SPDR® S&P Metals and Mining ETF

Latest SPDR® S&P Metals and Mining ETF News and Updates

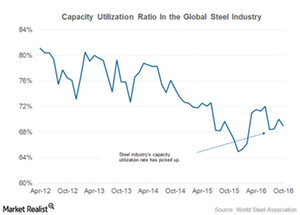

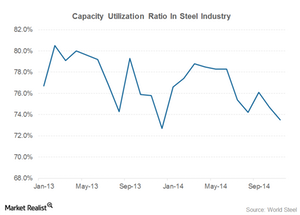

Why the capacity utilization rate came down at Steel Dynamics

One of the key metrics in the steel industry is the capacity utilization rate. It represents the actual production compared to the maximum possible production.

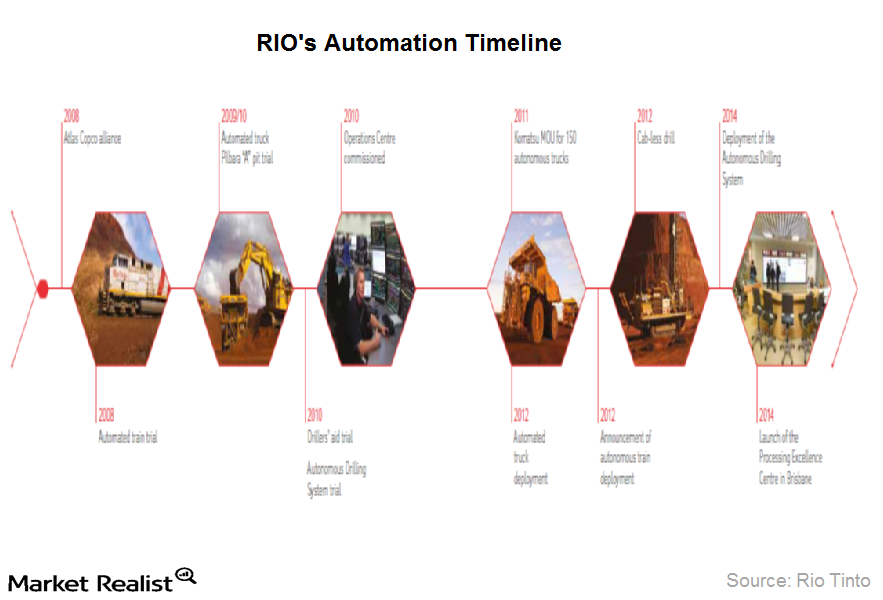

Why Rio Tinto has key advantages over its peers

Rio is the largest owner and operator of autonomous—driverless—trucks in the world. These initiatives are part of Rio’s “Mine of the Future” program.

What Should You Expect from U.S. Steel’s 1Q18 Earnings?

1Q18 earnings season is in full swing. So what should you expect for U.S. Steel?

