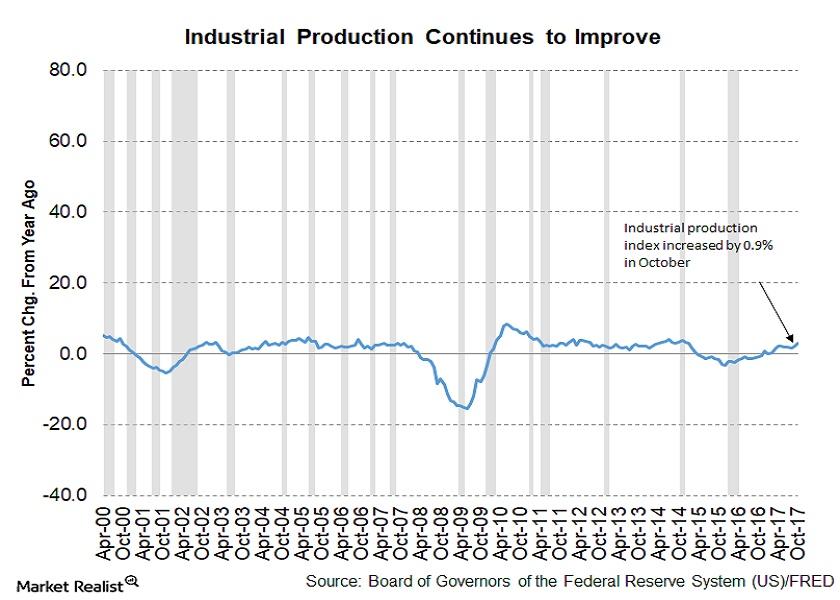

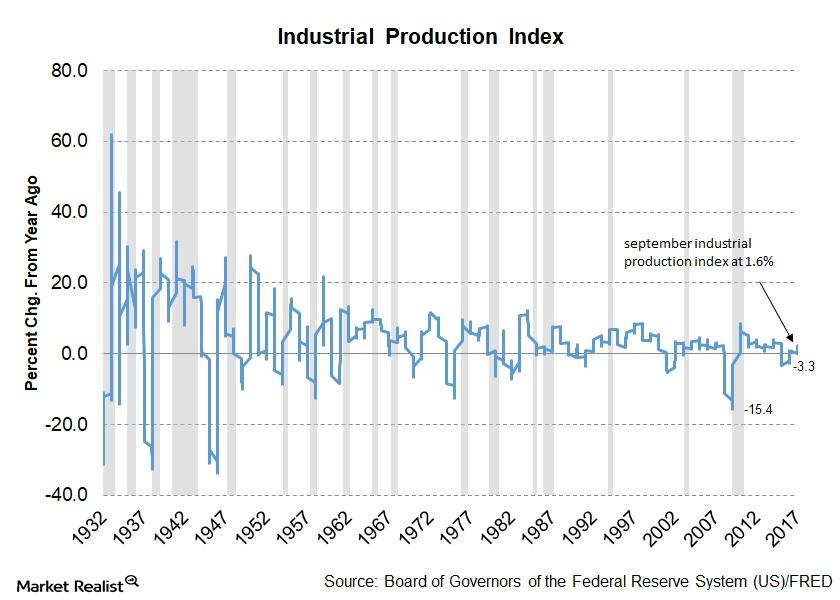

What Drove Industrial Production Higher in December 2017

The Fed’s December industrial production report was released on January 17. The report indicated that industrial production continued to improve throughout 2017.

