Royal Dutch Shell PLC

Latest Royal Dutch Shell PLC News and Updates

Gas Is Drying Up—Why There's a U.K. Petrol Shortage

Major petrol demand is causing gas stations in the U.K. to run dry. What's causing the demand, and will suppliers catch up?

Buy Royal Dutch Shell (RDS.A) Stock on the Dip, Bet on Green Energy

Royal Dutch Shell has fallen 12 percent from its 52-week highs and is in the correction zone. Should you buy the dip in RDS.A stock or wait?

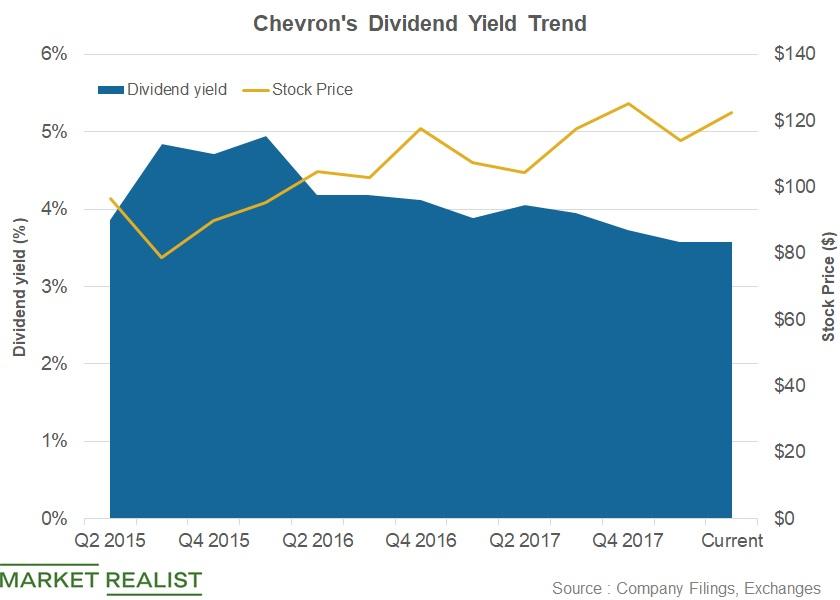

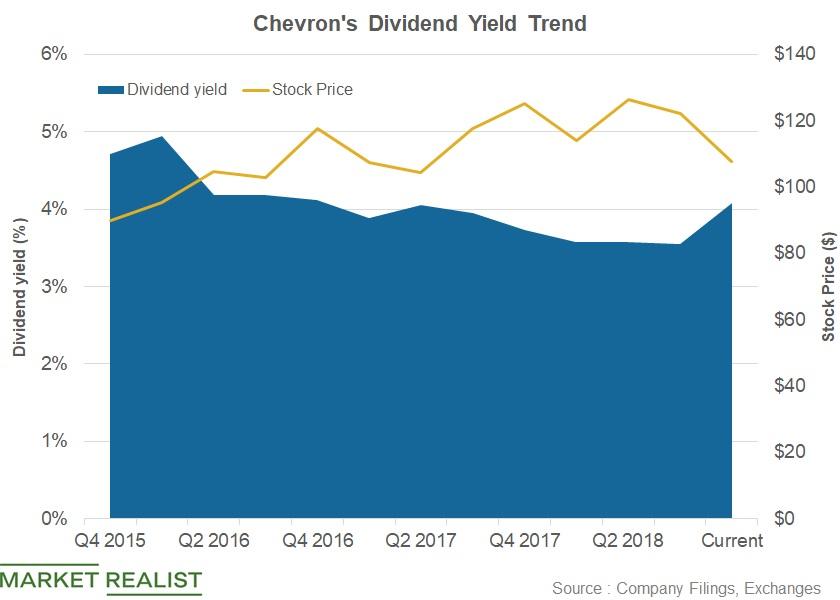

Chevron’s 3.6% Dividend Yield Ranks Sixth with High Valuations

Chevron (CVX) is the sixth stock on our list of the top eight dividend-yielding stocks.

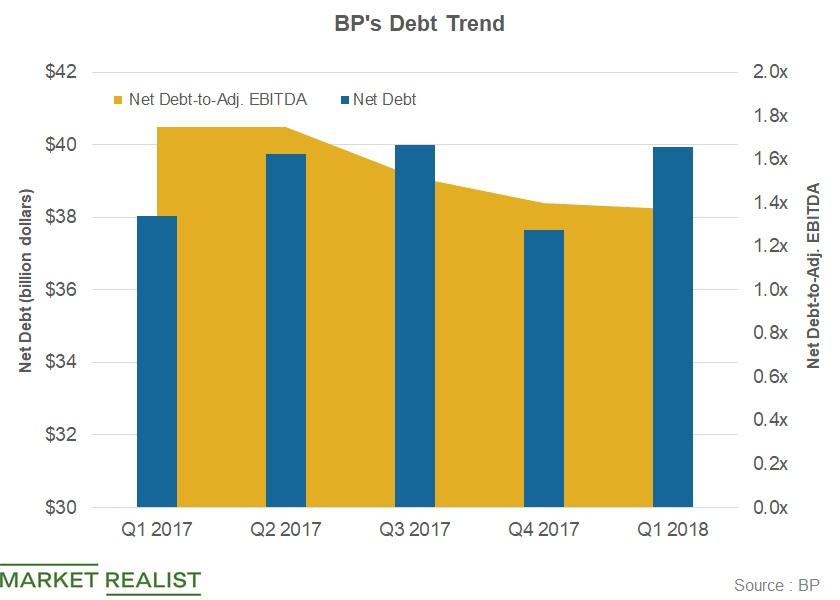

How BP’s Debt Position Compares

In this part, we’ll review whether BP’s (BP) debt position has improved. Let’s begin by comparing BP’s debt position with peers’.

