BTC iShares MSCI EMU ETF

Latest BTC iShares MSCI EMU ETF News and Updates

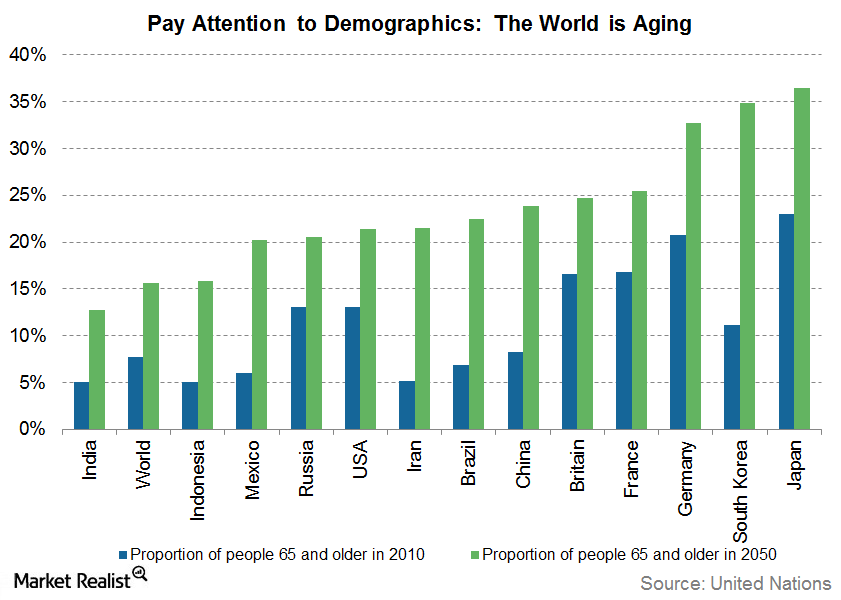

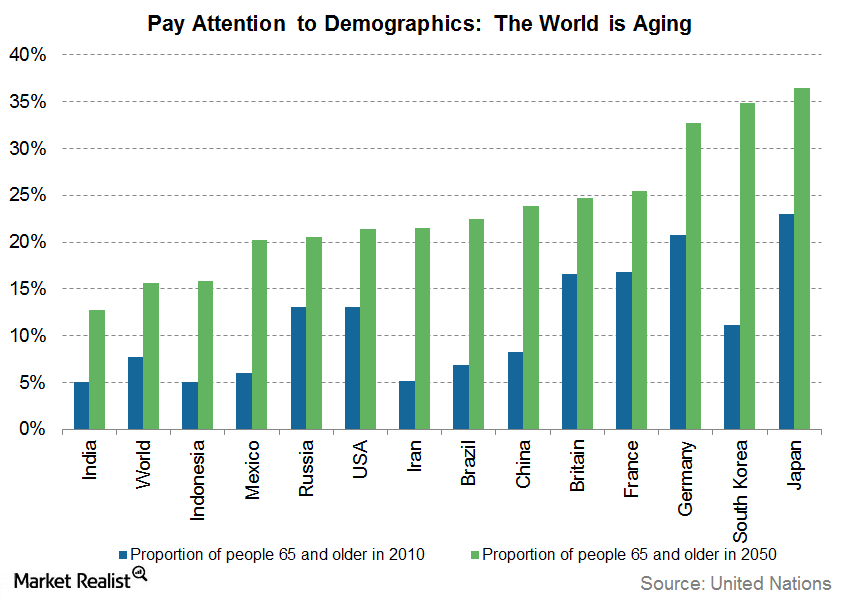

The Longevity Phenomenon: Impact on the World

The longevity phenomenon has given rise to a unique problem. The world’s population is aging rapidly, which could have a negative impact on productivity and growth rates.