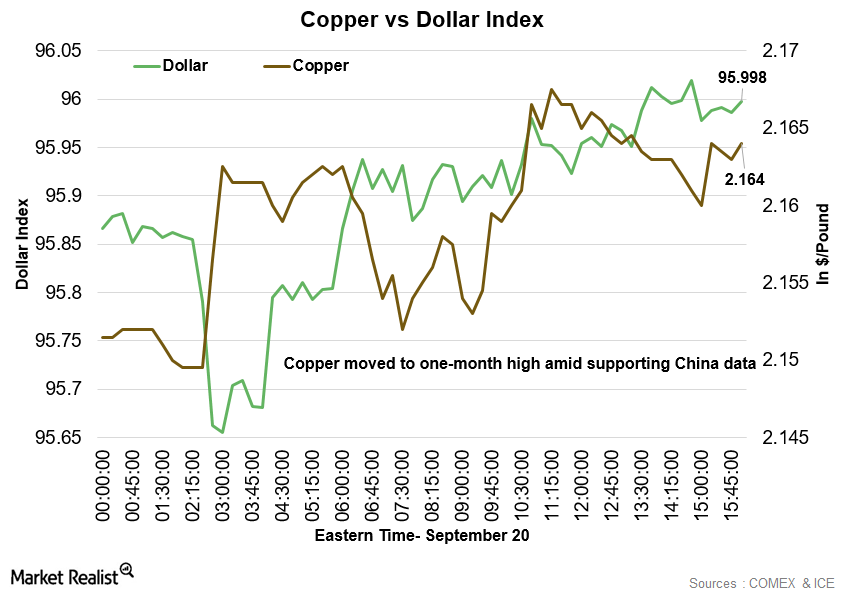

Copper Rose to 1-Month High Price Levels on September 20

At 1:15 PM EST on September 20, the COMEX copper futures contract for December delivery rose ~0.35%. It was trading at $2.16 per pound.

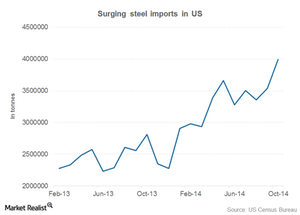

Steel Imports Reach Record Levels In October

Compared to the first ten months of last year, steel imports are up by more than 35%. This is an alarming situation.

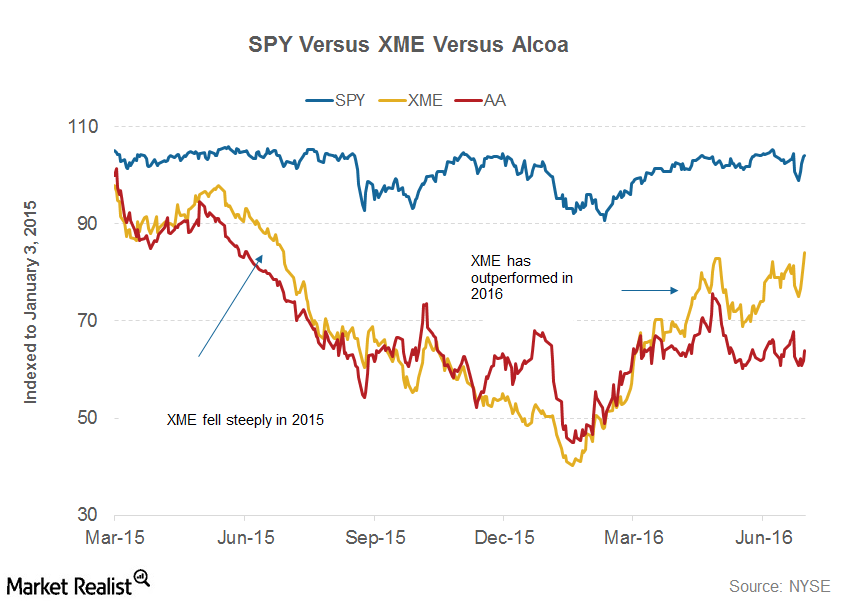

Alcoa’s 2Q16 Earnings: What Can Investors Expect?

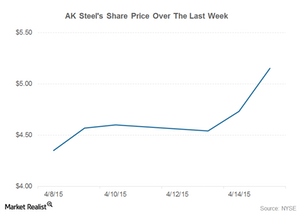

Alcoa (AA) is expected to release its 2Q16 earnings on July 11. The company is in the final stages of its split, which will create two new entities.Materials Must-know: Key risks that AK Steel investors face

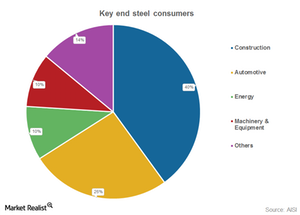

The increased use of aluminum in vehicles is a threat for AK Steel (AKS). The automotive industry accounts for ~26% of steel consumption in the U.S.

