Walt Disney Co (The)

Latest Walt Disney Co (The) News and Updates

Why Disney Had to Discontinue Its Share Repurchase Program

Disney announced that it would not continue its share repurchase program until it completed its proposed acquisition of media assets from 21st Century Fox.

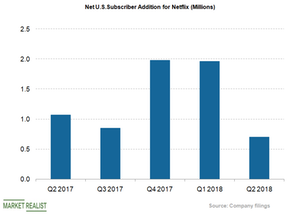

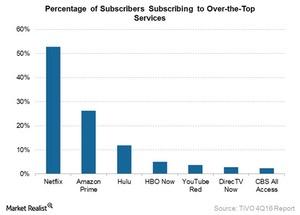

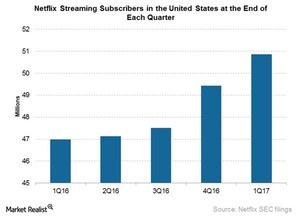

Take a Look at Netflix’s Competitive Landscape

All the competition is hurting Netflix’s membership growth. In fiscal Q2 2018, it missed its subscriber guidance for the first time.

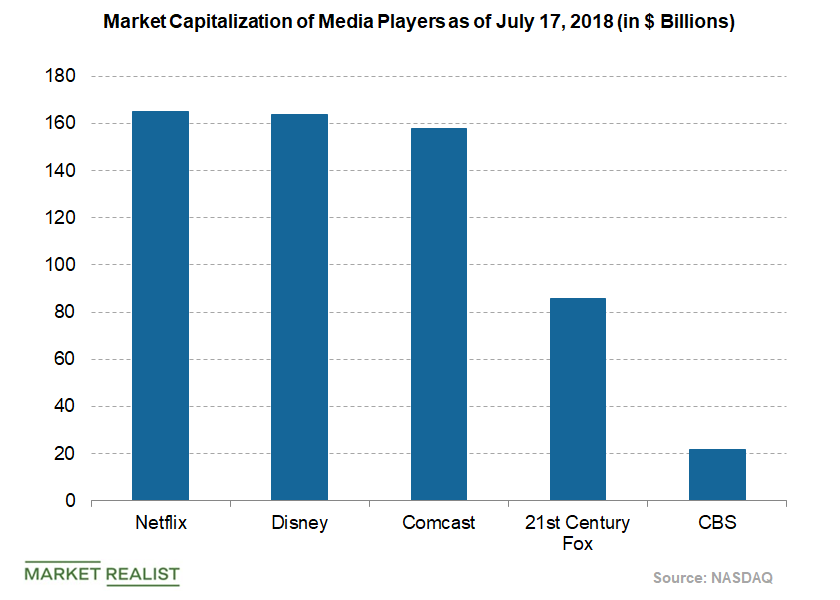

Where Netflix’s Valuation Stands among Its Peers

Netflix is now trading at a PE (price-to-earnings) multiple of 239.61x.

