Realty Income Corp

Latest Realty Income Corp News and Updates

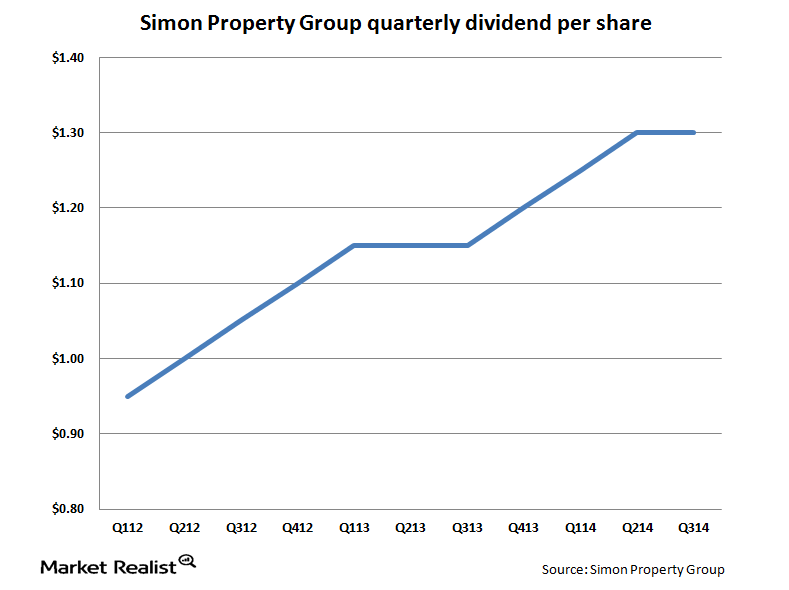

Simon Property Group faces competition from online retailers

Simon Property Group is by far the biggest shopping center REIT in the U.S., with a market capitalization of $53 billion. The next biggest REITs are less than half Simon’s size.

