BTC iShares MSCI EMU ETF

Latest BTC iShares MSCI EMU ETF News and Updates

What Does France’s Rising Manufacturing Activity Suggest?

According to data provided by Markit Economics, the final Markit France manufacturing PMI (purchasing managers’ index) stood at 55.8 in August 2017 compared to 54.9 in July 2017.

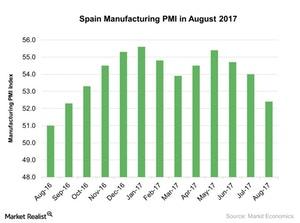

Why Spain Manufacturing PMI Showed a Huge Drop in August 2017

According to a report by Markit Economics, Spain’s manufacturing PMI fell to 52.4 in August 2017 as compared to 54 in July.

How France’s Flash Manufacturing Activity Is Trending

According to data provided by Markit Economics, the flash Markit France manufacturing PMI (purchasing managers’ index) stood at 55.8 in August 2017 compared to 54.9 in July 2017.

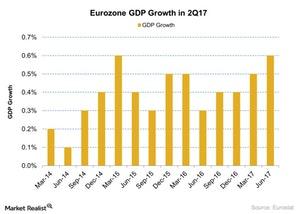

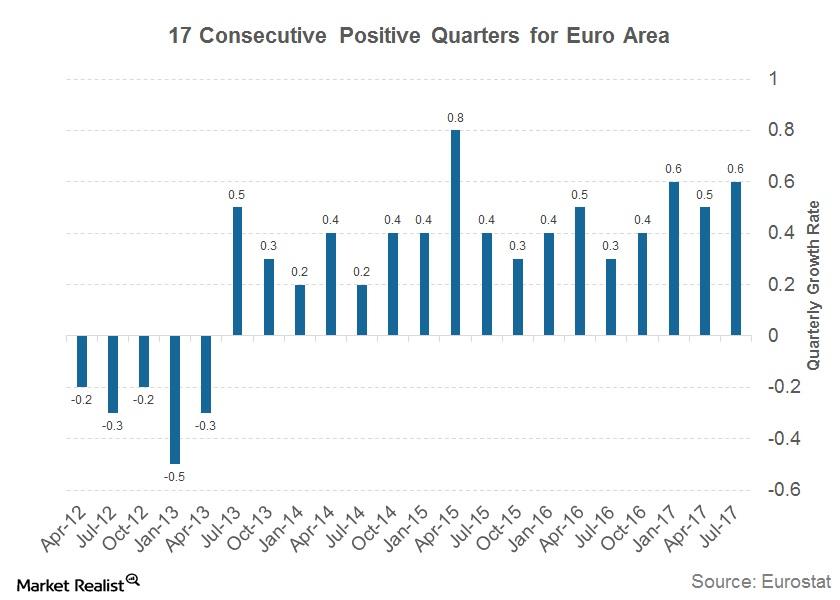

Eurozone’s Growth Rate Rose 0.6% in 2Q17

According to Eurostat, the Eurozone’s economy posted a growth rate of 0.6% in 2Q17. In 1Q17, the economy posted a growth rate of 0.5%.

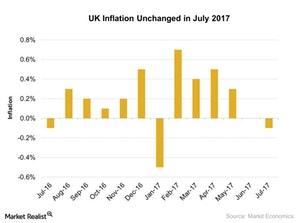

UK Inflation Fell: Possible Rough Path Ahead

According to a report by the Office for National Statistics, on a monthly basis, the United Kingdom’s inflation fell 0.1 in July 2017.

