Colgate-Palmolive Co

Latest Colgate-Palmolive Co News and Updates

Procter & Gamble Beats Third-Quarter Estimates

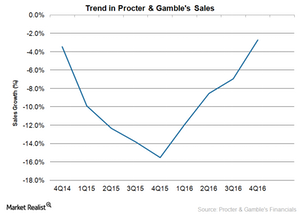

Procter & Gamble (PG) posted stronger-than-expected third-quarter results on Tuesday, April 23.

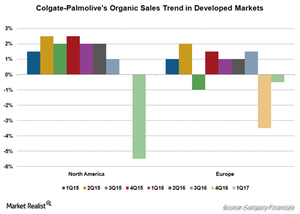

Colgate-Palmolive’s Developed Markets Remained a Drag in 1Q17

Net sales in North America fell 5.0% in 1Q17, reflecting a strong decline in volumes coupled with lower pricing.

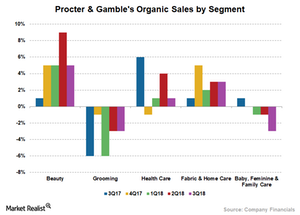

How Procter & Gamble’s Segments Performed in 3Q18

Lower pricing adversely impacted Procter & Gamble’s (PG) sales across product segments amid increased competitive activity.

How Much Has Colgate-Palmolive Increased Its Dividend?

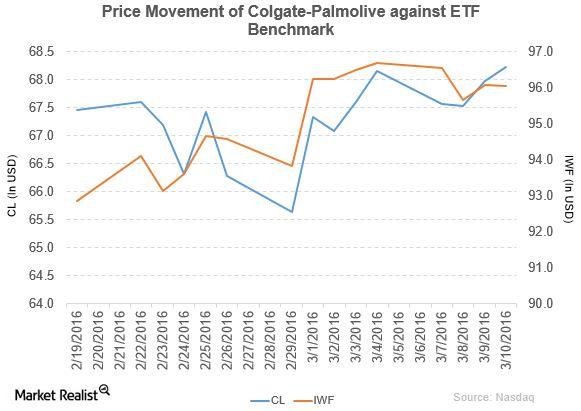

Colgate-Palmolive (CL) has a market capitalization of $60.9 billion. CL rose by 0.37% to close at $68.23 per share as of March 10, 2016.

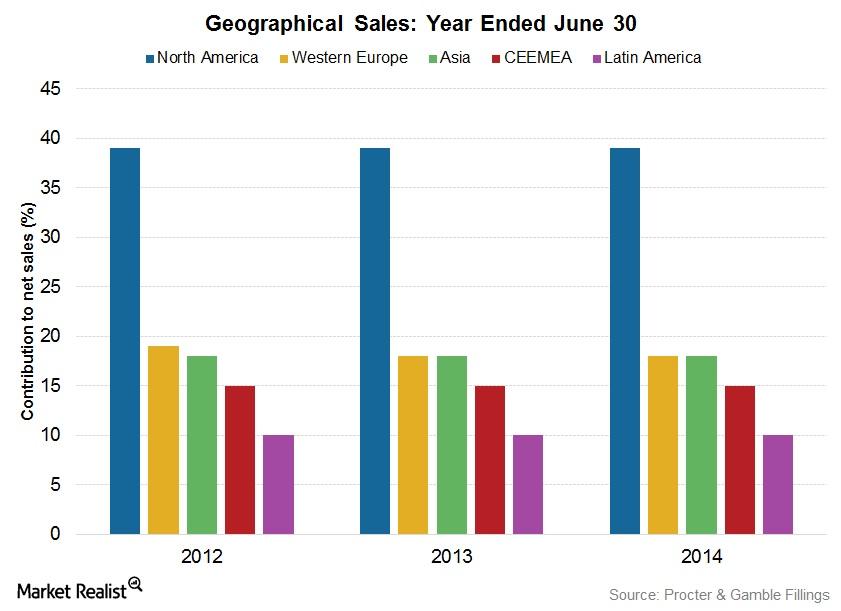

Procter & Gamble: Global Giant in Household, Personal Products

The Procter & Gamble Company, or P&G, is the largest household and personal products company in the world. It was established in 1837 by William Procter and James Gamble.

