Royal Dutch Shell PLC

Latest Royal Dutch Shell PLC News and Updates

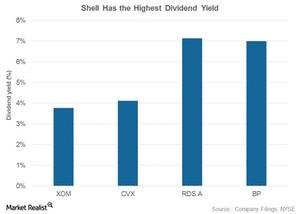

Who Has Higher Dividend Yields: RDS.A, XOM, CVX, or BP?

Shell has the highest dividend yield of 7.1% among the integrated energy stocks we’re covering in this series.

Inside Integrated Energy’s Dividend Yields: Comparing XOM, CVX, RDS.A, and BP

ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have consistently given returns to shareholders in the form of dividends.

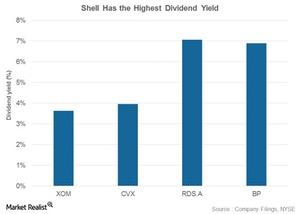

Understanding Integrated Energy Stocks’ Betas in April 2017

Royal Dutch Shell’s (RDS.A) 90-day daily beta fell from 0.96 on April 3, 2017, to 0.85 on April 11, 2017.

Integrated Energy Stocks: Who Stands Tall in Dividend Yield?

Shell’s dividend yield is 7.1%, the highest among the integrated energy stocks in this series.

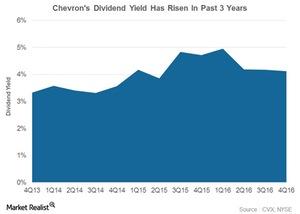

How Chevron’s Dividend Yield Has Trended

Chevron’s dividend yield Chevron (CVX) has consistently given returns to shareholders in the form of dividends. Therefore, we have evaluated its dividend yields. Yield is calculated as a ratio of the annualized dividend to stock price. Chevron’s dividend yield rose from 3.3% in 4Q13 to 4.1% in 4Q16, due to a dividend increase coupled with […]

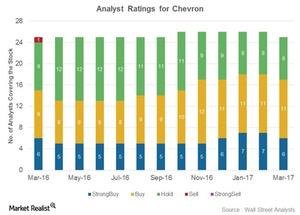

Why Most Analysts Rate Chevron a ‘Buy’

Analyst ratings for Chevron Chevron (CVX) has been rated by 25 analysts. Of the total, 17 analysts have given “buy” or “strong buy” ratings, eight have given “hold” ratings, and none have given “sell” or “strong sell” ratings on the stock. These ratings have improved from March 2016, when Chevron had fewer “buy” ratings, more […]

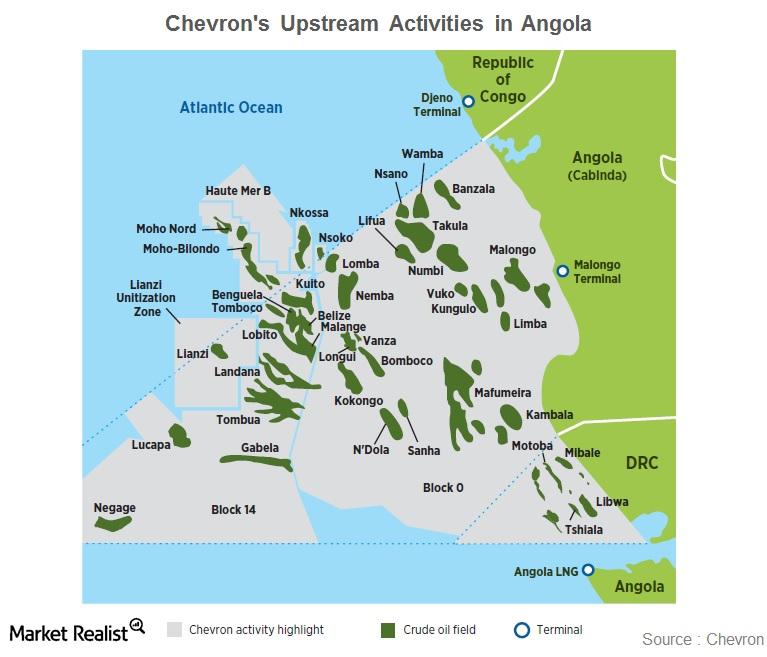

Chevron’s Mafumeira Sul Project Kick-Starts Production

In this series, we’ll provide updates on Chevron’s market performance. We’ll examine CVX’s latest stock performance, analyst ratings, dividend yield, PEG (price-to-earnings-to-growth) ratio, beta, short interest position, institutional ownership status, and implied volatility movement.

