Pfizer Inc

Latest Pfizer Inc News and Updates

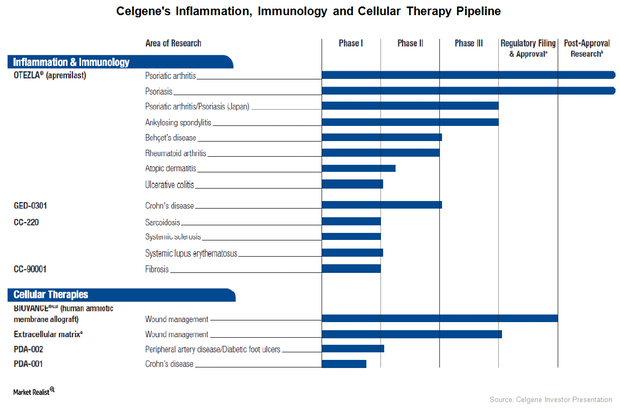

Celgene’s Growing Inflammation and Immunology Pipeline

Celgene has entered the inflammation and immunology drug market, as well as the cell therapies market, in order to be less dependent on MM drugs.

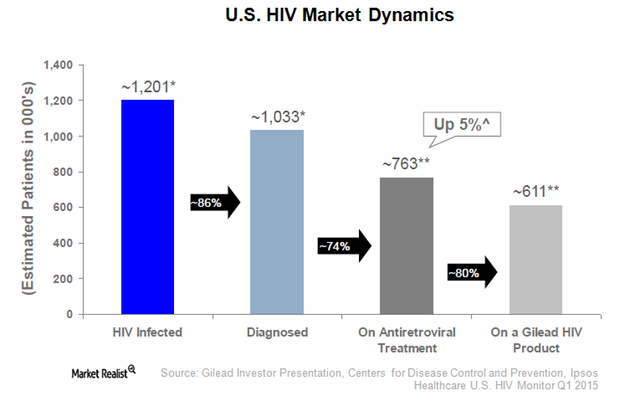

Gilead: Global Leader in the HIV Market

Gilead Sciences (GILD), a biotechnology leader in the human immunodeficiency virus, or HIV, market, offers drugs to eight out of every ten HIV naïve patients in the US.

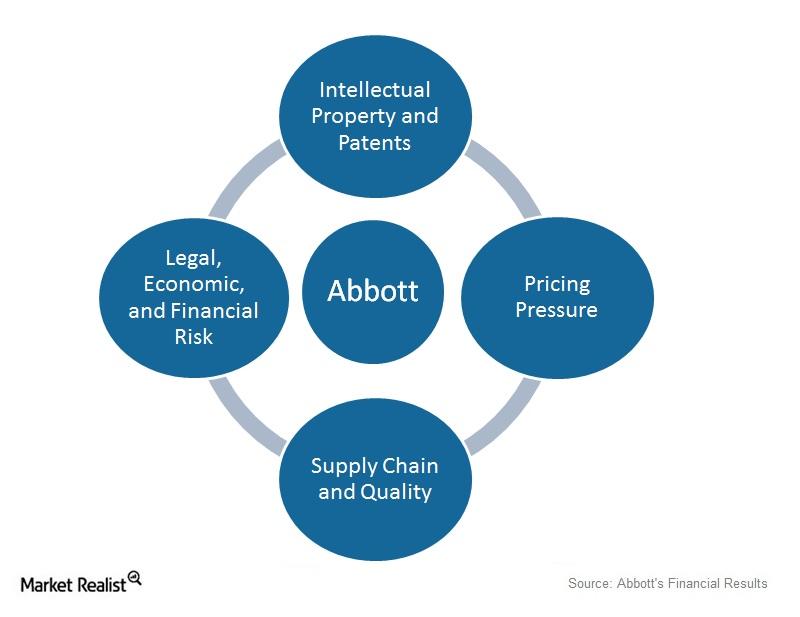

Why Abbott’s Business Is Susceptible to Numerous Risks

Abbott deals with innovative devices and established pharmaceutical products. Any infringement of intellectual property rights may lead to huge losses.

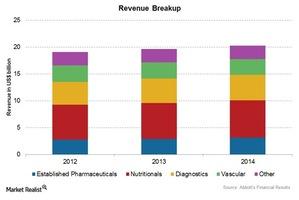

Abbott Laboratories’ Associated Business Segments

Abbott is organized around a broad portfolio—established pharmaceutical products, diagnostic products, nutritional products, and vascular products.

