Time Warner Cable Inc

Latest Time Warner Cable Inc News and Updates

Healthcare Farallon Capital adds a new position in Covidien

Ireland-based Covidien is a global healthcare leader that offers innovative medical technology solutions and patient care products to providers.

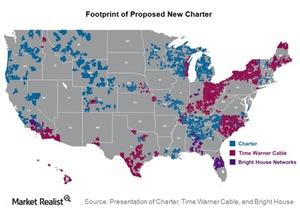

Merger Update: Charter, Bright House, and Time Warner Cable

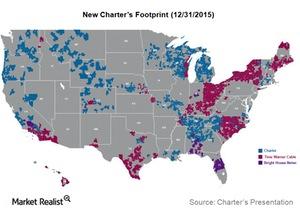

California is the only state where the merger between Charter Communications, Time Warner Cable, and Bright House Networks has yet to be approved. It could be approved as early as May 12.

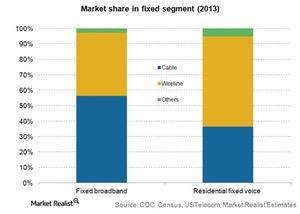

Understanding competition from other industries—cable companies

Telecom companies compete directly with cable companies—particularly in wired voice, data, and TV services. They compete in the residential and small business segments.

How Do Media Networks Make Money?

Media networks face stiff competition for acquisition and distribution of content. Quality and exclusivity add to competition across the media value chain.

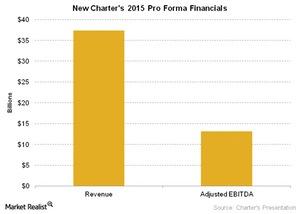

Charter Completes Merger with Bright House and Time Warner Cable

The merger of Charter Communications (CHTR), Time Warner Cable (TWC), and Bright House Networks was completed on May 18, 2016.

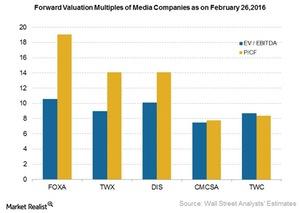

Key Valuation Metrics of the Media Sector

We prefer EV-to-EBITDA and PCF over the other multiples when comparing valuation of media conglomerates with different structures.

AT&T’s All in One Plan Offerings

Since the merger, AT&T has extended bundled video and wireless offerings, such as its All in One Plan, which is being offered to DIRECTV and AT&T customers.

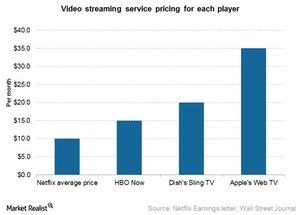

Netflix Is Slaying the Competition with Pricing

Netflix pricing is the lowest among all video streaming service players. Its basic plan of $7.99 is propelling the company’s streaming membership growth in the United States.

New Charter’s Footprint: Better Position to Reach Customers

New Charter is the proposed merged entity. The company will include networks of some of the largest cable operators in the US.

