SPDR® S&P Metals and Mining ETF

Latest SPDR® S&P Metals and Mining ETF News and Updates

Analyzing Trends in Mining Stocks’ Correlation

Gold remains the most dominant among the four precious metals. It’s crucial that investors analyze how the miners are moving versus precious metals.

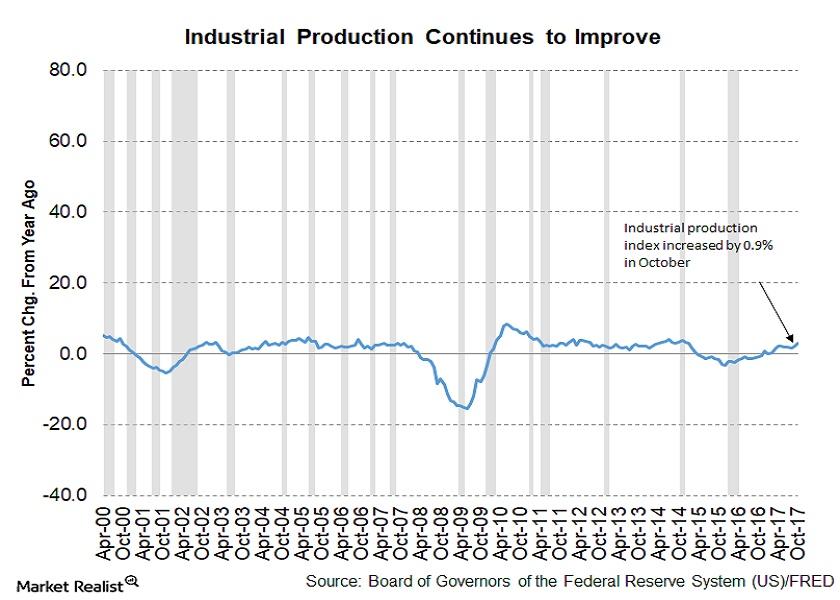

Which Industries Increased Industrial Production in October?

The October Industrial Production report was released by the Fed on November 16 and showed a continued rebound in key sectors of the US economy.

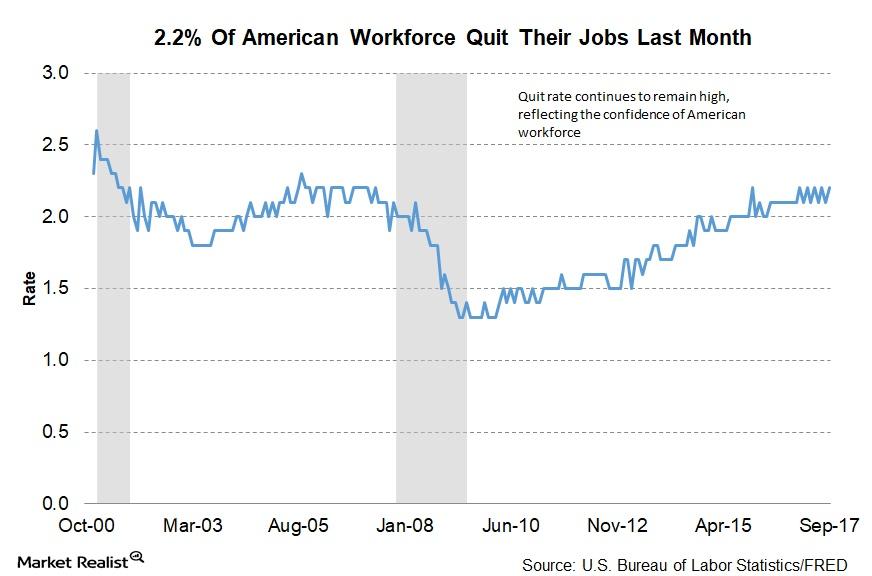

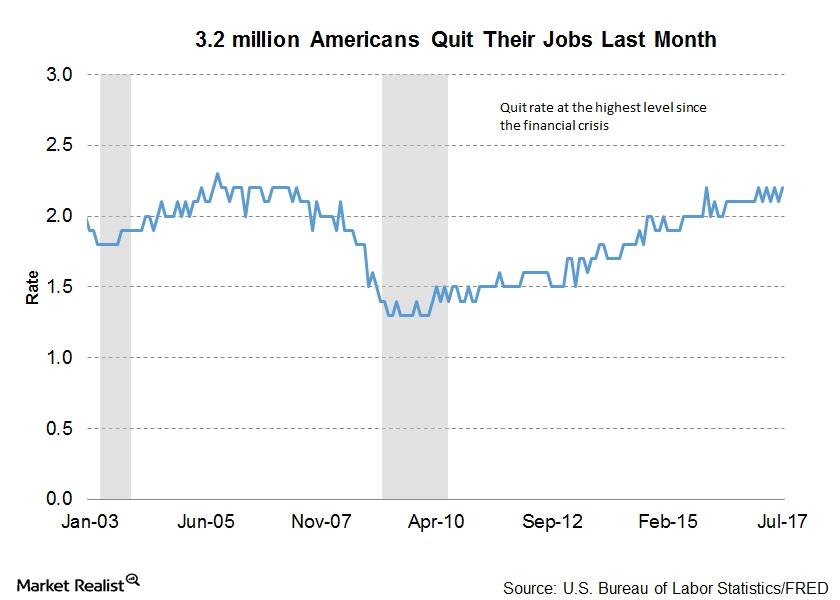

3.2 Million Americans Quit Their Jobs in September

As per the latest JOLTS report, about 3.2 million American workers quit their jobs voluntarily in September.