Henkel Acquired Procter & Gamble’s Haircare Brands

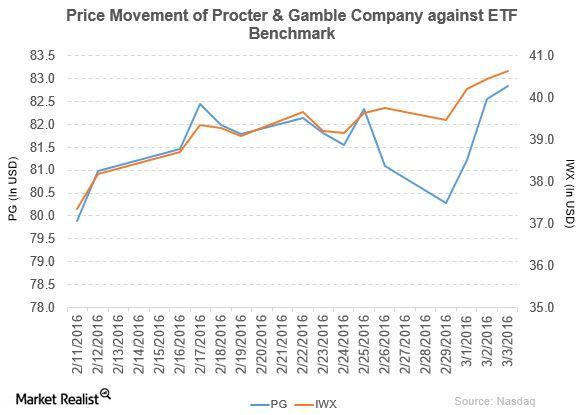

Procter & Gamble (PG) has a market cap of $224.1 billion. PG rose by 0.35% to close at $82.84 per share on March 3, 2016.

How Is Clorox Improving Product Distribution?

For distribution in the United States, Clorox (CLX) sells or markets its products primarily through mass retail outlets, e-commerce channels, wholesale distributors, and medical supply distributors.

Cannabis Stocks Up, Broader Equity Market Falls

Today, cannabis stocks are trading in the green despite the weakness in the broader market. The ETFMG Alternative Harvest ETF was up 2.5% as of 2:00 PM ET.

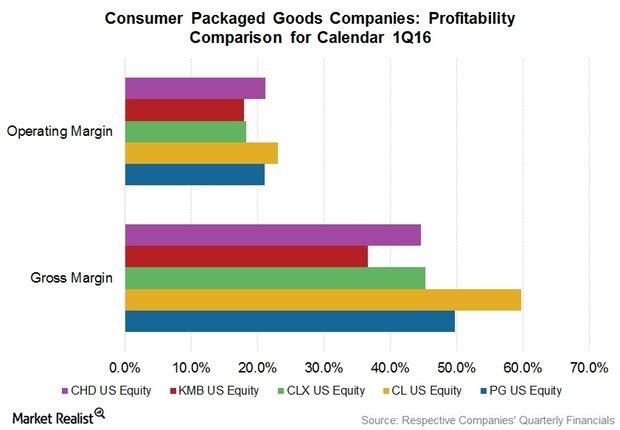

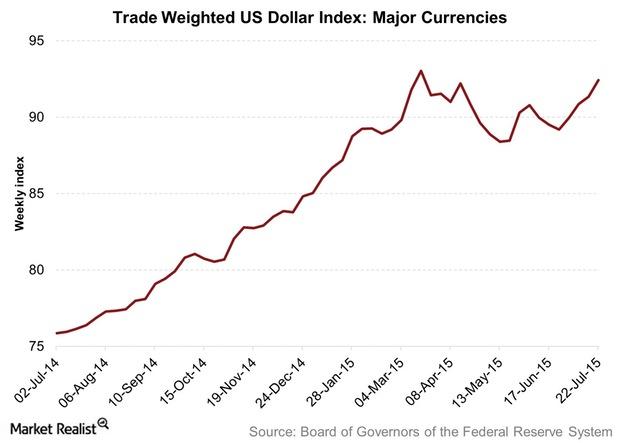

Weak Currencies, but Consumer Packaged Goods Margins Improved

The 1Q16 margins of consumer packaged goods (or CPG) companies sent strong signals. These companies have been investing heavily in innovative products and other growth initiatives.

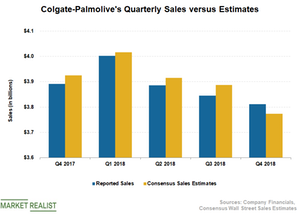

What Dragged Colgate-Palmolive’s Sales Down in Q4?