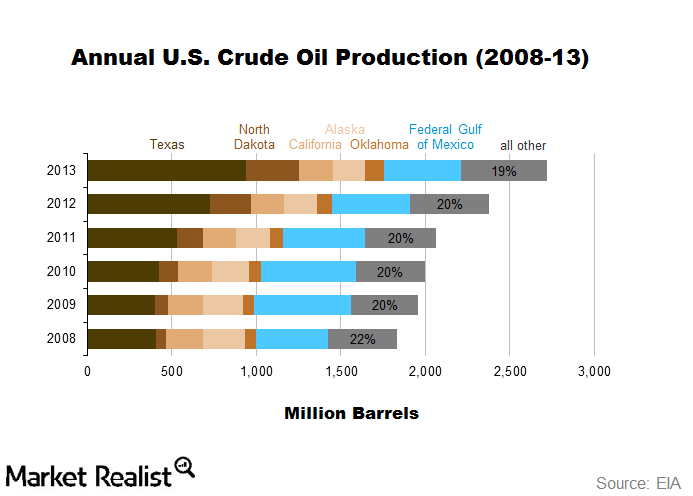

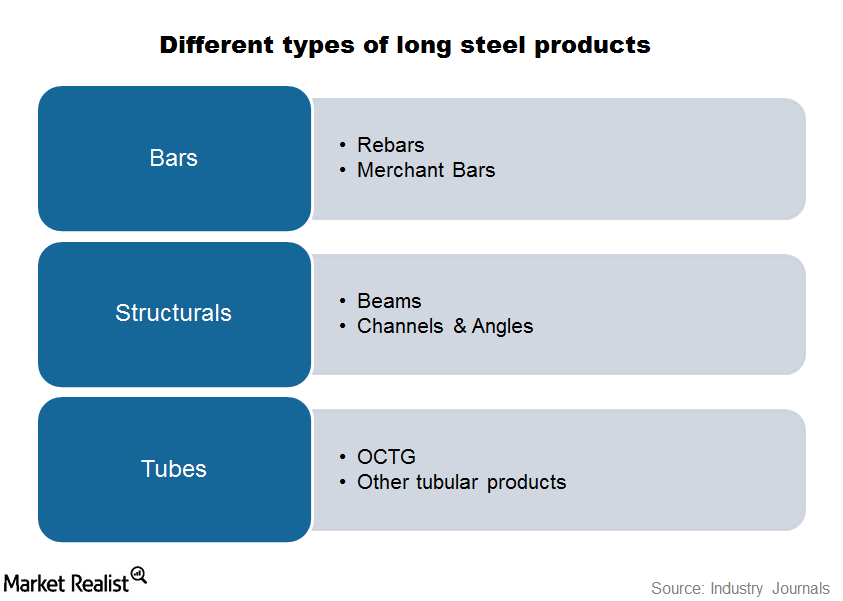

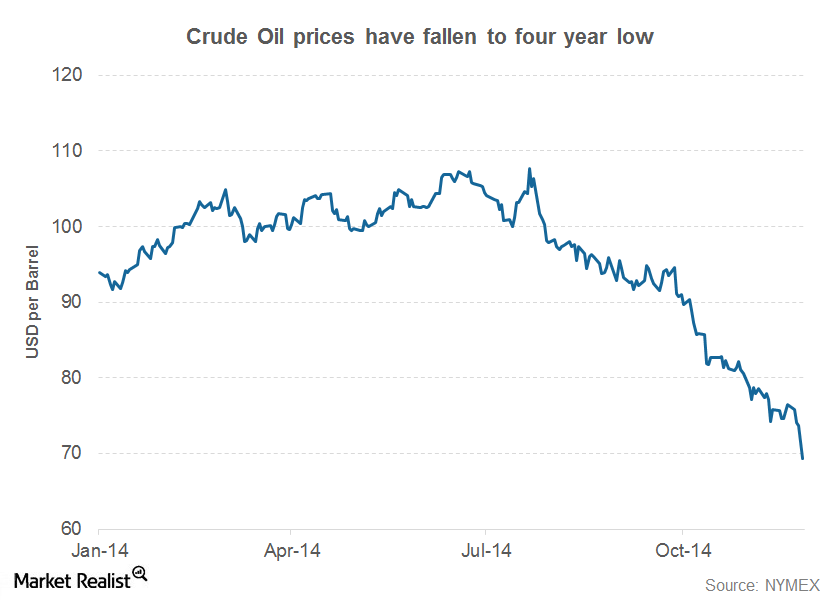

Why the outlook for US Steel’s tubular goods is positive

With the recent imposition of anti-dumping duties, imports of tubular goods will likely decrease, helping U.S. Steel’s revenue in the tubular segment to increase.

Key takeaways from Nucor’s 3Q14 cost structure

Due to an increase in electricity costs, Nucor’s energy cost per ton of steel in 3Q14 went up by almost $1 from the corresponding quarter last year.

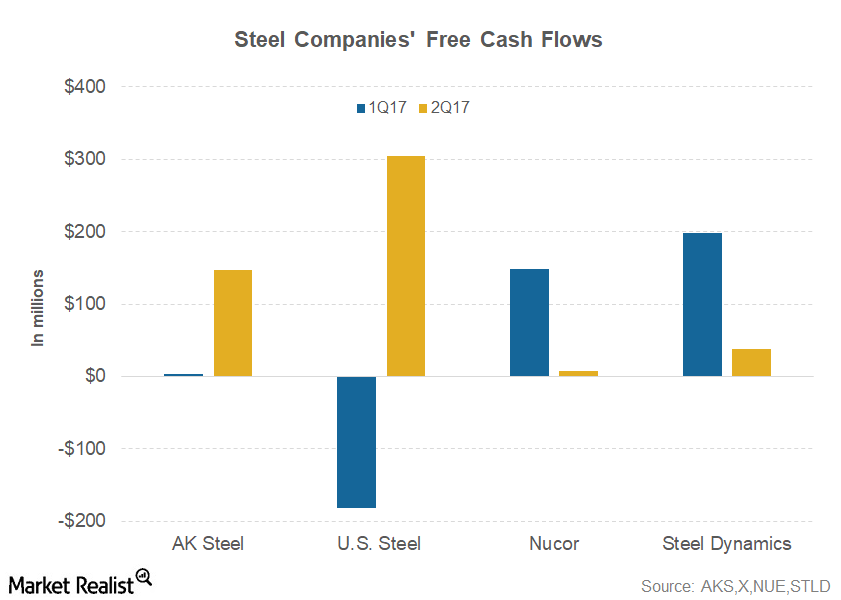

It’s Raining Cash for U.S. Steel amid Strong Markets

AK Steel (AKS) generated free cash flow of $147.0 million in 2Q17 compared to $3.8 million in 1Q17. It generated free cash flow of $111.0 million in 2Q16.Materials Why the demerger of non-core assets makes sense for BHP

BHP had been contemplating whether to sell the non-core assets or go for a demerger. Finally, the company decided in favor of a demerger on August 15. The proposed company will likely have assets in the range of $12–$20 billion.Materials Why Alcoa is improving its competitive position

Alcoa idled several smelting plants since 2007. Its aluminum smelting capacity has come down by 28% over the period. Most of these smelters had high unit production costs.Materials Why did the Cliff’s share price rally?

Iron ore prices are down 19% year-over-year (or YoY) and coal prices are down 30% YoY—volumes were also down YoY, but the stock rallied 7% in a single trading session the next day of the earnings call and up 3% the subsequent trading day.

