Pfizer Inc

Latest Pfizer Inc News and Updates

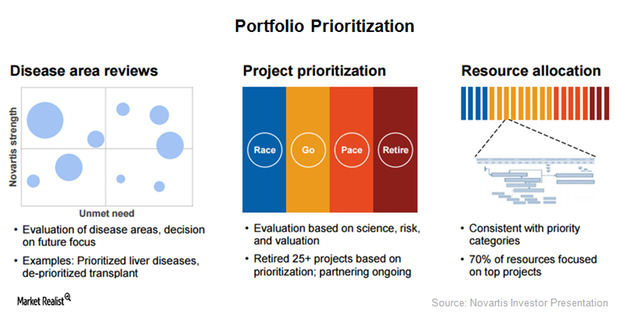

Novartis Focuses on Portfolio Prioritization to Boost Profitability

To ensure long-term relevance as well as quick adaptability to changing market needs, Novartis (NVS) is focusing on five major initiatives in 2017.

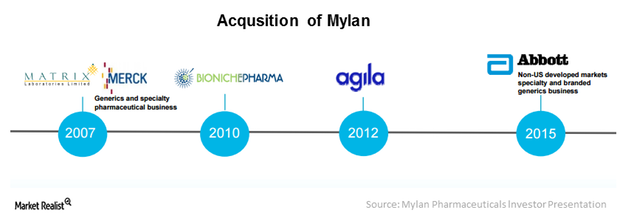

Mylan’s Recent Acquisitions Continue to Strengthen Its Position in International Markets

Mylan takes an M&A strategy to save time related to compliance activities for obtaining regulatory approvals across various international markets.

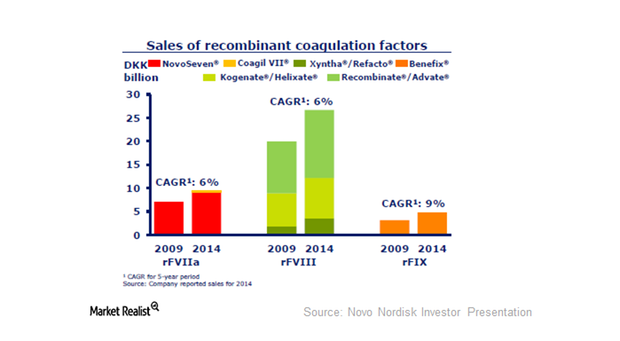

What Are the Current Treatment Options for Hemophilia?

Hemophilia treatment primarily includes factor replacement therapy and prolonged half-life therapy such as factor VIII or factor IX infusion.

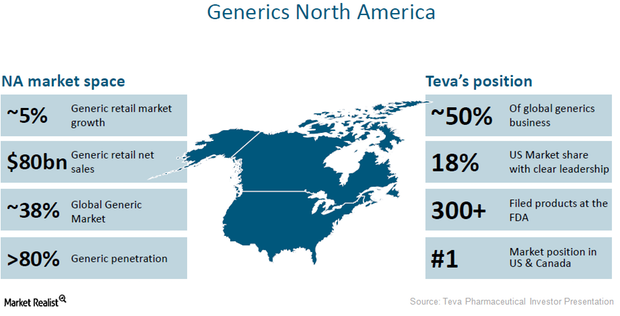

Teva’s Share of the US Generics Market Could Boost Its Stock

Teva Pharmaceutical Industries accounts for 18% of the US generic drug market. This share is significantly higher than those of Mylan, Novartis, and Pfizer.

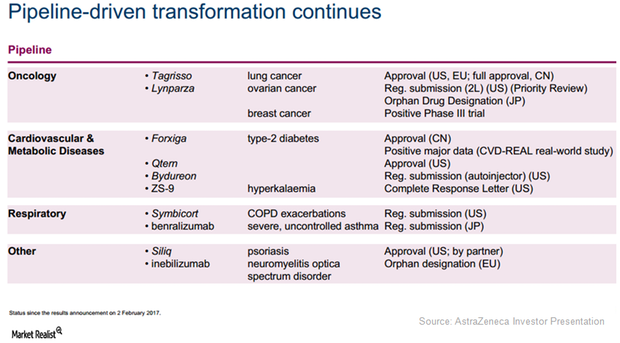

AstraZeneca May Witness a Fall in 2017 Net Profit Margin

Wall Street analysts have projected AstraZeneca’s (AZN) 2017 net profit margins at about 12.2%, which is lower by 300 basis points on a YoY basis.