Sanofi’s Position Compared to Its Peers

The forward PE ratio for Sanofi is ~15.1x for 2015, and ~18.1x for the industry.

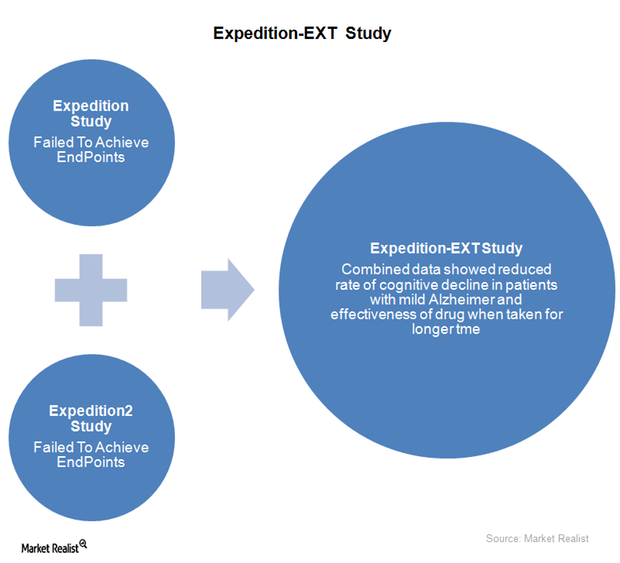

Eli Lilly’s Solanezumab: A Possible Cure for Alzheimer’s?

If approved, solanezumab would be a breakthrough therapy in the Alzheimer’s market. The drug actually seeks to cure the cognitive disease, not simply treat it.

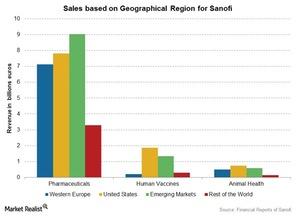

Sanofi’s Segment-Wise Sales by Region

Sanofi (SNY) products are sold in over 120 countries. The company’s markets are classified into four geographical regions for reporting purposes.

Risks for GlaxoSmithKline

GSK operates in over 170 countries and is subject to political, socioeconomic, and financial factors and risks across the globe.

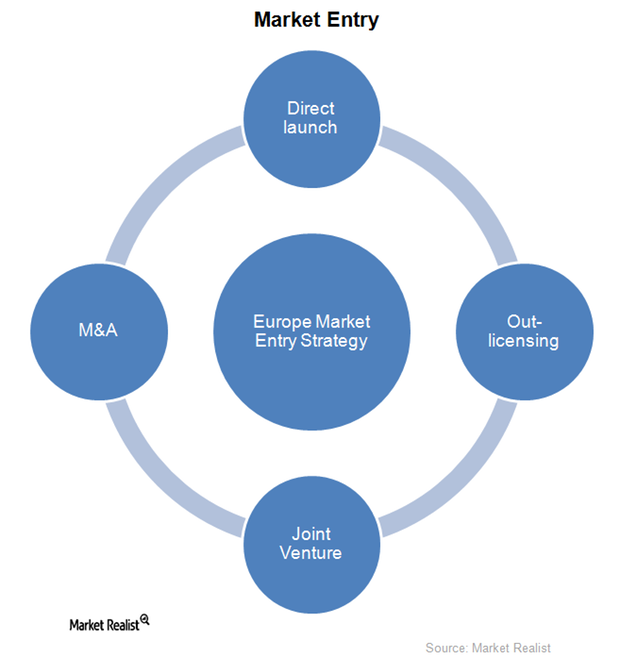

Market Entry Strategies for Biotechnology in Europe

When a US biotechnology company uses market entry strategies to launch its drug directly in the European market, it has to bear all the expenses related to the drug approval process in Europe.

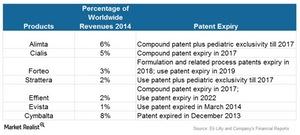

What Risks Does Eli Lilly and Company Face?

The risk of losing market share due to losing patents is the highest risk that Eli Lilly and other pharmaceutical companies face.

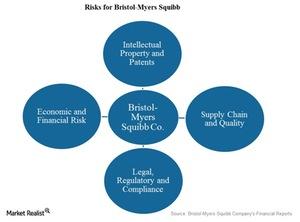

What Are the Risks for Bristol-Myers Squibb?