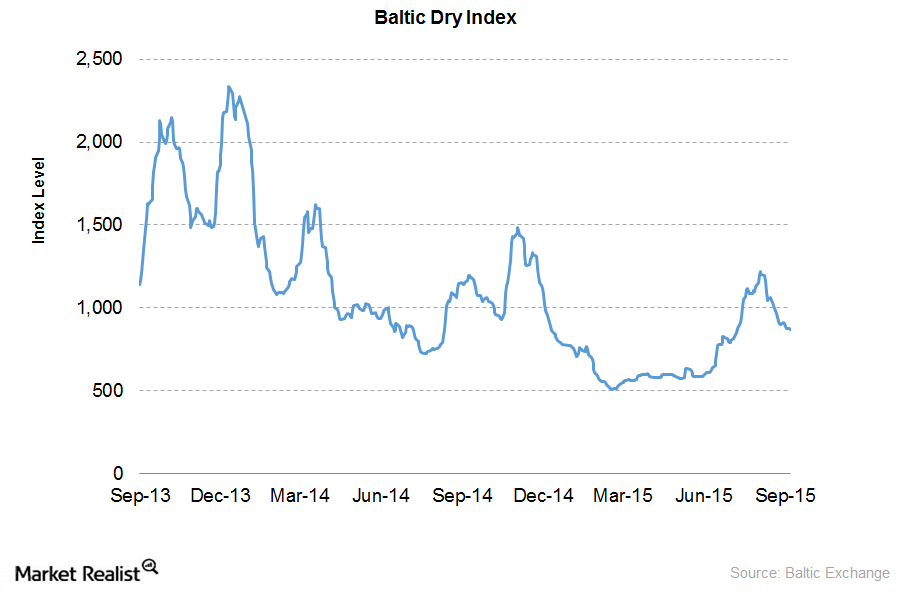

What Do Fundamental Bulk Shipping Indicators Say?

The BDI (Baltic Dry Index) is a leading indicator for the bulk shipping industry. It’s a measure of the cost of shipping major bulk commodities on a number of shipping routes.