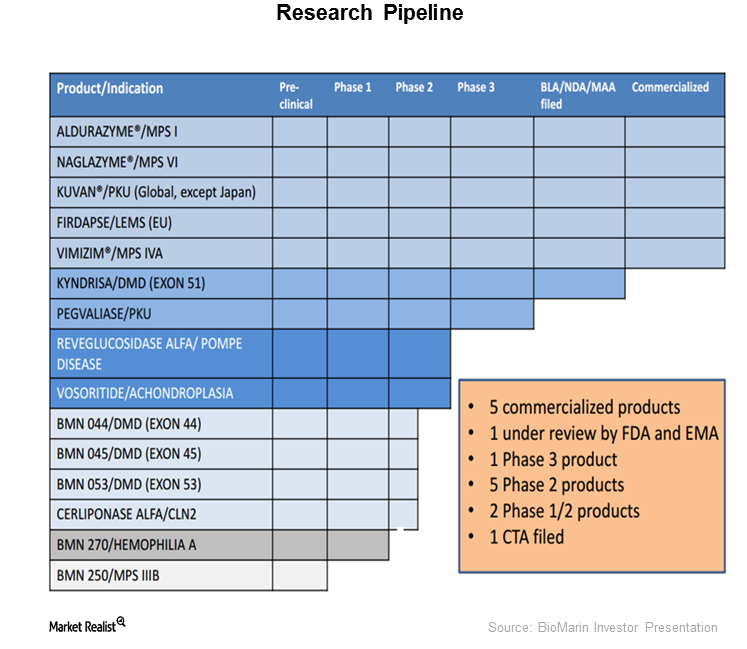

BMN 270: A Big Valuation Catalyst for BioMarin

On March 1, 2016, BioMarin received orphan drug designation for BMN 270 from the FDA. BioMarin’s stock jumped by about 6.96% the same day.

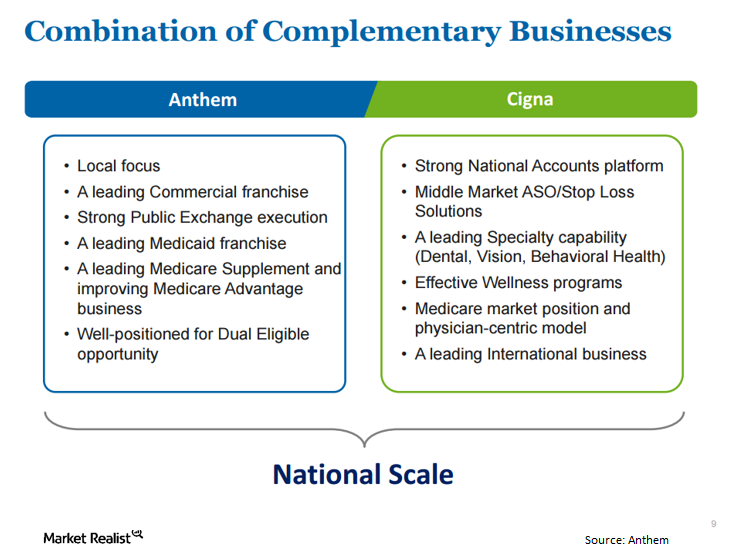

Anthem Files Bear Hug Letter for Cigna on June 21

On June 21, Anthem (ANTM) filed a bear hug letter for Cigna (CI). A bear hug letter is a formal press release in which an acquiring company discloses its interest in a target company.

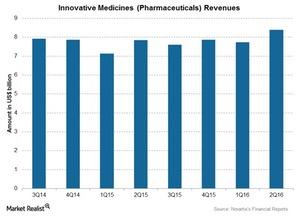

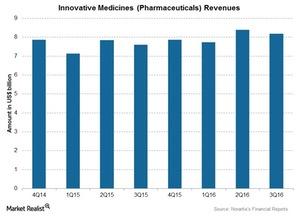

Novartis’s 3Q16 Estimates: Innovative Medicines Segment

Novartis’s Innovative Medicines segment, formerly referred to as the Pharmaceutical segment, consists of products for a variety of therapeutic areas.

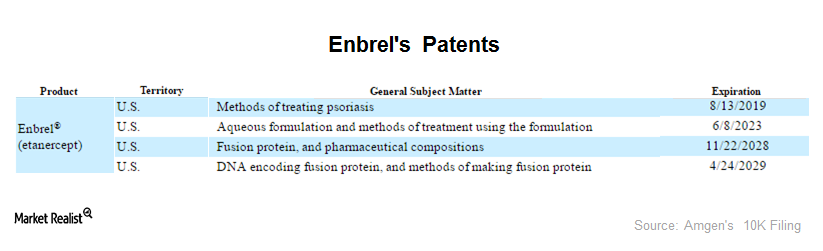

Why Is Enbrel So Important for Amgen?

YTD, Amgen’s (AMGN) stock has already fallen 9%. Perhaps the pressure that Enbrel (etanercept) is seeing is to blame for the negative investor sentiment.

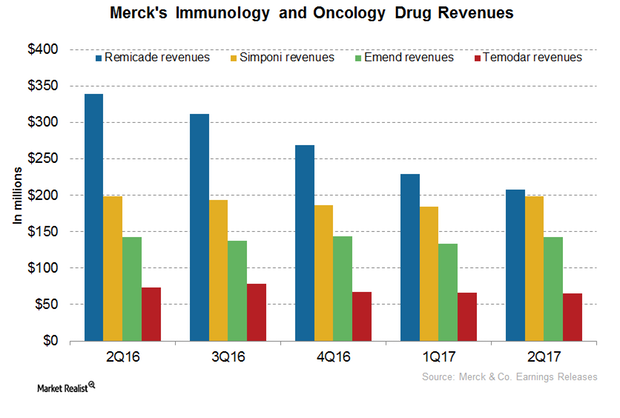

A Look into Merck’s Immunology and Oncology Portfolio

In 1H17, Remicade generated revenues of around $437 million, which is a 37% decline year-over-year.

