First Trust S&P REIT Index Fund

Latest First Trust S&P REIT Index Fund News and Updates

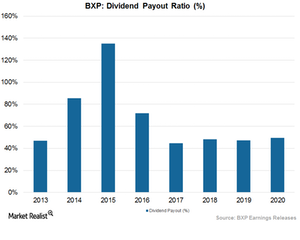

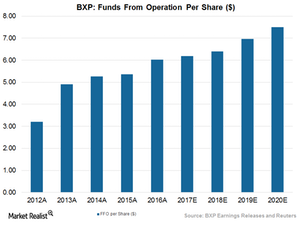

How Boston Properties Returns Value to Shareholders

In order to qualify as REITs (real estate investment trusts), companies usually have to pay 90% of their profits (excluding capital gains) as dividends.

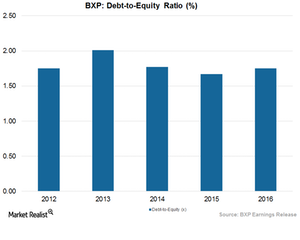

What’s Boston Properties’ Balance Sheet Position?

REITs depend on equity and debt for their working capital.

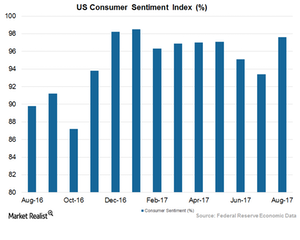

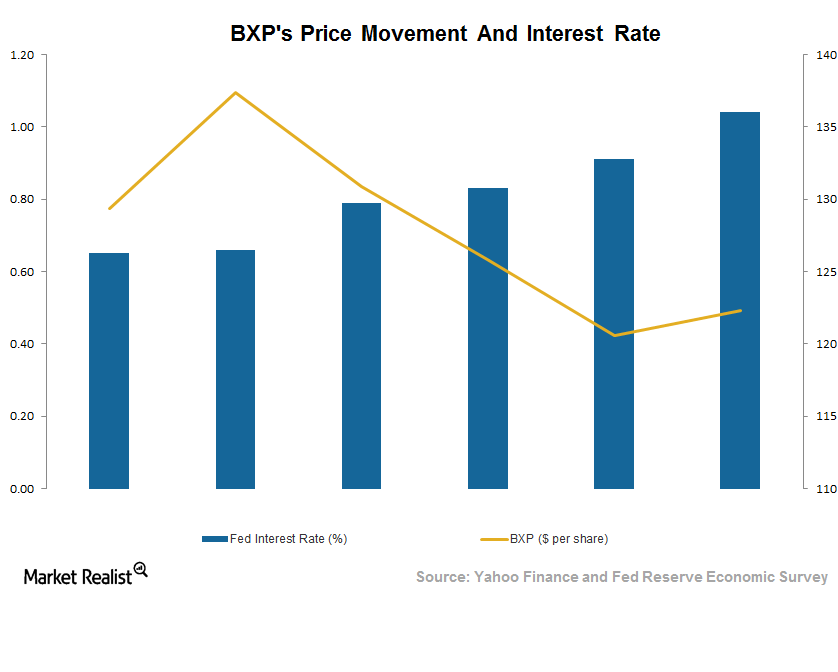

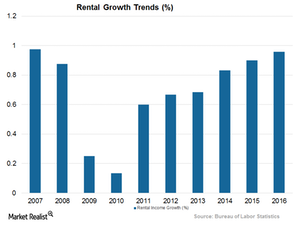

How Boston Property Is Flourishing despite Rising Interest Rates

Although it is a common belief that high interest rates are usually bad for REITs like Boston Properties (BXP), Simon Property (SPG), Prologis (PLD), and Vornado Realty Trust (VNO), we find that REITs have continued in their growth trajectory in the past few months.

Can Boston Properties Flourish amid Higher Interest Rates?

REITs have flourished for a considerable period in a record-low-interest-rate environment because they depend on debt and equity for their working capital.

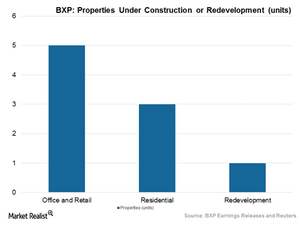

Boston Properties Maintained Profitability with Development Projects

BXP leased properties with a total area of 926,000 square feet in 2Q17.

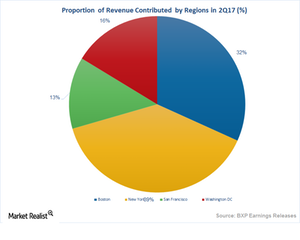

Boston Properties Could Ride High on These Factors

Boston Property (BXP) has strong business momentum and has been maintaining a decent growth trajectory for the past few years.

