Jennifer Mathews

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Jennifer Mathews

How Wall Street Analysts Rate Vornado Realty Trust

Analysts assigned VNO a mean price target of $108.18, which is 12.9% higher than its current price level.

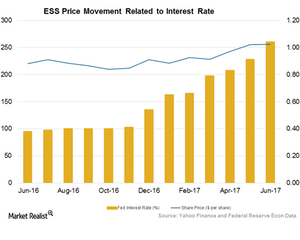

How High Interest Could Affect ESS and Residential REITs

REITs such as Essex Property Trust (ESS) yielded high returns in the long period during which interest rates were below average.

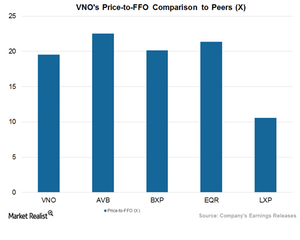

Where Vornado Stands among Its Peers

Vornado Realty Trust (VNO) currently offers a next-12-month (or NTM) dividend yield of 3%, which is in line with its close competitors.

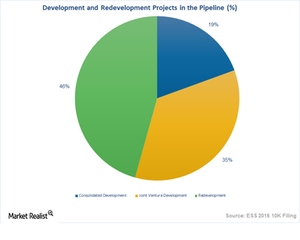

Development Projects Helps Essex Property Combat REIT Headwinds

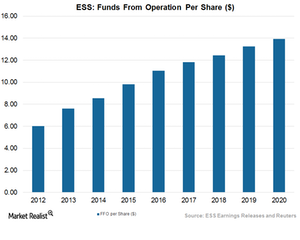

Amid the shifting residential REIT scenario, Essex Property Trust (ESS) has been able to maintain its dominant position.

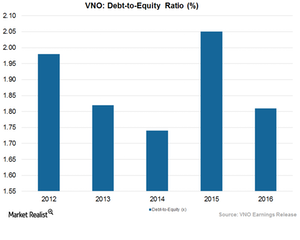

How Well Does Vornado Leverage Its Balance Sheet?

Vornado Realty Trust’s (VNO) total debt-to-total-equity ratio was 153.8%.

Essex Property to See Growth due to Winning Strategies

The current macroeconomic scenario is conducive for growth in the residential REIT (real estate investment trust) sector.

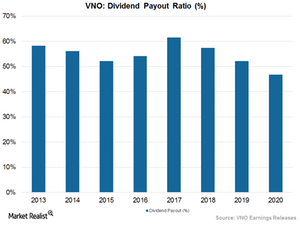

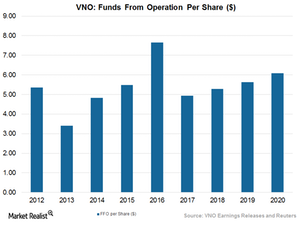

An Analysis of Vornado’s Shareholder Returns

Vornado Realty Trust (VNO) has been paying dividends to its shareholders consistently in every quarter since it became a public company in 1998.

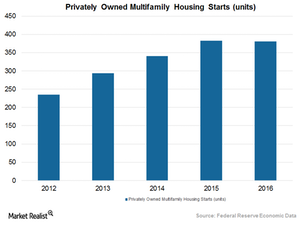

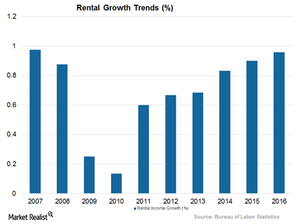

Essex Property and Residential REITs Are Poised to Grow

The home building sector has set itself a course for smooth sailing amid the current favorable economic scenario.

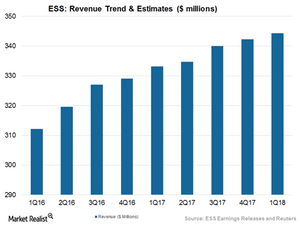

How Essex Property Maintains Its Revenue Growth

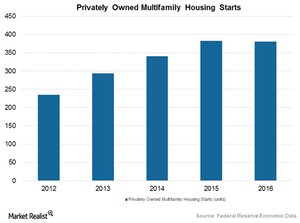

A slow and steady improvement in the job market and rising optimism among consumers about their economic welfare has triggered a spike in the construction sector.

Essex Property: An Apartment REIT Standing Strong amid Headwinds

The current economic environment has made investors skeptical about the real estate investment trust (or REIT) industry.

Vornado amid the Economic Transition under President Trump

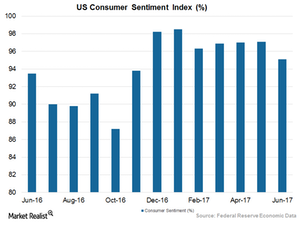

According to the University of Michigan, the June 2017 consumer sentiment index gained 1.7% year-over-year, standing at 95.1%.

