American Tower’s Enhanced Fiscal 2017 Outlook on Growth Opportunities

American Tower’s (AMT) revenues rose ~26% in 1Q17, driven by 22% growth in its Tenant Billings business and 8.6% growth in its Organic Tenant Billings business.

June 12 2017, Updated 9:07 a.m. ET

Business momentum to continue

American Tower (AMT) is expected to continue its business growth trajectory, backed by strategic investments and expansion in emerging markets. The company has a history of maintaining solid top line growth, a trend that’s expected to continue.

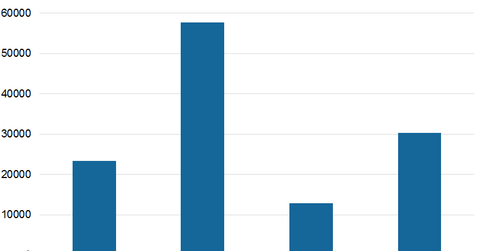

AMT’s towers exceed 800 feet, which provides sufficient space for leasing to multiple tenants, allowing it to generate robust revenue growth. American Tower is expected to generate revenue growth of 13.7%, 10.4%, 10.2%, and 7.8% in 2Q17, 3Q17, 4Q17, and 1Q18, respectively.

Robust revenue growth in 1Q17

American Tower’s (AMT) revenues rose ~26% in the first quarter of 2017, driven by 22% growth in its Tenant Billings business and 8.6% growth in its Organic Tenant Billings business.

The company’s US Property Segment reported revenue growth of 5%, backed by 6.5% growth in Organic Tenant Billings. This increase reflects a healthy demand environment and a record new business level, backed by the company’s recently signed master lease agreements.

AMT’s International Organic Tenant Billings gained more than 14%, backed by double-digit growth in all three segments of the International business. This growth in AMT’s International business resulted from significant geographic, technological, and tenant diversification coupled with a sharp rise in smartphone penetration.

Portfolio expansion

American Tower built almost 46,000 sites during fiscal 2016. Of these assets, the Viom Networks portfolio, as well as the French and Argentinean assets, contributed almost 13% to its International Tenant Billings growth. American Tower built 460 sites globally during 1Q17.

Enhanced guidance for 2017

American Tower (AMT) raised its revenue expectations for fiscal 2017 and expects its revenues to grow 14% to more than $6.5 billion. The updated guidance is 1.6% higher than the guidance provided at the end of March 2017. The higher guidance reflects higher straight-line revenue.

A favorable foreign exchange impact is also expected to affect AMT’s revenues positively. Strong organic growth in its US and international business, backed by consolidated tenant billing growth in the range of 6%–7%, is expected to drive its revenue growth during the first quarter of 2017.

Growth in colocation and amendment activity is expected to drive a 6% gain in AMT’s Domestic Organic Tenant Billing segment. A high-quality asset base on the domestic front, combined with strategically prominent locations and incremental capacity, is expected to keep the company in the present growth trajectory.

On the other hand, the company expects to incur a 9%–10% growth rate in tenant billing in its International segment. This new guidance is slightly lower than the 10% guidance provided earlier.

Churn levels

American Tower, which competes with other REITs such as Realty Income (O), expects higher churn levels in 2017. This increased churn level is mostly due to the ongoing consolidation and market rationalization in India’s telecom industry.

This slightly higher churn level is expected to offset the positive impact of newly commenced business in the upcoming months. Although the consolidation in the industry may cause some near-term headwinds, it could offer a solid structure to the telecom industry with well-capitalized tenants in a competitive market.

The PowerShares Active US Real Estate ETF (PSR) has a market cap–weighted index that covers a wide variety of REITs including specialized, residential, and commercial REITS. American Tower, Simon Property Group (SPG), and Crown Castle International (CCI) comprise 17% of PSR. Investors who prefer diversified risk can consider PSR, which provides a cushion against volatility in a market.

In the next article, we’ll look into the strategic initiatives taken by AMT to maintain its growth.