SPDR® S&P Metals and Mining ETF

Latest SPDR® S&P Metals and Mining ETF News and Updates

U.S. Steel’s Carnegie Way: Key Points Investors Should Understand

U.S Steel has embarked on an ambitious transformation plan, which it named “Carnegie Way.”

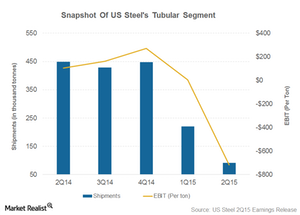

Losses Widen in U.S. Steel’s Tubular Segment as Fixed Costs Rise

Demand for OCTG products is expected to be subdued in the coming months. This would continue to put pressure on U.S. Steel’s Tubular segment.

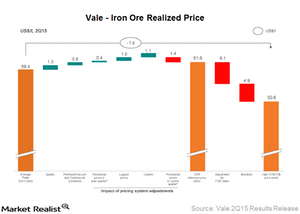

What Led to Vale’s Increased Realized Iron Ore Prices in 2Q15?

Vale’s (VALE) average CFR (cost and freight) realized price for iron ore fines increased by $3.30 per ton, from $58.20 per metric ton in 1Q15 to $61.50 in 2Q15.

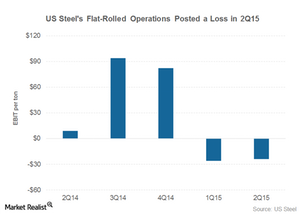

U.S. Steel’s Flat Rolled Segment Posts a Loss in 2Q15

U.S. Steel’s Flat-Rolled segment posted negative EBIT of $24 per ton in 2Q15. This represents a slight improvement over 1Q15 results.

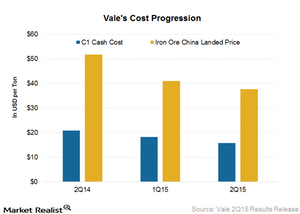

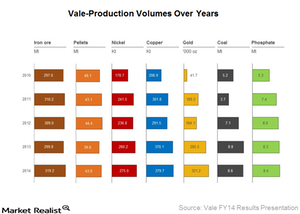

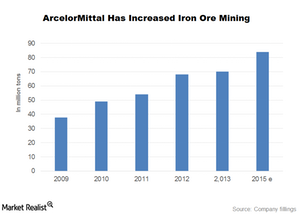

Vale’s 2Q15 Profitability Gets Boost from Iron Ore Cost Control

Vale’s (VALE) iron ore production for 1H15 was a record 159.8 million tons, 9.3 million tons higher than 1H14. For 2Q15, production was the second highest on record at 85.3 million tons.

Do Falling Gold Prices Mean More Mergers Are in the Cards?

Gold touched its lowest level on July 24. Its price fell to $1,073.70. Miner ETFs have suffered more than gold prices themselves.

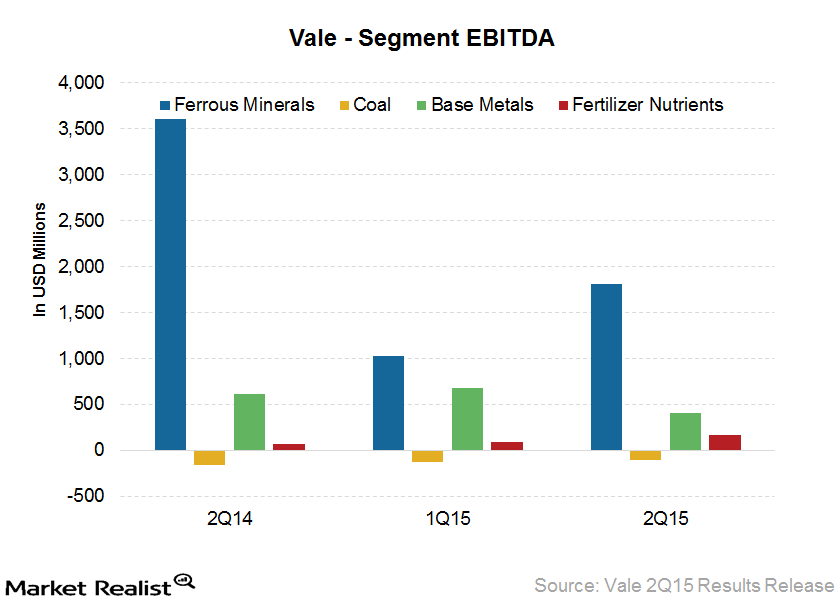

Why Did Vale Report a Beat on Market Expectations in 2Q15?