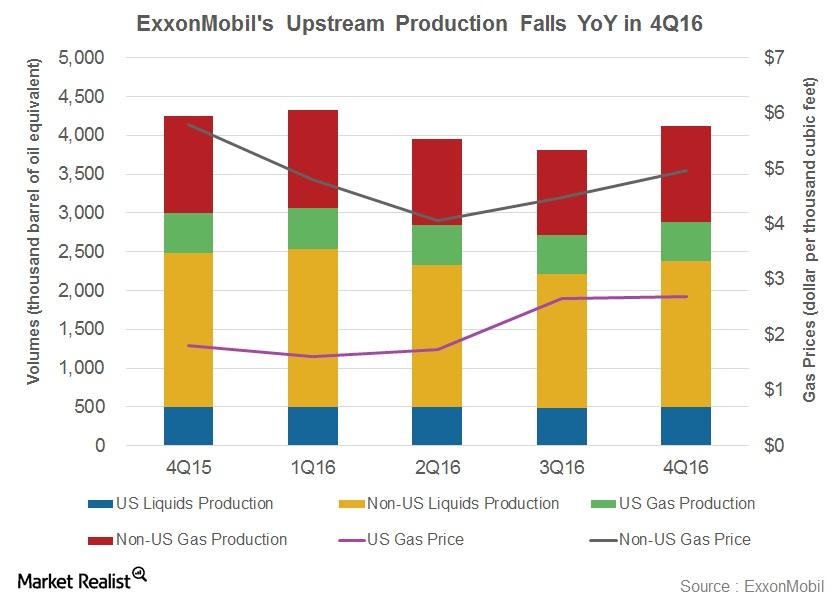

ExxonMobil’s Robust Upstream Portfolio: Poised for Growth

ExxonMobil (XOM) produced 4.1 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in 4Q16.

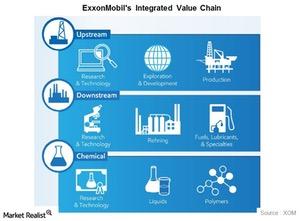

ExxonMobil Focuses on Integrated Growth, Reveals the Path Forward

In its latest analyst meeting, ExxonMobil (XOM) announced that it had plans to concentrate on an integrated earnings model, capturing value at every stage of the energy chain.

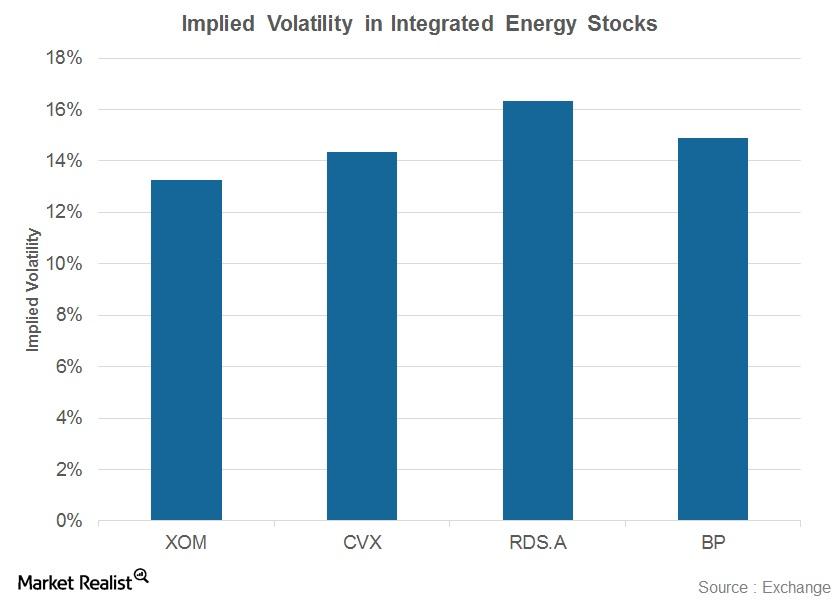

Where Do Implied Volatilities in Integrated Energy Stocks Stand?