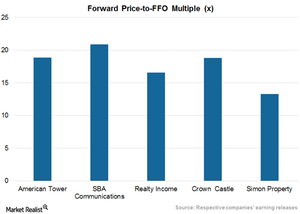

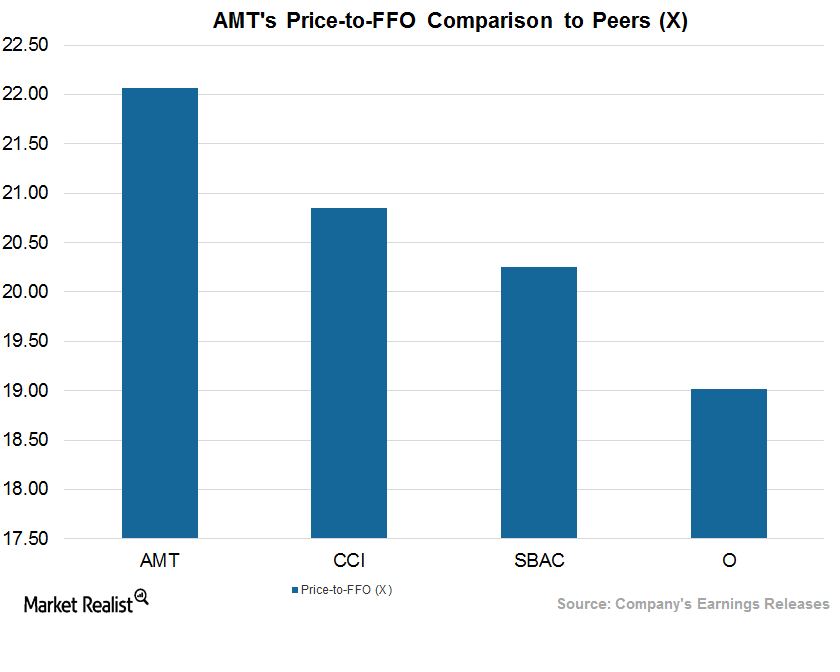

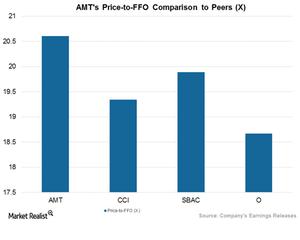

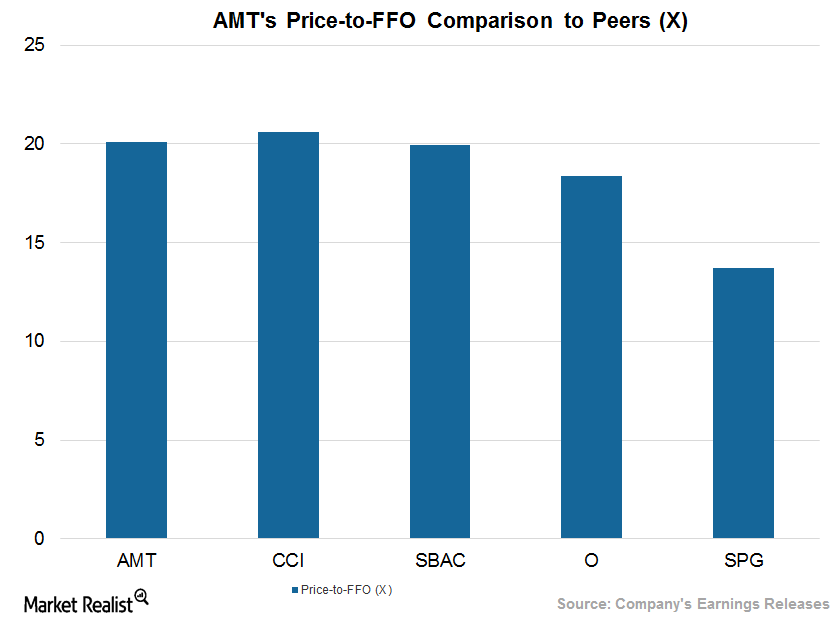

American Tower Is Trading at High Multiples amid Global Expansion

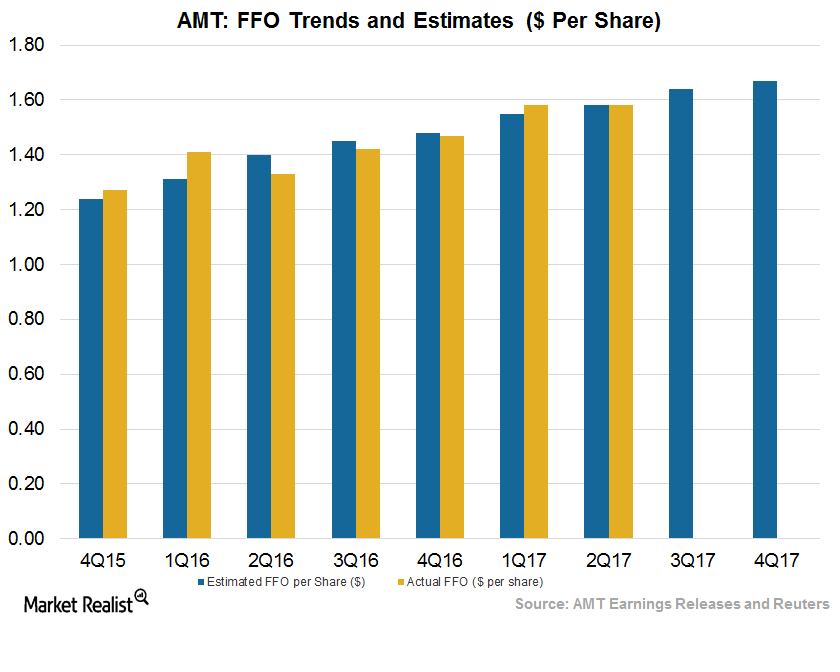

American Tower (AMT) is currently trading at a trailing-12-month price-to-FFO ratio of 20.2x.

