Jennifer Mathews

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Jennifer Mathews

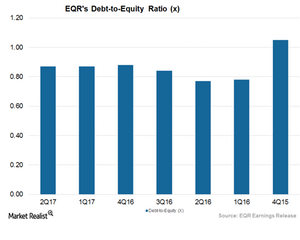

How Equity Residential Improved Its Balance Sheet in 2Q17

During 2Q17, Equity Residential (EQR) reported higher-than-expected top-line and bottom-line results backed by robust rent growth and occupancy levels.

GGP and Other Retail REITs Struggle to Exist in Digital Era

During 1Q17, General Growth Properties’ (GGP) occupancy rate (same-store leased percentage) fell to 95.9% from 96.6% in 1Q16.

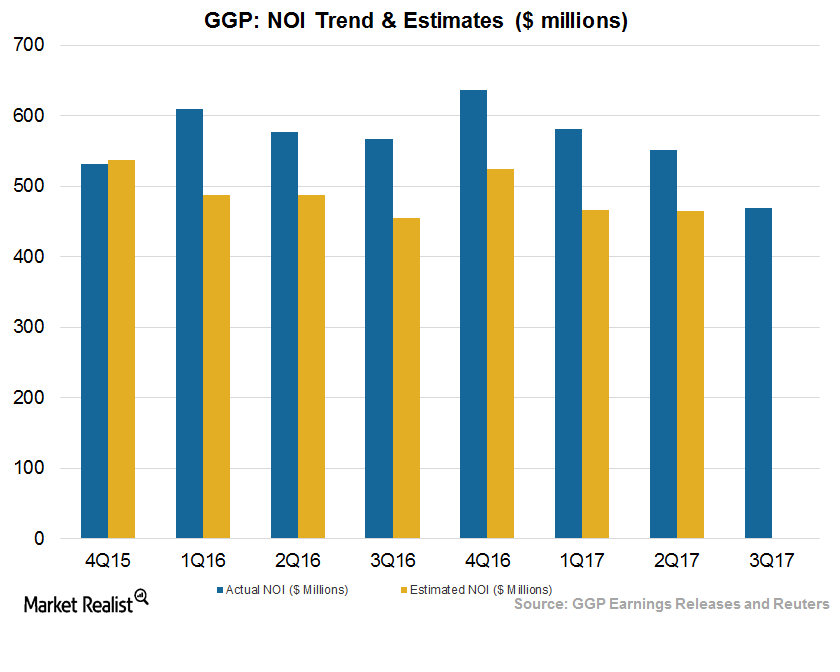

How GGP Managed Its Expenses in 2Q17

In 2Q17, GGP (GGP) reported NOI (net operating income) of $551.0 million, which came in higher than the previous year at $554.0 million.

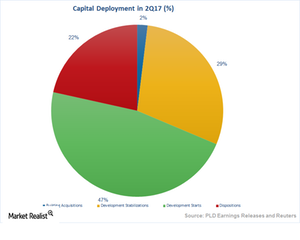

How Prologis Boosted Top-Line Growth in 2Q17

Prologis’s (PLD) upbeat top-line and bottom-line results in 2Q17 were driven by higher-than-expected rent growth and net operating income.

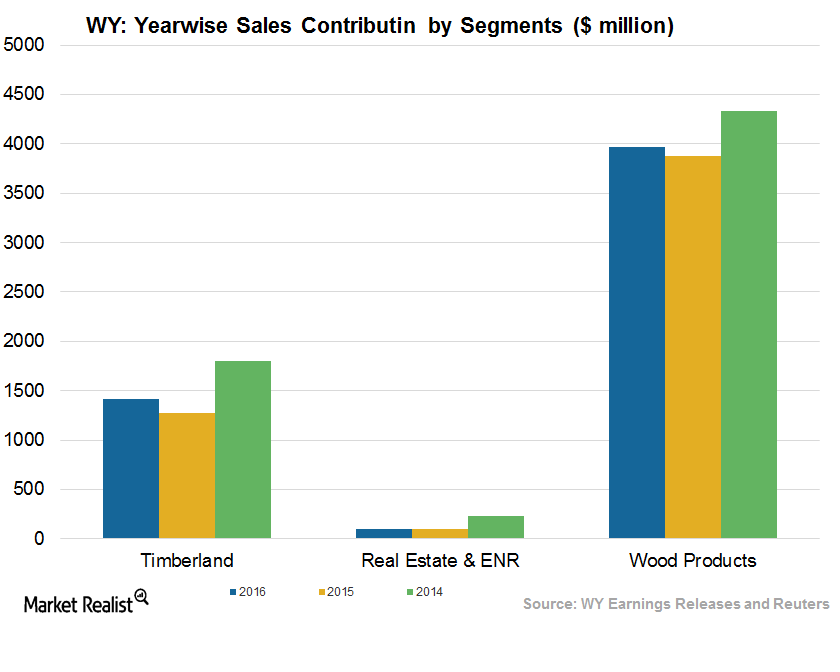

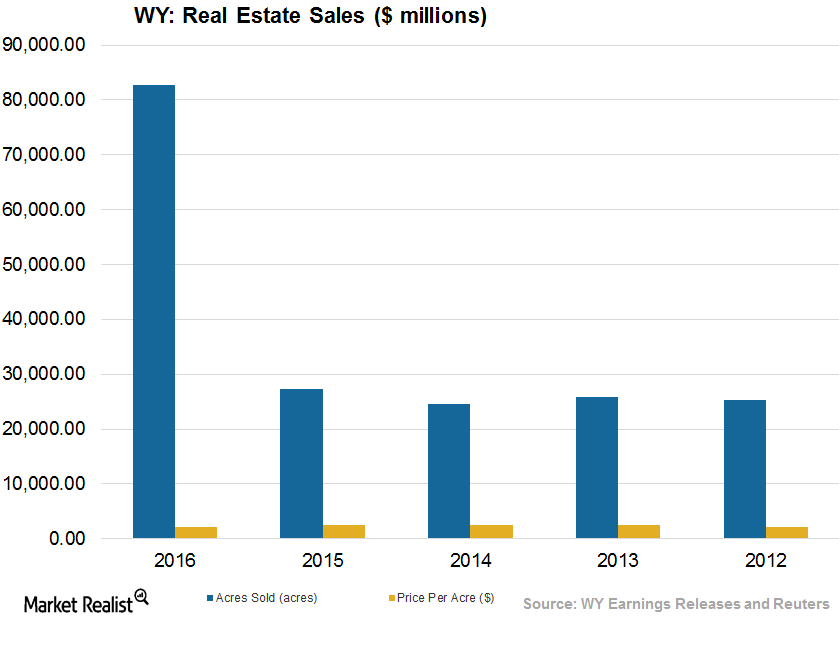

Understanding Weyerhaeuser’s Divestiture Policy

Weyerhaeuser (WY) has undertaken several divestiture policies in order to dispose of its underperforming and non-core businesses.

How Weyerhaeuser Fared in 2Q17: The Details

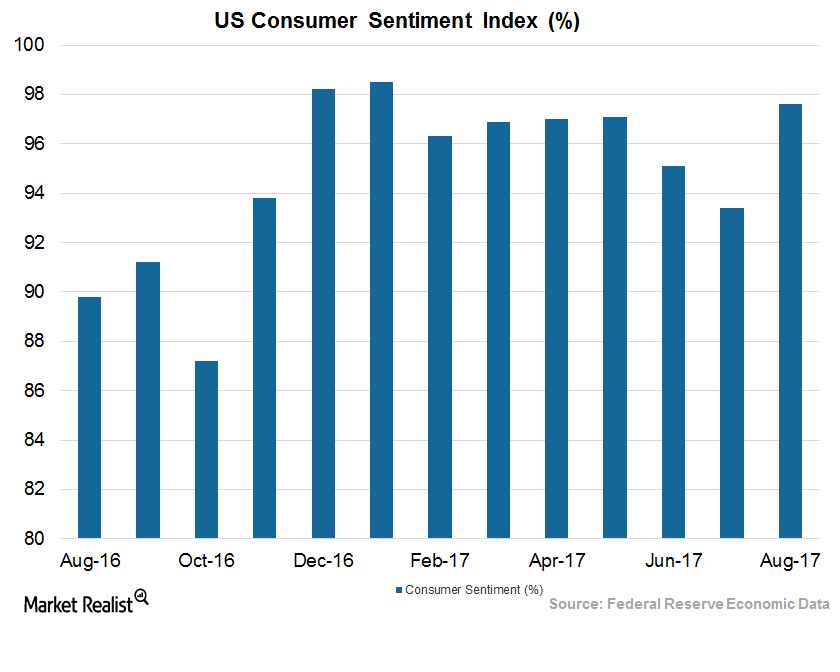

The growing economy has helped REITs including Weyerhaeuser (WY), Rayonier (RYN), Resolute Forests Products (RFP), and International Paper (IP) reap higher profits.