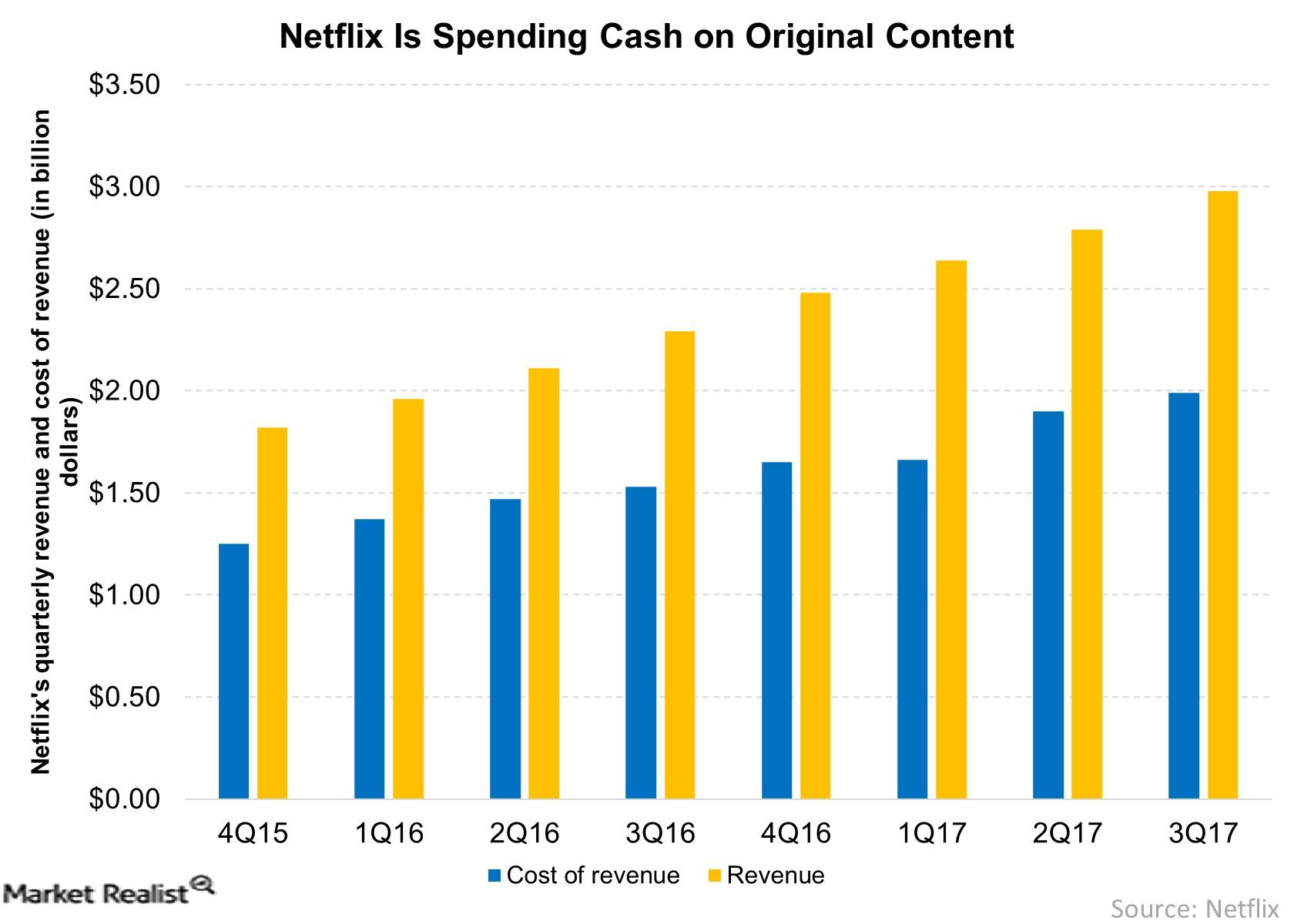

How Netflix’s Original Content Spending Impacts Its Rivals

On May 14, Netflix’s chief content officer, Ted Sarandos, announced that the company plans to invest ~85.0% of total spending in original content.

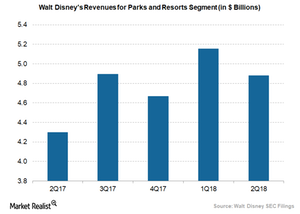

Why Disney Is Investing in Theme Parks

In fiscal 2Q18, Disney’s Parks and Resorts segment reported revenues of $4.9 billion.

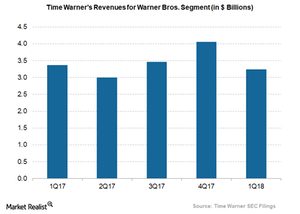

Understanding Time Warner’s Warner Bros. Revenue Trends

Time Warner’s (TWX) studio segment, Warner Bros., had a weak 1Q18, with both its revenue and operating income falling.

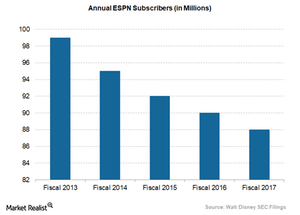

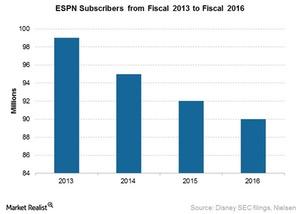

Will Disney’s Streaming Services Curb Falling ESPN Subscribers?