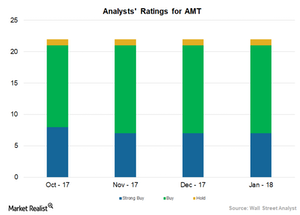

Analysts’ Views of American Tower

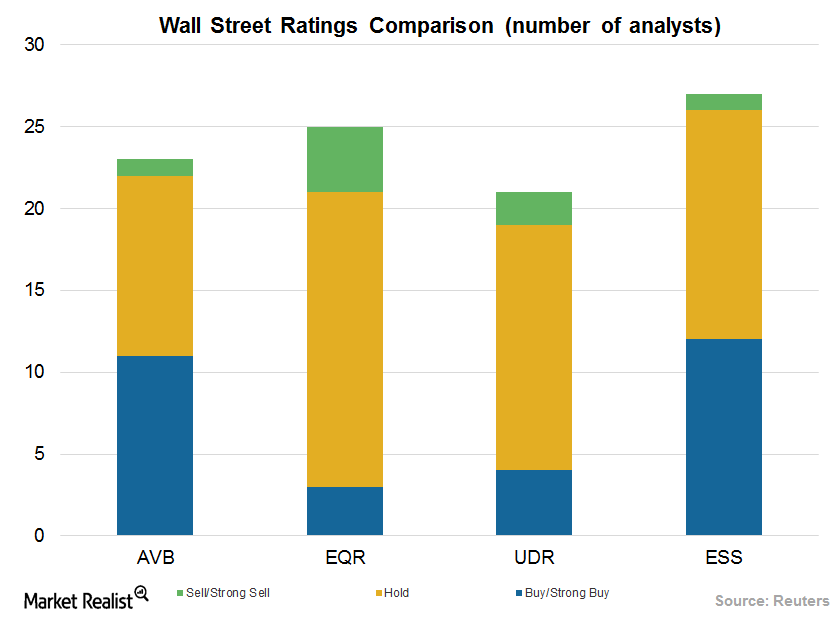

As of January 2018, 21 of the 22 analysts covering American Tower stock have given it a “buy” or “strong buy” rating. The remaining analyst gave it a “hold” rating.

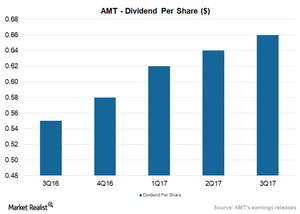

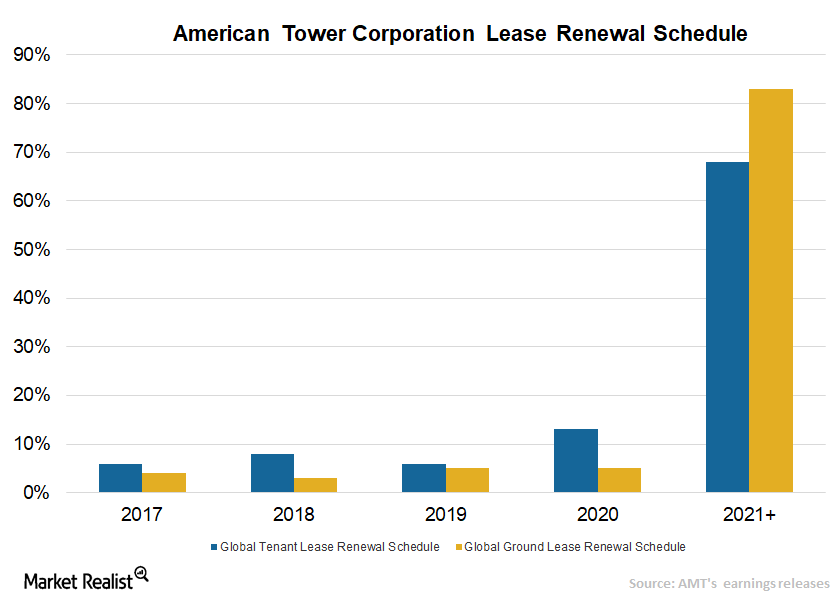

American Tower’s Disciplined Capital Allocation

American Tower (AMT) deployed $600 million of capital in 3Q17, bringing its year-to-date amount to $3.6 billion.