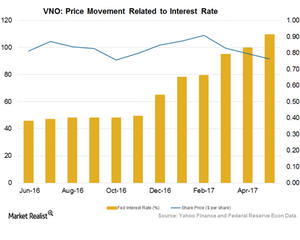

The Fed’s Interest Rate Hike—A Challenge for Vornado Realty Trust

After increasing interest rates in December 2016, the Fed hiked rates in March and June 2017 by 0.25%.

Vornado Realty Trust—Development, Redevelopment, and Occupancy

Vornado Realty Trust (VNO) invested in developing a high-demand office property in Highline at 512 West 22nd Street in Manhattan, which covers 173,000 square feet.

Vornado Realty Trust Works to Streamline Its Operations

Vornado Realty Trust (VNO) disposed of its 32.7% stake in Toys “R” Us and Urban Edge Properties as part of its strategy to concentrate on its core business.

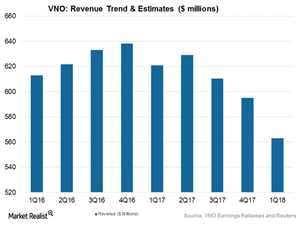

A Look at Vornado’s Top-Line Performance

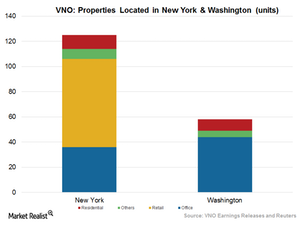

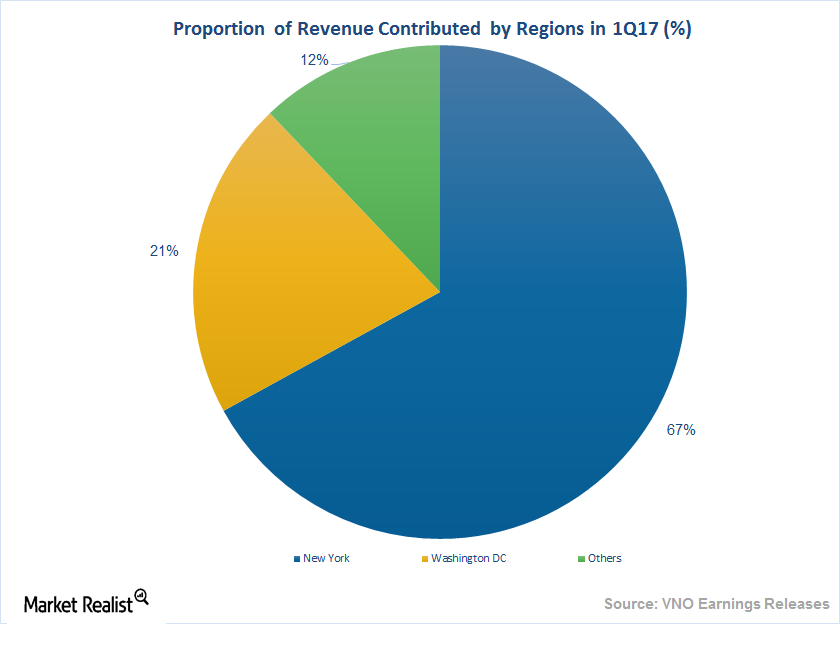

Vornado Realty Trust (VNO) is in talks to finalize the tax-free spinoff of its business in Washington, D.C. VNO expects to concentrate solely on its New York business after the spinoff.

Vornado Realty: A Commercial REIT Thriving amid a Retail Crisis

Vornado Realty Trust (VNO) is selling off its non-performing assets and focusing on its core business in a move to improve its profitability. Analysts are encouraged by Vornado’s strategy of optimizing its profits.

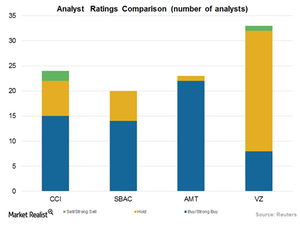

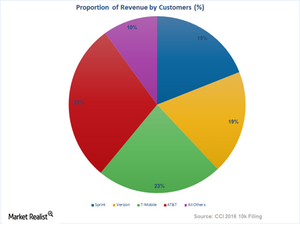

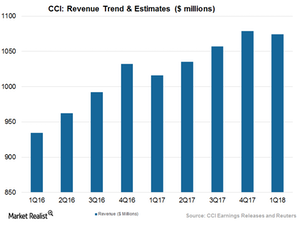

Crown Castle on the Street: Inside the Analyst Ratings

Analysts have given CCI a mean price target of $106.83, implying a rise of 7.1% from its current level of $99.75.

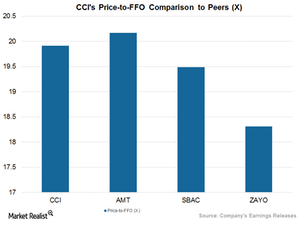

Where Crown Castle Stands among the Biggest Industry Players

CCI’s higher price-to-FFO multiple reflects the company’s ability to yield consistent capital value and its distribution of reliable and steady dividends.