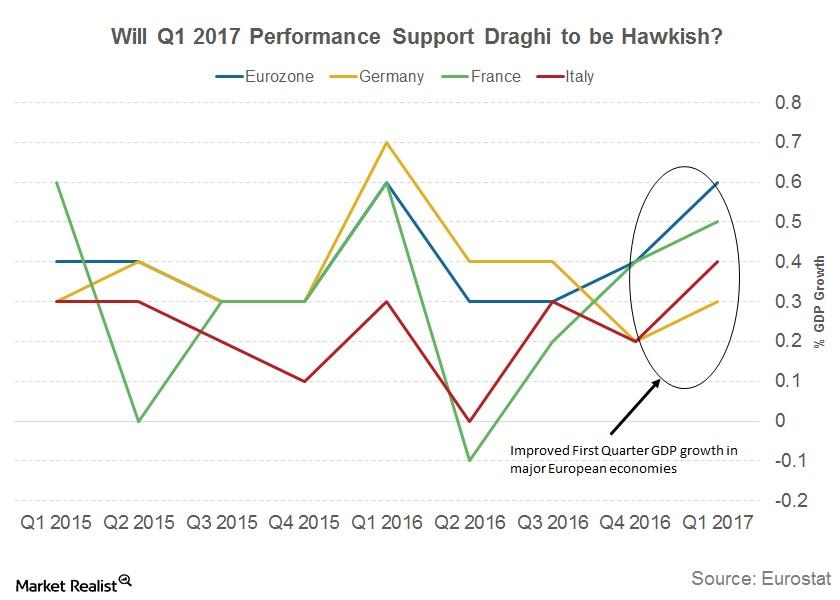

Why Draghi Is a Person of Interest at Jackson Hole

ECB President Mario Draghi is scheduled to speak at this year’s Jackson Hole Symposium on August 25—after a hiatus of three years.

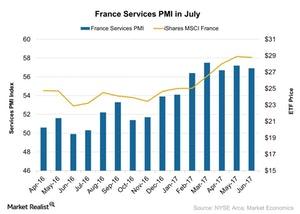

Behind the France Services PMI in July

The July France Services PMI (purchasing managers’ index) stood at 56.0 in July 2017, compared with 56.9 in June 2017, meeting the initial estimate of 55.9.

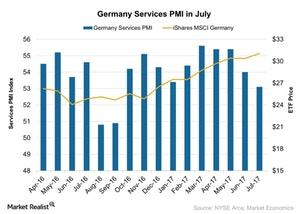

What Happened to Germany’s Services PMI in July?

The July Germany Services PMI stood at 53.1, compared with 54.0 in June 2017, falling short of the preliminary market’s estimation of 53.5.

Is Strong Economic Expansion in the Eurozone Driving the ECB?

The European economy has expanded in the last 17 consecutive quarters. The Eurozone’s annual growth rate is 2.1%—the highest growth rate in the last six years.

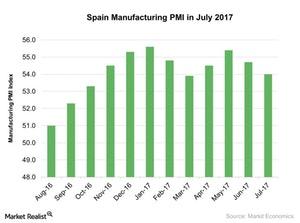

Spain’s Manufacturing Activity Fell in July

According to a report by Markit Economics, the final Spain Manufacturing PMI stood at 54 in July 2017 as compared to 54.7 in June.

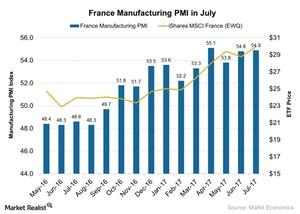

How France’s Manufacturing Activity Trended in July

According to data provided by Markit Economics, the final Markit France manufacturing PMI (purchasing managers’ index) stood at 54.9 in July 2017 compared to 54.8 in June 2017.

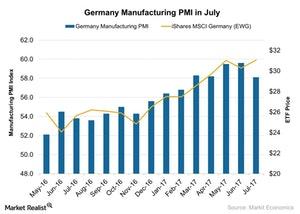

How Did Germany’s Manufacturing PMI Trend in July?

The final Markit Germany manufacturing PMI (purchasing managers’ index) stood at 58.1 in July 2017 compared to 59.6 in June 2017.

James Gorman Says the Global Economy Is Doing Well: Why?

Gorman believes the global economy is doing well in the present scenario. However, lower volatility is a major concern.