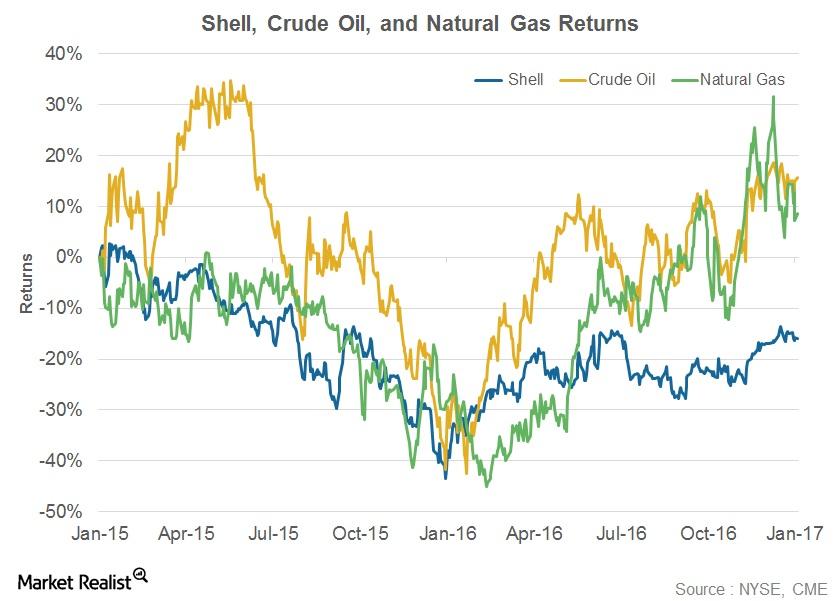

How Has Shell’s Stock Performed ahead of Its 4Q16 Earnings?

On January 20, 2016, Shell began recuperating from the falls it had experienced in the previous year. Shell has risen 49% since January 20, 2016.

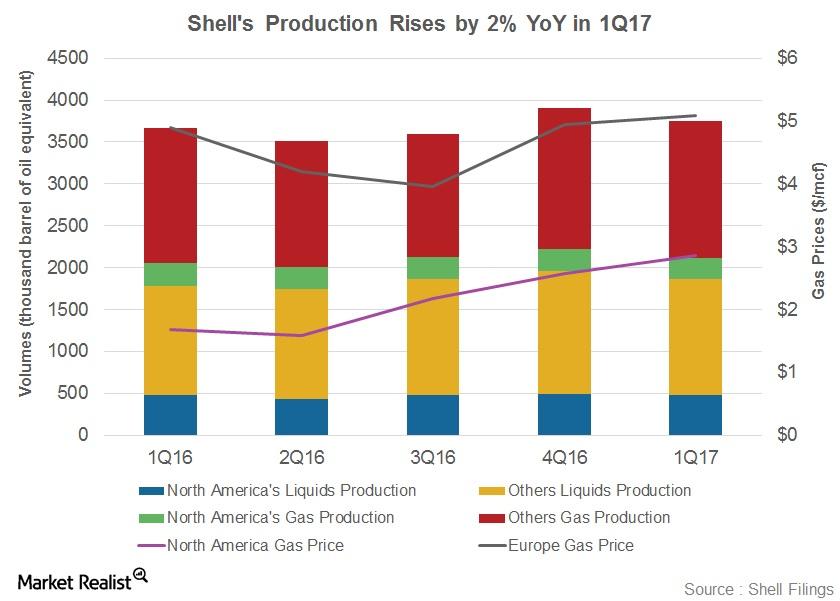

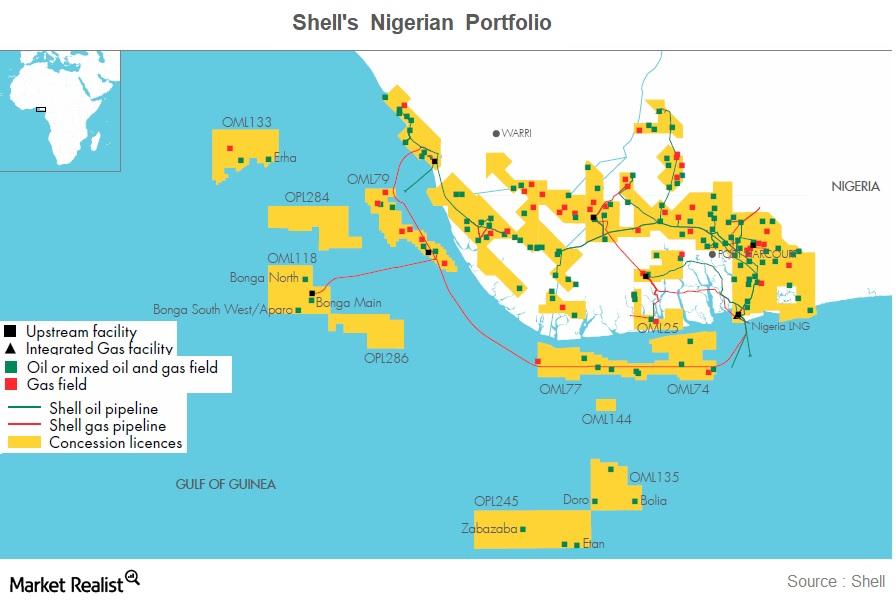

Shell’s Upstream Portfolio: Is it Poised to Grow?

