Colgate-Palmolive Co

Latest Colgate-Palmolive Co News and Updates

How Colgate is Gaining Share in Key Global Markets

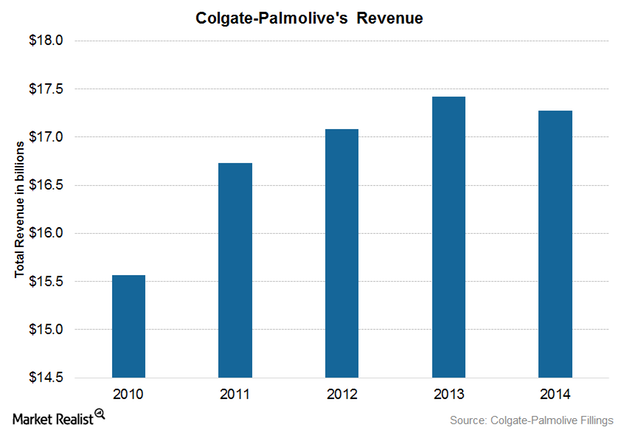

Colgate faces stiff competition from large international and local players worldwide. However, the company aims to have a disciplined approach to pricing management.

Colgate Has the Highest Brand Penetration in the World

Colgate has the highest brand penetration in the world. At a brand penetration rate of 64.6%, Colgate reaches more than half the households in the world, more than even Coca-Cola.

What Are Colgate’s Strengths and Opportunities?

A strong market position and brand image are some of Colgate’s chief strengths. Colgate holds 44.4% of the global market share in toothpaste.

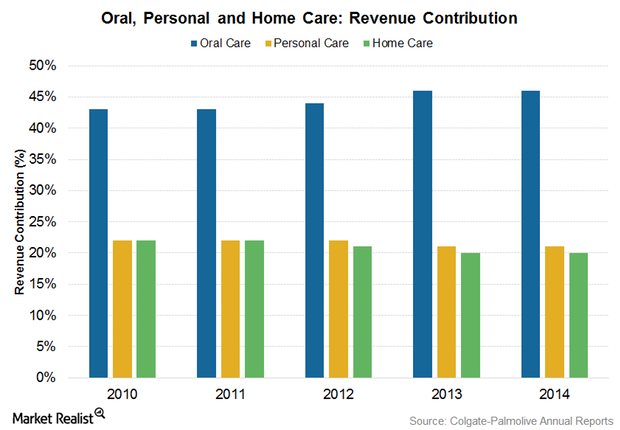

Colgate’s Oral Care Business Is the Jewel in Its Crown

Colgate estimated its share of the global toothpaste market and the global manual toothbrush market at 44.4% and 33.4%, respectively, in 2014.

How Much of the Market Share Do Colgate’s Leading Brands Have?

In North America, innovations in the Colgate Optic White Franchise increased market share of toothpaste from 5.3% to 5.6% in 2014.