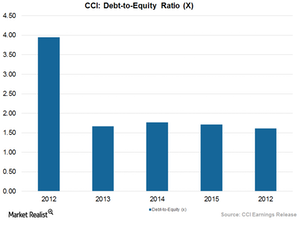

How Well Is Crown Castle Leveraging Its Balance Sheet?

It’s extremely important for REITs to maintain optimum debt levels, and managers work constantly to leverage balance sheets in the best possible ways.

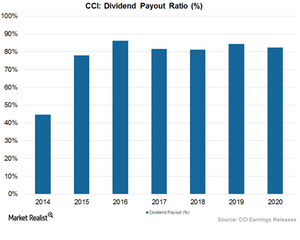

Why Some Are Investors Are Bullish on Crown Castle

REITs (real estate investment trusts) typically have to pay 90% of their taxable income to shareholders to qualify as an equity.

Is Telecom Consolidation Threatening Crown Castle?

The changing political scenario under the Trump administration has led to the anticipation of widespread M&A activity in the telecom industry.

Crown Castle amid the 5G Threat to Cell Towers

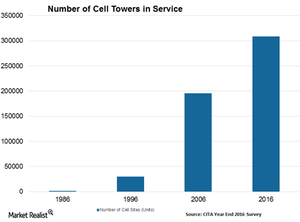

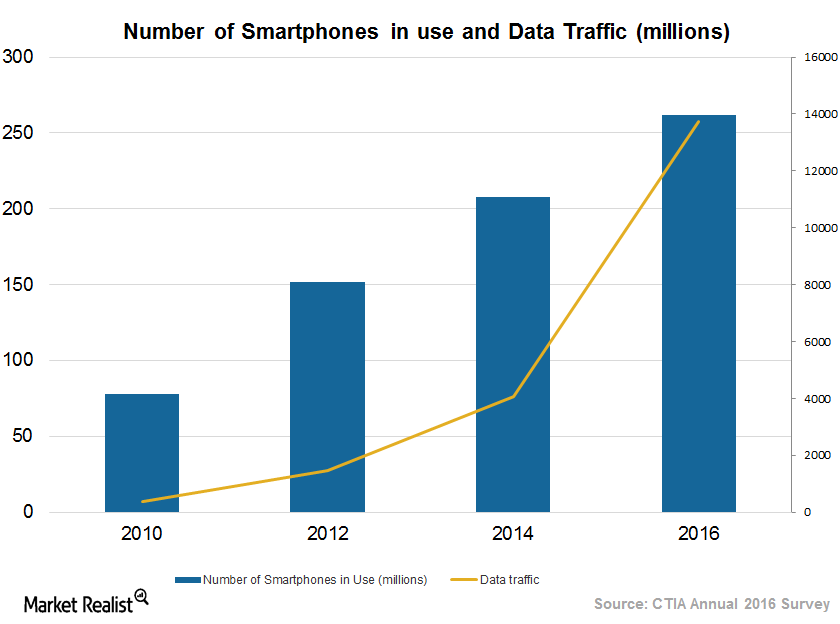

Many wireless providers are now opting for 5G (fifth-generation) technology for higher speeds and network reliability.

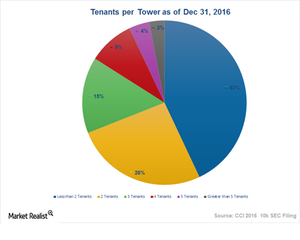

Inside Crown Castle’s Business Model

Crown Castle is expected to ride high on higher profitability, and analysts expect it to register significant AFFO (adjusted funds from operations) growth.

Why Crown Castle Expects to See Revenue Growth

Crown Castle is expected to keep riding high on its current growth trajectory, driven by strategic investments and exposure to the booming small cell business.

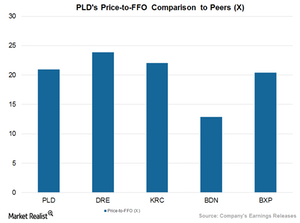

Understanding Prologis’s Multiples Next to Those of Peers

Prologis’s price-to-FFO multiple is now 20.95x, which means that it has been returning consistent capital value and reliable dividend yields to investors.

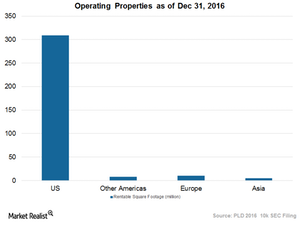

Why Prologis’s Business Model Promises Consistent Profitability

Prologis is expected to achieve a growth rate of 6%, 5.8%, 9.1% and 8.7%, respectively, in AFFO (adjusted funds from operations) over the next four quarters.

