Surbhi Jain

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Surbhi Jain

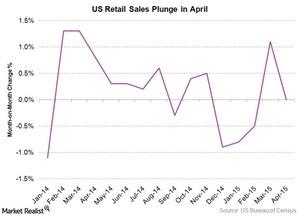

US Retail Sales Flat in April on Rising Oil Prices, Yet XRT Up 1%

Retail sales in the United States in April didn’t see any growth over March’s sales figures. But the jobless claims reading brought some positive news for the consumer sector.

Why Do Central Bankers Continue to Surprise Bill Gross?

In his recent webcast by Janus Capital, Bill Gross expressed his surprise at the extent to which central bankers of the developed world (EFA) (VEA) have distorted the financial system.

Will We See a Recession within the Next 2 Years?

In a recent interview, Jim Rogers said, “I’m on record as saying that we’re going to have a recession certainly within a year or two.”

Credit Suisse and Barclays Are Bullish on European Equity for 2016

Credit Suisse (CS) strategists forecast 10% earnings growth in Europe versus a 6.8% growth expected from the US.

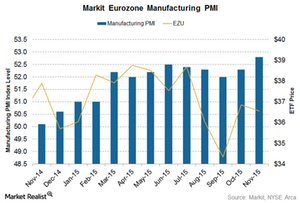

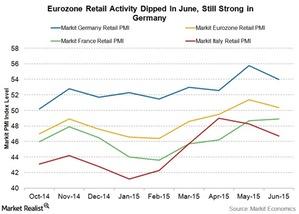

Eurozone Retail Activity Dipped In June, HEDJ Down 2.32%

The Eurozone’s Retail PMI (purchasing managers’ index) dipped to 50.4 in June from the 51.4 recorded in May.

Once Again, Soros Makes Money off the UK’s Woes

Four days before the UK (EWU) decided to leave the European Union (VGK), Soros warned the markets of a “Black Friday” and a crash in the pound.

Crimea, annexed – Is Mariupol next for Russia?

The artillery barrage in Mariupol could mean Russia is preparing to launch an offensive that would secure its hold on Crimea.

Where Are Interest Rates Going? Ray Dalio Weighs In

Ray Dalio, and Marketplace Morning Report host David Brancaccio discussed the future of the economy and the next recession. Here’s what you need to know.

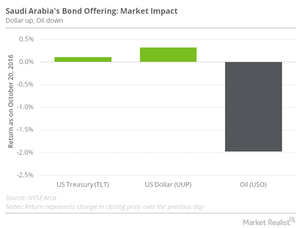

Saudi Arabia Enters International Bond Market, Raises $17.5 Billion

On October 20, the government of Saudi Arabia raised about $17.5 billion in an international bond issuance, marking the emerging market’s first foray into the international bond market.

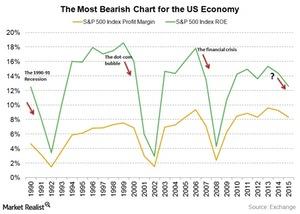

Why the S&P 500 Net Profit Margin May Predict a US Recession

Over a good four decades, the S&P 500’s net profit margin has fallen notably when the economy was on the verge of, or already into, a recession.Industrials Why China’s slowing consumption demand is an important threat

Real estate and construction are the two important drivers of China’s economic growth. They account for more than 20% of China’s gross domestic product (or GDP) when you also factor in cement, steel, chemicals, furniture and other related industries.Energy & Utilities Credit spreads: A fixed income investor’s must-know guide

Credit spreads are the difference in yield between U.S. Treasuries and corporate bonds of the same maturity. Corporate bonds yield more than Treasury bonds, as they carry a risk of default.

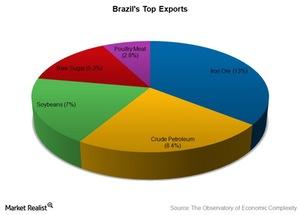

Are Commodities a Boon or a Bane for Brazil?

