iShares MSCI Spain ETF

Latest iShares MSCI Spain ETF News and Updates

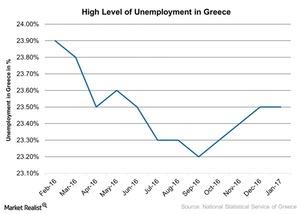

Greece’s Unemployment Falls, but Still the Highest Among Peers

Europe’s average unemployment has fallen to a four-year low of 9.8% as of 2016. Greece’s seasonally adjusted unemployment rate was 23.5% in January 2017.Financials Must-know: What caused the Greek, Irish, and Spanish debt issues?

Tourism revenues—a key revenue component for all these countries—declined substantially because foreign tourists stayed away during the aftermath of the Great Recession. Key industries were also affected—notably cyclical industries like shipping.

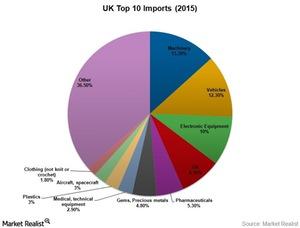

Will Brexit Weaken the UK’s Competitive Advantage over the US?

On Brexit, import restrictions and tariff quotas currently applicable to importers in the UK and foreign businesses that export to the UK are set to change.

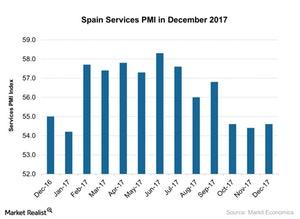

How Did Spain’s Services PMI Perform in December 2017?

According to a report by Markit Economics, the final Spain services PMI stood at 54.6 in December 2017 as compared to 54.4 in November.

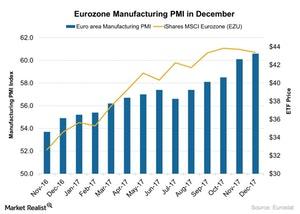

Eurozone Manufacturing Activity Reaches a High in December 2017

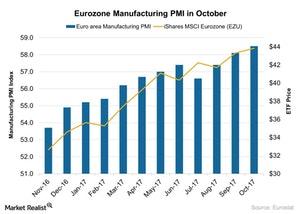

Eurozone manufacturing activity in December According to Markit Economics, the Eurozone’s manufacturing PMI (purchasing managers’ index) rose strongly in December 2017, to 60.6 from 60.1 in November 2017. It beat the market expectation of 60.4 and marked the strongest expansion in manufacturing activity since 1997. Major Eurozone members Germany (EWG) (DAX-INDEX), France (EWQ), Spain (EWP), and Italy […]

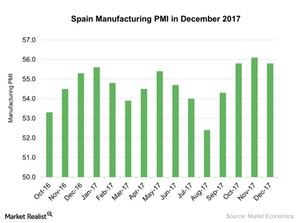

A Look at Spain’s Manufacturing Activity in December 2017

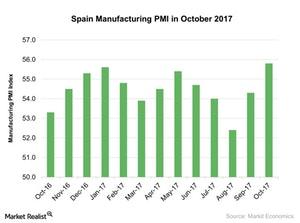

Spain’s manufacturing activity in December According to Markit Economics, Spain’s manufacturing PMI (purchasing managers’ index) rose to 55.8 in December 2017 from 56.1 in November. Whereas the index had reached an 11-year high in November, in December, it missed the market estimate of 56.4. Despite the lower PMI figure, manufacturing activity remained strong. Spain’s manufacturing PMI performance in […]

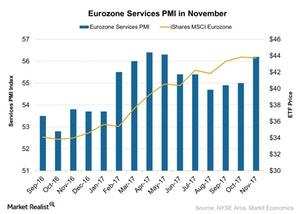

Eurozone Services PMI: Why It Strengthened in November

The final Eurozone Services PMI stood at 56.2 in November compared to 55.0 in October. It met the preliminary market estimate of 56.2.

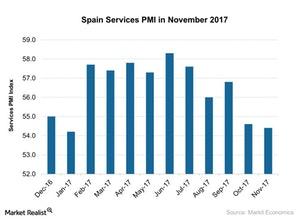

Insights into the Spain Services PMI for November 2017

The final Spain Services PMI stood at 56.1 in November compared to 55.8 in October. It didn’t beat the preliminary market estimate of 56.5.