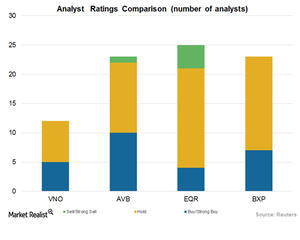

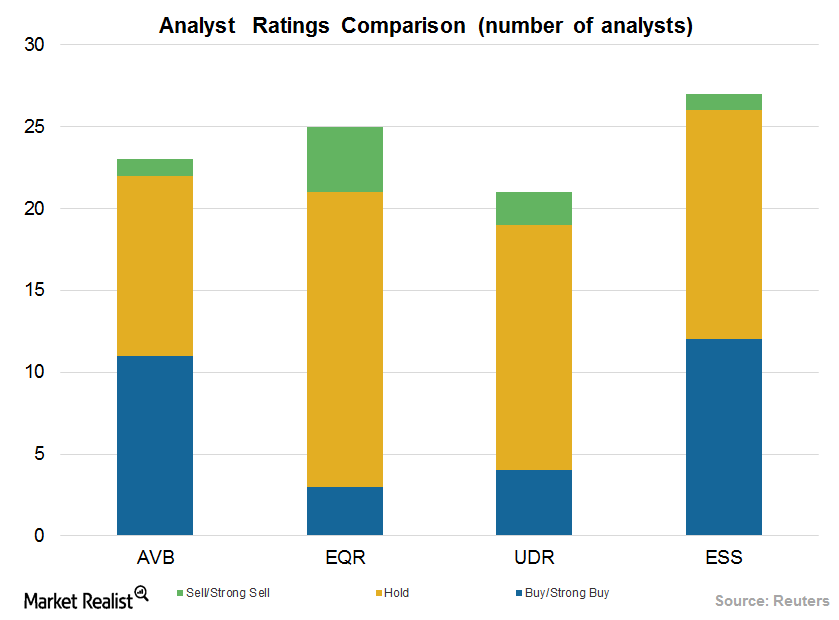

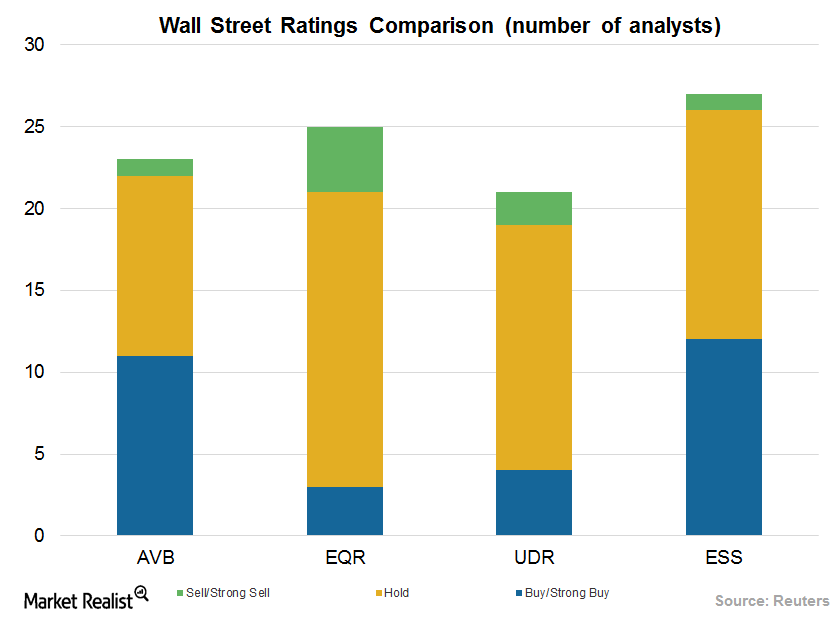

How Wall Street Analysts View AvalonBay Stock

In May 2017, 11 of 23 analysts covering AVB stock issued “buy” or “strong buy” ratings.

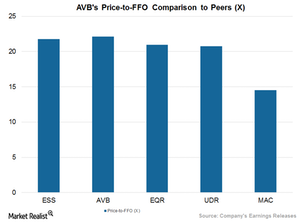

AvalonBay—Comparison with Other Retail REITs in Its Industry

Currently, AvalonBay Communities is offering a next-12-month (or NTM) dividend yield of 3%, which is in line with its close competitors.