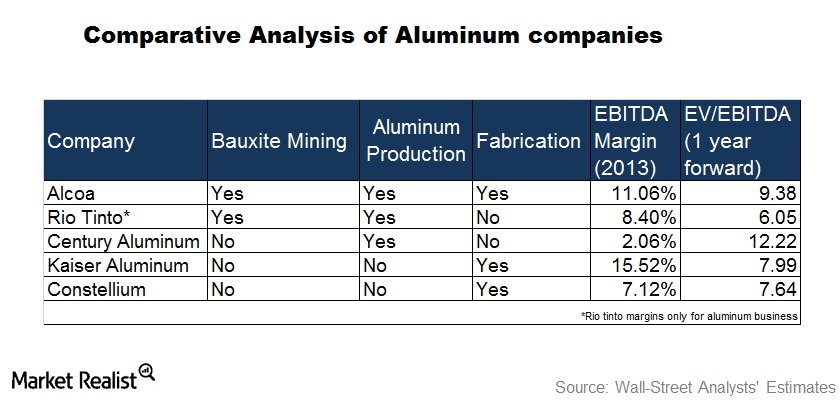

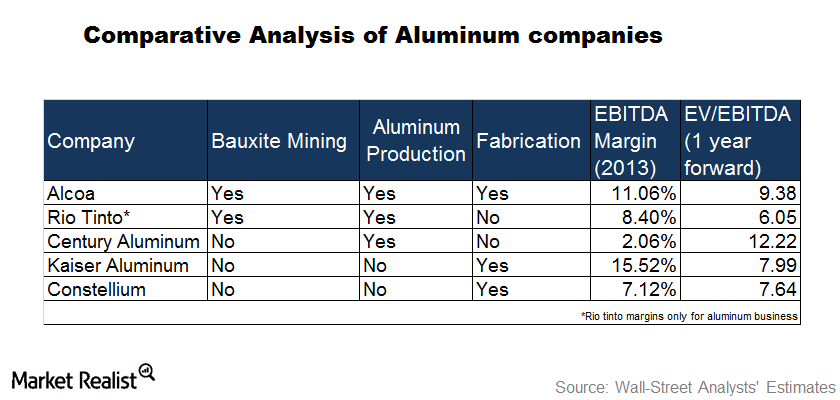

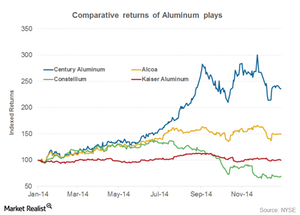

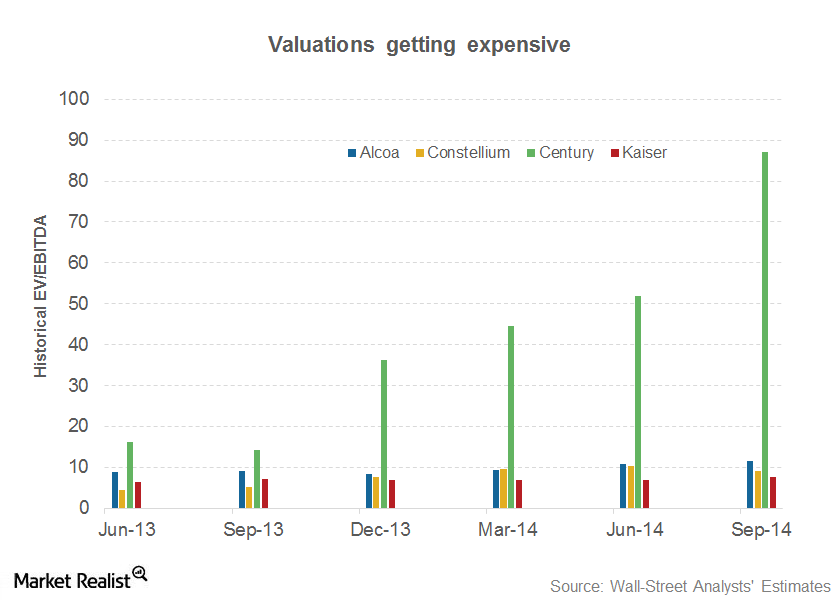

Aluminum company metrics compared

Trading on the London metal exchange determines the price for primary aluminum. Any increase in the price of aluminum benefits companies that produce primary aluminum.

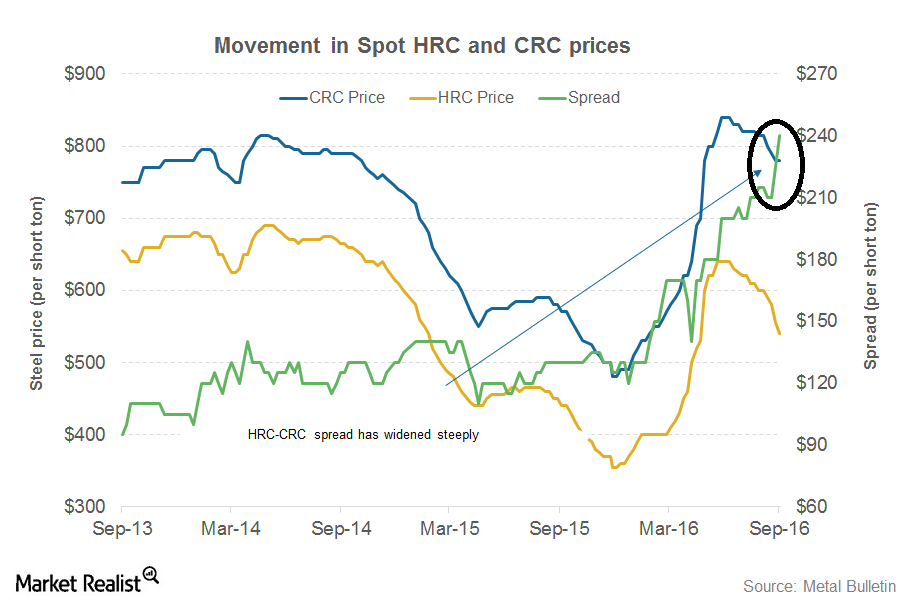

Must-Know: US HRC-CRC Spread Widens to Record Highs

During its 2Q16 call, AK Steel (AKS) pointed to a “significant rise” in CRC steel imports from Turkey, Vietnam, and Australia.