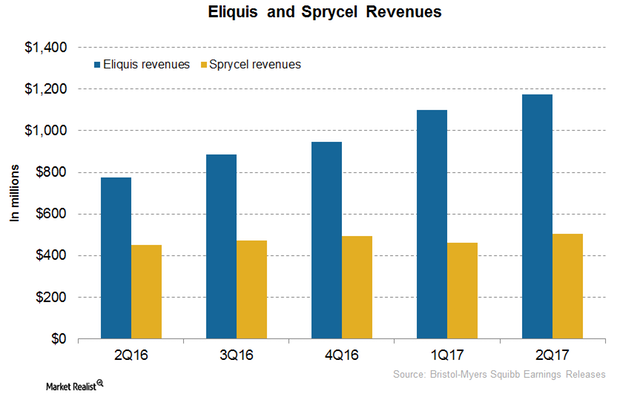

Eliquis and Sprycel Could Boost BMY’s Revenue Growth in 2H17

In July 2017, the FDA accepted Bristol-Myers Squibb’s supplemental New Drug Application (or sNDA) for expanding the indication of Sprycel.

Novartis’s 4Q16 Estimates: Innovative Medicines Segment

The overall contribution of the Innovative Medicines segment is ~67% of Novartis’s total revenues.

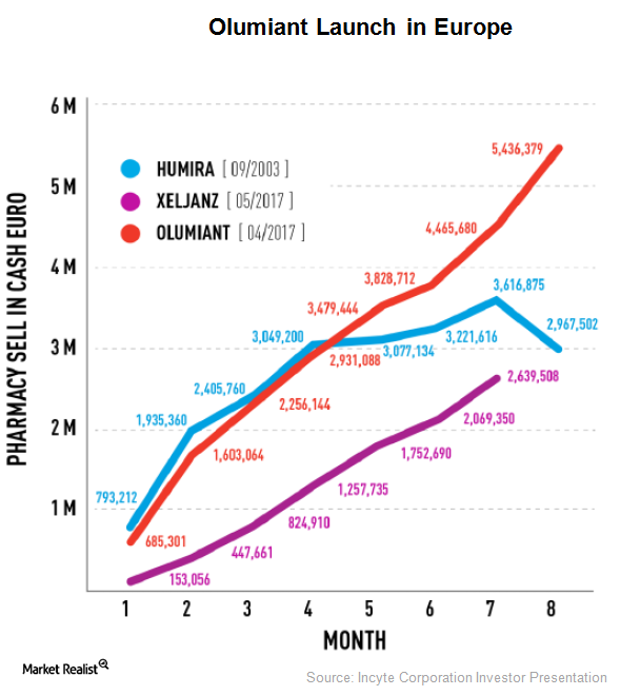

Olumiant Could Boost Incyte’s Revenues

In February 2017, Eli Lilly (LLY) secured approval for Olumiant (baricitinib) from the European Medicines Agency (or EMA) for patients suffering from moderate-to-severe rheumatoid arthritis.

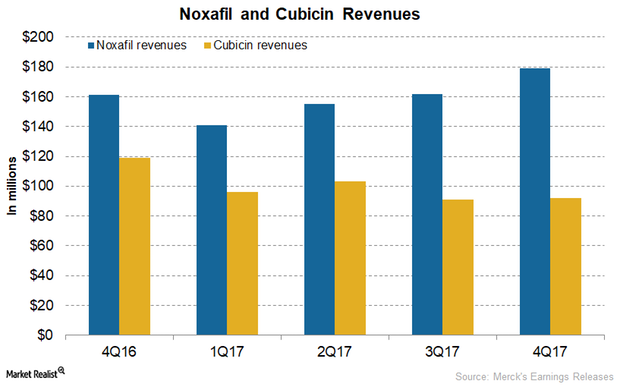

Understanding the Performance of Merck’s Hospital Acute Care Drugs Noxafil and Cubicin

In 4Q17, Merck’s (MRK) Cubicin reported revenues of $92 million, which was ~23% lower on a YoY (year-over-year) basis.

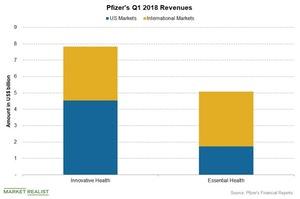

Pfizer Reports 1Q18 Earnings and Revenue Growth

Pfizer (PFE) released its 1Q18 earnings today, reporting another strong quarter for the Innovative health business.

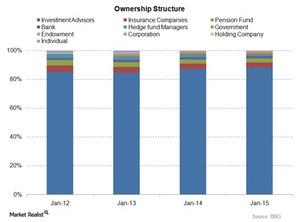

Understanding Johnson & Johnson’s Ownership Structure

As of January 2015, Johnson & Johnson’s ownership structure is dominated by passive investments. They account for more than 80% of the total ownership structure.