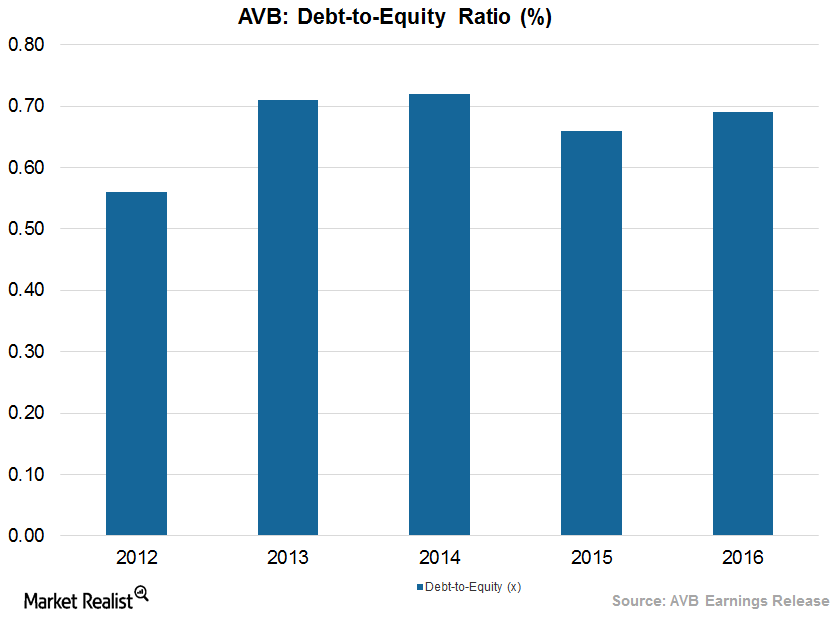

How AvalonBay Communities Leverages Its Balance Sheet

AvalonBay has been able to maintain a low debt-to-equity ratio in the last five years. The company reported a debt-to-equity ratio of ~1.5x in 1Q17.

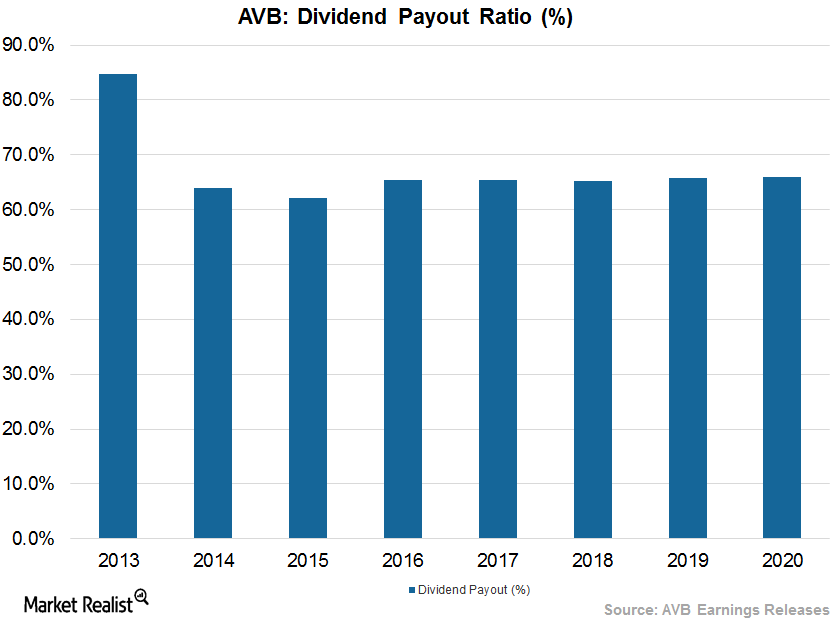

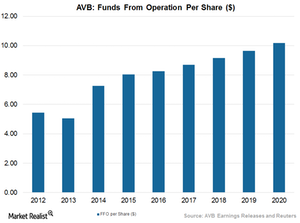

AvalonBay Communities: A Rewarding Stock for Shareholders

During 2016, AvalonBay Communities (AVB) repurchased 57,172 shares worth $0.6 million.

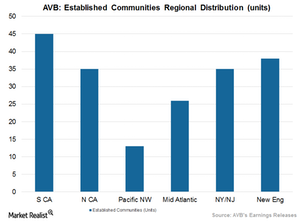

AvalonBay, Residential REITs Target Headwinds through Diversification

During 1Q17, AvalonBay Communities (AVB) had completed the development of projects worth $650 million at an initially projected yield of 5.6%.

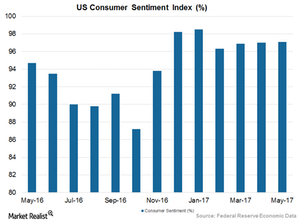

Could Rising Consumer Sentiment Boost REITs Like AVB?

According to the University of Michigan, the consumer sentiment index for May 2017 gained 2.5% year-over-year, standing at 97.1%.

The Impact of Trump’s Proposed 2018 Budget on Residential REITs

According to President Trump’s proposed budget for fiscal 2018, the administration is expected to slash $6 million from the U.S. Department of Housing and Urban Development budget, decreasing its funding by 13.2% to $40.7 billion.

