Guggenheim Solar ETF

Latest Guggenheim Solar ETF News and Updates

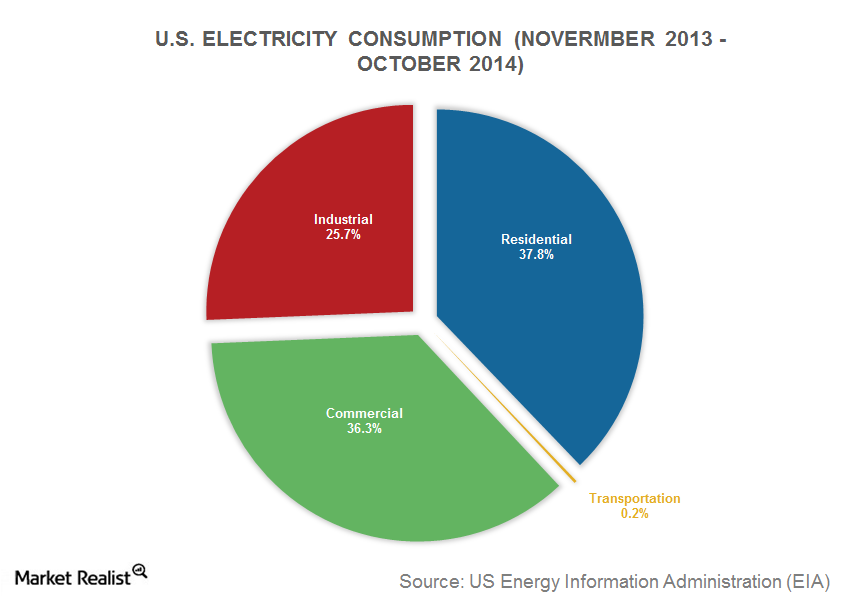

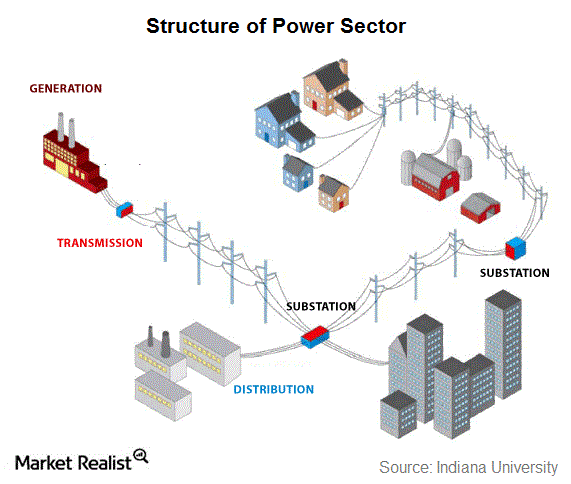

The must-know dynamics of the global power industry

In this series, we’ll look at the structure of the thermal power industry before moving on to focus on the power generation equipment sector.

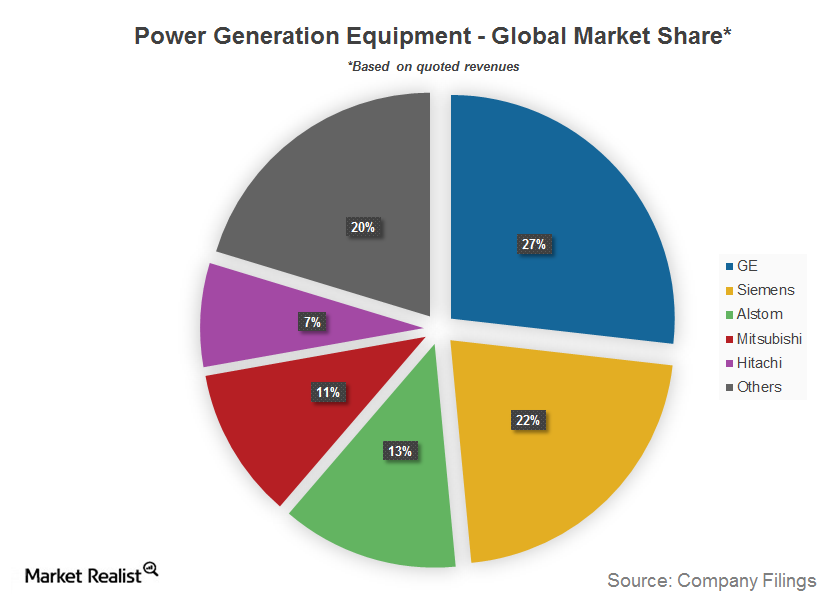

The major sub-industries of the global power equipment industry

The power generation equipment industry is made up of various sub-industries, each with a structure of its own.