Implied volatility in Royal Dutch Shell (RDS.A) currently stands at 16%, which is the highest compared to peers ExxonMobil (XOM), Chevron (CVX), and BP (BP).

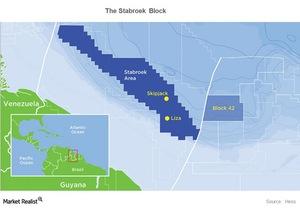

Once Again, ExxonMobil Discovers Oil in Guyana

ExxonMobil (XOM) has found oil in the Payara-1 Well in the Stabroek Block, positioned 120 miles offshore Guyana. This is the company’s second discovery in the block.

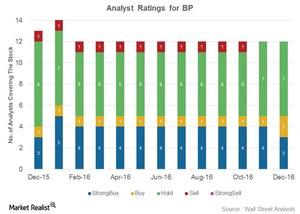

Why Do a Majority of Analysts Rate BP as a ‘Hold’?

BP (BP) plans to rebalance its sources and uses of cash by 2017 at an oil price level of $50–$55 per barrel.

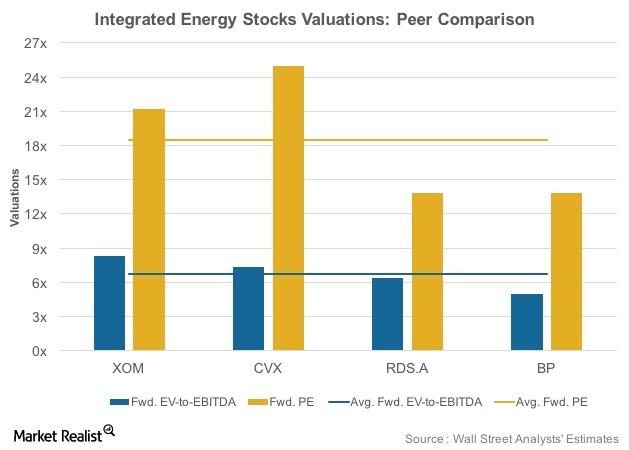

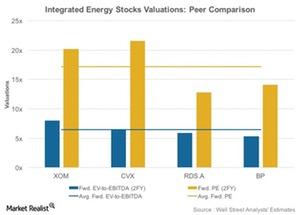

Integrated Energy Stocks’ Post-3Q16 Forward Valuations

XOM trades at 8.3x forward EV-to-EBITDA and 21.2x forward price-to-earnings, both above its peer averages.

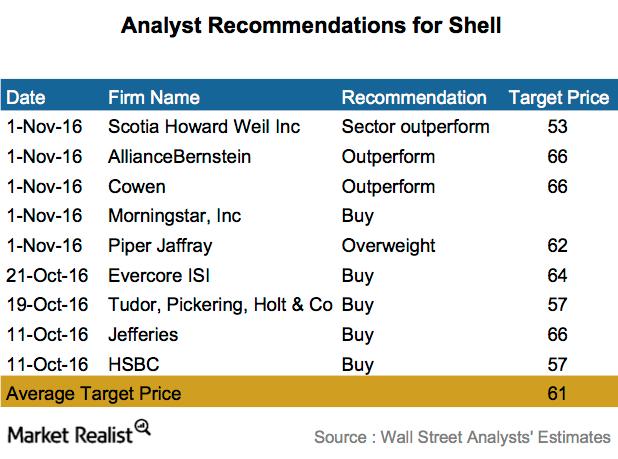

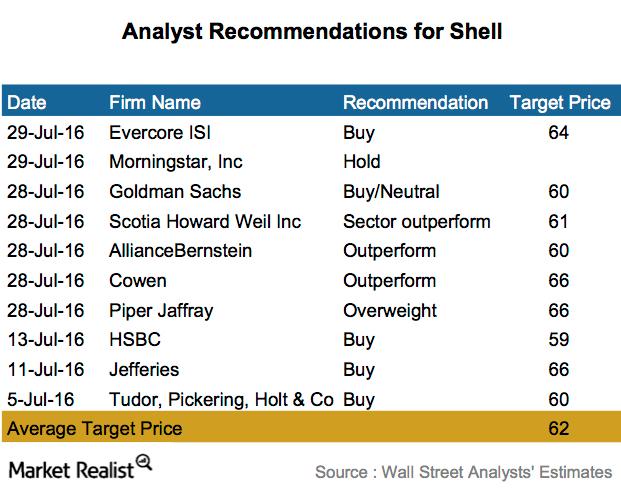

Analysts’ Recommendations for Shell: Most Say ‘Buy’