In this article, we’ll look at Vale’s (VALE) 2Q15 results and why they’re a beat on market expectations. Vale reported adjusted EPS of $0.19, which was 55% above consensus.

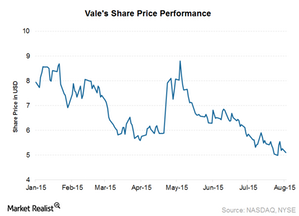

Vale Reports a Beat in 2Q15 Results, but Stock Falls

Vale S.A. (VALE) reported its 2Q15 results on July 30, 2015. Overall results were a beat on market expectations. However, Vale’s stock price fell 6.5% after Vale announced its results.

U.S. Steel Recovers from 52-Week Low: But Is It out of the Woods?

U.S. Steel has bounced back from its 52-week low. In fact, most steel company earnings have been better than analyst expectations.

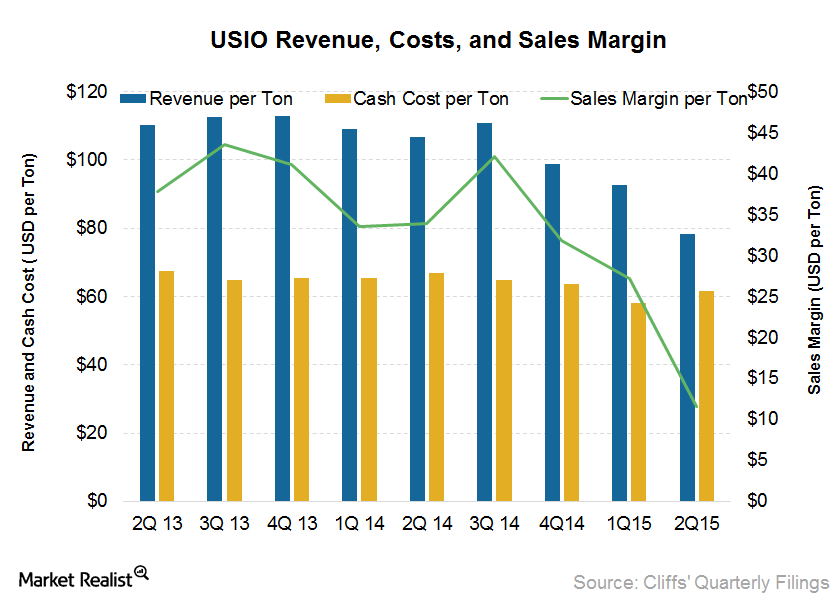

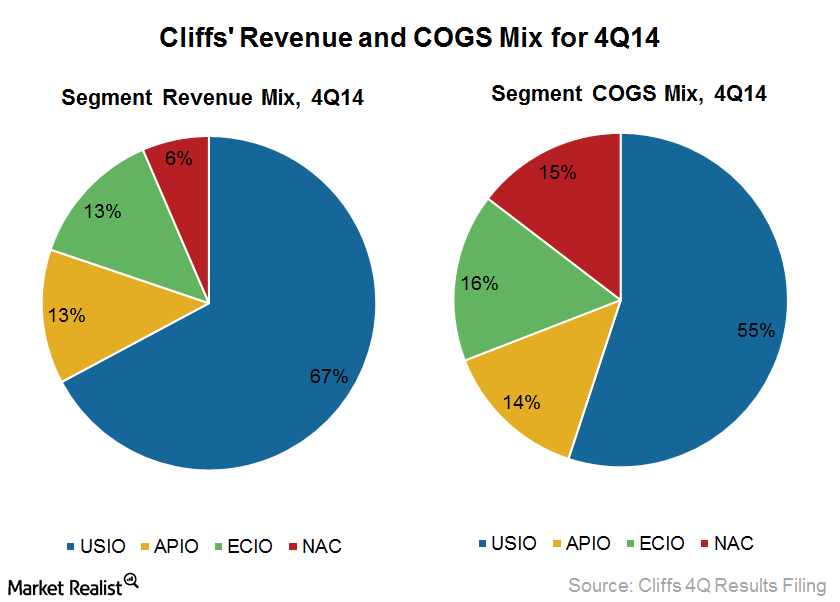

Cliffs’ US Iron Ore Segment Reports Lower Realized 2Q15 Revenues

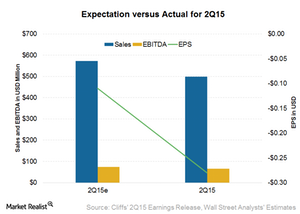