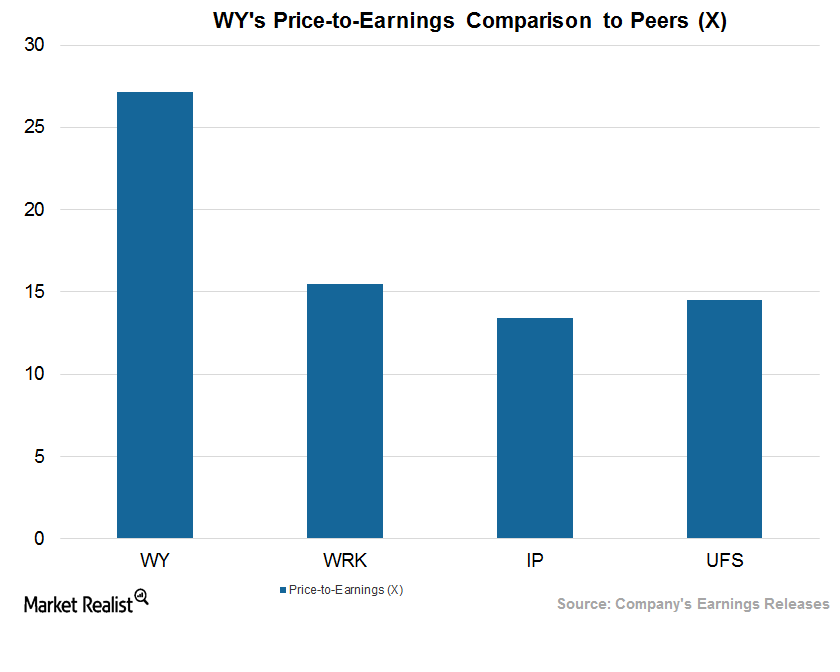

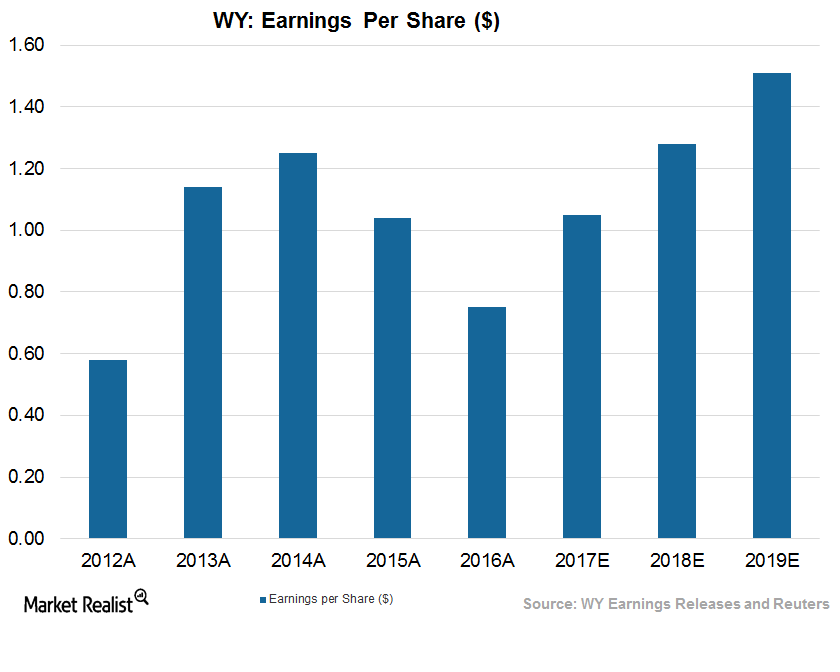

How Weyerhaeuser Compares with Peers

The expected performance of timberland REIT Weyerhaeuser (WY) for the rest 2017 and in 2018 can be best understood by its valuation multiples.

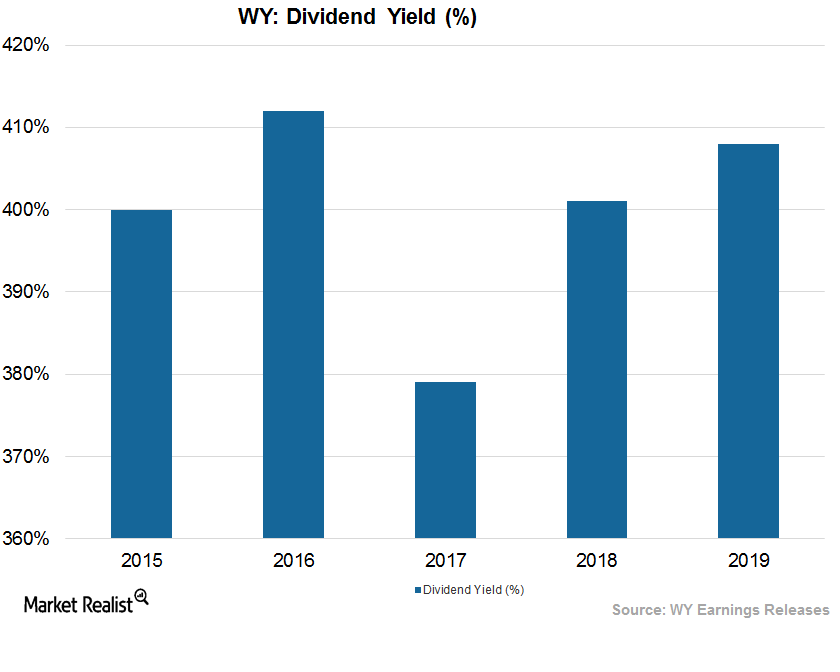

How Weyerhaeuser Treats Its Shareholders

REITs (real estate investment trusts) usually provide generous returns to their shareholders in the form of dividends or share buybacks.

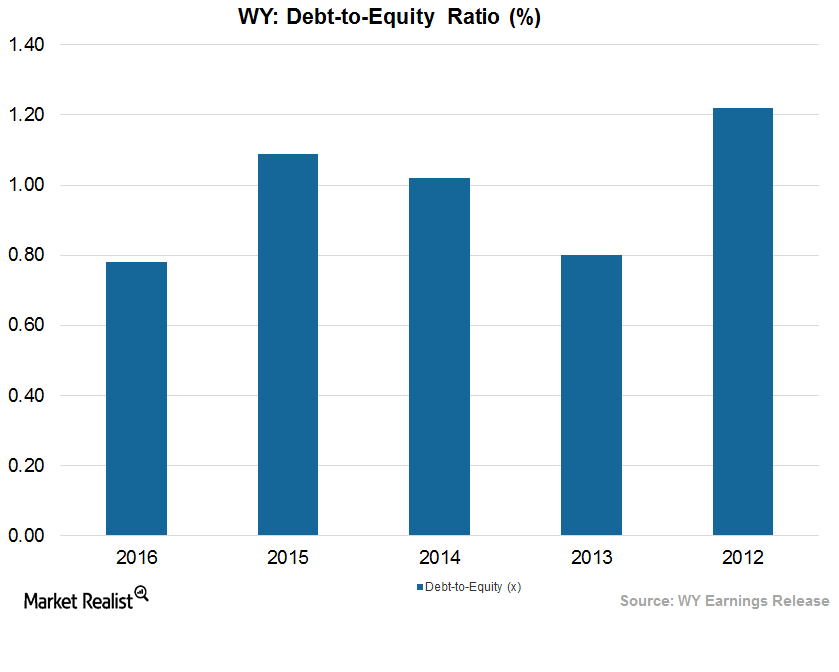

Is Weyerhaeuser Maintaining a Strong Balance Sheet?

REITs (real estate investment trusts) depend mostly on debt for their day-to-day functioning and working capital.

How Weyerhaeuser and REITs Can Fight the Interest Headwind

After thriving for a long time in a low interest rate environment, REITs (real estate investment trusts) are now facing a high interest rate.

How the Rising Interest Rate Affects REITs like Weyerhaeuser

REITs (real estate investment trusts) depend on debt and equity for their working capital, and so they’re directly impacted by the Fed’s interest rate policy.