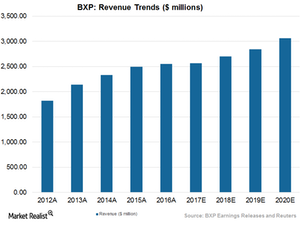

What Lies Ahead for Boston Properties in 2017?

Boston Properties raised its EPS (earnings per share) outlook for 2017 to a range of $2.72 to $2.77 per share.

How Did Boston Properties Fare in 1H17?

The growing economy has acted as a boon to REITs, and with the help of their strategic initiatives, these REITs have been able to take advantage of the opportunity and report higher revenue and profits.

Why Boston Properties Could Be Strong Enough to Combat Headwinds

Boston Properties’ recent upbeat results came on the back of higher leasing activity as well as strong occupancy levels, which led to revenue growth.

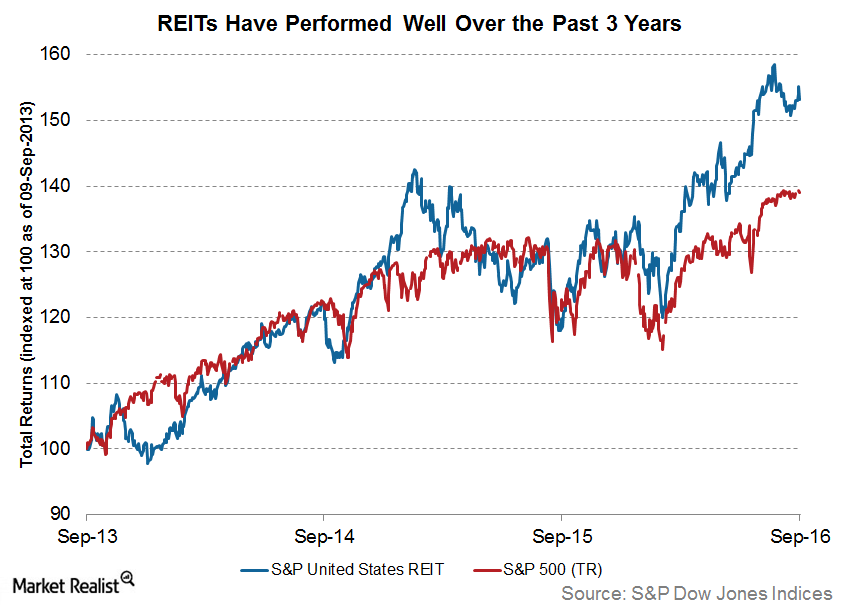

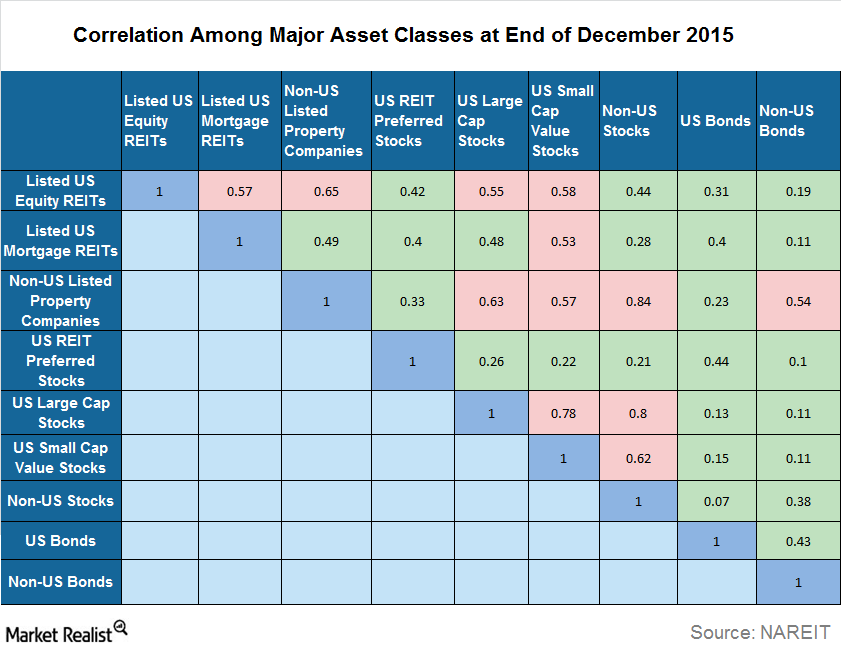

The REIT Advantage: High Return, Low Correlation

RETURNS AND RISKS OF REITS REIT and property stock performance has been relatively strong over the long term, especially when compared with traditional bond and equity indices. Since 1992, the Dow Jones Global Ex-U.S. Select RESI has had an average total return close to 9%, while the Dow Jones U.S. Select REIT Index has had […]