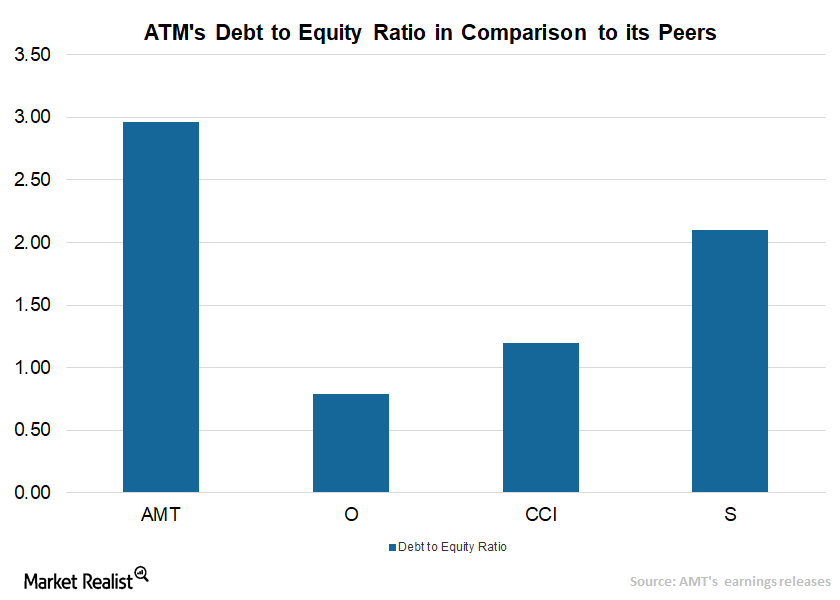

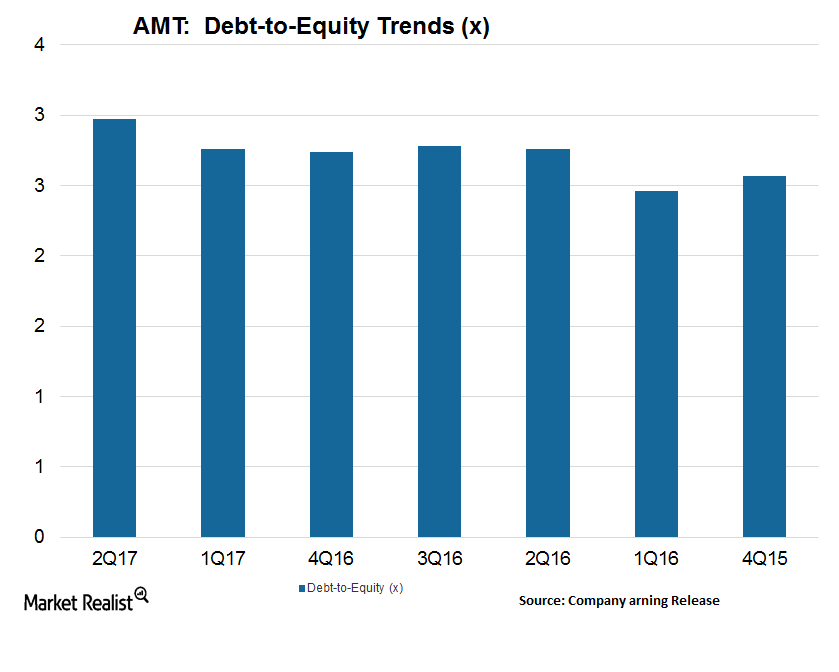

A Look at American Tower’s Well-Built Balance Sheet

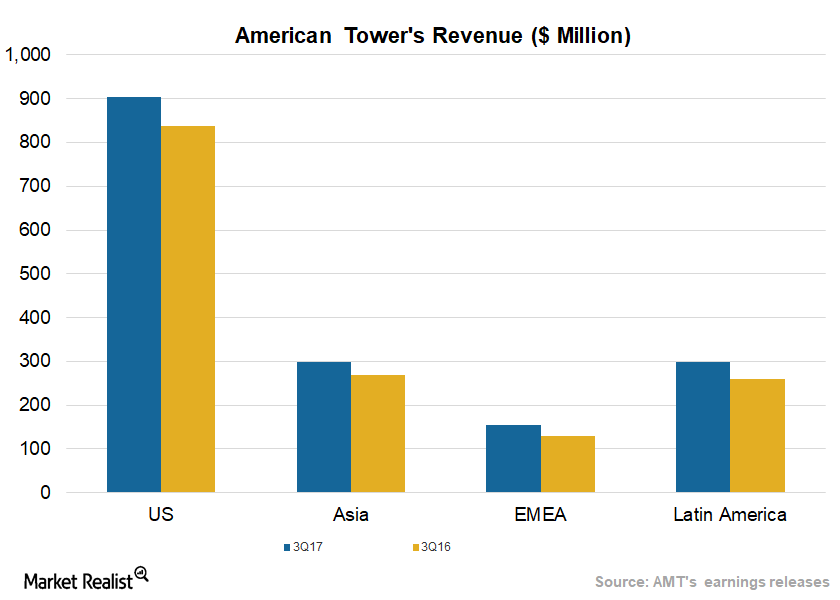

During 3Q17, American Tower (AMT) strengthened its revenues on higher organic growth in domestic and international markets such as India and Mexico.