Brazil (EWZ) is rich in commodities. It’s among the top producers and exporters of iron ore, crude petroleum, soybeans, sugar, and meat.

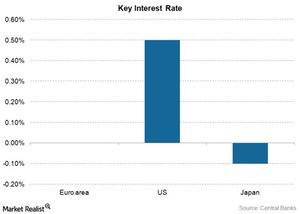

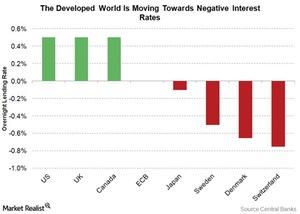

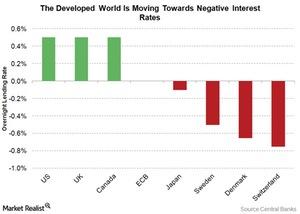

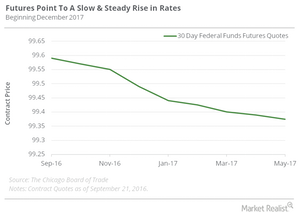

Will the Fed Have to Use More Unconventional Measures?

Global monetary policy is unconventional. From an era of lowering interest rates to boost economic growth, central bankers are taking rates into negative territory.

Bill Gross’s Views on Growth and Inflation

Gross believes that money has stopped generating growth and inflation. Equity prices are artificially elevated, and negative yields are guaranteeing capital losses.

Currency warfare: A ‘beggar-thy-neighbor’ situation

In a currency war, the “beggar-thy-neighbor” strategy is about increasing the demand for a nation’s exports at the expense of other countries’ export share.

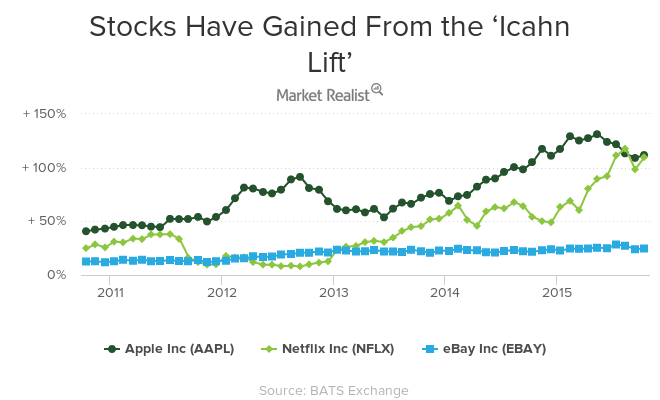

The ‘Icahn Lift’: What Companies Have Gained from It?

Market commentators have noticed that when Icahn starts buying into a company, its stock prices rise. This trend has been called the “Icahn Lift.”

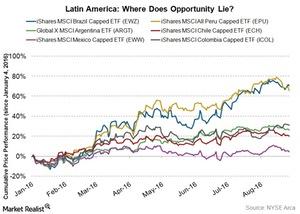

Investing in Latin America Can Bear Fruit, but Should We?

With commodity prices recovering and major developed markets (EFA) (VEA) caught in the lull, Latin America should see sunnier days ahead.