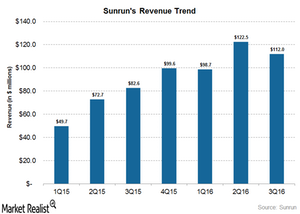

Why Did Sunrun Miss Analysts’ 3Q16 Revenue Estimates?

For 3Q16, Sunrun’s (RUN) consolidated revenue came in at ~$112 million against analysts’ expectations of $135 million.

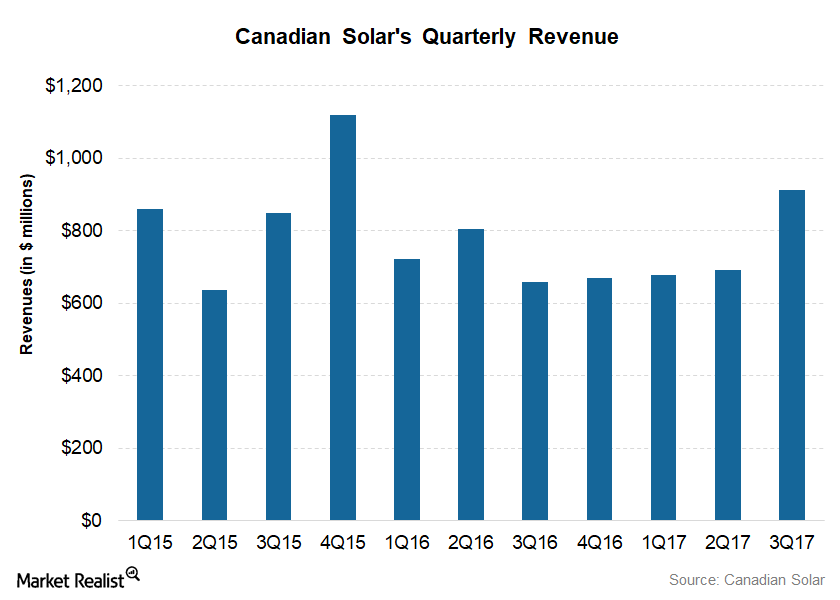

Canadian Solar Beat Analysts’ 3Q17 Revenue Estimates

Canadian Solar’s revenues from the sale of electricity in 3Q17 totaled $9.6 million, which was marginally lower than $9.8 million in 2Q17.

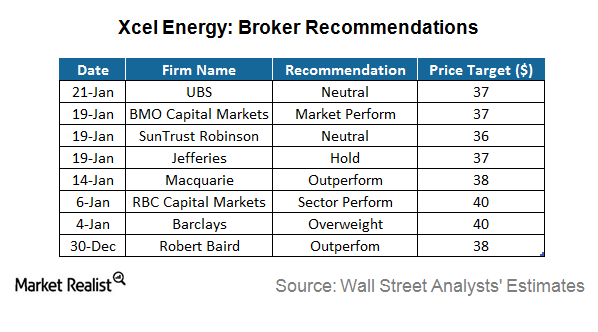

No Analysts Recommend a “Sell” on Xcel Energy

Of the 18 analysts tracking Xcel Energy, 13 recommend it as a “hold,” five recommend it as a “buy,” and none recommend it as a “sell.”