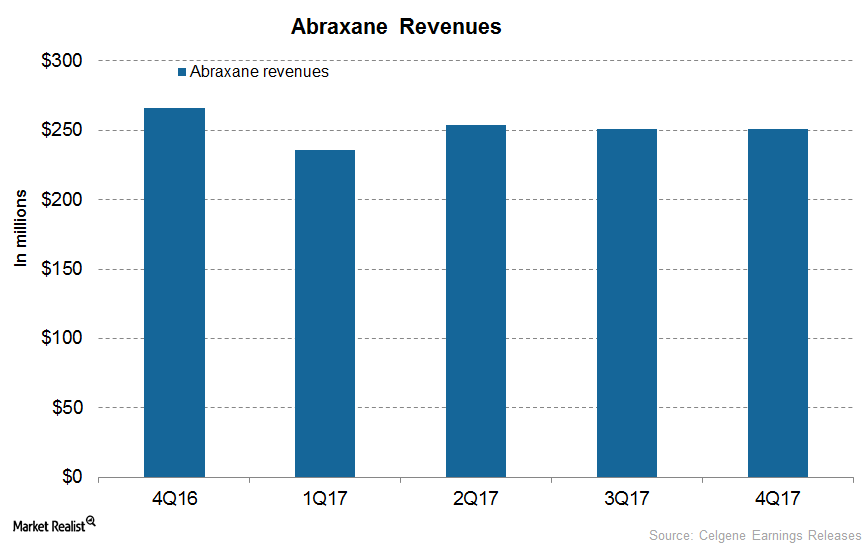

How’s Celgene’s Abraxane Positioned after 4Q17?

In 4Q17, Celgene’s (CELG) Abraxane generated revenues of $251 million, which reflected a decline of ~6% on a YoY (year-over-year) basis.

Who Owns Pfizer?

On Nov. 9, Pfizer announced that its coronavirus vaccine is more than 90 percent effective. Who owns Pfizer and where is the company based?

Who Owns Pfizer and BioNTech?

The Pfizer-BioNTech vaccine holds life-changing potential. Who are the owners that are running the show?

Pfizer CEO Says COVID-19 Vaccine Could be Ready This Year

Albert Bourla, CEO of pharmaceutical giant Pfizer, has said there is a 60 percent chance that the company's scientists will know whether their vaccine is effective by the end of October.

Operation Warp Speed Has Invested Billions in Potential COVID-19 Vaccines

The U.S. government’s Operation Warp Speed program has already invested billions in six potential coronavirus vaccine candidates.

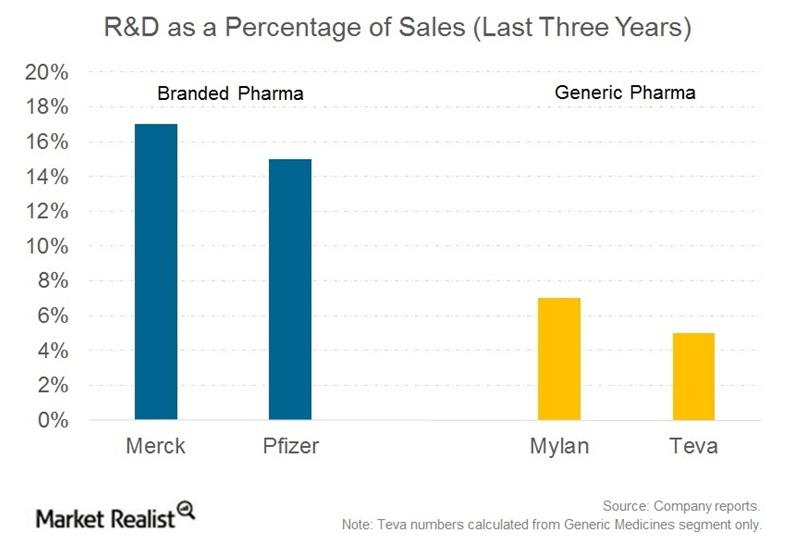

Expert Q&A: What to Know Before Investing in Generic Pharma? (Part 2)

(continued from Part 1) 4. What is the nature of the cash flows for generics companies? Stable, driven by a constant demand for prescription drugs? Or lumpy, driven by growth from drugs coming off patent? The larger companies in this sector tend to have stable, steadier cash flows due to established lineups of approved products. […]

An Easier Way to Understand the Pharma Industry

In 2018, the global pharmaceutical industry stood at $1.2 trillion, and experts expect $1.5 trillion by 2023. Here’s everything investors need to know.

Jim Simons’ Renaissance Technologies Is Bearish on TSLA

On May 14, Jim Simons’ Renaissance Technologies filed its 13F for the first quarter of 2020. The hedge fund reduced its holdings in Tesla.

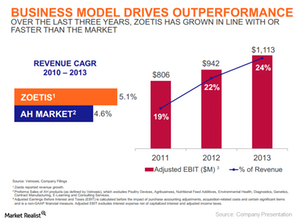

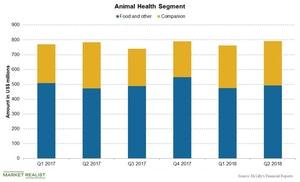

Zoetis: An attractive business model

Zoetis said in a recent statement that “its unique characteristics have established the company as the world leader in animal health, growing revenue faster than the market for the last three years.”