Royal Dutch Shell (RDS.A) produced 3.8 MMboepd in 1Q17 from its worldwide operations, compared to 3.7 MMboepd in 1Q16.

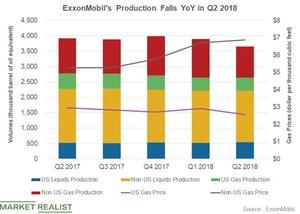

How Was ExxonMobil’s Upstream Performance in Q2 2018?

ExxonMobil (XOM) produced 3.7 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in the second quarter.

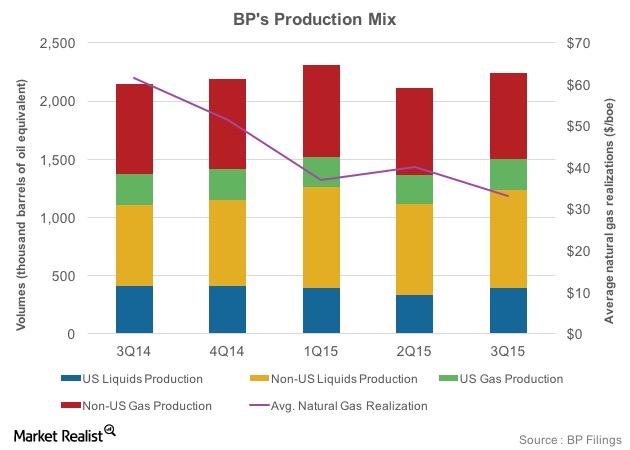

BP’s Upstream Segment: Large Upcoming Gas Projects

BP has a strong pipeline of projects in its upstream portfolio. These projects are expected to result in 800,000 barrels per day of new production by 2020.

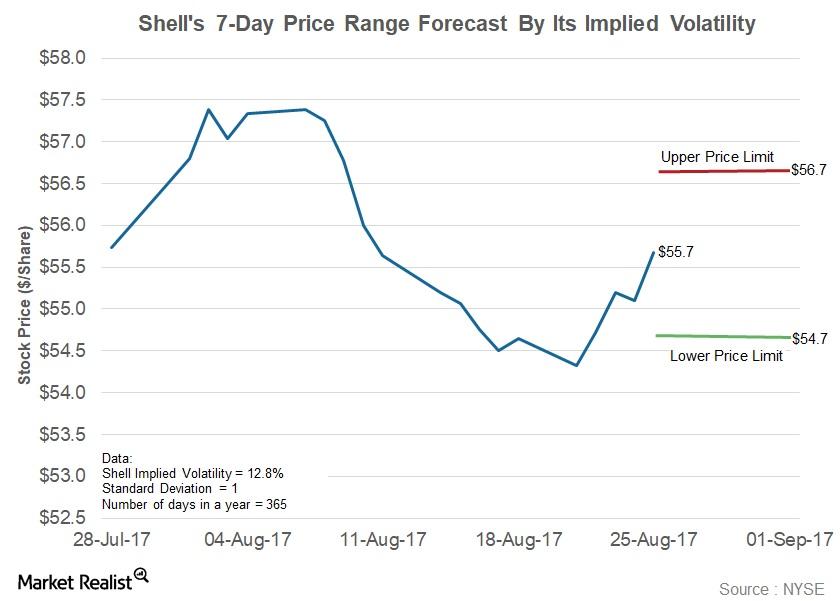

What’s the Forecast for Shell Stock for the Next 7 Days?

Implied volatility in Royal Dutch Shell (RDS.A) has fallen 4.9% since July 3, 2017, to the current level of 12.8%.

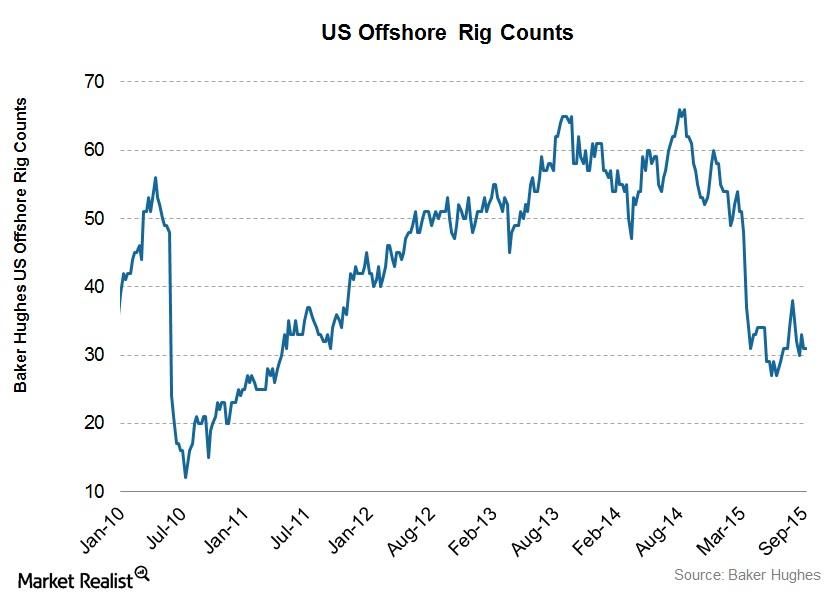

US Offshore Rig Count Was Steady in the September 18 Week

In the week ending September 18, 2015, the US offshore rig count didn’t change. The offshore rig counts have averaged 33 over the past eight weeks.