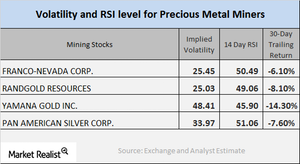

Inside Mining Stock Technicals on October 12

Most precious metals had a down day on Tuesday, October 10, despite the recent overall upward movement in precious metals.

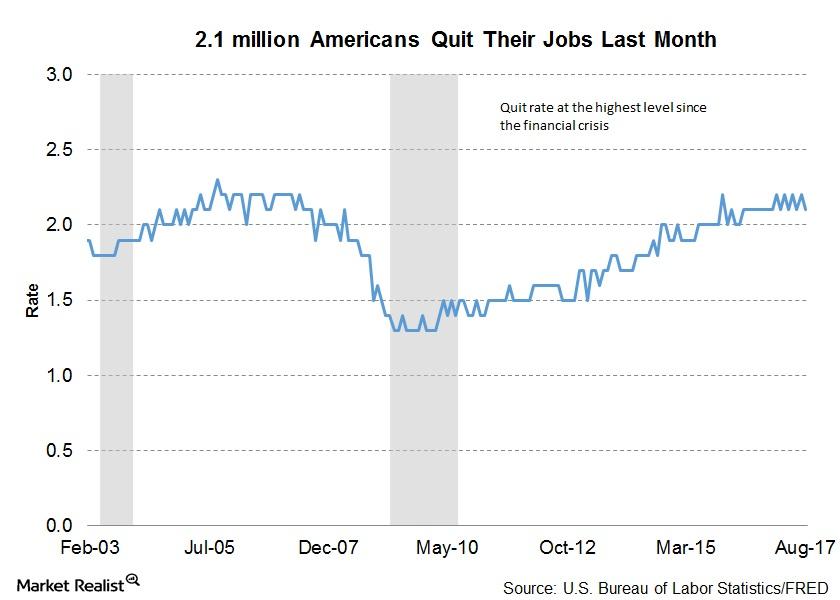

How Many Americans Quit Their Jobs in August?

As per the latest JOLTS report, about 2.1 million Americans quit their jobs voluntarily in August, which was a decrease of 70,000 from the previous reading.

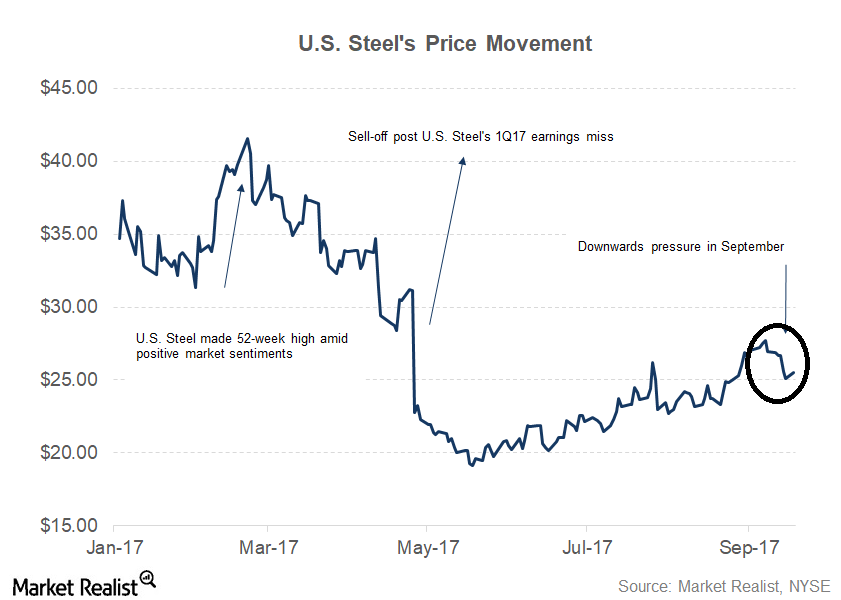

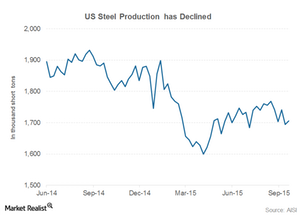

How the US Steel Industry’s Supply and Demand Looks before 4Q17

Steel stocks have recouped some of their losses in the last two trading sessions. However, U.S. Steel Corporation (X) and AK Steel (AKS) have lost 5.3% and 4.1%, respectively, month-to-date based on their September 27 closing prices.

Why Are So Many Americans Quitting Their Jobs?

As per the latest JOLTS report, about 3.2 million Americans quit their jobs voluntarily last month. This is an increase of 0.1 million from the previous month.

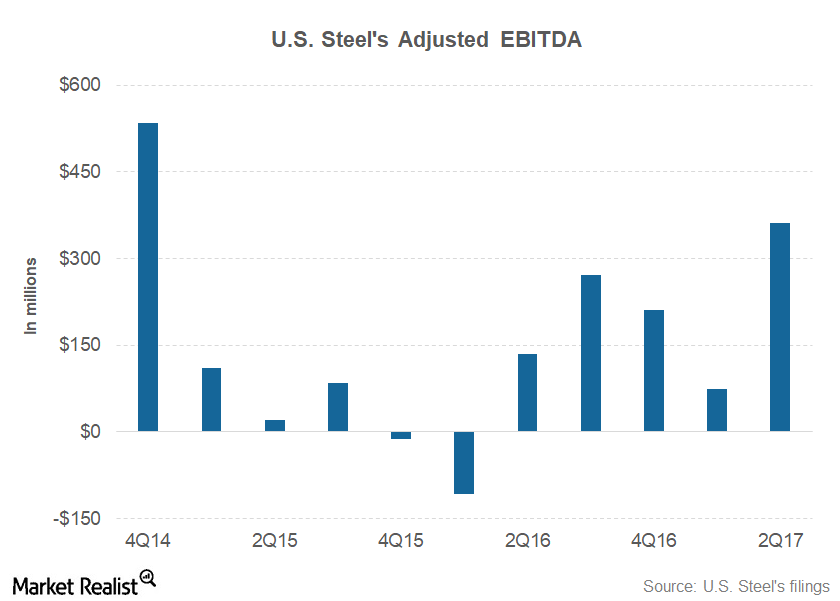

A Comparative Analysis of Steel Companies’ Leverage

Steel companies have high sensitivity to steel prices and their earnings tend to be volatile. Spot steel prices have been volatile in the last few years.