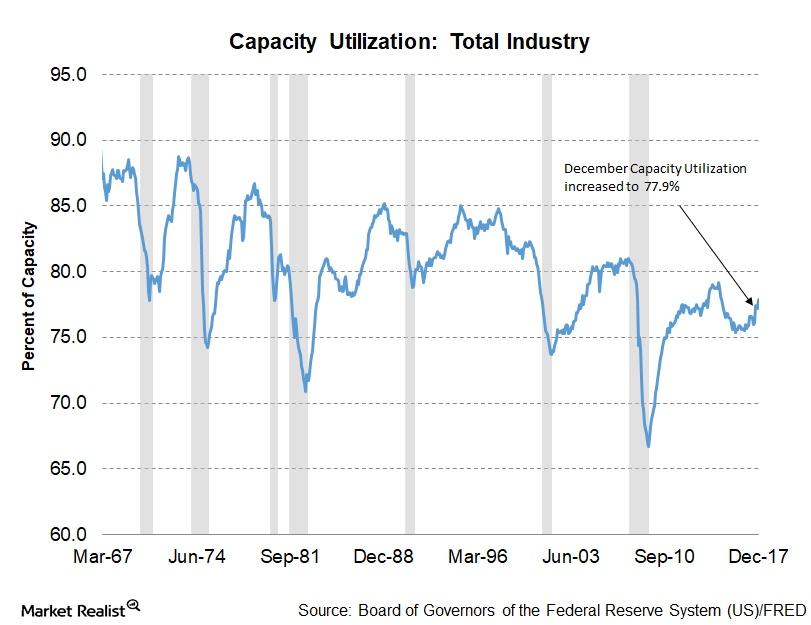

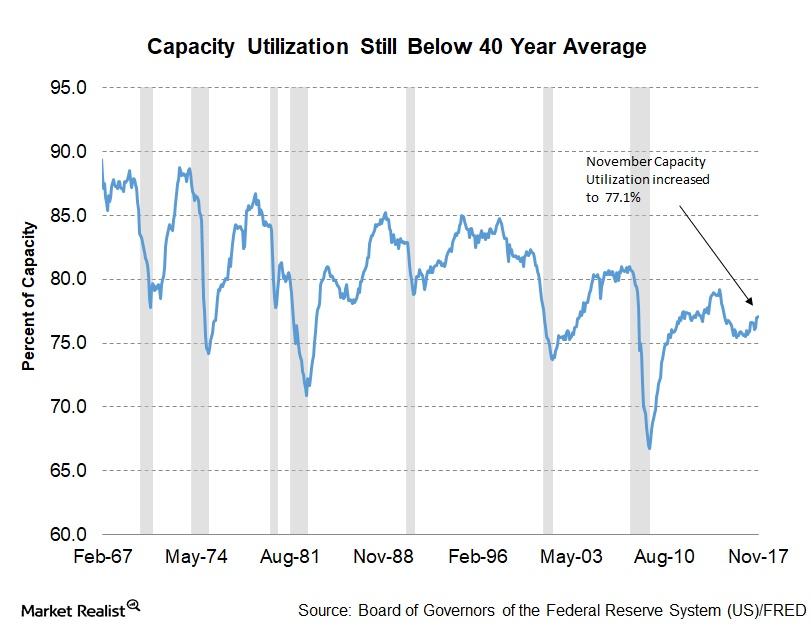

Capacity Utilization Trends across US Industries in December

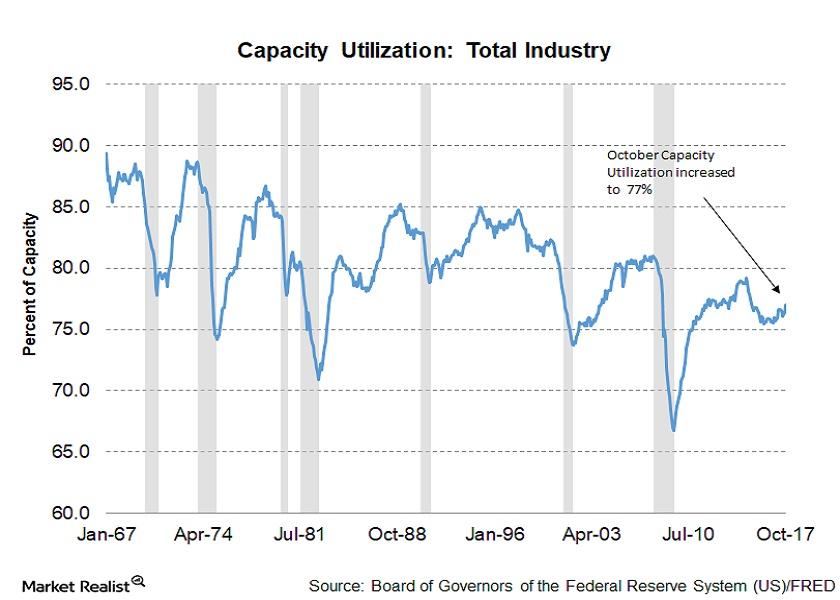

Capacity utilization and the US economy Among the key macroeconomic indicators published by the Federal Reserve, US industries’ capacity utilization is particularly important for understanding the health of each industry. Changes to this indicator can help forecast any changes to the business cycle, product demand, and workforce demand. Increasing levels of capacity utilization could translate to a higher number […]

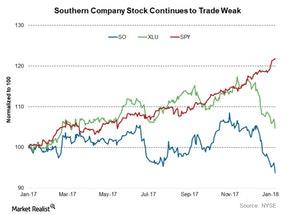

Does Southern Company Stock Have an Attractive Valuation?