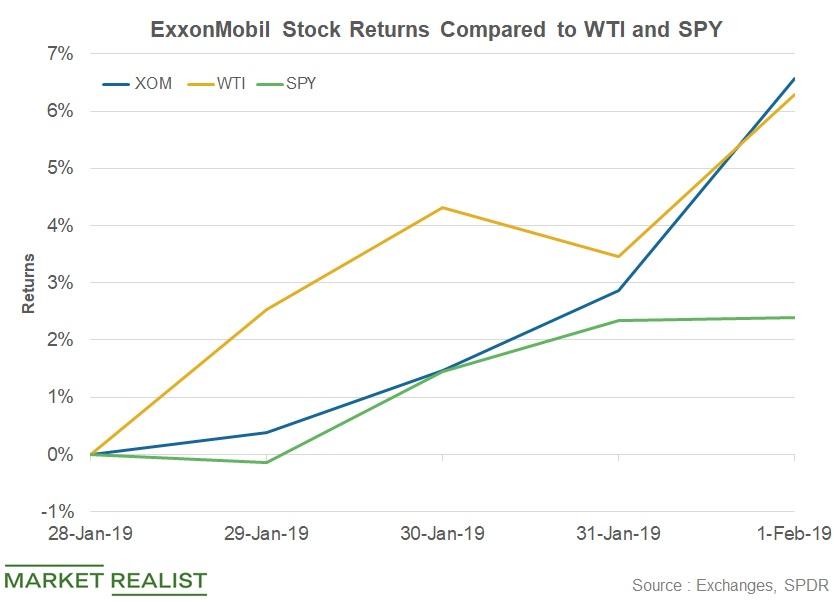

ExxonMobil Stock Rose 4% after Its Q4 Earnings

ExxonMobil (XOM) announced its fourth-quarter earnings on February 1. ExxonMobil stock opened at $74.9 per share on February 1.

Chevron Ranks Second-Last in Terms of Its Dividend Yield

In terms of its dividend yield, Chevron (CVX) is the fifth-best performer among the six stocks under review.

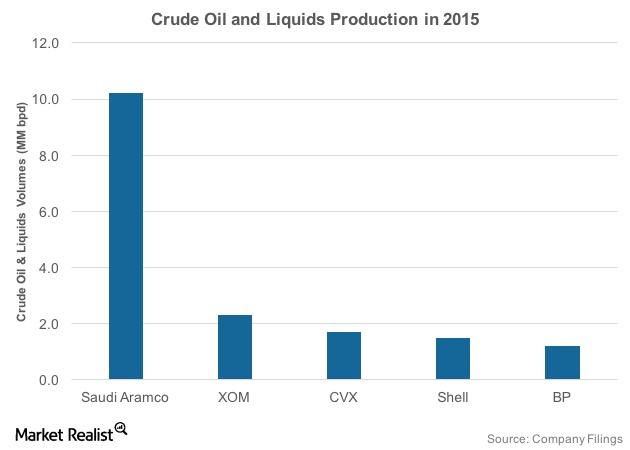

Must-Know: World’s Top Oil Companies by Production

The US, Saudi Arabia, and Russia are the world’s top three crude oil producers. Let’s take a look at the world’s top oil players by production volumes.

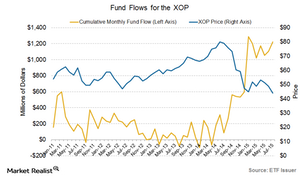

XOM, CVX, RDS.A, BP: Are They Underperforming the S&P 500?

So far in 1Q18, Chevron (CVX) stock fell 13.9%, the highest among its peers ExxonMobil (XOM), BP (BP), and Royal Dutch Shell (RDS.A).

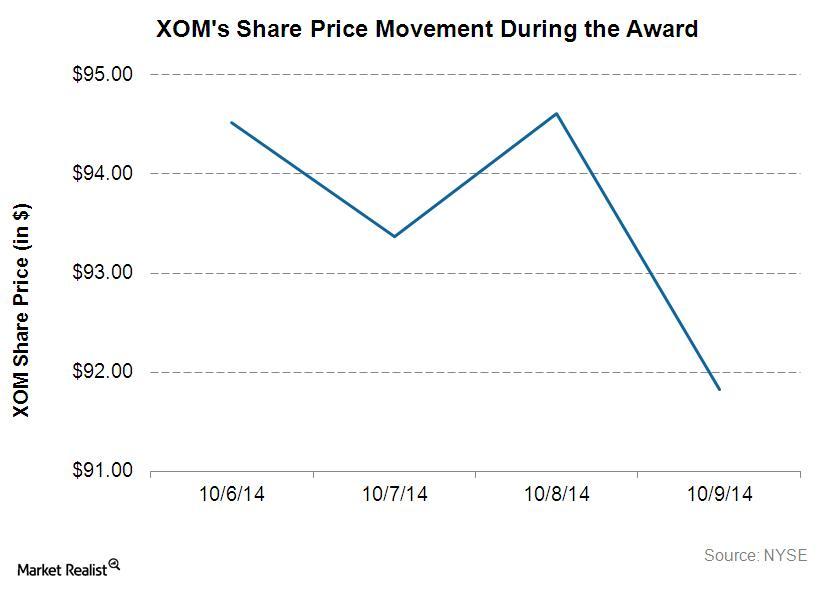

Exxon Mobil wins $1.6 billion in arbitration case against Venezuela

Exxon Mobil alleged that the Venezuelan government illegally expropriated its Venezuelan assets in 2007 and paid unfair compensation.

Goldman Sachs Favors Chevron Compared to ExxonMobil

Chevron and ExxonMobil stocks have provided almost flat returns in the current quarter. As a result, Goldman Sachs favors Chevron over ExxonMobil.