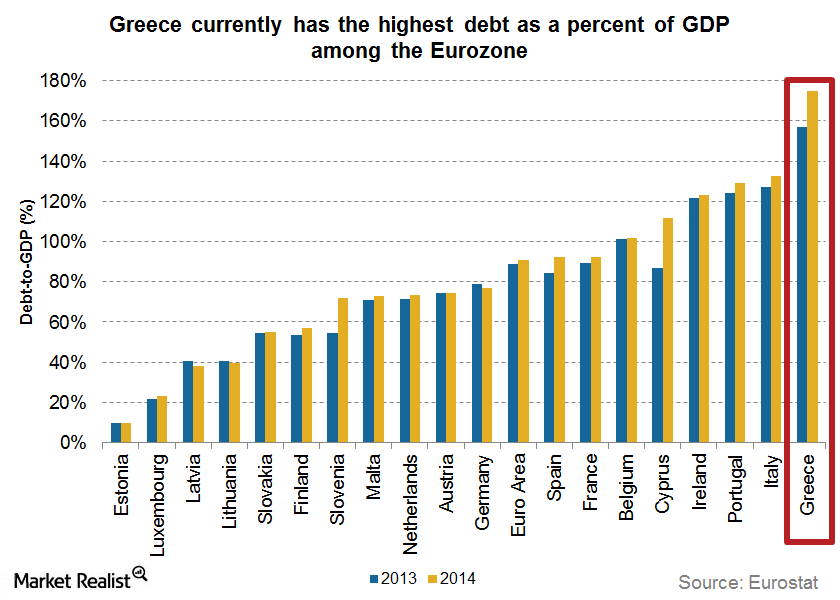

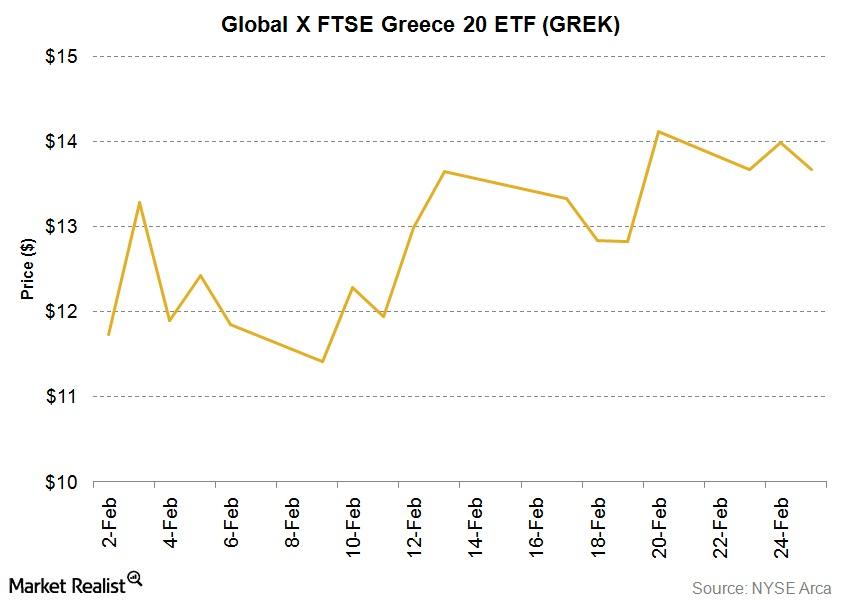

Greek Debt Crisis 101: Getting To The Crux Of The Matter

According to estimates by EuroStat, Greek debt stood at more than 315 billion euros at the end of September 2014.

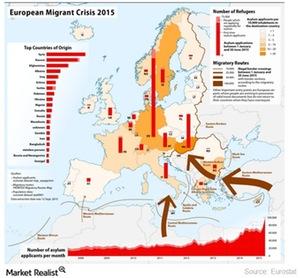

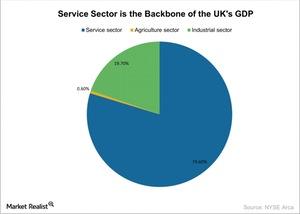

What Does the UK Really Have to Gain from Exiting the EU?

The EU’s light immigration laws allow young talent to work across the EU, but with more immigrants entering the UK, local citizens have less access to jobs.

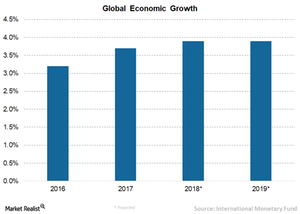

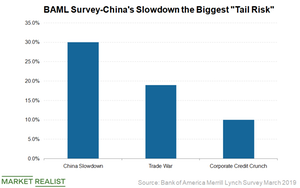

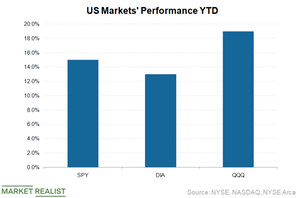

Are Tougher Days ahead for Global Equities?