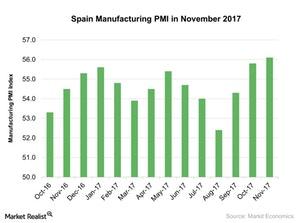

Spain’s Manufacturing Activity Recovers

Spain’s manufacturing data According to Markit Economics, Spain’s manufacturing PMI (purchasing managers’ index) score rose to 56.1 in November 2017 from 55.8 in October 2017. Although the PMI figure didn’t beat the preliminary estimate of 56.5, it marked the fastest expansion seen since February 2007. Spain’s stronger manufacturing PMI performance was mainly due to increases in the following: improved […]

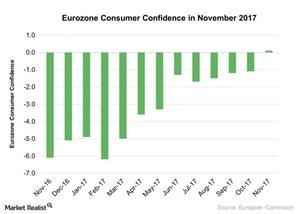

Eurozone Consumer Confidence in Positive Zone after a Decade

According to a report from the European Commission, the Eurozone Consumer Confidence Index stands at 0.1 so far in November compared to -1.1 in October 2017.

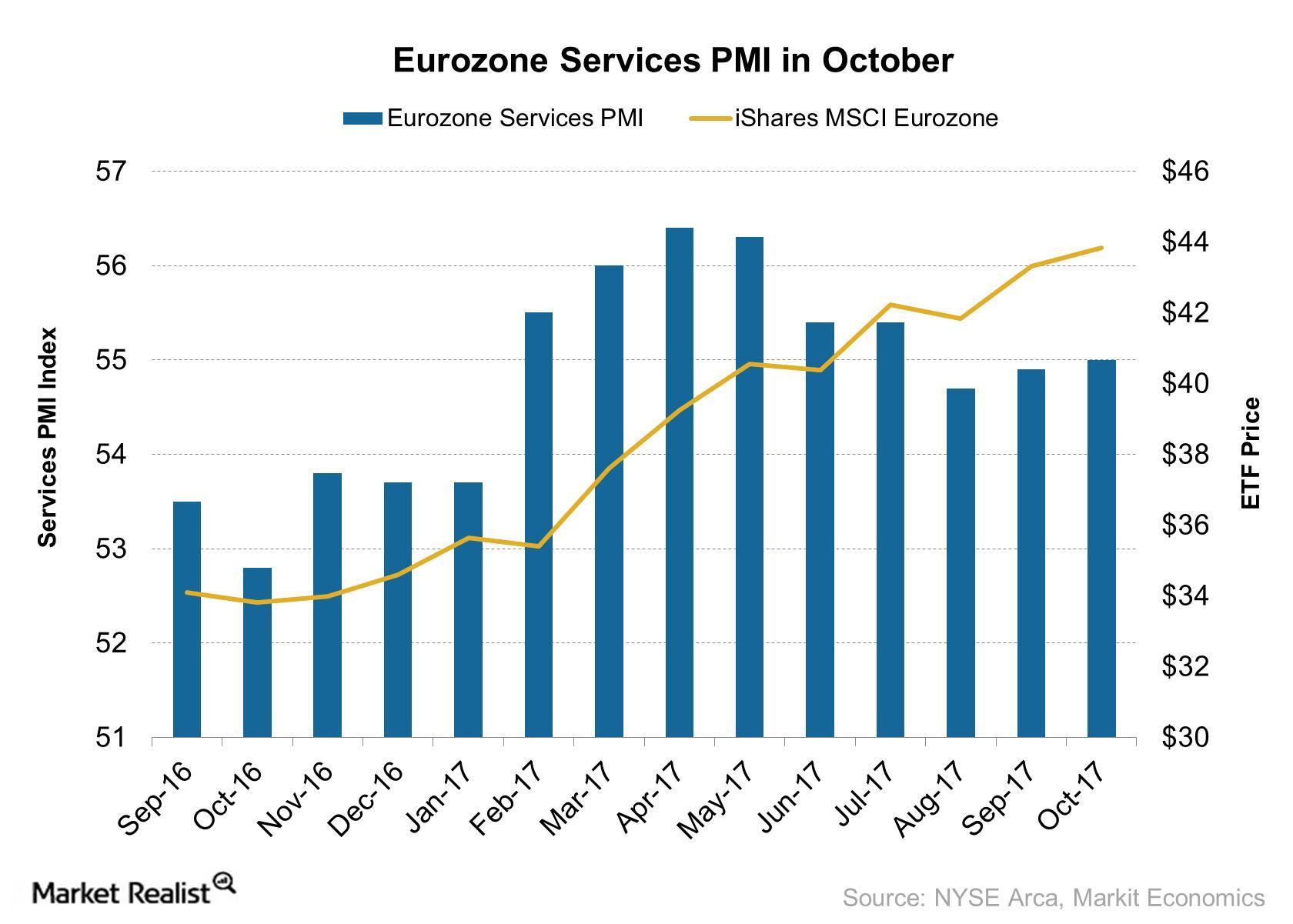

Why the Eurozone Services PMI Weakened in October 2017

The final Eurozone services PMI (purchasing managers’ index) stood at 55.0 in October 2017 compared to 55.8 in September 2017.