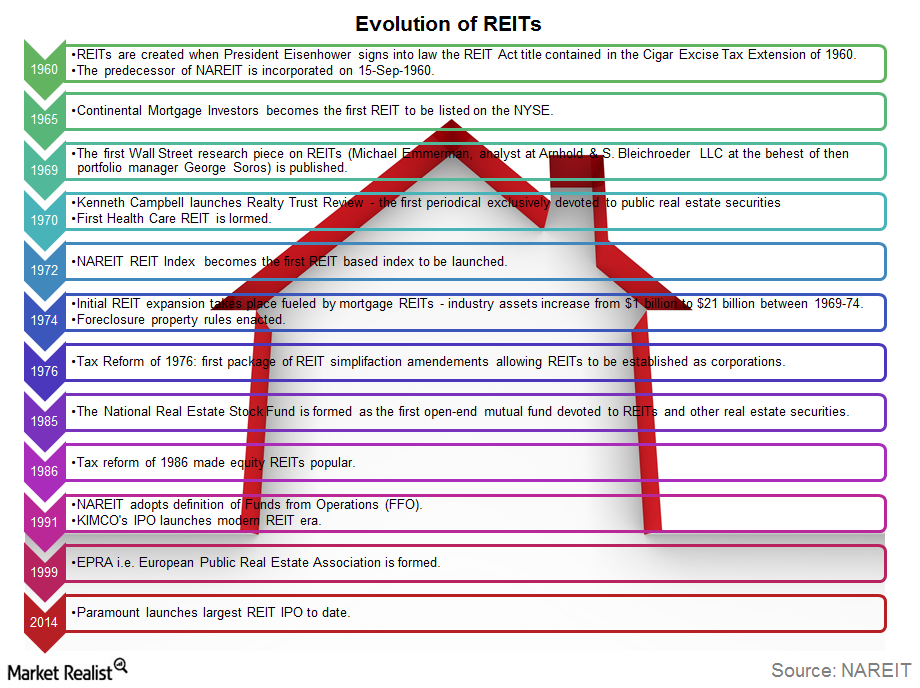

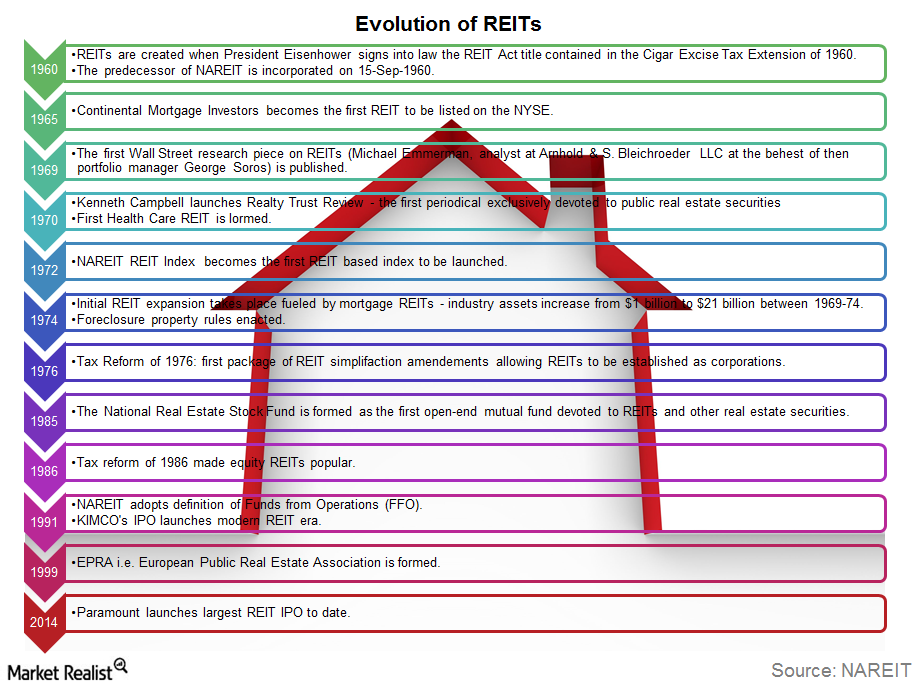

The Evolution of the REIT

The Evolution of REITs The basic concept of REITs originated with the business trusts that were formed in Massachusetts in the mid-19th century, when the wealth created by the industrial revolution led to a demand for real estate investment. The first REIT was set up in 1961, but it took several decades before REITs were […]

The REIT Advantage: High Returns, Low Correlation

Not only do REITs tend to provide steady and stable returns over the long term, but they also help in diversifying investor portfolios effectively.

The Evolution of REITs

The REITs (IYR) sector has shown phenomenal growth over the years. In the past five decades, REITs have grown to a market cap of nearly $1 trillion.