A Look at American Tower’s Well-Built Balance Sheet

During 3Q17, American Tower (AMT) strengthened its revenues on higher organic growth in domestic and international markets such as India and Mexico.

Jan. 12 2018, Updated 9:03 a.m. ET

3Q17 performance

During 3Q17, American Tower (AMT) strengthened its revenues on higher organic growth in domestic and international markets such as India and Mexico.

REITs are heavily dependent on debt for their routine activities, so they need to maintain a strong balance sheet.

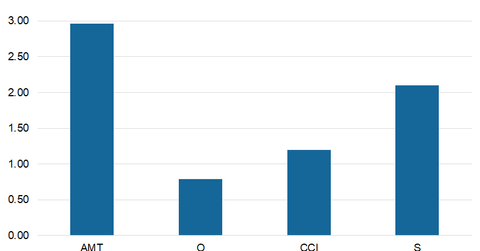

AMT’s debt-to-equity ratio stands at 2.96x, which is much higher than the industry average of 1.03x. Its debt-to-equity ratio was at a similar level in 2Q17, while it rose 6.2% on a YoY (year-over-year) basis.

Leverage ratio

Leverage ratio is calculated by dividing net debt to EBITDA. It signifies how much time it will take for a company to repay its debt. A significantly higher ratio implies that a company is not able to maintain its debt and cannot take on the burden of increasing its debt.

AMT has a net leverage ratio of 18.59x for 3Q17 against 18.82x for 2Q17. Realty Income (O) has a ratio of 21.34x as of 3Q17, while SBA Communications (SBAC) and Crown Castle International (CCI) have ratios of 29.89x and 19.24x, respectively. Compared to its peers, AMT has the lowest leverage ratio.

Liquidity

As of 3Q17, AMT has a total liquidity of $2.5 billion, which includes $0.8 billion in cash and cash equivalents. It also has the ability to borrow $1.7 billion under its revolving credit facilities.

AMT completed the redemption of 4.5% in senior unsecured notes due in 2018 and borrowed $690 million under its revolving credit facilities, which it used along with cash on hand to acquire 500 sites in the United States and for general corporate purposes.