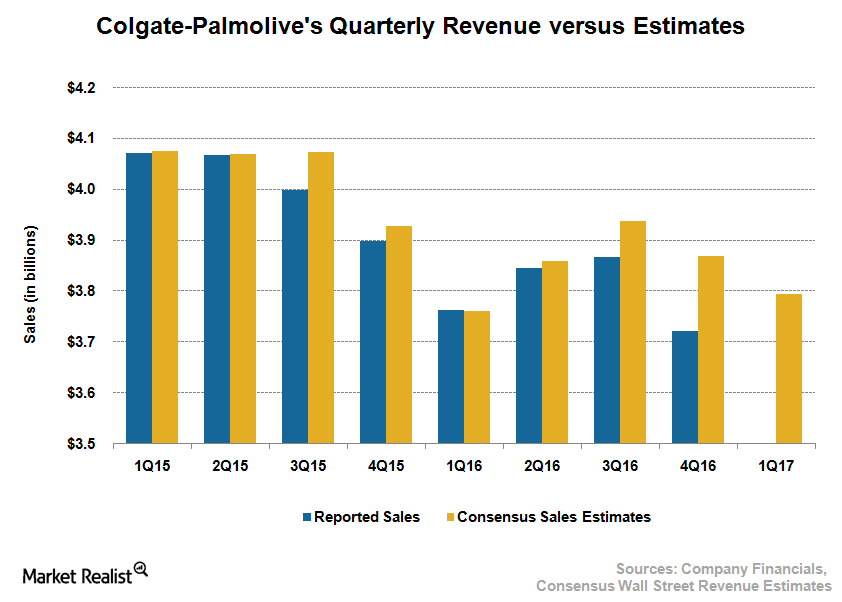

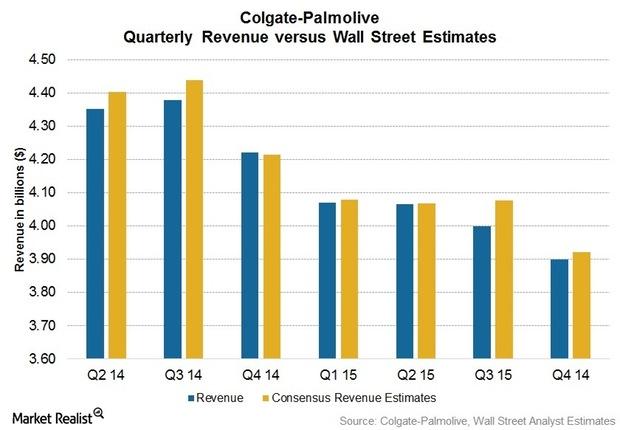

Colgate-Palmolive (CL) posted net sales of $3.8 billion, a decline of about 2% on a YoY (year-over-year) basis, as unfavorable currency rates hurt the top line by 5%.

Net Exports: Why They Matter and What Drives Them

A country’s net exports measure the value of total exports less the value of its total imports. It’s positive if exports are larger in value than imports.

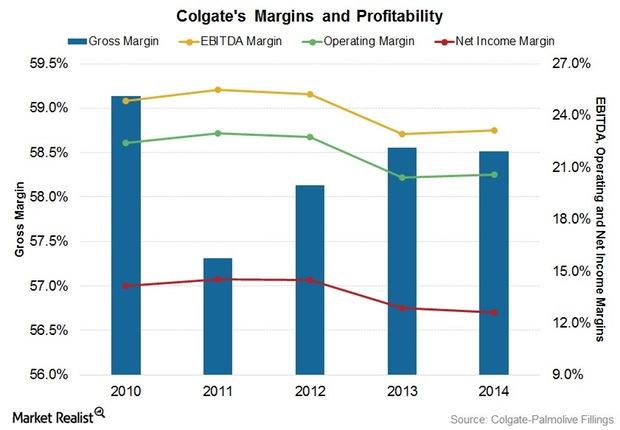

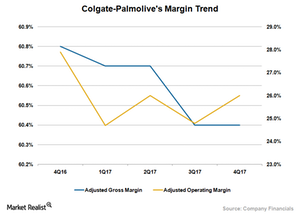

How Colgate Is Maintaining Margins in the Face of Headwinds

Colgate’s worldwide gross profit margin fell to 58.5% in 2014 from 58.6% in 2013.

Will the Rally in Clorox Stock Continue?

The COVID-19 pandemic boosted Clorox’s sales. People started paying more attention to cleaning and sanitizing.

Why Is There Optimism before Cresco Labs’ Q4 Earnings?

Analysts expect Cresco Labs to report revenue of $43.7 million in the fourth quarter—YoY growth of 157.9% from $17.0 million in the fourth quarter of 2018.

Clorox Gets Rating Upgrade, Coronavirus Triggers Demand

Clorox stock rose 4.1% on March 16, even though the US stock market crashed amid the coronavirus pandemic. JPMorgan Chase upgraded its rating.