‘Medicare for All’ Is No Reason to Drop Healthcare Stocks

While the media caters to Millennial preferences, there’s one economic sector that’s shifting to a more seasoned crowd: healthcare stocks.

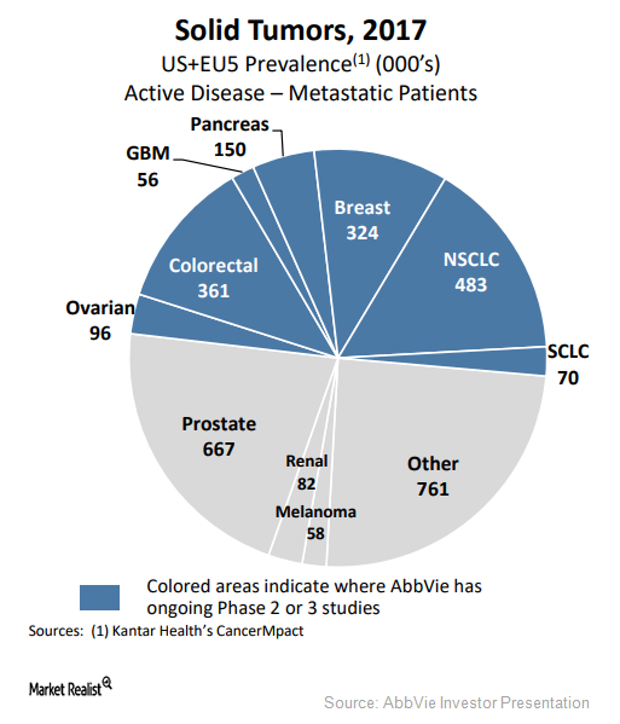

AbbVie Rapidly Advancing Its 2018 Solid Tumor Portfolio

AbbVie (ABBV) is currently evaluating more than 20 investigational therapies targeting solid tumors. Seventeen of them are in Phase 1 trials.

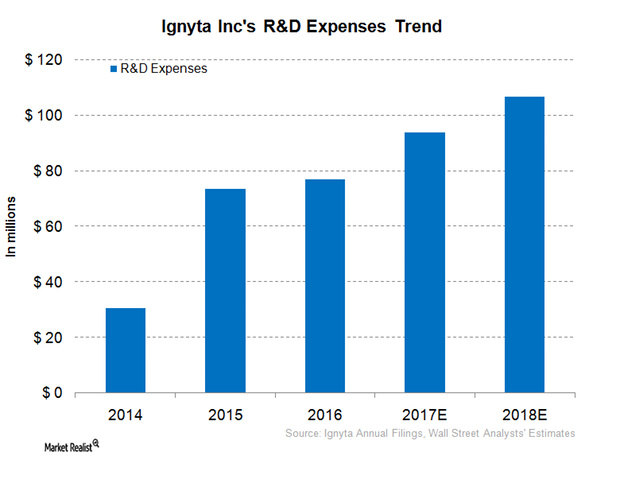

Inside Ignyta’s Financial Performance

Ignyta’s (RXDX) R&D (research and development) expenses increased from $16.6 million in 3Q16 to $21.7 million in 3Q17, a 30% rise.

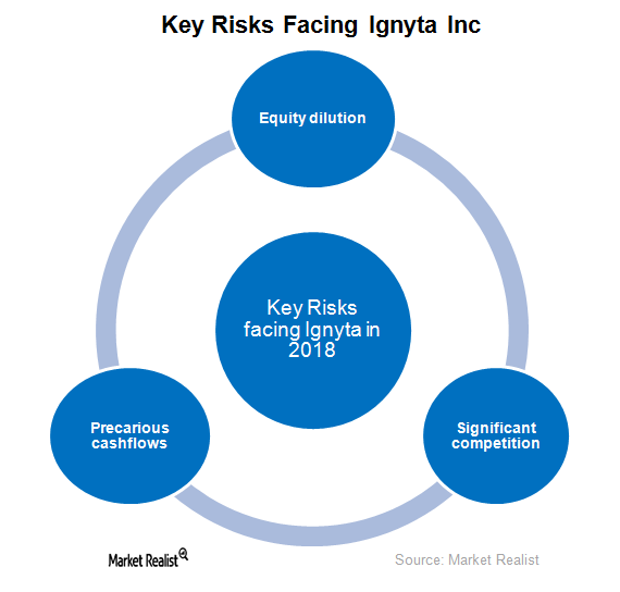

Ignyta and Its Key Risks in 2018

In October 2017, Ignyta (RXDX) raised $150 million by issuing 10 million shares of its common stock.

Why Pfizer Stock Continues to Tank after Mylan Deal

Pfizer stock (PFE) has fallen 10% in the past two days on its deal with Mylan (MYL) and its lower earnings guidance.

