Jennifer Mathews

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Jennifer Mathews

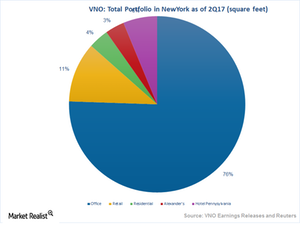

How Vornado’s New York Office Segment Performed in 2Q17

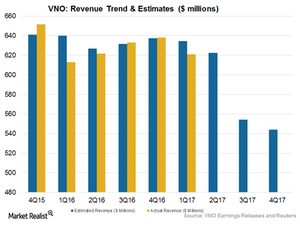

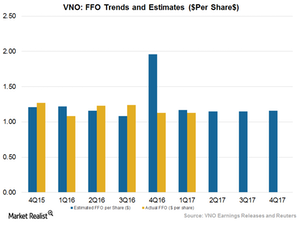

Vornado Realty Trust (VNO) reported higher year-over-year top-line and bottom-line results during 2Q17 backed by higher rent growth, lower costs, and new leases during the quarter.

Vornado’s New Leases Drove Revenue in 2Q17

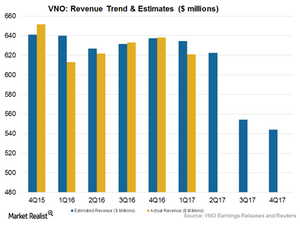

VNO posted rental revenue of $626 million in 2Q17, missing Wall Street’s estimates of $633.2 million.