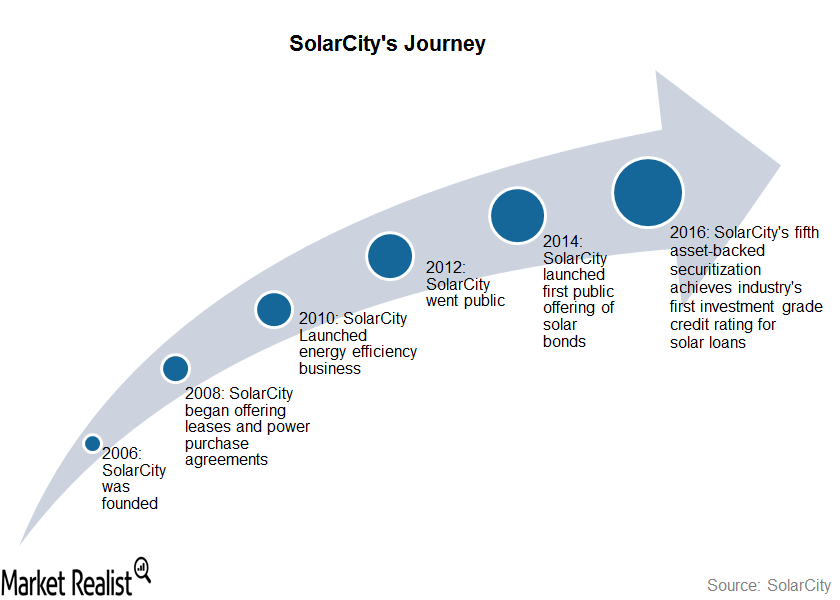

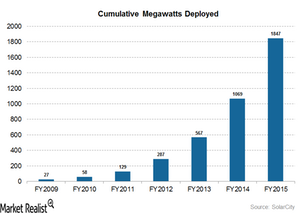

SolarCity: A Quick Trip down Memory Lane

SolarCity was founded in 2006 with the initial focused on selling, financing, and installing solar energy systems for residential and commercial customers.

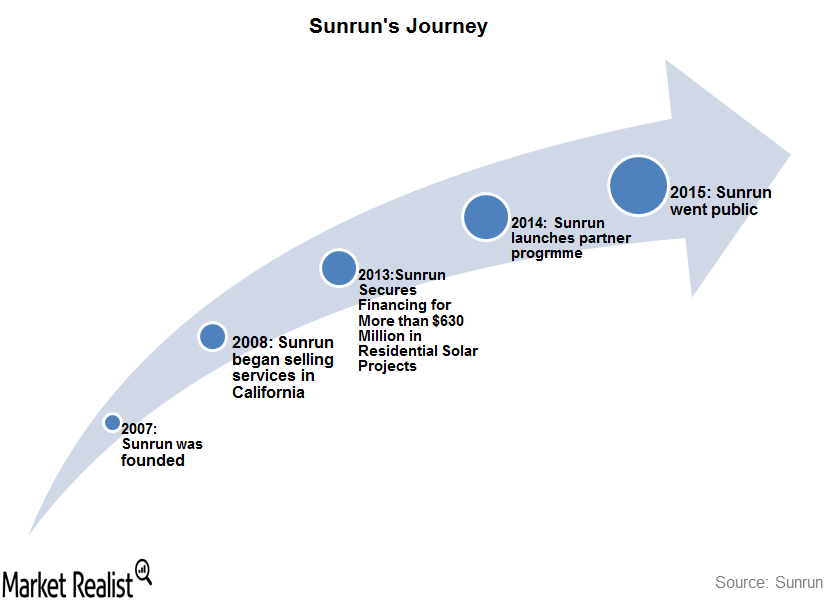

Sunrun: The Beginning of a Residential Solar Major

Sunrun was co-founded in 2007 as a startup by Ed Fenster and Lynn Jurich, with an aim to create worldwide use of solar energy. It began offering solar services in 2008.

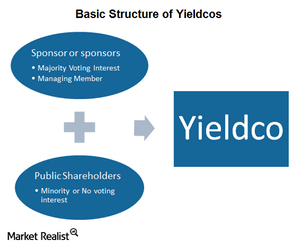

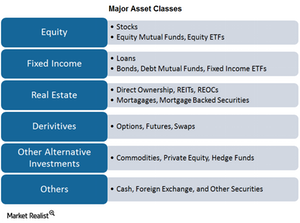

Yieldco: A Green Investment Option That Pays

While REITs started trading in 1951 and MLPs started off in 1981, the first yieldco was floated in 2005 by Seaspan Corporation, a shipping company.