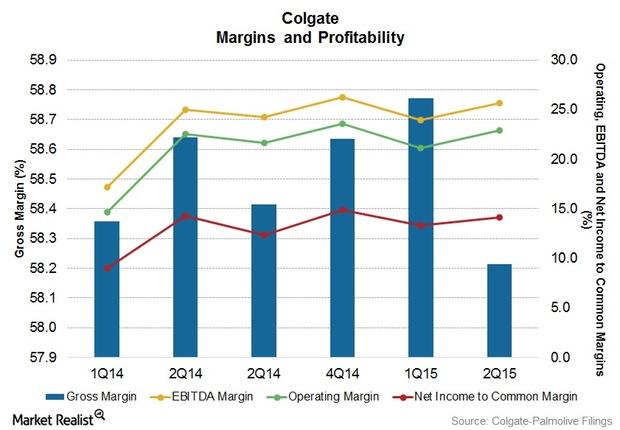

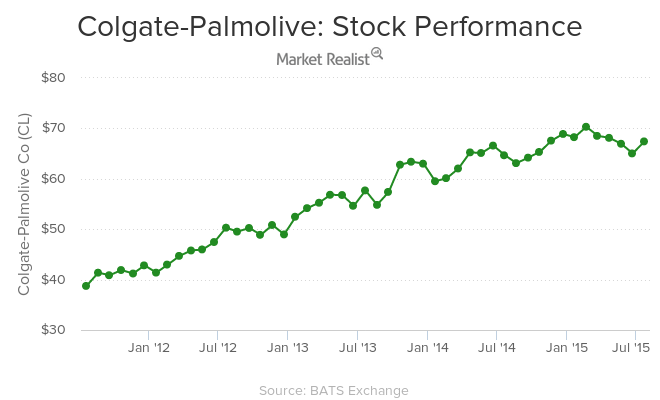

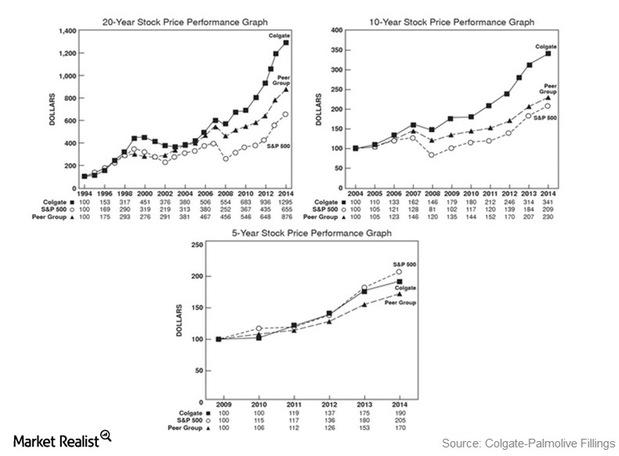

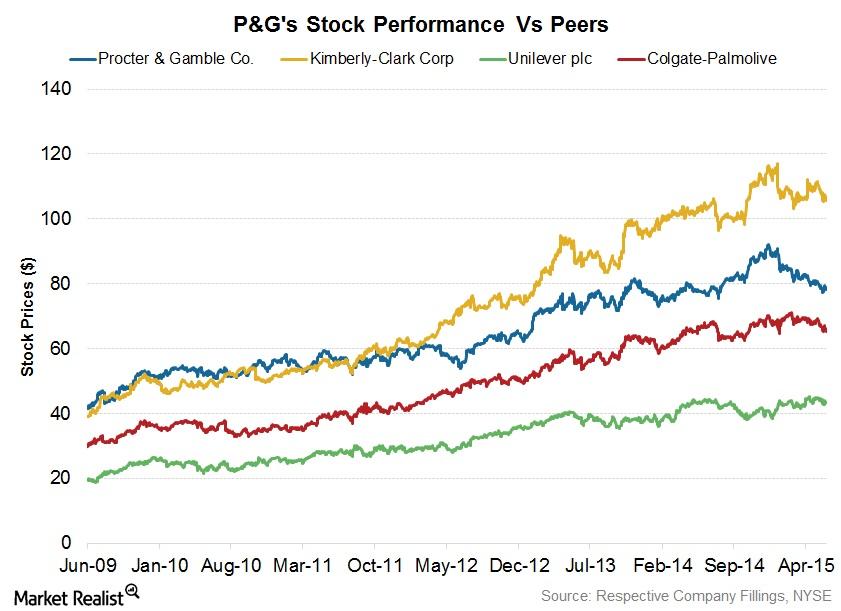

Key Performance Drivers for Colgate’s Stock Price

Colgate’s stock price has always been fairly stable primarily due to its oral care business.

Analyzing Colgate’s Competitive Position

As the consumer staples (XLP) sector is highly competitive, Colgate faces local as well as global competition from various local and international players worldwide.

Colgate-Palmolive Is a Leading Fast-Moving Consumer Goods Firm

Colgate-Palmolive is a multinational consumer staples (XLP) firm, focused on the production, distribution, and provision of household products.