Shell’s highest and lowest 12-month price targets stand at $66 and $53. It indicates a 27% and 2% rise from its current levels, respectively.

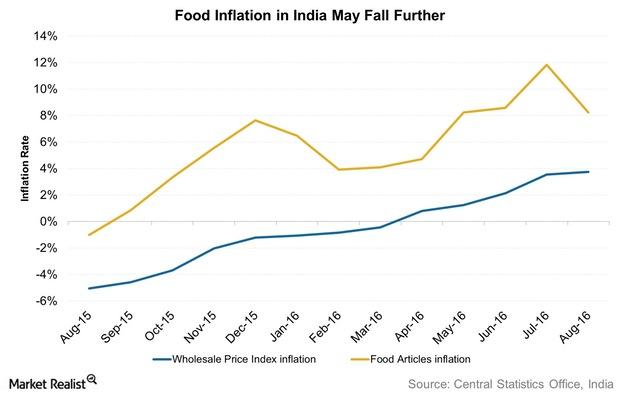

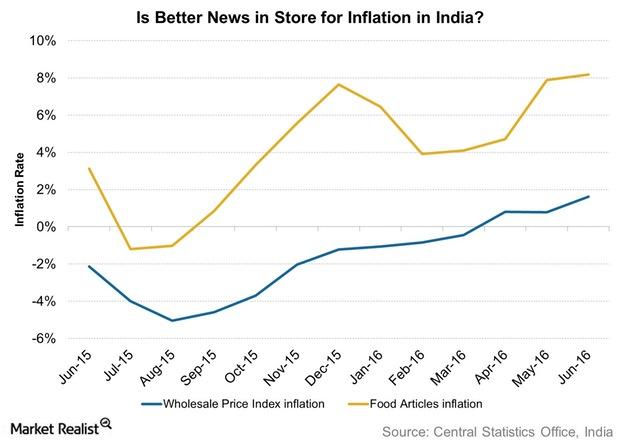

How Does the RBI See Food Inflation Panning out in India?

Components of inflation While food inflation in India has been pushing retail inflation up, fuel inflation (BP) (STO) (RDS.B), another important component, has been subdued. According to the October monetary policy statement issued by the RBI (Reserve Bank of India), “Fuel inflation has moderated steadily through the year so far.” The RBI has also announced […]

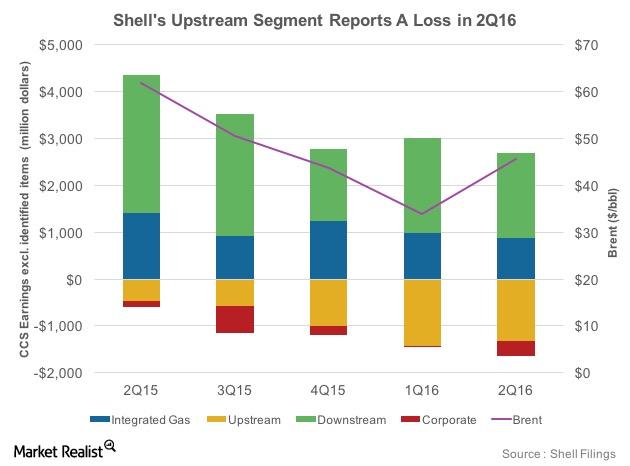

Shell’s Segments: Upstream Continues to Report Losses

Falling crude oil prices have changed the segmental dynamics within integrated energy companies such as Royal Dutch Shell (RDS.A).