The IMF revealed that emerging Asia is expected to grow ~6.5% in 2018 and 2019.

Markets Look at US-China Trade Talks as Slowdown Concerns Multiply

Today, another round of trade talks started in Beijing.

Strong Economy and a Rate Cut: Can Trump Have It Both Ways?

Today, President Donald Trump told reporters, “Our country’s doing unbelievably well economically.”

Eurozone grants bailout extension to Greece

Europe-tracking ETFs gained significantly from February 19 to February 24, when the bailout extension to Greece was approved.

Which Sectors in the UK Will the ‘Brexit’ Decision Affect Most?

The financial sector has contributed heavily to the UK economy. Financial institutions like HSBC and Barclays will face challenges doing business in the EU.

Beyond the Ephemeral: Pay Attention to Demographics

Lost in all the chatter about interest rates is a structural phenomenon that may be of far greater significance: demographics.

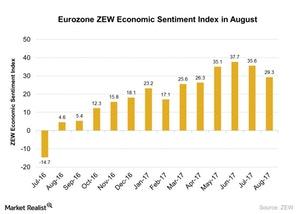

How the Eurozone ZEW Economic Sentiment Index Looked in October

According to a report by the Centre for European Economic Research (ZEW), the Eurozone ZEW Economic Sentiment Index fell to 26.7 so far in October compared to 31.7 in September.

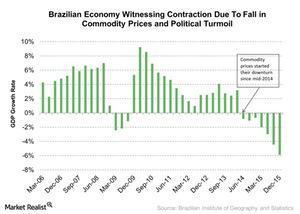

Why Is David Rubenstein Optimistic about Brazil?

The Brazilian economy is experiencing contraction due to a fall in commodity prices and the political turmoil. The commodities market is one of Brazil’s most important growth drivers.

Eurozone ZEW Economic Sentiment Fell after a Year

According to a report by the Centre for European Economic Research (ZEW), the Eurozone ZEW Economic Sentiment Index fell to 29.3 in August.

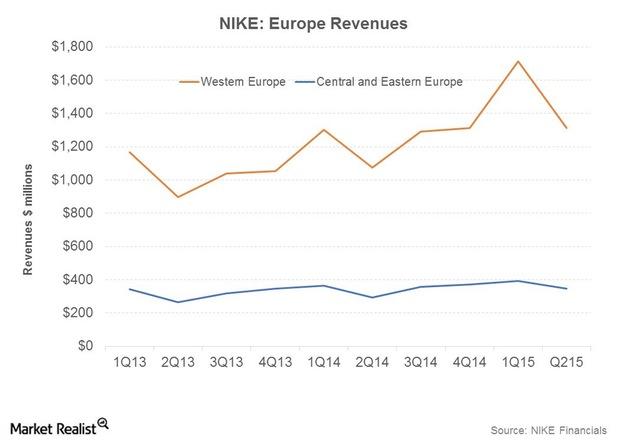

NIKE Defies Macro Headwinds In Europe

NIKE is in the midst of transforming the Western Europe market. It’s looking to improve profitability by increasing the premium on its brand.Financials The key arguments of the Yes campaign of the Scottish referendum

The voting result of the Scottish Referendum, due September 18, will have a direct bearing on Scotland, the United Kingdom, and the 28-member European Union as a whole.Financials Must-know: What caused the Greek, Irish, and Spanish debt issues?

Tourism revenues—a key revenue component for all these countries—declined substantially because foreign tourists stayed away during the aftermath of the Great Recession. Key industries were also affected—notably cyclical industries like shipping.

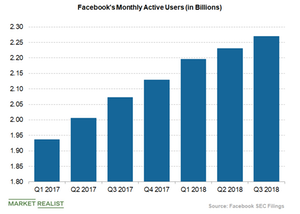

How Are Google and Facebook Planning to Fight Fake News?

