SPDR® S&P Metals and Mining ETF

Latest SPDR® S&P Metals and Mining ETF News and Updates

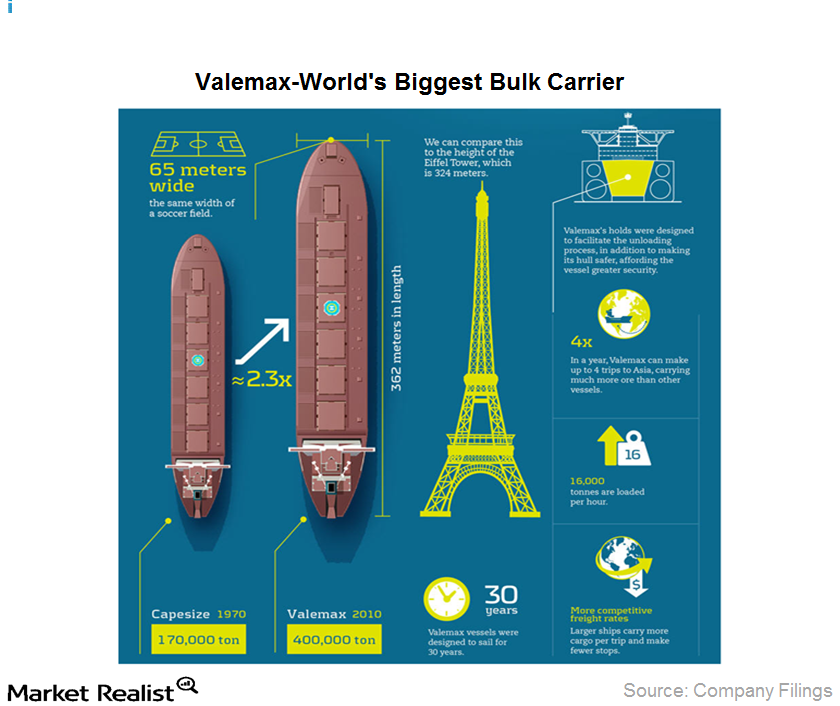

Valemax ships sail Vale SA to cost-effective distribution

Valemax ships are ultra-large vessels, capable of carrying 400,000 dwt (dead weight tons) each. That’s 2.3 times more than traditional Capesize ships. They also emit 35% less CO2 per ton of ore transported.

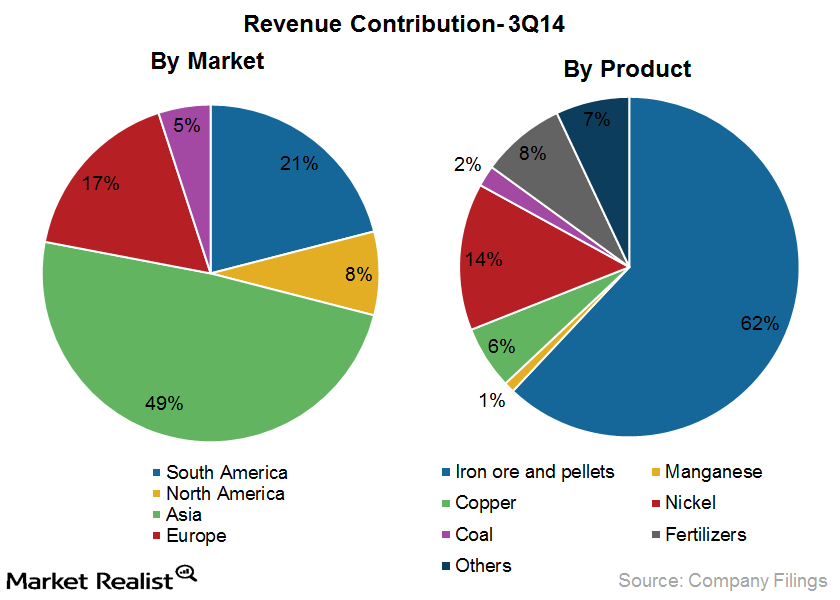

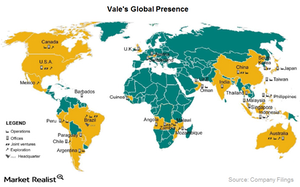

Vale SA: Overview of the world’s largest iron ore company

Vale SA (VALE) is a Brazilian multinational diversified metals and mining company. It is the world’s largest producer of iron ore and iron ore pellets and the world’s second-largest producer of nickel.

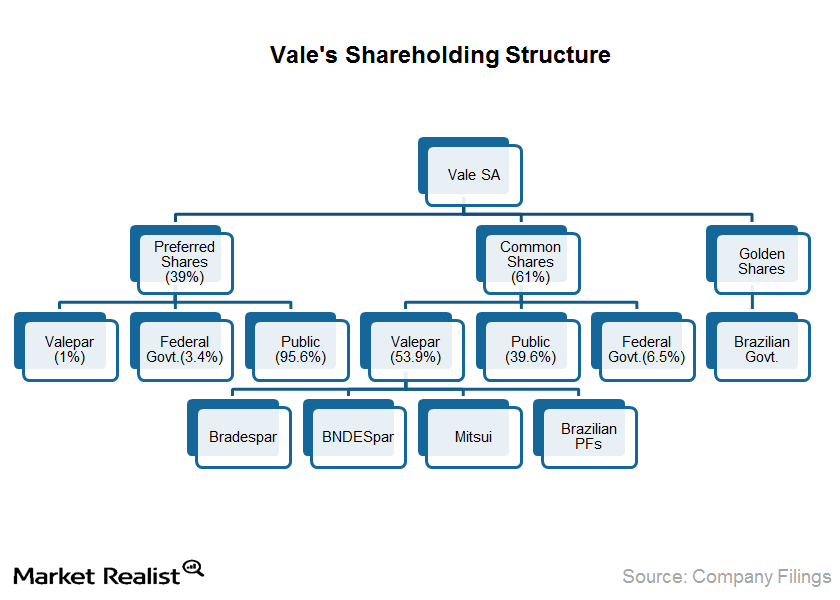

The implications of the Vale SA ownership structure

Although there hasn’t been any recent cause for concern, and the government doesn’t interfere in the day-to-day workings of Vale, there’s always a risk that the company could be pushed into pursuing objectives that aren’t in the best interests of all shareholders.

Vale SA: Top-quality iron ore and pellets

Vale SA (VALE) is the world’s largest producer of iron ore and pellets. Pellets are manufactured by gathering together the powder generated during the ore extraction process.

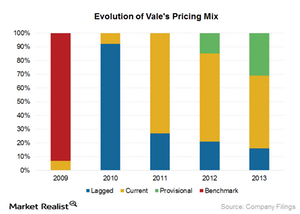

How Vale SA values its iron ore customers

Vale SA offers technical assistance to its customers and operates sales support offices in several cities. These offices monitor customer requirements and ensure timely deliveries.

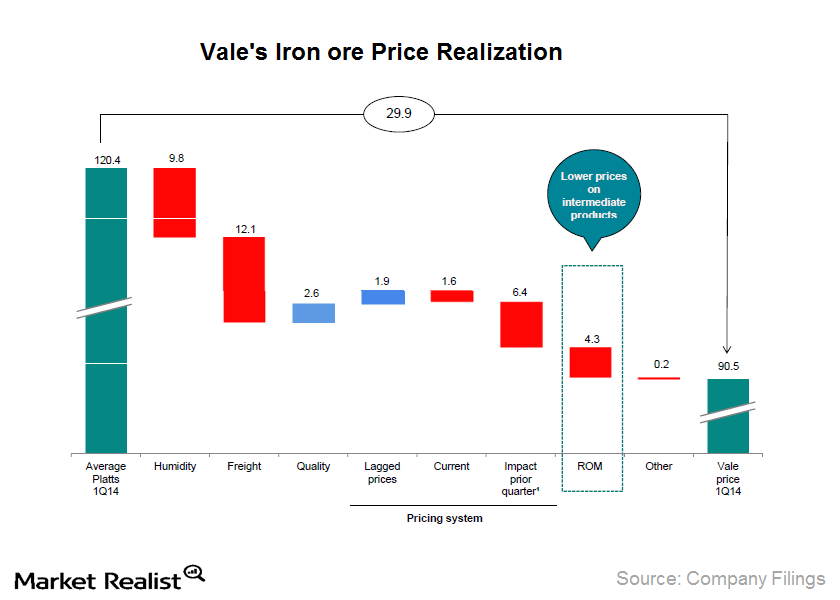

Realized price: The factors impacting Vale SA iron ore

Realized prices for iron ore vary depending on quality, moisture content, freight costs, and pricing mechanisms. ROM sales reduced Vale’s realized price by about $6 per ton in 2013.

