United States Steel Corp

Latest United States Steel Corp News and Updates

X Stock Forecast: Analysts Are Bearish, Stock Is too Cheap to Ignore

Wall Street analysts have been getting bearish on U.S. steel stocks including X. What’s the forecast for X stock?

Is There More Upside Left in CLF and U.S. Steel (X) Stock?

Steel stocks have bounced back and Cleveland-Cliffs (CLF) and U.S. Steel (X) look strong this week. Is there more upside left in the stocks?

X or NUE: Which Is the Best U.S. Steel Stock to Buy Now?

U.S. steel stocks are outperforming in 2021 with Nucor in the lead. Between NUE and X, which is the best steel stock to buy now?

U.S. Steel Stock (X) Could Rise More Amid Commodity Supercycle

U.S. Steel stock has risen sharply in 2021. U.S Steel stock could rise more amid the commodity supercycle. What can investors expect?

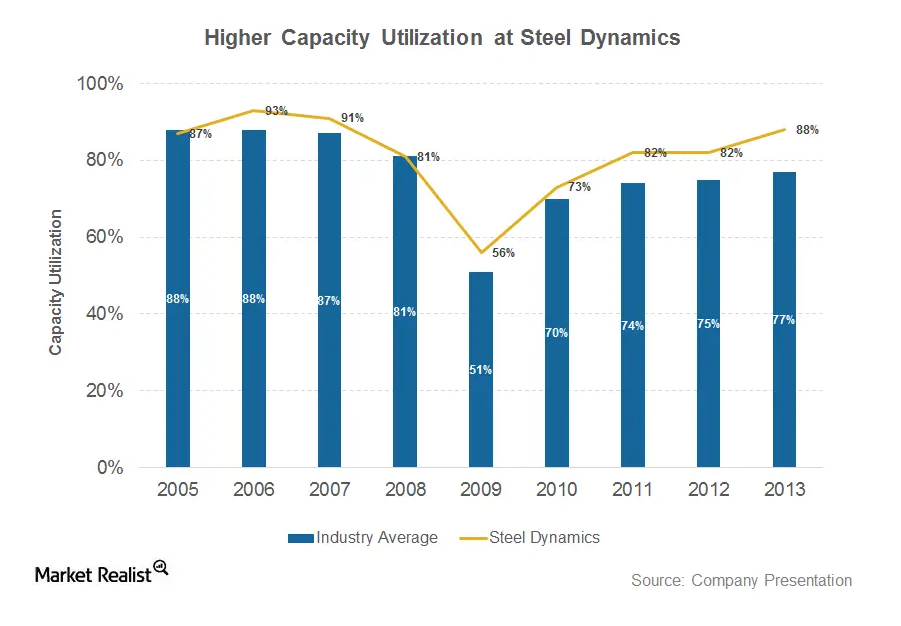

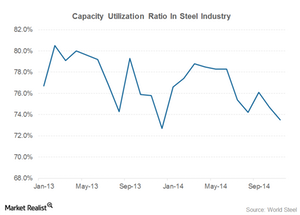

Why the capacity utilization rate came down at Steel Dynamics

One of the key metrics in the steel industry is the capacity utilization rate. It represents the actual production compared to the maximum possible production.

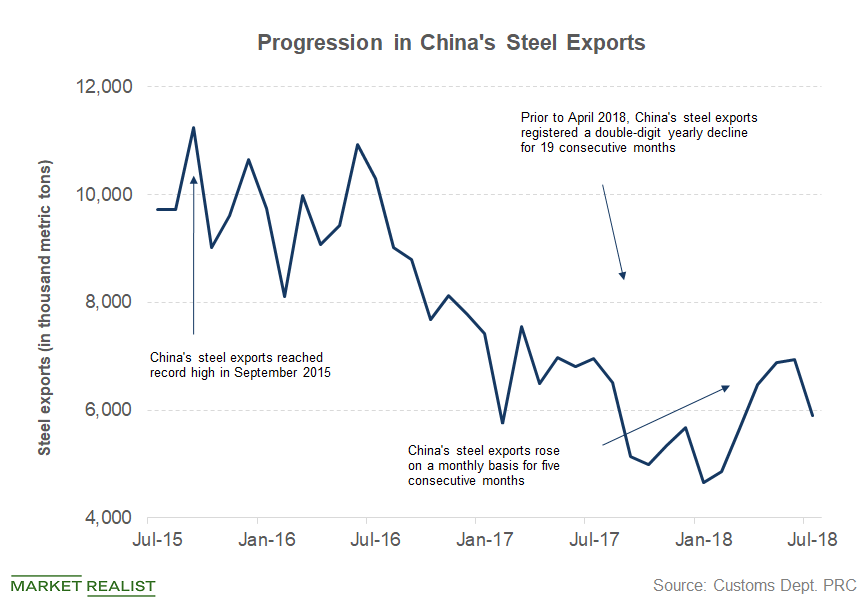

How to Counter China: Steel Could Show the Way

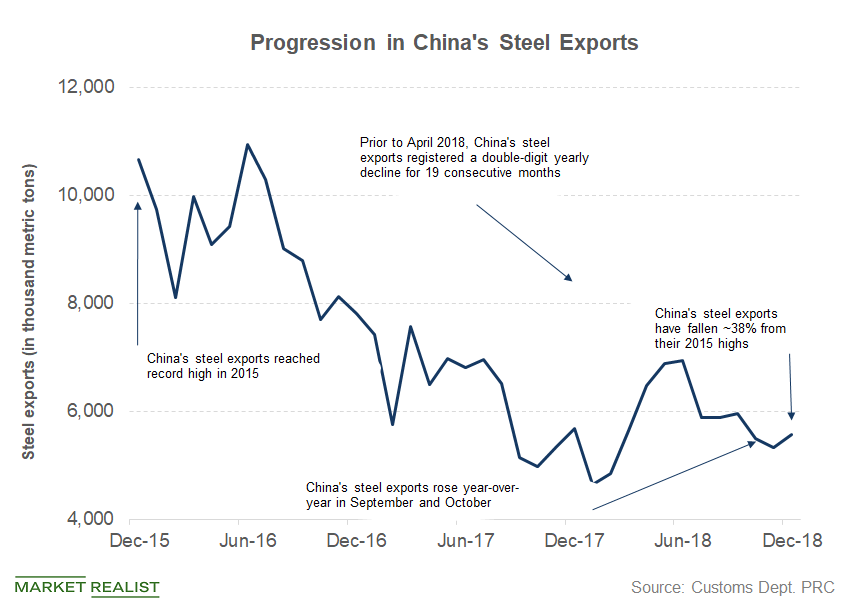

China (FXI) exported 5.56 million metric tons of steel in December, a yearly fall of 1.9%.

