Key Valuation Metrics of the Media Sector

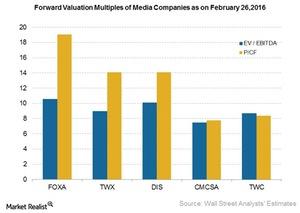

We prefer EV-to-EBITDA and PCF over the other multiples when comparing valuation of media conglomerates with different structures.

March 7 2016, Updated 8:06 a.m. ET

Valuation metrics

In this final part of the series, we’ll look at some key metrics investors can use to compare values of media companies. We’ll specifically look at media valuation multiples, which may be used to value conglomerates.

Some of the usual valuation multiples for companies are PE (price-to-earnings), EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization), PCF (price-to-cash flows), and PFCF (price-to-free cash flows).

The price-based multiples take into account value from a shareholder’s perspective. The EV-based multiples help investors understand the value of the company from the point of view of a company’s holders of sources of capital. These are forward multiples based on expected values of the denominator after a year.

Cable companies are trading at a discount

We prefer EV-to-EBITDA and PCF over the other multiples when comparing valuation of media conglomerates with different structures. One of the reasons we use these multiples is to take out the impact of various capital investments made by distributors such as cable companies and satellite TV providers. As you can see in the above chart, cable companies are trading at a discount to media producers and aggregators.

Among the three media content producers, the Walt Disney Company (DIS), 21st Century Fox (FOXA), and Time Warner (TWX), TWX appears undervalued based on EV-to-EBITDA. Among cable companies, Comcast (CMCSA) appears to be undervalued based on both the EV-to-EBITDA and price-to-cash-flow multiple as compared to Time Warner Cable (TWC).

Notably, Comcast makes up 2.9% of the PowerShares QQQ ETF (QQQ). For investors interested in getting exposure to the television and radio sector, QQQ has 4.9% exposure to TV and radio.