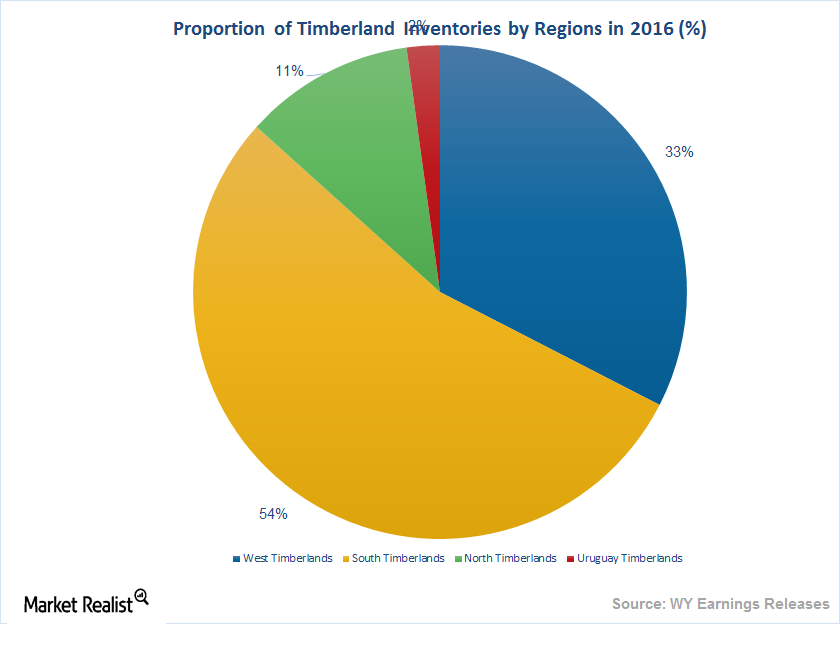

Inside the Weyerhaeuser-Plum Creek Merger

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) owns almost 13.1 million acres of timberlands across the US.

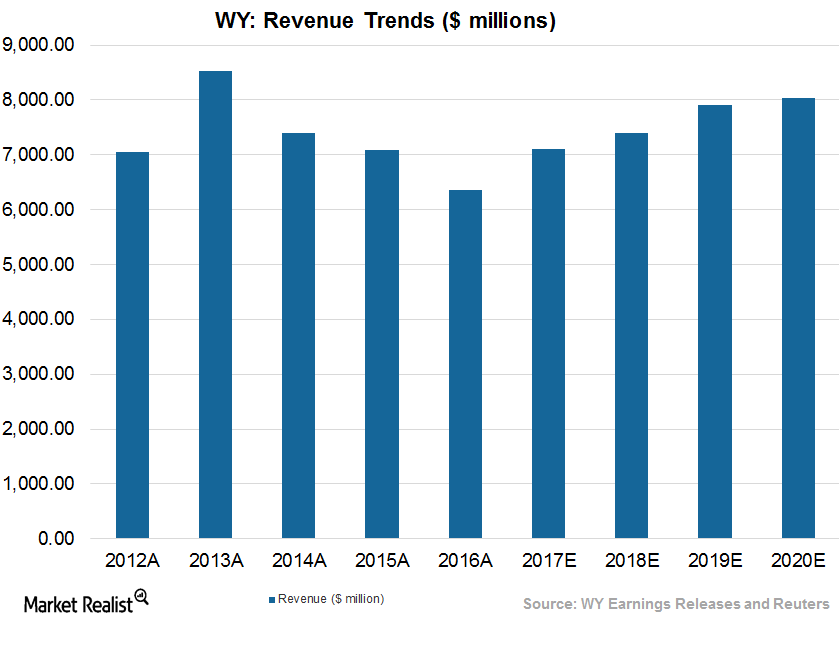

What Lies ahead for Weyerhaeuser in 2017?

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) expects to continue its growth trajectory for the rest of 2017.

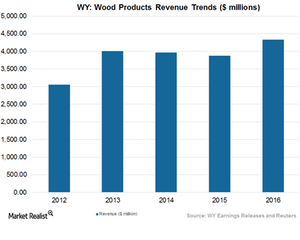

What Strong Wood Means for Weyerhaeuser’s Momentum

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) has been able to use the opportunities of the booming housing sector to its advantage.

Behind Weyerhaeuser’s Growth Trajectory

Timberland REIT (real estate investment trust) Weyerhaeuser (WY) reported upbeat earnings results for 2Q17, backed by higher sales and prudent cost management.

How Weyerhaeuser and Timberland REITs Came through the Fire

Timberland REITs (real estate investment trusts) in the US don’t seem to be in doubt about their continued growth momentum in the near future.

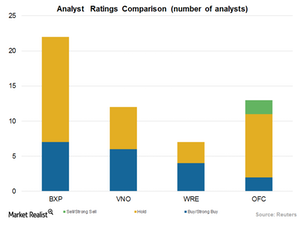

How Do Wall Street Analysts Rate Boston Properties?

In this article, we’ll look into the rating analysts have given Boston Properties and also compare these ratings with those of the company’s close peers.

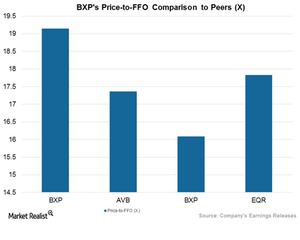

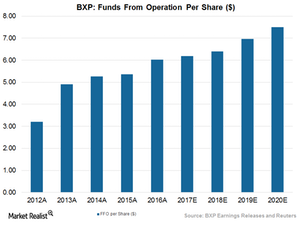

How Does Boston Properties Compare to Peers?

Boston Properties’ (BXP) valuation multiple can help us understand its expected performance for the rest of the year.

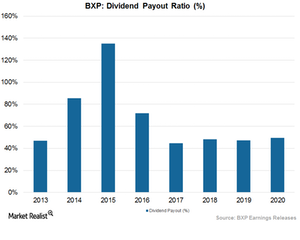

How Boston Properties Returns Value to Shareholders

In order to qualify as REITs (real estate investment trusts), companies usually have to pay 90% of their profits (excluding capital gains) as dividends.

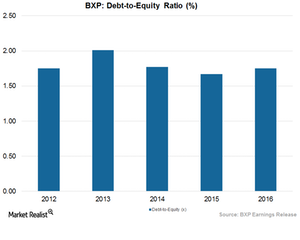

What’s Boston Properties’ Balance Sheet Position?

REITs depend on equity and debt for their working capital.

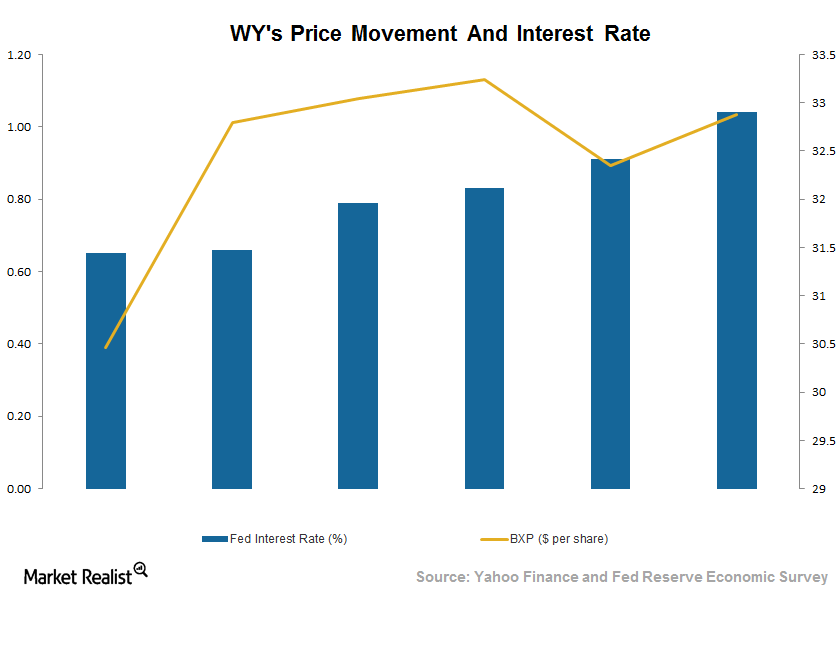

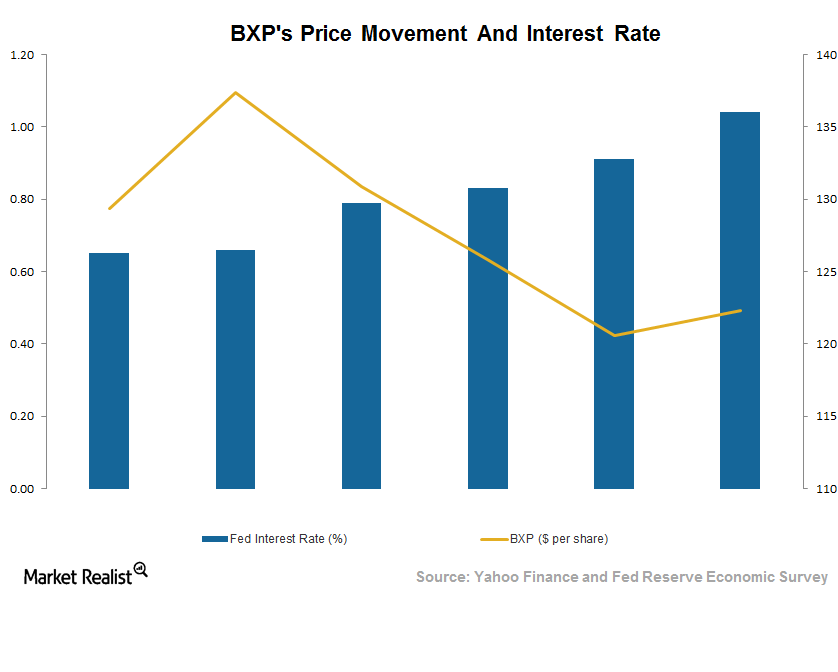

How Boston Property Is Flourishing despite Rising Interest Rates

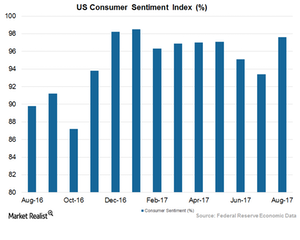

Although it is a common belief that high interest rates are usually bad for REITs like Boston Properties (BXP), Simon Property (SPG), Prologis (PLD), and Vornado Realty Trust (VNO), we find that REITs have continued in their growth trajectory in the past few months.