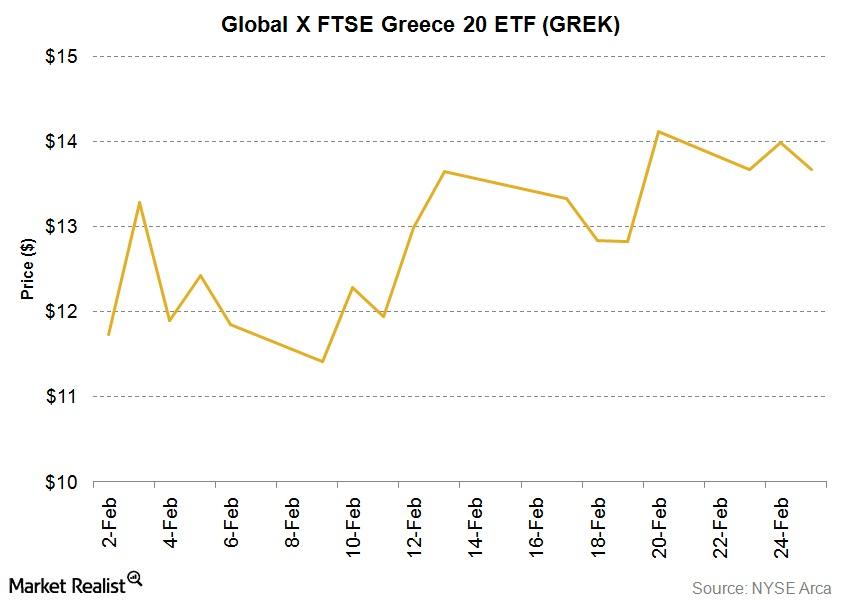

Eurozone grants bailout extension to Greece

Europe-tracking ETFs gained significantly from February 19 to February 24, when the bailout extension to Greece was approved.

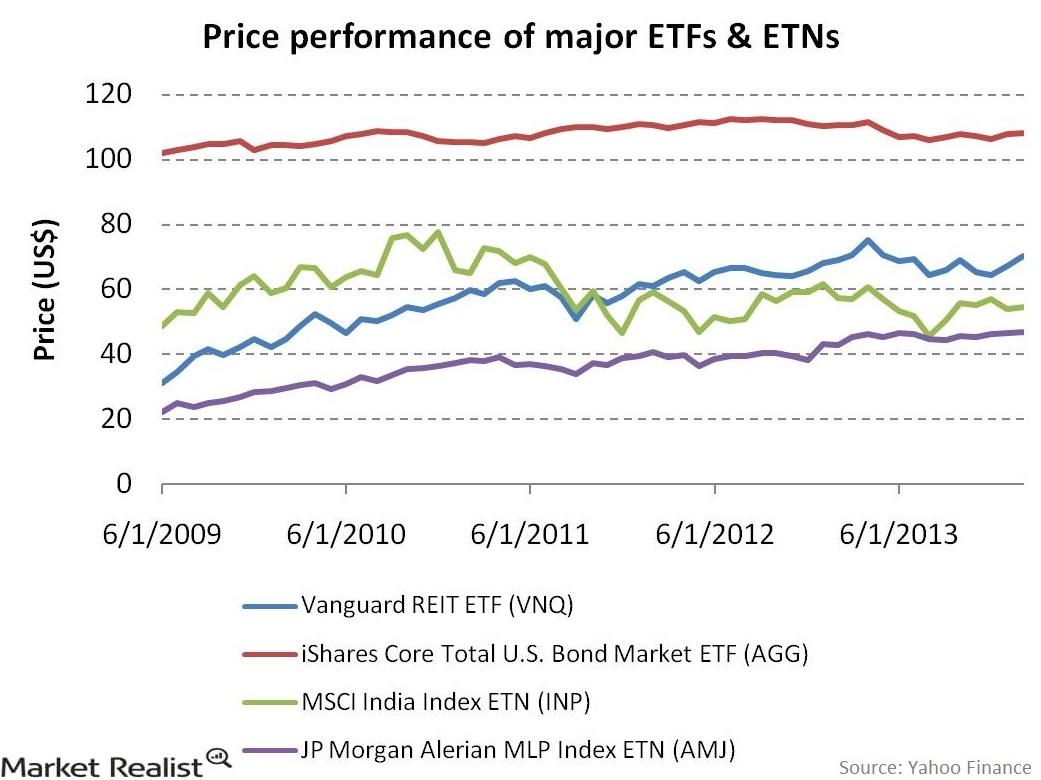

A head-to-head comparison: What are ETFs and ETNs?