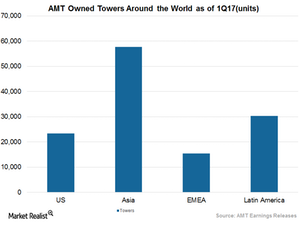

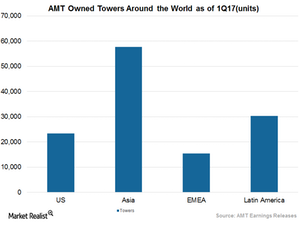

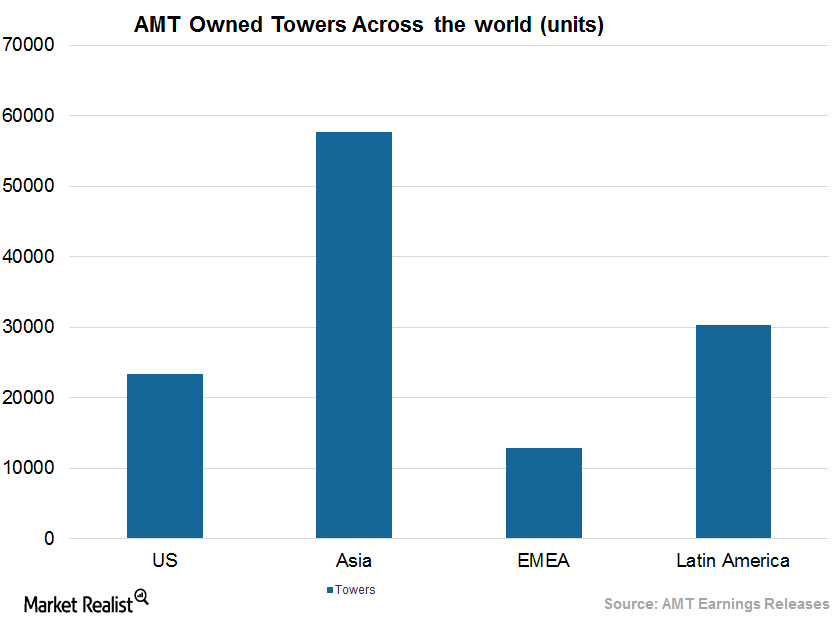

American Tower’s Strong Hold in the International Market

Mexico is one of American Tower’s (AMT) vital international markets. AMT has entered into an agreement to acquire certain telecommunication assets in Mexico.