Analysts Still Hate Steel Stocks despite Bumper Earnings

Overall, it has been a mixed earnings season for steel companies.

Four Risks U.S. Steel Corporation Investors Should Know Before Q4 Earnings

U.S. Steel Corporation (X) will likely report its fourth-quarter earnings on Jan. 28. There are the four risks that the company needs to address.

What Should You Expect from U.S. Steel’s 1Q18 Earnings?

1Q18 earnings season is in full swing. So what should you expect for U.S. Steel?

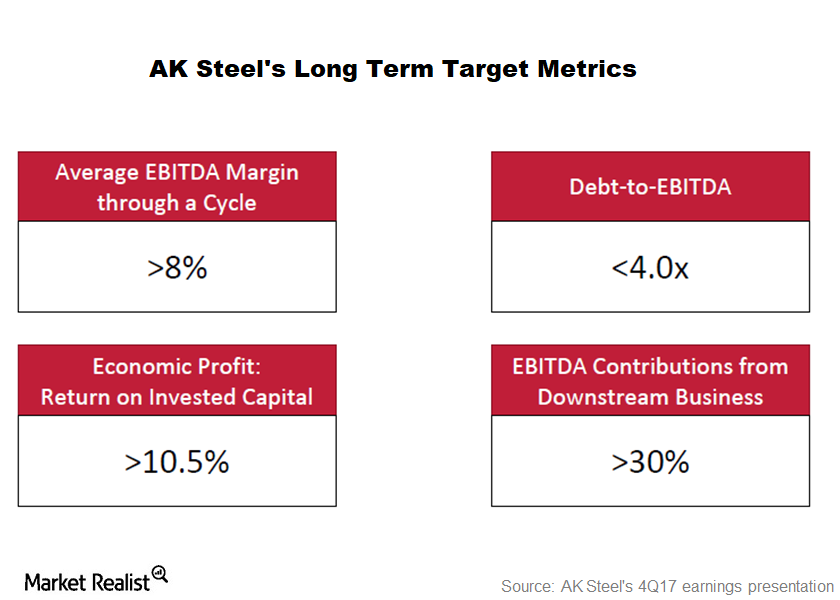

AK Steel Could Face Challenges in Meeting Its Goals

AK Steel is working towards stable margins throughout the business cycle. AK Steel has deliberately lowered its exposure to spot markets (X) (CLF).

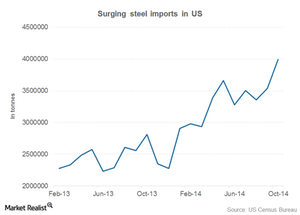

Steel Imports Reach Record Levels In October

Compared to the first ten months of last year, steel imports are up by more than 35%. This is an alarming situation.

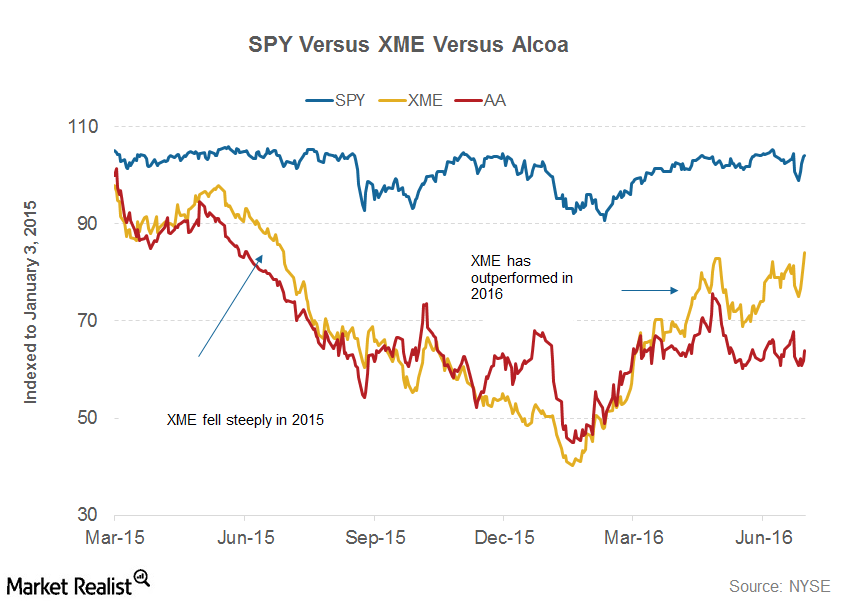

Alcoa’s 2Q16 Earnings: What Can Investors Expect?

Alcoa (AA) is expected to release its 2Q16 earnings on July 11. The company is in the final stages of its split, which will create two new entities.

Will President Trump’s Pressure Tactics Work Out?

In March 2018, President Donald Trump imposed a tariff of 25% on steel imports. What’s happened since?Materials Must-know: Key risks that AK Steel investors face

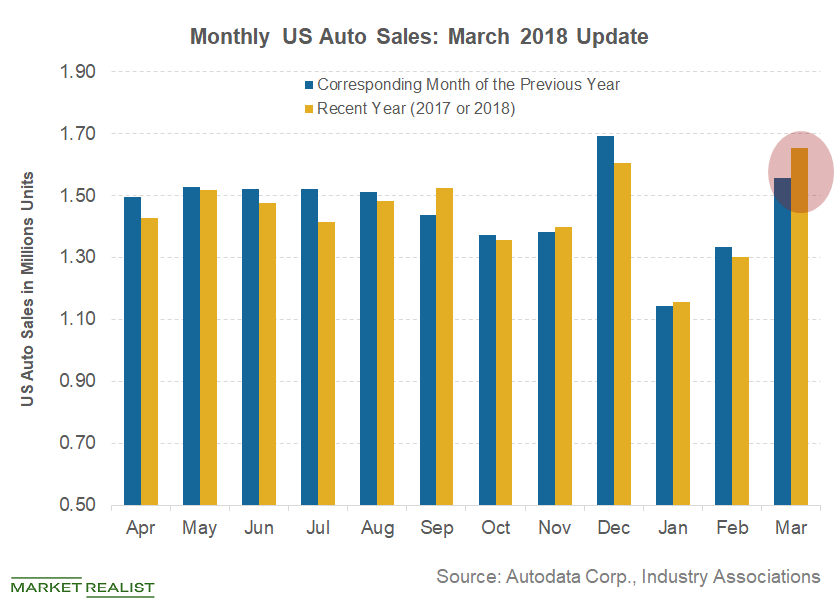

The increased use of aluminum in vehicles is a threat for AK Steel (AKS). The automotive industry accounts for ~26% of steel consumption in the U.S.