Oil Majors Keep New Projects Worth $200 billion on Ice

Wood Mackenzie research shows that the oil majors have deferred more than 45 significant oil and gas projects since the beginning of the crude oil price collapse last year.

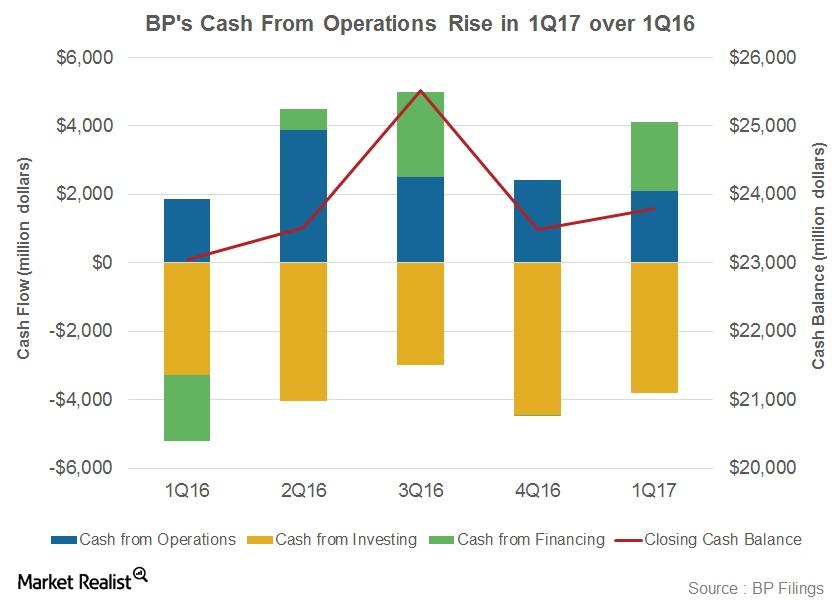

Is BP’s Cash Flow Slated for Growth?

Rising oil prices have given BP some hope that its cash flows could improve. The robust upstream project pipeline is also likely to result in higher production.

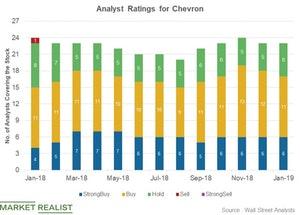

Chevron: Analysts’ Recommendations

In January, 23 analysts rated Chevron (CVX). Among the analysts, 17 (or 74%) recommended a “buy” or “strong buy.”

How Does Saudi Aramco’s Production Compare to Its Peers?

Saudi Aramco’s production accounted for 27% of OPEC’s average production in 2015. After Saudi Arabia, Iraq and Iran have the highest production in OPEC.

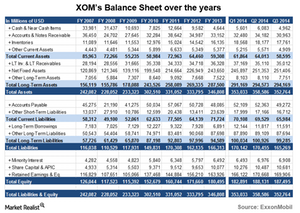

An essential analysis of ExxonMobil’s balance sheet

On a combination of several factors such as its earnings, share buybacks, and XTO acquisition, XOM’s balance sheet has grown.

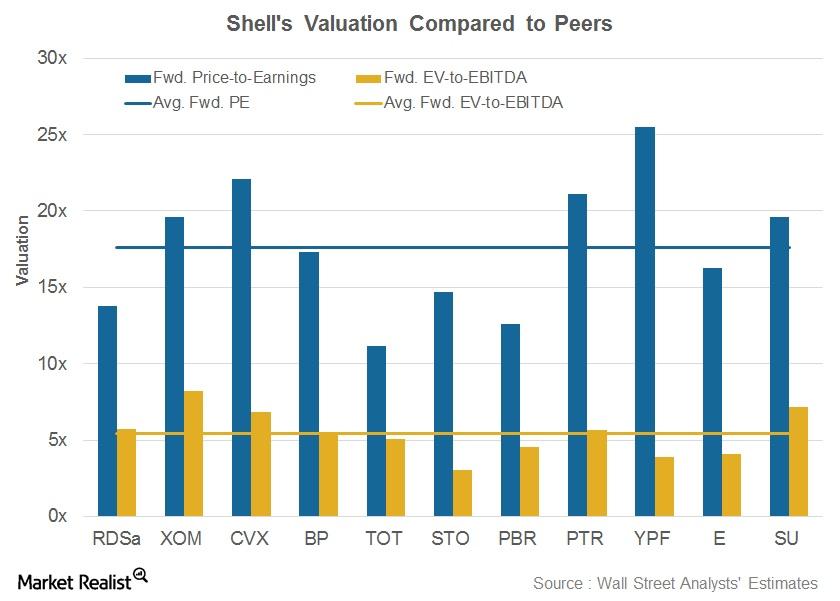

Shell’s Valuation Compared to Its Peers

Shell is trading at a forward PE of 13.8x, below its peer average of 17.6x.

The World’s Top Oil-Producing Countries

These are the countries who produce the most oil in the world as well how much they produce

Do Technical Indicators Hint at Strength for BP Stock?

BP stock has had almost flat returns in 2019, and its stock is up 0.3% year-to-date. Lower oil prices have impacted the stock’s performance.

2019 Oil and Gas Bankruptcies Paint Bleak Outlook

Haynes and Boone reported that 50 energy companies filed for bankruptcy in the first nine months of 2019, including 33 oil and gas producers.

Chevron: Is It a Good Time to Invest in the Stock?