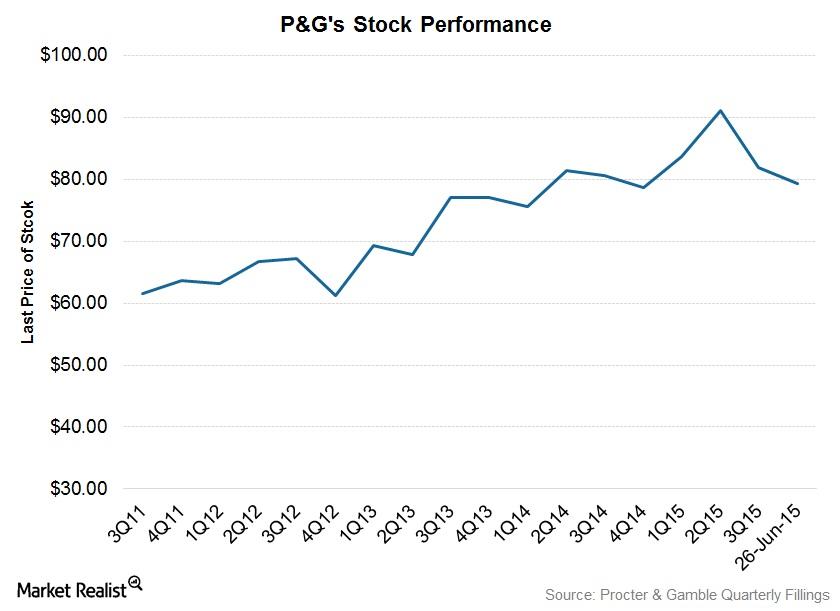

Procter & Gamble: Successes, Weaknesses along the Road to Success

Procter & Gamble aims to harness opportunities in developing countries like China, India, and Russia to enhance its market share as well as stabilize its top-line growth.