The Walt Disney Company’s (DIS) flagship sports network, ESPN, has been facing a continued decline in its number of subscribers over the past few years.

How PlayFab Could Boost Microsoft’s Azure Capabilities in the Cloud?

In late January 2018, Microsoft announced the acquisition of PlayFab.

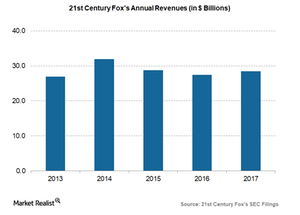

How Will the New Fox Look after the Disney Deal?

21st Century Fox (FOXA) will be left with news and sports assets after selling most of its assets to the Walt Disney Company (DIS) in a $52.4 billion deal.

How Will Disney Benefit from Its 21st Century Fox Acquisition?

Media behemoth the Walt Disney Company (DIS) has announced the purchase of another media company, 21st Century Fox (FOXA).

Understanding Walt Disney’s Deal with 21st Century Fox

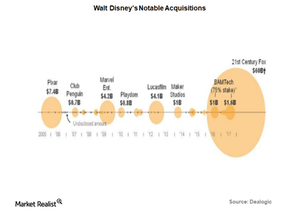

In December 2017, the Walt Disney Company (DIS) announced its plans to buy some of the assets of 21st Century Fox (FOXA) for an equity value of ~$52.4 billion.

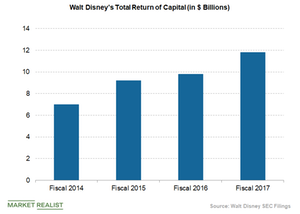

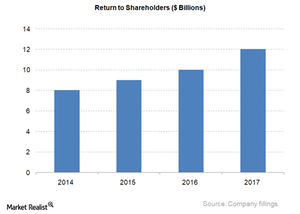

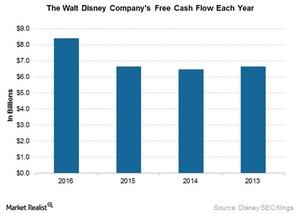

Disney’s Capital Return Policy Looks Attractive

Capital return trends Leading media mogul The Walt Disney Company (DIS) has continued to improve its capital return policy, driven by attractive dividend payments and strong share repurchase programs. In fiscal 2017, the media giant returned ~$11.8 billion to shareholders via buybacks and dividend payments, compared with $9.8 billion in fiscal 2016. In fiscal 2018, the […]

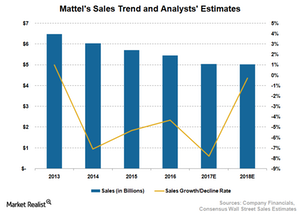

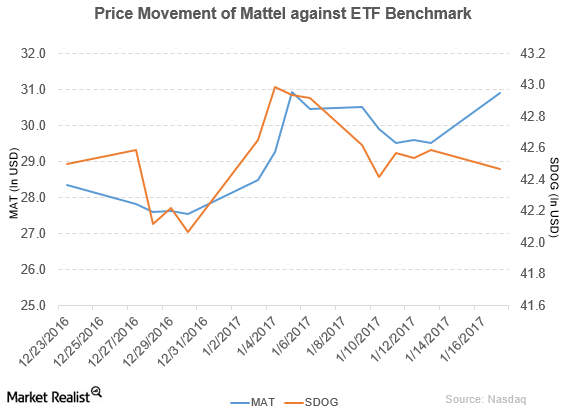

Why Mattel’s Sales Could Keep Falling in the Near Term

Toy makers in the United States (SPY) are facing near-term disruptions affecting their top-line performance. Toys “R” US, one of the leading distribution partners for US toy companies, filed for bankruptcy.