American Tower’s Place among Peers after 2Q17

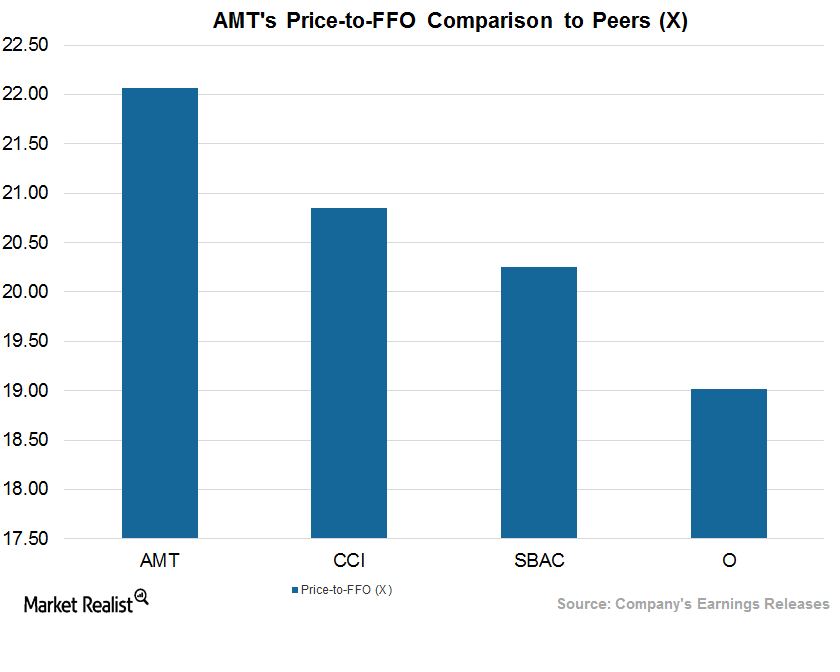

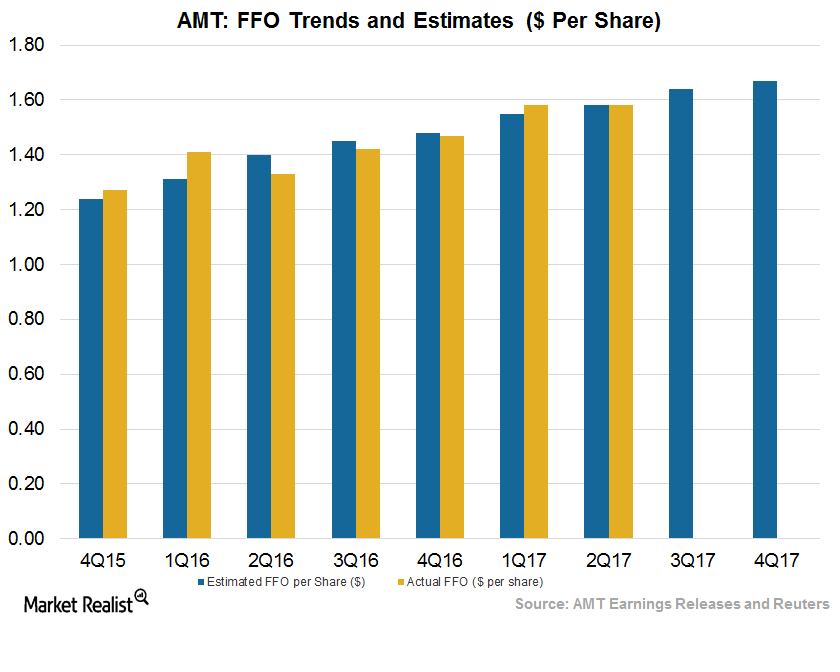

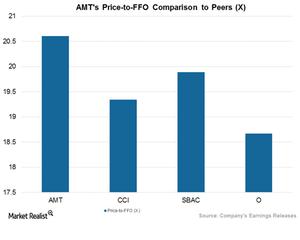

AMT’s current price-to-FFO multiple stands at ~22.1x. After 2Q17, American Tower offers a next-12-month dividend yield of 1.9%.

The Story behind American Tower’s Strong Balance Sheet

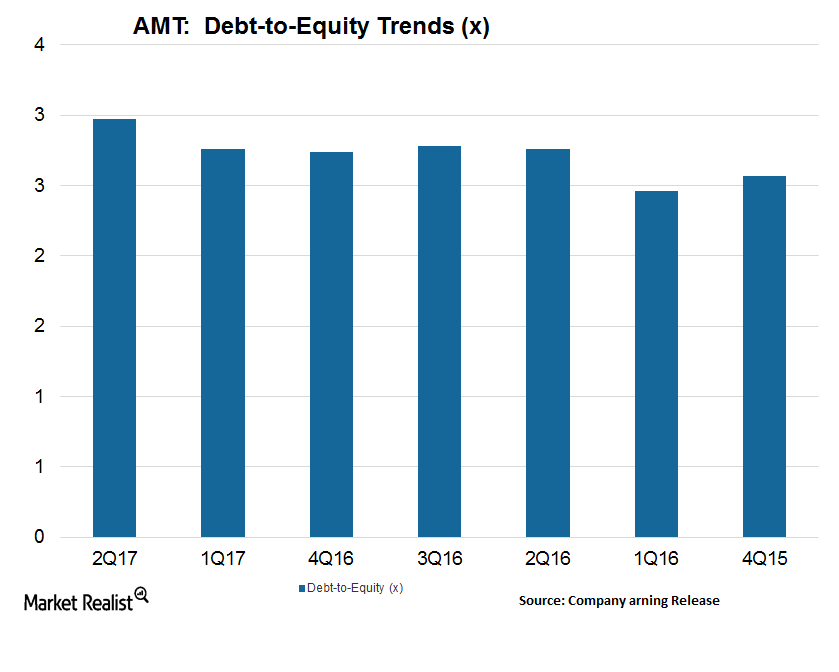

In 2Q17, American Tower (AMT) topped its 2Q16 results on higher organic tenant billing and prudent cost controls.

How American Tower Rewarded Stockholders in 2Q17

In 2Q17, American Tower distributed cash worth $275 million among its common stockholders and paid preferred stock dividends totaling $27 million.