Bristol-Myers Squibb deals with innovative products, and any failure to secure or protect intellectual property rights is a huge risk and may lead to huge losses.

GlaxoSmithKline: The British Multinational Pharmaceutical Company

GlaxoSmithKline is a British multinational pharmaceutical company with a significant presence in the US. GSK has over 100,000 employees in operations around the world.

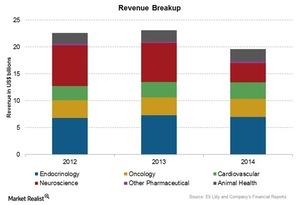

Analyzing Eli Lilly and Company’s Associated Business Segments

The human pharmaceutical segment includes the discovery, development, manufacturing, marketing, and sales of human pharmaceutical products.

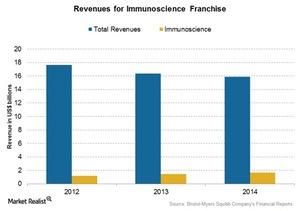

Bristol-Myers Squibb’s Immunoscience Franchise

Bristol-Myers Squibb’s (BMY) immunoscience franchise deals with medicines that help defend the body against invading pathogens like bacteria, viruses, and cancer cells.

Risks Facing Merck & Co.

Merck faces risks from other governments. In Japan, the pharmaceutical industry is subject to government-mandated biennial price reductions of pharmaceutical products and vaccines.

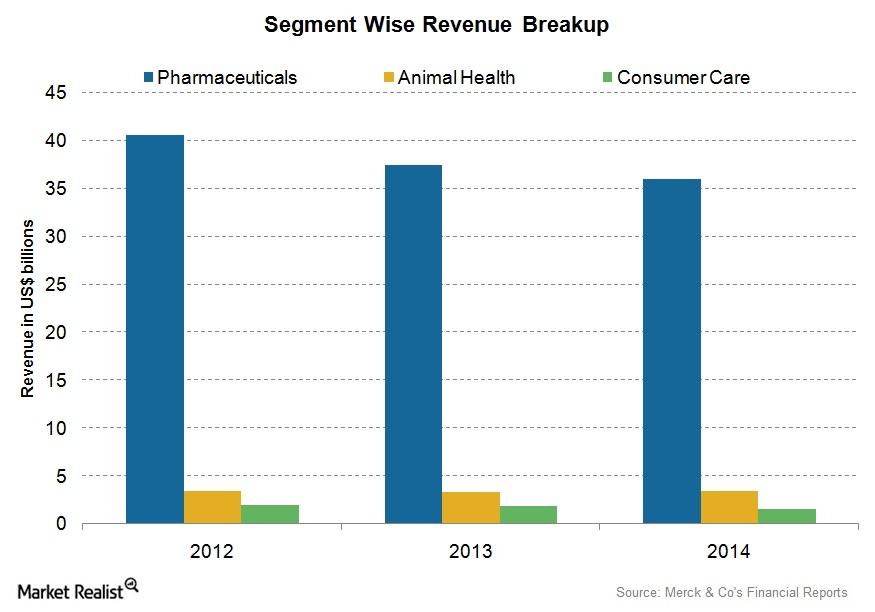

Merck’s Associated Business Segments

Merck’s Pharmaceuticals division accounted for $36.0 billion, or 85%, of group net sales during 2014.