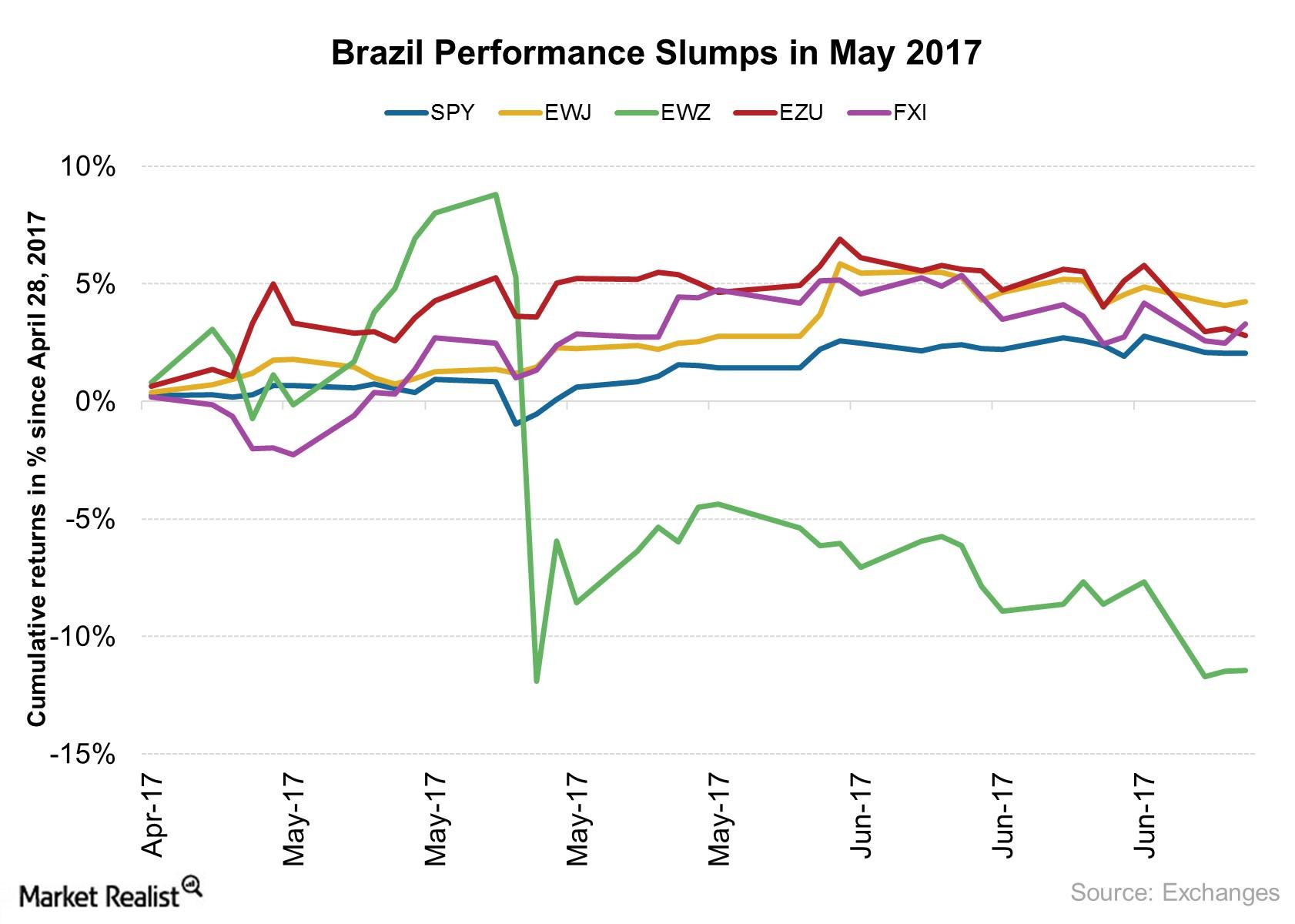

How Political Instability Affected Brazil’s Stock Performance in May 2017

The International Monetary Fund is projecting 0.5% growth in Brazil’s GDP output in 2017, according to its April 2017 outlook report.

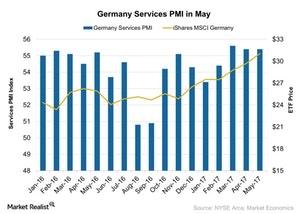

Why Germany’s Services PMI Didn’t Change in May

According to data provided by Markit Economics, the final Markit Germany services PMI (purchasing managers’ index) stood at 55.4 in May 2017.