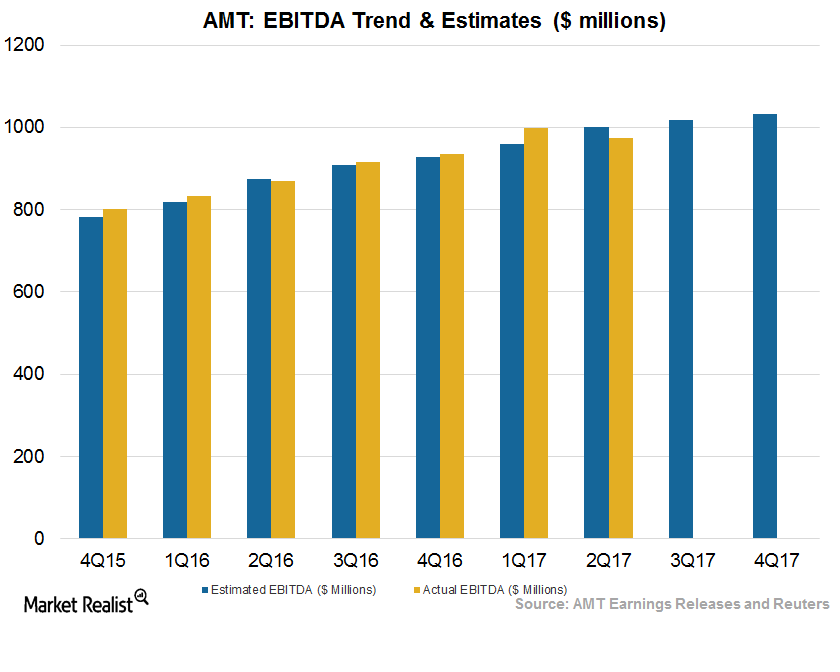

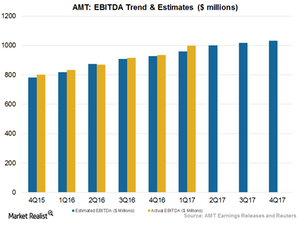

Can American Tower Maintain Consistent EBITDA Growth after 2Q17?

American Tower’s (AMT) 2Q17 EBITDA grew 17.5% to $1.02 billion. These results surpassed the analysts’ expectations of $1 billion.

American Tower’s 2Q17 Growth Rode on This

American Tower’s (AMT) total deployment consisted of $79 million for acquisitions and over $400 million for stock repurchases.