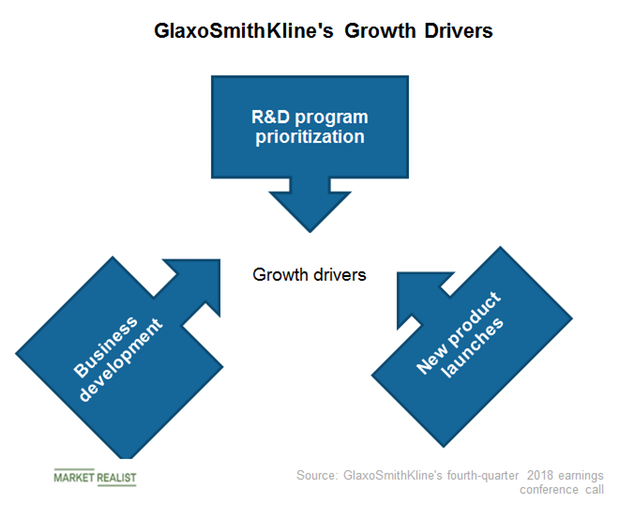

What Are the Key Growth Drivers for GlaxoSmithKline in 2019?

GSK highlighted the prioritization of research and development programs, business development, and new product launches as its key growth drivers in 2018.

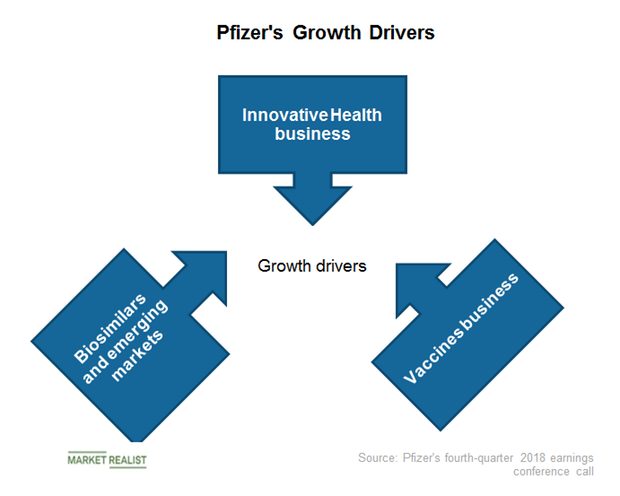

What Are the Key Growth Drivers for Pfizer in Fiscal 2019?

According to Pfizer’s fourth-quarter earnings conference call, Ibrance has managed to report global revenues of $4.1 billion in fiscal 2018.

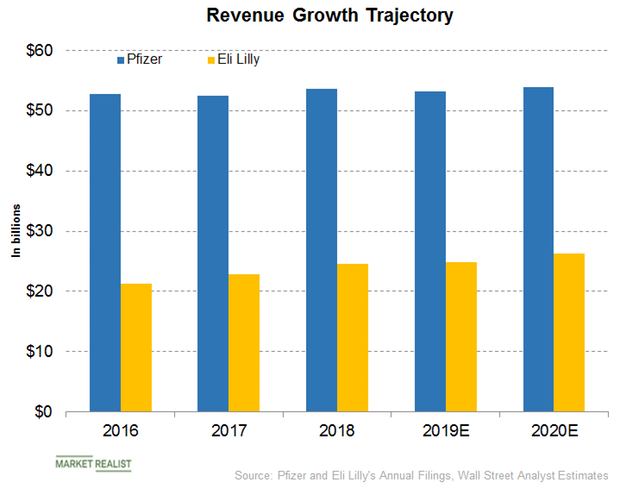

Pfizer or Eli Lilly: Who Will Report Better Revenue Growth?

In its fourth-quarter earnings conference call, Pfizer (PFE) has guided for revenues of $52 billion to $54 billion for fiscal 2019.

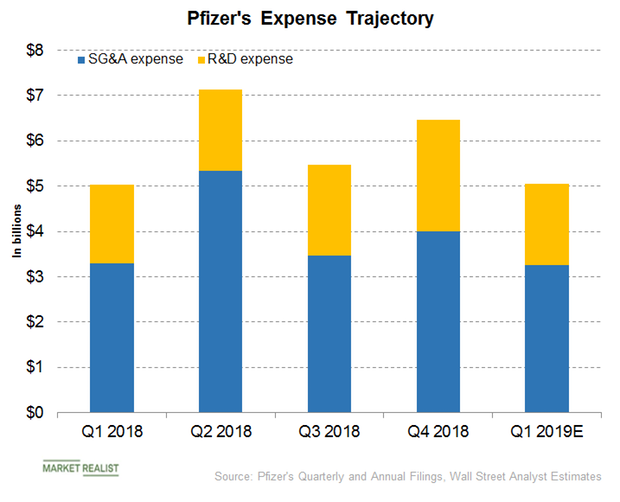

Pfizer’s Expenses Are Expected to Rise in Fiscal 2019

Pfizer expects its adjusted SI&A expenses to fall by $13.5 billion–$14.5 billion in fiscal 2019—a decline of ~$200 million YoY at the midpoint.

Pfizer and GlaxoSmithKline Form a Joint Venture

On December 19, GlaxoSmithKline (GSK) and Pfizer (PFE) entered into an agreement to combine both of their consumer health businesses.