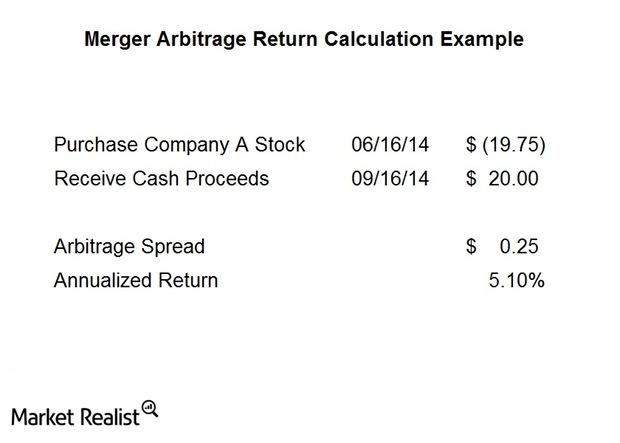

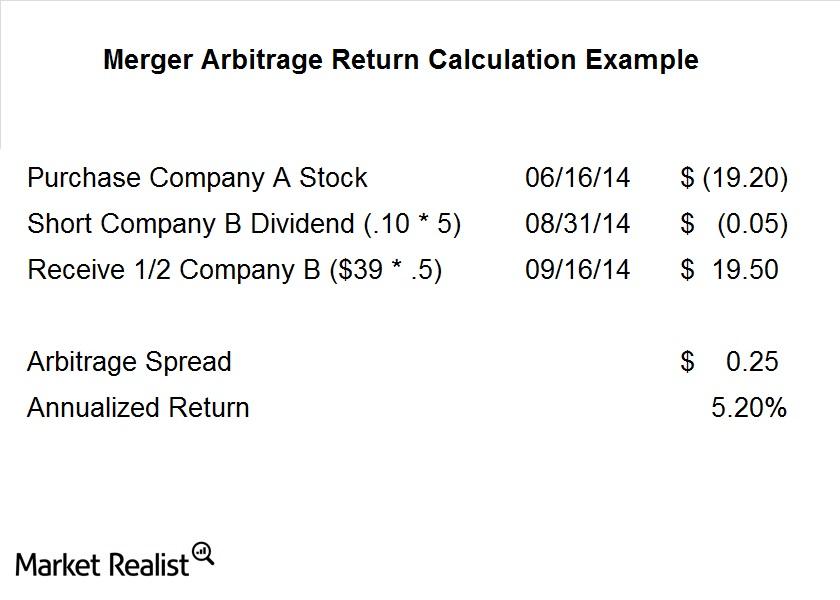

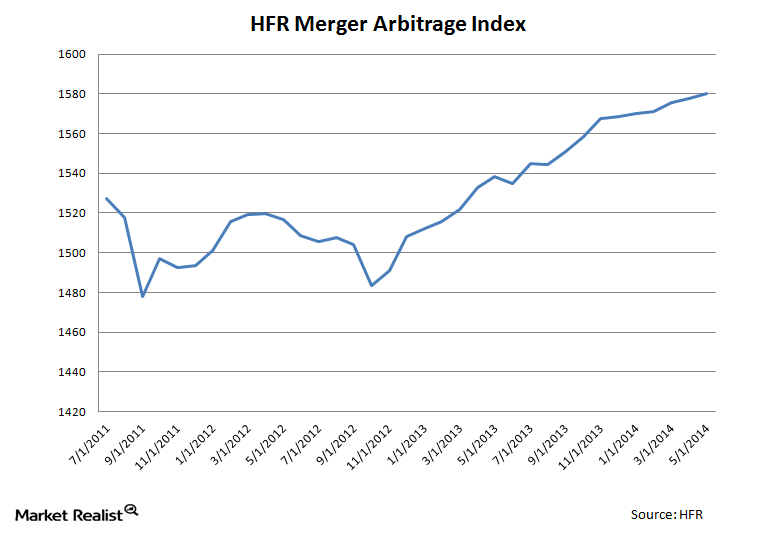

Identifying and analyzing a typical cash merger arbitrage spread

What are the components of a risk arbitrage spread? There are a number of factors that figure into a trade. Let’s look at a typical cash deal first.

Merger arbitrage must-knows: A typical stock merger spread

Not all deals are cash deals, however. Often companies will issue stock in lieu of giving cash for a deal. This adds a layer of complication to the process and also some risk factors we need to consider.