Internet giants such as Facebook (FB), Twitter (TWTR), and Alphabet’s (GOOGL) Google have been facing pressure from lawmakers in the US and Europe since last January.

Eurozone Investor Confidence Improved: Will It Help Equity Market?

Eurozone (FEZ) (VGK) investor confidence has shown strong improvement in December 2017.

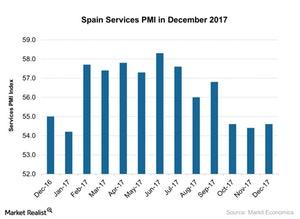

How Did Spain’s Services PMI Perform in December 2017?

According to a report by Markit Economics, the final Spain services PMI stood at 54.6 in December 2017 as compared to 54.4 in November.

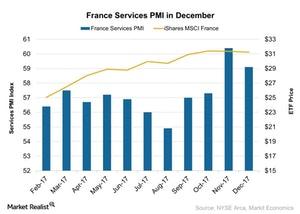

How Did France’s Services PMI Look in December 2017?

According to the data provided by Markit Economics, the final Markit France services PMI (purchasing managers’ index) fell marginally in December as compared to the previous month.

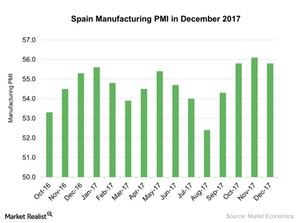

A Look at Spain’s Manufacturing Activity in December 2017

Spain’s manufacturing activity in December According to Markit Economics, Spain’s manufacturing PMI (purchasing managers’ index) rose to 55.8 in December 2017 from 56.1 in November. Whereas the index had reached an 11-year high in November, in December, it missed the market estimate of 56.4. Despite the lower PMI figure, manufacturing activity remained strong. Spain’s manufacturing PMI performance in […]

What France’s Manufacturing Activity Indicates

France’s manufacturing activity in December According to Markit Economics, France’s manufacturing PMI (purchasing managers’ index) rose strongly in December 2017, to 58.8 from 57.7 in November 2017. Whereas the index didn’t meet the market estimate of 59.3, it marked the strongest improvement in manufacturing activity since September 2000. France’s expansion in manufacturing activity suggests that business […]

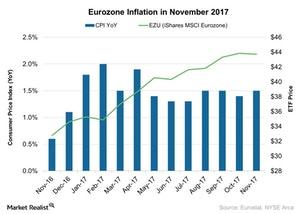

Can Rising Eurozone Inflation Make European Central Bank Hawkish?

According to Eurostat, on a year-over-year basis, inflation in the Eurozone (VGK) (IEV) (EZU) was 1.5% in November 2017 compared to 1.4% in October 2017.