Currently, Chevron stock trades at 18.5x its 2019 forward EPS and at 17.2x its 2020 forward EPS. The stock is higher than most of its peers.

Oil Prices and ExxonMobil Stock: What’s the Correlation?

ExxonMobil stock and oil prices have a strong correlation. The one-year correlation coefficient between the stock and WTI crude oil prices stood at 0.54.

Which Country Has the Most Oil?

Let’s take a look at the countries that own the most proven oil reserves and see why that matters for investors. You might find some surprises!

Get Real: Powell Puts the Ball Back in Trump’s Court

Jerome Powell tossed the ball back into President Trump’s court. He trade development and global growth weakness as the top reasons for the rate cuts.

ExxonMobil and Chevron: Do Moving Averages Show a Breakout?

Leading energy stocks like ExxonMobil (XOM) and Chevron (CVX) are facing bleak business conditions. Oil prices have been weaker in the third quarter.

BP Stock: Should You Buy It Now?

BP (BP) stock rose 3.9% on Monday due to higher oil prices. The drone attack on Saudi Arabia’s oilfield increased WTI crude oil by about 13%.

Energy Stocks Fall: Right Time to Invest?

The recent slump in energy stocks provides investors with an opportunity to invest in well-placed stocks. Shell looks like an attractive investment option.

ExxonMobil Stock: JPMorgan Chase Cut Its Target Price

ExxonMobil’s (XOM) earnings fell in the second quarter. After the earnings, JPMorgan Chase cut its target price on ExxonMobil stock from $85 to $83.

BP’s Earnings Beat Analysts’ Expectations

BP (BP) reported its second-quarter results today. Its earnings per American depositary share of $0.84 beat analysts’ estimate by about 7%.

Total SA Stock Fell Marginally After Q2 Earnings

Total SA stock fell 0.9% on Thursday—its earnings release day. The stock was impacted by a 20% YoY fall in its earnings.

ExxonMobil Tops the Charts with Strong Financials

ExxonMobil (XOM) has the lowest percentage of debt in its capital structure compared to its peers. In the first quarter, ExxonMobil’s total debt-to-capital ratio stood at 17%.

Has Shell’s Dividend Yield Risen?

Shell’s dividend payments have stayed steady in the past few years. In the second quarter, Shell will pay a dividend of $0.94 per share.

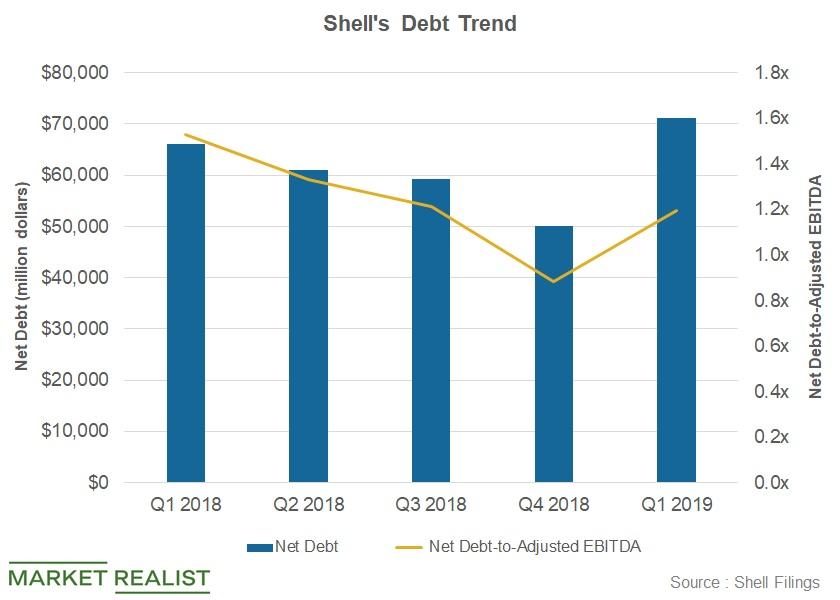

Does Shell Have a Comfortable Debt Position?

Royal Dutch Shell’s (RDS.A) net debt-to-adjusted EBITDA ratio was 1.2x in the first quarter—in line with the average industry ratio of 1.2x.

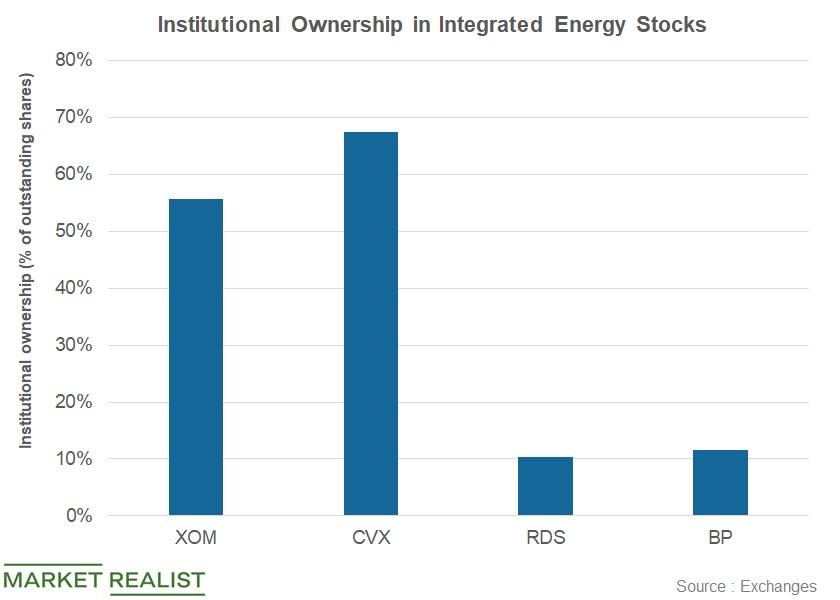

Which Institutions Raised Holdings in Integrated Stocks?