Can Boston Properties Flourish amid Higher Interest Rates?

REITs have flourished for a considerable period in a record-low-interest-rate environment because they depend on debt and equity for their working capital.

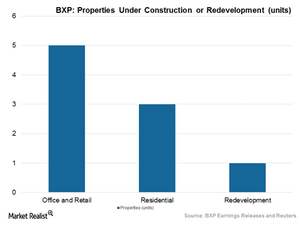

Boston Properties Maintained Profitability with Development Projects

BXP leased properties with a total area of 926,000 square feet in 2Q17.

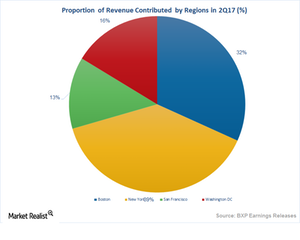

Boston Properties Could Ride High on These Factors

Boston Property (BXP) has strong business momentum and has been maintaining a decent growth trajectory for the past few years.

What Lies Ahead for Boston Properties in 2017?

Boston Properties raised its EPS (earnings per share) outlook for 2017 to a range of $2.72 to $2.77 per share.

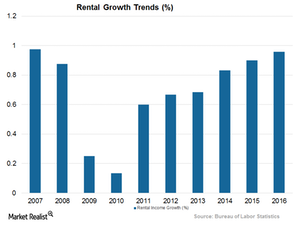

How Did Boston Properties Fare in 1H17?

The growing economy has acted as a boon to REITs, and with the help of their strategic initiatives, these REITs have been able to take advantage of the opportunity and report higher revenue and profits.

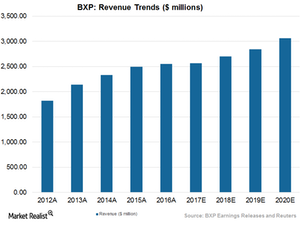

Why Boston Properties Could Be Strong Enough to Combat Headwinds

Boston Properties’ recent upbeat results came on the back of higher leasing activity as well as strong occupancy levels, which led to revenue growth.

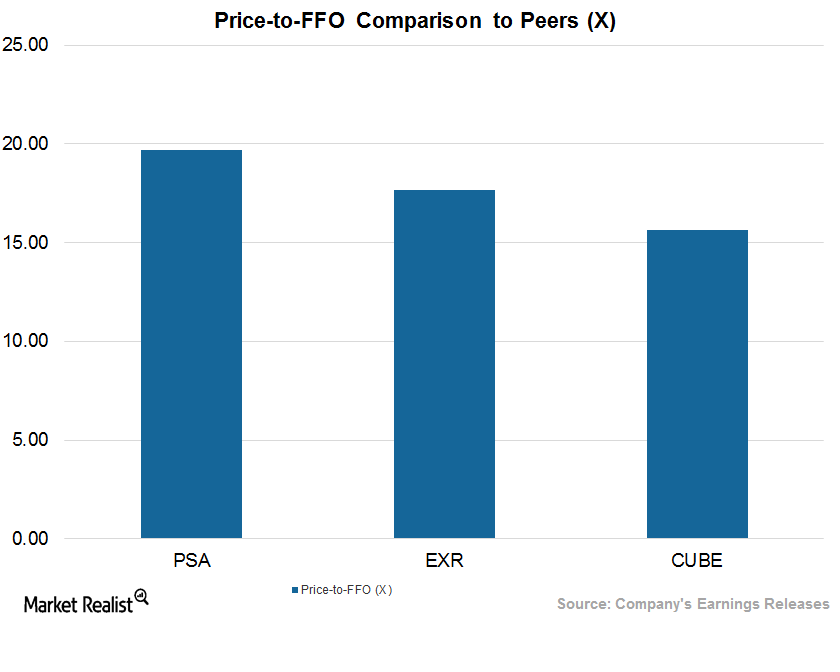

Comparing the Valuations of 3 Leading Self-Storage REITs after 2Q17

Public Storage (PSA) trades at an EV-to-EBITDA multiple of ~21.5x.

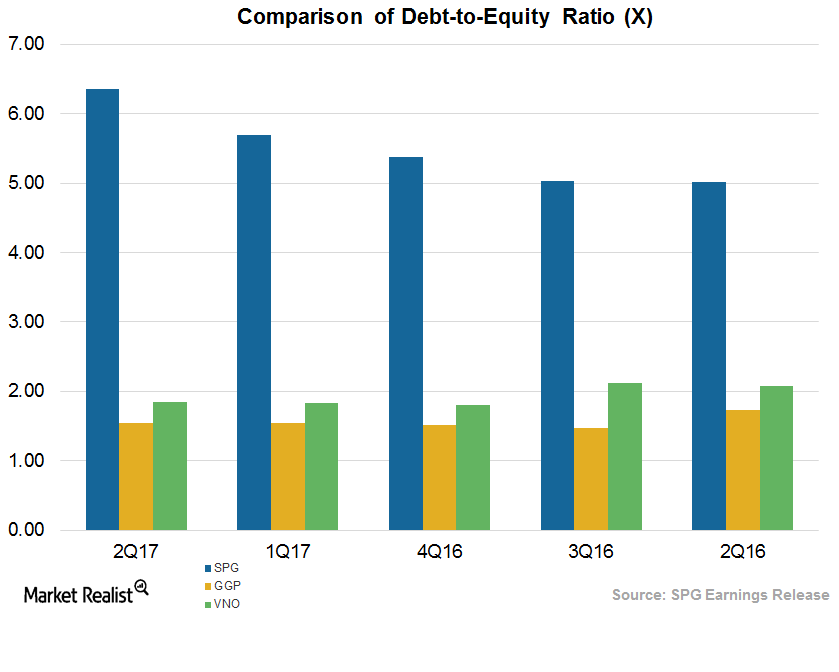

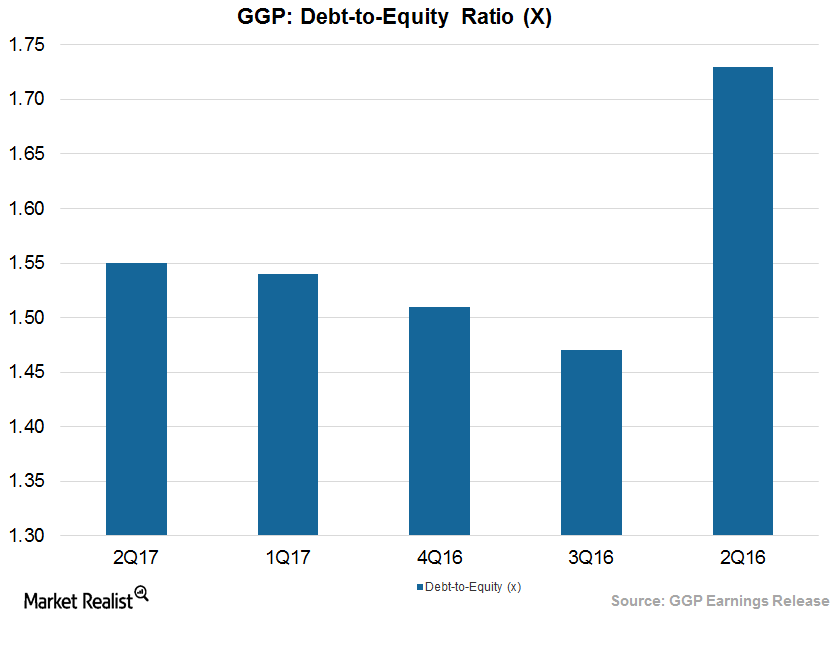

Commercial REITs Have Higher Debt-to-Equity Ratios

GGP’s (GGP) debt-to-equity was 1.55x for 2Q17, which was higher than the industrial mean of 1.07x. As of 2Q17, GGP had $2.0 billion of liquidity.