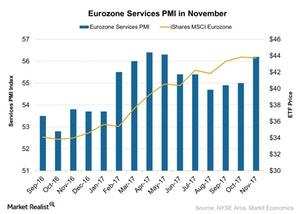

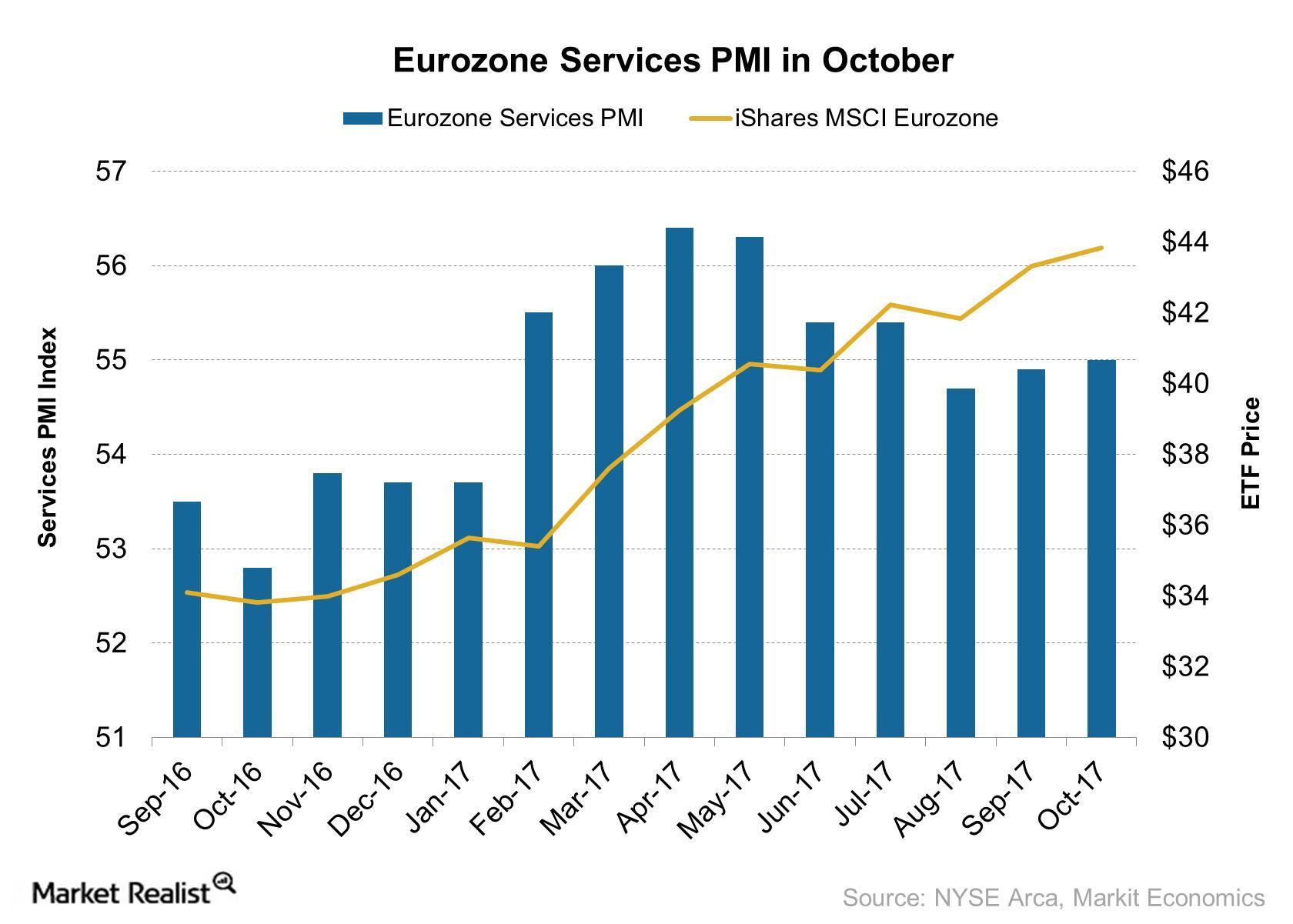

Eurozone Services PMI: Why It Strengthened in November

The final Eurozone Services PMI stood at 56.2 in November compared to 55.0 in October. It met the preliminary market estimate of 56.2.

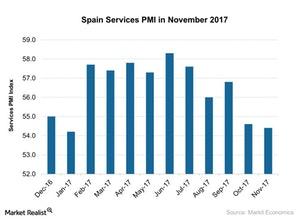

Insights into the Spain Services PMI for November 2017

The final Spain Services PMI stood at 56.1 in November compared to 55.8 in October. It didn’t beat the preliminary market estimate of 56.5.

France’s Manufacturing Data Shows Robust Growth in November

France’s manufacturing purchasing managers’ index According to IHS Markit, France’s final manufacturing PMI (purchasing managers’ index) stood at 57.7 in November 2017, compared with 56.1 in October 2017. The preliminary market expectation was 57.5. Factory activity was at its highest in seven years. Why manufacturing activity rose France’s manufacturing PMI score rose due to the following […]

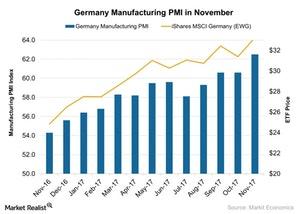

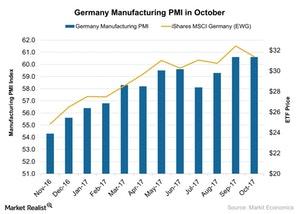

Germany’s Manufacturing Growth Signals Stronger Business Climate

Germany’s manufacturing data in November Germany’s final manufacturing PMI (purchasing managers’ index) stood at 62.5 in November, compared with 60.6 in October 2017, according to Markit Economics. The November reading met the preliminary estimate of 62.5, and was the second-highest score since February 2011. Germany’s (DAX-INDEX) manufacturing PMI score improved due to increases in the following: new orders exports employment […]