What Do Analysts Recommend for KushCo Holdings?

KushCo Holdings reported its Q1 earnings on January 8. KushCo reported revenue of $34.96 million, below analysts’ forecast of $41.5 million.

Why 2019 Wasn’t As Good As 2018 for Church & Dwight Stock

Although Church & Dwight stock is trading in the green, it has lagged its peers and the broader markets. The stock didn’t repeat its 2018 performance.

Procter & Gamble Stock: What’s Fueling the Growth?

Procter & Gamble stock has generated a significant amount of wealth for investors this year. The company boosted shareholders’ returns.

Why Colgate-Palmolive’s Q3 Earnings Failed to Impress

Colgate-Palmolive released its third-quarter earnings results today. The company’s performance was mixed, irking investors.

Cannabis Stocks Rise: CURLF, IIPR, ACB, WEED

After closing in the red yesterday, the US equity market was trading marginally higher today. The cannabis sector is also up—and here’s why.

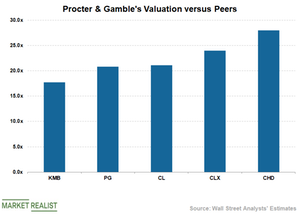

Procter & Gamble Stock: Valuation Limits Upside

Procter & Gamble stock trades at 24.7x its fiscal 2020 estimated core EPS of $4.85. The stock trades at 23.2x its fiscal 2021 estimated core EPS of $5.17.

Church & Dwight Stock: Valuation Overshadows Growth

Church & Dwight (CHD) stock has risen 9.5% on a YTD (year-to-date) basis as of September 13. However, the stock lags its peers by a wide margin.

Procter & Gamble Stock: What’s behind Its Solid Return?

Procter & Gamble stock benefits from its strong organic sales. On average, the company’s organic sales have increased by 5% in the last four quarters.

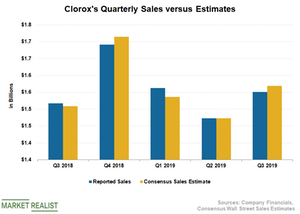

Why Clorox Stock Is Underperforming Peers

Clorox stock (CLX) is down about 8% since the company posted its third quarter of fiscal 2019 earnings on May 1.

Currency and Competition Hurt Clorox’s Q3 Sales

Clorox (CLX) posted net sales of $1.55 billion, which fell short of Wall Street’s estimate of $1.57 billion.

These Consumer Staples Stocks Marked Stellar Gains in Q1

The Consumer Staples Select Sector SPDR ETF (XLP) rose 10.5% in the first quarter of 2019.

What Drove Clorox’s Q2 Sales?

Clorox (CLX) posted net sales of $1.47 billion during the second quarter.

Procter & Gamble’s Valuation Compared to Its Peers

Procter & Gamble (PG) stock trades at 20.8x its estimated fiscal 2019 EPS of $4.41, which doesn’t look attractive.

Will Colgate-Palmolive Stock Recover?

Colgate-Palmolive (CL) stock is down about 9.6% on a YTD (year-to-date) basis as of March 26, 2018.

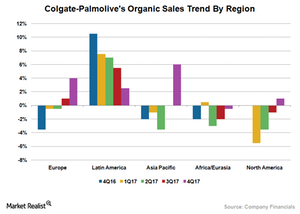

Analyzing Colgate-Palmolive’s Regional Sales in 4Q17

Colgate-Palmolive (CL) witnessed improved volumes across several regions thanks to the improvement in volumes driven by new products supported by increased advertising.

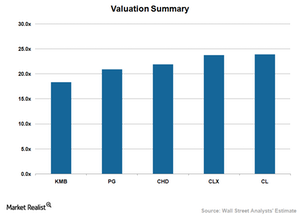

How PG, KMB, CL, CLX, and CHD Compare on Valuation

As of November 24, 2017, Colgate-Palmolive (CL) stock was trading at a forward PE multiple of 24.0x, which is higher than its peers.

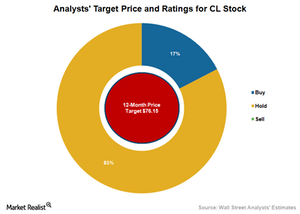

What Analysts Recommend for Colgate-Palmolive

The majority of analysts providing recommendations on Colgate-Palmolive (CL) stock maintain a neutral outlook.