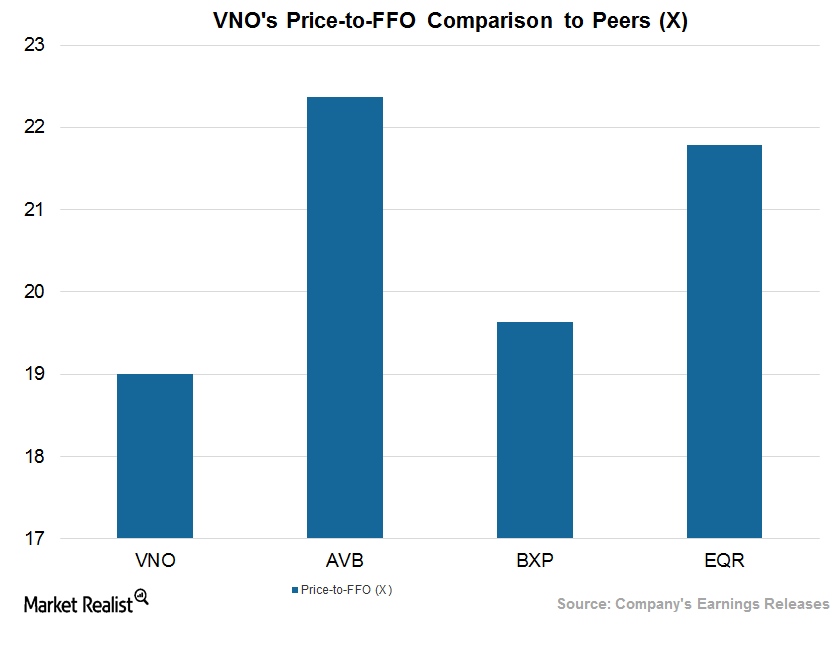

How AvalonBay Compares after 2Q17

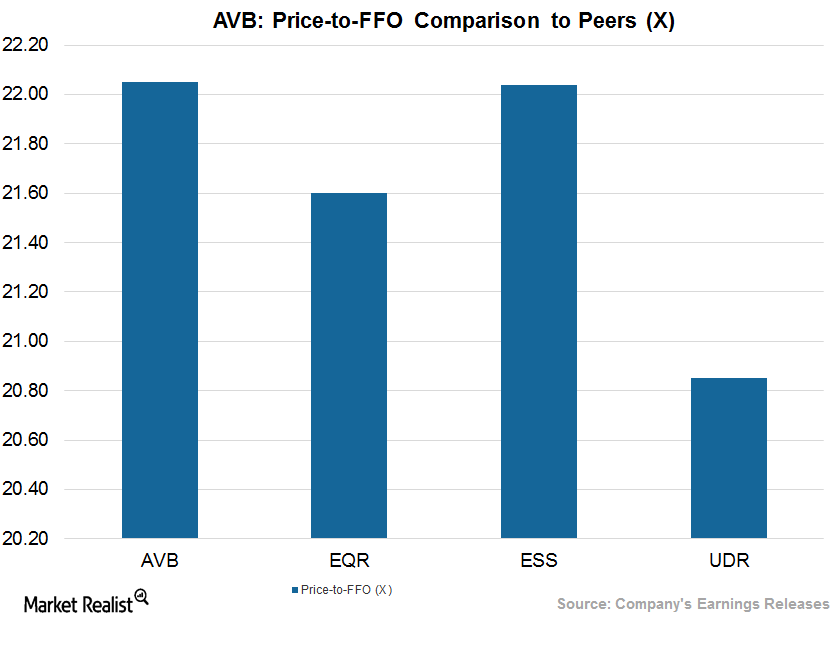

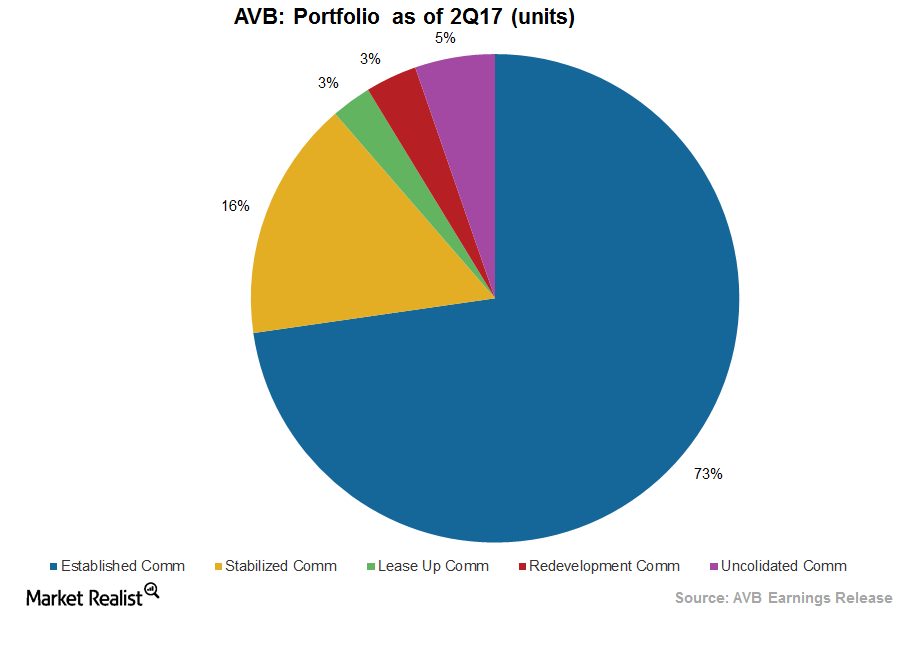

Price-to-funds from operations multiple AvalonBay Communities’ (AVB) performance in 2Q17 can be best evaluated by looking at its price-to-FFO (funds from operations) multiple. The multiple, widely used for REITs, gives an idea of how much an investor pays for a particular stock per unit of its profit. The multiple, which has the same implications as the price-to-earnings […]

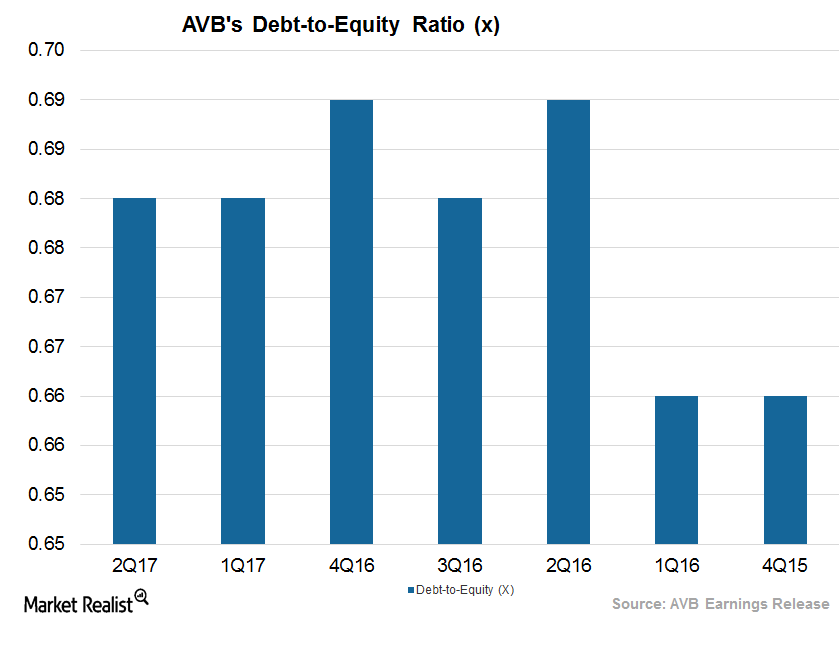

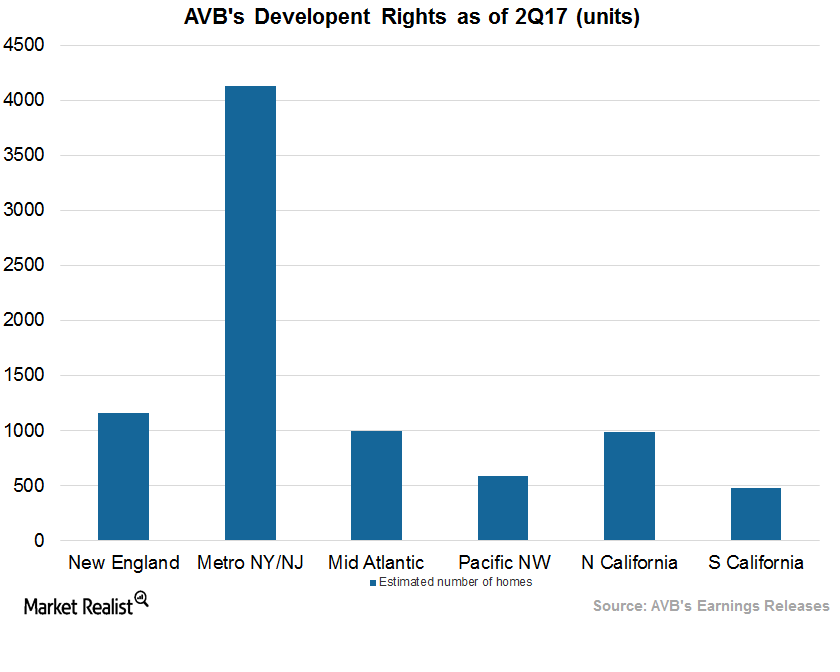

Financing Activities Leverage AvalonBay’s Balance Sheet in 2Q17

Performance in 2Q17 AvalonBay Communities (AVB) has undertaken several development, redevelopment, and expansion projects to maintain its share in the market. It invested $400 million in new developments during the quarter. REITs such as UDR (UDR), Essex Property Trust (ESS), and Equity Residential (EQR) fund these activities with the help of debt and equity. Therefore, […]