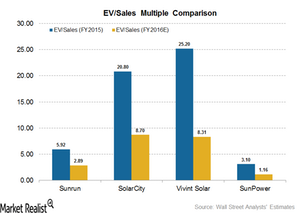

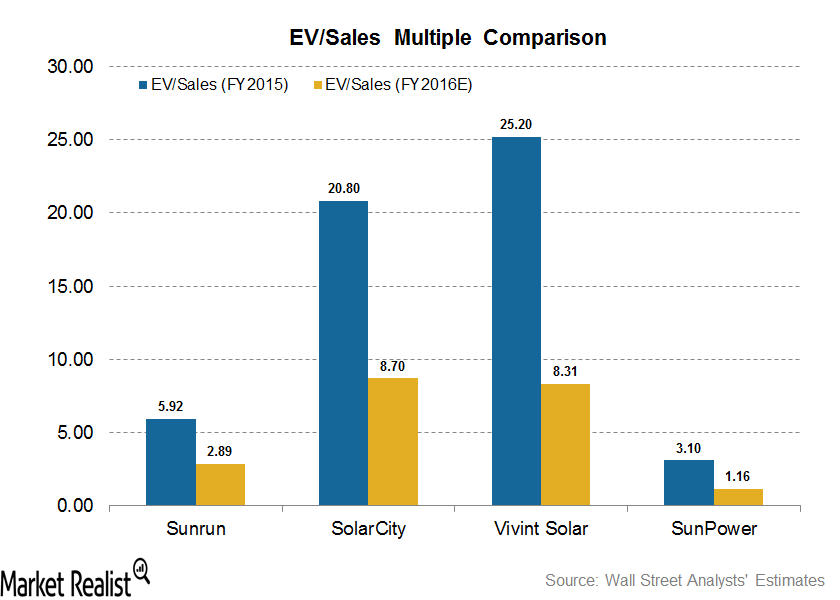

Understanding SolarCity’s Valuation Compared to Peers: Who’s Trading at a Discount?

Among the downstream solar companies, SolarCity (SCTY) has the highest EV-to-sales value of 8.70x, which is closely followed by Vivint Solar at 8.31x.

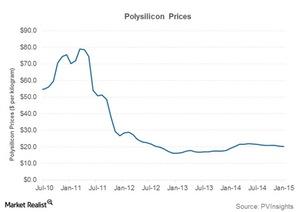

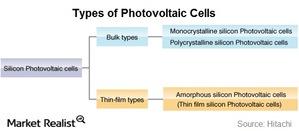

First Solar faces some must-know challenges

While First Solar has traditionally been manufacturing thin-film CdTe modules, which don’t require polysilicon, their prices have fallen in recent years.

Solar Stocks with Bright Upside Potential: FSLR, ENPH

Solar stocks have had a great run this year. Strong demand, falling costs, and higher corporate investments have supported these renewables in 2019.

Why First Solar Stock Could Continue to Climb

Top solar stock First Solar (FSLR) has surged about 10% in September. FSLR is trading close to its 52-week high and might continue to march upward.

Generac Challenges Enphase Energy, SolarEdge Duopoly

Short-seller Citron Research noted that Generac Holdings could challenge solar microinverter makers Enphase Energy and SolarEdge’s duopoly.

Enphase Energy Stock Looks Strong, 600% 2019 Gain

Solar microinverter company Enphase Energy (ENPH) has rallied more than any other stock in the space this year with a more-than-600% gain.

First Solar Disappoints in Q2 but Raises Guidance

First Solar (FSLR) reported its second-quarter earnings results yesterday. It reported EPS of -$0.18 for the quarter.

How’s First Solar Stock Placed Compared to Its Peers?

First Solar stock is trading at a forward PE ratio of 18x. On average, solar stocks (TAN) are trading at a forward valuation multiple of 14x.