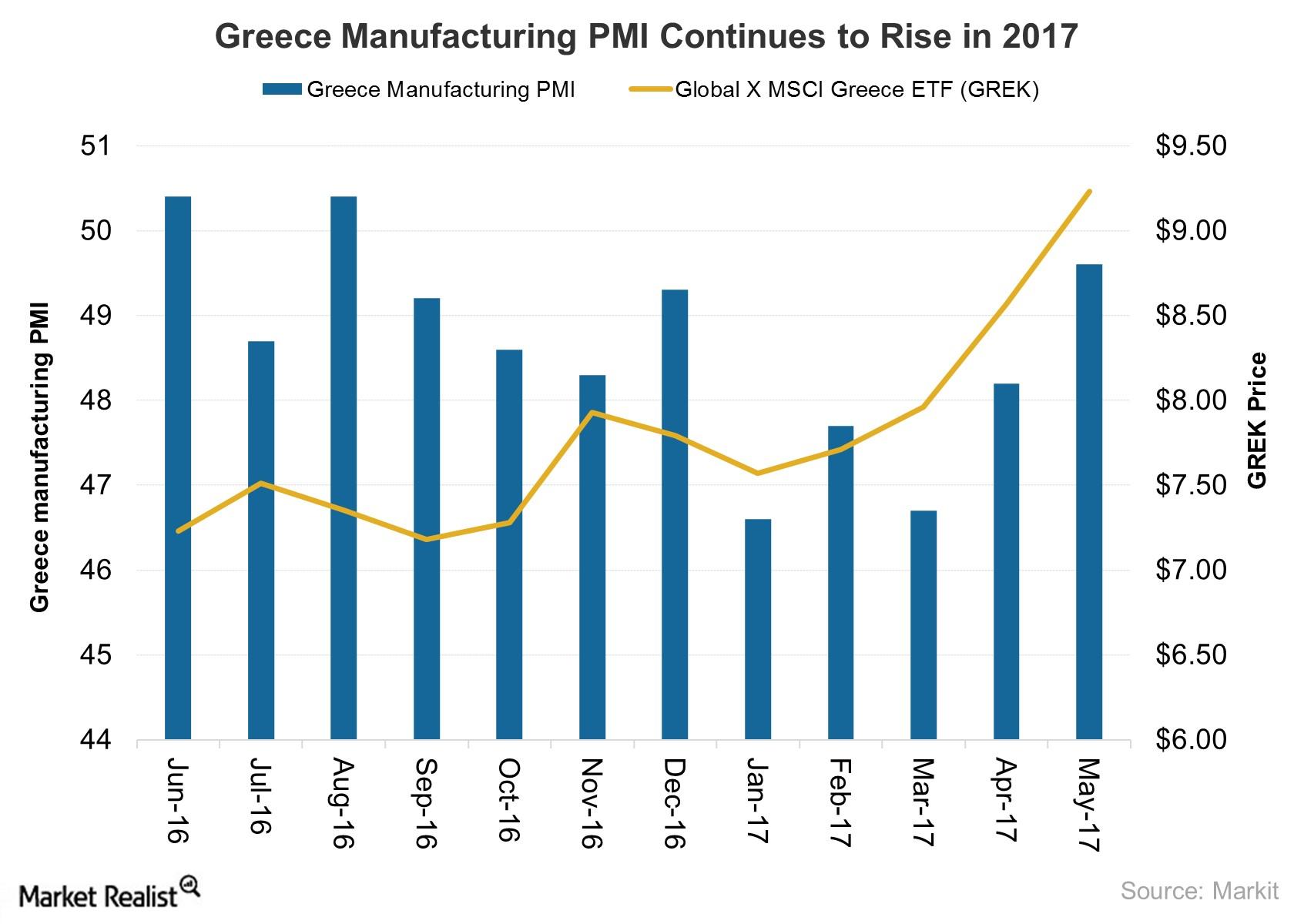

Did Greece’s Manufacturing Activity Improve amid Growth Expectations?

The Markit Greece Manufacturing PMI advanced to 49.6 in May 2017 compared to 48.2 in the previous month.

How Germany’s Services PMI Performed in April

According to Markit Economics, the Germany Services PMI stood at 55.4 in April 2017 compared to 55.6 in March 2017.

Why Greece’s Manufacturing Activity Is Struggling amid Improved Expectations

Amid its financial chaos, Greek manufacturing activity rose in April 2017, though it remains below the acceptable mark of 50.

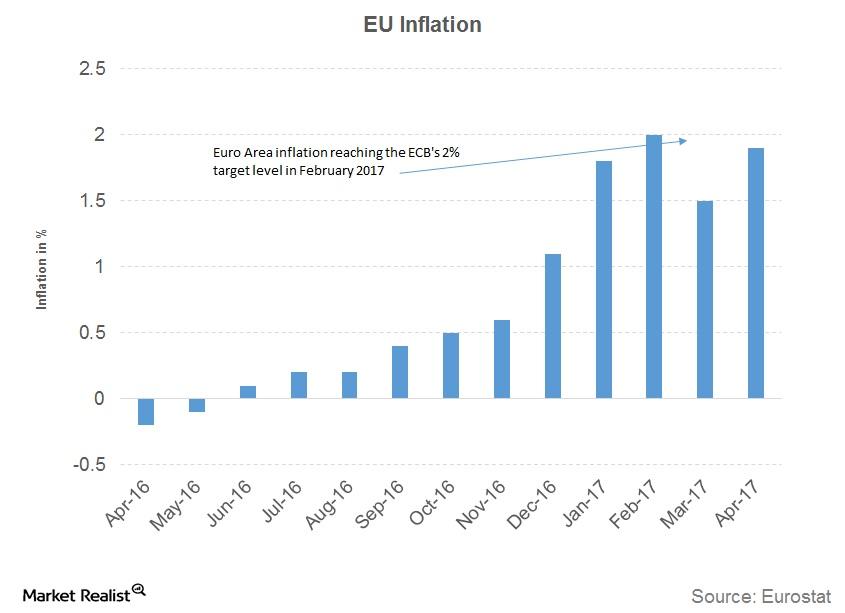

Why the ECB Is Struggling to Hide Its Excitement

The European Central Bank’s (or ECB) policy statement that was released on April 28 reported that the ECB left monetary policy unchanged, which was in line with expectations.