Nucor Looks to Contract Resets to Further Improve Performance

Nucor (NUE) expects its 3Q16 performance to improve as compared to 2Q16. The key driver of Nucor’s 3Q16 performance would be the reset of contracts.

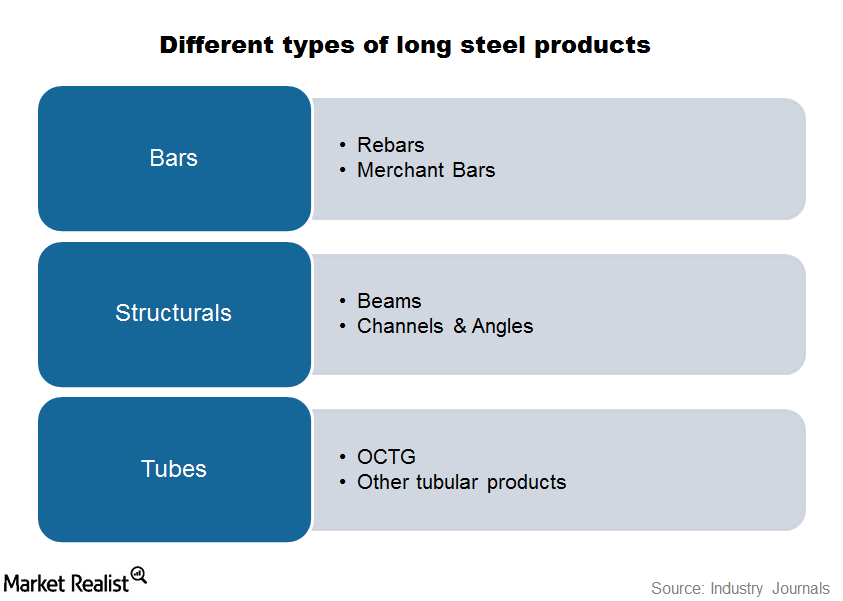

Why the outlook for US Steel’s tubular goods is positive

With the recent imposition of anti-dumping duties, imports of tubular goods will likely decrease, helping U.S. Steel’s revenue in the tubular segment to increase.

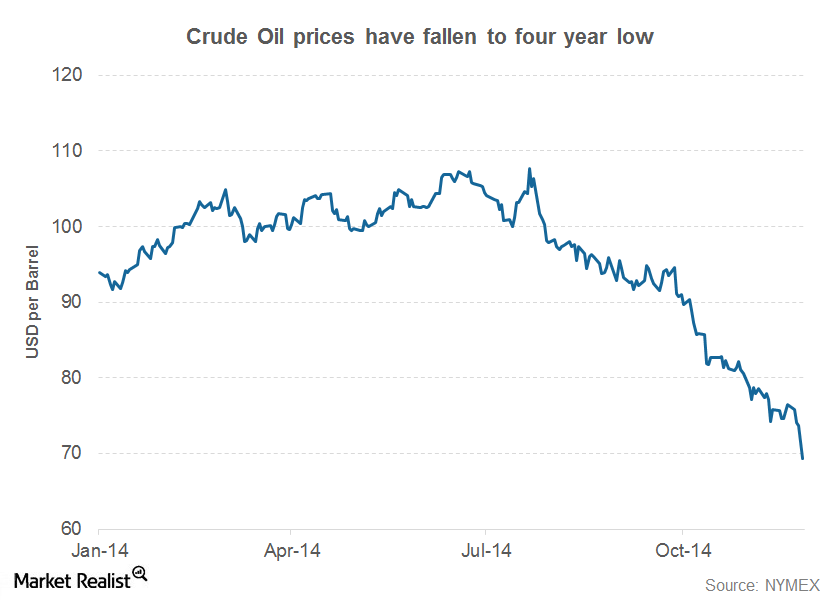

Key takeaways from Nucor’s 3Q14 cost structure

Due to an increase in electricity costs, Nucor’s energy cost per ton of steel in 3Q14 went up by almost $1 from the corresponding quarter last year.

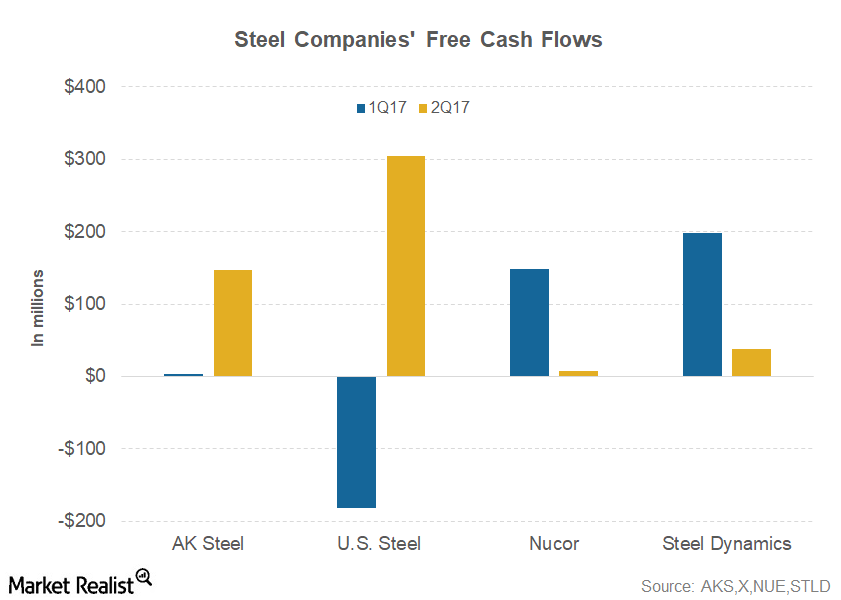

It’s Raining Cash for U.S. Steel amid Strong Markets

AK Steel (AKS) generated free cash flow of $147.0 million in 2Q17 compared to $3.8 million in 1Q17. It generated free cash flow of $111.0 million in 2Q16.