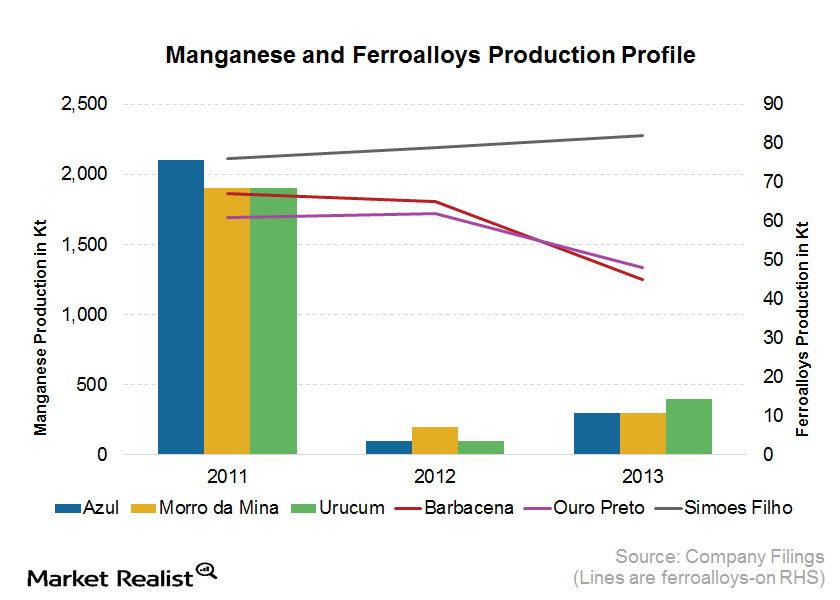

Vale SA in the manganese and ferroalloys business

Vale SA is the largest manganese producer in Brazil, accounting for roughly 70% of the country’s market. The Azul Mine in Para is responsible for 80% of its output.

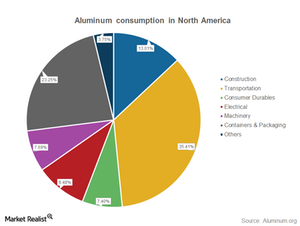

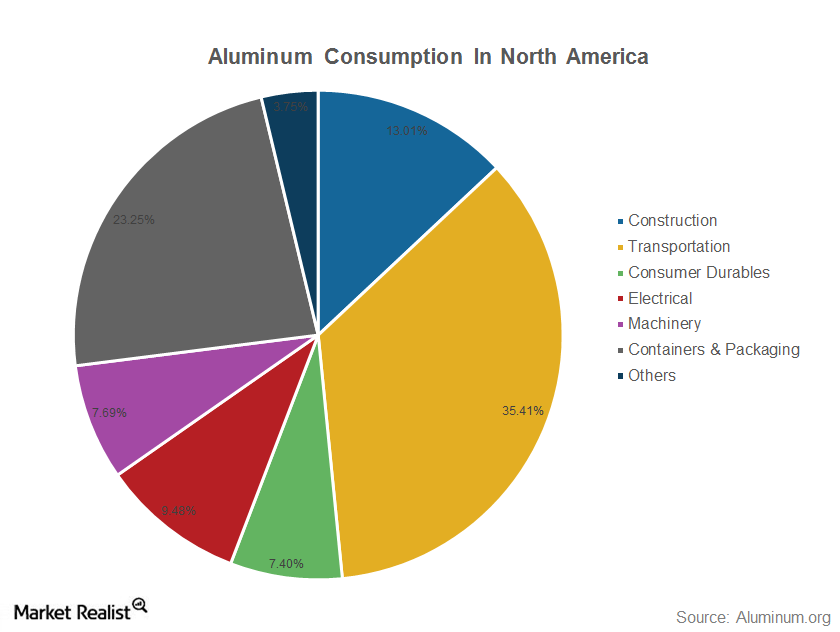

Why Aluminum Is An Important Metal For Investors

Investors like aluminum. They can play the aluminum industry by trading aluminum on commodity exchanges. Investors can also investment in aluminum plays.

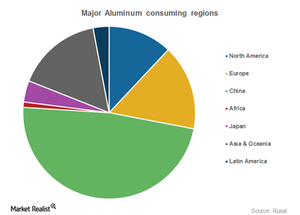

What Are The Major Regions That Consume Aluminum?

China is the biggest consumer. It consumes almost half of the aluminum that’s produced globally. However, this isn’t surprising. China is the biggest consumer of most industrial commodities.