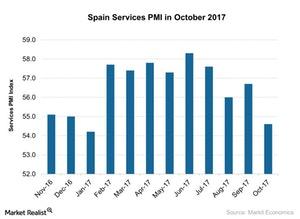

Why Spain’s Services PMI Fell in October 2017

According to a report by Markit Economics, the final Spain services PMI stood at 54.6 in October 2017 compared to 56.7 in September 2017.

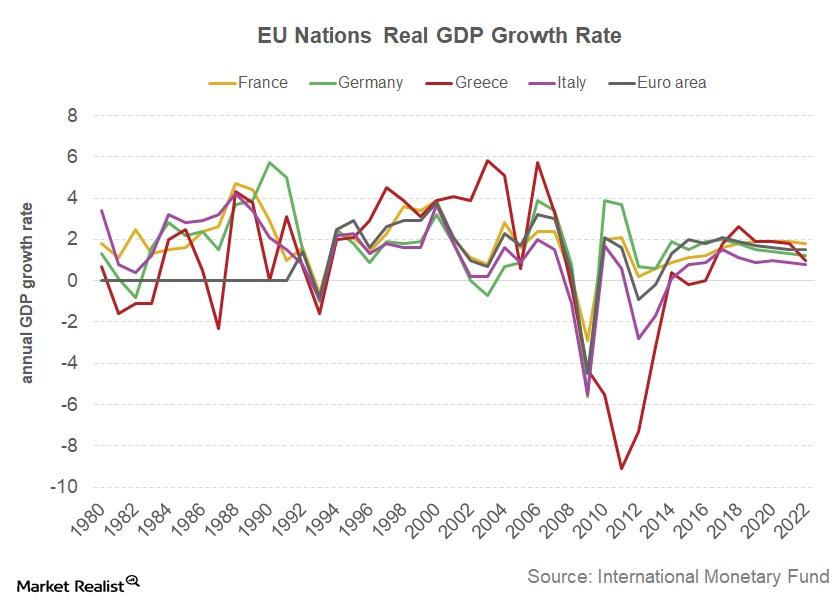

Why the IMF Upgraded Its Eurozone Growth Forecast

The International Monetary Fund (or IMF) has upgraded its growth projections for Eurozone countries, including France, Germany, Italy, and Spain.

Charting the Steady Rise of the Eurozone’s Manufacturing PMI

The Eurozone’s final manufacturing PMI showed solid improvement in October 2017, coming in at 58.5, compared with 58.1 in September.

Behind Spain’s New and Improved Manufacturing PMI

Spain’s manufacturing PMI rose to 55.8 in October 2017, compared with 54.3 in September 2017. The PMI figure beat the preliminary market estimation of 54.9.

