American Tower’s Business Model Seeks Consistent Profitability

AMT maintains non-cancellable long-term leases with an initial term of ten years. Almost 50% of the company’s leases have a renewal date of 2022 or beyond.

June 12 2017, Updated 10:37 a.m. ET

Growth trajectory

Analysts are optimistic about American Tower (AMT), and they expect the company to provide a healthy growth trajectory. In the next four quarters, AMT is expected to achieve respective growth rates of 18.7%, 14.7%, 12.8%, and 11.8% in terms of adjusted funds from operation (or AFFO).

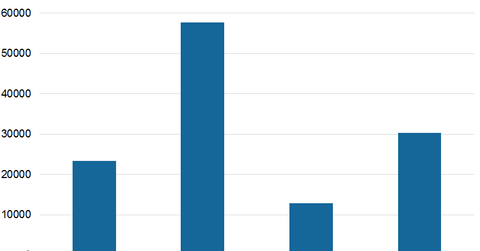

AMT’s management is also confident about its performance, raising its guidance for fiscal 2017 in order to reflect the company’s strong business momentum. Let’s explore how the company could maintain its business momentum. The chart below shows the towers owned by the company in various parts of the world.

Predictability of business reduces risk of negative surprises

American Tower’s (AMT) business is fairly predictable and involves very few surprises. American Tower’s maintenance costs are generally low. Apart from the tower and the land it is located on, American Tower doesn’t maintain anything else. Any infrastructure needed for transmission is maintained by its tenants.

As a result, the company is able to garner maximum profit from its operations. Any incremental costs associated with adding new tenants to existing sites are minimal.

AMT maintains non-cancellable long-term leases with an initial term of ten years. Almost 50% of the company’s leases have a renewal date of 2022 or beyond. Thereafter, the leases are renewed after every five years. Historically, 98%–99% of the leases are renewed. Inflation is also considered in the lease agreements with the tenants.

American Tower has signed several master lease agreements (or MLAs) with its tenants. These agreements provide consistent, long-term revenues. They also reduce the probability of churn apart from reducing colocation cycle times. These factors provide a predictable base for organic growth of the company.

Peers and ETF

Major competitors of AMT include Simon Property Group (SPG), AvalonBay Communities (AVB), and Crown Castle International (CCI). These three companies have an ~19.9% weighted market cap in the PowerShares Active US Real Estate ETF (PSR). PSR has an average traded volume of 1.8 billion shares.

In the next article, we will discuss the company’s tenant diversification and growth strategy.