Southern Company (SO), the second largest rate-regulated utility, is currently trading at an EV-to-EBITDA multiple of 10.5x.

How US Utility Stocks Are Valued for the New Year

US utilities have corrected notably over the past few weeks, and their recent valuations could start attracting new entrants.

Analyzing Top Utilities’ Current Valuations

The steep fall in utilities in the last couple of weeks seems to have aggravated utilities due to their record high valuations.

A Look at Capacity Utilization across US Industries in November

In the November capacity utilization report, the manufacturing sector remained strong with 76.4% capacity utilization, the highest level since May 2008.

Why Industrial Production Fell from 1.2% to 0.2% in November

The Federal Reserve released its November industrial production report on December 15, 2017. The report indicated that industrial production improved 0.2% in November.

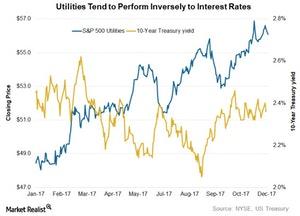

Utilities Tend to Have Inverse Relationship with Interest Rates

On December 13, 2017, ten-year Treasury yields fell to 2.4%. The ten-year Treasury yields (TLT) reported a yearly high of 2.6% prior to the first rate hike in March 2017.

Reading the Trends in Capacity Utilization across US Industries in October

Among the key macroeconomic indicators published by the Fed, capacity utilization in US industries helps investors forecast business cycle changes.

Which Industries Increased Industrial Production in October?

The October Industrial Production report was released by the Fed on November 16 and showed a continued rebound in key sectors of the US economy.

Which Industries Increased Production Last Month?

The Federal Reserve released its September industrial production report on October 17. The report indicated that key sectors in the US economy increased production in September.

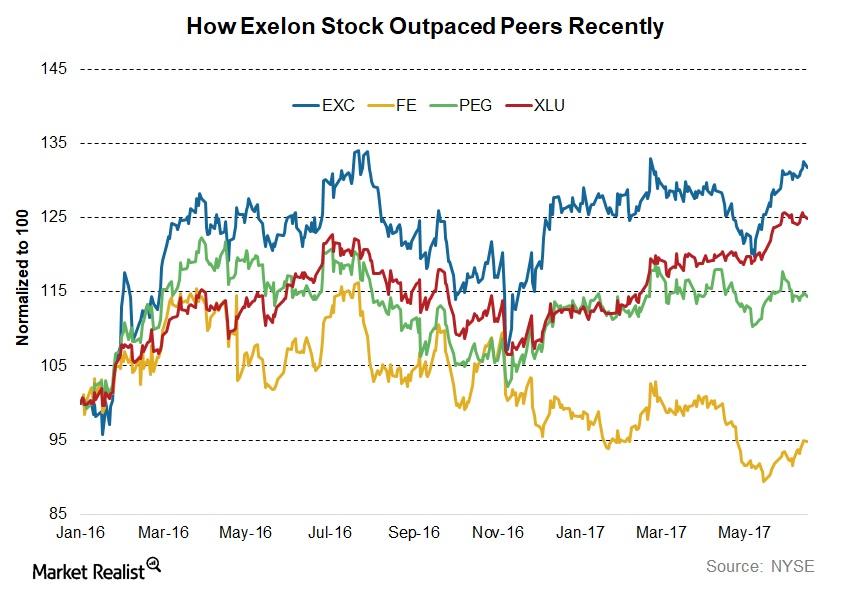

EXC, FE, and PEG: Are Hybrid Utilities Really Worth the Risk?

US utilities including giants like Duke Energy (DUK) and Southern Company (SO) have done fairly well in the last few months compared to broader markets.

Dominion Resources Stock Approaches Peak: What’s Next?

Dominion Resources (D) continues to look interesting from an investor’s perspective as the stock approaches multiyear highs.