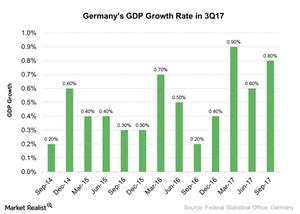

Germany’s GDP at 0.8% in 3Q17: Will It Raise Investor Sentiment?

According to a report by the Federal Statistical Office, Germany’s GDP growth rate was 0.8% in the third quarter of 2017 compared to 0.6% growth in the second quarter of 2017.

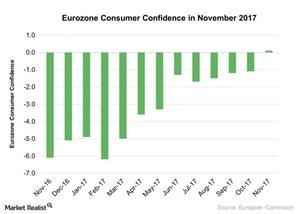

Eurozone Consumer Confidence in Positive Zone after a Decade

According to a report from the European Commission, the Eurozone Consumer Confidence Index stands at 0.1 so far in November compared to -1.1 in October 2017.

Is Improving Eurozone Inflation Minimizing Deflation Risk?

On a year-over-year basis, the Eurozone inflation index was 1.4% in October compared to 1.5% in September 2017, according to data provided by Eurostat.

A Look at Key Economic Indicators Released Last Week

In this series, we’ll take a look at US inflation, US retail sales, and China’s retail sales for October 2017. We’ll also analyze some economic indexes and the Eurozone’s consumer confidence in November 2017.

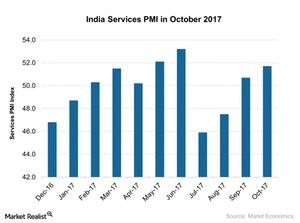

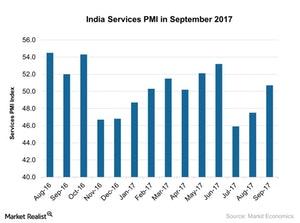

Why India’s Services PMI Rose in October

According to data provided by Markit Economics, the final Markit services PMI (purchasing managers’ index) for India strengthened in October 2017.

Why the Eurozone Services PMI Weakened in October 2017

The final Eurozone services PMI (purchasing managers’ index) stood at 55.0 in October 2017 compared to 55.8 in September 2017.