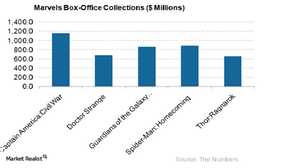

How the Marvel Acquisition Is Working out for Disney

Marvel acquisition helping film business The Walt Disney Company’s (DIS) acquisition of Marvel has worked out well for Disney, earning money for its Studio Entertainment segment. The latest flick, Thor: Ragnarok, has already collected more than $600 million worldwide. Blockbuster movie releases and other license fees have driven the company’s business and created a strong brand. The […]

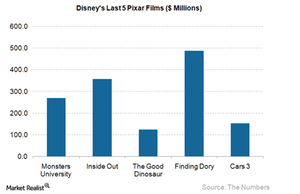

Disney’s Pixar Holds the Key to Film Success

Pixar’s historical success The Walt Disney Company’s (DIS) Pixar continues to boost its Studio Entertainment segment with hit movie releases. To date, Pixar has produced 18 films, including Toy Story, Finding Nemo, and Cars. These movies have generated business of more than $11 billion for the company worldwide. Even its latest movie, Cars 3, released this year, […]

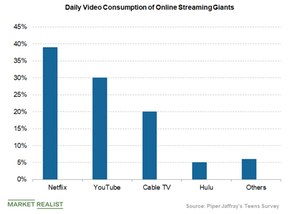

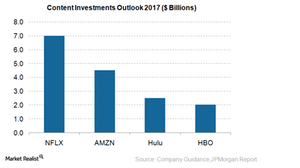

Netflix Battles Competition through Huge Investments

In a bid to retain market share, Netflix (NFLX) continues to boost its investment goals by strengthening its content portfolio.

Why Netflix Plans to Spend Billions on Original Content

Netflix noted that it would spend $8 billion on original content in 2018.

What Drives Success for Comcast’s Universal Studios

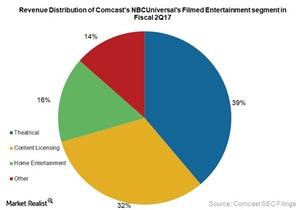

Comcast’s franchise-focused strategy In the first part of this series, we looked at how Comcast’s (CMCSA) fiscal 2Q17 results were strongly driven by the company’s filmed entertainment and theme parks businesses. In this part of the series, we’ll look at the key factors that are driving Comcast’s filmed entertainment business. Comcast’s filmed entertainment business is […]

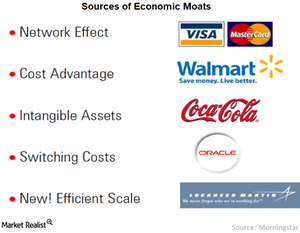

How to Identify Economic Moats

In this series, we’ll discuss how intangible assets can create long-term competitive advantages for companies.

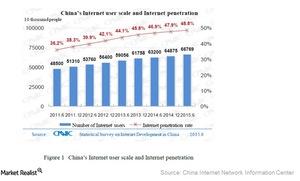

Why China Is Becoming an Important Market for Disney

Popularity of English-language content in China Media companies in the United States (SPY) are increasingly looking at the Chinese (FXI) market as Hollywood movies become popular there. However, there have also been concerns about box office success in the country. On June 27, The Wall Street Journal reported, citing an unknown source, that the six […]

A Look at Disney’s Advertising Strategy

The Walt Disney Company’s (DIS) revamp of its ABC Network seems to be reaping strong results. Let’s look at how other aspects of its strategy are working out.

How Disney Could Buck ESPN’s Subscriber Loss Trend

ESPN continues to lose subscribers Late last month, The New York Post reported, citing Nielsen data, that The Walt Disney Company’s (DIS) ESPN has continued to lose subscribers. In May, ESPN lost 3.8% of its subscribers. The Nielsen data did not include ESPN’s subscribers from OTT (over-the-top) services such as Dish Network’s (DISH) Sling TV. It […]

Understanding Disney’s Capital Allocation Strategy

Disney stated at the conference that it will keep investing in its businesses not just for growth but also to give superior returns to shareholders.

Understanding Disney’s Digital Distribution Strategy for ESPN

Disney (DIS) has been looking more and more at the distribution of its content in digital format—specifically for ESPN.

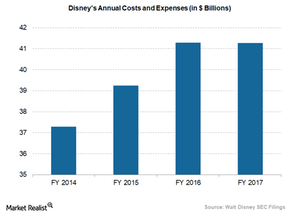

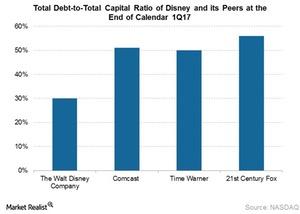

A Closer Look at Disney’s Financials

Walt Disney (DIS) is carrying a total debt of $21.6 billion. But can it easily pay the interest?