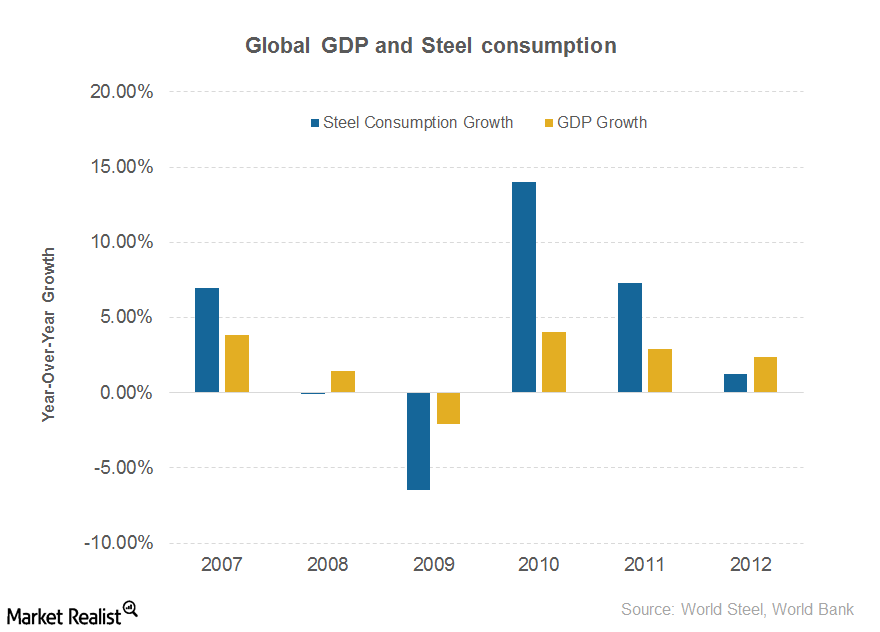

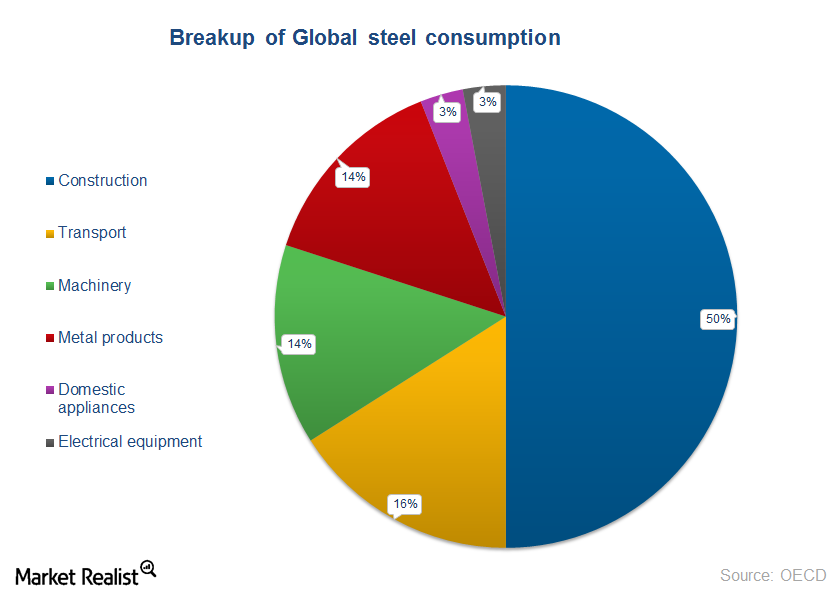

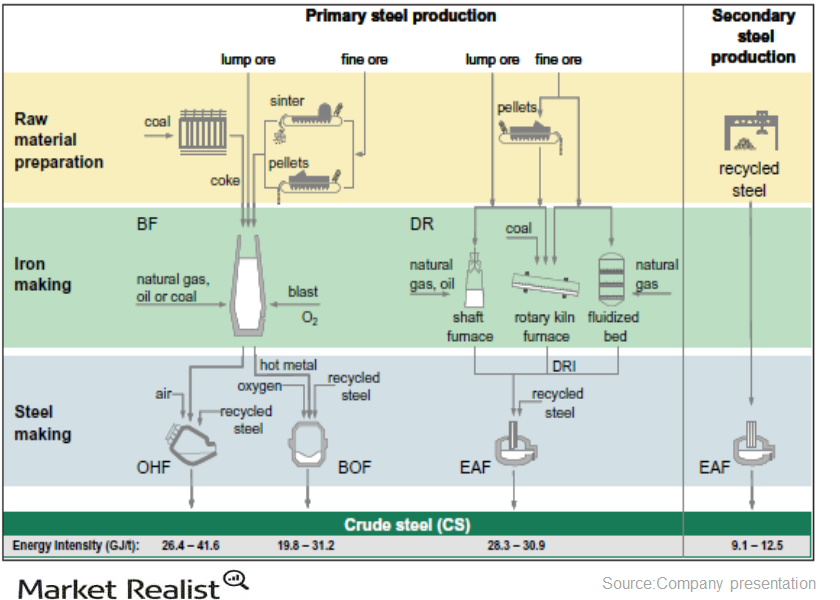

How Investors Can Play The Steel Industry

Steel is a cyclical industry and is dependent on the growth in economic activity. In this series, we’ll learn key facts related to the steel industry and how investors can play the steel industry.

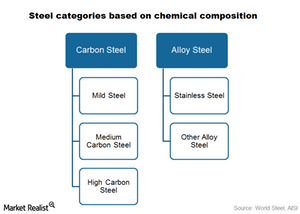

Key Facts Investors Need To Know About Steel

Steel can be classified into several categories. Various types of steel products are based on chemical composition. Types of steel are made by altering the chemical properties of steel.

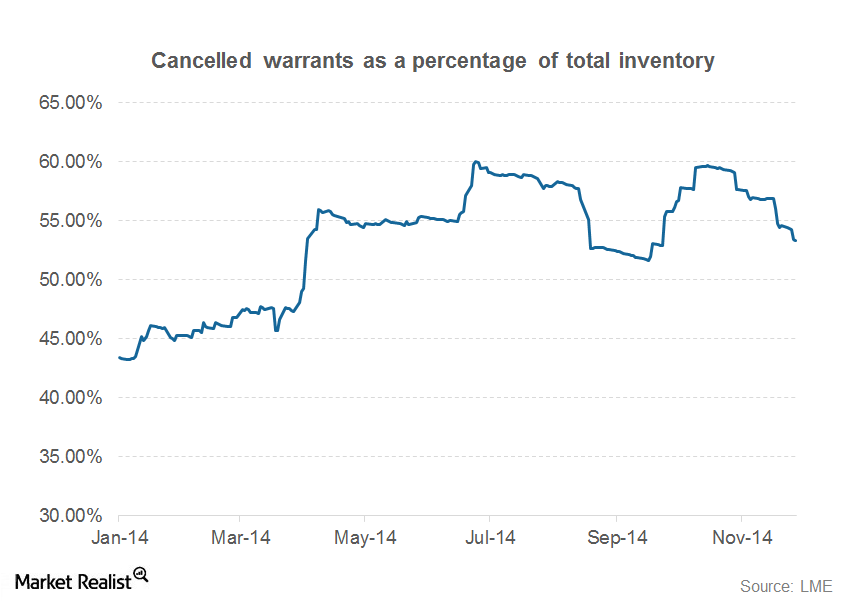

What Investors Need to Know About Aluminum Warrants

Analysts expect that most of the metal has been moving away from LME registered warehouses to non-LME registered warehouses, which typically charge less rent than registered warehouses.

Why the automobile industry is important for metal companies

Automobile companies are one of the biggest metal product consumers. Steel and aluminum are widely used in the automobile industry. Aluminum is being used more in automobiles.Materials Why investors should understand Alcoa’s business model

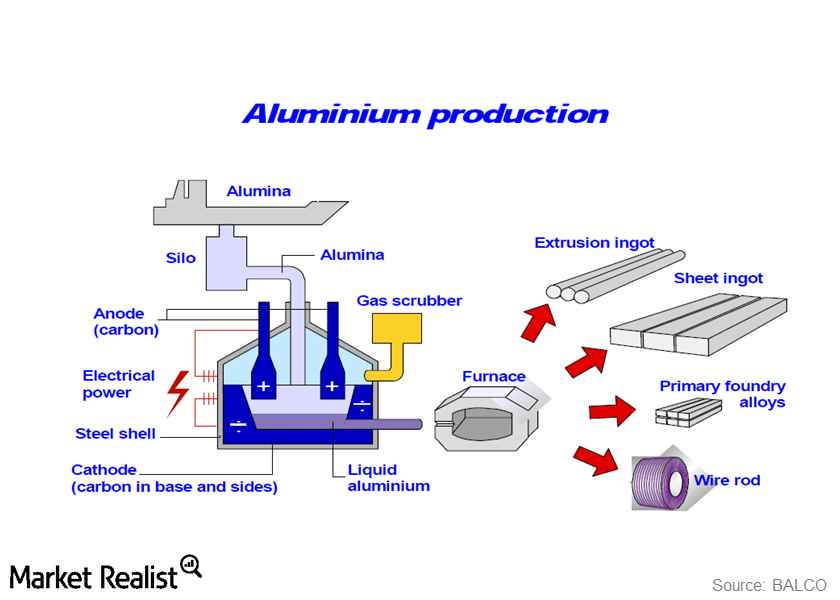

Alcoa is an integrated player in the aluminum value chain. This means its operations extend from bauxite refining to aluminum fabrication.

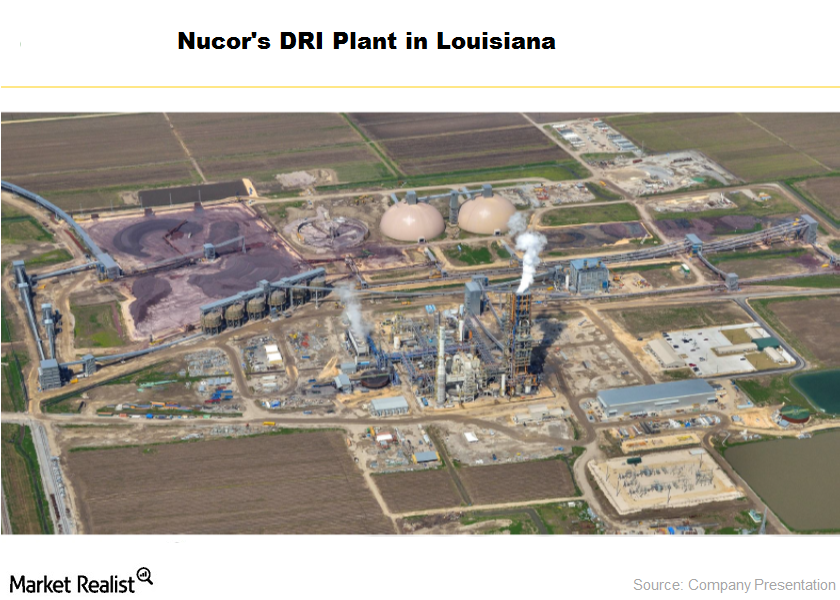

Why mini mills are changing their raw material strategy

Along with steel scrap, EAF can also produce steel through direct reduced iron (or DRI). DRI is produced by heating iron ore. STLD and NUE increased their focus on DRI.