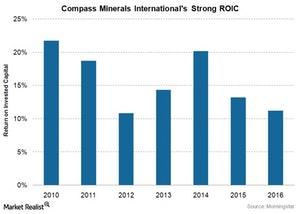

What’s Compass Minerals Doing to Gain a Cost Advantage?

Led by its superior assets, location, and geological advantages, Compass Minerals holds a competitive position with a wide economic moat rating.

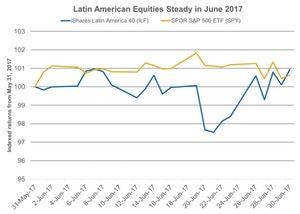

Performance of Latin American Equities Steady in June 2017

Latin American (ILF) equities in June 2017 remained steady amid the political turmoil among its member nations.

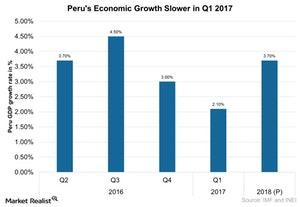

Why Global Mining Leader Peru Is Seeing Slower Growth in 2017

According to Peru’s Ministry of Economy and Finance, the El Niño–related infrastructure damages were close to $4 billion.

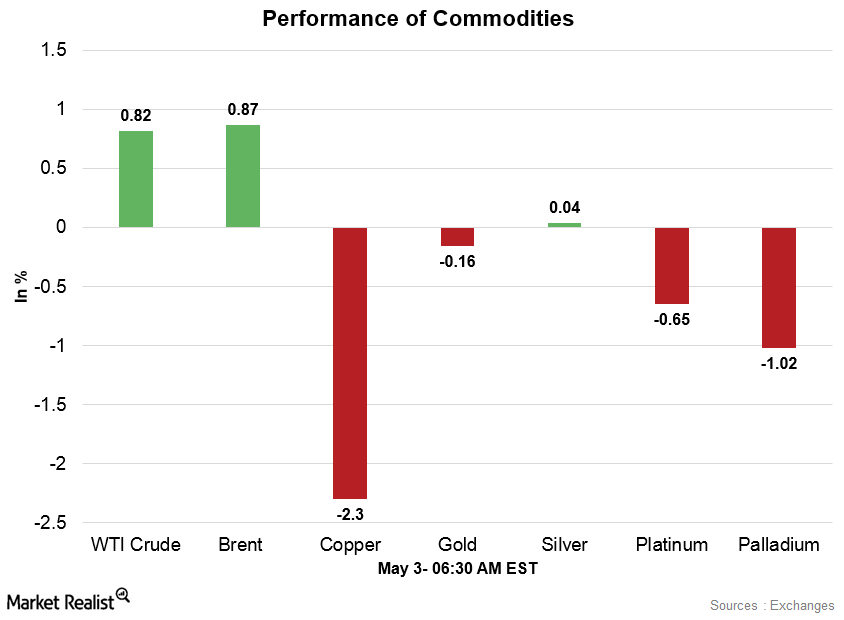

Crude Oil Is Stable amid Lower Inventory Levels

After falling to five-week low price levels on May 2, crude oil prices are stable in the early hours on May 3. The market opened higher on Wednesday.

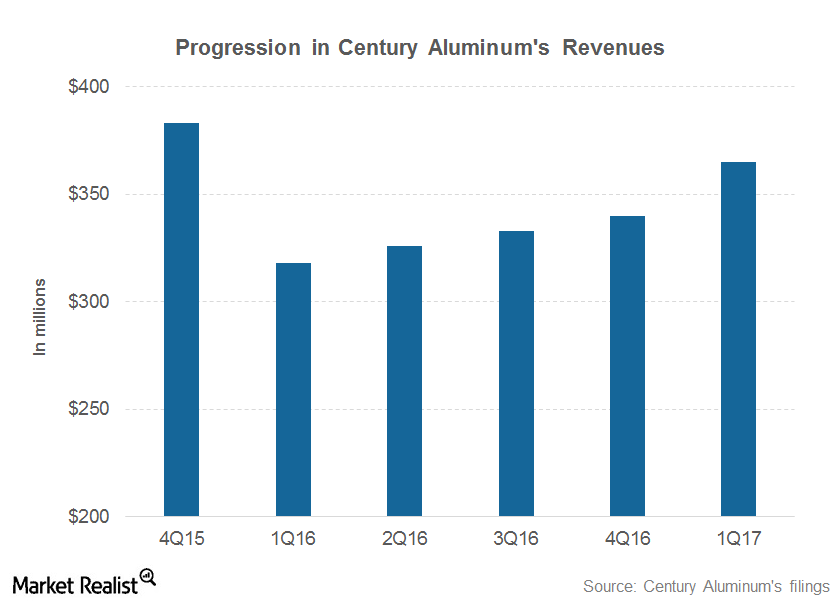

What Investors Should Know about Century Aluminum’s 1Q17 Results

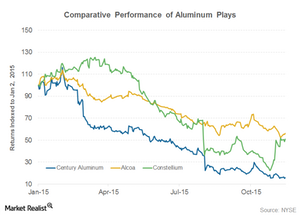

Century Aluminum (CENX) was among the best-performing aluminum stocks (NHYDY) (ACH) (SOUHY) last year with gains of 94%.