ETFs and ETNs are very similar—both trade on an exchange like a stock, follow an underlying product, and are easily accessible to investors.

Ray Dalio: The Next Downturn May Be a Difficult One to Reverse

“The next downturn may be a difficult one for central banks to reverse,” warned Ray Dalio, CEO of the world’s largest hedge fund.

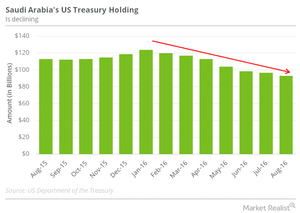

How Saudi Arabia’s Bond Sale Affects US Treasury Bonds

Saudi Arabia has also been involved in the sale of US Treasuries. The country is the 15th-largest holder of US Treasury bonds in the world.

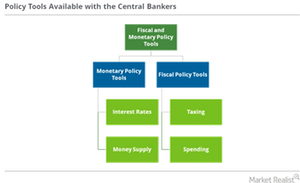

Dalio: What Policies Are Required of Central Bankers?

Ray Dalio: Here’s what’s required of central bankers Given the inadequacy of monetary policy measures to stimulate the economy, we may see “more direct placements of purchasing power in the hands of spenders,” believes Ray Dalio. He has outlined what central bankers should do. “Continue to make debt assets extremely unattractive for savers” For some […]

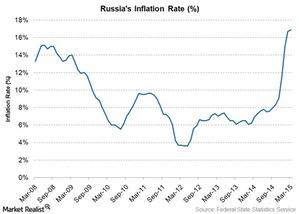

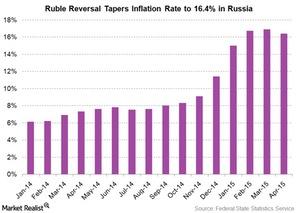

Sliding Ruble Pumps Russia’s Inflation Rate to 16.9% in March

Russia’s inflation rate has been trending upwards since the beginning of 2014 alongside the ruble’s decline. The ruble has declined by almost 40%.Technology & Communications Exposure to junk bonds: How much should you hedge?

Junk bonds are high yield bonds issued by below–investment grade corporations. Due to the low ratings and high risk of default attached to these bonds, they’re popularly called “junk bonds.”

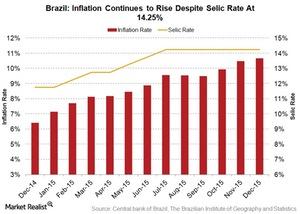

How Low Interest Rates Have Hurt Venezuela, Puerto Rico, and Brazil

Low global interest rates have been catastrophic for Brazil. Growth is stagnant while inflation continues to soar.

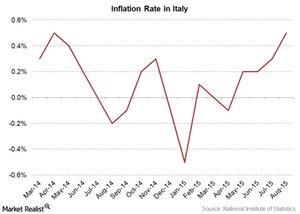

Italy’s Inflation Rate Rose in August: EWI Fell 0.40%

According to the August 31 release by the ISTAT, the EU’s harmonized inflation rate in Italy rose to an impressive 0.50% in August on a YoY (year-over-year) basis.Consumer Overview: What is Pipelineistan?

As percentages of the worlds’ total reserves, Russia holds 45% of the gas, 23% of the coal, 14% of the uranium, and 13% of the oil. Currently, Russia is the world’s largest energy supplier.

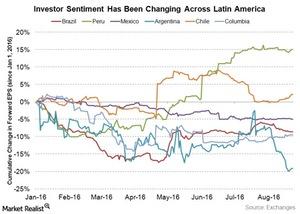

Investor Sentiment Favors Peru, Chile, and Brazil

Investor sentiment with respect to Latin American economies has definitely been changing since the beginning of the year.