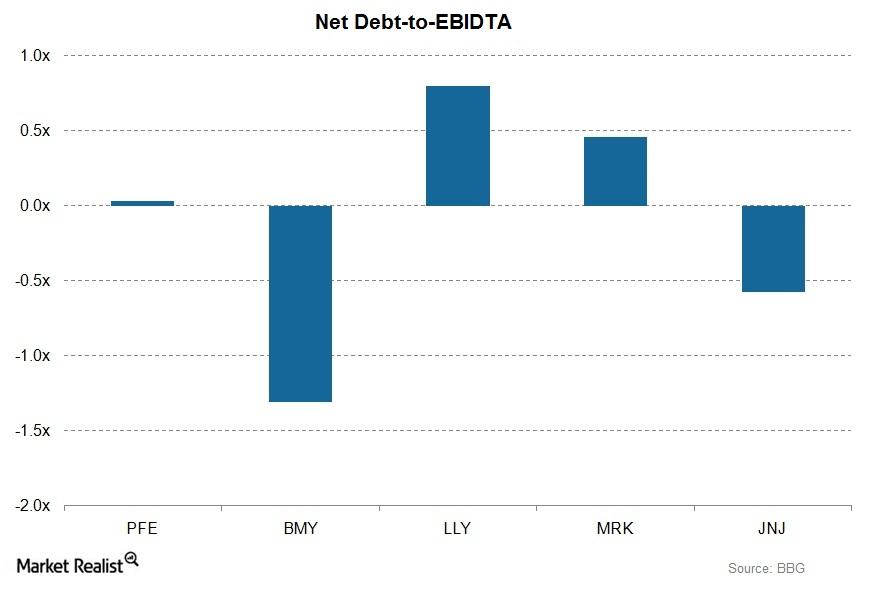

Why Pfizer’s Leverage Is Important to Investors

Leverage ratios determine the company’s ability to repay its debt. Leverage ratios directly affect the credit ratings. Pfizer has good credit ratings.

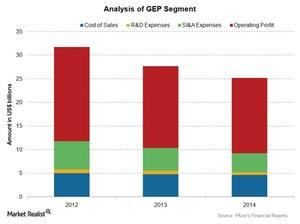

Pfizer’s Global Established Pharmaceutical Segment

The Global Established Pharmaceutical segment deals with products that have or are expected to lose market exclusivity through 2015 in most major markets.

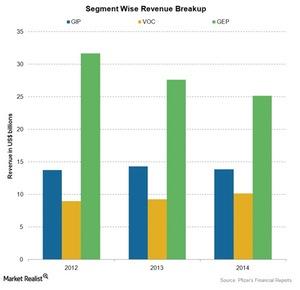

Analyzing Pfizer’s Business Segments

Pfizer (PFE) is one of the oldest and largest pharmaceutical companies in the US. The company deals in two major business segments.

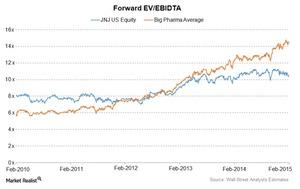

Where Does Johnson & Johnson Stand in the Industry?

Estimates suggest that Johnson & Johnson’s forward PE ratio increased from 15.5x in 2014 to 16.1x in 2015. The PE ratio is hovering around 19x for the industry.

What Risks Does Johnson & Johnson Face?

Johnson & Johnson (JNJ) faces a unique combination of risks. The risks are in addition to specific risks in the pharmaceutical industry.