Institutional ownership in ExxonMobil and BP stands at ~56% and ~12%, respectively.

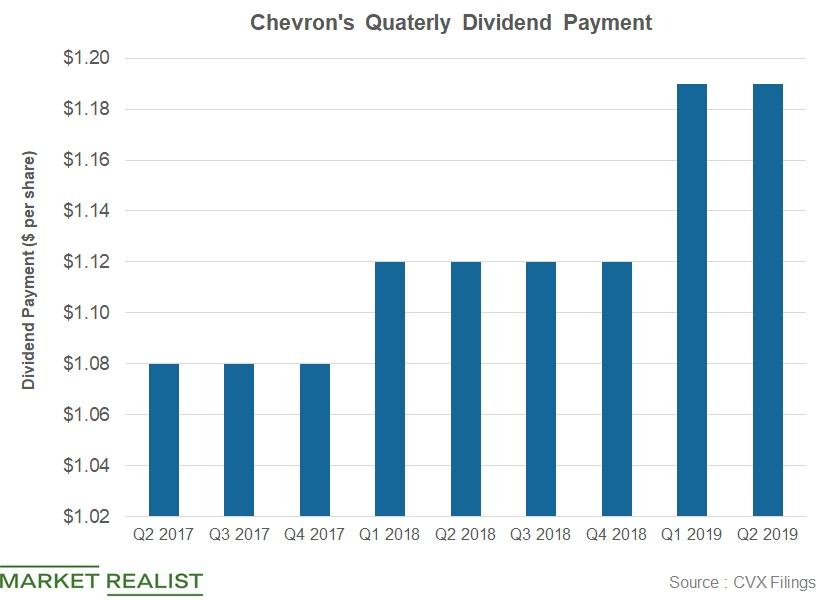

How Will Chevon’s Dividend Payment Trend in Q2?

Chevron (CVX) released its first-quarter earnings on April 26. The company paid $2.2 billion in dividends in the first quarter.

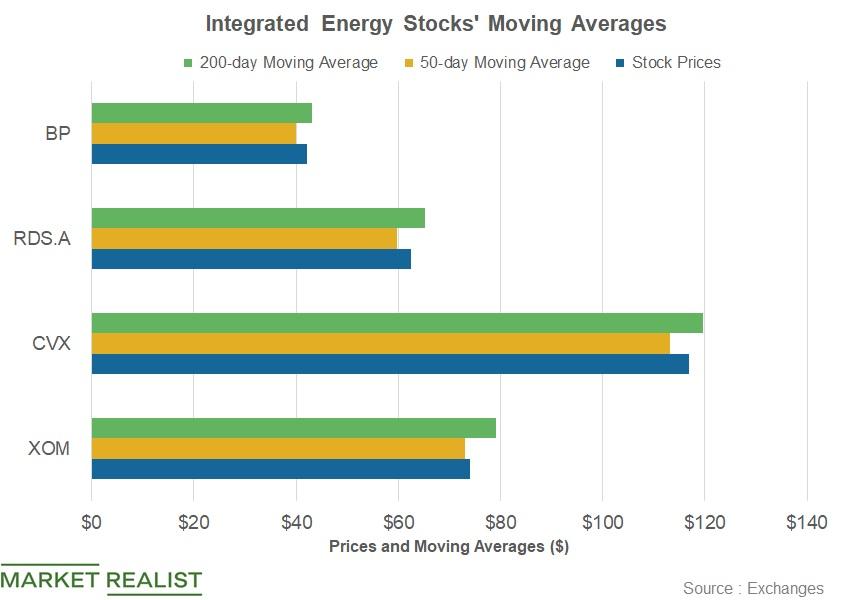

XOM, CVX, Shell, BP: What Do Moving Averages Suggest?

In the first quarter so far, integrated energy stocks ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have risen due to the rise in oil prices.

Chevron: Analysts Expect Higher Q3 Earnings

Chevron (CVX) is expected to post its third-quarter results on November 2. Chevron is expected to post an EPS of $2.1 in the third quarter.

Integrated Energy Stocks: The Top Eight Dividend Yielders

In this series, we’ll look at eight integrated energy stocks and rank them on dividend yields. Royal Dutch Shell (RDS.A) holds the top spot.

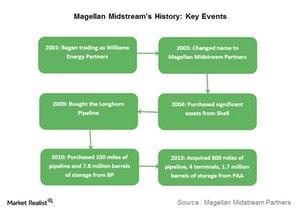

Magellan Midstream Partners: A Brief History

Magellan’s history Magellan Midstream Partners (MMP), which began trading in 2001, has grown through various asset acquisitions and expansion projects over the years. Magellan was formerly a part of Williams Companies (WMB). The company started trading as Williams Energy Partners in 2001, and changed its name to Magellan Midstream Partners in 2003. In 2004, the […]