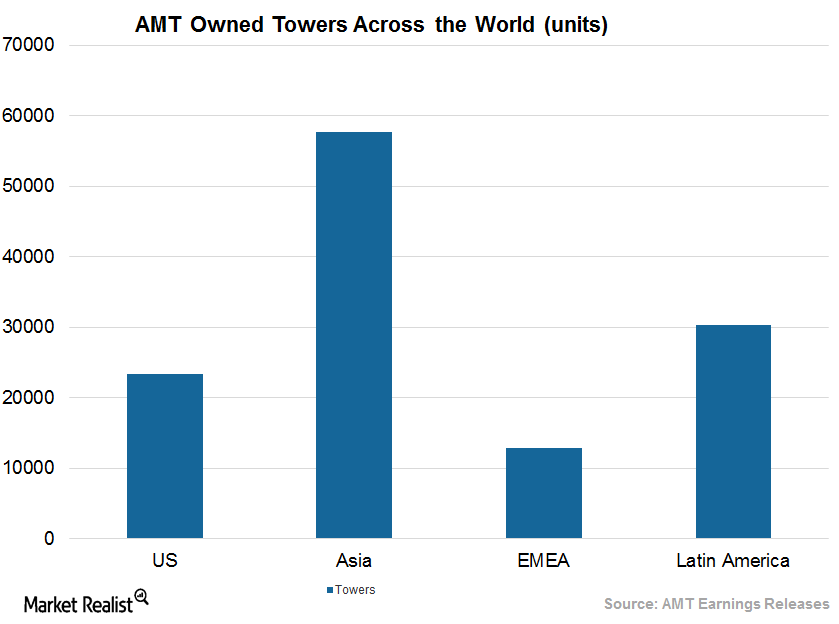

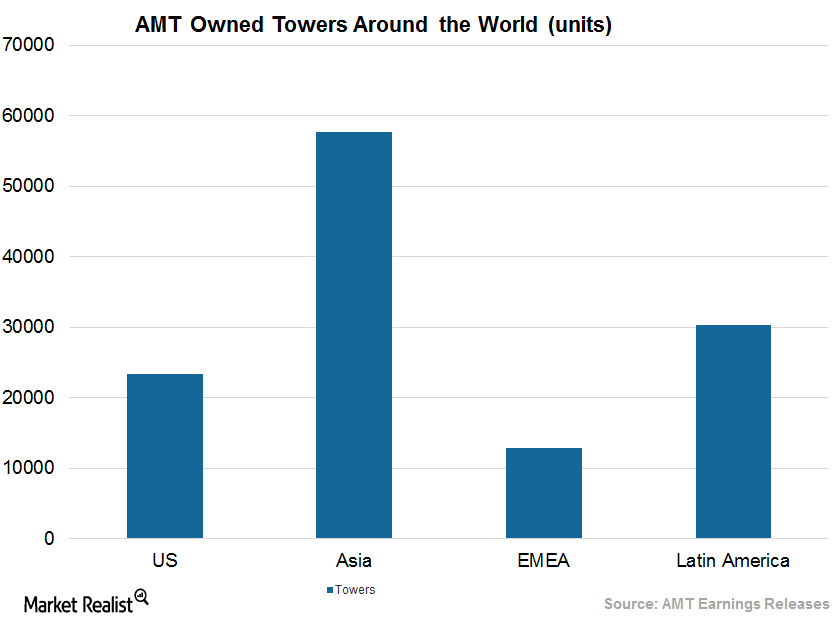

How Wall Street Analysts Rate American Tower

Analysts gave AMT a mean price target of $143.14, implying a rise of 8.7% from its current level of $131.70. In May 2017, 22 of 23 analysts covering AMT stock issued “buy” or “strong buy” ratings.

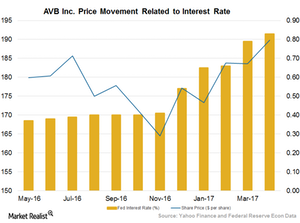

How Rising Interest Rates Impact AVB and Residential REITs

There is wide anticipation in the market that the Federal Reserve could raise interest rates again during its upcoming meeting on June 14, 2017.