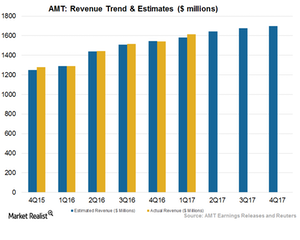

Behind American Tower’s Robust 2Q17 Revenue Growth

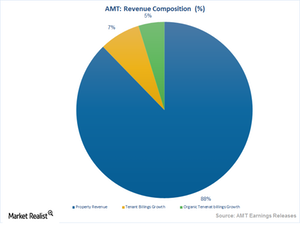

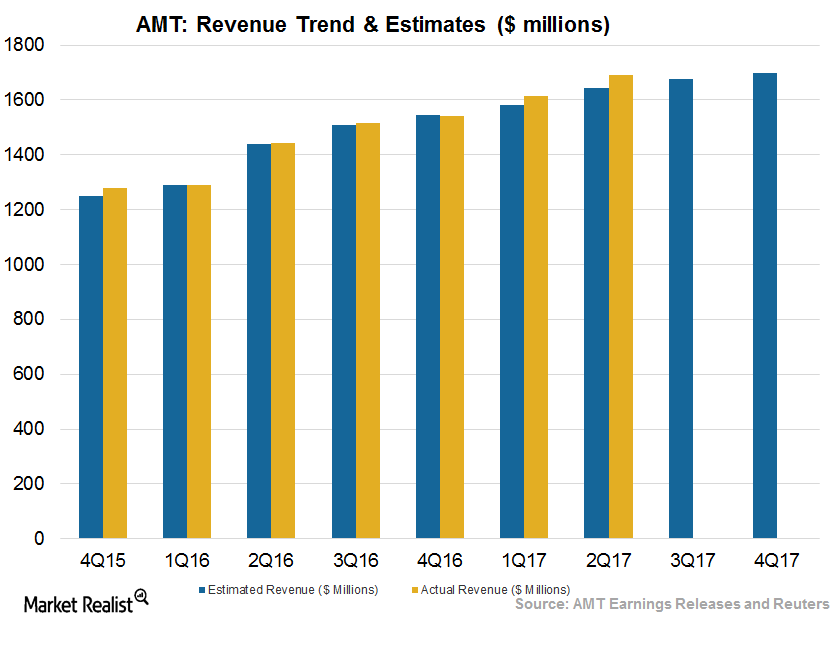

For 2Q17, American Tower (AMT) has reported robust double-digit revenue growth of 15.3%, backed primarily by higher tenant billing growth.

What Lies Ahead for American Tower

For fiscal 2017, American Tower expects to report property revenues that would be 14% higher on a year-over-year basis, or by $25 million.

Inside American Tower’s 2Q17 Results: What You Need to Know

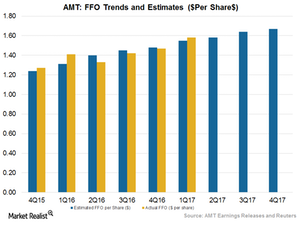

For 2Q17, American Tower (AMT) reported adjusted funds from operation of $1.58 per share, meeting Wall Street estimates and topping 2Q16 by 18.8%.

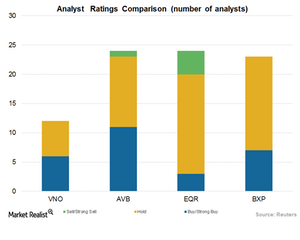

How Wall Street Analysts Rate Vornado

Analysts assigned VNO a mean price target of $89.52, 13.8% higher than its current price level.

How Vornado Stacks Up against Other Industry Players

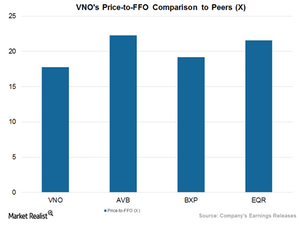

VNO’s current price-to-FFO multiple is 17.77x. The company has been able to return value to its shareholders consistently in the form of dividends and share repurchases.

Will Vornado Benefit from a Growing Economy in 2Q17?

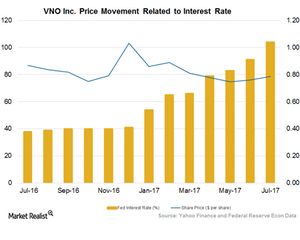

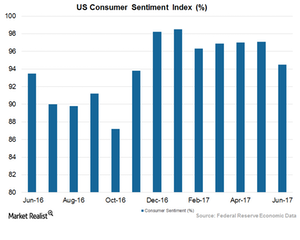

Although Vornado Realty Trust (VNO) may witness lower margins during a higher interest rate environment, it may see significant growth in the near future.

How Macro Issues Could Affect Vornado in 2Q17

Wall Street expects Vornado Realty Trust (VNO) to post flat year-over-year top-line and bottom-line results in 2Q17.

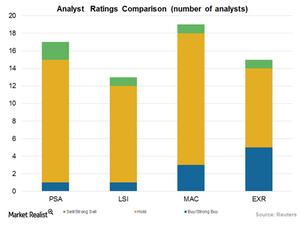

How Analysts View Public Storage

Analysts have assigned PSA a mean price target of $217.67, which is 4.9% higher than its current price level.

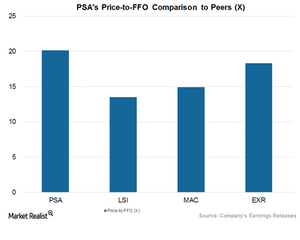

Where Public Storage Stands among Other Major Players

Public Storage has consistently been able to return capital value as well as shareholder returns in the form of dividends and share buybacks.