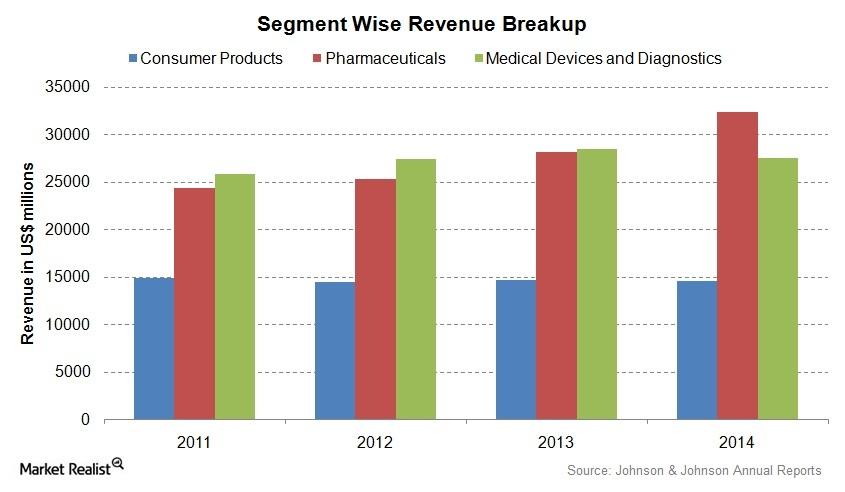

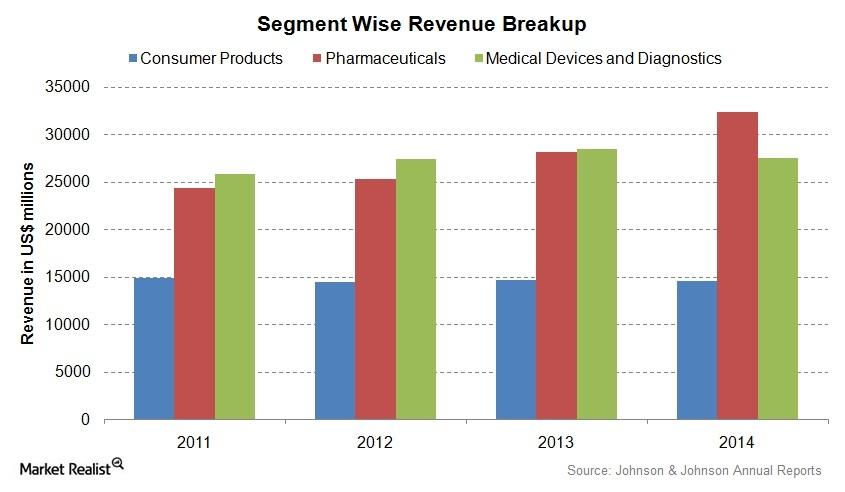

Johnson & Johnson’s Revenue Stream Increased in 2014

Johnson & Johnson’s (JNJ) net revenue increased by 4.2% from $71.3 billion in 2013 to $74.3 billion in 2014. There was an operational increase of 6.1%.

Johnson & Johnson’s Global Business Strategy Promotes Growth

Johnson & Johnson (JNJ) operates in nearly 60 countries. Its products are sold in about 200 countries. Almost 55% of its total business comes from outside the US.

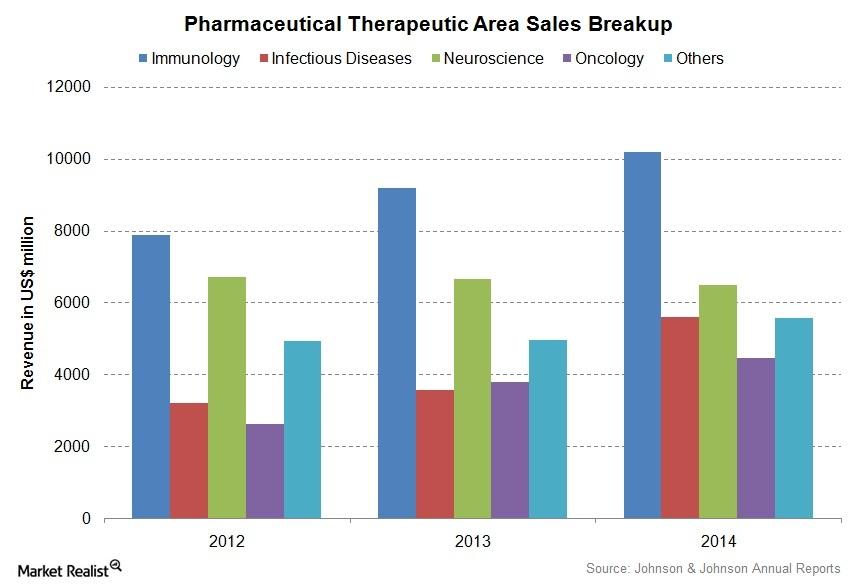

Exploring Johnson & Johnson’s Pharmaceuticals Segment

Johnson & Johnson (JNJ) is the largest pharmaceutical company in the US. The Pharmaceuticals segment contributes over 43% of the company’s revenue.