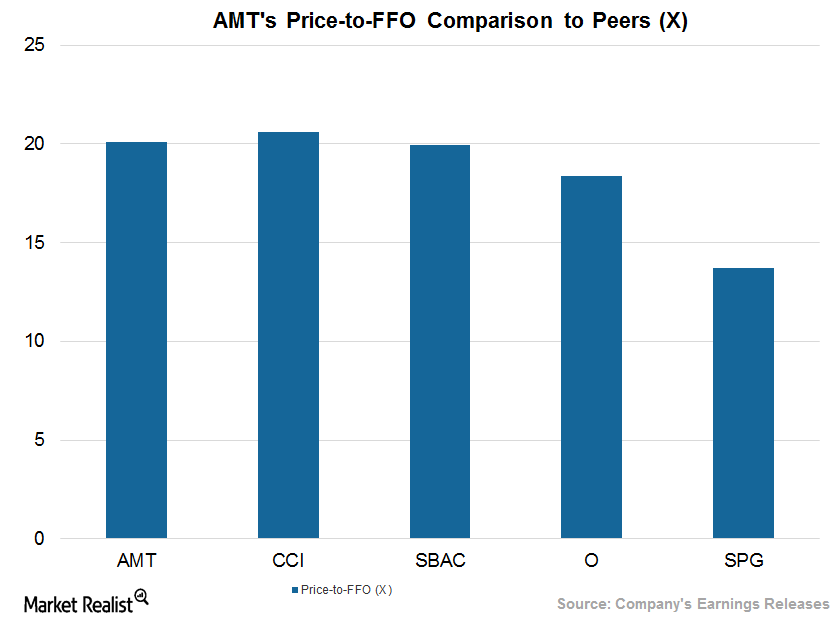

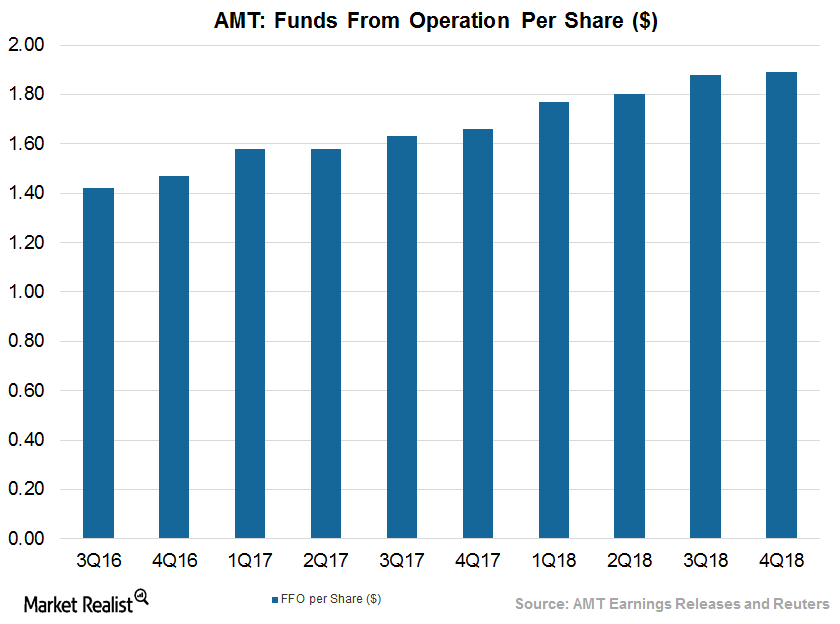

Comparing American Tower with Retail REITs in Its Industry

AMT’s current price-to-FFO multiple is ~20.1x.

AvalonBay Communities and the Residential REIT Industry Overview

According to NHAB’s Housing Economics survey, housing starts are expected to rise 6.2% in 2017 and ~6.3% in 2018, backed by respective 9.6% and ~11.8% gains in single-family home sales.

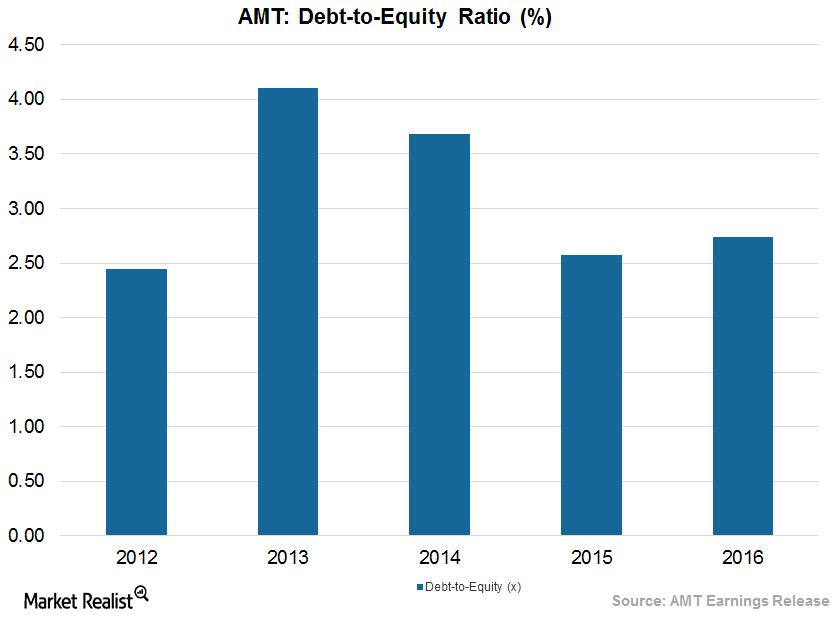

How Well Does American Tower Manage Its Balance Sheet?

AMT reported a debt-to-equity ratio of ~2.8x in 1Q17. The industry median debt-to-equity ratio is ~1.1x.

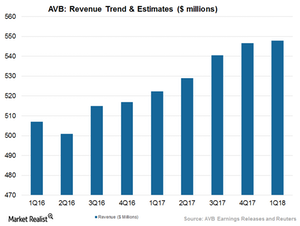

AvalonBay Maintains Revenue Growth amid Industrial Headwinds

AvalonBay’s 1Q17 revenues came in at ~$522.3 million and surpassed estimates by 0.3%.

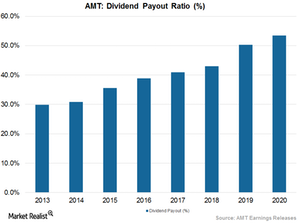

American Tower: A Rewarding Stock for Shareholders

AMT has maintained a consistent dividend yield over the last two years. Its dividend yield was ~1.8% in 2015 and ~2.0% in 2016.