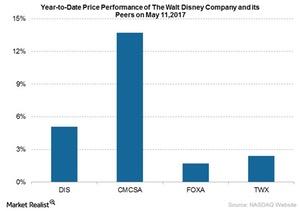

Disney’s Stock Price: Identifying the Key Drivers

The Walt Disney Company (DIS) announced its fiscal 2Q17 results on May 9. The company’s stock price closed at $109.58 on May 11, 2017.

How the Changing Regulatory Environment Could Impact Disney

Disney said in an earnings call that the US corporate tax policy needs to be changed because American companies are no longer competitive.

Disney’s Theme Parks and Consumer Products in 2017

Disney’s (DIS) parks and resorts are doing extremely well in the United States. The company is continuing to add new attractions.

Mattel Announces New Management Appointment

On January 17, 2017, Margaret H. Georgiadis was appointed as Mattel’s new chief executive officer, effective February 8, 2017.

Disney’s Key Financial Metrics: Let’s Take a Look

In fiscal 2017, The Walt Disney Company (DIS) expects currency fluctuations and a rise in pension expenses to negatively impact the company by around $175 million

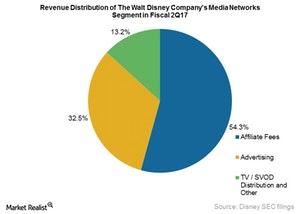

Disney’s Cable Networks: What You Can Expect for Affiliate Fees

Media companies like The Walt Disney Company (DIS) mainly derive their revenues from affiliate fees and advertising.

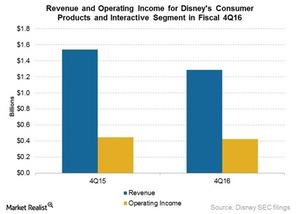

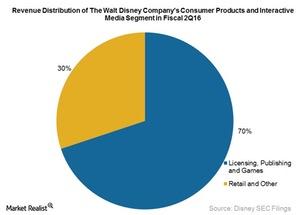

The Outlook for Disney Consumer Products and Interactive Media

The Walt Disney Company (DIS) stated in its fiscal 4Q16 earnings call that in fiscal 1Q17, it expects operating income for Disney Consumer Products and Interactive Media to fall.

What Will Drive Growth for Walt Disney Parks and Resorts?

The Walt Disney Company’s (DIS) theme parks and resorts are doing extremely well in the United States, and the company continues to add new attractions.

What Factors Could Be Impacting Disney’s Stock?

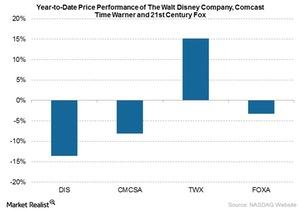

On November 2, 2016, The Walt Disney Company’s (DIS) stock closed at $92.39. The company’s stock price has fallen 13.6% year-to-date (or YTD) and 3.3% in the past three months.

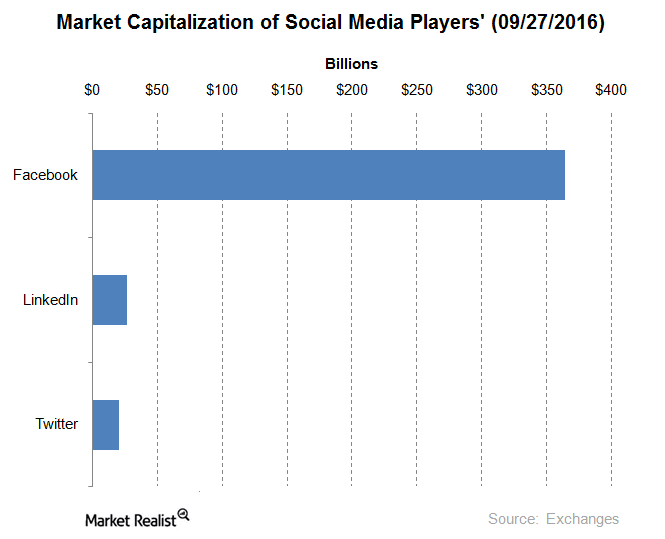

How Does Twitter Compare with Its Peers?