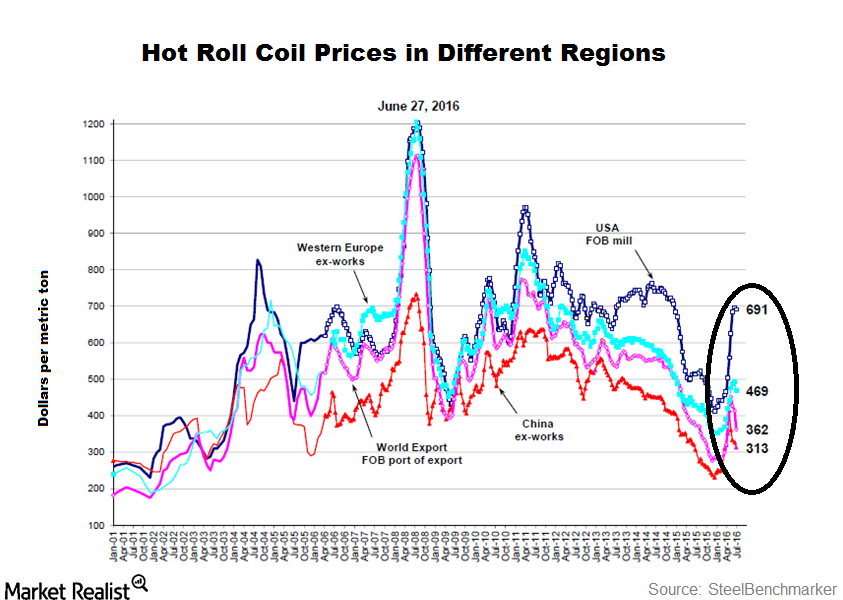

Why US Steelmakers’ Party Might Not Last Long

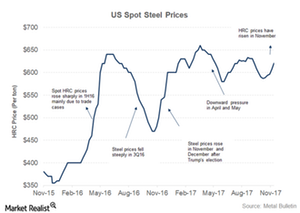

Due to trade cases, the US steel industry has turned into a virtual island largely immune to global steel prices—at least in the short term.

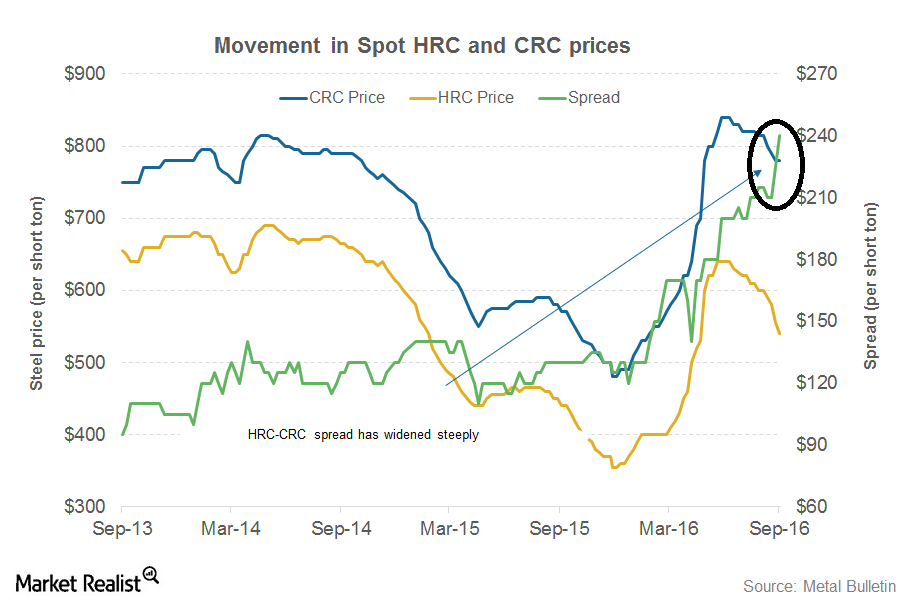

Must-Know: US HRC-CRC Spread Widens to Record Highs

During its 2Q16 call, AK Steel (AKS) pointed to a “significant rise” in CRC steel imports from Turkey, Vietnam, and Australia.

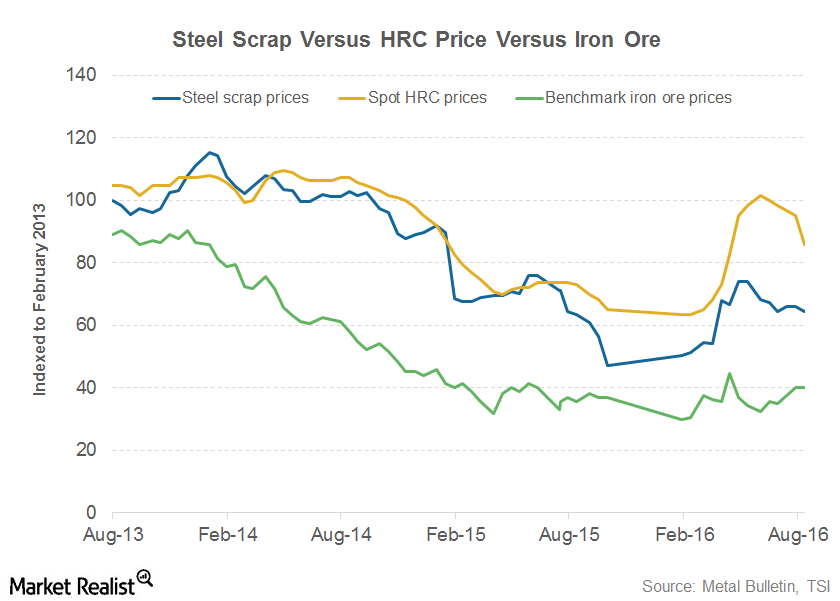

Iron Ore and Steel Scrap Prices Diverge after Section 232 Tariffs

Iron ore and steel scrap are the key steelmaking raw materials. In the United States, steel prices and scrap prices tend to move in tandem.

Why the Outlook for US Steel Prices Is Bright beyond 4Q17

While US steel prices rose to a high of $660 per ton in March 2017, they fell to $580 per ton in June.