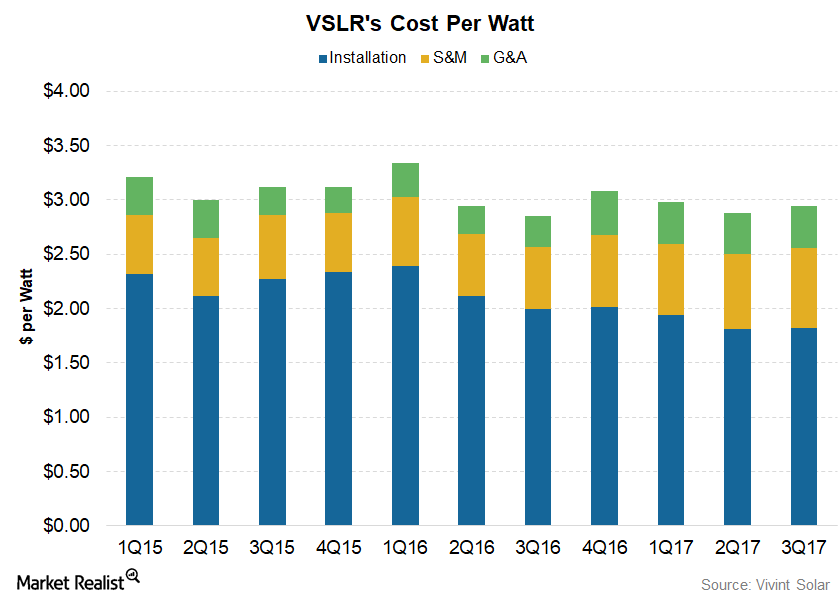

Vivint Solar Reported Rise in Estimated Retained Value in 3Q17

Vivint Solar (VSLR) reported a cost per watt of $2.94 for 3Q17, higher than the $2.88 it reported in 2Q17 and $3.85 in 3Q16.

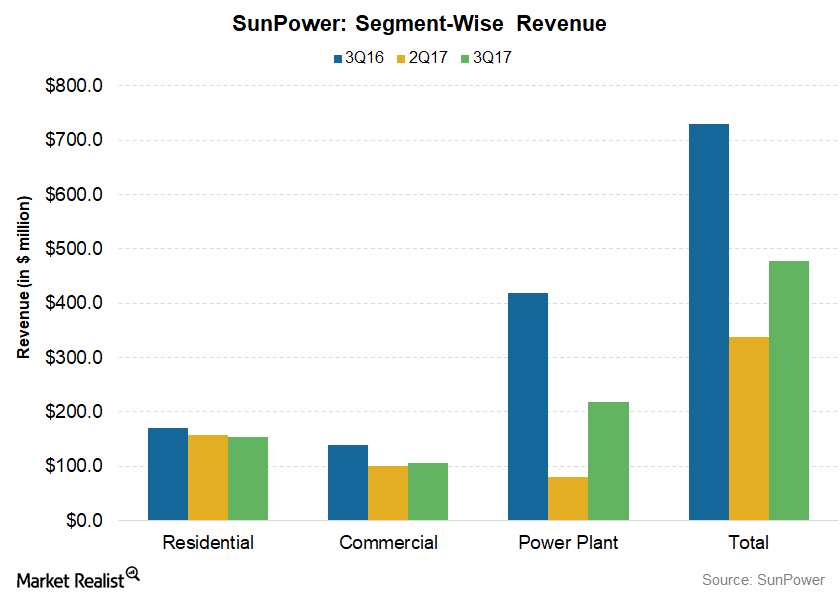

Why SunPower Reported Lower 3Q17 Revenues

SunPower (SPWR) reports its revenue under the power plant, residential, and commercial segments. The latter two segments are together called the distributed generation segments.

First Solar: A Key Player in the Global Solar Power Industry

First Solar (FSLR) produces solar energy equipment. In this series, we’ll look at its performance and the outlook for the industry.