Will Vornado’s Project Streamlining Drive Net Operating Income?

Wall Street analysts expect Vornado Realty Trust (VNO) to report net operating income of $338.1 million in 2Q17.

How Vornado’s Revenue Could Benefit from Strategic Initiatives

Analysts expect Vornado Realty Trust (VNO) to report revenues of $622.3 million for 2Q17 when it releases its earnings on July 31, 2017.

What’s in Store for Vornado’s 2Q17 Earnings?

Vornado Realty Trust (VNO) is scheduled to report its 2Q17 earnings on July 31, 2017.

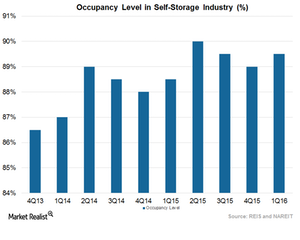

Public Storage and the Growing US Economy

Public Storage (PSA) is expected to witness a higher cost of debt in 2Q17, mainly due to the Fed’s rate hikes in 2017.

Inside Public Storage’s 2Q17 Battle with Macro Headwinds

Public Storage (PSA) is expected to post flat top-line and bottom-line results in 2Q17.

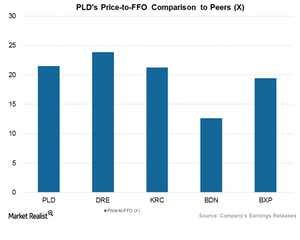

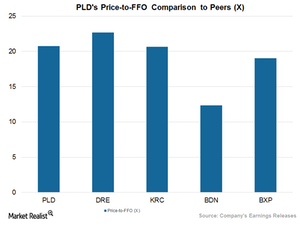

How Prologis Stacks Up against Peers after 2Q17 Earnings

The price-to-FFO multiple is the best way to evaluate Prologis (PLD).

What’s Really Driving Public Storage’s Expected 2Q17 Upbeat Results

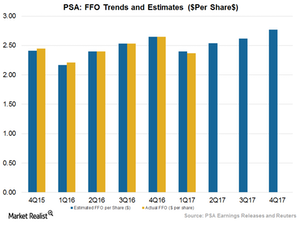

Wall Street expects PSA to report adjusted FFO (funds from operation) of $2.40, compared with $2.54 in 2Q16.

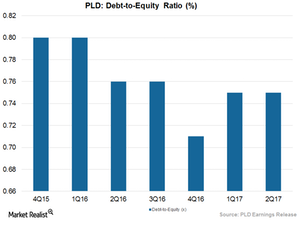

How Prologis Improved Its Balance Sheet

Prologis maintained a debt-to-equity ratio of 0.75x for 2Q17, which was lower than the industrial mean of 1.07x.

Will Public Storage’s Cost-Reduction Initiatives Drive Higher NOI in 2Q17?

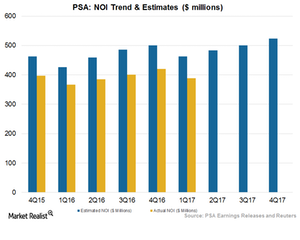

Wall Street analysts expect Public Storage (PSA) to report NOI (net operating income) of $483.7 million for 2Q17.

Will Public Storage Ride High on Top Line in 2Q17?

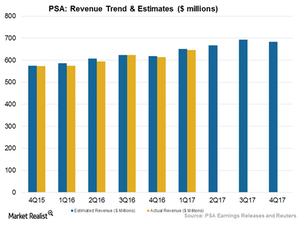

Wall Street expects Public Storage (PSA) to report revenue of $667.9 million for 2Q17. Its earnings call will be on July 27, 2017.