Cliffs’ results were a miss primarily on lower-than-expected realized revenues for its USIO segment. US iron ore’s realized revenues were $78.30 per ton in 2Q15, compared with $106.80 per ton in 2Q14.

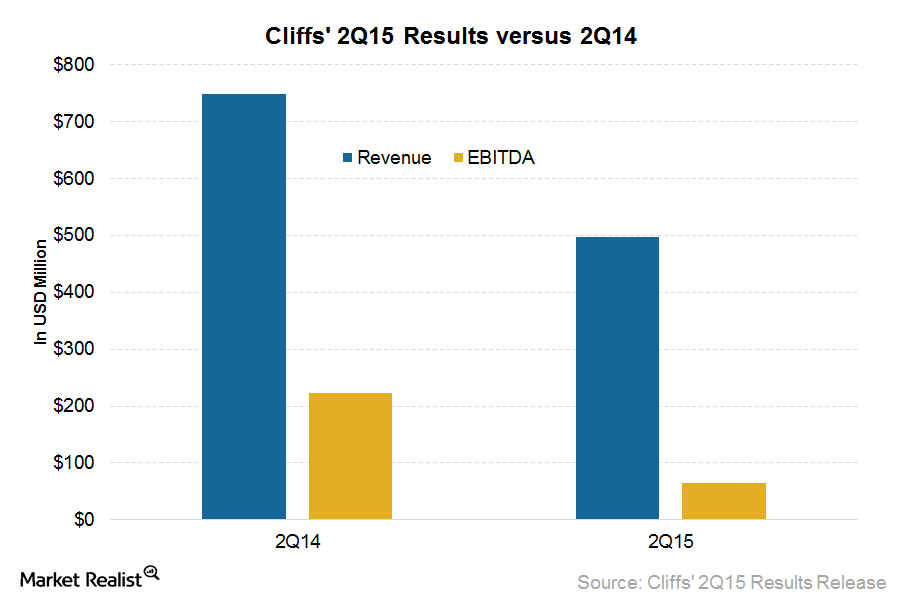

Key Highlights of Cliffs Natural Resources’ 2Q15 Earnings

Cliffs Natural Resources reported revenues of $498 million for 2Q15, a decline of 33% year-over-year.

Cliffs Natural Resources 2Q15 Results Miss Estimates

Cliffs Natural Resources announced its 2Q15 earnings on July 29, and its results missed market expectations this time. Cliffs offered positive results six out of the last eight times.

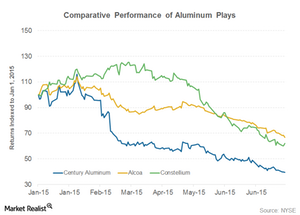

Alcoa at a 52-Week Low: What Should Investors Do?

Alcoa was trading at its 52-week low on July 23 and closed at $9.96—breaching the psychologically crucial level of $10 per share for two consecutive days.