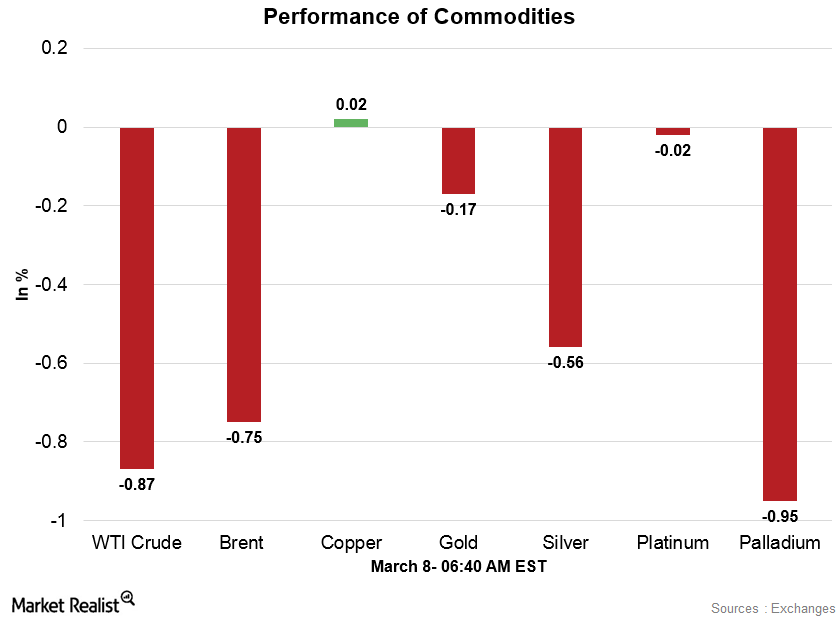

Commodities Are Weaker amid the Firmer Dollar

Gold (GLD) and silver (SLW) are weaker in the early hours due to the firmer dollar and expectations of a US interest rate hike in the Fed’s March meeting.

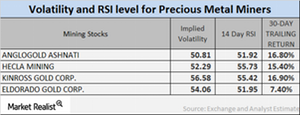

What the Latest Volatility and RSI Numbers Indicate

It’s important to monitor the implied volatilities of large mining stocks as well as their RSI levels, particularly after changes in precious metal prices.

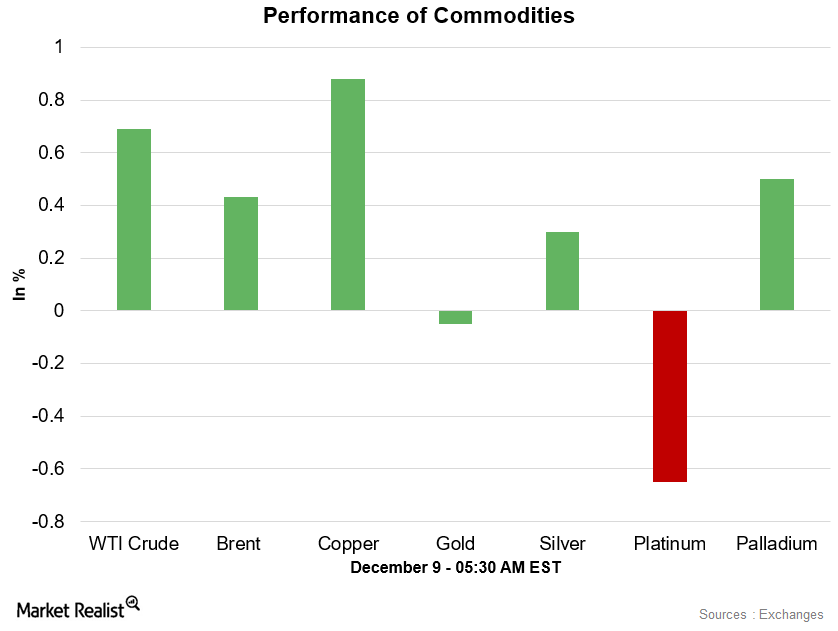

Crude Oil and Copper Are Stable, Gold Is Weaker on December 9

At 5:00 AM EST on December 9, the WTI crude oil futures contract for January 2017 delivery was trading at $51.21 per barrel—a rise of ~0.71%.