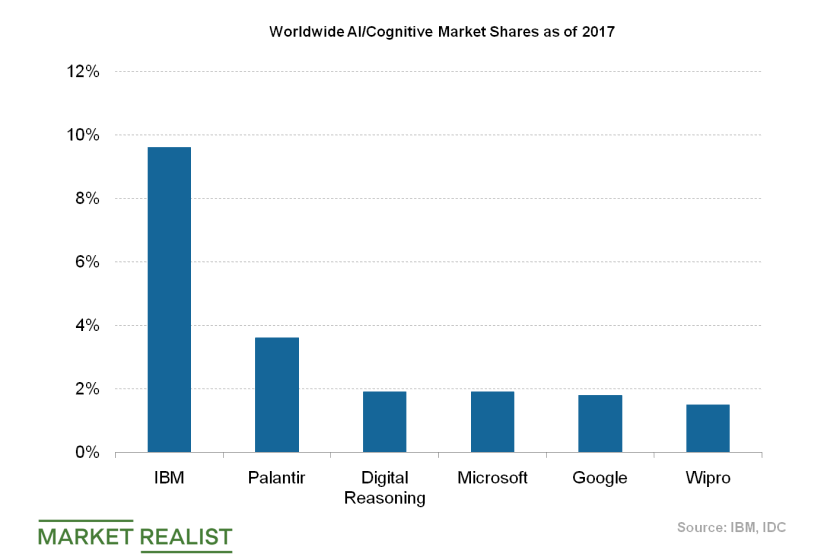

How IBM Is Investing in AI Solutions

AI is the buzzword these days, and the market has huge growth potential.

How Nektar Performed in the Third Quarter

Nektar Therapeutics generated total revenues of $27.76 million in the third quarter of 2018 as compared with $152.93 million in the third quarter of 2017.

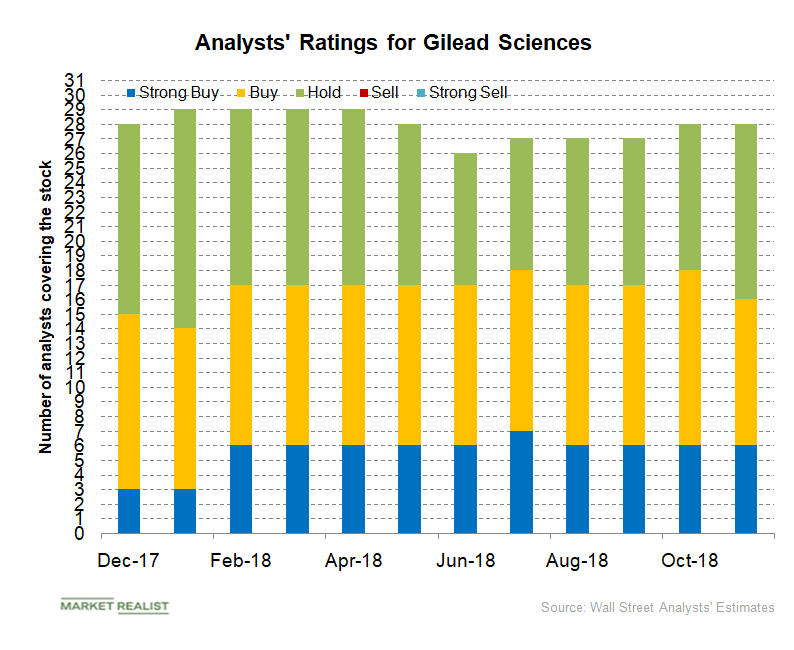

Gilead Sciences: Analysts’ Recommendations

In November, six analysts recommended a “strong buy,” ten recommended a “buy,” and 12 recommended a “hold” for Gilead Sciences.

What Are Pfizer’s Revenue Drivers?

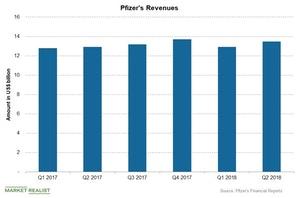

Pfizer reported revenues of $13.5 billion during the second quarter—4% growth YoY compared to $12.9 million during the second quarter of 2017.

A Look at Elanco, Eli Lilly’s Animal Health Business

Eli Lilly’s Elanco reported a 1% YoY (year-over-year) rise in revenue to $792.1 million in the second quarter.

A Look at Pfizer’s Market Cap and Shareholding Pattern

The total number of Pfizer’s outstanding shares is ~5.862 billion. Of these, its free-floating shares total ~5.859 billion.

Pharma Stocks: Pfizer’s Revenue Trend and 2018 Estimates

Pfizer (PFE) reported revenue of ~$13.5 billion in the second quarter, a 4% YoY (year-over-year) rise in revenue.