How Higher Interest Rates Can Impact Utilities

Treasury yields (TLT) become more attractive when interest rates rise, making utilities (XLU) less competitive in terms of yields.

Understanding How Higher Interest Rates Impede Utilities

The near-zero interest rate environment has resulted in a low cost of debt, which has motivated more new debt issuances by utilities.

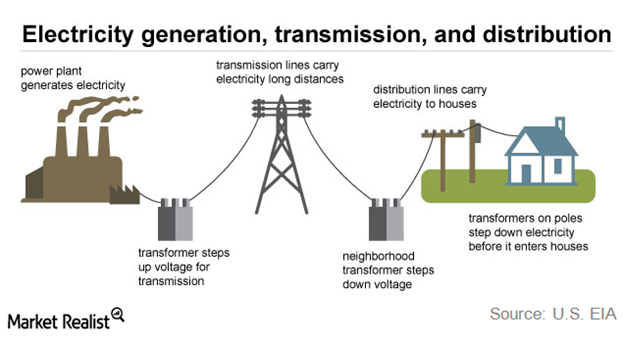

Utilities Overview: How Does the Electricity Supply Chain Work?

The US electric utility industry is a mature business that is growing slowly and steadily. The country’s electric grid consists of 7,300 power plants and 160,000 miles of high-voltage power lines that deliver electricity to more than 145 million customers.

Narayana Kocherlakota on Trump and the Federal Reserve

Narayana Kocherlakota, 12th president of the Federal Reserve Bank of Minneapolis, said central banks have been able to control inflation better when left alone by the government.

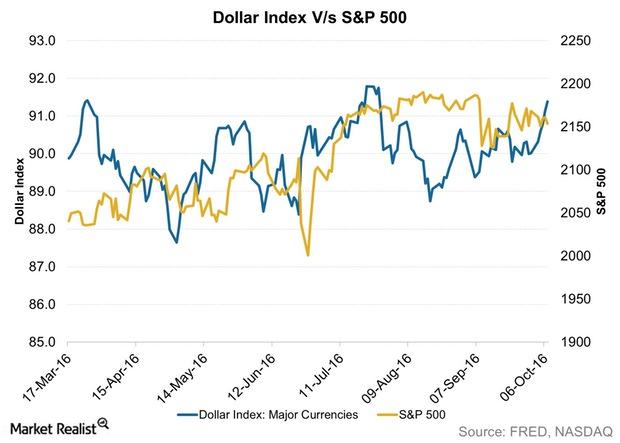

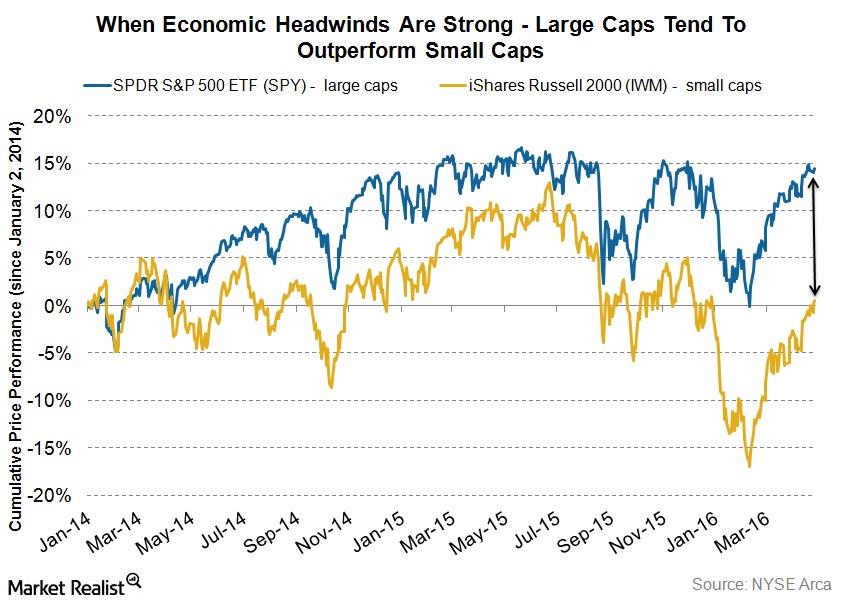

How Does a Strong Dollar Affect Stocks?

The relationship between the US dollar and US stock indexes can be best said to be complex. It’s mostly a change in the greenback that impacts stocks.