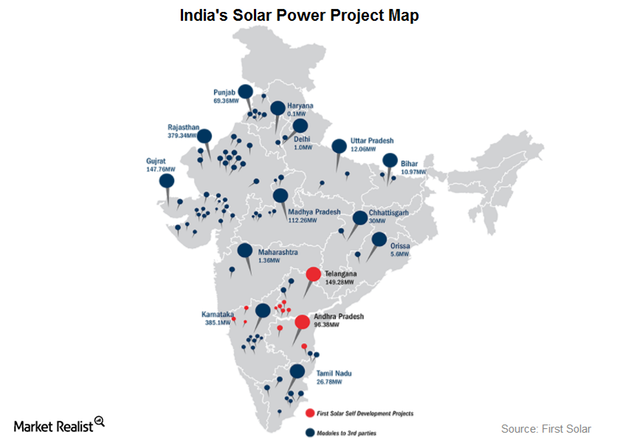

How India Became First Solar’s Second-Biggest Market

India’s rising electricity demand According to the EIA’s (U.S. Energy Information Administration) 2017 International Energy Outlook, India’s electricity generation is expected to increase by 3.2% per year through 2040, to meet increasing electricity demand in rural areas. Solar outlook Even though coal is the primary fuel used for electricity generation in India, the focus on renewable […]

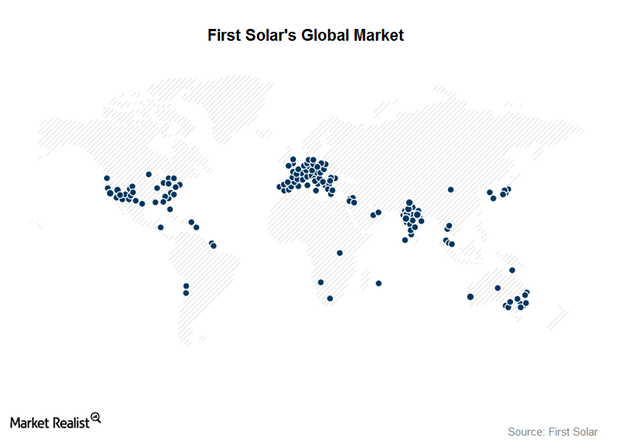

First Solar’s Global Market Strategy

The Americas The US PV (photovoltaic) market made up ~83% ($2.9 billion) of First Solar’s (FSLR) revenue. The United States has typically been First Solar’s largest market, and where many of its prominent projects and customers are located. First Solar has completed the construction of Del Sur, a 26 MW (megawatt) solar project in Honduras. It commenced […]

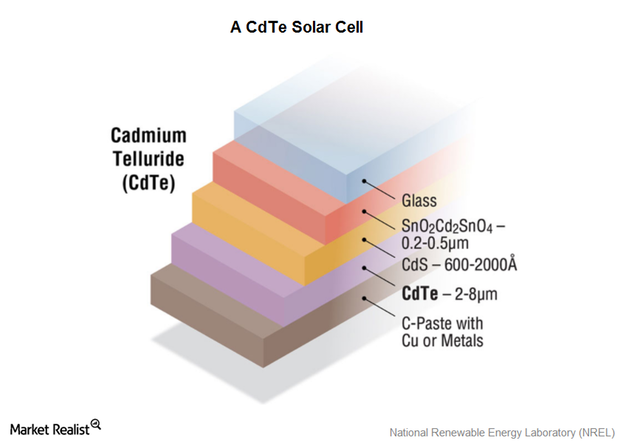

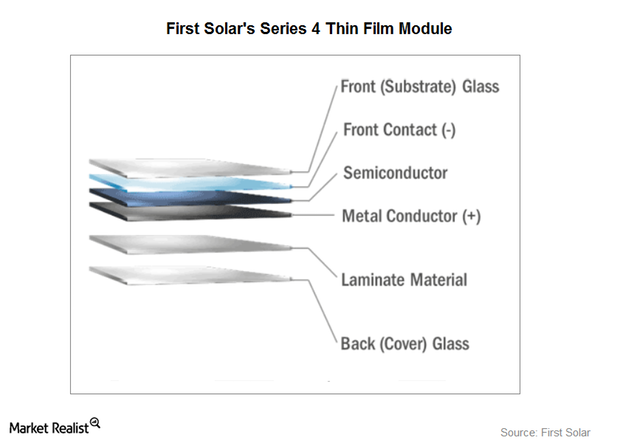

Behind First Solar’s Operations

Operating segments Previously, we looked at First Solar’s (FSLR) history. The photovoltaic module manufacturer operates two business segments: Components and Systems. The Components segment First Solar is a manufacturer of solar (TAN) photovoltaic (or PV) modules. First Solar also designs and sells these modules. They manufacture thin-film PVs, in which the semiconductor material used is […]