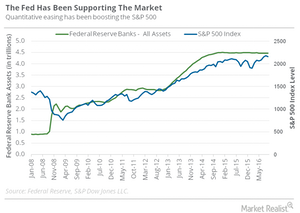

Jeffrey Gundlach: The Fed Has Been Supporting the S&P 500

Gundlach also believes it’s interesting to look at the correlation between the size of the Fed’s balance sheet and the S&P 500 (SPY) (SPXS) (SPXL) level.

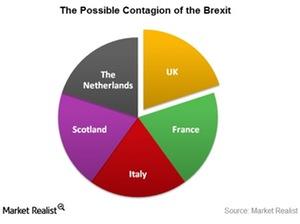

Is the Brexit Vote the Beginning of a Movement?

Popular opinion holds that the Brexit referendum has opened the gates for other such votes in the future.

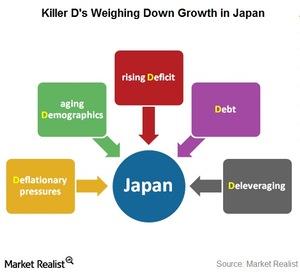

Dalio: Japan Is Undergoing an ‘Ugly Deflationary Deleveraging’

“Deleveraging” refers to reducing the debt level. With Japan’s debt burden, deleveraging the economy’s balance sheet seems more than imperative.

Russian Ruble Reversal: Inflation Rate Falls to 16.4% in April

Russia’s inflation rate had been trending upward since the beginning of 2014, in tandem with the ruble’s decline. But the country’s central bank believes that the worst is now over for Russia.

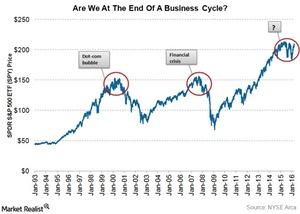

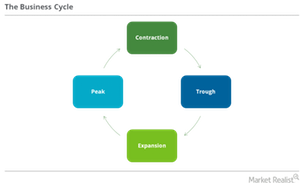

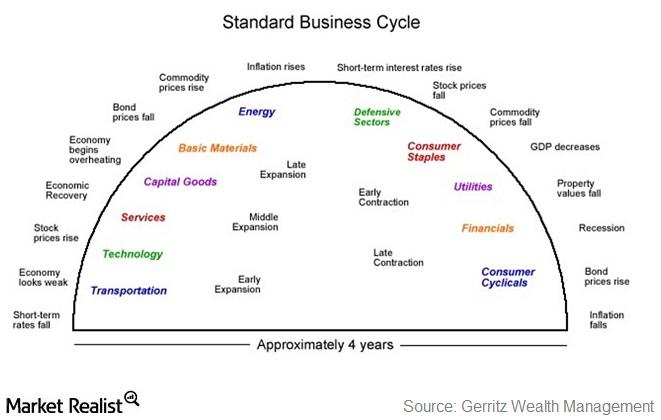

Are We at the End of a Business Cycle?

An early contraction, middle bear phase seems to suggest that we are near the end of the current business cycle.

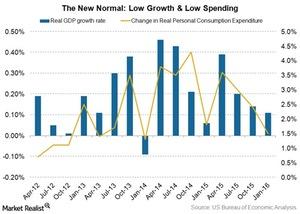

We’re in ‘an Environment of Abnormally Slow Growth,’ Says Dalio

This isn’t a normal business cycle Billionaire hedge fund manager Seth Klarman said, “the stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” Ray Dalio believes that this isn’t a normal business cycle. In our April 2015 series Business Cycle Investing: What Should You Look […]Financials The big 3 ETF providers in the US—iShares, SPDR, and Vanguard

In the U.S., Blackrock (BLK), State Street GA (STT), and Vanguard are the top three ETF providers. They have a 40.1%, 22.3%, and 20.7% market share, respectively.Consumer Must-know: The pros and cons of investing in dividend ETFs

A dividend exchange-traded fund (or ETF) consists of dividend-paying stocks. Usually, ETFs track a dividend index. The stocks in the fund or index are selected based on their dividend yield.