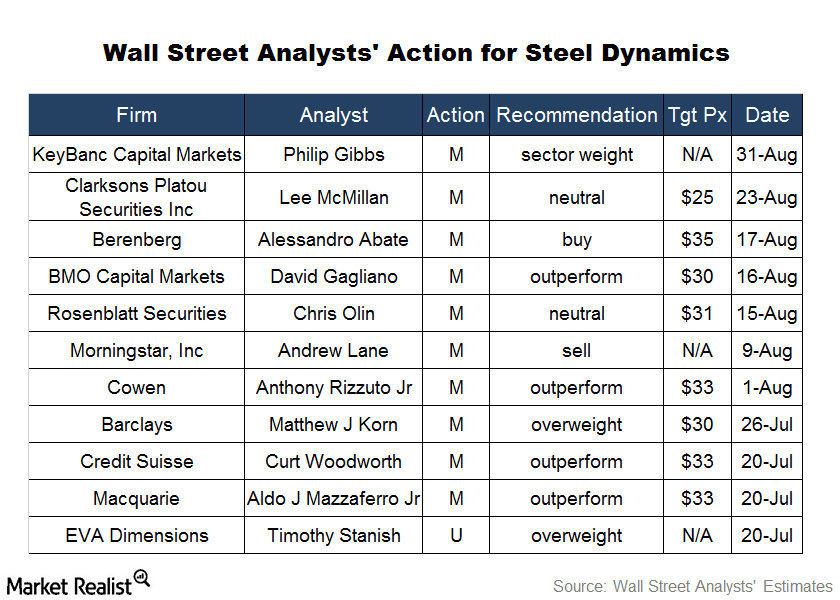

Why Most Analysts Have Rated Steel Dynamics as a ‘Buy’

Steel Dynamics has one of the most diversified end-market exposures compared to other steel companies.

Is President Trump Robbing Peter to Pay Paul?

While higher steel prices benefit US steel producers, they raise input costs for downstream manufacturers.

US Steel Demand: The Latest Indicators

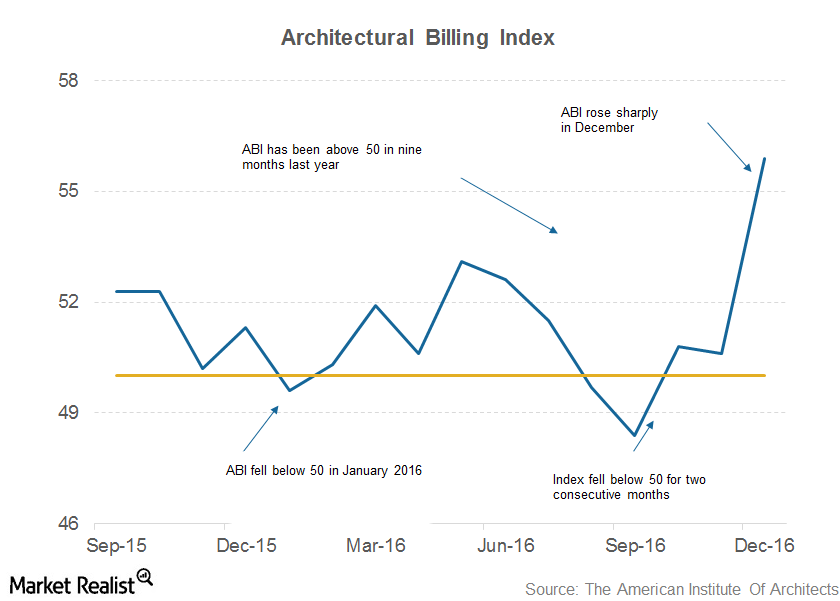

Steel demand is a key driver of steel companies’ performances, and the construction sector accounts for almost 40% of US steel demand.

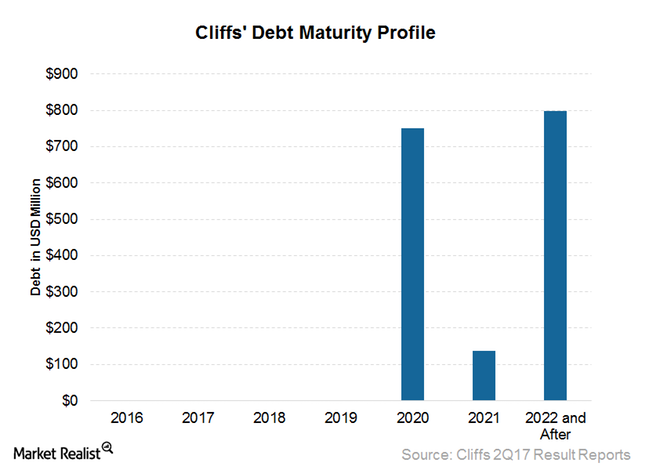

What Cliffs Natural Resources’ Debt Tender Offer Means

On July 31, 2017, Cliffs Natural Resources (CLF) announced a tender offer for a $575.0 million aggregate principal amount of its 5.75% guaranteed notes due in 2025.

How ArcelorMittal Fared in 1Q18

ArcelorMittal (MT), the world’s largest steel producer, reported revenues of $19.2 billion for 1Q18, the highest since 3Q14.

U.S. Steel: Past Success, Current Scenario, and Uncertain Future

U.S. Steel Corporation (NYSE:X) was 27th among global steel producers last year. The company’s rank has slipped gradually over the years.

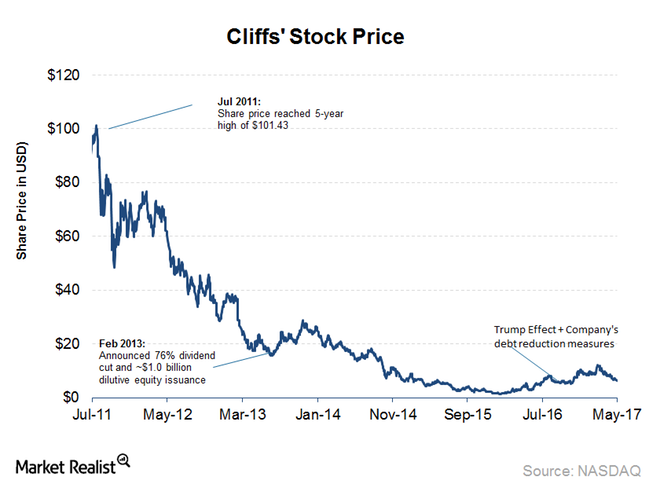

What to Expect from Cliffs Natural Resources’ 2Q17 Earnings

In this series, we’ll see what investors could expect from Cliffs Natural Resources’ (CLF) 2Q17 earnings report. CLF stock has gained 23% in the last 15 trading days.

Different Steel Types Have Distinct End Use

Steel producers manufacture steel in several shapes according to demand from end consumers.