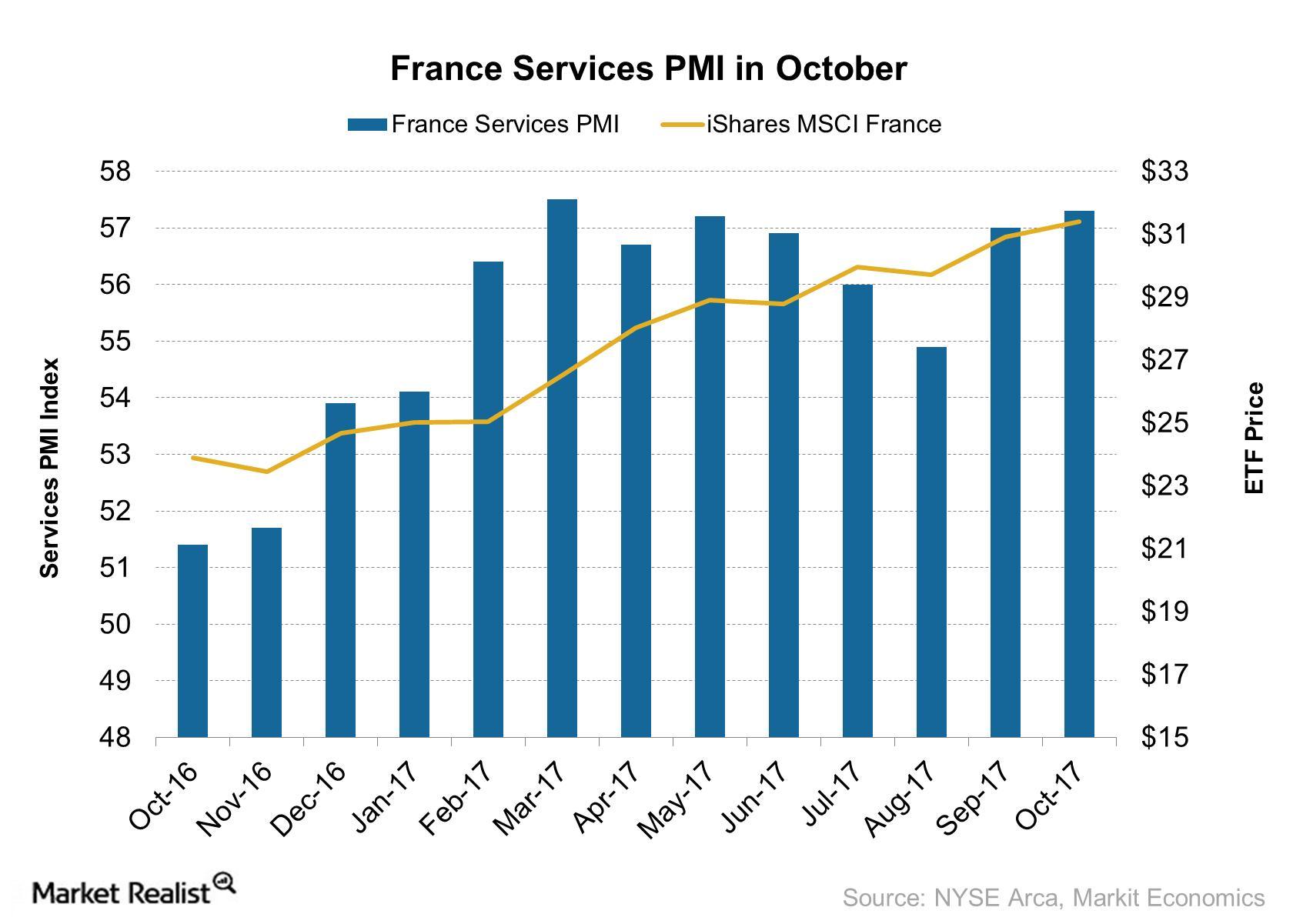

Insight into France’s Services PMI in October 2017

The final Markit France services PMI (purchasing managers’ index) stood at 57.3 in October compared to 57 in September 2017.

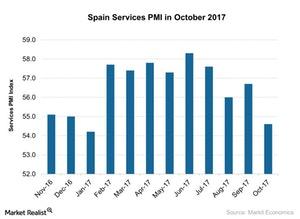

Why Spain’s Services PMI Fell in October 2017

According to a report by Markit Economics, the final Spain services PMI stood at 54.6 in October 2017 compared to 56.7 in September 2017.

What No Change in Germany’s Manufacturing PMI Could Mean for Its Economy

Germany’s final manufacturing PMI showed no change in October, coming in at 60.6, and meeting the preliminary market estimation of 60.5.

How France’s Unchanged Manufacturing PMI in October Could Affect Markets

The final France manufacturing PMI, remained unchanged in October 2017, standing at 56.1 and falling short of the preliminary market estimate of 56.7.

Why India’s Services PMI Expanded in September

The final Markit India Services PMI (Purchasing Managers’ Index) stood at 50.7 in September 2017 compared to 47.5 in August 2017.

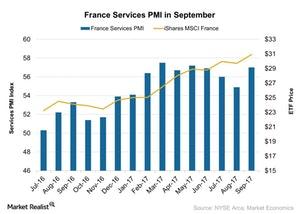

France’s Services PMI Strengthened in September after a Gradual Fall

The iShares MSCI France ETF (EWQ), which tracks France’s performance, rose 4% in September 2017.

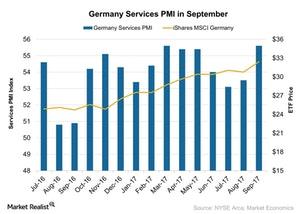

Why Germany’s Services PMI Rose Strongly in September

The iShares MSCI Germany Small-Cap ETF (EWGS), which tracks the performance of small-cap stocks in Germany, rose 3.5% in September.