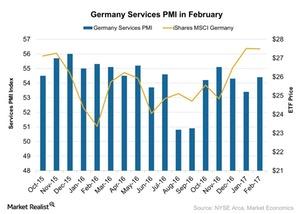

What the Strengthening of the Germany Services PMI Indicates

According to data provided by Markit Economics, the final Markit Germany services PMI (purchasing managers’ index), released on March 3, 2017, stood at 54.4 in February 2017.

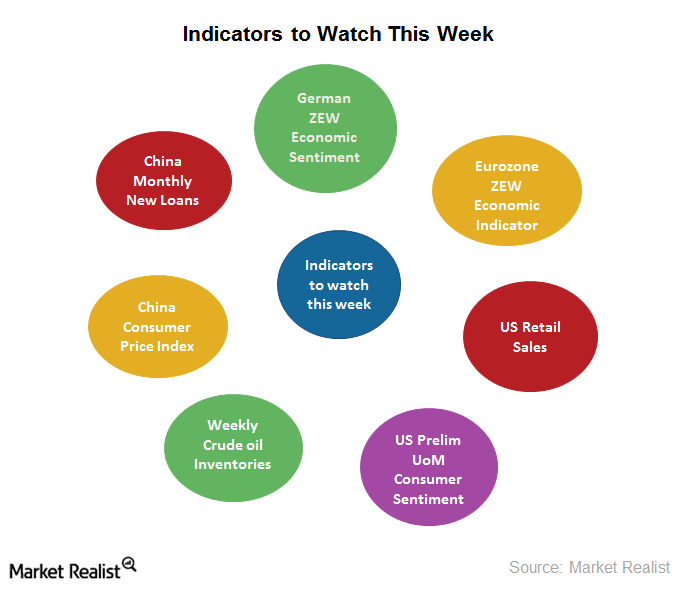

Which Economic Indicators Should Investors Watch This Week?

The most important indicator for this week is China’s monthly new loans. According to data from the People’s Bank of China, China’s (FXI) (YINN) (MCHI) new credit growth is increasing.

Should You Short European Bonds due to Taper Talks?

Like their equity peers, bonds can be short-sold as well. You can do it by either shorting an ETF or investing in an inverse ETF.

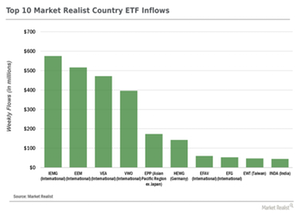

Country ETFs: Hungry Emerging Market Bulls

Investor appetite for emerging market exposure has been growing steadily, and last week’s fund flows showed that emerging market bulls are still hungry.

Category Flows: ETF Construction Matters!

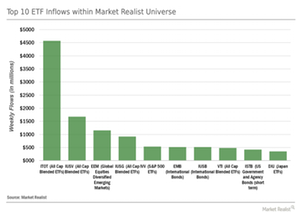

The iShares Core S&P Total U.S. Stock Market ETF (ITOT) saw by far the largest inflows within our ETF universe last week.

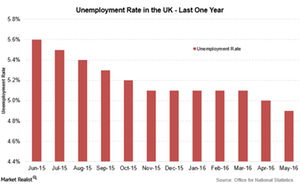

UK Unemployment Rate Improves, Brexit Concerns Remain

The unemployment rate in the United Kingdom reached 11-year low levels as the jobless rate fell to 4.9% for the period from March to May.

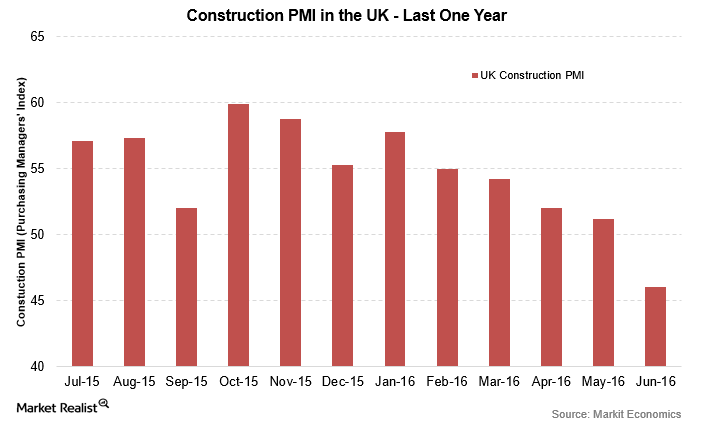

UK Construction PMI Contracts Due to Uncertain Brexit Implications

The United Kingdom’s construction PMI (purchasing managers’ index) came in at 46 for June—compared to 51.2 in the previous month.