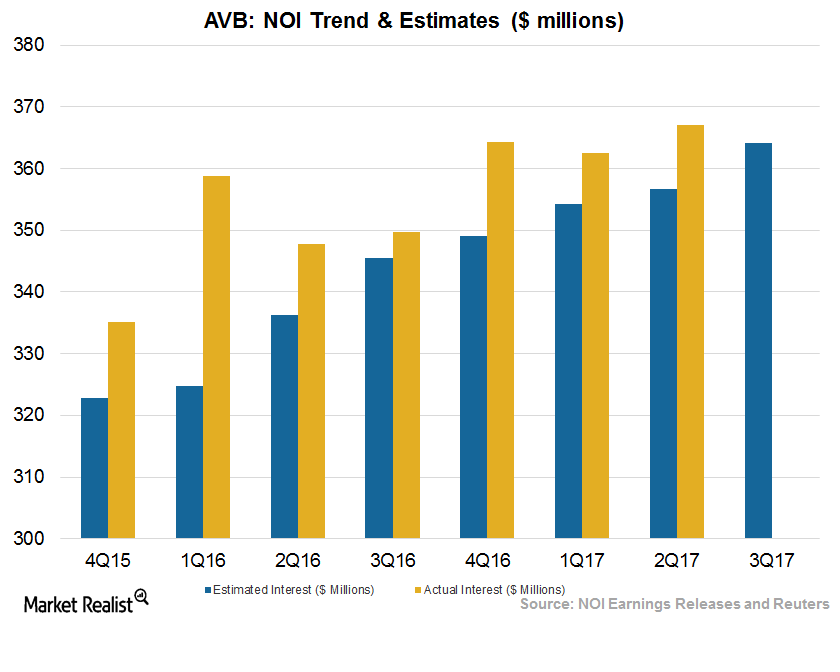

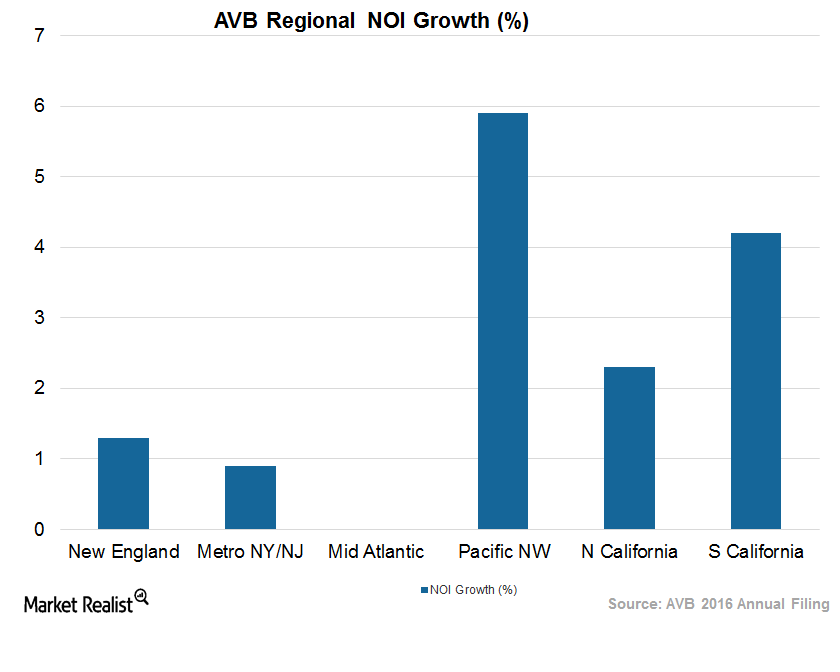

Income Rises in 2Q17, AvalonBay Expects Higher Expenses

Income generated in 2Q17 AvalonBay Communities (AVB) reported NOI (net operating income) of $367.1 million, compared with $339.6 million in 2Q16. The Northern California region reported the highest NOI of $64.6 million, followed by the New York metropolitan area, which reported NOI of $61.5 million. Development and redevelopment communities reported NOI growth of $40.1 million, […]

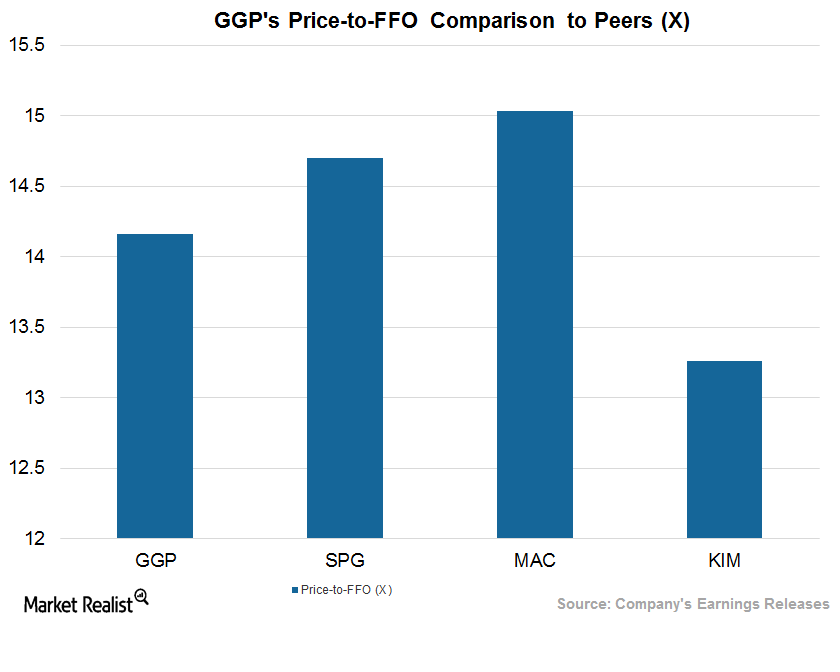

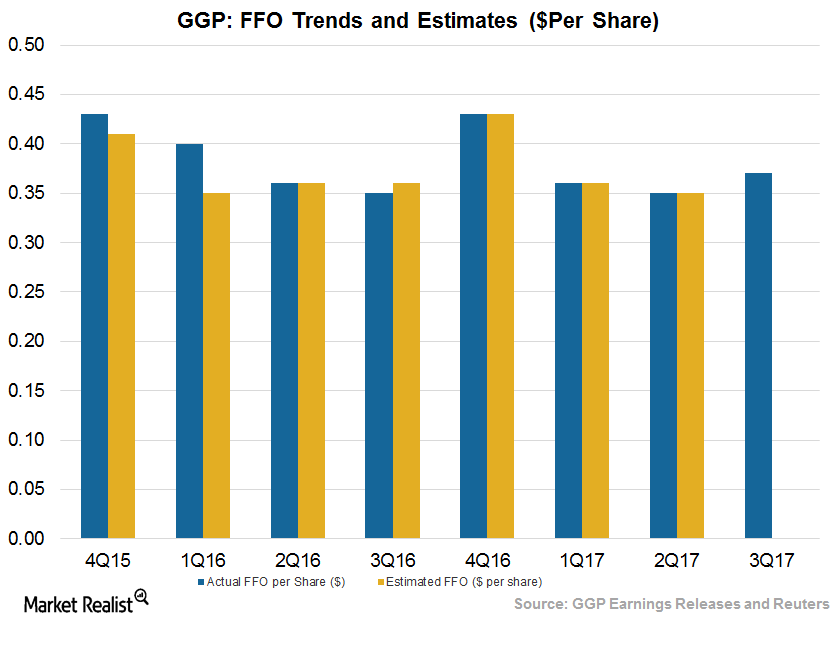

How GGP Stacks Up against Its Peers after 2Q17

GGP’s estimated price-to-FFO multiple for fiscal 2018 is 14.2x, which is at a premium compared to its peers.