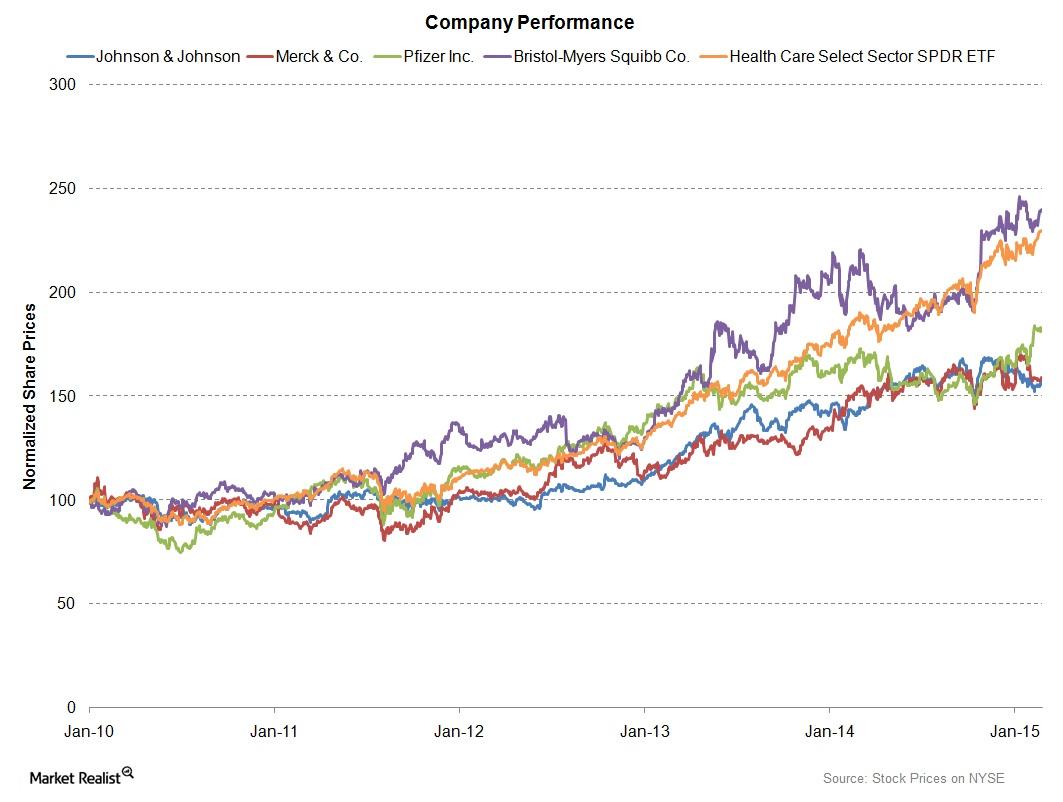

Johnson & Johnson: A Leading Pharmaceuticals Company

Johnson & Johnson is a leading pharmaceuticals and healthcare company in the US. It delivered returns of 13.4% from February 2010 to February 2015.

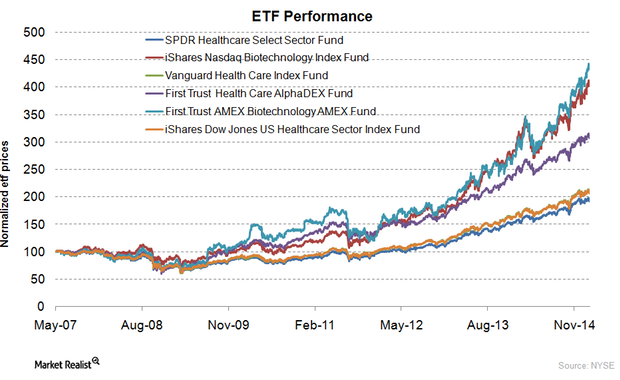

Why should you invest in healthcare ETFs?

Biotechnology funds have performed better than other healthcare ETFs. They invest in companies that use biological processes to produce medical products.

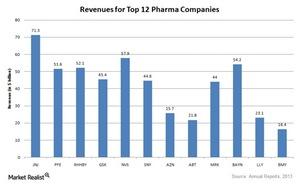

What it takes to be called ‘big pharma’

Pharmaceutical companies either deal with patented drugs, generic drugs, or both. Most big pharma companies deal with both.Healthcare The case for Pfizer’s proposed takeover of AstraZeneca

U.S. pharma giant Pfizer’s (PFE) second takeover proposal, of $106 billion (£64 billion), was rejected by Anglo-Swedish drug maker AstraZeneca (AZN) last week.

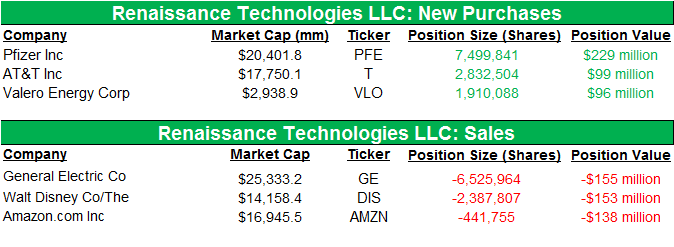

Renaissance Technologies’ 4Q13 positions in Disney and more

The fund initiated positions in Pfizer Inc. (PFE), AT&T Inc. (T), and Valero Energy Corp. (VLO). It sold stakes in General Electric Co. (GE), The Walt Disney Co. (DIS), and Amazon.com Inc. (AMZN).