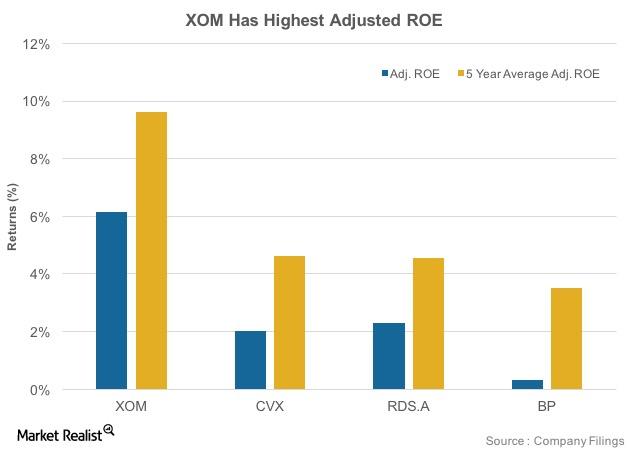

Look to This Energy Company for the Best ROE

Battered by falling oil prices, the 2Q16 ROE numbers for ExxonMobil (XOM), Chevron, Royal Dutch Shell, and BP were lower than their five-year average historical ROE figures.

Looking 2 Years Out, Energy Stocks Trade at Respectable PEs

ExxonMobil (XOM) trades at an 8.1x EV-to-EBITDA multiple and a 20.2x price-to-earnings ratio, both above its peers’ averages.

What Risks Does the RBI See for Retail Inflation?

The RBI thinks that risks to inflation are “tilted to the upside.” A subsequent rise in inflation could have a negative impact on consumer spending.

Majority of Analysts Rate Shell as a ‘Buy’ Post-2Q16 Earnings

Nine out of the ten companies surveyed rated Royal Dutch Shell (RDS.A) a “buy,” “overweight,” or “outperform.”

What Does Suncor’s Short Interest Analysis Reveal?

Suncor Energy (SU) has witnessed a 34% rise in its short interest since April 2016.

What Does a Fall in Shell’s Short Interest Mean?

Shell has witnessed a 49% fall in its short interest volumes since February 10, 2016. This indicates that the bearish sentiment for the stock is weakening.