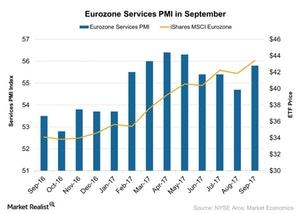

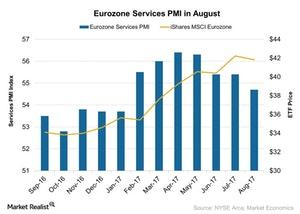

The Eurozone Services PMI Improved Strongly in September

The final Eurozone services PMI (purchasing managers’ index) rose strongly in September 2017. It stood at 55.8 in September 2017, up from 54.7 in August 2017.

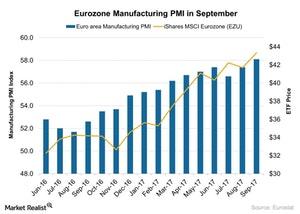

Does Eurozone Manufacturing Signal a Healthier Economy?

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) improved strongly in September 2017.

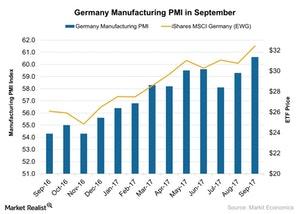

Germany’s Rising Manufacturing Signals a Stronger Path Ahead

According to a report by Markit Economics, Germany’s final manufacturing PMI stood at 60.60 in September 2017, compared to 59.30 in August.

Does France’s Rising Manufacturing Mean a Strong Business Climate?

According to data provided by Markit Economics, the final Markit France manufacturing PMI (purchasing managers’ index) stood at 56.10 in September 2017, compared to 55.80 in August 2017.

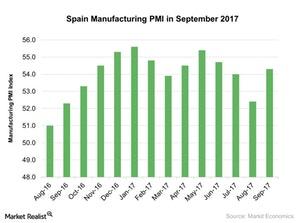

Why Spain’s Manufacturing Recorded a Strong Rise in September

According to a report by Markit Economics, Spain’s manufacturing PMI rose to 54.3 in September 2017, compared to 52.4 in August.

What Does August Eurozone Sentix Investor Confidence Indicate?

The Eurozone Sentix Investor Confidence Index stood at 28.2 for September 2017 as compared to 27.7 in August 2017.

Eurozone Services PMI Weakened: Will It Affect the Business Climate?

According to a report by Markit Economics, the Eurozone services PMI (purchasing managers’ index) stood at 54.7 in August as compared to 55.4 in July 2017.

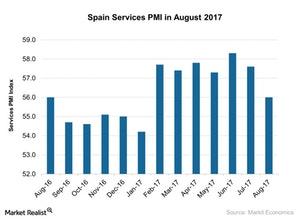

Why Spain’s Service Activity Dropped in August 2017

According to a report by Markit Economics, the Spain Services PMI (purchasing managers’ index) stood at 56 in August compared with 57.6 in July.

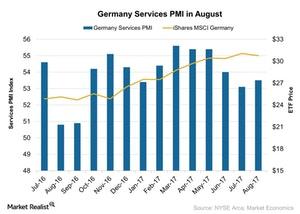

What Affected Germany Services PMI in August?

According to data provided by Markit Economics, the August Germany Services PMI (purchasing managers’ index) stood at 53.5 compared with 53.1 in July 2017.

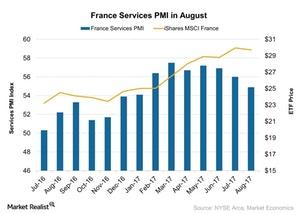

Why France’s Services PMI Fell in August

According to data provided by Markit Economics, the August France Services PMI (purchasing managers’ index) stood at 54.9 in August 2017 compared with 56 in July 2017.

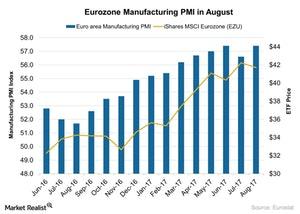

Eurozone’s Manufacturing PMI Indicates Healthier Economy

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) improved in August 2017.