Will AMT’s Business Model Drive Higher Earnings in 2Q17?

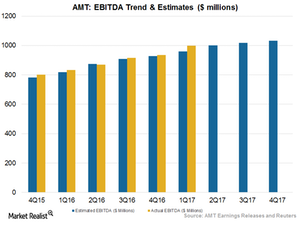

According to Wall Street analysts, American Tower (AMT) is expected to report EBITDA (earnings before income tax, depreciation, and amortization) of $1 billion in 2Q17.

July 20 2017, Updated 7:39 a.m. ET

Analysts’ expectations

According to Wall Street analysts, American Tower (AMT) is expected to report EBITDA (earnings before income tax, depreciation, and amortization) of $1 billion in 2Q17, a fall of just 0.2% year-over-year (or YoY).

AMT is scheduled to release its earnings on July 25, 2017. Its EBITDA margin is expected to expand 70 basis points to 60.9% in the quarter compared to a year ago.

Expenses expected to be lower in 2Q17

American Tower has incurred fewer marginal costs related to maintaining its towers. Apart from the land and the tower sites, the company doesn’t incur any other costs, as its tenants maintain all other expenditures related to wireless operations. The addition of new tenants also doesn’t result in costs for AMT.

Higher EBITDA expected in 2Q17

During 1Q17, AMT’s adjusted EBITDA rose 20% to ~$998 million. The company raised its 2017 adjusted EBITDA outlook by $70 million, or 1.8%. This upward revision reflected $42 million from favorable foreign exchange and ~$26 million from a net straight-line recognition.

During 1Q17, American Tower reported double-digit growth in its EBITDA for the 16th consecutive quarter. This trend is expected to continue in 2Q17 as well.

Wall Street expects AMT’s close competitors Realty Income Corporation (O), SBA Communications (SBAC), and Crown Castle International (CCI) to report EBITDAs of $270.2 million, $294.6 million, and $582.7 million, respectively, in 2Q17.

The ProShares Ultra Real Estate ETF (URE) holds almost 17% in AMT and its peers. The ETF is diverse in terms of both geography and products, so it offers a cushion to investors.