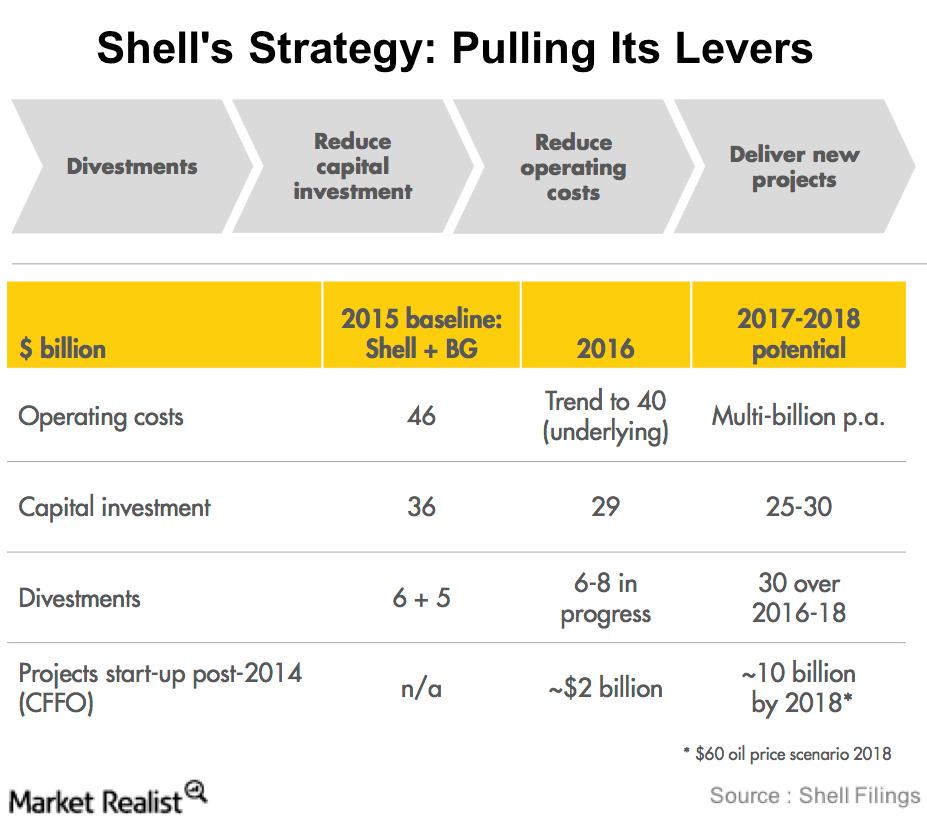

Shell’s Strategy: Pulling Its Levers

Shell plans to restructure itself to become more resilient to lower oil prices and more focused in terms of assets. To do this, it plans to use four levers.

Why TIPS Are an Attractive Investment Option Right Now

Asset managers have warned that costs may rise. They recommend inflation-linked securities such as Treasury inflation-protected securities (or TIPS).

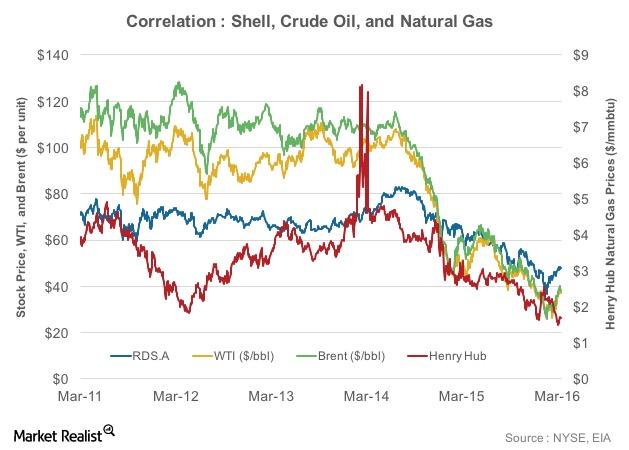

Correlation Analysis: Shell and Oil Price

Shell’s stock price has largely moved in-line with crude oil prices. This is reflected in the results of a correlation test.

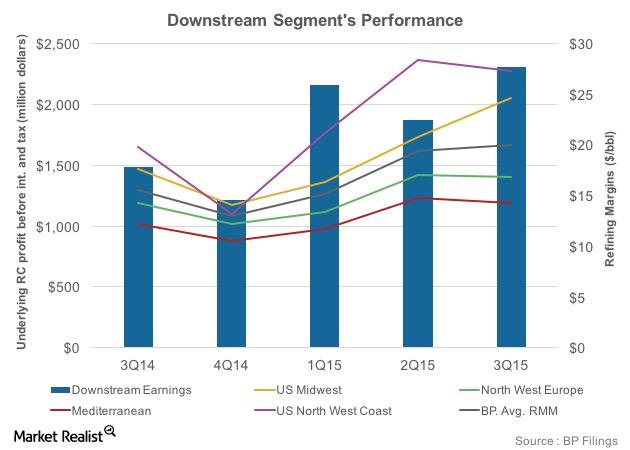

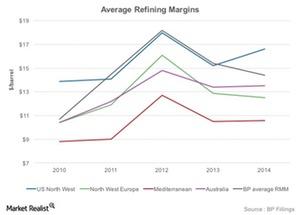

Overview of BP’s Refining Segment and Margins

BP’s refining segment has 2.0 million barrels per day of refining capacity worldwide. In the United States, it has around 0.74 MMbpd of refining capacity.

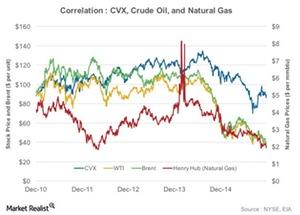

The Correlation of Chevron’s Stock to Oil and Natural Gas Prices

The integrated energy model provides Chevron’s insulation from oil and natural gas price volatility. This is reflected in the results of the correlation test.

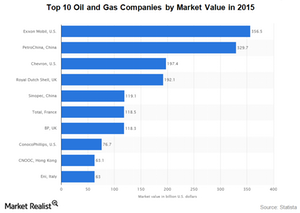

Bearish Crude Oil Market Has Put $5 Trillion at Risk

The depressed energy market has erased just over $1 trillion of market capitalization from oil and gas companies around the globe.