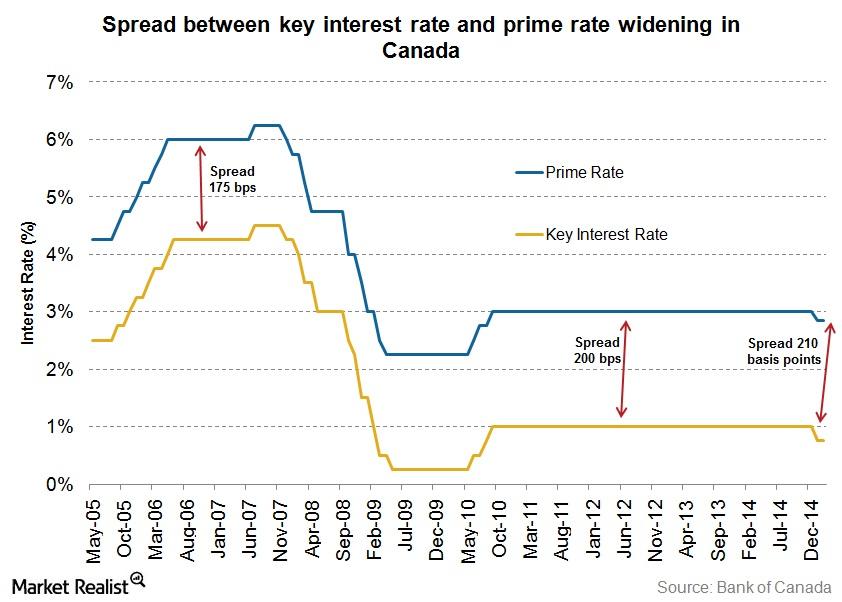

The widening spread in the Canadian prime and key interest rates

The “Big Six Banks” in Canada have only reduced their prime rates by 15 basis points. So the spread between the prime and key interest rates is now 0.1%.

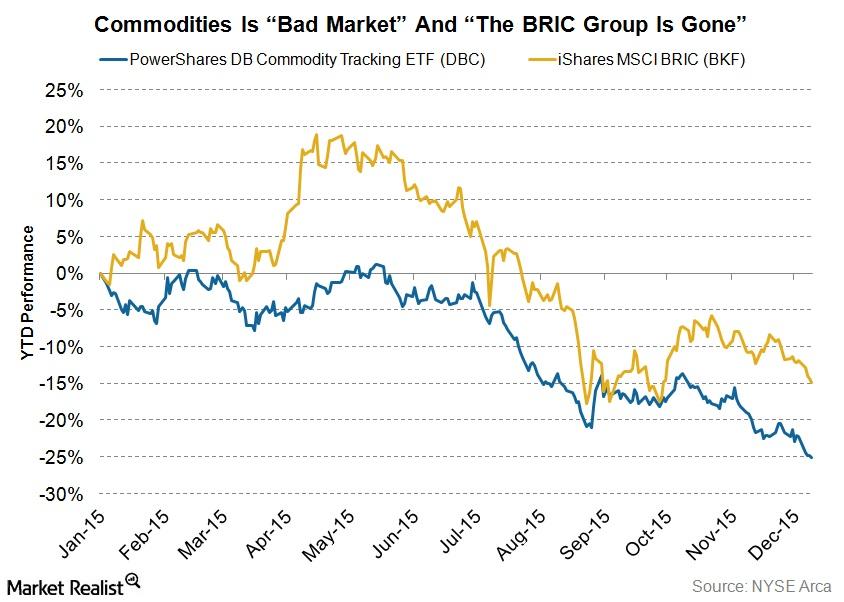

Commodities Are a ‘Bad Market’ and Volatility Isn’t Expected in 2016

In regards to commodities, gold is a “bad market” for Bernstein. On the currency front, he thinks that the US dollar (UUP) will lose strength.Financials Why Brazil seeks diversification

Given the declining competitiveness of its commodity exports, Brazil’s economy is attempting to diversify away from its economic model.Financials How close is the FOMC to achieving its dual mandate?

