How Much Lower Can BHP’s Unit Iron Ore Costs Go?

Iron ore costs are key to determining BHP’s iron ore segment’s profitability, which ultimately impacts its stock price and relative performance.

Sept. 10 2015, Updated 12:08 p.m. ET

Iron ore costs

Iron ore miners are responding to the current weak seaborne price environment by either increasing volumes, reducing costs, or both. BHP Billiton (BHP) (BBL) is making efforts to improve both of these variables. Iron ore costs are key to determining BHP’s iron ore segment’s profitability, which ultimately impacts its stock price and relative performance.

Impressive cost-cutting in iron ore

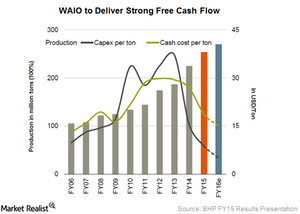

- Unit costs for BHP’s WAIO (Western Australia iron ore) fell 31% to $19 per ton in fiscal 2015. Cash costs were down to $17 per ton in 2H15.

- Cost reduction was driven by lower labor, contractor, and maintenance costs as well as lower diesel prices and a stronger US dollar.

- Management also attributed increased productivity to the centralized shutdown management, which improved the availability of its ore handling plants. This has usually been a bottleneck at BHP’s mines.

- Increased volumes and lower costs led to an EBITDA (earnings before interest, taxes, depreciation, and amortization) margin of 59%. This is despite the 41% fall in average realized iron ore prices during the period.

Further lowering unit costs

- For fiscal 2016, BHP management expects unit costs for WAIO to fall further to $15 per ton. Management maintains that while productivity measures will help further reduce costs, the company’s concentrated geographic footprint and low strip ratio underpin its strong low-cost position.

- Current management guidance of $15 per ton is also lower than the $16 per ton guidance the company provided in May 2015. Rio Tinto’s (RIO) per unit costs for 2Q15 also fell by $4.2 per ton to $16.2 per ton. Vale SA’s (VALE) costs fell 14% quarter-over-quarter to $15.80 per ton in 2Q15. Cliffs Natural Resources (CLF) also reduced its production costs by 9% year-over-year in the United States due to headcount reduction and other input costs.

In a commoditized space such as iron ore mining, miners can’t control prices. Controlling costs in such a scenario could be a key differentiator between the companies and could lead to stock price performance divergence.

BHP Billiton, Rio Tinto, and Vale form 32.1% of the iShares MSCI Global Metals & Mining Producers ETF (PICK). The SPDR S&P Metals and Mining ETF (XME) also provides exposure to this space.

In the next part, we’ll see what BHP is doing to tide over the equally depressing state of affairs in the coal market.