These Factors Are Helping American Tower’s Growth

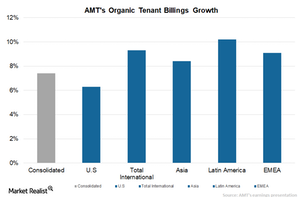

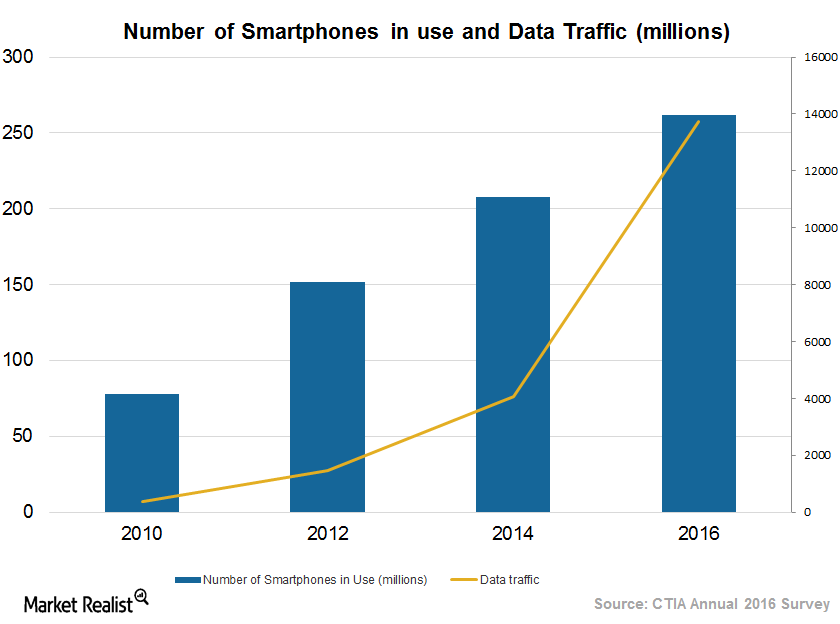

Data usage is increasing in international markets due to smartphone penetration.

American Tower Riding High with Strong Organic Growth

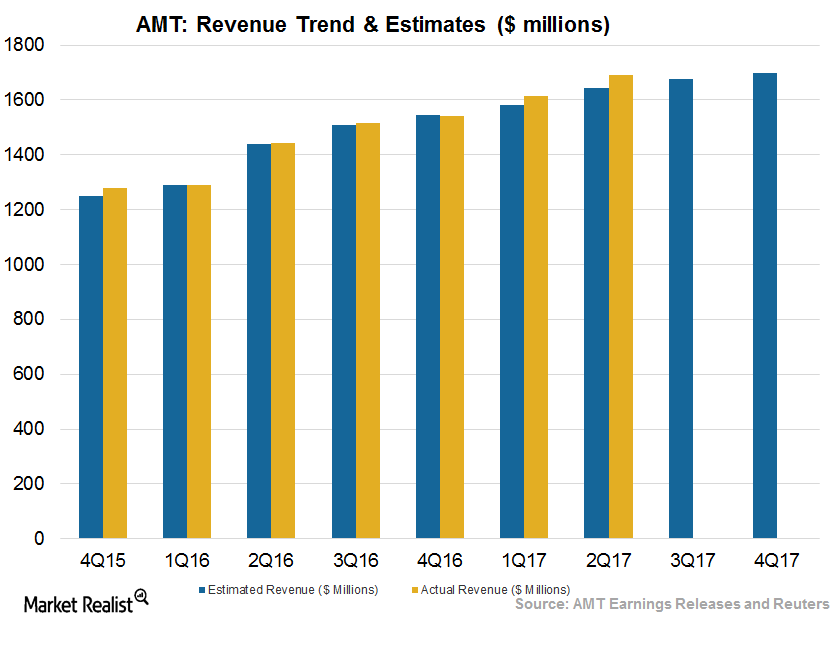

American Tower (AMT) has increased its 2017 revenue outlook to $6.55 billion from $6.53 billion, an addition of $15 million and a 0.2% increase.

How Realty Income’s Dividend Yield Looks

Revenue and earnings Realty Income (O), a retail REIT engaged in US real estate investment, recorded 8% revenue growth in 2016, compared with 10% growth in 2015. The growth was driven by rentals and tenant reimbursements. Its operating costs and other expenses (including interest expenses) rose 6% in 2016 and 8% in 2015. Its gains on asset […]

American Tower’s Place among Peers after 2Q17

AMT’s current price-to-FFO multiple stands at ~22.1x. After 2Q17, American Tower offers a next-12-month dividend yield of 1.9%.

The Story behind American Tower’s Strong Balance Sheet

In 2Q17, American Tower (AMT) topped its 2Q16 results on higher organic tenant billing and prudent cost controls.