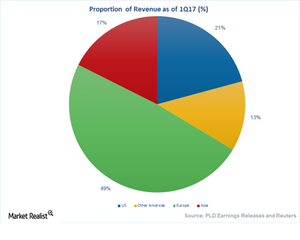

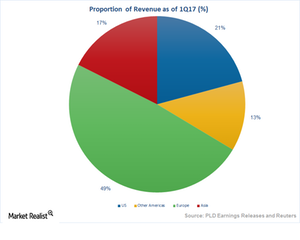

Robust US Business Growth Helped Prologis in 2Q17

Prologis’s (PLD) properties are spread across the globe. This geographical diversity ensures that the company gets the optimum value from the retail and supply chains in different parts of the world.

What Lies Ahead for Public Storage in 2Q17

Analysts expect PSA to report adjusted FFO (funds from operation) of $2.40, compared with $2.54 in 2Q16.

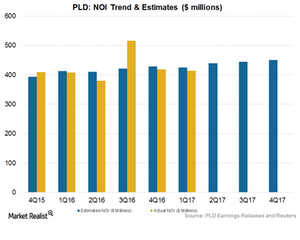

Prologis’s Strong 2Q17 Results Backed by Rent Growth

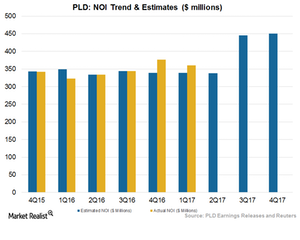

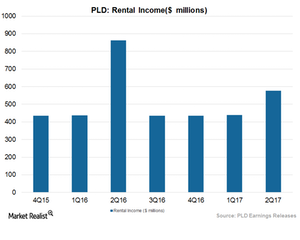

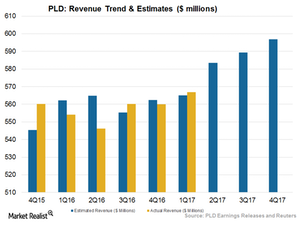

Prologis (PLD) reported better-than-expected 2Q17 top-line and bottom-line results.

Where Does Prologis Stand after 2Q Earnings?

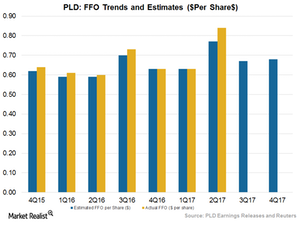

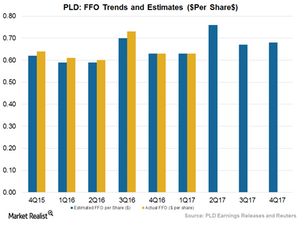

Prologis (PLD) reported core funds from operation (or FFO) of $0.84 per share in 2Q17, which surpassed Wall Street’s estimates of $0.77 by a remarkable 9.1%.

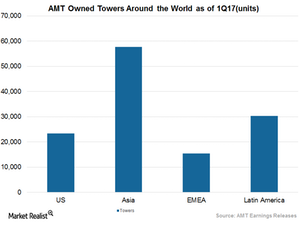

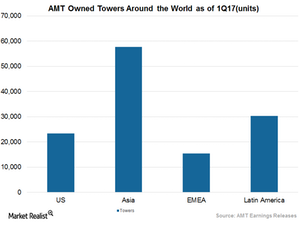

American Tower: A Peer Comparison

AMT’s current price-to-FFO ratio stands at 20.06x. The company has undertaken several acquisitions and strategic partnerships to boost its presence in high-demand geographies.