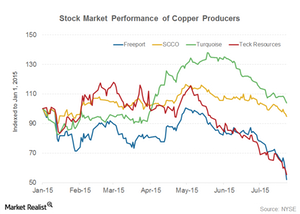

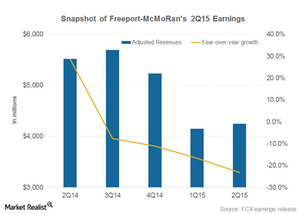

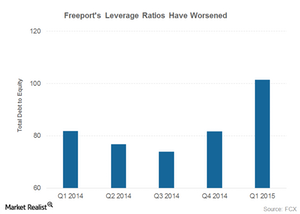

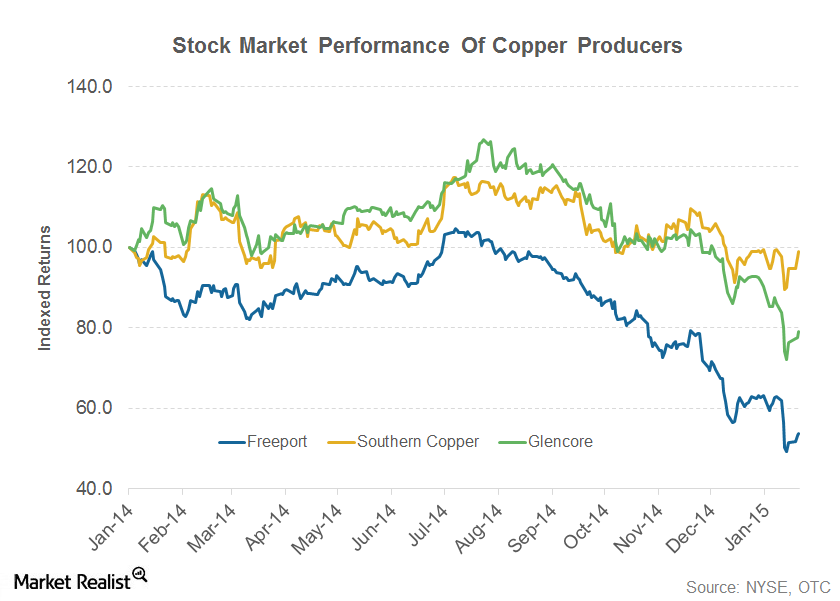

Freeport-McMoRan: 2Q15 Earnings, Outlook Fail to Cheer Investors

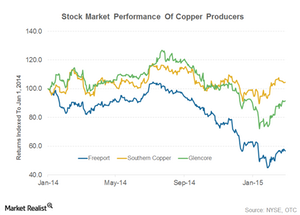

Freeport-McMoRan (FCX) released its 2Q15 earnings on July 23. It reported a net loss of $1.85 billion, which was largely attributable to the $2 billion write-down of its oil and gas assets.

Lower Commodity Prices Take a Toll on Freeport’s 2Q15 Profits

Freeport’s average realized copper prices fell 14% in 2Q15 on a year-over-year basis. Lower commodity prices took a toll on Freeport’s 2Q15 profits.

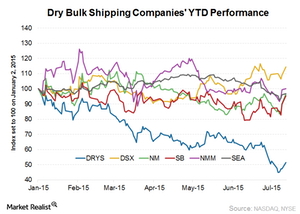

Where Is the Dry Bulk Shipping Industry Headed?

In this series, we’ll discuss some of the important metrics that drive the dry bulk shipping industry. Investors can gain exposure to commodities through the SPDR S&P Metals and Mining ETF (XME).

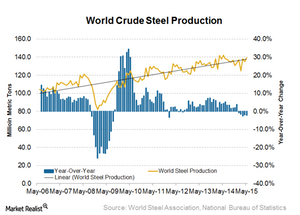

World Steel Production Falls for Five Straight Months

According to data released on June 22 by the WSA, world crude steel production totaled 139 million tons in May. This is a 2.1% decline year-over-year.

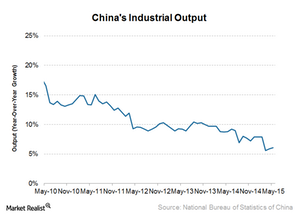

China’s Investment Data Down, Industrial Production Up in May

China’s industrial production grew by 6.1% year-over-year in May. Economists were expecting an increase of 6.0%. May’s growth is higher than the 5.9% year-over-year growth in April.Materials Must-know: Why Nucor is different from its competitors?

According to Nucor “Empowerment isn’t a corporate buzzword—it’s a way of life.”

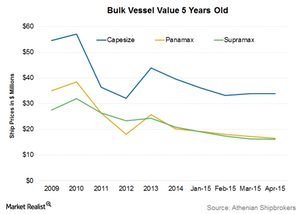

Secondhand Vessel Prices Continue to Fall

Secondhand vessels are delivered faster than newbuilds. As a result, secondhand vessels represent more of the short to medium-term outlook.