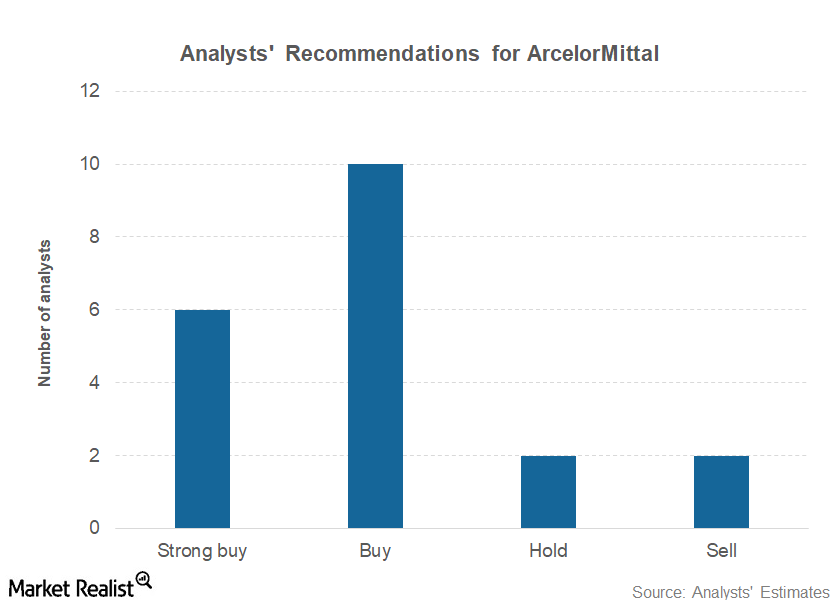

ArcelorMittal Could Keep Outperforming US Steel Stocks

ArcelorMittal (MT), the world’s largest steel producer, outperformed its US-based peers including U.S. Steel Corporation (X) and AK Steel (AKS) last year.

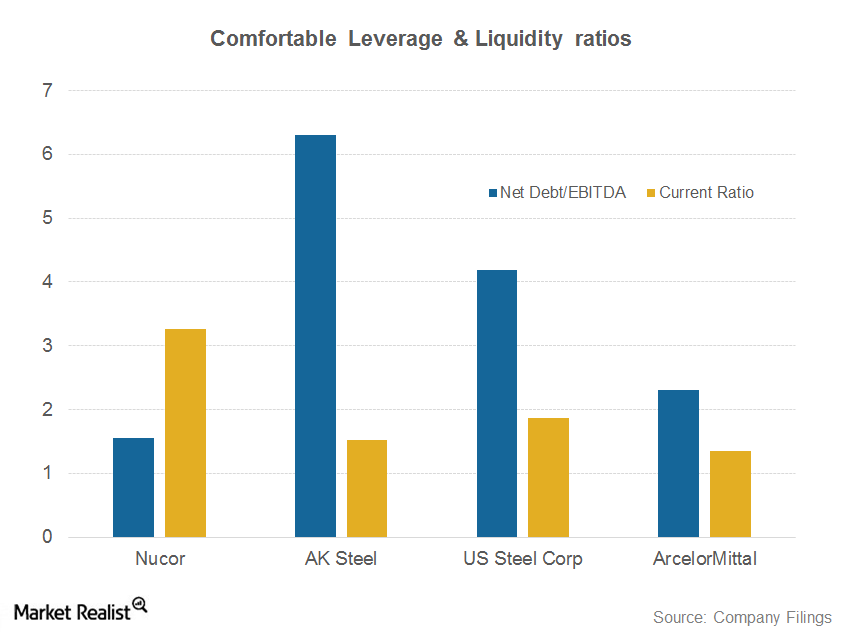

Why Nucor might acquire mining assets

Nucor is the only North American steel producer to hold investment-grade credit ratings due to its comfortable liquidity and leverage ratios.