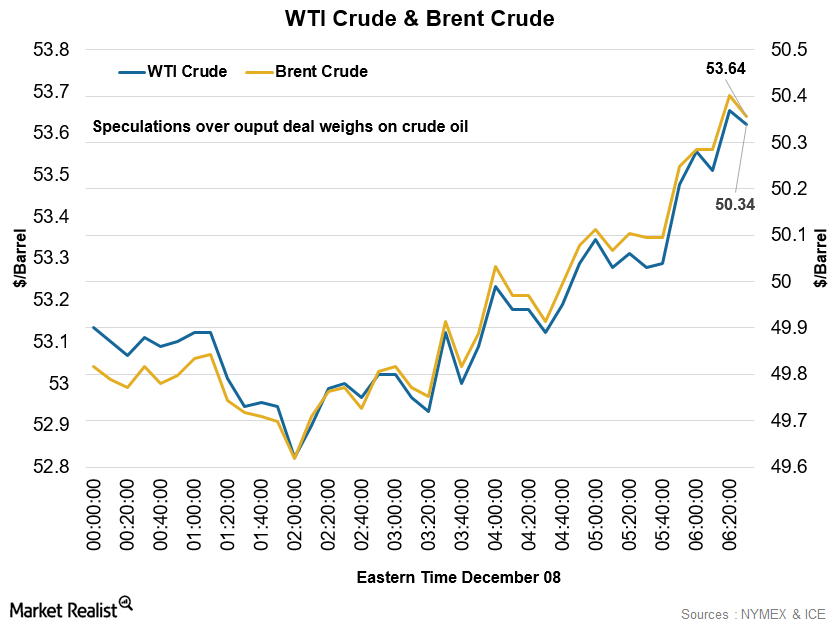

China’s Trade Data and the Weaker Dollar Support Commodities

Copper prices are stable in the early hours on December 8. China’s upbeat trade balance data are supporting the sentiment in the copper market.

Early Morning Update: Crude Oil Fell, Metals Were Mixed

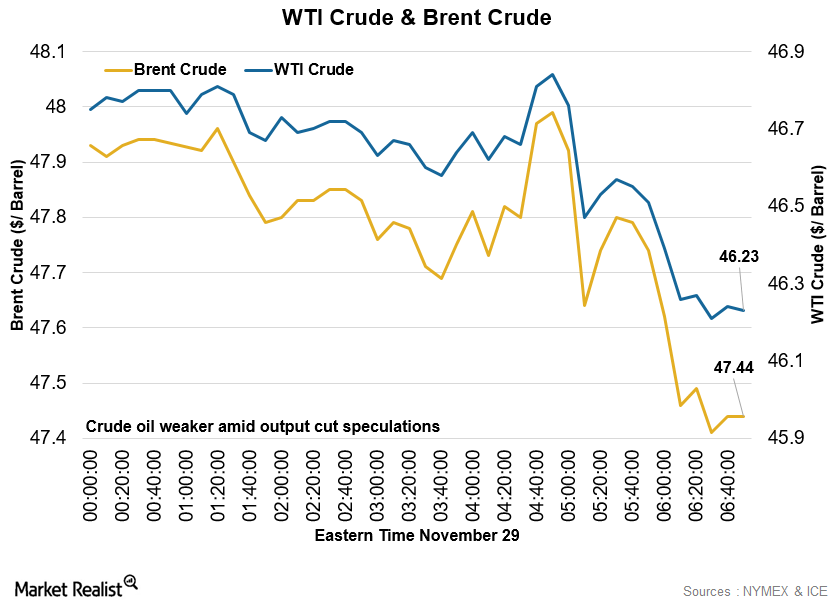

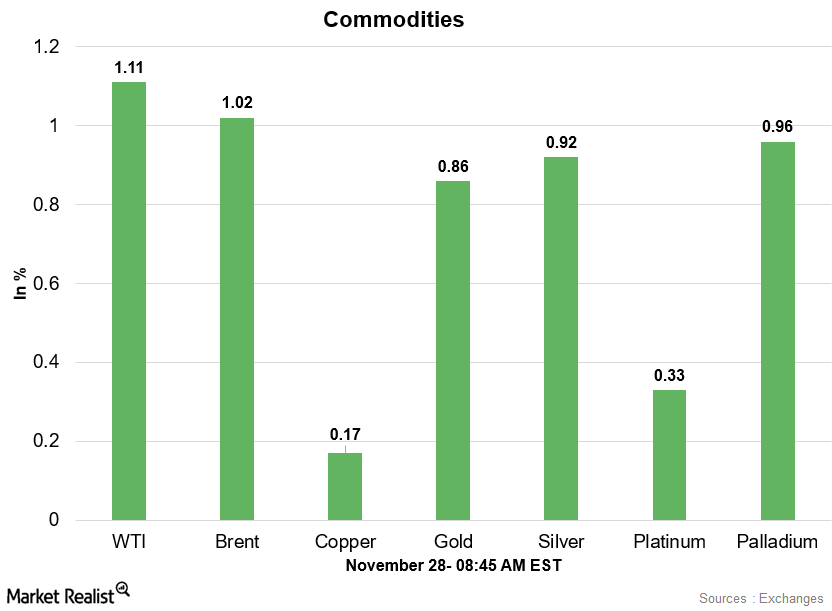

Crude oil prices are weaker early on November 29 amid speculations about the supply cuts. Russia confirmed that it wouldn’t attend OPEC’s meeting.

Early Morning Update: Energy, Metals, and Mining Sector

The market is also waiting for the weekly crude oil inventory reports from the U.S. Energy Information Administration and the American Petroleum Institute.

Goldman Sachs Gets Bullish on Commodity Prices

Goldman Sachs has gone bullish on commodities. The finance major, which is the biggest commodities dealer (in sales), has advised clients to go overweight.