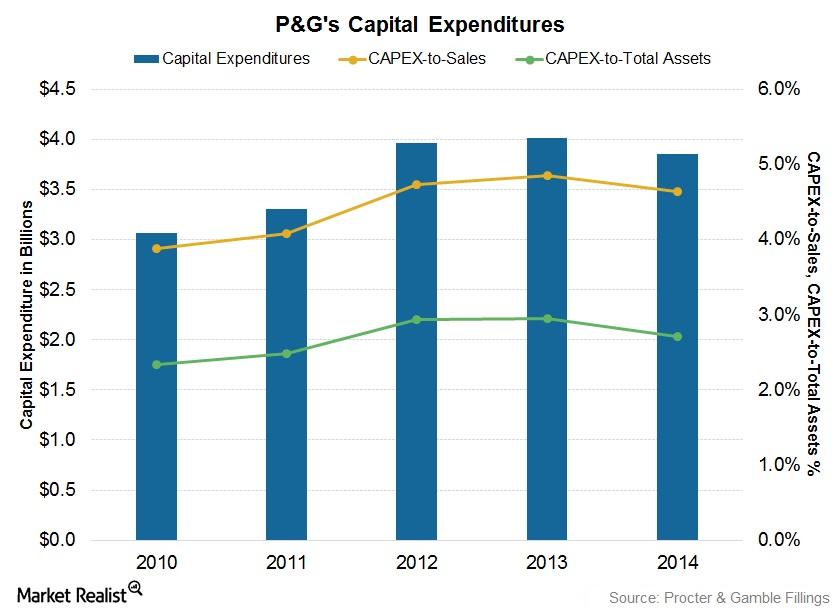

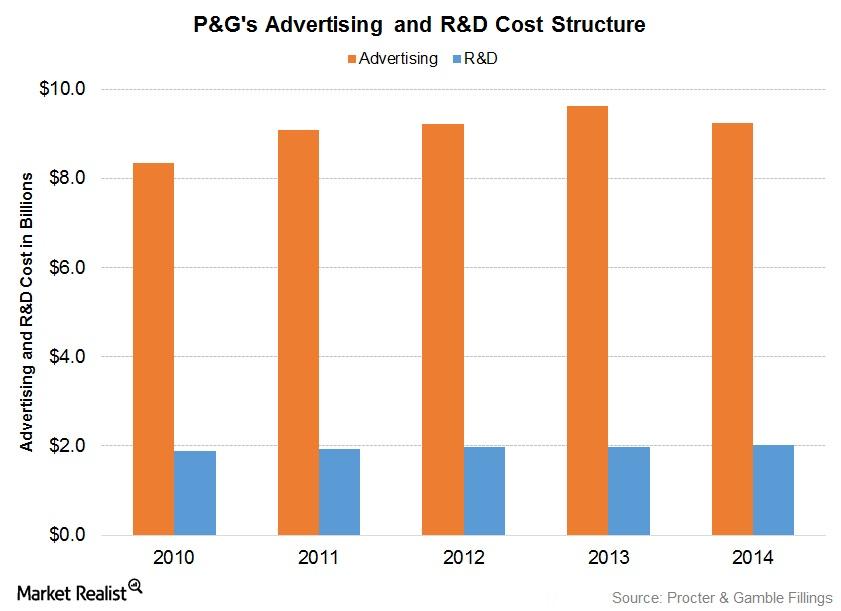

Procter & Gamble’s Efforts to Reduce Capex

Less capex has been required since P&G reduced the number of brands as well as the research and development, marketing, and innovation costs associated with them.

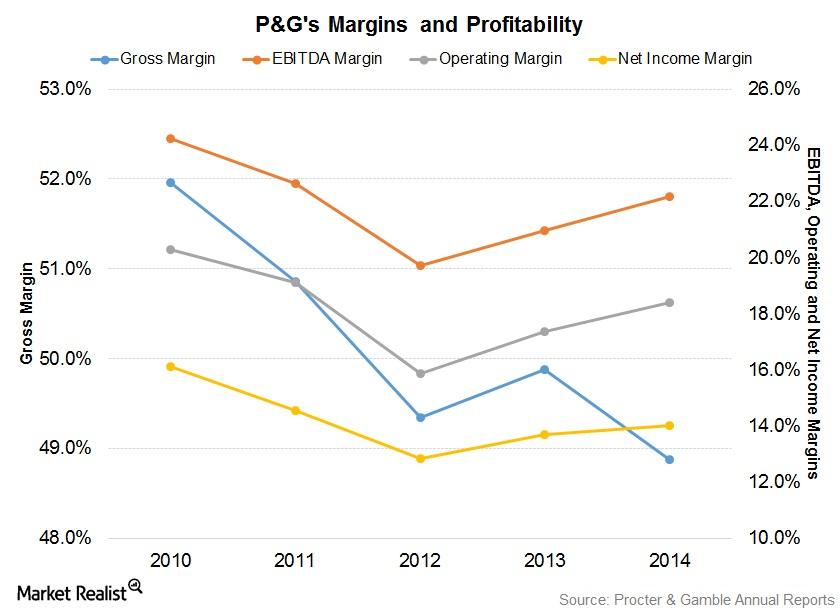

What Are the Drivers Affecting Procter & Gamble’s Profitability?

Last August, P&G announced it was working on exit options for ~100 brands to improve sales and profitability. All of the brands contributing little to growth will be disposed of.