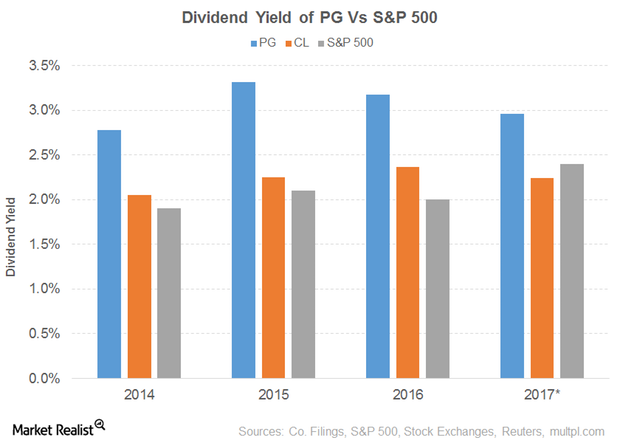

Dividend Yield of Procter & Gamble

Procter & Gamble’s (PG) PE ratio of 25.1x compares to a sector average of 23.3x. The dividend yield of 3.0% compares to a sector average of 3.8%.

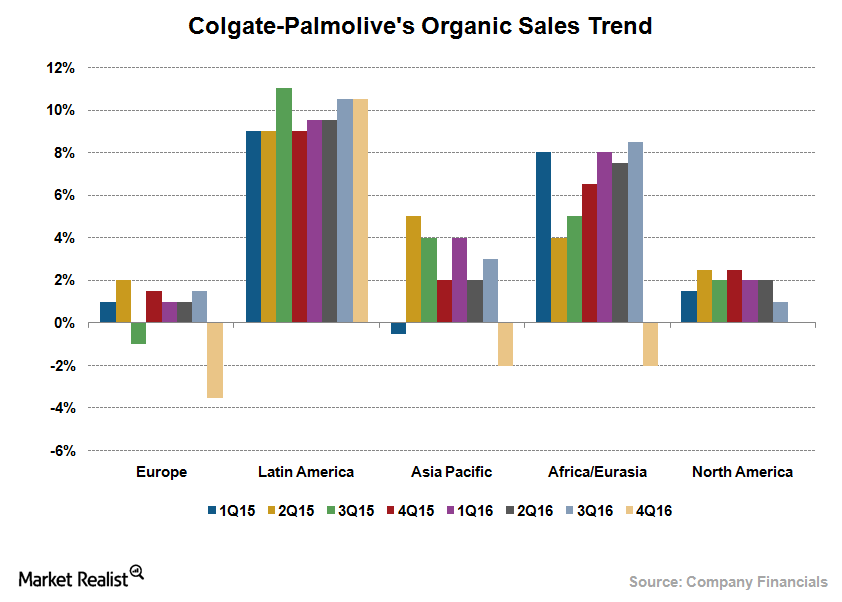

Colgate-Palmolive’s Regional Trends Are Now Headed This Way

CL’s organic sales in its North American segment remained flat in 4Q16. Volume gains in toothpaste were offset by a fall in toothbrushes and liquid hand soap.

Colgate-Palmolive’s Sales Growth: Understanding Analyst Expectations

Analysts expect Colgate-Palmolive (CL) to post revenue of $3.8 billion in 1Q17, which would represent a YoY (year-over-year) growth of 0.8%.

What Are Procter & Gamble’s Strategies for Future Growth?

Procter & Gamble (PG) is trying to boost its sales through a continued focus on innovation. It spent $1.9 billion on research and development in fiscal 2016.

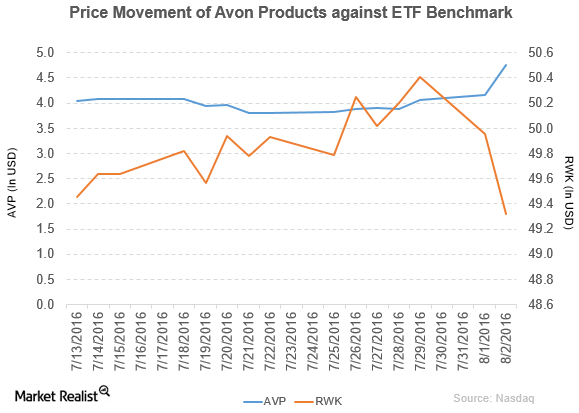

Avon’s Beauty Sales Show Fewer Are Dolling Up with Its Products

Avon Products (AVP) has a market cap of $2.1 billion. It rose by 14.4% to close at $4.76 per share on August 2, 2016.