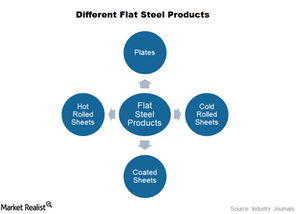

Why Flat Steel Products Are Important For Steel Companies

Flat steel products consist of sheets and plates rolled from slabs, which are a semifinished steel product. These products are used in a wide range of industries such as automobile, domestic appliances, shipbuilding, and construction.

Where Vale SA operates and why

Currently, the the private sector is leading significant expansion and major rehabilitation of Mozambique’s infrastructure. Vale itself is investing in the development of the Nacala infrastructure project.Materials Why Nucor’s Louisiana DRI plant could be a game changer

Nucor has produced 1.2 million tons of DRI this year at the Louisiana plant and expects to produce another 0.5 million tons in the next quarter.

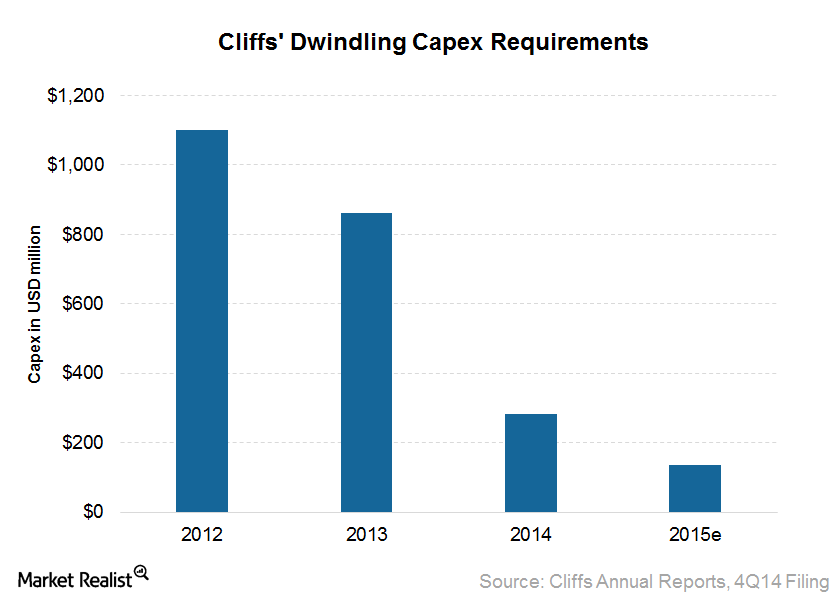

Why Cliffs plans to reduce its capex going forward

Cliffs Natural Resources’ (CLF) estimation for the 2015 annual capital expenditure, or capex, is $125–$150 million.Materials Must-know: Understanding the major markets for AK Steel

AK Steel (AKS) gets most of its revenues from the U.S. For the past three years, more than 85% of its sales have come from the U.S. This makes AK Steel more exposed to the domestic market’s dynamics than global factors.Materials Key drivers of steel consumption: A must-know overview

Steel serves as a raw material for various industries. You and I don’t consume the crude steel that’s produced in factories directly.

Steelmaking: An investor’s guide to the raw materials and process

Iron ore, steel scrap, and coal are three main raw materials for steelmaking. Steelmaking is a raw material–intensive business.

Overview: An investor’s guide to the aluminum industry

Aluminum is the most abundant metal found in the earth’s crust. It’s soft, lightweight, and durable in nature. Its low density and resistance to corrosion make it a very important metal that a lot of industries use.

Must-know: Understanding aluminum’s value chain

The aluminum industry has a value chain that consists of both upstream and downstream companies. Upstream companies are engaged in the mining and refining operations.

Analyzing Alcoa’s 2019 Outlook

On paper, aluminum’s fundamentals look strong. Aluminum markets were expected to be in a deficit of 1.5 million metric tons last year.

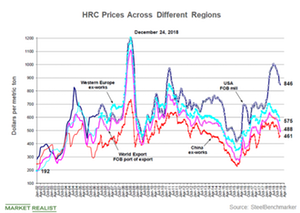

What China’s Steel Price Trends Could Mean for Iron Ore Miners

Bumper margins prompted Chinese steel mills to continue increasing their output.

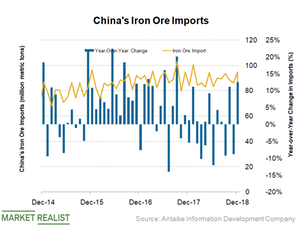

Why China’s Iron Ore Demand Could Soon Weaken

As China consumes more than 70% of seaborne-traded iron ore, it’s imperative for iron ore investors to track the country’s demand and outlook.

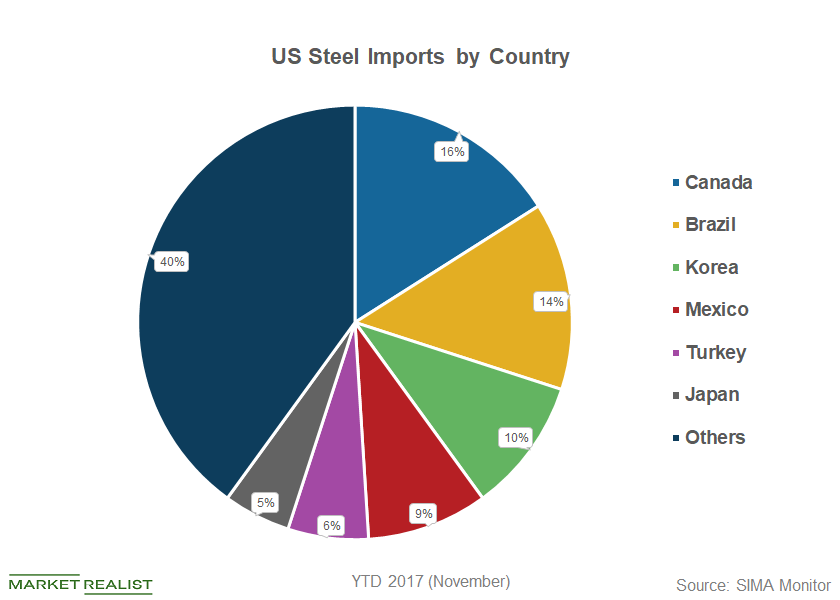

US Steel Companies Keep Fingers Crossed, Key Deadline Looms

U.S. Steel Corporation, AK Steel, Nucor, and Steel Dynamics will probably keep their fingers crossed as the “final” deadline approaches.

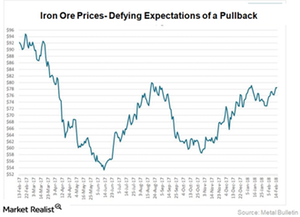

Why Seaborne Iron Ore Prices Might Not Impact Cleveland-Cliffs Much

Iron ore prices showed a lot of volatility in 2017, which is continuing well into 2018.