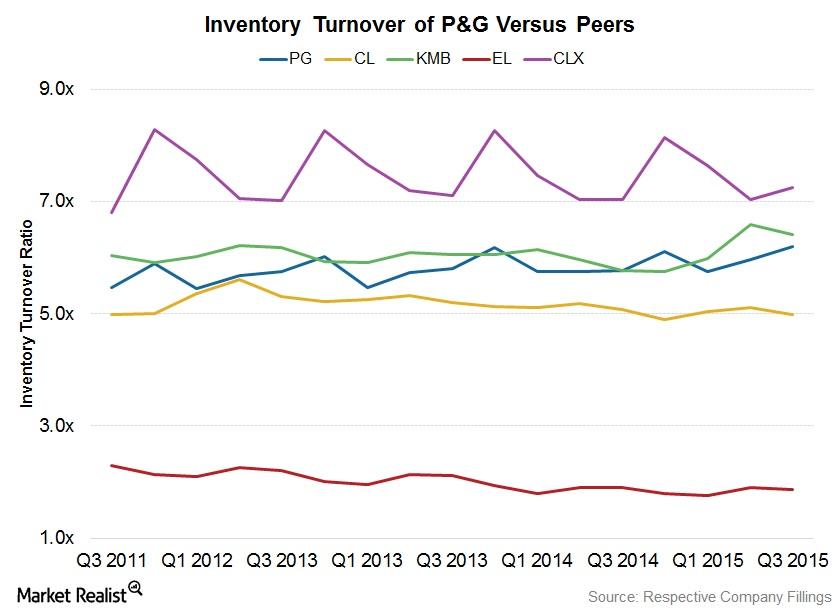

Procter & Gamble Supply Chain Initiatives Improve Productivity

In an effort to partially digitize its supply chain, P&G has introduced an automated re-ordering system. It maintains a count of inventory in stores and relays the information to its suppliers.

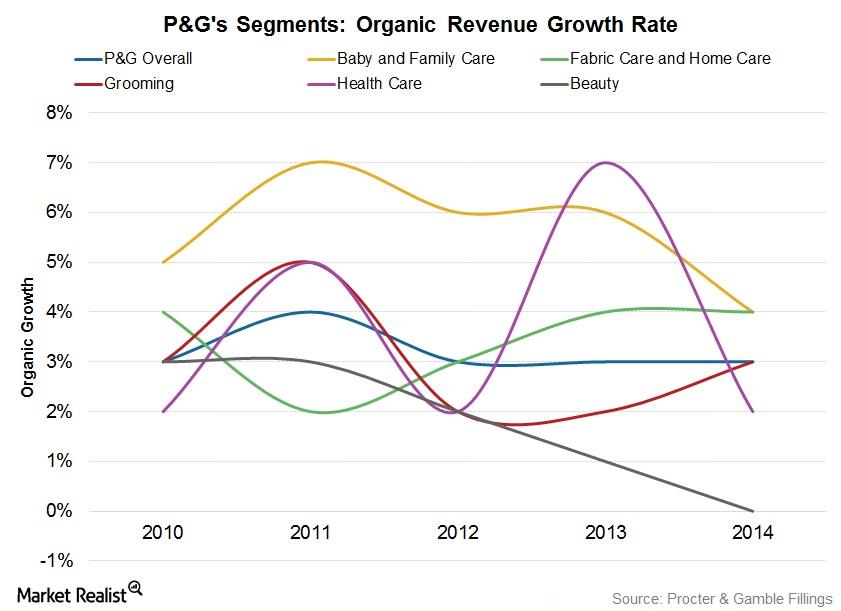

What Drives Procter & Gamble’s Growth?

The emerging markets of Asia, Eastern Europe, and Latin America offer ample growth opportunities for the consumer staples sector.

Procter & Gamble: A Brand Marketing Pioneer

P&G is one of the world’s biggest advertisers. The company has defined many of the marketing strategies used globally.