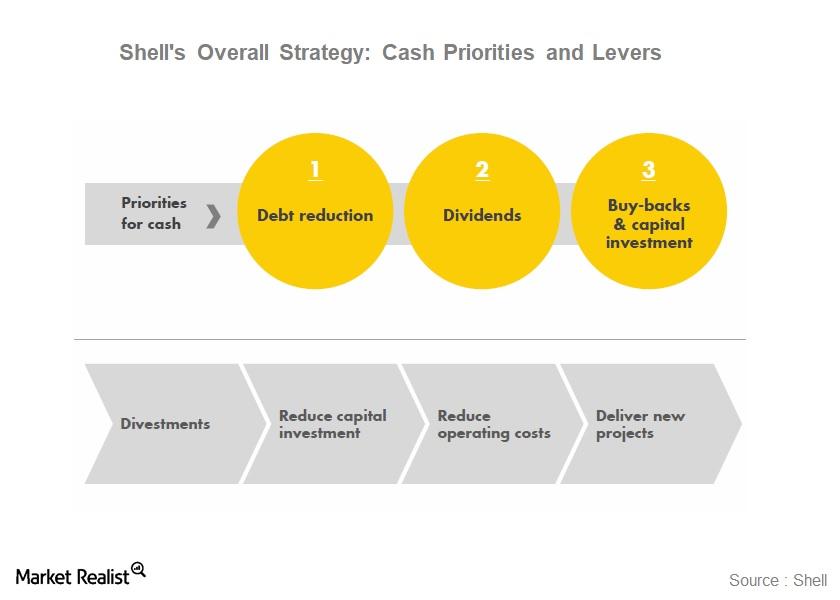

How Shell’s Levers Could Help It Achieve Its Priorities

Royal Dutch Shell (RDS.A) intends to become more resilient to lower oil prices.

Why Shell’s Gbaran-Ubie Project Is Vital to Upstream Portfolio

In this series, we’ll look at Shell’s overall performance, its robust upstream portfolio, its changing downstream portfolio, and the company’s overall strategy.

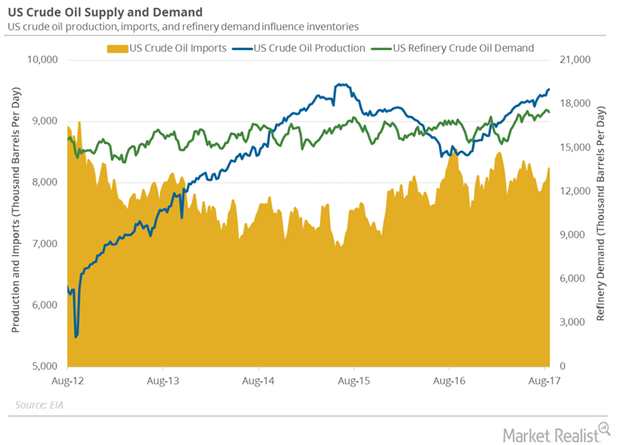

How Tropical Storm Harvey Impacts US Crude Oil and Gasoline Prices

WTI (West Texas Intermediate) crude oil (SCO)(BNO)(PXI) futures contracts for October delivery rose 0.4% and were trading at $46.8 per barrel in electronic trading at 2:05 AM EST on August 29.

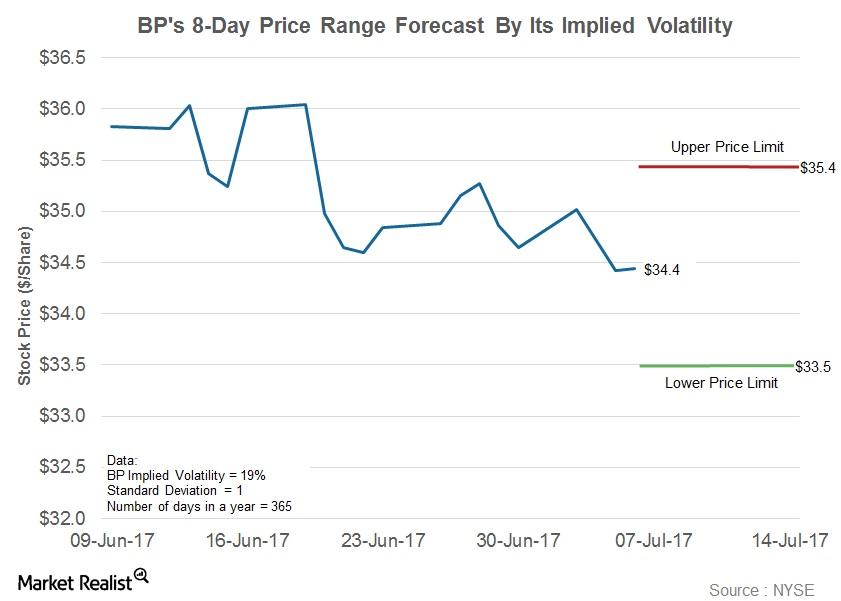

Estimating BP’s Stock Price Using Implied Volatility

What is implied volatility? Volatility gauges changes in a stock’s return over a period. When estimated based on historical stock prices, it is called historical volatility. We can estimate the future volatility, or implied volatility, of security using an option pricing model. A high implied volatility would indicate that a stock price is expected to move […]

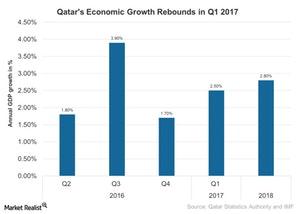

Understanding Qatar’s Resilience amid Sanctions

Qatar’s (QAT) economy continued to grow in 1Q17 amid improved oil prices since 2Q16. But more recently, oil prices have hit a downtrend.

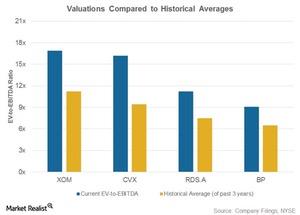

Energy Stock Valuations and Their Historical Averages

EV-to-EBITDA multiples in 1Q17 for ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) were above their historical averages.