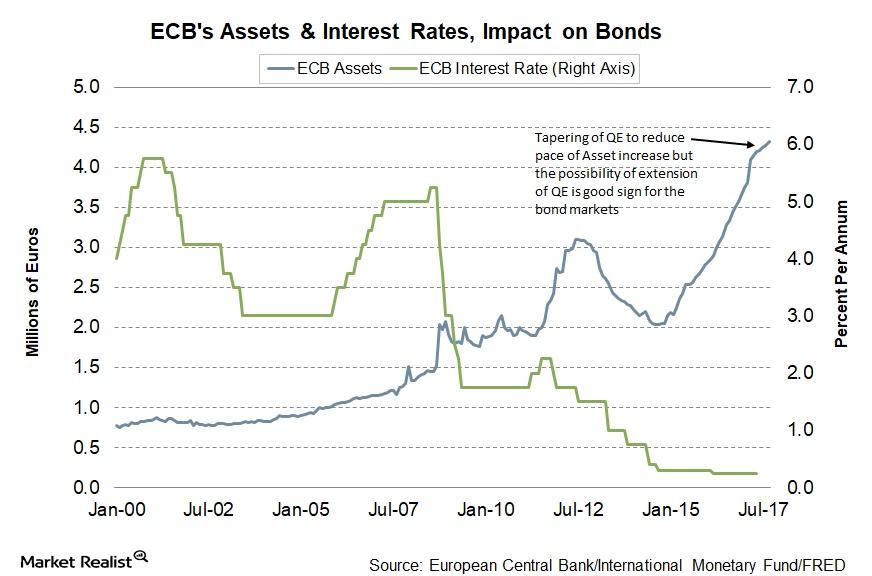

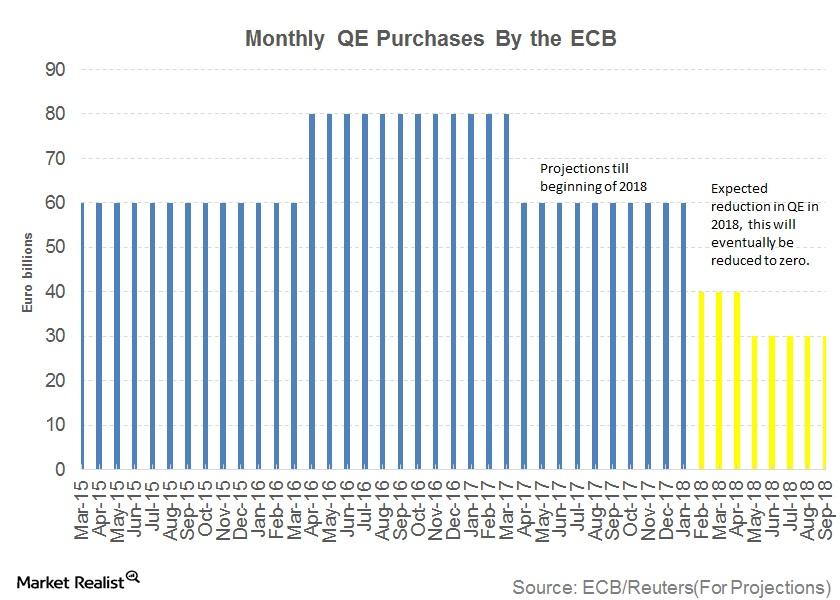

Analyzing the European Central Bank’s October Statement

The reduction to the ECB’s bond-buying program will likely have a mixed impact on the bond markets of countries in the European Union.

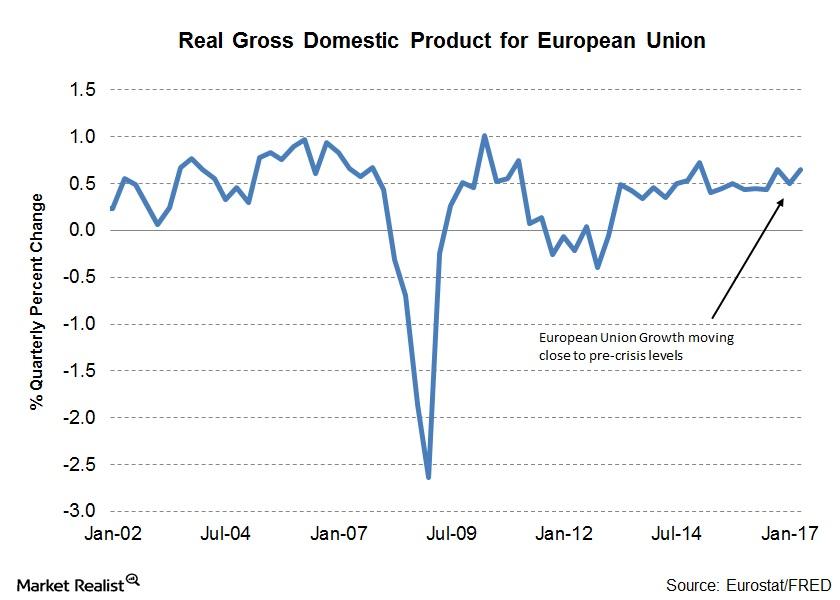

What’s behind the European Central Bank’s Normalization Plans?