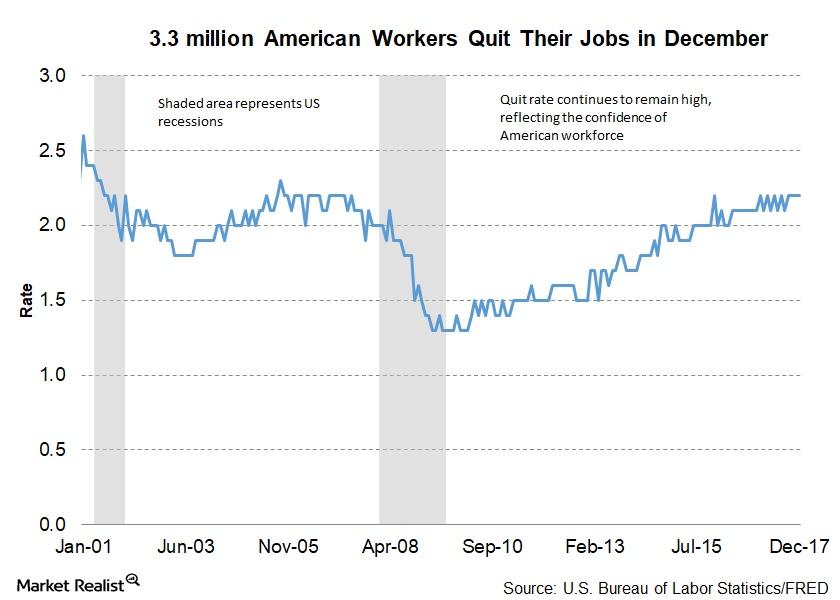

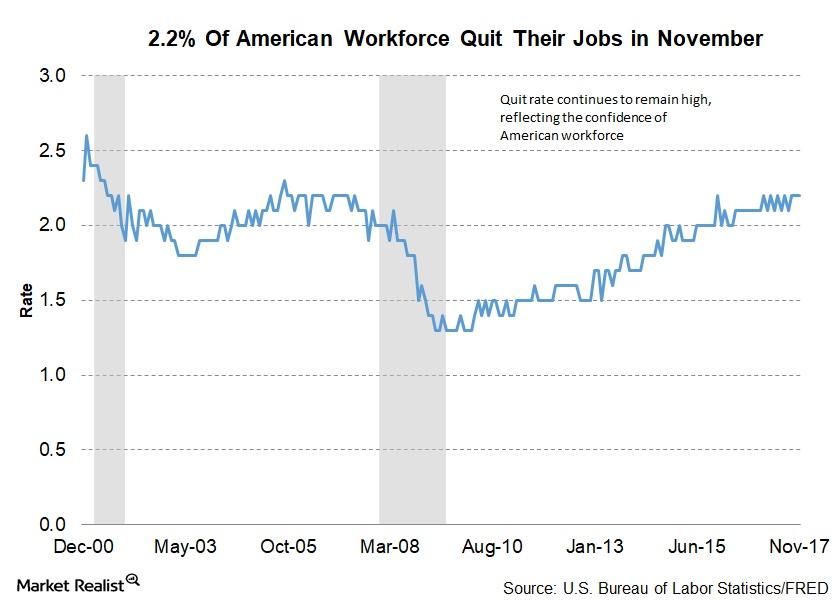

Why Quit Rate Indicates a Strong US Employment Market

As per the latest JOLTS report, total separations for December were 5.2 million, which is 3.6% of the total workforce.

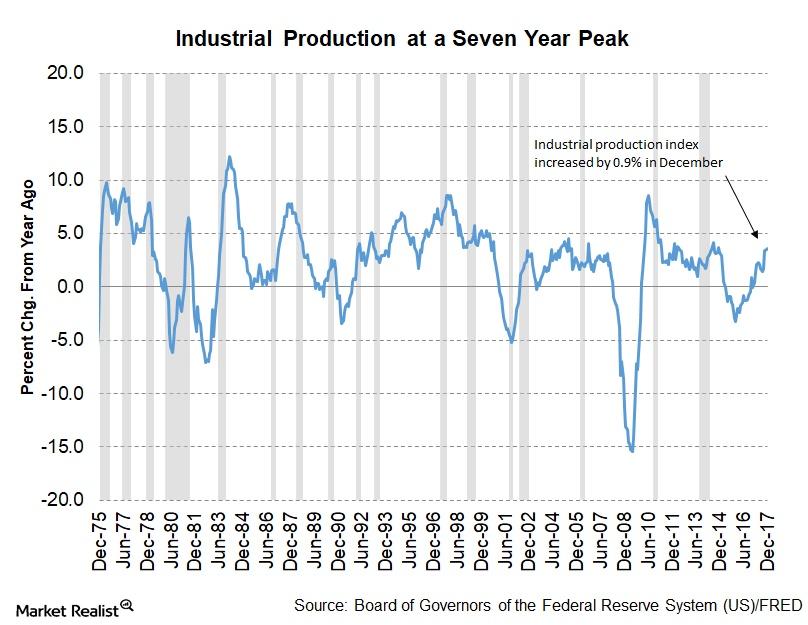

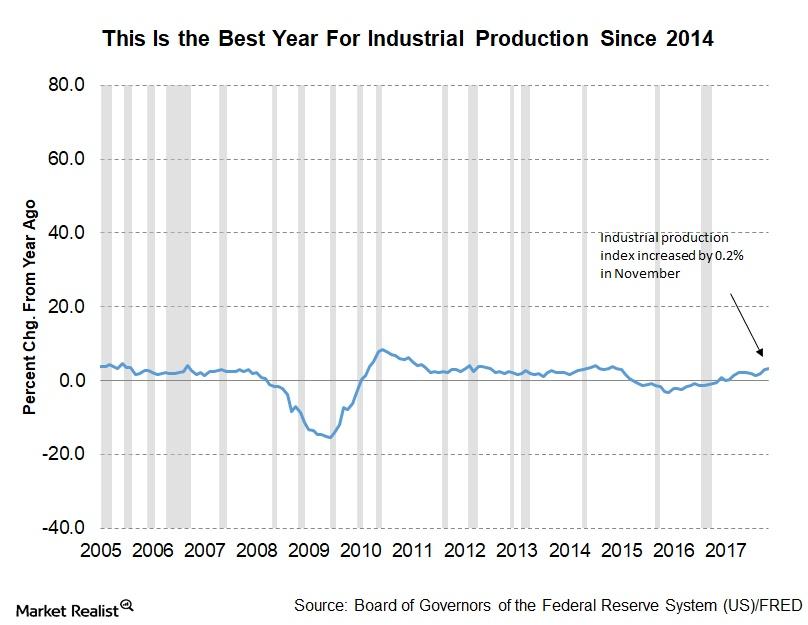

What Drove Industrial Production Higher in December 2017

The Fed’s December industrial production report was released on January 17. The report indicated that industrial production continued to improve throughout 2017.

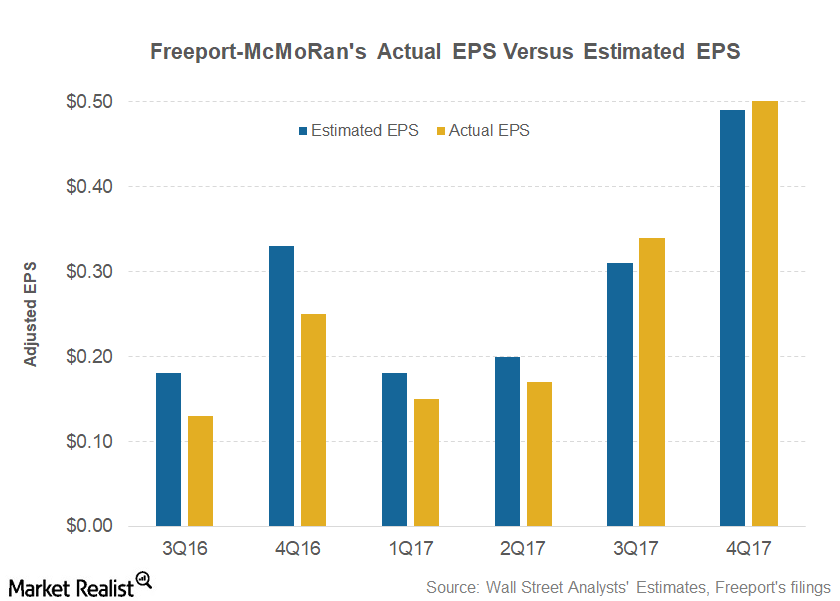

Freeport-McMoRan’s 4Q17 Earnings: What You Need to Know

Freeport-McMoRan (FCX) reported its 4Q17 earnings on January 25, 2018. The company reported an adjusted net income of $750 million.