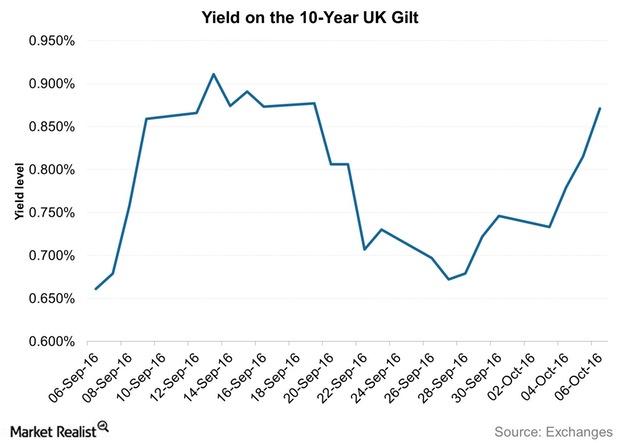

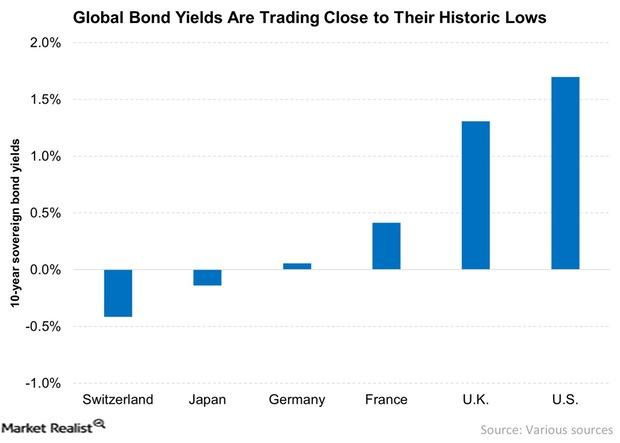

Yield-O-Philes Face a Difficult Challenge

Yields remain at unattractive levels. This has caused yield-thirsty investors to flock to high-dividend-yielding stocks, driving their valuations higher.

What Are the Key Risks to the Eurozone’s Growth?

The biggest risk to the Eurozone’s (EZU) (IEV) growth is Britain’s exit from the EU (European Union).

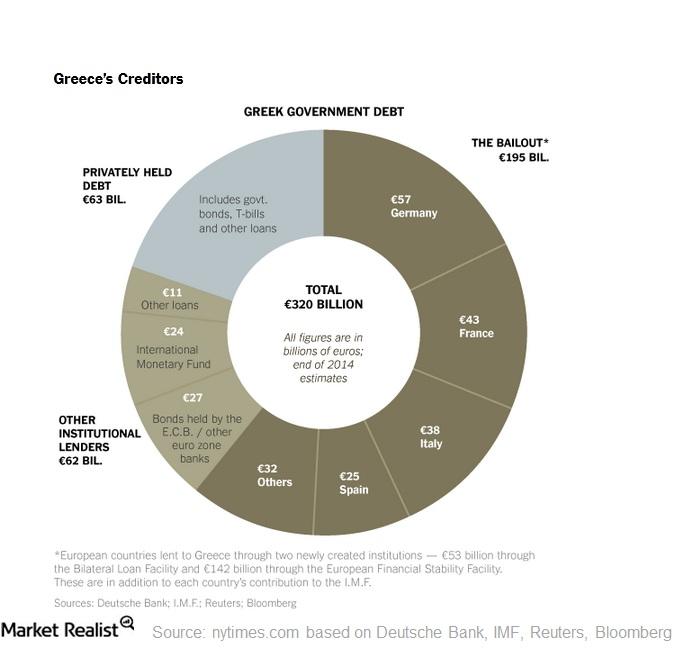

How Does the Greek Debt Crisis Impact the Eurozone?