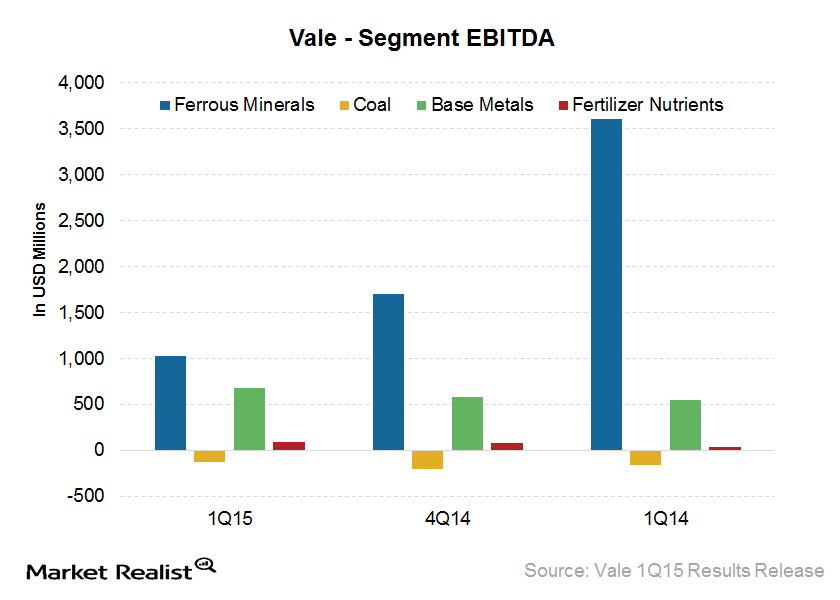

Vale’s 1Q15 Earnings Take a Hit

Vale S.A. (VALE) reported revenues of $6.4 billion in 1Q15, a decline of $2.9 billion compared to 4Q14. Most of the decline is due to seasonally lower sales volumes and lower commodity prices.

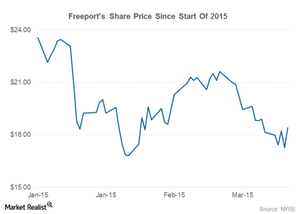

Cash-Starved Freeport Looks at IPO of Energy Business

On April 23, Freeport said it might look at selling a minority stake in its energy business and come out with an IPO of its oil and gas subsidiary later in the year.

Key Takeaways from Alcoa’s 1Q 2015 Earnings

Alcoa (AA) reported its 1Q 2015 earnings on April 8. It reported net income of $195 million on revenues of $5.8 billion.

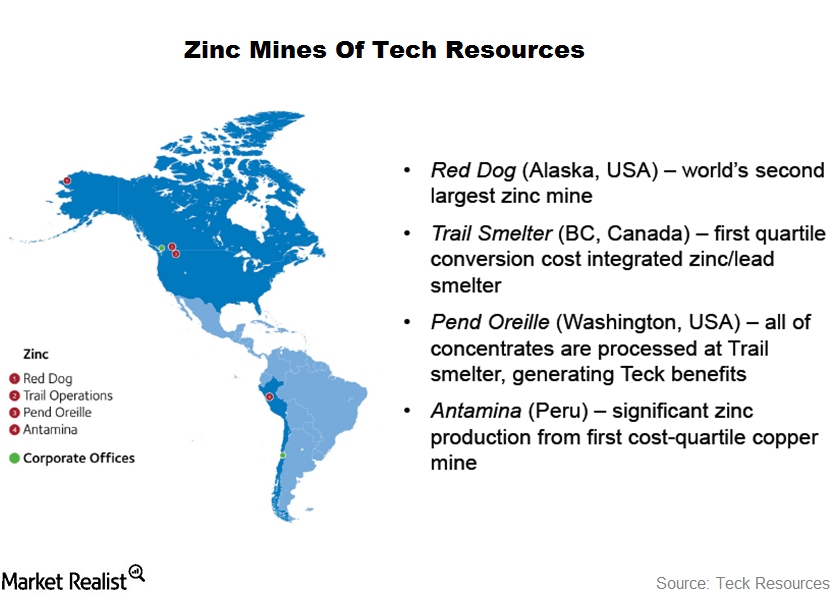

Teck Resources Zinc Operations Focused on Alaska’s Red Dog Mine

In 2014, its zinc operations contributed 31% to revenues and made up 27% of gross profit before depreciation and amortization.