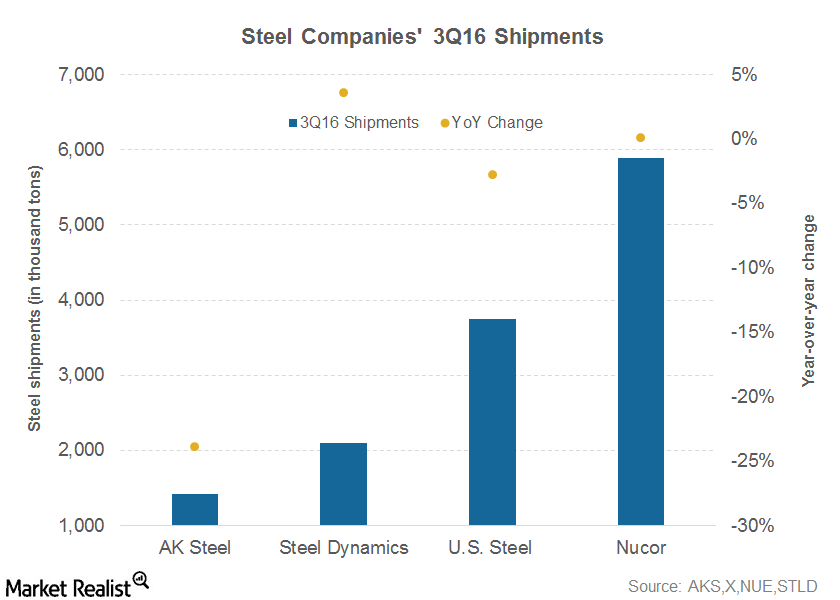

Revenue Miss Was a Hallmark of Steel Companies’ 3Q16 Earnings

One of the key features of steel companies’ 3Q16 financial performance was lower-than-expected revenues.

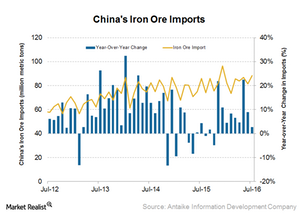

Why China’s Iron Ore Imports May See a Near-Term Pullback

In July 2016, China’s iron ore imports came in at 88.4 million tons. This was a rise of 2.7% compared to 86.1 million tons in July 2015 and 81.6 million tons in June 2016.

How the 15% Rule Became a Stepping Stone for 3M’s Innovation

3M company owes much of its innovative culture to William McKnight, who became the General Manager of the company in 1914.

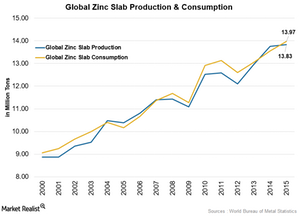

Why Zinc Demand Could Pick Up in 2016–2017

Zinc has gained more than 15% in 2016 so far, outperforming other base metals in the same category.

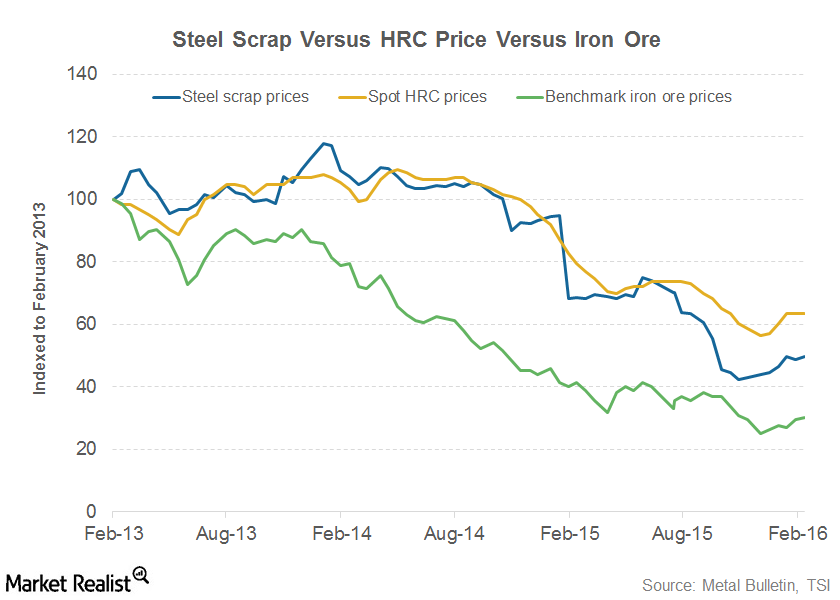

Scrap or Iron Ore: What Drives US Steel Prices?

Even the recent uptick in US steel prices has been accompanied by strength in steel scrap prices.

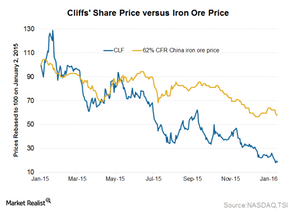

What to Look for in Cliffs Natural Resources’ 4Q15 Results

In its 4Q15 earnings release on January 27, 2016, Cliffs Natural Resources (CLF) may provide a further update on its venture into a direct reduced iron business.

Cliffs Natural Resources’ Woes Continued in the Fourth Quarter

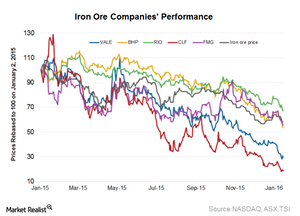

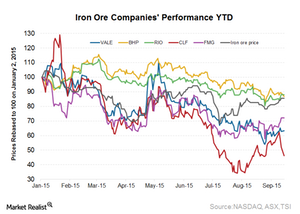

In 2015, Fortescue Metals Group (FSUGY) and Cliffs Natural Resources (CLF) fell 35% and 78%, respectively.

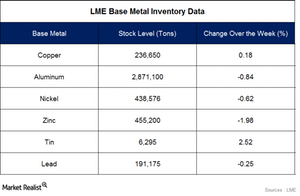

Base Metal Inventories Fell Last Week: How Much?

In the week ended January 9, copper and tin inventories increased. Levels for other base metals fell.

2015 Has Been Hard on Mining Companies

2015 has been tough for miners, especially due to the price rout in the commodities market. The commodities market has fallen about 24.3% since the start of the year.