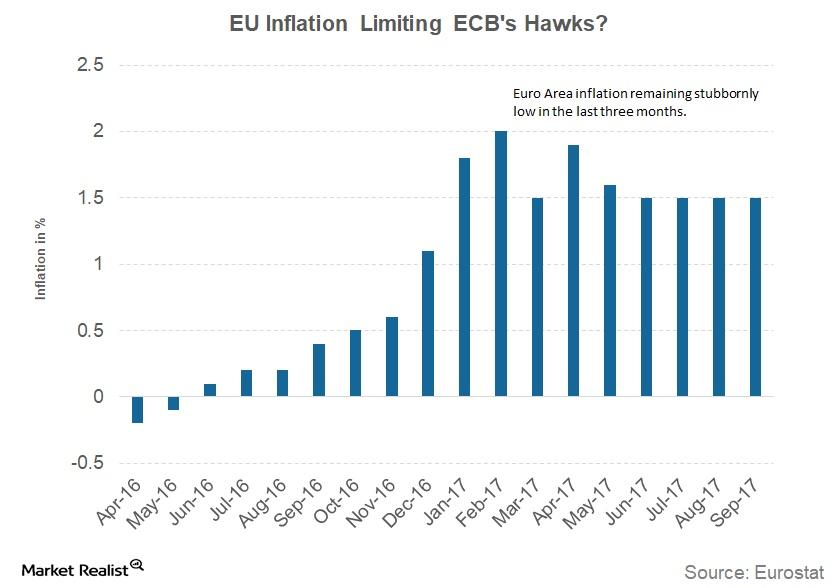

Economic growth has picked up in recent quarters. According to data from Eurostat, the European economy (VGK) grew 2.3% in the recent quarter.

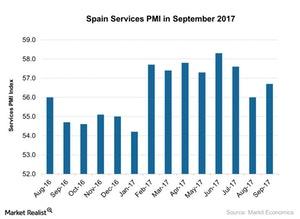

Chart in Focus: Spain’s Services PMI in September 2017

According to a report by Markit Economics, the final Spain services PMI stood at 56.7 in September 2017 compared to 56.0 in August.

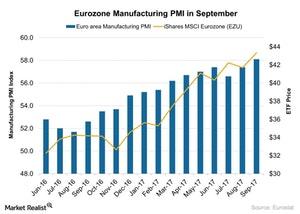

Does Eurozone Manufacturing Signal a Healthier Economy?

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) improved strongly in September 2017.

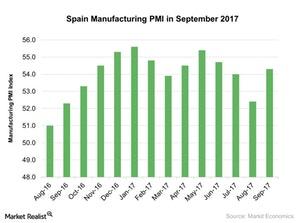

Why Spain’s Manufacturing Recorded a Strong Rise in September

According to a report by Markit Economics, Spain’s manufacturing PMI rose to 54.3 in September 2017, compared to 52.4 in August.

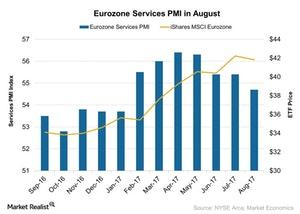

Eurozone Services PMI Weakened: Will It Affect the Business Climate?

According to a report by Markit Economics, the Eurozone services PMI (purchasing managers’ index) stood at 54.7 in August as compared to 55.4 in July 2017.

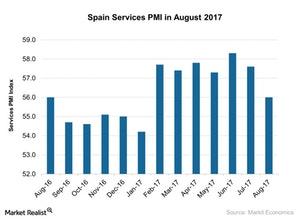

Why Spain’s Service Activity Dropped in August 2017

According to a report by Markit Economics, the Spain Services PMI (purchasing managers’ index) stood at 56 in August compared with 57.6 in July.

How ECB Tapering Could Impact European Bond Markets

The European bond market’s reaction to the ECB’s (European Central Bank) September 7 statement has so far been positive.