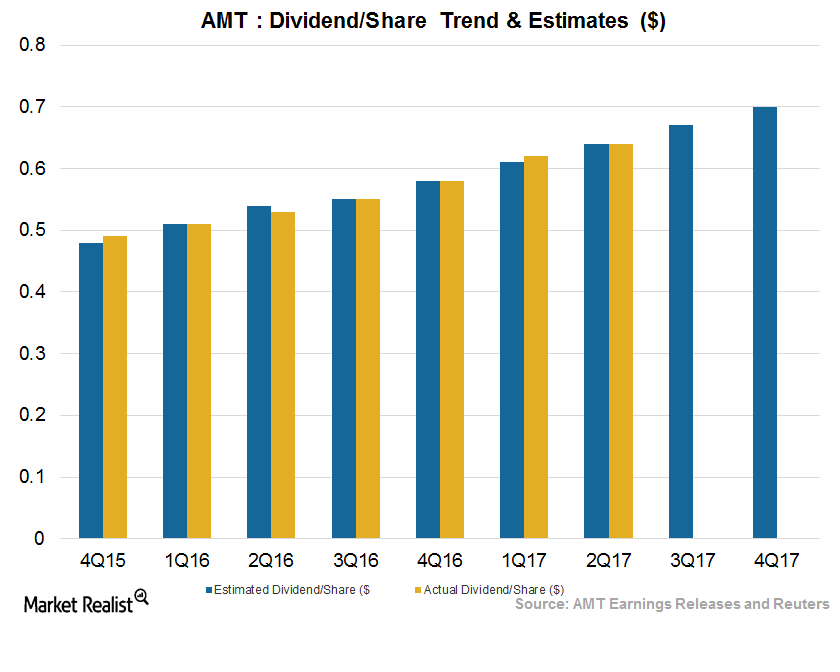

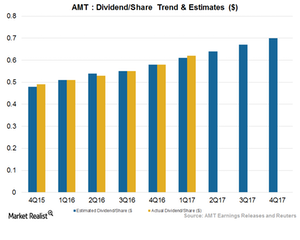

Will American Tower Boost Its Shareholders’ Returns in 2Q17?

American Tower has paid dividends to its shareholders in every quarter since it became a public company. On June 1, AMT hiked its quarterly dividend by 3.2%.

Will AMT’s Business Model Drive Higher Earnings in 2Q17?

According to Wall Street analysts, American Tower (AMT) is expected to report EBITDA (earnings before income tax, depreciation, and amortization) of $1 billion in 2Q17.

What Are the Main Contributors to AMT’s 2Q17 Revenue Growth?

Wireless tower owner American Tower (AMT) is expected to post flat year-over-year (or YoY) top and bottom line results when it releases its 2Q17 earnings on July 27, 2017.

Will American Tower Ride High on Its Top Line in 2Q17?

Analysts expect wireless tower operator American Tower (AMT) to report revenue of $1.6 billion in its 2Q17 earnings call on July 27, 2017.

What to Expect from Wireless REIT American Tower in 2Q17

American Tower is scheduled to report its 2Q17 earnings on July 27, 2017. Analysts expect it to report adjusted funds from operations per diluted share of $1.58.

Will Welltower Maintain Its Business Momentum in the Future?

Welltower’s (HCN) strategic presences in high-barrier and affluent markets help it to maintain its leadership in the healthcare infrastructure industry.

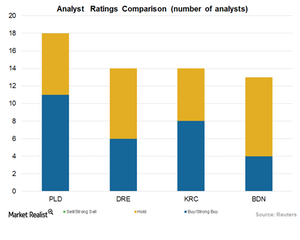

Prologis: What Analysts Recommend for the Stock

Analysts have assigned Prologis stock a mean price target of $58.47, which is 2.1% higher than its current price of $57.28.

Where Does Prologis Stand among Its Peers?

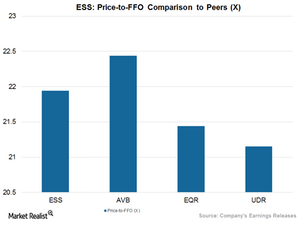

In terms of price-to-FFO multiple, PLD trades at par with most of its peers except Brandywine Realty Trust (BDN).

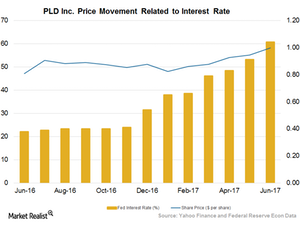

Will Prologis Be Able to Turn Macro Issues to Its Advantage?