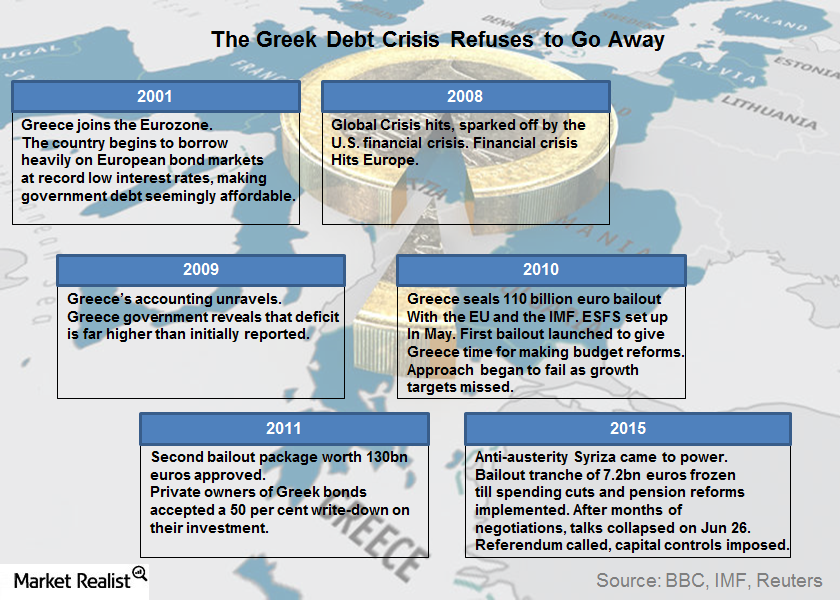

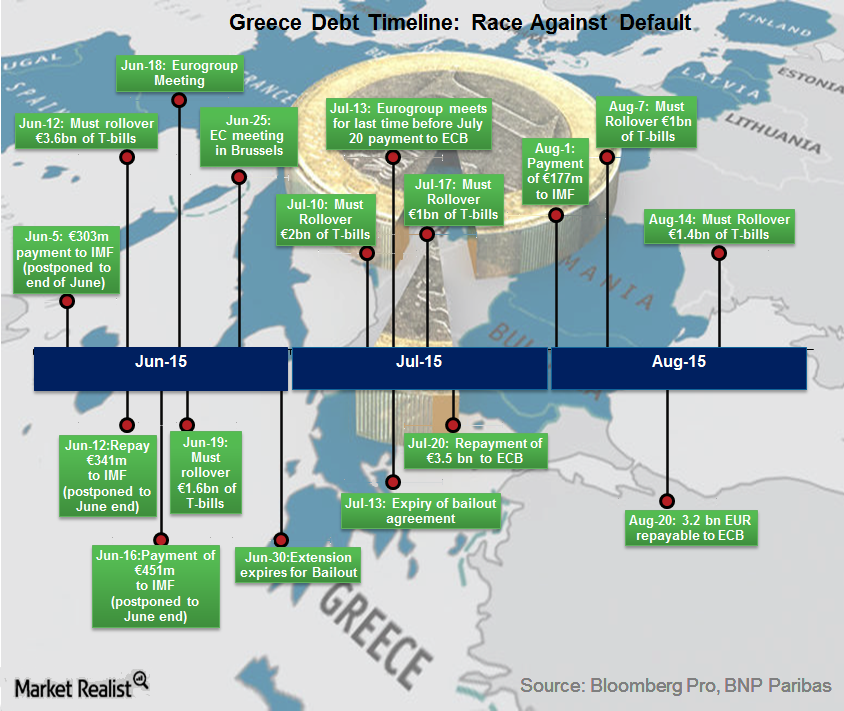

Greece’s debt was around 250 billion euros. It’s nearly 175% of its 2013 GDP figures. The GDP could fall more in 2016. The debt crisis started in 2010.

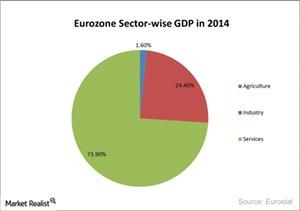

Analyzing the European Union’s GDP Composition

The EU’s (European Union) GDP (gross domestic product) depends on the service sector. The service sector contributes ~73.90% towards the EU’s (EZU) GDP.