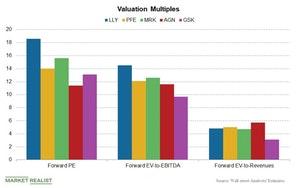

Pharma Stocks in Review: A Valuation Comparison

In this article, we’ll compare the valuations of Eli Lilly and Company (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

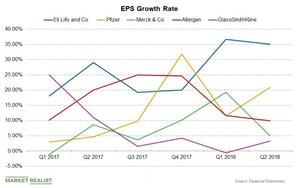

A Review of Pharma Stocks’ EPS Growth Rates

In this article, we’ll compare the EPS growth rates of Eli Lilly (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

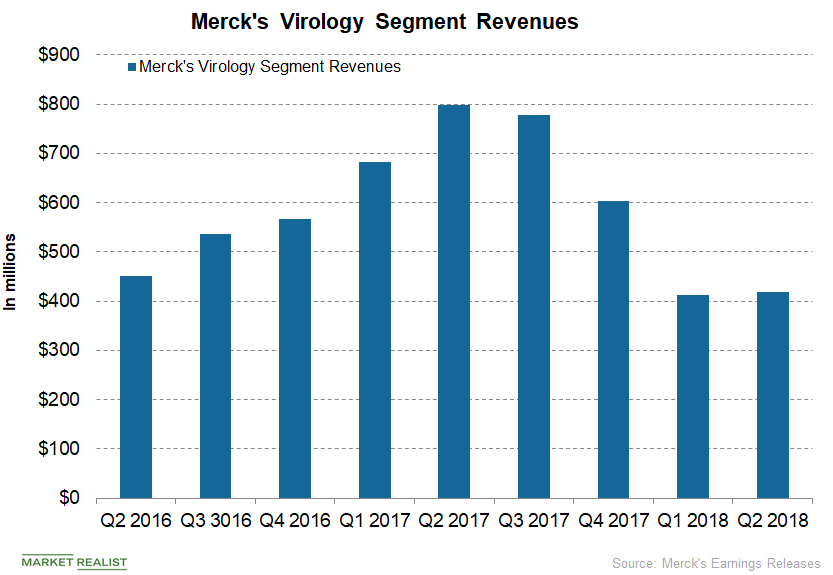

Delstrigo, Pifeltro, and Merck’s Antiviral Therapy Portfolio

Gilead Sciences’ Atripla, Genvoya, and Stribild generated revenues of $663.0 million, $2.2 billion, and $361.0 million, respectively, in the first half of 2018.

How Pfizer’s Business Segments Have Performed

As discussed, Pfizer’s (PFE) business is divided into two business segments, Innovative Health and Essential Health.

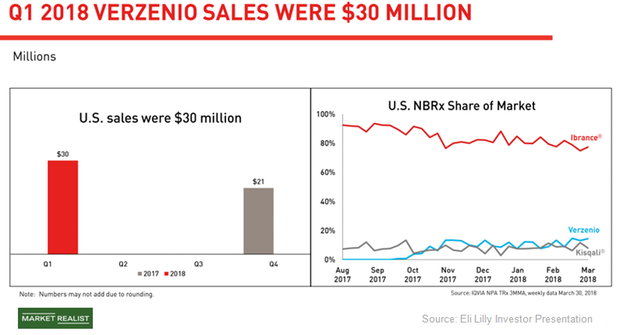

Verzenio: Major CDK4/6 Inhibitor in the Future

Verzenio has demonstrated double-digit growth in new patient usage in patient segments targeted by the drug’s first two approved indications.

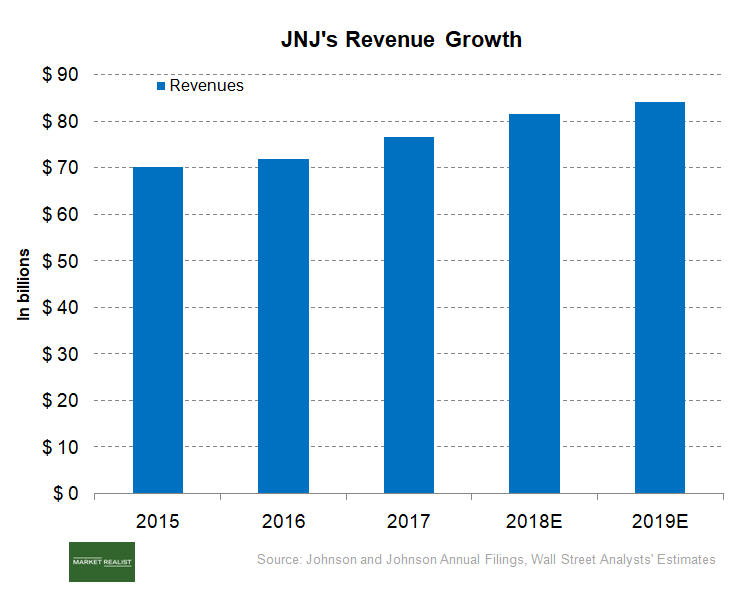

Johnson & Johnson’s Financial Performance

In 1Q18, Johnson & Johnson (JNJ) generated revenue of $20 billion, compared with $17.7 billion in 1Q17.

Analysts’ Ratings for Spark Therapeutics and Its Peers in April 2018

Of the 20 analysts covering Spark Therapeutics in April 2018, four have given the stock “strong buy” recommendations.

Pfizer’s Inlyta Expansion Thwarted by Failed Phase III Study

On April 11, 2018, Pfizer (PFE) said its ATLAS trial with Inlyta failed to show improvement in RCC disease-free survival.