We’ve talked about the dual mandate and factors constraining the Federal Reserve from achieving this mandate. Let’s now assess how close the Fed has come to achieving its macroeconomic objectives.Financials Must-know investment pledges to India from Fortune 500 CEOs

The group spoke about how these companies and India could benefit from investment flow into the country. Modi sought investment pledges from many of these CEOs, who were impressed with what India had to offer.Financials The key arguments of the Yes campaign of the Scottish referendum

The voting result of the Scottish Referendum, due September 18, will have a direct bearing on Scotland, the United Kingdom, and the 28-member European Union as a whole.

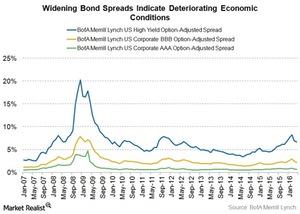

What Do Widening Bond Spreads Indicate?

Widening spreads indicate a slowing economy. Since companies are more likely to default in a slowing economy, credit risk related to their bonds rises.

Jeffrey Gundlach: Buy Mortgage REITs, Short Utilities

Gundlach thinks that investors should short low volatility equity funds. People invest in them thinking that they’re safe, but they aren’t.

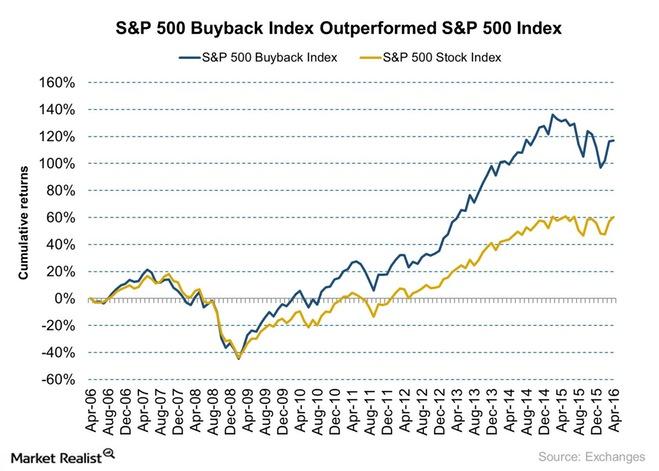

Icahn Identifies a Key Motivation behind the Buyback Spree in the US

Carl Icahn is one of the first activist investors to voice his opinion against share buybacks. He believes that companies are increasingly putting money into buybacks instead of using them for much-needed capital improvements.

Carl Icahn’s View on Share Buybacks Is Divided

Apple (AAPL) is one of the most cash-rich companies in the US. While Carl Icahn has been talking about share buybacks artificially inflating the Market and asset values, some buybacks have occurred as a result of his push.

Structural Issues with the EU Could Lead to Further Referendums

Many European countries want the ability to print their own money and come to their own aid instead of going to the ECB (European Central Bank).

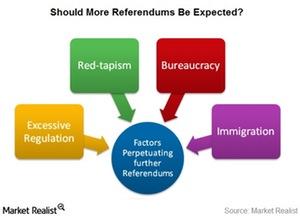

Bill Gross: Credit Is the Oil That Lubes the System

Currently, we’re in a highly levered system, especially the developed world. A levered economy depends on continued credit creation for stability and growth.

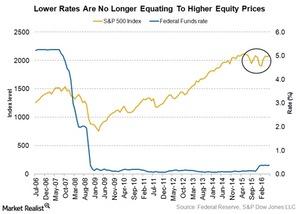

Lower Rates Aren’t Equating to Higher Equity Prices

Bill Gross provided his view on lower rates no longer resulting in credit creation in the economy. They have also lost their efficacy in raising equity prices.