How Does Boston Properties Compare to Peers?

Boston Properties’ (BXP) valuation multiple can help us understand its expected performance for the rest of the year.

Sept. 6 2017, Updated 7:36 a.m. ET

The multiple that is most suitable for REITs

Boston Properties’ (BXP) valuation multiple can help us understand its expected performance for the rest of the year. The best valuation multiple to use for REITs is its price-to-FFO (funds from operation) multiple, which is the amount an investor pays per unit of the company’s profit.

The price-to-FFO multiple, used for evaluating REITs, carries the same significance as the price-to-earnings multiple for companies operating in other sectors.

The price-to-FFO multiple for BXP

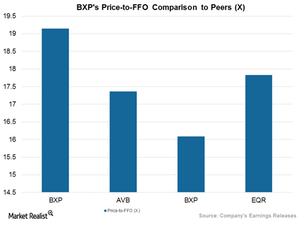

Boston Properties trades at a price-to-FFO multiple of 19.15x. Although this is slightly above peers in the industry, the stock is cheaper than Equity Commonwealth (EQC) and AvalonBay Communities, which trade at 31.50x and 22.19x, respectively.

Boston Properties has reported higher-than-expected results for the first half of 2017. The company has surpassed analysts’ expectations for both revenue and FFO. Plus, the company has enhanced guidance for fiscal 2017. Further, Boston Properties has carried out several development and expansion projects in order to maintain profitability. It has positioned its properties in Class A cities like Boston, New York, Washington DC, and San Francisco, giving it ample opportunity to boost profit. These high-income growth cities have high demand for the company’s office and residential properties.

Other Boston Properties peers like Vornado Realty Trust (VNO), Corporate Office Property Trust (OFC), and Washington Real Estate Investment Trust (WRE) trade at price-to-FFO multiples of 17.36x, 16.09x, and 17.83x, respectively.

EV-to-EBITDA multiple

Another multiple used for evaluating REITs is the enterprise value to earnings before interest tax and depreciation multiple. BXP trades at an EV-to-EBITDA of 20.45x. VNO, OFC, and WRE trade at multiples of 19.93x, 18.41x, and 20.31x, respectively. BXP and VNO account for almost 4% of the First Trust S&P REIT ETF (FRI).