How Geography Affected AvalonBay’s 2Q17 Results

Wide geographical diversity AvalonBay Communities (AVB) has its assets well placed in high-demand Class A cities. These cities have soaring job growth, a high barrier to entry for competitors, and proximity to premium infrastructure. REIT peers UDR (UDR), Equity Residential (EQR), and Essex Property Trust (ESS) are repositioning their properties to Class A cities and […]

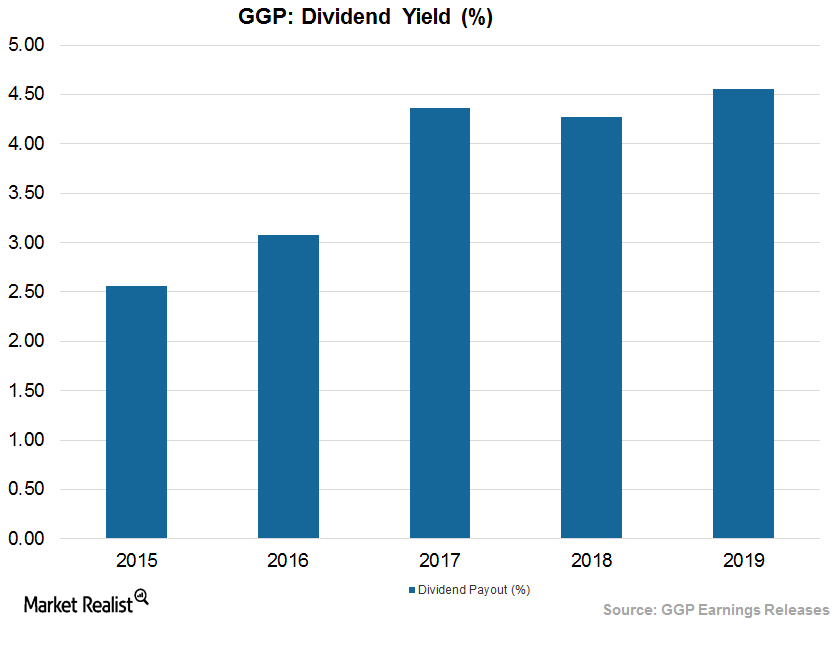

GGP’s Generous Return to Stockholders in 2Q17

In 2Q17, GGP (GGP) paid $17.5 million in dividends to its shareholders. That was higher than $13.3 million paid a year ago.

AvalonBay Maintains Profit with Strategic Capital Deployment

Demographic shift American demographics are shifting towards Class A cities with high-income growth and demand for residential apartments. These cities offer job prospects and proximity to offices, schools, and other necessities for premium social living. Although these cities also have high barriers to entry, more residential apartment owners are repositioning their properties in these areas. […]

GGP Has High Debt-to-Equity Ratio as of 2Q17: Can It Be Lowered?

GGP maintained a debt-to-equity ratio of 1.55x for 2Q17. That was higher than the industrial mean of 1.07x.

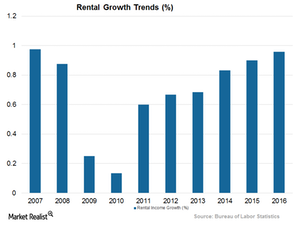

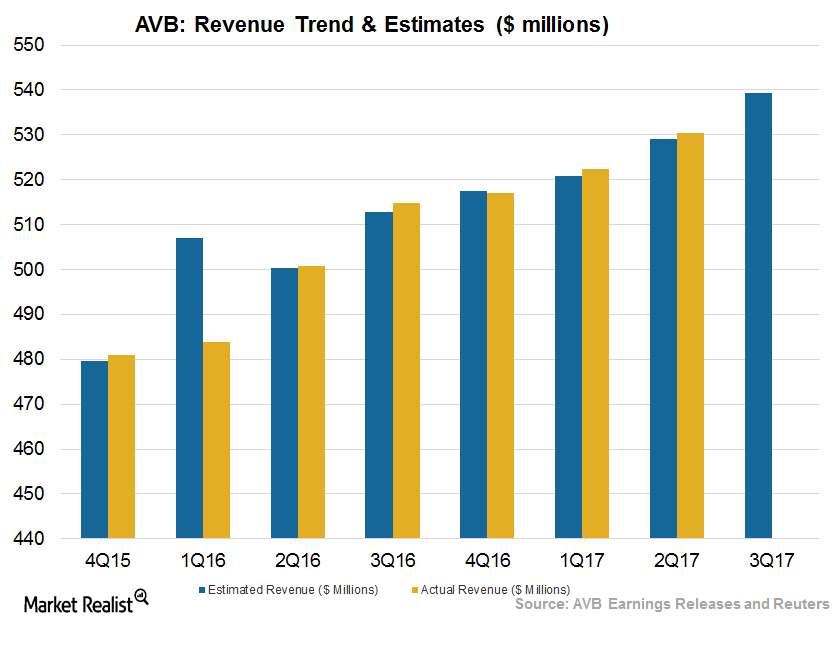

AvalonBay Revenue Climbs in 2Q17, Backed by Rent Growth

Robust 2Q17 driven by rent growth AvalonBay Communities’ (AVB) total revenue of $530.5 million marginally surpassed Wall Street estimates by 0.3%. However, revenue rose by almost 6% from the year prior. Upbeat top-line growth reflected growth in development communities and stabilized operating communities. Same-store revenue rose 2.5% year-over-year. Including revenue from redeveloped communities, same-store revenue […]

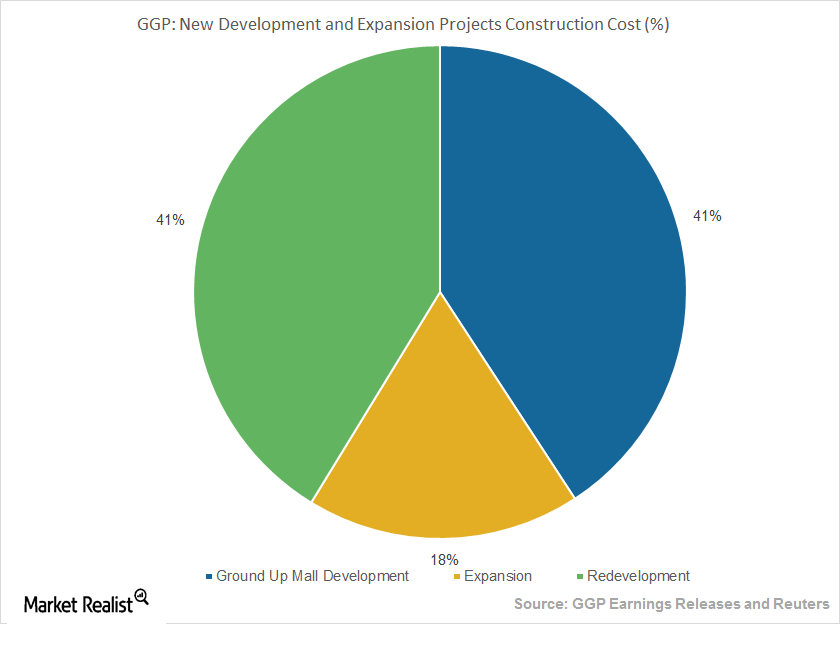

GGP Grew in 2Q17 Due to Development and Redevelopment

GGP has redeveloped its vacant spaces for non-retail uses such as restaurants, entertainment zones, fitness centers, and grocery stores.

What Lies Ahead for AvalonBay

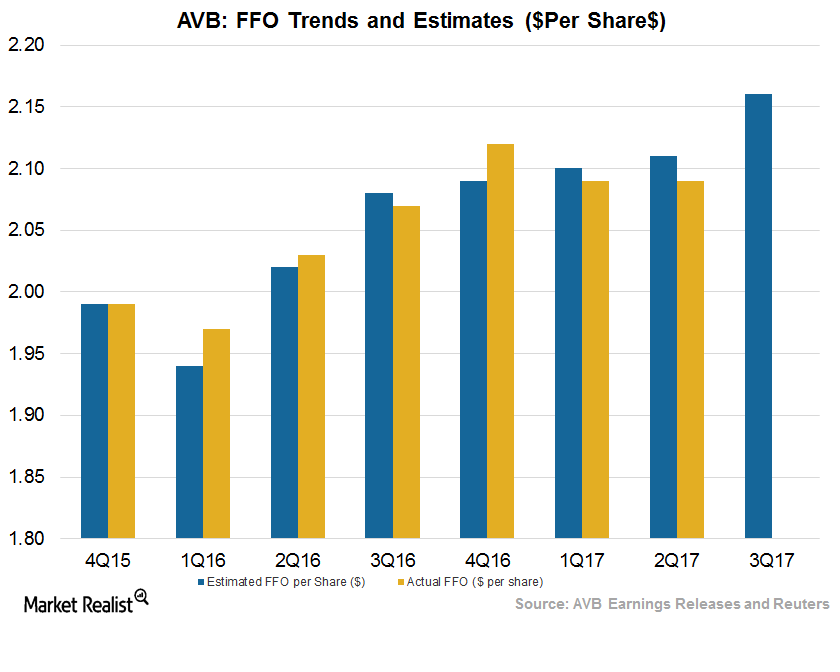

Robust 2Q17 results AvalonBay Communities’ (AVB) top and bottom lines exceeded expectations, backed by higher net operating income growth of 8.1%. Factors affecting profit during 2Q17 Higher occupancy and rent growth in development communities and stabilized operating communities led to upbeat results during the quarter. Higher funds from operations expected for 3Q17 AvalonBay expects […]

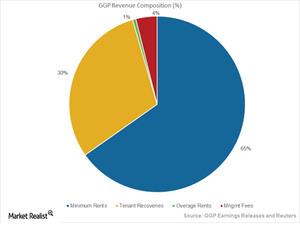

What Caused GGP’s Soft Rent Growth in 2Q17?