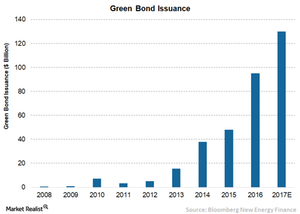

Green Bond Drivers: The Same as Conventional Bonds

Green bonds are used by organizations worldwide to fund environmentally sustainable projects such as renewable energy, energy efficiency, and clean water.

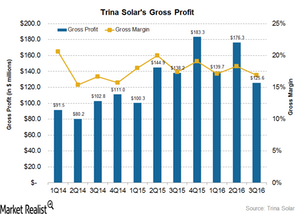

How Did Trina Solar’s Costs Affect Its Gross Margin in 3Q16?

In 3Q16, Trina Solar (TSL) reported a gross profit of $125.6 million compared to $176.3 million in 2Q16. On a YoY basis, the company’s gross profit fell nearly 9.0%.Macroeconomic Analysis Statoil Expects Cost Reductions in Offshore Wind

One reason that renewable energy hasn’t caught on in a big way is the cost associated with energy generation.

Understanding SolarCity’s Business Strategy

Business expansion is crucial for companies like SolarCity, which intends to expand its presence via partnerships with homebuilders and industry leaders.

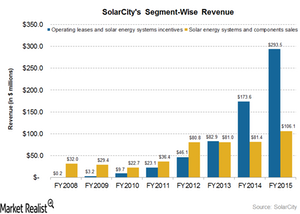

How Does SolarCity Make Money?

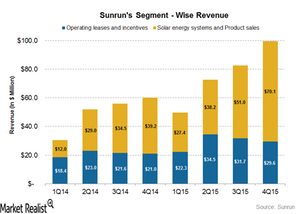

SolarCity’s business is divided into two segments: Operating Leases and Solar Energy Systems Incentives and Solar Energy Systems and Component Sales.

Is Vivint Solar Trading at a Discount Compared to Its Peers?

One out of four analysts covering Vivint Solar (VSLR) has rated the stock a “buy,” two analysts rated the stock a “hold,” and one analyst recommends a “sell” for the stock.

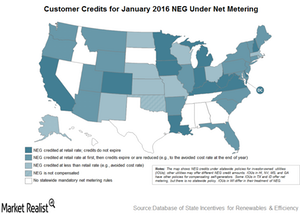

How Vivint Solar’s Customers Benefited from Solar Tax Credits

ITCs (investment tax credits) are a dollar-for-dollar reduction on an income tax bill. It is applicable to both residential and commercial deployment of solar systems.