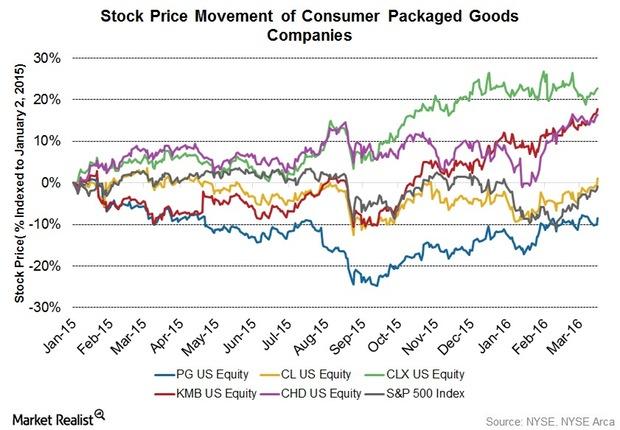

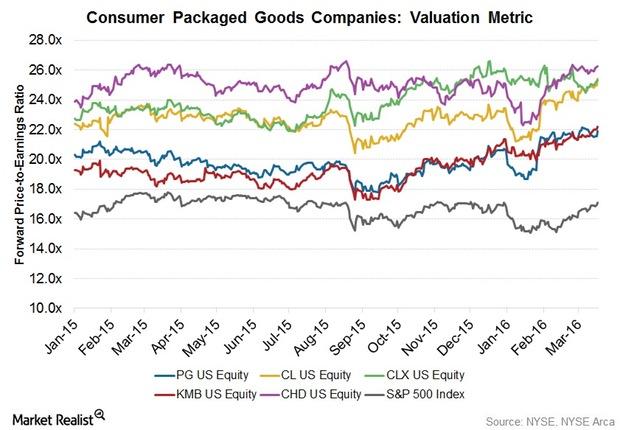

Valuation Multiples Higher for Consumer Packaged Goods in 1Q16

Consumer packaged goods (or CPG) companies are trading at higher valuations compared to the S&P 500 Index (IVV) (SPY) (VOO) and the Dow Jones Industrial Average (DIA).

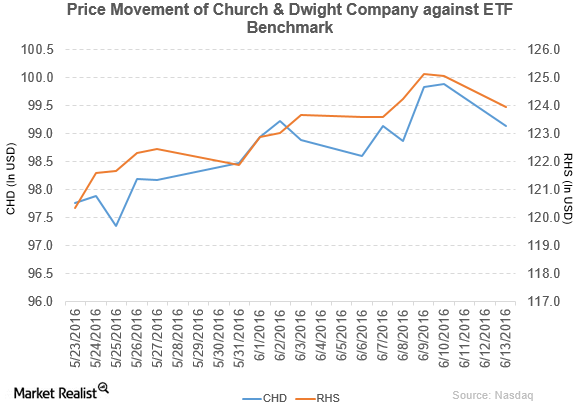

Why Church & Dwight Sold Its Brands to Armaly Brands

Church & Dwight (CHD) has a market cap of $12.7 billion. It fell by 0.74% to close at $99.14 per share on June 13, 2016.

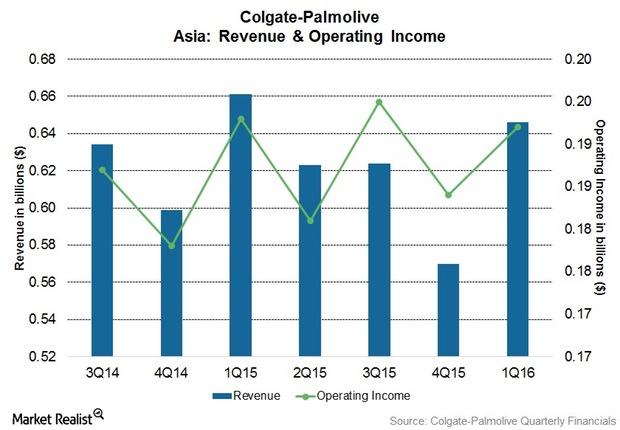

How Colgate Improved Market Share in Its Asia Segment in 1Q16

Colgate’s (CL) Asia segment’s net revenue decreased 2.3% to $0.6 billion in 1Q16.