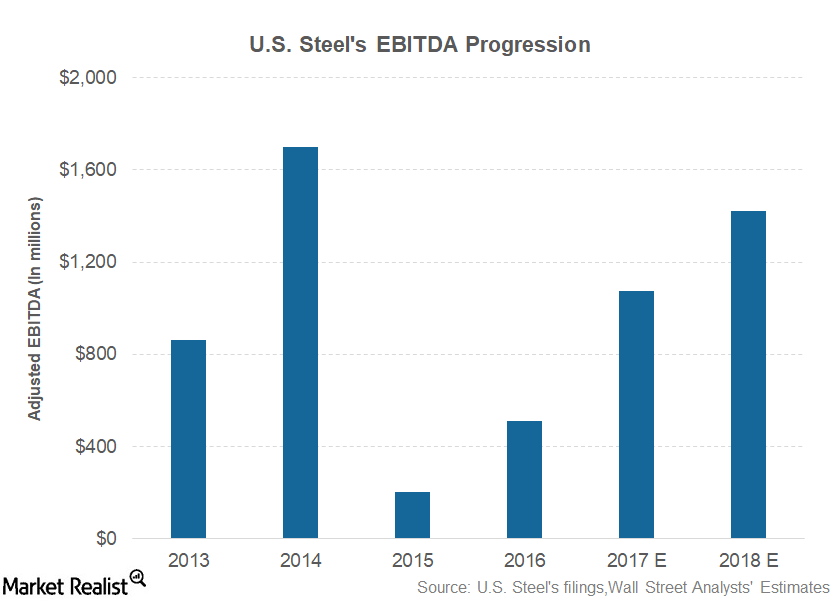

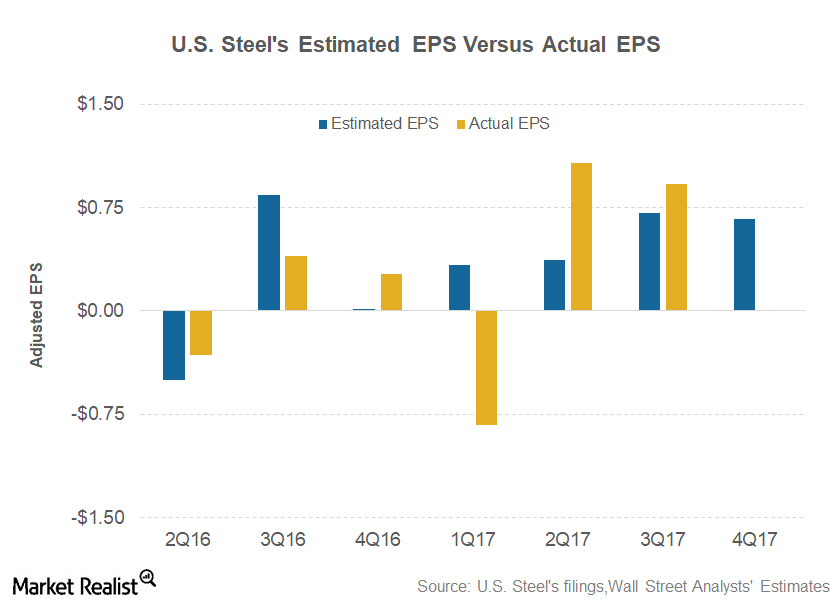

Analyzing U.S. Steel Corporation’s 4Q17 Earnings Call

During the 4Q17 earnings call, analysts will carefully watch U.S. Steel Corporation’s 2018 guidance.

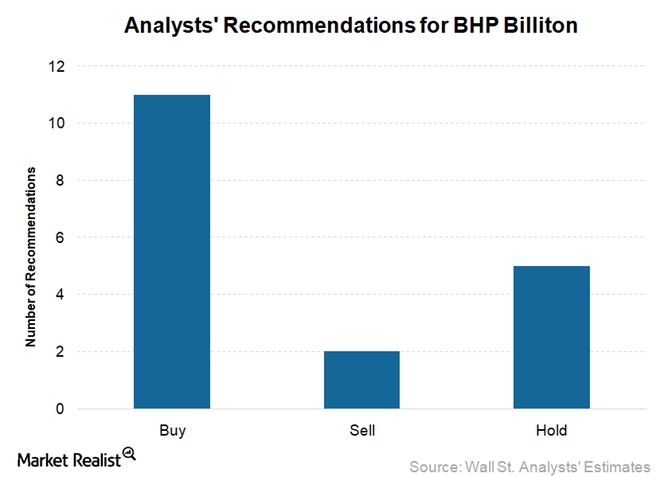

BHP Billiton: Recent Wall Street Upgrades and Downgrades

Of the 18 Wall Street analysts currently covering the BHP Billiton’s (BHP) stock, 61% rate it as a “buy,” 28% recommend a “hold,” and the remaining 11% have a “sell” recommendation on the stock.

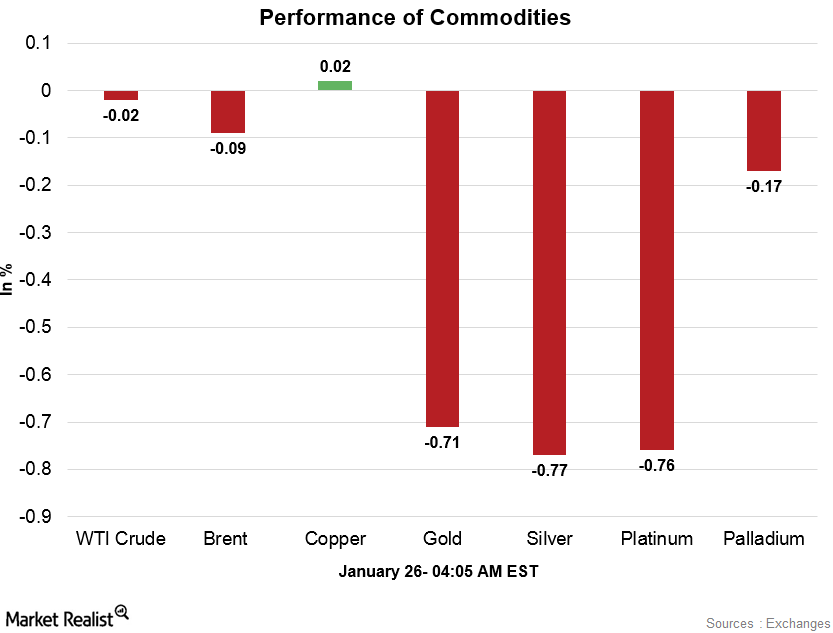

Commodities Are Strong in the Early Hours on January 26

At 4:00 AM EST on January 26, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $65.44 per barrel—a drop of 0.11%.

What to Expect from U.S. Steel Corporation’s 4Q17 Shipments

U.S. Steel Corporation’s 4Q17 European shipments could be higher—compared to the sequential quarter. Steel demand tends to be slow in the third quarter.

Can U.S. Steel Corporation Continue to Fly High?

U.S. Steel Corporation (X) is scheduled to release its 4Q17 financial results on January 31, 2018. U.S. Steel Corporation closed 2017 with gains of 6.6%.

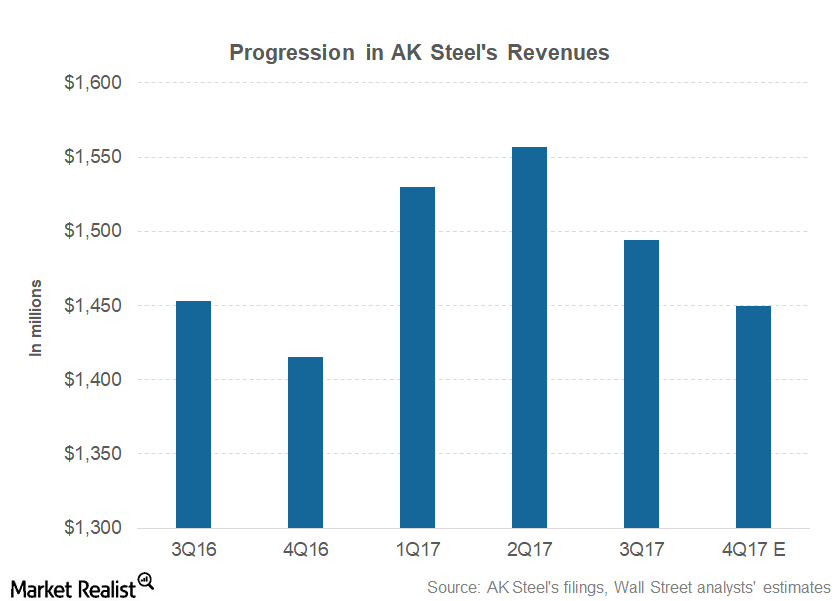

What Could Drive AK Steel’s 4Q17 Financial Performance

AK Steel’s 4Q17 financial performance AK Steel’s (AKS) 4Q17 earnings results are expected on January 30. In this article, we’ll see what analysts are projecting for AK Steel’s 4Q17 revenue. We’ll also look at what could drive AK Steel’s 4Q17 financial performance. According to analyst estimates compiled by Thomson Reuters, AK Steel is expected to post […]