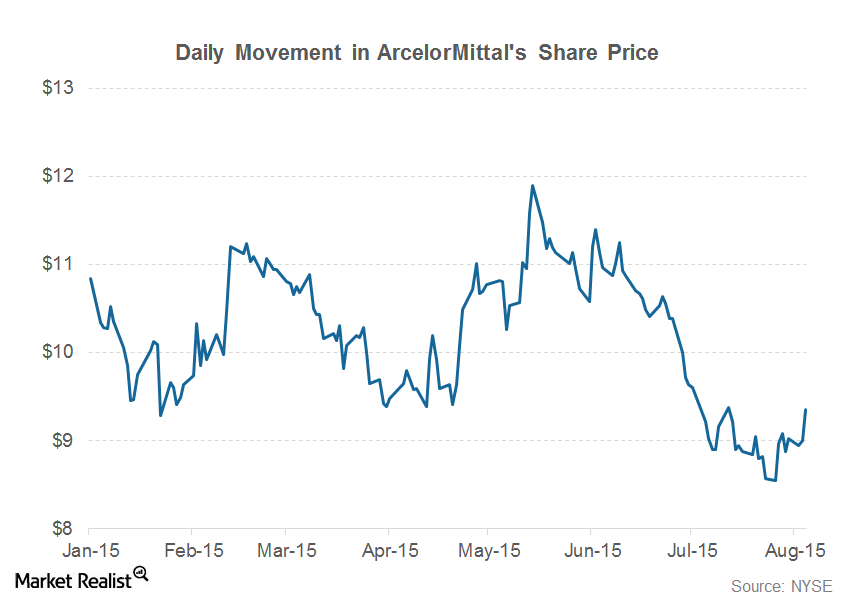

ArcelorMittal’s 2Q15 Earnings: Key Investor Takeaways

ArcelorMittal (MT) released its 2Q15 earnings on July 31. It reported net earnings of $0.2 billion in 2Q15 compared to a loss of $0.7 billion in 1Q15.

The Greek Debt Crisis Refuses to Go Away

Greek Prime Minister Alexis Tsipras walked away from negotiations this weekend and called for a referendum from his people on July 5. This surprising turn of events has sharply raised the probability of a Grexit.

The Seemingly Never-Ending Greek Debt Saga at a Tipping Point

The seemingly never-ending Greek debt (GREK) saga continues to play out, complete with twists, turns, and obstacles à la typical potboiler.

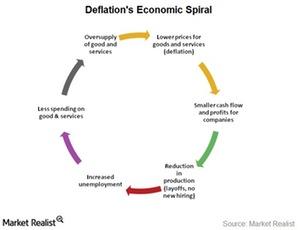

Currency warfare is a way to export deflation

When a country depreciates its currency, its major trading partners depreciate their own currencies. They do this to save their economies from entering into deflation.

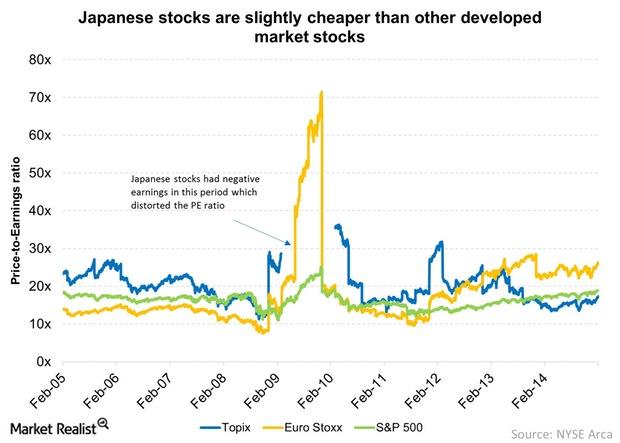

Why Japanese Stock Valuations Could Be Justified

Japan looks cheap compared to other developed markets. Japanese stock valuations can be justified if the “three arrows” are used prudently.

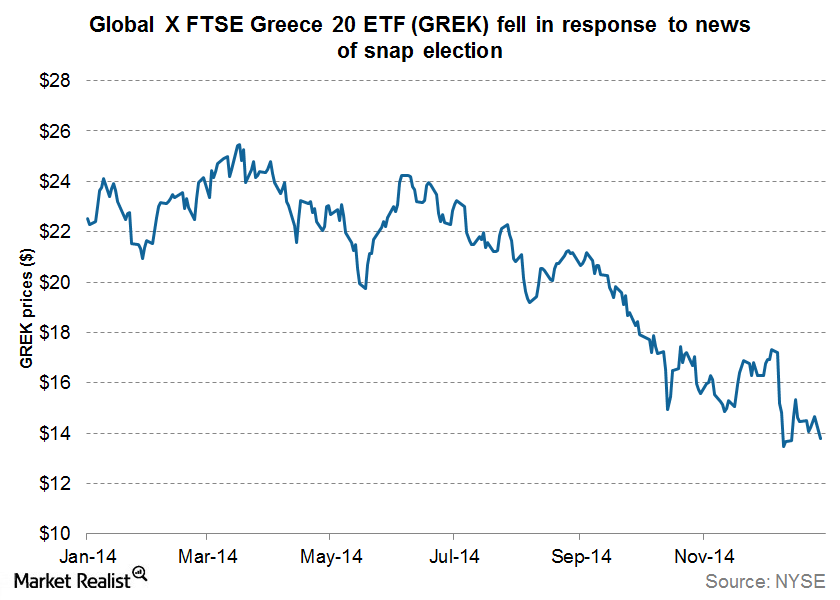

Is Greek Political Instability A Tragedy In The Making?

It’s indeed déjà vu as a fresh round of worry over Greek political instability engulfs the Eurozone (EZU).