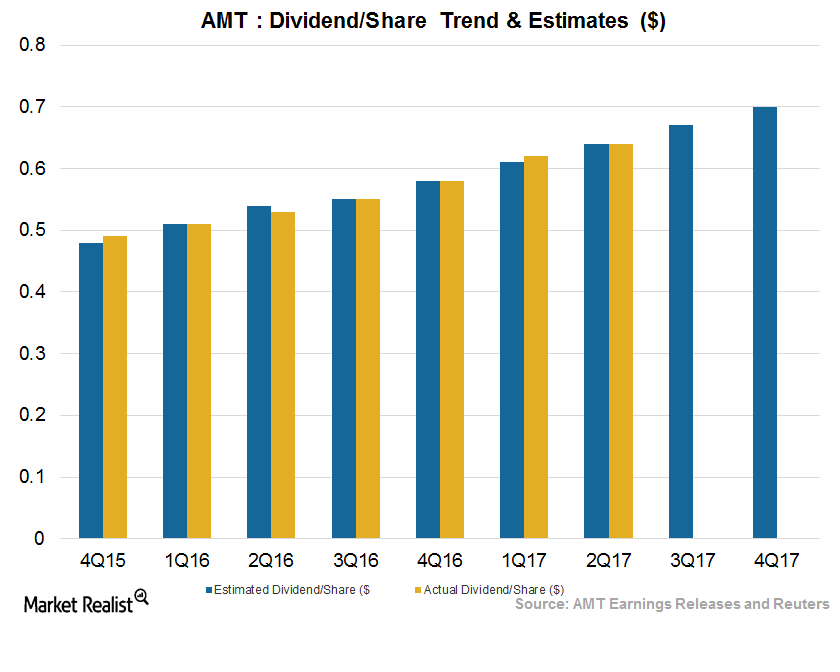

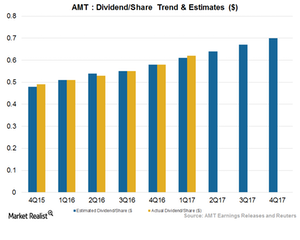

How American Tower Rewarded Stockholders in 2Q17

In 2Q17, American Tower distributed cash worth $275 million among its common stockholders and paid preferred stock dividends totaling $27 million.

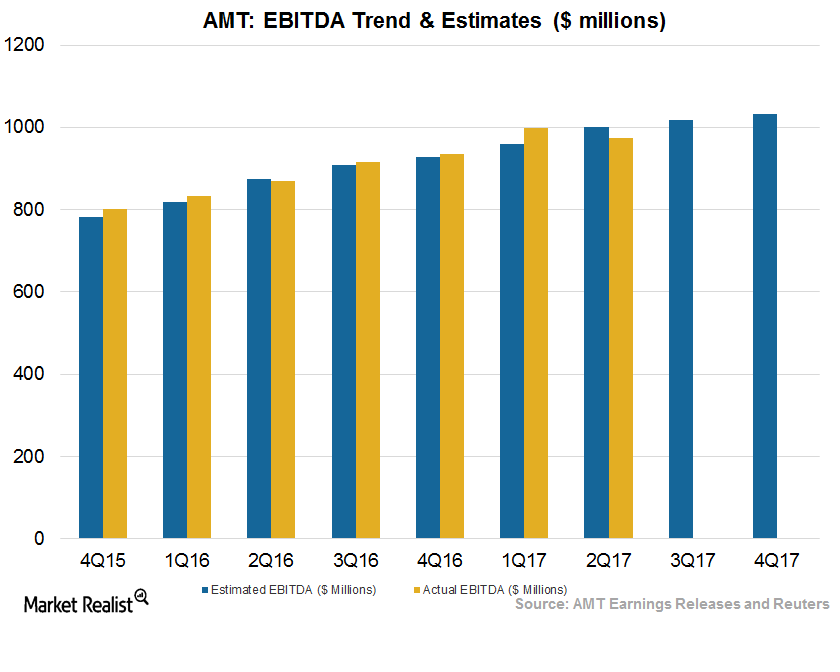

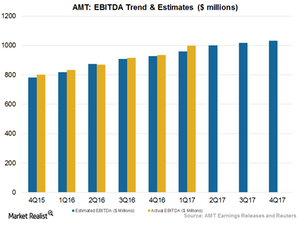

Can American Tower Maintain Consistent EBITDA Growth after 2Q17?