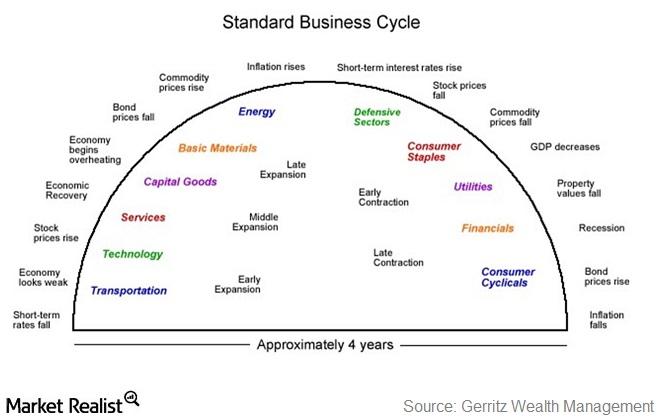

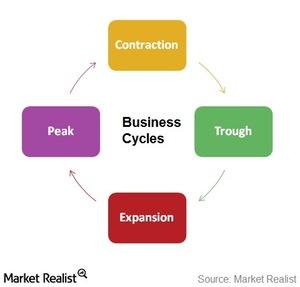

Will the Cyclical Sector Outperform the Defensive Sector?

The cyclical sector has a sizeable correlation with the different phases of the business cycle.

How Would an Interest Rate Hike Affect the Stock Market?

A hike in interest rates increases the cost of borrowing for companies. Most publicly traded companies carry at least some debt to fund their operations, and higher borrowing costs can cause their profit margins to contract.

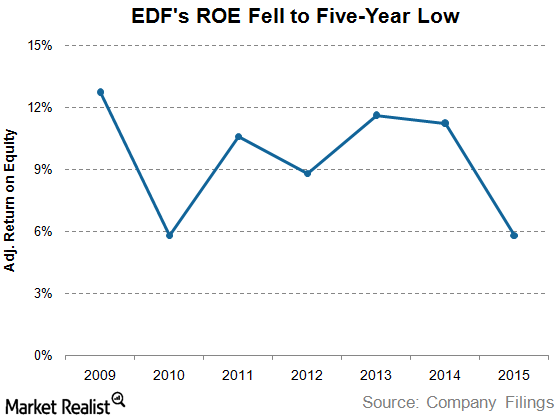

Électricité de France’s Operational Insights

Électricité de France’s adjusted return on equity has fallen drastically due to weak power prices and slowing demand.

Business Cycle Investing? Here Are the Sectors You Should Look At

We’ve moved from a phase in the business cycle where defensive stocks do well to the phase where utilities outperform.

Positioning Your Portfolio According to the Business Cycle

Style investing involves selecting a particular asset class that should outperform during a business cycle phase and positioning your portfolio accordingly.

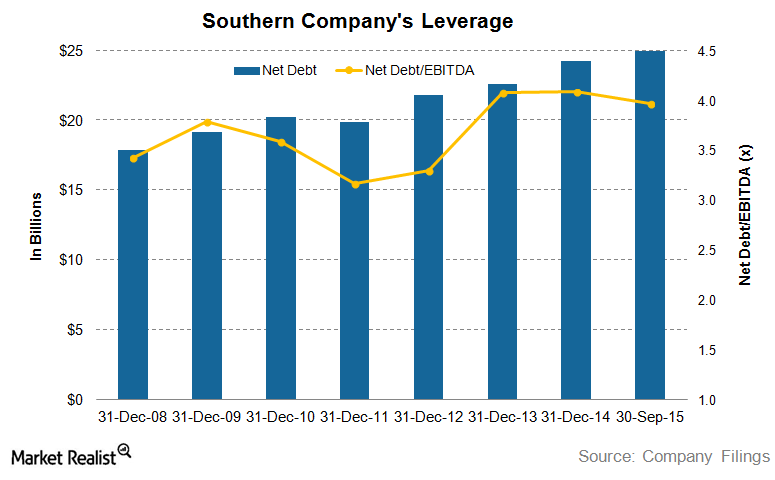

Analyzing Southern Company’s Debt Profile

As of September 30, 2015, Southern Company had total debt of $27 billion against equity of $20.6 billion. Of this, $22.3 billion is long-term debt.