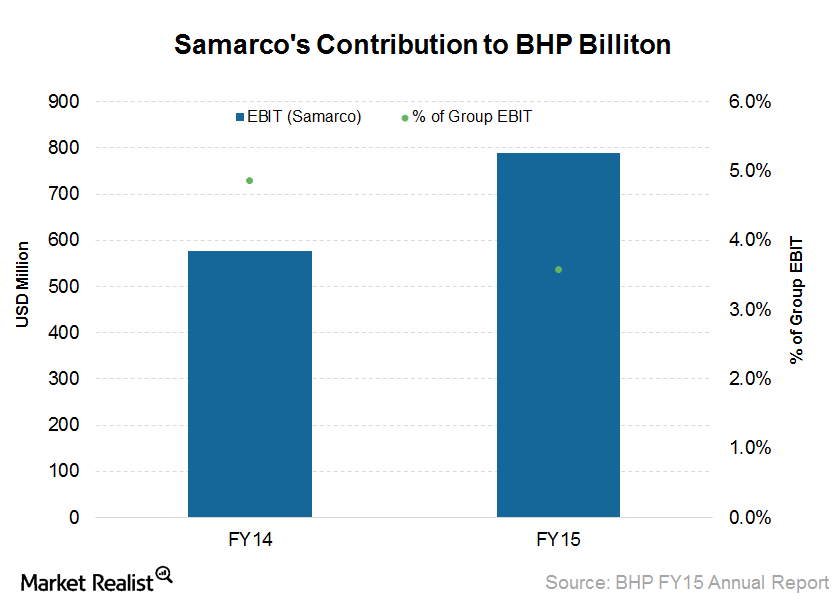

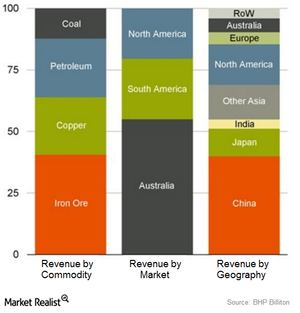

How Could the Samarco Dam Failure Impact BHP Billiton?

Brazil’s government has announced that it intends to start legal proceedings against Samarco, Vale, and BHP Billiton for Samarco’s tailings dam failure.

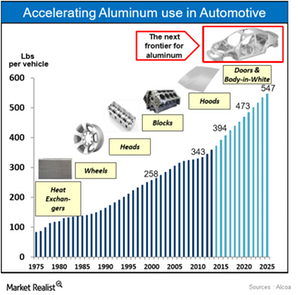

The Auto Industry’s Aluminum Usage Is Increasing

The usage of aluminum in automobiles has been gradually increasing, as it improves vehicle performance, reduces CO2 emissions, and boosts fuel economy.

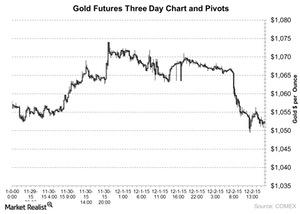

Gold Touched Its Lowest Levels in the Last Six Years on Wednesday

Gold futures trading on COMEX, the commodity division of the New York Mercantile Exchange, fell 0.91% on December 2, 2015. Also, platinum fell 0.36%.

What’s Driving Alcoa’s Stock?

Alcoa’s stock has witnessed a decent upwards move over the last few trading sessions, gaining more than 16% since November 12.

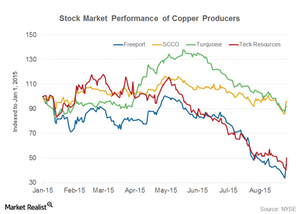

Why Aren’t BHP and RIO Cutting Copper Production?

While major mining companies like Freeport-McMoRan and Glencore are declaring copper production cuts, BHP Billiton says it is reluctant to decrease its copper production.

Is there More Downside to Cliffs’s USIO Division Volume Guidance?

In its 2Q15 results, Cliffs Natural Resources (CLF) downgraded its volume guidance for the USIO division for 2015, from 20.5 million tons to 19 million tons.

Cliffs Natural Resources: 3Q15 Market Expectations

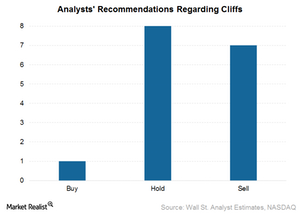

Market expectations for Cliffs Natural Resources (CLF) are varied. Of the analysts covering Cliffs, one has a “buy” recommendation, eight have a “hold,” and seven have a “sell.”

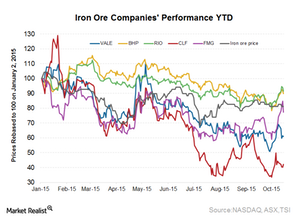

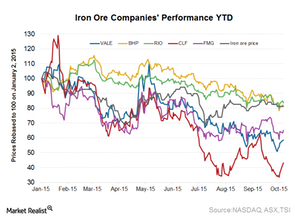

Cliffs Natural Resources Has Underperformed Iron Ore Peers So Far

The third quarter of 2015 hasn’t been good for iron ore equities. Most of them lost significant value during the quarter.

Cliffs to Announce 3Q15 Results on October 29

Cliffs Natural Resources (CLF) will release its 3Q15 results before the US market opens on October 29, 2015. A conference call will occur at 10:00 AM ET on October 29.

What is Driving the Iron Ore Miners’ Stock Price Performance?

Iron ore prices fell 49% in 2014, which was reflected in the share price performance of major miners. In this series, we’ll discuss the position of various iron ore players on the cost curve relative to iron ore prices.

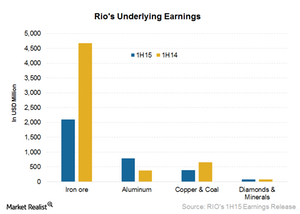

Will the Slide in Rio Tinto’s Underlying Earnings Continue?