GGP’s (GGP) minimum rent fell by $17.0 million in 2Q17, mainly because of dilution resulting from the sale of an interest in the Fashion Show Mall in Las Vegas n 2016.

Where AvalonBay Stands after Its 2Q17 Earnings Release

AvalonBay Communities (AVB) reported core FFO (funds from operations) of $2.09 per share, in line with Wall Street estimates.

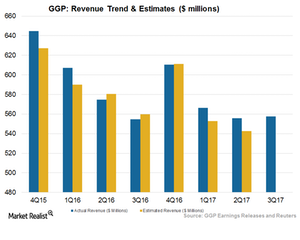

GGP’s Revenue Rode High in 2Q17, Backed by New Leases

GGP’s minimum rent fell 3.9% to $349.2 million, and tenant recoveries fell 4.6% to $161.9 million. Overage rent fell 25.0% to $3.3 million.

GGP’s 2Q17 Results from an Investor’s Perspective

GGP (GGP) reported funds from operations (or FFO) of $0.35 per share, which was in line with Wall Street estimates. Adjusted FFO remained flat year-over-year.

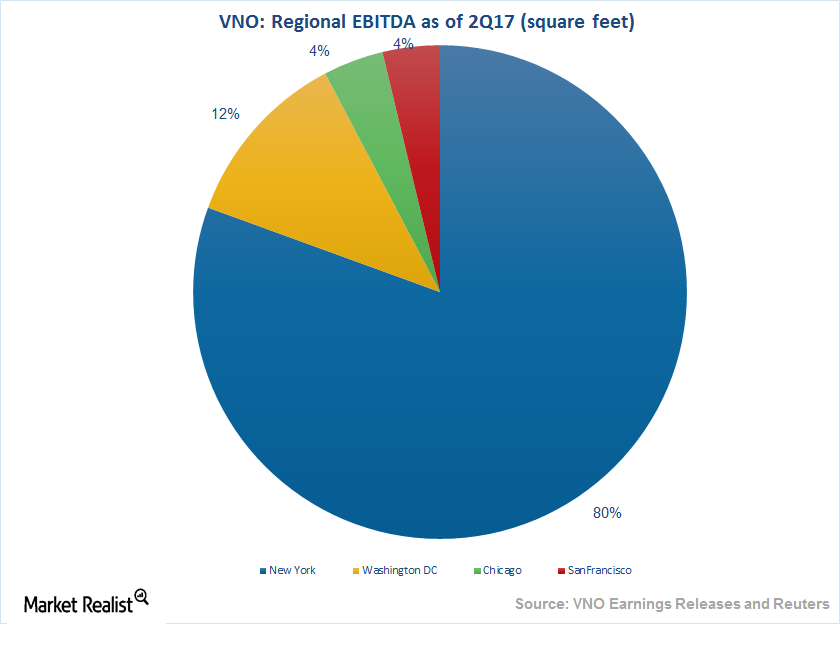

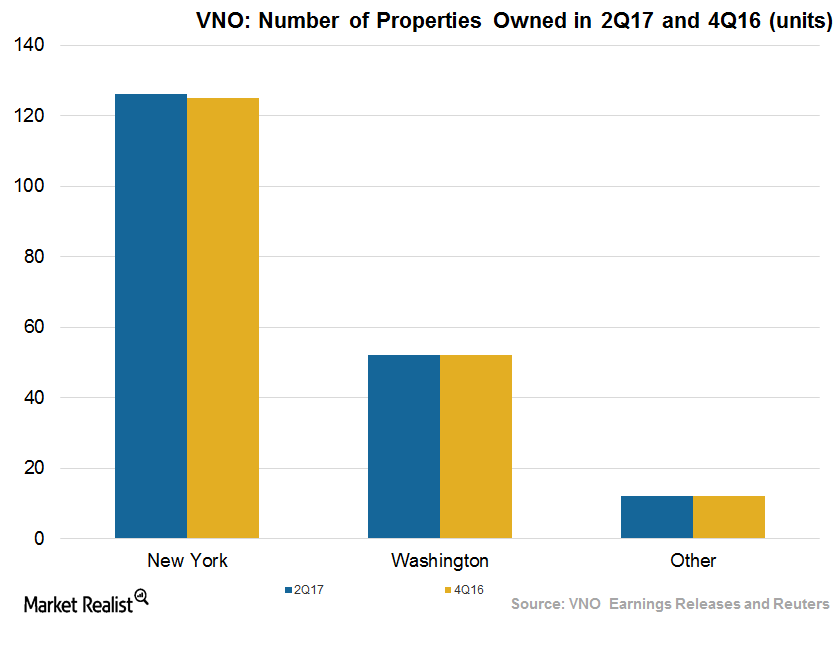

How Vornado Stacks Up against Peers

Vornado’s recent development and redevelopment activities have made investors optimistic about the stock.

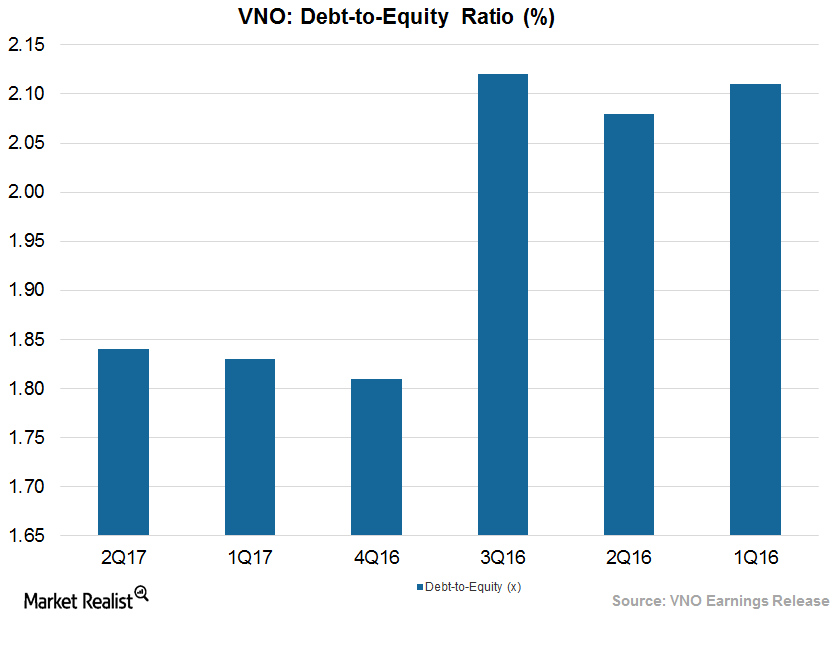

Financing Helped Vornado Maintain Strong Balance Sheet in 2Q17

During 2Q17, Vornado Realty Trust (VNO) reported higher year-over-year top-line and bottom-line results backed by growth in rent and occupancy level.

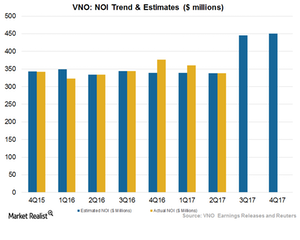

Did Vornado’s Cost Reduction Efforts Bear Fruit in 2Q17?

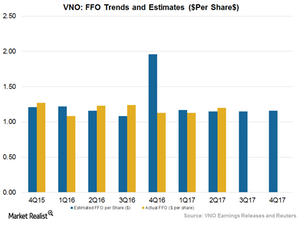

Vornado Realty Trust reported adjusted FFO (funds from operation) of $1.35 per share, which beat Wall Street estimates of $1.20 per share.

How Recent Disposition Activities Helped Vornado in 2Q17

Vornado Trust’s (VNO) top-line and bottom-line results improved year-over-year backed by higher rent growth and lower operational costs.

Project Development Spurred Vornado’s Growth in 2Q17

Vornado Realty Trust (VNO) reported decent results in 2Q17. Its top line and bottom line surpassed results from 2Q16 backed by higher rent and new lease activities.

Where Does Vornado Stand after 2Q17 Earnings?

Vornado Realty Trust (VNO) reported core funds from operation (or FFO) of $1.35 per share in 2Q17, which surpassed Wall Street estimates of $1.20 per share.