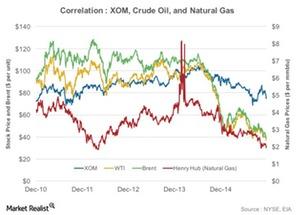

Correlation Analysis: ExxonMobil’s Crude Oil, Natural Gas prices

The correlation coefficients of ExxonMobil to Brent, West Texas Intermediate, and Henry Hub natural gas prices stand at 0.22, 0.35, and 0.36, respectively.

How OPEC’s Crude Oil Reserves Affect the Crude Oil Market

OPEC countries control 40% of global crude oil production and have around 81% of global crude oil reserves, as of 2014.

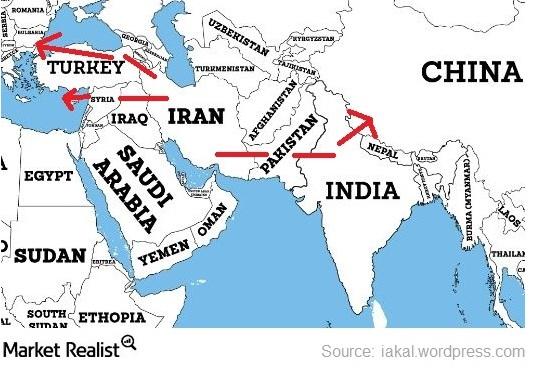

Could Iran Become a Big Gas Supplier to Europe and Asia?

Geographically, Iran is between the Europe and Asia’s gas markets. Iran could be a potential supplier to China (FXI) through Pakistan and India (INDY).

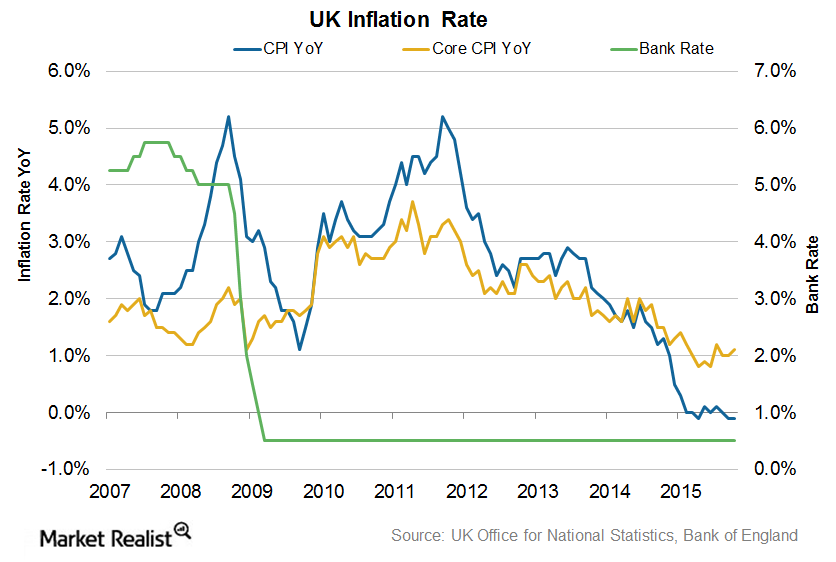

Falling Crude Oil Prices Keep UK Inflation in Check

The Bank of England or BoE is targeting an inflation rate at 2.0% in order to attain economic growth in the United Kingdom.

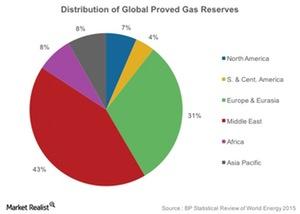

A Vital Resource: Which Region Has the Most Natural Gas Reserves?

Total global natural gas reserves stand at 6,606 trillion cubic feet, of which 43% are in the Middle East.

What Are the Key Indicators of Refining Profits?

Investors should track the GRM and crack spread of a region where a company’s refinery is located.

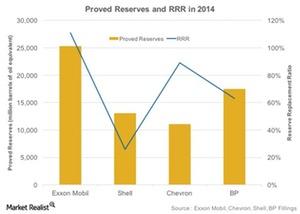

Why Is Reserve Replacement Ratio Important to the Upstream Sector?