American Tower’s (AMT) 2Q17 EBITDA grew 17.5% to $1.02 billion. These results surpassed the analysts’ expectations of $1 billion.

American Tower’s 2Q17 Growth Rode on This

American Tower’s (AMT) total deployment consisted of $79 million for acquisitions and over $400 million for stock repurchases.

Behind American Tower’s Robust 2Q17 Revenue Growth

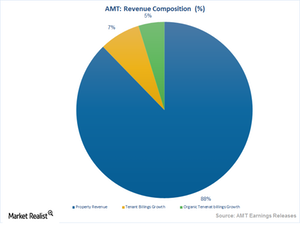

For 2Q17, American Tower (AMT) has reported robust double-digit revenue growth of 15.3%, backed primarily by higher tenant billing growth.

What Lies Ahead for American Tower

For fiscal 2017, American Tower expects to report property revenues that would be 14% higher on a year-over-year basis, or by $25 million.

Inside American Tower’s 2Q17 Results: What You Need to Know

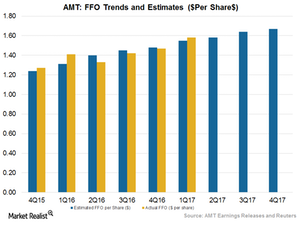

For 2Q17, American Tower (AMT) reported adjusted funds from operation of $1.58 per share, meeting Wall Street estimates and topping 2Q16 by 18.8%.

American Tower: A Peer Comparison

AMT’s current price-to-FFO ratio stands at 20.06x. The company has undertaken several acquisitions and strategic partnerships to boost its presence in high-demand geographies.

Will American Tower Boost Its Shareholders’ Returns in 2Q17?

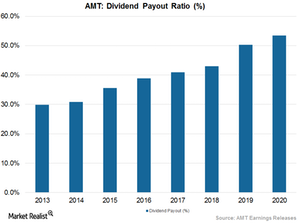

American Tower has paid dividends to its shareholders in every quarter since it became a public company. On June 1, AMT hiked its quarterly dividend by 3.2%.

Will AMT’s Business Model Drive Higher Earnings in 2Q17?

According to Wall Street analysts, American Tower (AMT) is expected to report EBITDA (earnings before income tax, depreciation, and amortization) of $1 billion in 2Q17.

What Are the Main Contributors to AMT’s 2Q17 Revenue Growth?

Wireless tower owner American Tower (AMT) is expected to post flat year-over-year (or YoY) top and bottom line results when it releases its 2Q17 earnings on July 27, 2017.

What to Expect from Wireless REIT American Tower in 2Q17

American Tower is scheduled to report its 2Q17 earnings on July 27, 2017. Analysts expect it to report adjusted funds from operations per diluted share of $1.58.

How Wall Street Analysts Rate American Tower

Analysts gave AMT a mean price target of $143.14, implying a rise of 8.7% from its current level of $131.70. In May 2017, 22 of 23 analysts covering AMT stock issued “buy” or “strong buy” ratings.

Comparing American Tower with Retail REITs in Its Industry

AMT’s current price-to-FFO multiple is ~20.1x.

American Tower: A Rewarding Stock for Shareholders

AMT has maintained a consistent dividend yield over the last two years. Its dividend yield was ~1.8% in 2015 and ~2.0% in 2016.

How Telecom Industry Ownership Could Affect American Tower

Under the leadership of Ajit Pai and Jeffrey Eisenach, the FCC is expected to unblock several stalled deals as well as pave the way for some new deals.

5G Is the Future of Internet Data—Is It a Threat to AMT?

More than 95% of AMT’s towers are located in suburban and rural areas, where the majority of the US population resides.

American Tower’s Enhanced Fiscal 2017 Outlook on Growth Opportunities

American Tower’s (AMT) revenues rose ~26% in 1Q17, driven by 22% growth in its Tenant Billings business and 8.6% growth in its Organic Tenant Billings business.