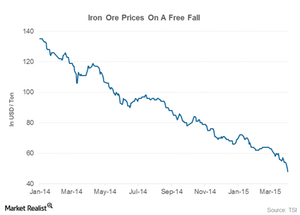

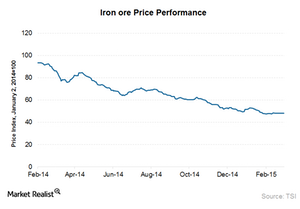

Iron Ore Prices Fall Below $50 Per Ton

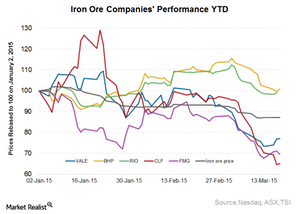

The iron ore price slide has been particularly pronounced in the last few weeks, as Chinese demand didn’t pick up as expected after the New Year holiday.

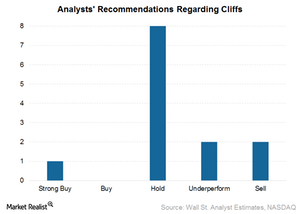

What’s the Current Market Sentiment for Cliffs Natural Resources?

As for market sentiment, Cliffs (CLF) seems to be on the receiving end. Most of it is due to the worsening current and future outlook for iron ore prices.

A Business Overview of Cliffs Natural Resources

Cliffs Natural Resources’ (CLF) key driver is global demand for the raw materials used to make steel.

Why Freeport Investors Should Track China’s Automobile Industry

China is the world’s biggest automotive market, where close to 22 million vehicles are sold each year. A mid-sized vehicle has ~50 pounds of copper content.

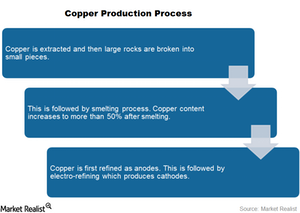

An Investor’s Guide to the Copper Supply Chain

Copper is also known as “Dr. Copper,” as analysts see the metal’s prices as a reflection of the global economy’s health.

Key Indicators Freeport Investors Should Track

Freeport has lost almost 20% of its market capitalization so far this year, making 2015 a turbulent period for the company.

Cliffs Natural Resources stock prices in a changing environment

Cliffs’ (CLF) stock prices fell to a fresh 52-week low of $4.24 on March 19, mostly due to an iron ore supply glut coupled with slowing Chinese demand.

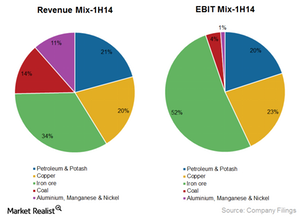

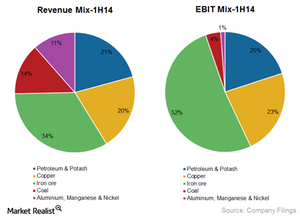

BHP Billiton: A critical business overview

BHP Billiton (BHP) is a leading global diversified resources company and is one of the world’s largest major commodity producers.

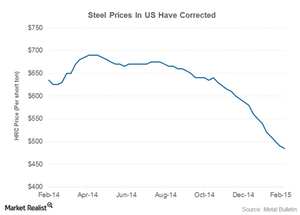

Steel prices hit rock bottom, the lowest level since 2009

Steel prices crashed by almost two-thirds at the peak of the global financial crisis in 2009. Last year, they dropped by 10%.

Why Vale’s Results Are a Miss on Expectations

Vale’s results were a miss on expectations with a reported adjusted EPS loss of $0.05 per share. This is below the consensus of $0.19 per share.