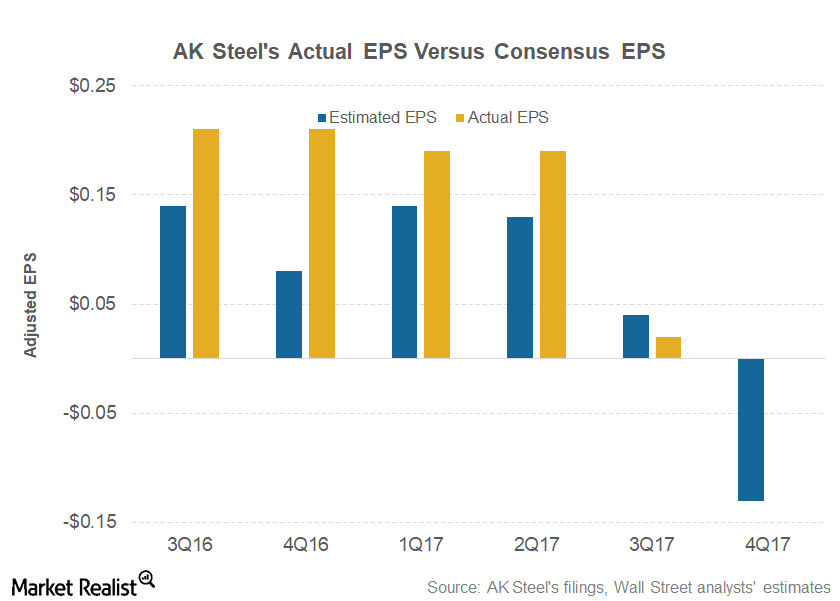

Could AK Steel’s 4Q17 Results Keep Investors’ Optimism Alive?

AK Steel (AKS) is scheduled to release its 4Q17 earnings results on January 30, 2018.

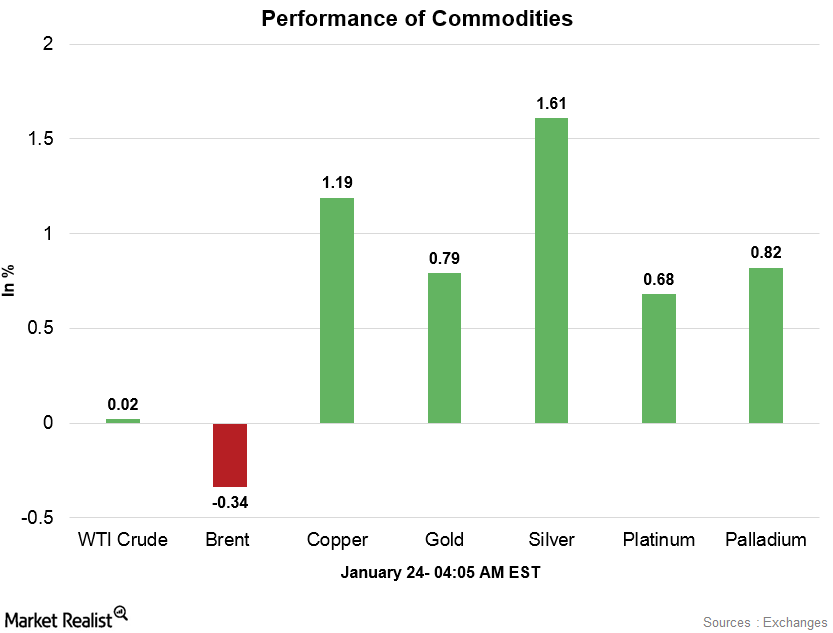

Commodities Are Strong Early on January 24

At 4:00 AM EST on January 24, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $64.50 per barrel—a gain of 0.05%.

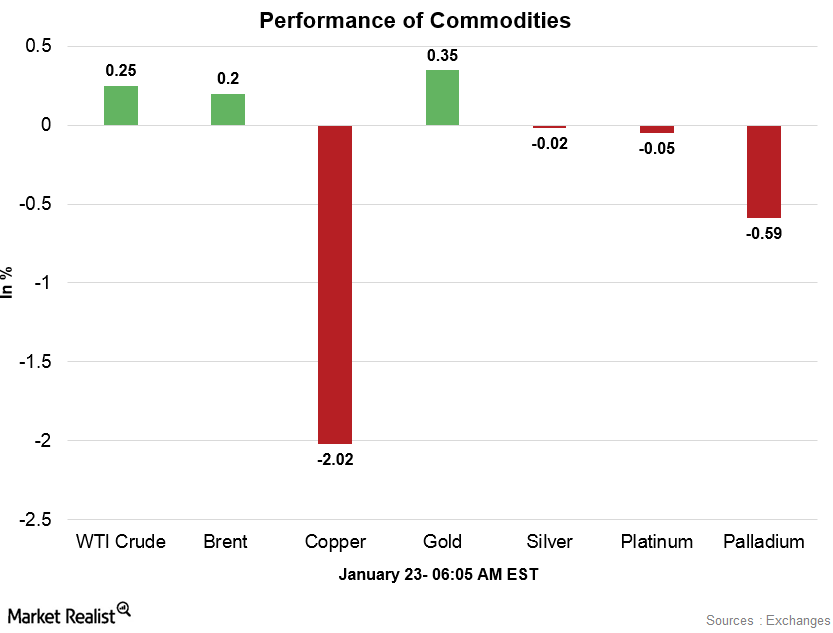

Analyzing Commodities in the Early Hours on January 23

At 5:55 AM EST on January 23, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $63.88 per barrel—a gain of 0.49%.

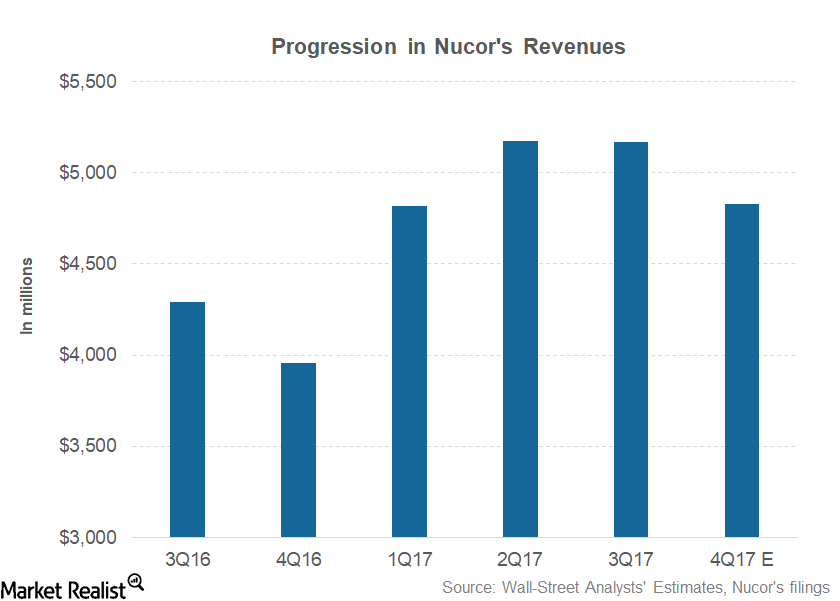

Nucor’s 4Q17 Earnings: What’s the Word on Wall Street?

Nucor (NUE), the leading US-based steel producer, is expected to release its 4Q17 earnings on January 30. Analysts polled by Thomson Reuters expect Nucor to post 4Q17 revenues of ~$4.8 billion.

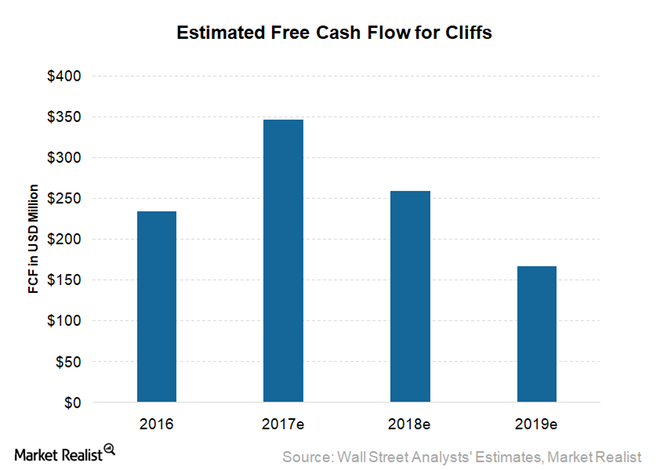

These Factors Could Lead to Upside to CLF’s Free Cash Flow

Cleveland-Cliffs (CLF) had accumulated debt over a number of years.