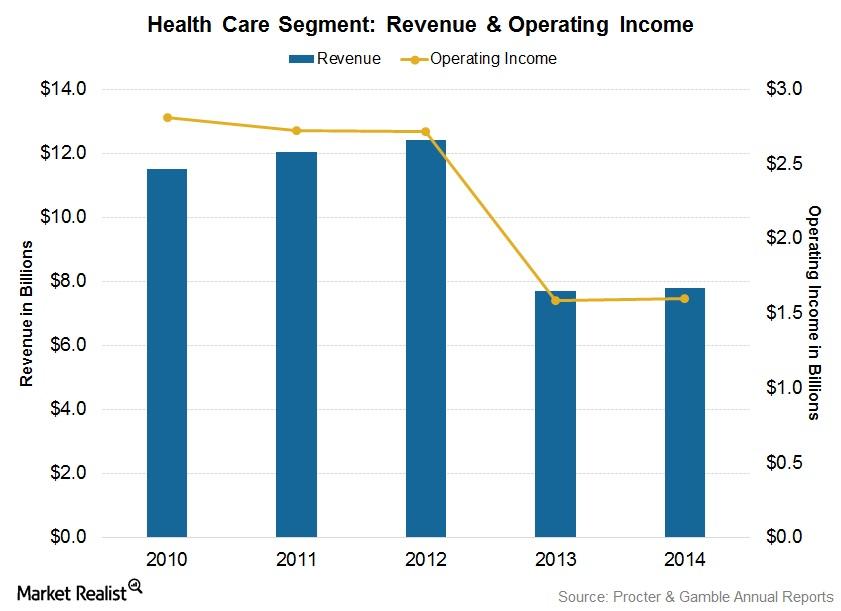

Crest and Oral-B: Stars in Procter & Gamble’s Health Care Segment

The Health Care segment is P&G’s smallest segment. The segment’s net revenue for the year ending June 30, 2014, was $7.8 billion, or 9.5% of the company’s total net revenue.

Procter & Gamble Leads the Market in Baby, Feminine, Family Care

The company’s Baby, Feminine and Family Care segment is the second-largest grossing segment at Procter & Gamble.

Procter & Gamble: Global Leader in Fabric Care and Home Care

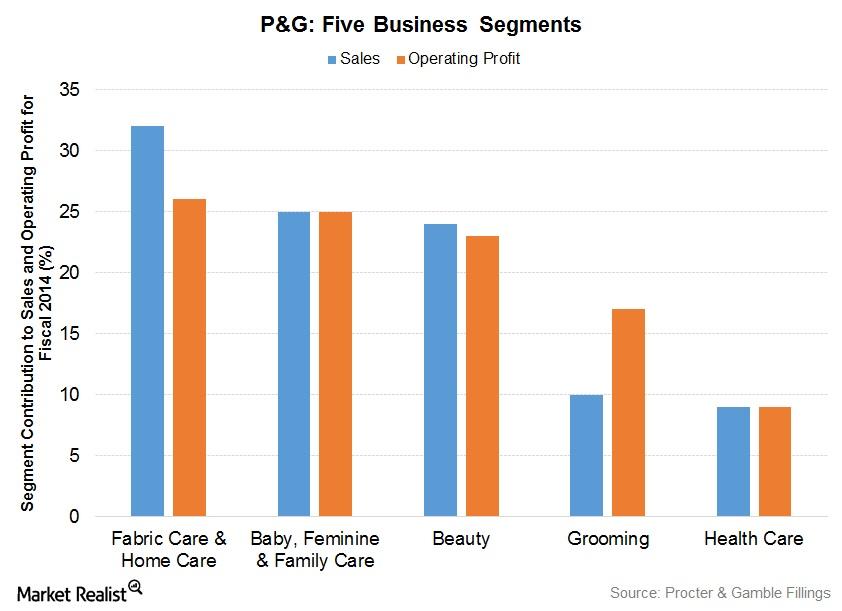

P&G’s Fabric Care and Home Care segment’s annual revenue was reported to be $26.1 billion in fiscal 2014. It contributed 31.7% of the company’s total net sales.

An Overview of Procter & Gamble’s 5 Segments, Product Categories

Of its five business segments, the majority of P&G’s sales and earnings are derived from its Fabric Care and Home Care business.

Porter’s Five Forces: Procter & Gamble’s Competitive Position

In examining Porter’s five forces at work at P&G, we find that three competitive forces are horizontal in nature and two are vertical.