Twitter trades at lower multiples than its peers Earlier in this series, we discussed rumors of Twitter’s (TWTR) possible acquisition and how Salesforce (CRM), Google (GOOG), and The Walt Disney Company (DIS) could be contenders. In this part, we’ll compare Twitter’s value proposition with that of other companies in the social media space. As of […]

Why Does Janus Think Inflation Is on the Rise?

In the “Janus Market GPS,” the team had outlined its belief that a low unemployment rate signaled tighter labor market conditions.

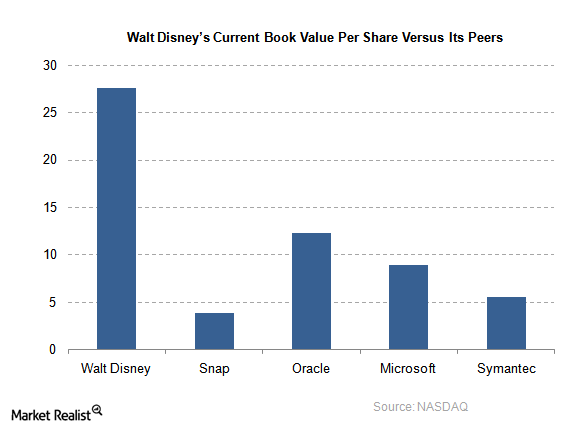

How Disney Is Managing Its Valuation Metrics

Disney stands out from its competitors in the media industry due to its large amount of intellectual property.

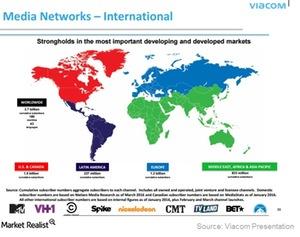

United Kingdom: A Stronghold Market for Viacom

The Channel 5 acquisition has led to Viacom (VIAB) gaining access to nearly 100% of the United Kingdom’s television audience, particularly for the Nickelodeon brand.

How Is Disney’s Acquisition Strategy Reaping Rewards?

On May 20, The Walt Disney Company announced that Marvel’s Captain America: Civil War was set to surpass $1 billion in earnings at the global box office.

What Is Disney’s Core Strategy for Its US Theme Parks Business?

The Walt Disney Company’s (DIS) theme parks and resorts business is doing extremely well in the United States.

Why Is Time Warner Increasing Its Focus on China?

Time Warner stated at a Deutsche Bank (DB) investor conference early last month that it expects the number of movie screens in China to increase by about 30% in the next two years.

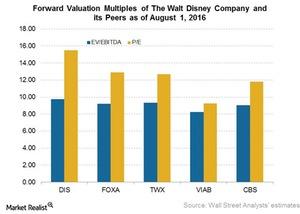

Key Valuation Metrics for Disney: How Do They Compare?

Disney stands out from its competitors in the media industry because of its vast intellectual property.

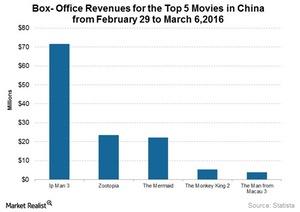

Why Is China Such an Important Market for Disney?

Disney’s Zootopia earned $23.5 million at the Chinese box office between February 29 and March 6, 2016, and was ranked second at the box office in China.

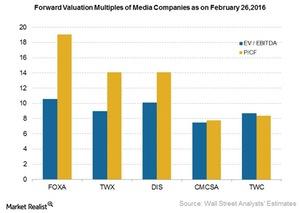

Key Valuation Metrics of the Media Sector

We prefer EV-to-EBITDA and PCF over the other multiples when comparing valuation of media conglomerates with different structures.

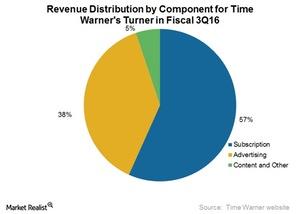

Low Theatrical Revenues Pull Down Warner Bros. Revenue

Time Warner’s (TWX) Warner Bros. had revenues of $13 billion in fiscal 2015, up by 4% year-over-year. However, Warner Bros. had a 13% year-over-year decrease in revenues in fiscal 4Q15.