In addition to Prologis’s strategic initiatives such as acquisitions, dispositions, and project development activities, several macroeconomic factors also impact performance.

The Factors behind Prologis’s Expected 2Q17 Upbeat Results

Wall Street expects Prologis to report adjusted FFO (funds from operations) of $0.76, a 27.3% rise year-over-year.

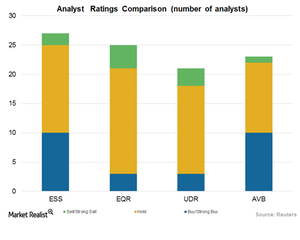

How Does Wall Street Rate Essex Property Trust?

Essex Property Trust’s (ESS) performance expectations in 2017 are reflected in analysts’ ratings for its stock. Analysts have given ESS a mean price target of $257.6.

Can Prologis’s Cost Reductions Drive Net Operating Income Higher?

According to Wall Street analysts, Prologis (PLD) is expected to report NOI (net operating income) of $440.2 million in 2Q17.

How Essex Property Trust Compares to Other Industry Players

The price-to-FFO (funds from operation) ratio is the most popular method of measuring the relative valuation of real estate investment trusts (or REIT) such as Essex Property Trust.

Prologis’s Main Revenue Drivers in 2Q17

Prologis (PLD) is expected to see higher revenue growth as well as higher margins for 2Q17.

Will Prologis Ride High on Its Top Line in 2Q17?

Analysts expect Prologis (PLD) to report revenue of $583.5 million for 2Q17 when it releases its earnings on July 18, 2017.

What’s in Store for Prologis in 2Q17?

Prologis (PLD) is scheduled to report its fiscal 2Q17 earnings on July 18. 2017. Analysts expect it to report adjusted FFO (funds from operations) of $0.76.

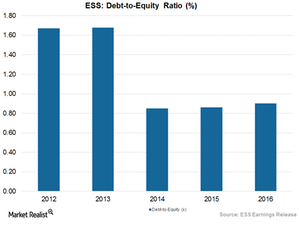

How Well Does Essex Property Manage Its Balance Sheet?

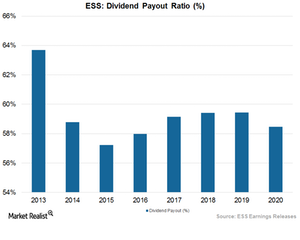

In order to function as real estate investment trusts (or REIT), companies such as Essex Property Trust (ESS) have to pay almost 90% of their taxable income out as dividends.

How Well Does Essex Property Return Value to Its Shareholders?

Real estate investment trusts (or REIT) such as Essex Property Trust (ESS) need to pay at least 90% of their taxable incomes as dividends or share buybacks as a prerequisite for functioning as REITs.

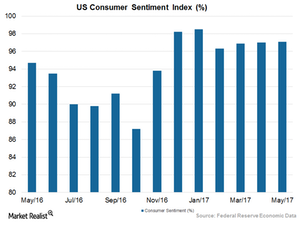

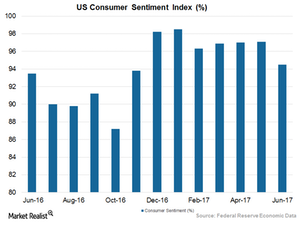

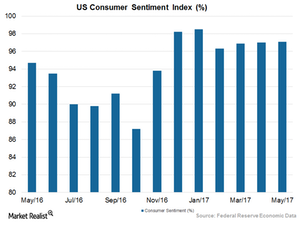

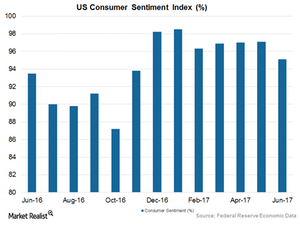

Are Trump and the Rate Hike Blessings in Disguise for ESS?

Rising optimism among citizens bodes well for REITs such as Essex Property Trust (ESS) AvalonBay Communities (AVB), Equity Residential (EQR), and UDR (UDR).