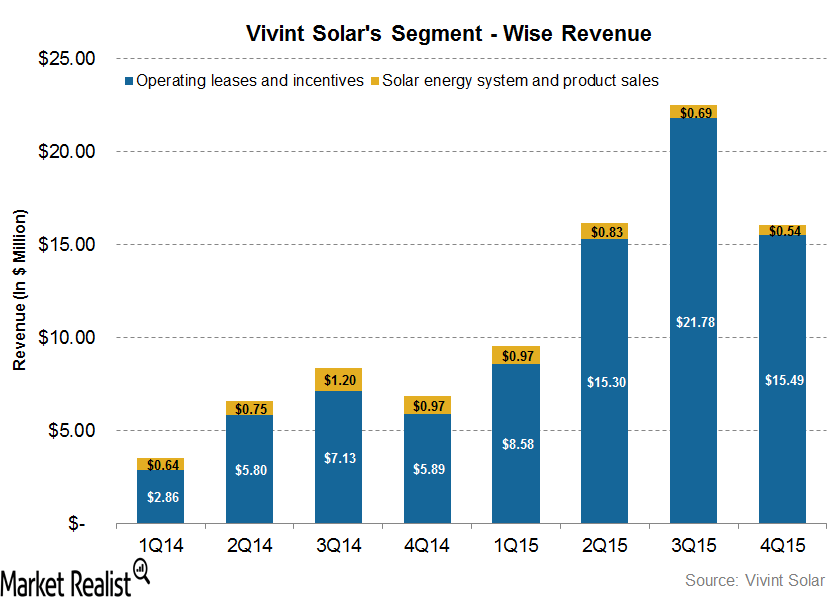

How Does Vivint Solar Make Money?

Vivint Solar’s business model is divided into two revenue segments: Operating Leases and Incentives and Solar Energy Systems and Product Sales.

Analyzing Key Elements of Sunrun’s Business Strategy

Unlike its peers, Sunrun is building an open platform of services and tools to provide a differentiated customer experience and, at the same time, gaining a wide customer base.

Need to Know: Sunrun’s Major Acquisitions

In February 2014, Sunrun (RUN) acquired the residential business of REC Solar, AEE Solar, and SnapNrack from Mainstream Energy Corporation for $78.8 million.

How Does Sunrun Make Money?

Extension of ITCs for investments in solar energy has been key for the rapid expansion of downstream solar companies like Sunrun, Vivint Solar (VSLR), SolarCity (SCTY), and SunPower (SPWR).

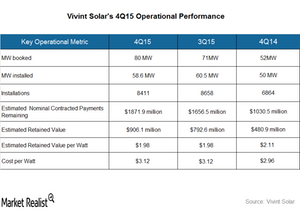

Behind Vivint Solar’s Key Operational Metrics

Vivint Solar’s estimated nominal contracted payments remaining increased by $251.4 million during 4Q15, compared to $214 million during 3Q15.

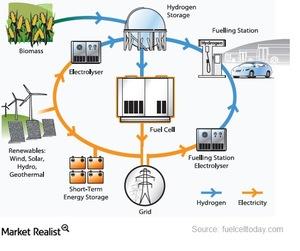

What Paris Climate Agreement Means for Fuel Cells and Solar Energy

Clean energy was one of the important issues in the Paris Climate Agreement. Fuel cells produce clean energy from a chemical reaction between anodes and cathodes.

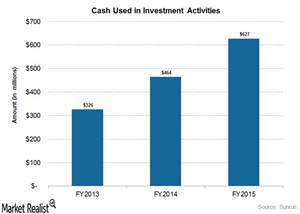

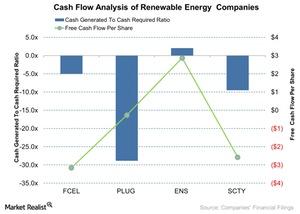

Cash Flow Analysis for Renewable Energy Companies

The cash flow is an important part of a company’s financials. Lower cash flows increase a company’s chances of being caught in a vicious cycle of debt raising and refinancing.

How Does AES Manage Its Businesses across 18 Countries?

AES has businesses spread across 18 countries and has various operating subsidiaries, each focusing on a specific area of business.

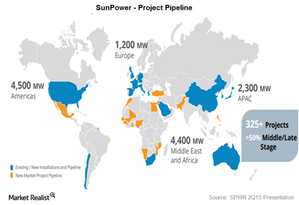

What Does the Future Hold for SunPower?

In 3Q15, SunPower (SPWR) expects to generate $400 million to $450 million in revenues and net losses of $0.50 to $0.60 per share.

SunPower’s Solar Components Business Model: How Does It Work?

SunPower uses solar cells to produce solar panels at its facilities in the Philippines, Mexico, and France. It has a total solar panel capacity of 1.7 GW.

Equity Sub-Asset Class Basics for Retail Investors

Financial engineers are constantly introducing the market to new sub-asset classes, often confusing retail investors in the process.

Understanding the structure of the global power sector

While the power sector differs country by country, the operational structure of the sector across the world is pretty much the same.