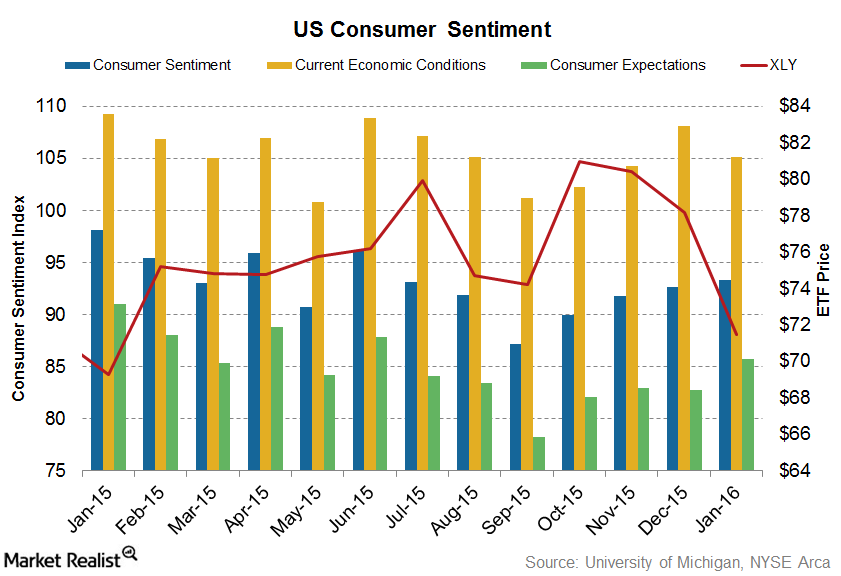

Future Expectations and Consumer Sentiment Rise

With improved consumer sentiment, there may be greater consumer spending in the economy, which may translate into faster economic growth.Technology & Communications Must-know factors that could drive future growth at Disney

Disney considers itself a creative content company, and creative excellence is the key to its success. It expects to continue to invest both organically and inorganically.

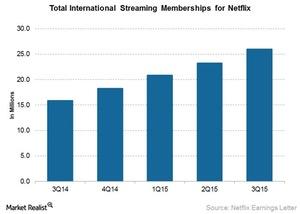

Netflix’s Challenges in Acquiring Global Streaming Rights

Netflix has had difficulty in acquiring global streaming rights for content from media companies. This is due to its status as the sole buyer of streaming rights on a global basis.

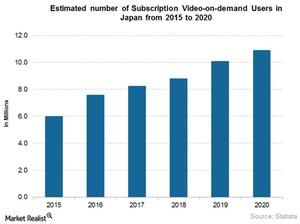

How Is Netflix Performing in Japan?

Netflix considers Japan to be a brand-sensitive market. Once it establishes its brand, it expects its connection with the Japanese audience to be long term.

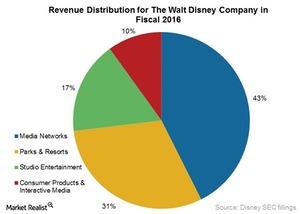

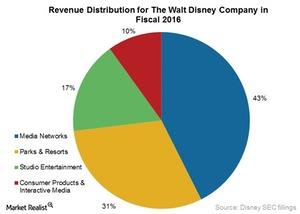

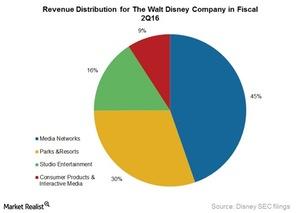

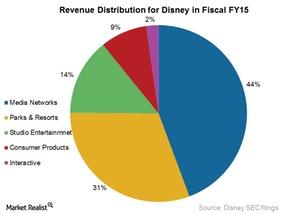

Assessing Disney’s Business Segment Performance in Fiscal 2015

Disney’s (DIS) Media Networks segment was the biggest contributor to its revenue, at 44% or $52.5 billion, in fiscal 2015.