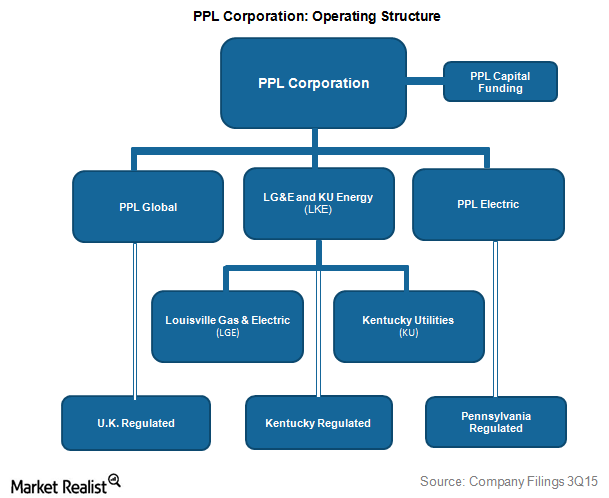

An Analysis of the Operating Structure of PPL

PPL is concentrated in the UK. It manages utility operations through PPL Global, PPL Electric, Louisville Gas and Electric, and Kentucky Utilities.

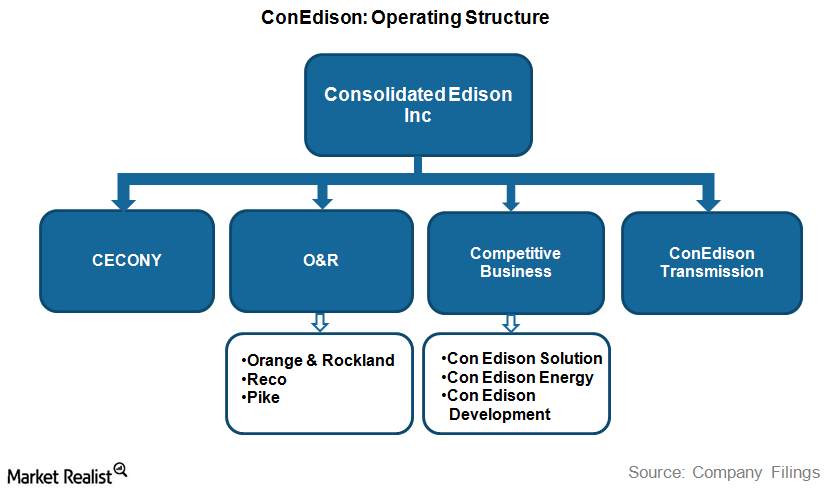

What You Should Know about Con Edison’s Operating Structure

Con Edison handles its competitive energy business through its three wholly-owned subsidiaries: Con Edison Solutions, Con Edison Energy, and Con Edison Development.

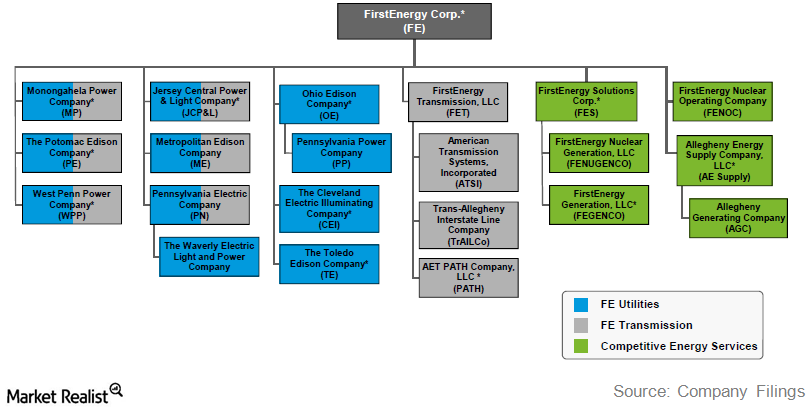

A Key Overview of FirstEnergy’s Operating Structure

FirstEnergy’s revenues are primarily derived from electric services provided by ten subsidiaries. The company serves a combined population of ~13.5 million.

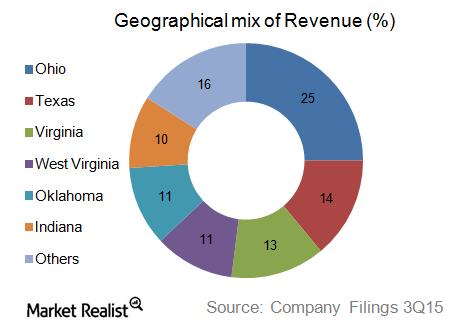

American Electric Power’s Balanced Geographical Revenue Mix

American Electric Power has a geographically diversified market combination, with a major chunk of its revenue coming from its homeland Ohio.