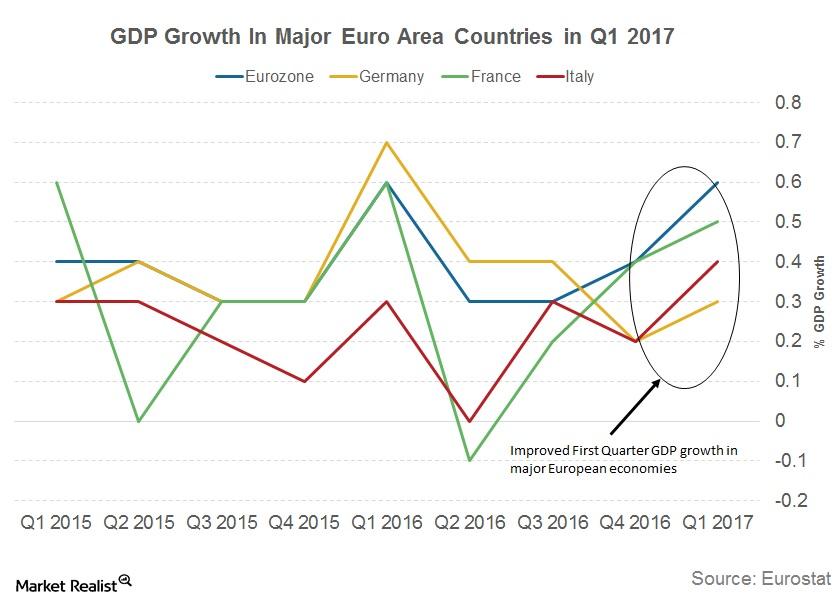

Why Strong European GDP Growth Momentum Gives Confidence to the ECB

In its September 7 meeting, the ECB (European Central Bank) governing council sounded optimistic about the strong growth momentum in the EU.

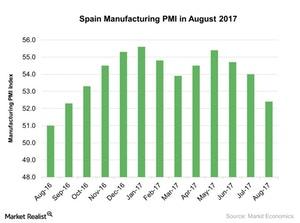

Why Spain Manufacturing PMI Showed a Huge Drop in August 2017

According to a report by Markit Economics, Spain’s manufacturing PMI fell to 52.4 in August 2017 as compared to 54 in July.

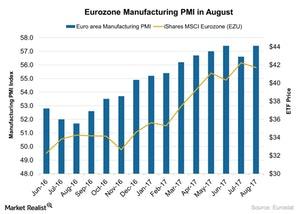

Why Eurozone’s Flash Manufacturing PMI Could Be Signaling a Change

According to a report by Markit Economics, the flash Eurozone manufacturing PMI (purchasing managers’ index) improved in August 2017.

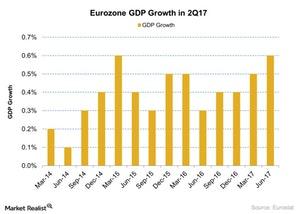

Eurozone’s Growth Rate Rose 0.6% in 2Q17

According to Eurostat, the Eurozone’s economy posted a growth rate of 0.6% in 2Q17. In 1Q17, the economy posted a growth rate of 0.5%.

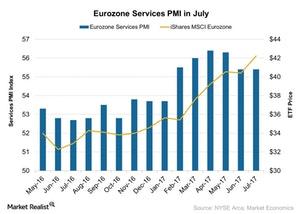

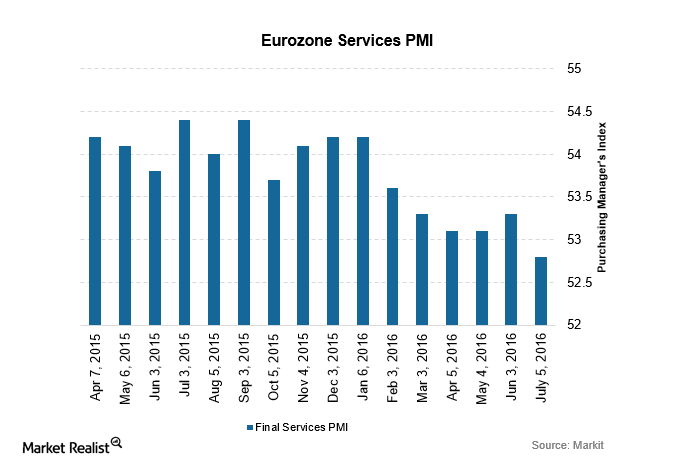

What Happened to the Eurozone Services PMI in July

The Eurozone Services PMI remained unchanged in July 2017, coming in at 55.4 but missing the preliminary market estimation.