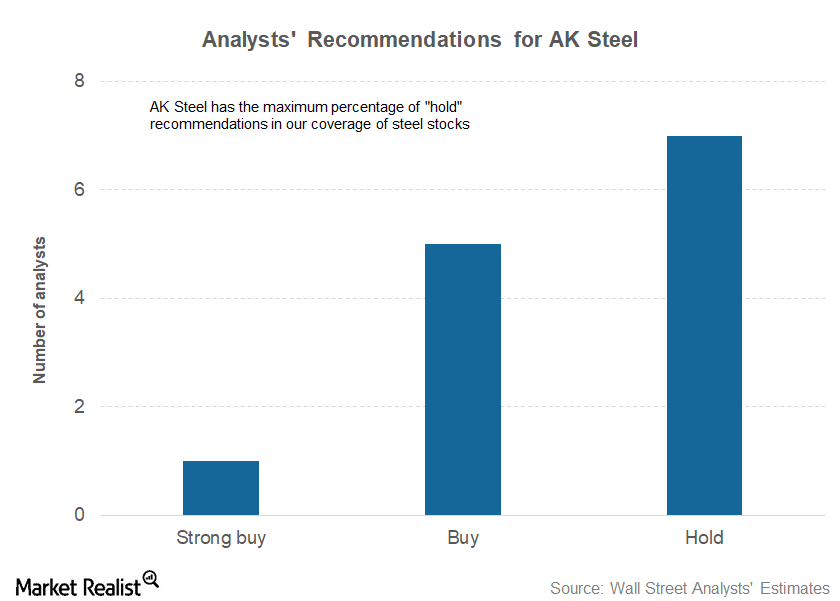

AK Steel Could See More Upside after the Strong Rally

AK Steel (AKS) has gained sharply since mid-December. The stock, which traded weak for most of 2017, has shown strength in the past month.

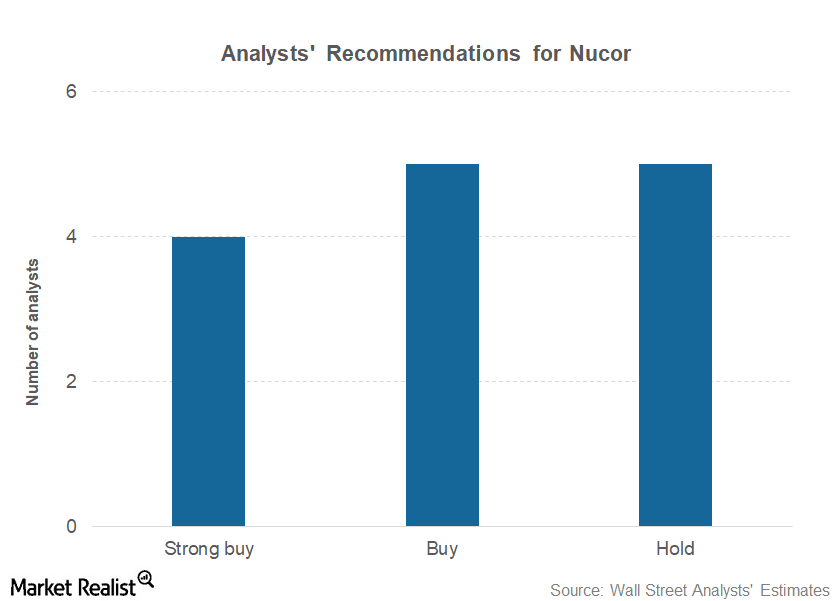

Nucor: What Analysts Expect This Earnings Season

Nucor received a “strong buy” rating from four analysts, while five analysts have a “buy” rating on the stock and five analysts have a “hold” rating.

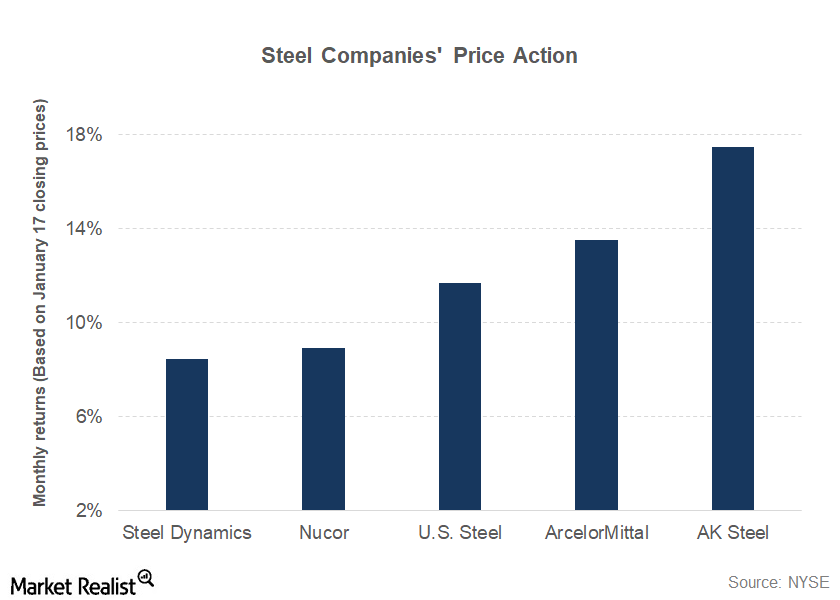

How Markets See US Steel Stocks before 4Q17 Earnings

Steel Dynamics will release its 4Q17 financial results on January 22, 2018. AK Steel and Nucor are scheduled to release their 4Q17 earnings on January 30.

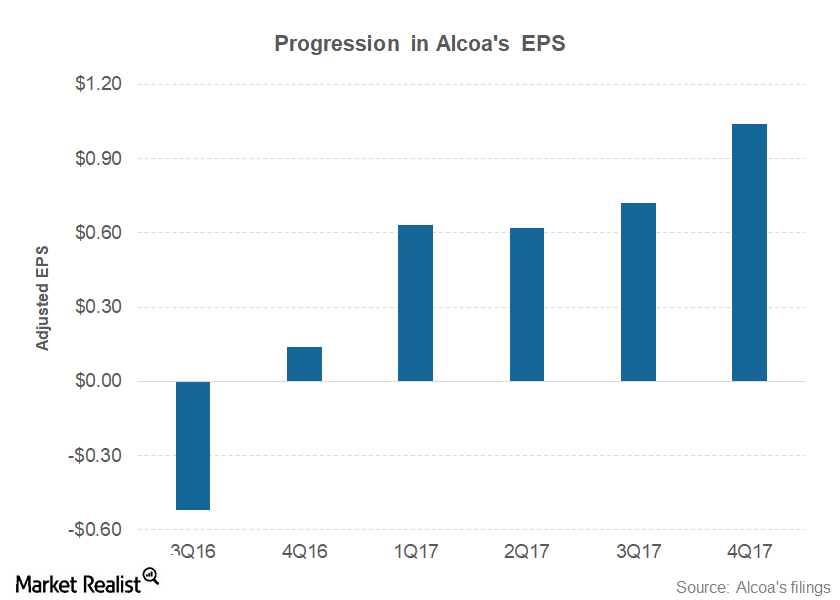

How Alcoa Fared in 4Q17

While Alcoa’s 4Q17 earnings rose sharply as compared to previous quarters, the quarterly results fell short of expectations.

How Many Americans Quit Their Jobs in November?

As per the latest JOLTS report, about 3.2 million American workers quit their jobs voluntarily in November.

Why Industrial Production Fell from 1.2% to 0.2% in November

The Federal Reserve released its November industrial production report on December 15, 2017. The report indicated that industrial production improved 0.2% in November.

After a Tough 2017, What Lies ahead for AK Steel in 2018?

While U.S. Steel shed ~26% of its market cap after its 1Q17 earnings miss, AK Steel investors were left poorer by 21% after AKS’s 3Q17 earnings miss.