AvalonBay: Weathering Ups and Downs in Residential REITs

In May 2017, 11 of 23 analysts covering AvalonBay Communities (AVB) stock issued “buy” or “strong buy” ratings. Eleven analysts gave AVB a “hold” rating, and one analyst gave it a “sell” or a “strong sell” rating.

How Telecom Industry Ownership Could Affect American Tower

Under the leadership of Ajit Pai and Jeffrey Eisenach, the FCC is expected to unblock several stalled deals as well as pave the way for some new deals.

5G Is the Future of Internet Data—Is It a Threat to AMT?

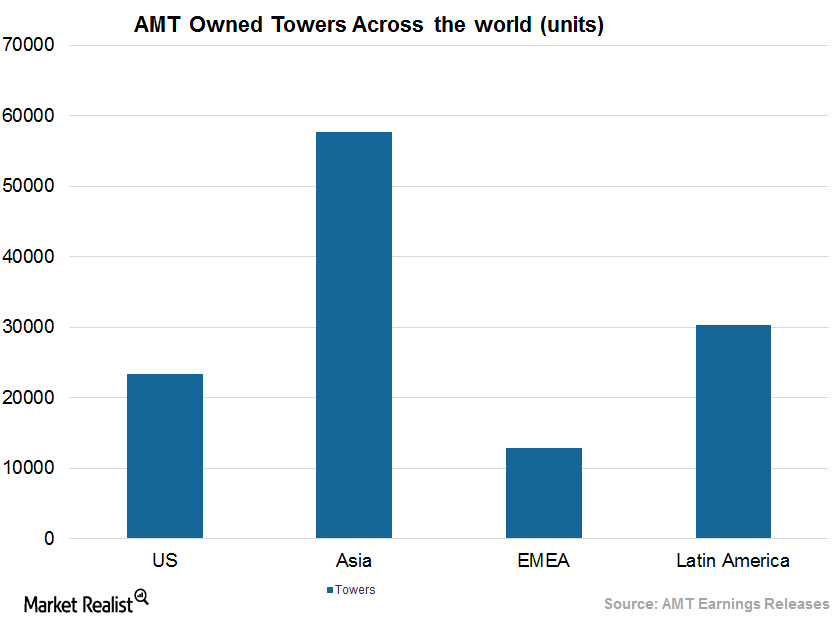

More than 95% of AMT’s towers are located in suburban and rural areas, where the majority of the US population resides.

American Tower’s Business Model Seeks Consistent Profitability

AMT maintains non-cancellable long-term leases with an initial term of ten years. Almost 50% of the company’s leases have a renewal date of 2022 or beyond.

American Tower’s Enhanced Fiscal 2017 Outlook on Growth Opportunities

American Tower’s (AMT) revenues rose ~26% in 1Q17, driven by 22% growth in its Tenant Billings business and 8.6% growth in its Organic Tenant Billings business.

American Tower Rises above Uncertainty in Wireless Tower Sector

For fiscal 2017, American Tower (AMT) expects to report adjusted funds from operations exceeding $2.8 billion. This figure is $55 million, or ~2%, higher than expected by the company.

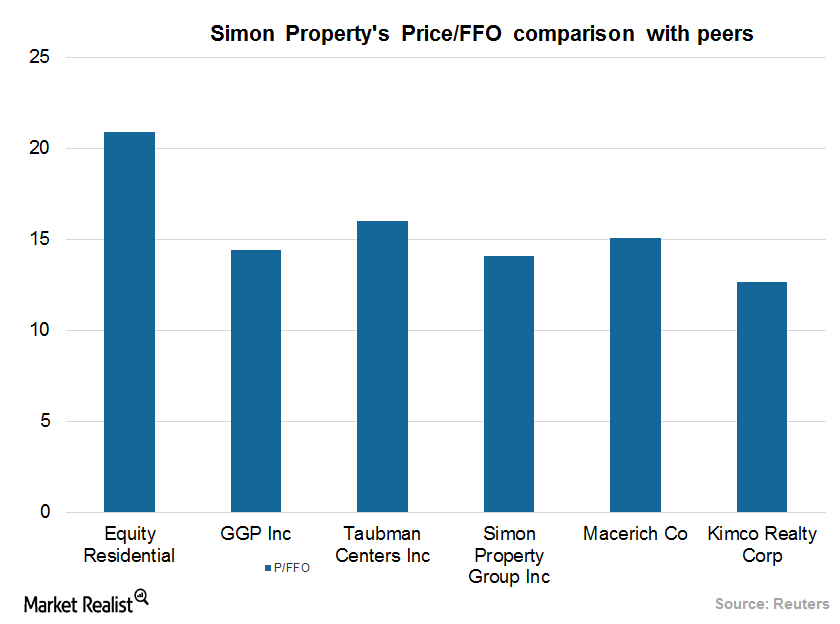

Investing in Simon Property Group: Relative Valuation

Simon Property Group’s current price-to-FFO multiple is ~14.1x.