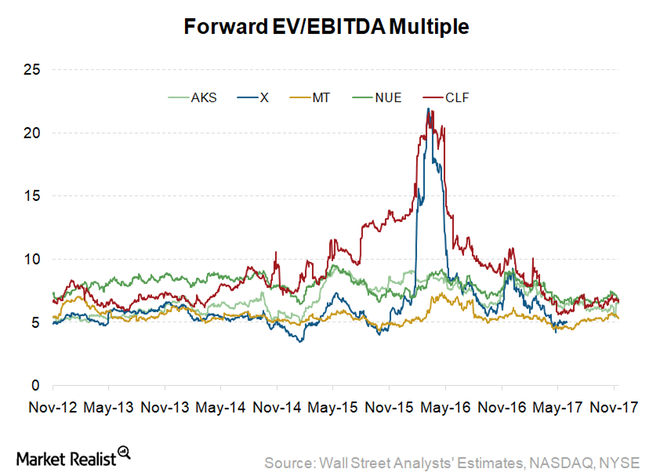

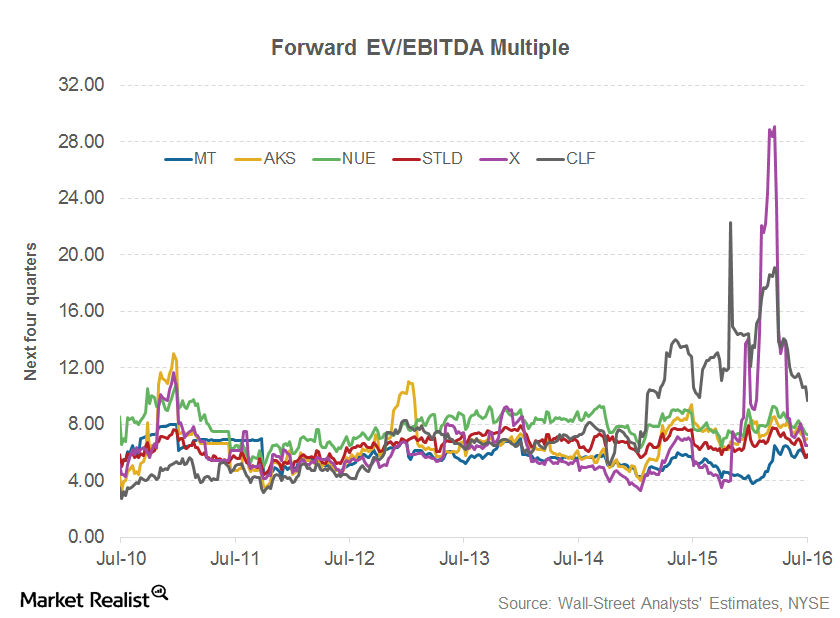

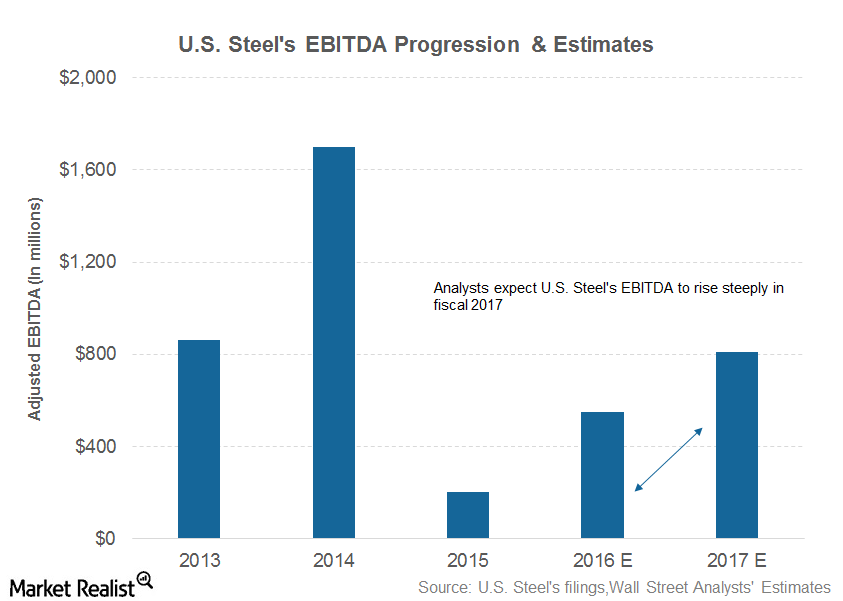

These Factors Could Affect CLF’s Valuation

Among the US steel players (SLX), only Cliffs and U.S. Steel are trading at a discount to their respective last five-year average multiples.

Could There Be More Upside to Cliffs Natural Resources’ Valuation?

For companies in cyclical industries such as steel and mining, the EV-to-EBITDA multiple is the preferred valuation metric.

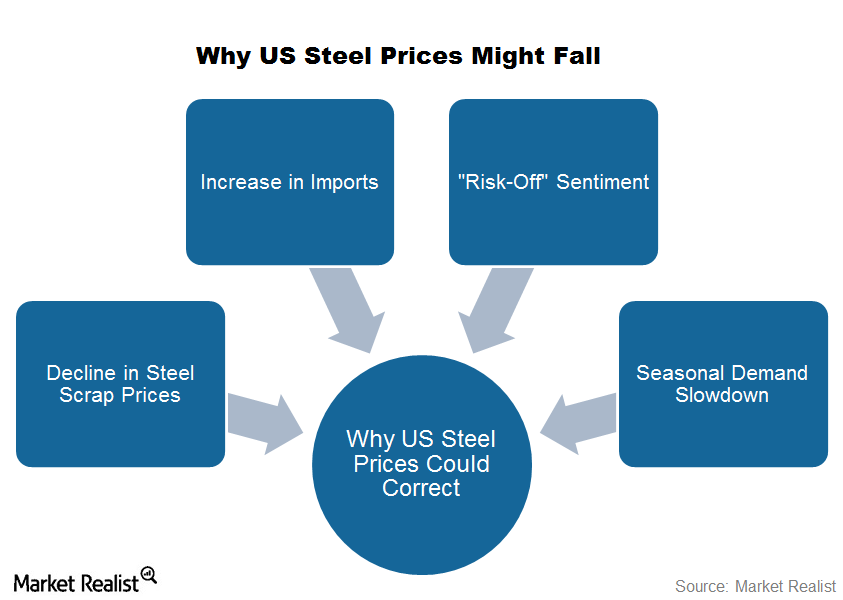

Could Steel Scrap Prices Follow Steel Prices Lower?

Steel scrap prices could follow steel prices lower. Steel mills might negotiate hard with scrap suppliers as steel prices pare some of their 2016 gains.

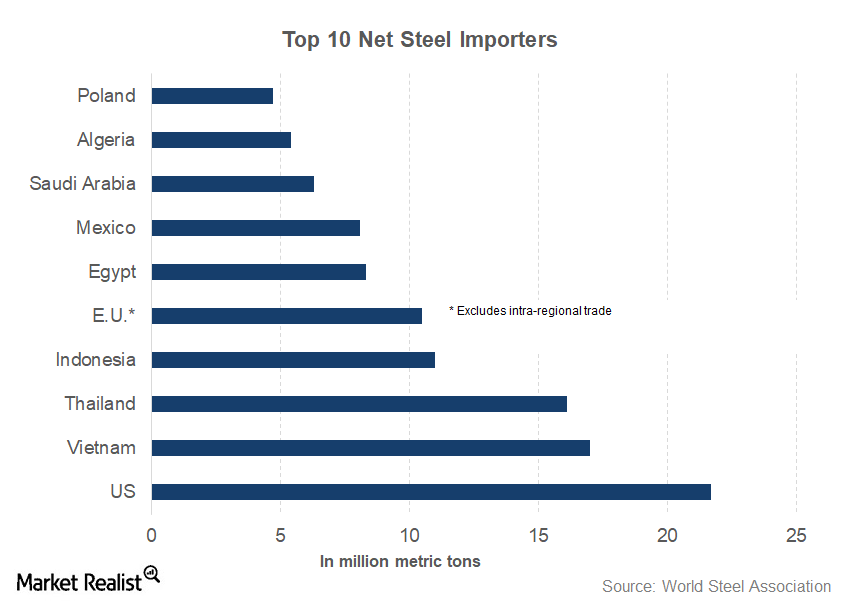

Top 10 Steel Importers: Is US Steel Industry Justified?

The United States is the world’s largest net steel importer. The country’s net steel imports totaled 21.7 million metric tons last year.

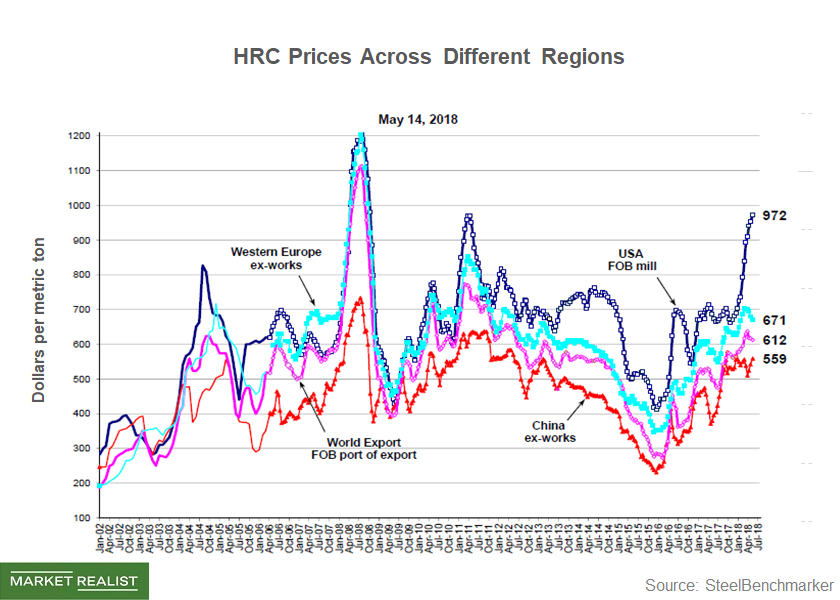

Does 2018 Bode Well for US Steel Prices?