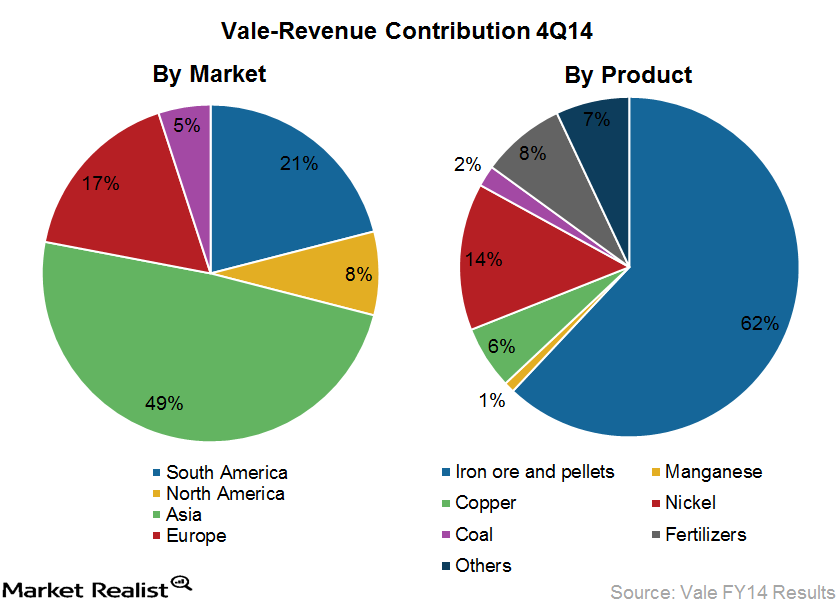

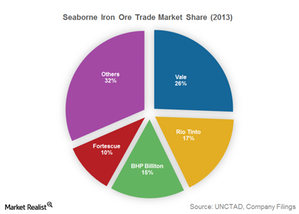

Vale SA – World’s Largest Iron Ore Company

Vale is the world’s largest producer of iron ore and iron ore pellets. It’s the second largest nickel producer.

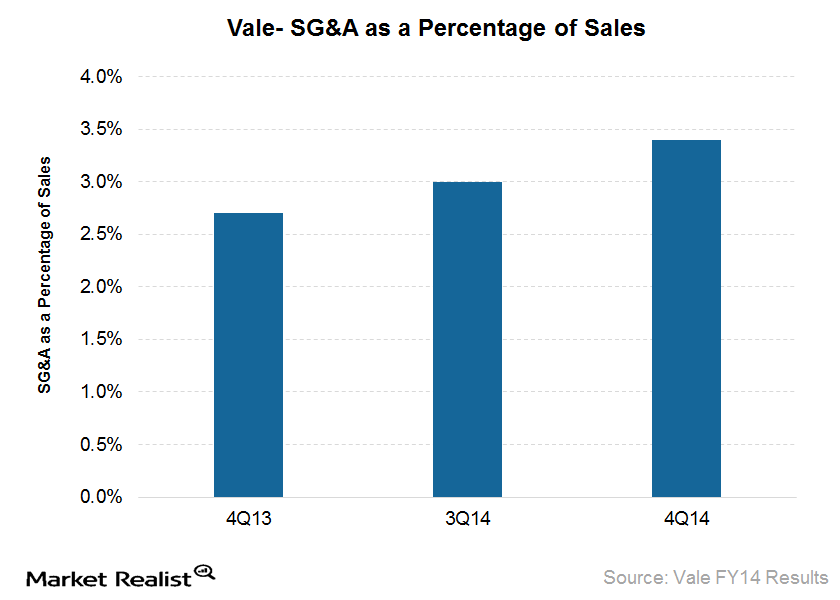

Key Earnings Takeaways from Vale’s FY14 Results

Key earnings takeaways from Vale’s results show cost of goods sold amounted to $25.1 billion in 2014, an increase of $819 million from 2013.

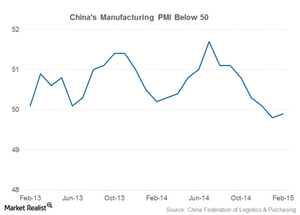

China’s manufacturing PMI below 50 for second consecutive month

China’s manufacturing PMI has been below 50 for two consecutive months. This reflects a slowdown in the Chinese economy and impacts industrial commodities.

Key iron ore indicators to consider

It’s important to look at iron ore indicators collectively because they give clues about the direction of iron ore prices.

An investor’s guide to Freeport-McMoRan

Freeport-McMoRan (FCX) is a leading natural resources company. It’s among the top copper producers and holds the position of largest molybdenum producer.

