Chart in Focus: Spain’s Services PMI in September 2017

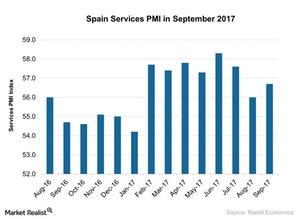

According to a report by Markit Economics, the final Spain services PMI stood at 56.7 in September 2017 compared to 56.0 in August.

Oct. 12 2017, Updated 7:38 a.m. ET

Spain’s services PMI in September

According to a report by Markit Economics, the final Spain services PMI stood at 56.7 in September 2017 compared to 56.0 in August. The PMI figure beat the preliminary market estimation of 55.5.

The stronger performance in Spain’s services PMI in September was mainly due to the following factors:

- Production volume and output improved at a stronger rate in September 2017.

- New business orders and export orders also showed faster improvement in September compared to August 2017.

- The employment growth in the service sector also rose at a stronger pace in September 2017.

Performance of various ETFs in September

The iShares MSCI Spain Capped ETF (EWP), which tracks Spain’s performance, rose marginally in September 2017. The Vanguard FTSE Europe ETF (VGK), which tracks Europe’s (HEDJ)(EZU)(IEV) economic performance, rose 3.2% in September 2017.

Spain is one of the most important economies in the Eurozone. In September 2017, Spain’s manufacturing and services PMI readings showed strong improvement. The improvement in domestic demand helped this performance, and it signaled that consumer confidence is improving in the economy.

The improving investor’s confidence in major economies such as Germany (EWG), France (EWQ), and Spain (EWP) is improving the overall confidence in the Eurozone economy.

In the next part of this series, we’ll analyze the services PMI for the Eurozone in September 2017.