Rio Tinto’s (RIO) underlying EBITDA (earnings before interest, taxes, depreciation, and amortization) was $7.3 billion for 1H15.

After 1H15, Rio Tinto Looks Forward to Further Cost Cuts

Within four trading days of its 1H15 results, Rio Tinto’s stock price rose 3%. This is despite a 1.7% fall in benchmark seaborne iron ore prices.

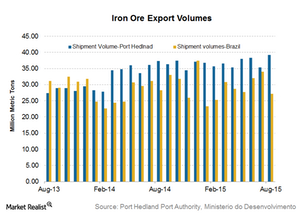

Iron Ore Shipments Remain Strong for August

Iron ore shipments through Port Hedland reached an all-time high of 39.2 million tons in August as compared to 35.3 million tons in July.

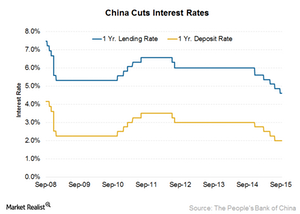

Will China’s Monetary Easing Impact Iron Ore Miners Favorably?

Chinese credit easing measures should positively impact the steel industry. This will help iron ore companies like Rio Tinto and BHP Billiton.

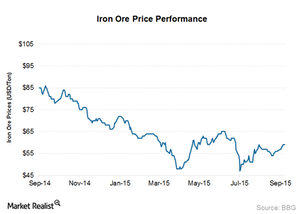

Iron Ore Prices Are Holding Steady Thus Far

Since the end of July, benchmark iron ore prices have been holding steady near $55–$57 per ton. This is despite the continuing slide in other commodities amid China slowdown worries.

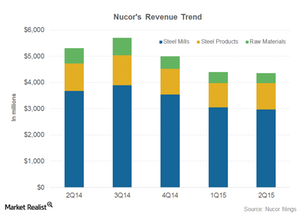

The Hows and Whys of Nucor’s Recent Falling Revenues

Nucor’s net revenues fell ~18% in 2Q15, compared to the corresponding quarter last year. Most steel companies have reported lesser revenues in 2Q15 as well.

Is Freeport-McMoRan Worth a Look for Investors?

With the recent news of activist investor Carl Icahn taking an 8.5% stake in the company coupled with Freeport’s lower capital expenditure guidance, the stock has seen a smart up move.

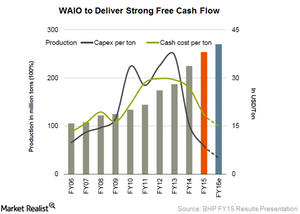

How Much Lower Can BHP’s Unit Iron Ore Costs Go?

Iron ore costs are key to determining BHP’s iron ore segment’s profitability, which ultimately impacts its stock price and relative performance.

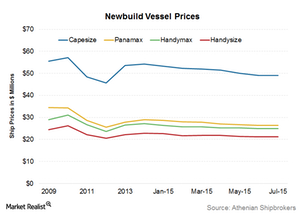

Newbuild Vessel Prices Remained Steady in July

Newbuild vessel prices for all of the ship sizes remained constant in July 2015—compared to June 2015—according to data from Athenian Shipbrokers.

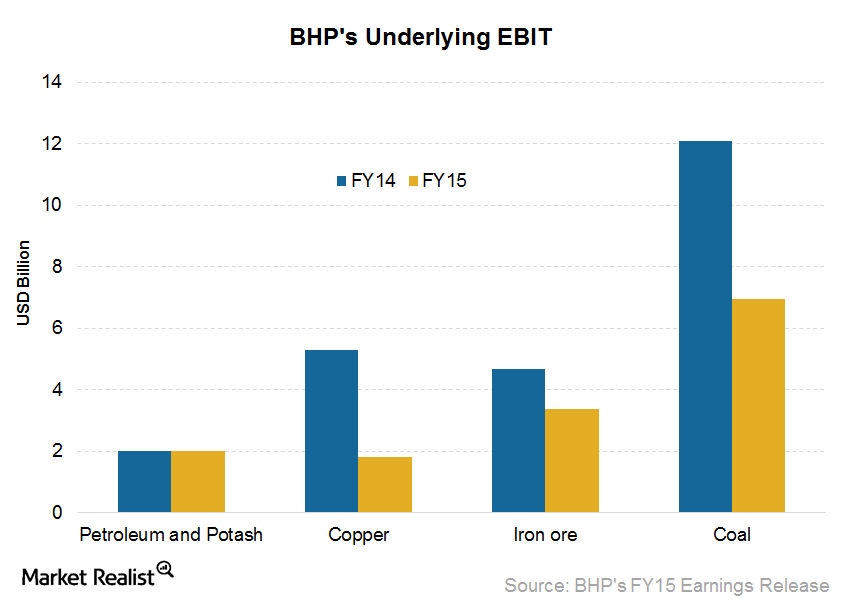

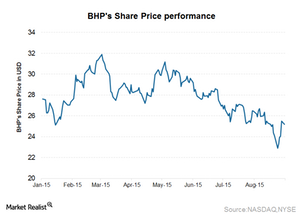

Why BHP’s Operating Income Fell in Fiscal 2015

BHP Billiton’s (BHP) (BBL) underlying EBITDA was $21.9 billion for fiscal 2015. This is a fall of 28% year-over-year (or YOY). Operating income also fell 46% YoY in fiscal 2015.

Is Everything Going According to Plan for BHP Billiton?

BHP Billiton (BHP) (BBL), the world’s largest miner by market capitalization, reported its fiscal 2015 results on August 25. The results were mostly in line with market expectations.