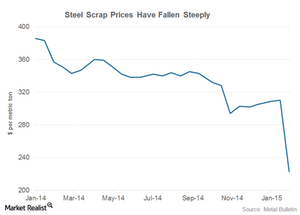

Steel Scrap Prices Have Fallen Sharply in 2015

Steel scrap prices fell by ~20% in 2014. Lower steel scrap prices should bring down unit production costs for steel plays.

Key Facts About The Copper Value Chain

Cathodes are not used directly by copper consumers. Cathodes are melted and cast into shapes based on end usage, such as cakes, ingots, rods, and billets.

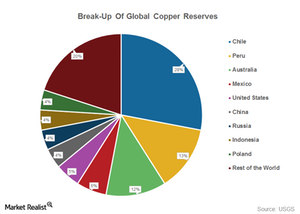

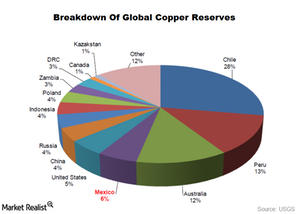

Why It’s Important To Understand Global Copper Reserves

Copper mining is concentrated in Latin America, while the major copper consumers are in Asia. More than 60% of global copper consumption comes from Asia.

An Investor’s Guide To The Copper Industry

Mining giants Rio Tinto and BHP Billiton have diversified portfolios of iron ore, aluminum, and copper assets, with most revenues coming from iron ore.

Vertically Integrated Steel Mills Are At A Disadvantage

While iron ore prices crashed, production costs for iron ore haven’t come down. Steel plays’ mining operations have been hit by the fall in iron ore prices.

Operations overview for BHP Billiton

Headquartered in Melbourne, Australia, BHP Billiton operates 100 locations in 25 countries. A merger between BHP and Billiton created the company in June 2001.

Difference Between Chinese And US Steel Prices Narrows

The difference between Chinese and US steel prices is still quite high to encourage imports. Marginal narrowing of the price difference won’t deter imports.

An Investor’s Guide To China’s Shadow Banking System

China’s shadow banking includes the trust sector, the off balance sheet lending by commercial banks, and financing vehicles of commercial banks.

VALE, RIO, and BHP can swing the global iron ore prices

With over 65% exports going to China, China is the real swinger in global iron ore prices. A slowdown in China caused panic among all major commodity exporters.Materials Why steel investors are mindful of capacity utilization rates

Steel prices tend to move in tandem with capacity utilization rates. Steel prices are a key factor affecting performance, directly impacting the revenues of companies.

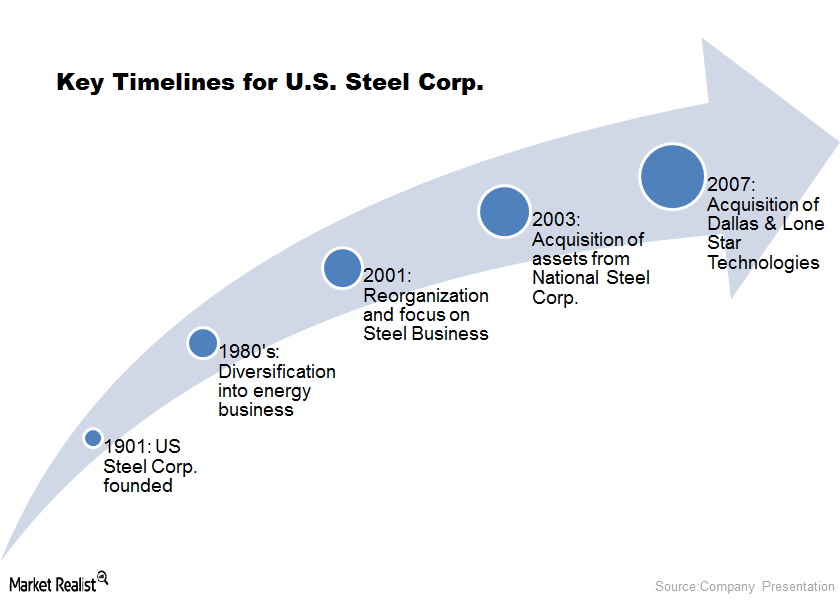

Everything you need to know about US Steel Corporation

U.S. Steel Corporation’s stock has surged in the past few months, delivering more than 150% growth in the last year.