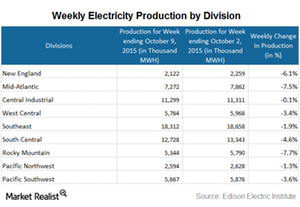

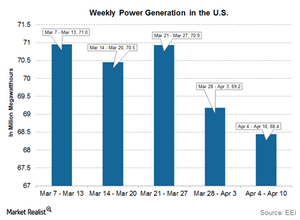

Electricity Generation Falls in All Census Divisions

the electricity generation in the US fell by 3.5% to 71.1 million mWh. Electricity generation fell in all of the nine census divisions during the week ended October 9.

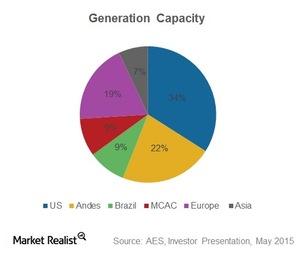

How Does AES Corporation Categorize Its Businesses?

AES Corporation (AES) is a diversified power generation and utility company. It operates its business under six SBUs (strategic business units).

How Does AES Manage Its Businesses across 18 Countries?

AES has businesses spread across 18 countries and has various operating subsidiaries, each focusing on a specific area of business.

AES Corporation: Its Evolution Up until Now

AES Corporation is a global entity and operates through its six strategic business units, created based on the geographical areas they cater to.

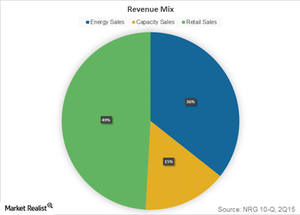

How Does NRG Energy Earn Its Revenues?

NRG Energy (NRG) earns revenues in three primary ways across its segments: energy sales, capacity sales, and retail sales.

Southern Company Is a Diversified Utility Company

Southern Telecom is a telecommunications subsidiary of Southern Company. It provides dark fiber optic solutions to various businesses.

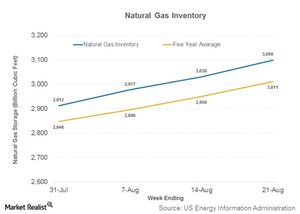

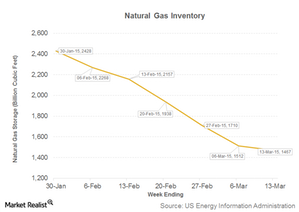

Natural Gas Inventory Figure Puts Pressure on Coal

The EIA’s natural gas inventory report for the week ended August 21 came in at 3,099 billion cubic feet, compared to 3,030 Bcf a week earlier. Natural gas is stored underground to save the fuel for peak demand during the winter.

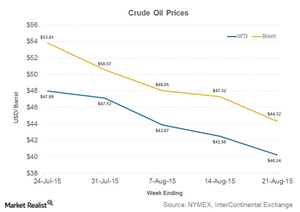

Continued Slump in Crude Oil Prices May Benefit Coal

Crude oil prices are a mixed driver for the coal industry (KOL) in the United States. On the one hand, a fall in crude oil prices results in a fall in fuel costs.

Leading Indicators that Help Identify the Current Business Cycle

The business cycle, which reflects fluctuations of activity in an economy, can be a critical determinant of equity sector performance over the intermediate term.

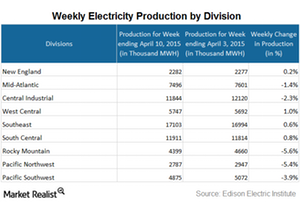

Rocky Mountain Division Sees a Large Drop in Electricity Generation

Out of nine divisions, electricity generation increased in four divisions and decreased in five divisions for the week ending April 10.

US Electricity Production Falls for the Second Straight Week

Electricity storage is expensive. Most of the produced electricity is consumed instantaneously. As a result, electricity generation mirrors consumption.

The Latest Natural Gas Inventory Report Proves Neutral for Coal

The EIA (US Energy Information Administration) publishes a weekly natural gas inventory and withdrawal report every Thursday.