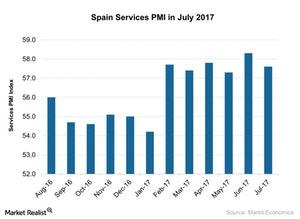

Why Spain’s Services PMI Declined in July

The Spain Services PMI stood at 57.6 in July, compared with 58.3 in June. The PMI figure didn’t meet the preliminary market estimation of 58.3.

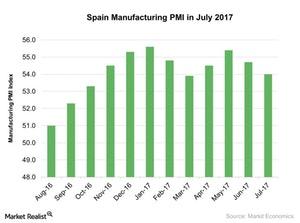

Spain’s Manufacturing Activity Fell in July

According to a report by Markit Economics, the final Spain Manufacturing PMI stood at 54 in July 2017 as compared to 54.7 in June.

Why the International Monetary Fund Expects Continued Euro Growth

Growth projections for Euro area upgraded The International Monetary Fund (or IMF) has revised its growth projections for France, Germany, Italy, and Spain. Growth projections for Germany (FGM), France (EWQ), and Italy (EWI) were upgraded by 0.2% for 2017, and 0.1% for 2018. Spain (EWP) had a higher upgrade to growth expectations, with a change of […]

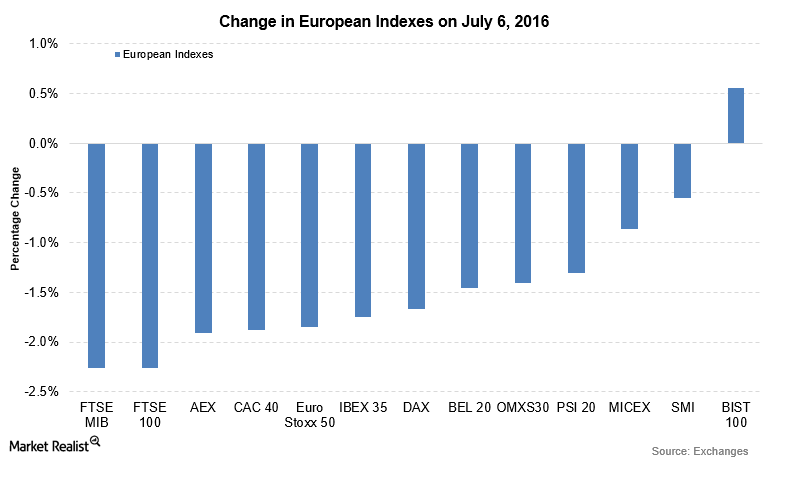

Weak Data Puts Downward Pressure on European Indexes

On July 6, major European indexes were trading lower for the second day. The fall in the indexes was led by the Italian FTSE MIB and the UK-based FTSE 100.

Contrasting Services PMI from the Eurozone and the UK

The composite PMI came out at 53.1—above the flash estimates of 52.8. The rise was primarily due to the rise in manufacturing production.

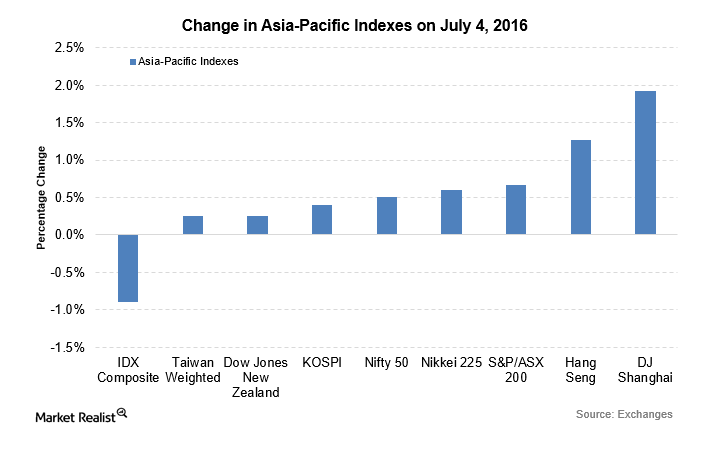

Asian Markets Rise as Australian Housing Data Disappoint

Key Asian indexes (AAXJ) were trading higher on July 4. This week, the major data release on the Asian front will be Australian monetary policy.