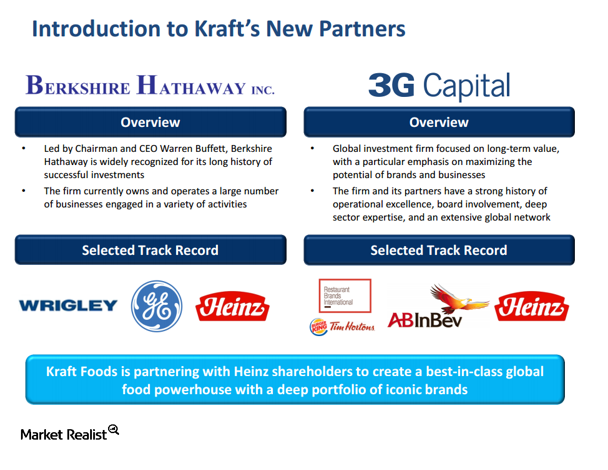

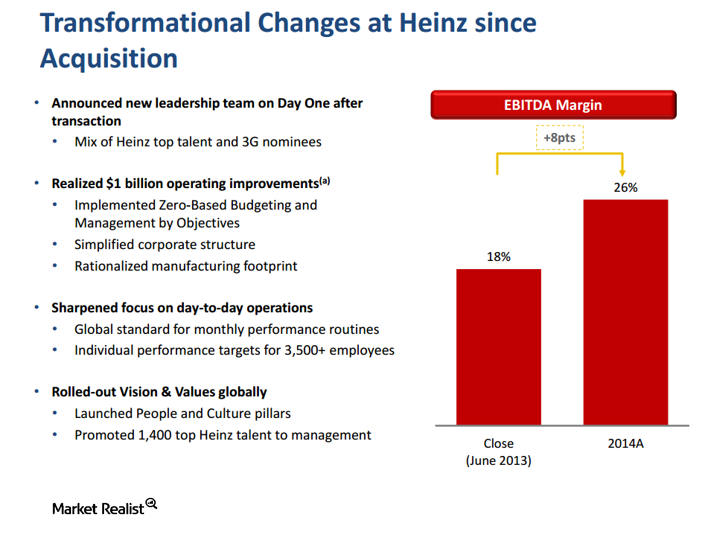

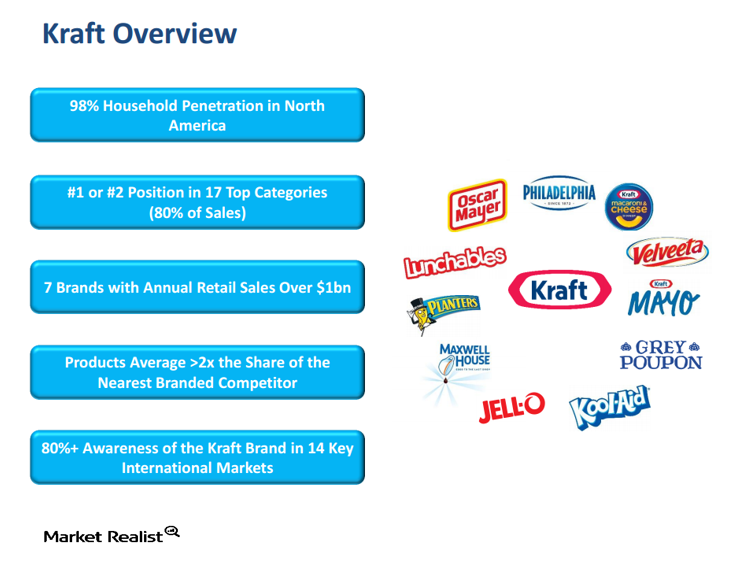

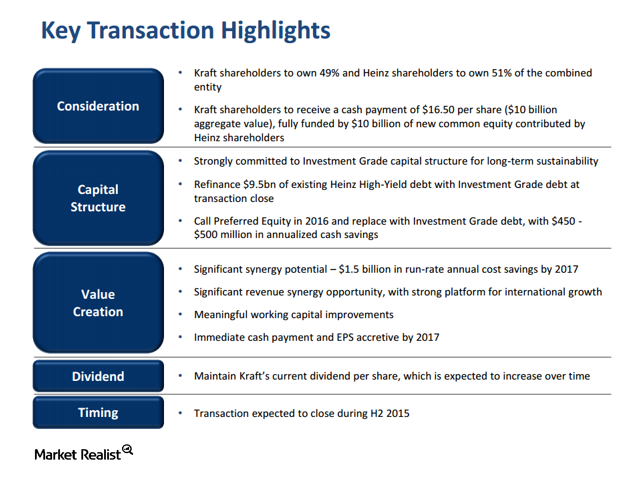

The Kraft–Heinz merger: Overview of Heinz

Kraft’s (KRFT) and Heinz’s portfolio of brands are highly complementary, which is a big reason for the Kraft–Heinz merger.

The Kraft–Heinz Merger: What If the Deal Breaks?

The Kraft–Heinz merger isn’t a typical risk arbitrage deal because you can’t arbitrage a spread. Before the deal, Kraft was trading at $62.40 a share.

The Kraft–Heinz Merger: Transaction Rationale

The Kraft–Heinz merger entity will maintain Kraft’s current dividend, and management anticipates it will grow.

Is Antitrust an Issue in the Kraft–Heinz Merger?

The first place arbitrageurs look to get a handle on antitrust risk is the 10-K, where companies often disclose the names of competitors.

The Kraft–Heinz Merger and Material Adverse Change, Part 3

Other important merger spreads include the deal between Time Warner Cable and Comcast as well as the merger between Pharmacyclics and AbbVie.

The Kraft–Heinz Merger: Transaction Benefits for Kraft Investors

Kraft has a non-solicitation agreement with a fiduciary out. This means that Kraft could discuss another merger if approached by another suitor.

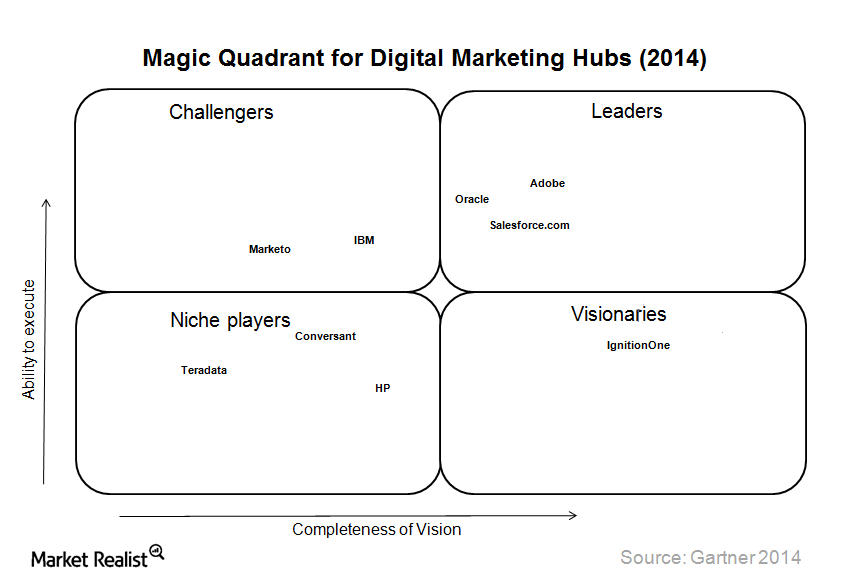

Why Adobe is leading in Gartner’s ‘Magic Quadrant’

In December 2014, Adobe announced that it had been recognized by Gartner as a leader in the 2014 “Magic Quadrant for Digital Marketing Hubs” research report.

Merger arbitrage must-knows: A key guide for investors

Merger arbitrage, otherwise known as “risk arbitrage,” is an investment strategy that primarily focuses on mergers and capturing the spreads on announced deals.