The Story behind Colgate-Palmolive’s Commercial Strategies

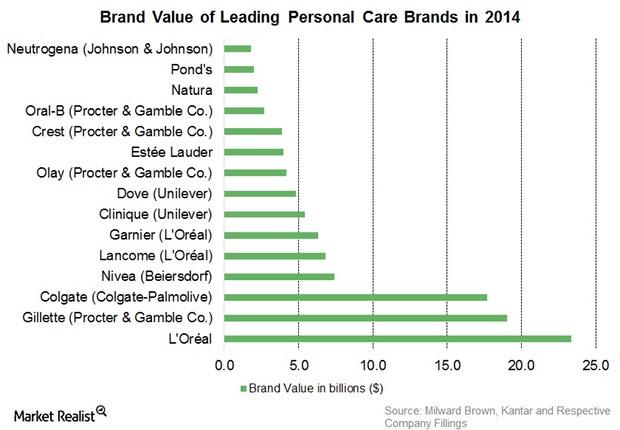

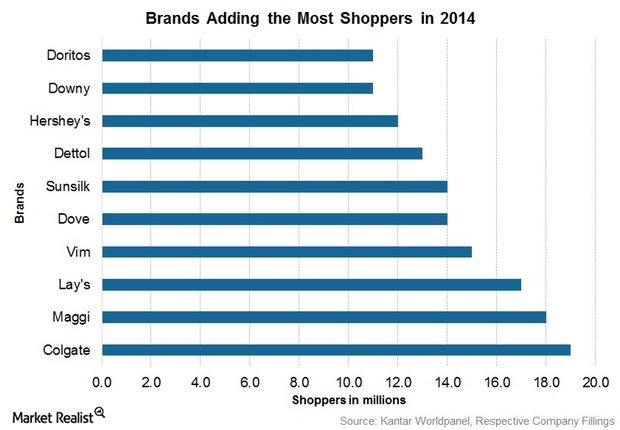

Colgate-Palmolive’s global market share is ~45%. It is the leading toothpaste compared to Oral-B and Close-up, especially in emerging markets like India.

Behind CPG Companies’ High Valuation Multiples in 4Q15

As of March 17, 2016, CPG companies were trading at higher valuations relative to the S&P 500 Index (SPY) and the Dow Jones Industrial Average (DIA).

Why Does Colgate’s Revenue Keep Falling?

Colgate’s (CL) revenue declined 7.5% to $3.9 billion in 4Q15. The reported revenue was negatively impacted by foreign exchange and divestitures.

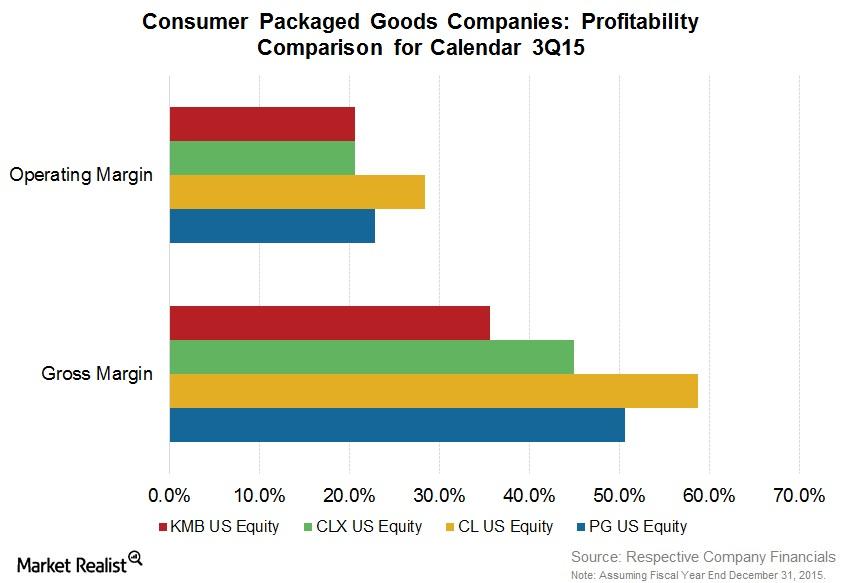

Consumer Packaged Goods Companies Saw Improved Margins

CPG companies’ 3Q15 margins sent strong signals. They have been investing in innovative products and other growth initiatives. This is impacting their margins.