RRR reflects how many barrels of oil equivalent the company adds to its reserves in replacement of ones that are produced.

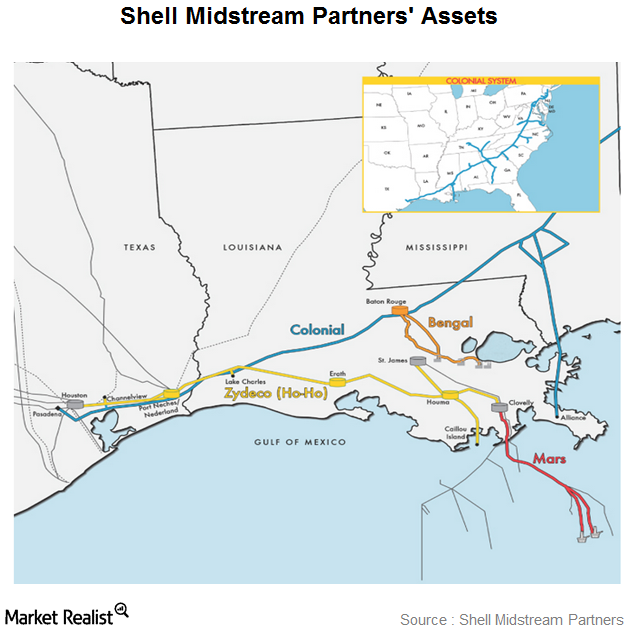

A Brief Overview of Shell Midstream Partners

Shell Midstream Partners (SHLX) is a MLP formed by Shell Pipeline Company, an affiliate of the international integrated energy giant, Royal Dutch Shell.

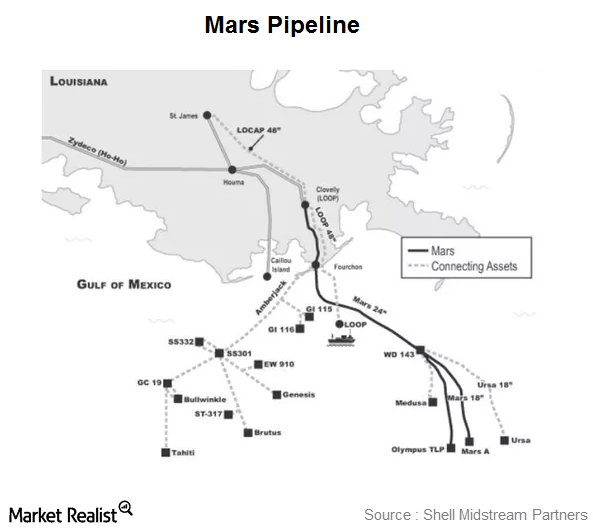

Shell Midstream’s Mars: A Corridor Pipeline Servicing the Gulf

Shell Midstream Partners (SHLX) has a 28.6% ownership in the Mars pipeline, and Shell Pipeline Company has a 42.9% interest.

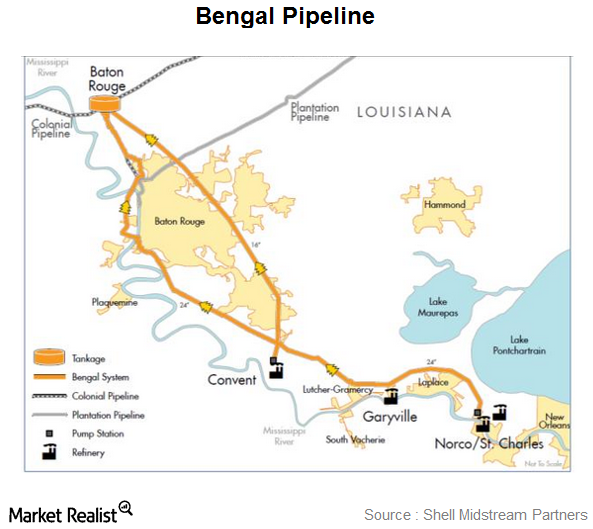

Shell Midstream Partners Refined Products Pipeline Systems

The Colonial pipeline system is the largest refined products pipeline in the US based on barrels per mile transported.