Does Eurozone Manufacturing Signal a Healthier Economy?

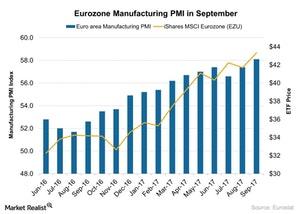

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) improved strongly in September 2017.

Oct. 9 2017, Updated 10:38 a.m. ET

Eurozone manufacturing PMI in September

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) improved strongly in September 2017. It stood at 58.10 in September, compared to 57.40 in August. It beat market expectations of 57.8. Some member countries of the Eurozone—such as France (EWQ), Spain (EWP), and Germany (EWG)—posted a stronger manufacturing activity in September 2017.

The strong performance in the Eurozone manufacturing PMI in September was mainly due to the following factors.

- Production volume and output rose at a stronger pace in September 2017.

- New business orders and export orders also grew at a faster pace in September 2017.

- The employment growth also rose at a faster pace in that month.

Impact on the economy

The improvement in manufacturing activity is mainly due to the recovery in client demand. Both the domestic economy and international economy showed a huge rise in demand in September 2017. All these conditions signal that the Eurozone economy is gradually reaching a healthier place.

Changing economic conditions could provide a huge opportunity to investors in European equities. As the corporate demand outlook is improving, it might help them achieve stronger revenue growth. Many fund managers also believe Europe could provide more value in the present scenario than other parts of the world.

The iShares MSCI Eurozone ETF (EZU) and the Vanguard FTSE Europe ETF (VGK), which track the performance of the Eurozone (HEDJ)(FEZ)(IEV), rose 3.5%, and 3.2%, respectively, in September 2017.

In the next part of this series, we’ll look at the performance of Japan’s manufacturing PMI September 2017.