Weighing Clorox’s Strengths and Opportunities

Clorox (CLX) has a strong research and development (or R&D) team and devotes significant resources and attention to product development.

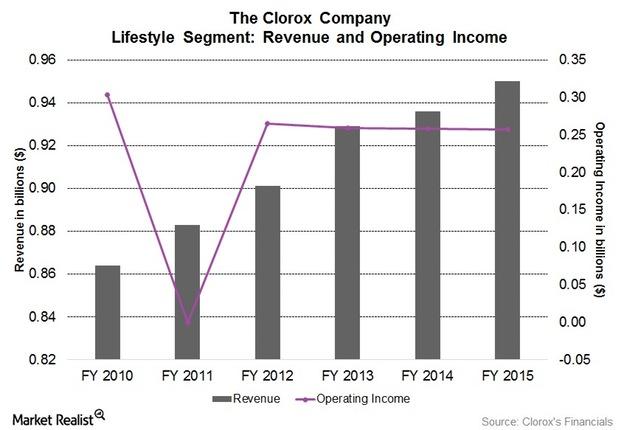

Understanding Clorox’s Lifestyle Product Segment

Clorox’s Lifestyle segment’s revenue increased 1.5% to $1 billion in fiscal 2015 compared to $0.9 billion in fiscal 2014. The increase was primarily due to higher shipments in natural personal care.

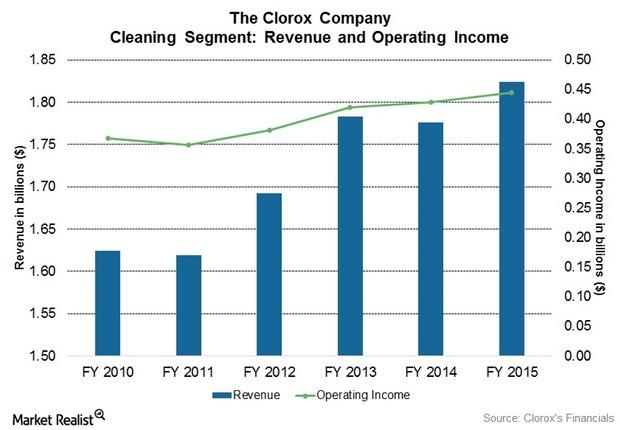

Clorox’s Largest Operating Segment: Cleaning

The Cleaning segment contributed 32.3% to the total consolidated sales of Clorox, the highest among all the segments. The increase was primarily due to higher volume growth.

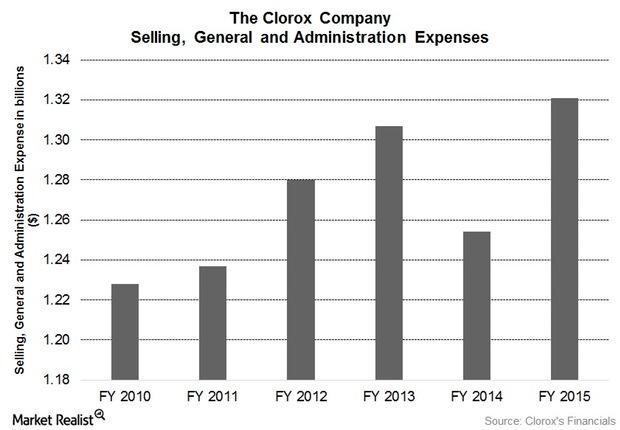

Why Clorox’s Marketing Strategies Are Reaching More Households

Clorox’s (CLX) SG&A expenses increased 5.3% in fiscal 2015 compared to fiscal 2014. The increase was primarily due to increased advertising and marketing programs.

Colgate’s Efforts to Engage Consumers to Build Brand Awareness

In order to attract consumers in retail stores, Colgate has increased its commercial investment in advertising, promotions, trade spending, and creative brand building.

Colgate’s Efforts to Generate Savings to Fund Growth

Colgate’s funding-the-growth technique is the key component of the company’s financial strategy, according to comments by Ian Cook, the company’s CEO.