Steel prices are the major driver of steelmakers’ earnings and revenues. So it’s important for steel investors and Cleveland-Cliffs (CLF) investors to track the trend in steel prices.

The U.S. Steel Bulls Only Hope?

Analysts’ opinions remain divided over U.S. Steel (X) after its 1Q17 earnings results.Materials Must-know: An investor’s guide to Nucor’s supply chain

To fulfill its iron ore requirements, Nucor has a DRI plant in Trinidad.

What Are Direct And Indirect Steel Imports?

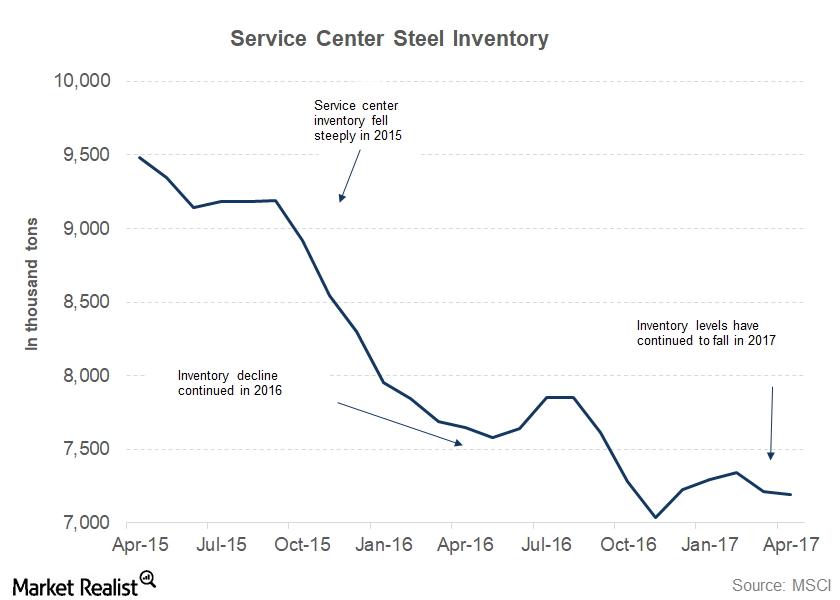

We’re analyzing the surging steel imports in the United States. But first, investors should understand about various types of steel imports.Materials Why metal service centers are important for U.S. Steel

Metal service centers account for about one-fifth of U.S. Steel’s total revenues. This makes these centers an important customer segment for the company.

What Leading Indicators Tell Us about US Steel Demand

The construction sector is the largest steel user. In the residential construction sector, US housing starts rose to an 11-year high in May.

Despite Gloomy Outlook, It’s Not the End of Road for Steel Stocks

US steelmakers such as U.S. Steel Corporation (X), AK Steel (AKS), and Nucor (NUE) stand to gain from duties against imported steel products, as they help them protect their turf from foreign steelmakers.

Steel Industry’s Capacity Utilization Ratio Is At A 1-Year Low

The capacity utilization ratio is a key determinant of steel companies’ profitability. As a result, it’s a key metric that steel play investors should actively track.

Challenges that aluminum faces as a steel replacement

Using aluminum, instead of steel, increases the vehicles’ manufacturing costs. With lower energy prices, analysts’ doubt that consumers will pay extra to purchase an all-aluminum body vehicle.

2Q16 Earnings Call: Will U.S. Steel Raise Its 2016 Guidance?

One would expect U.S. Steel to increase its 2016 guidance during its 2Q16 earnings call. However, U.S. Steel might be conservative.

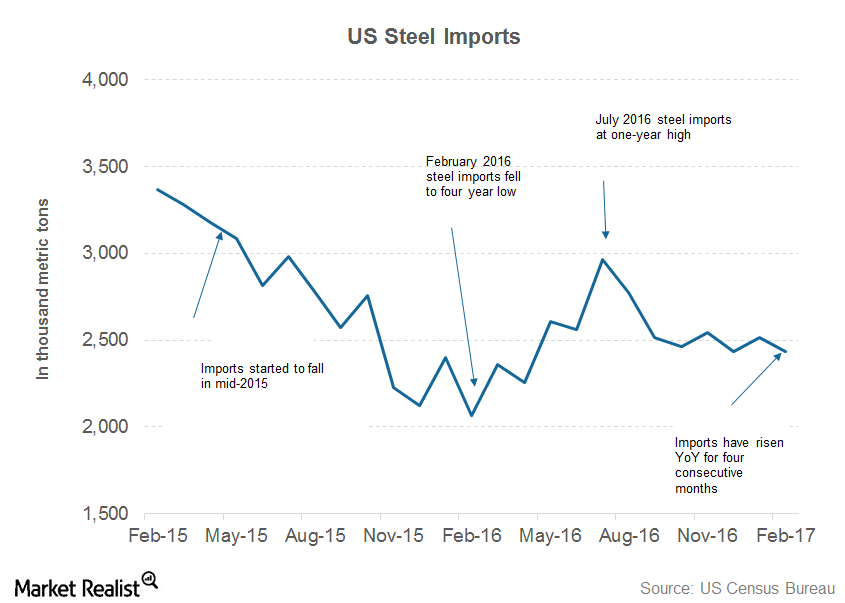

US Steel Imports Fell: Don’t Celebrate Just Yet!

Preliminary data showed that US steel imports fell sharply in August after the spike in July. However, falling imports haven’t restored investor sentiments.

For the US Steel Industry, China’s No Longer the Villain!

For a long time, US steel producers blamed Chinese steel exports for depressing prices. However, Chinese exports have fallen sharply this year.Materials Why steel production has slowed down in China, affecting stocks

The steel industry in China has witnessed a slowdown, largely as a result of a slowdown in the real estate industry in China.

Are Global Macros Supportive of US Steel Stocks?

Although US steel producers have trade protections in the form of the Section 232 tariffs, the global steel pricing environment still affects US steel prices.