Must-know: Alcoa is placed better than other aluminum companies

The aluminum process starts by extracting bauxite from the Earth’s crust. The bauxite is refined into alumina. Alumina is a key raw material—along with carbon and electricity.

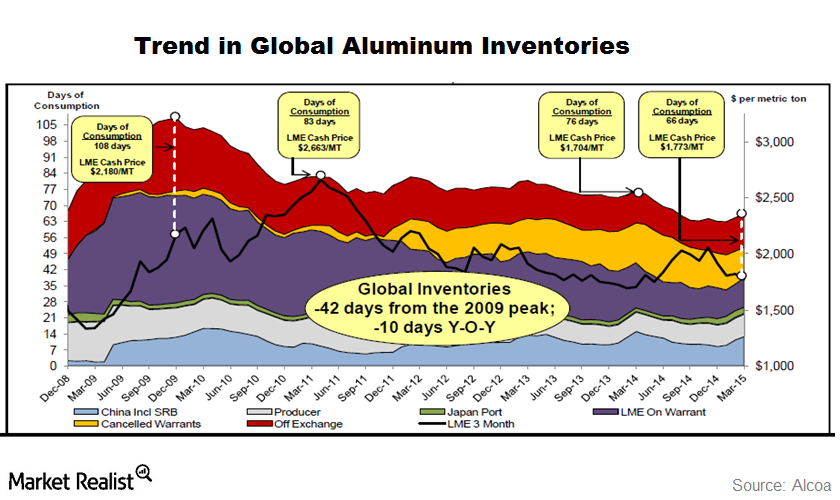

How Do Aluminum Inventories Work?

Aluminum inventories with London Metal Exchange (or LME) registered warehouses have declined this year. Aluminum inventories have been on a decline for almost two years.

Alcoa Is Optimistic about Aluminum’s 2018 Outlook

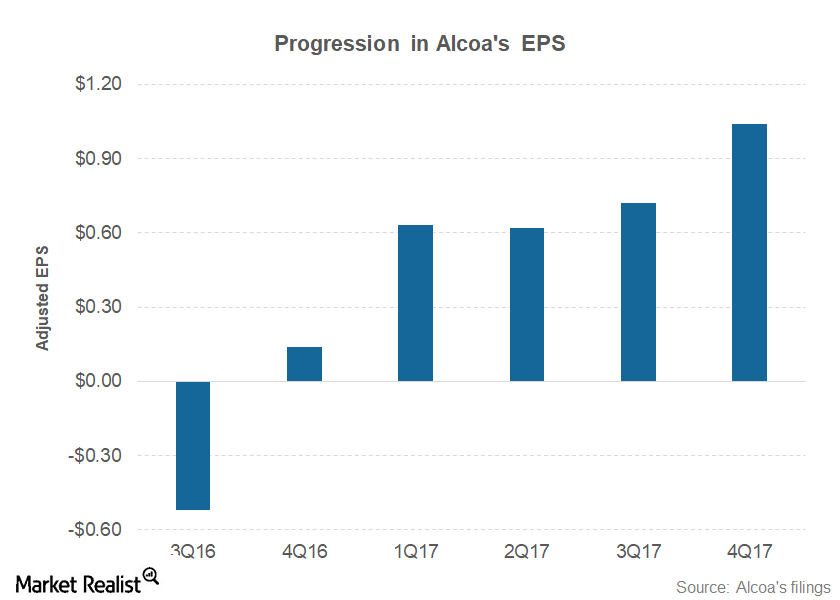

Alcoa (AA) reported its 4Q17 earnings on January 17, 2018, after the markets closed. The company posted an adjusted EPS of $1.04 in 4Q17.

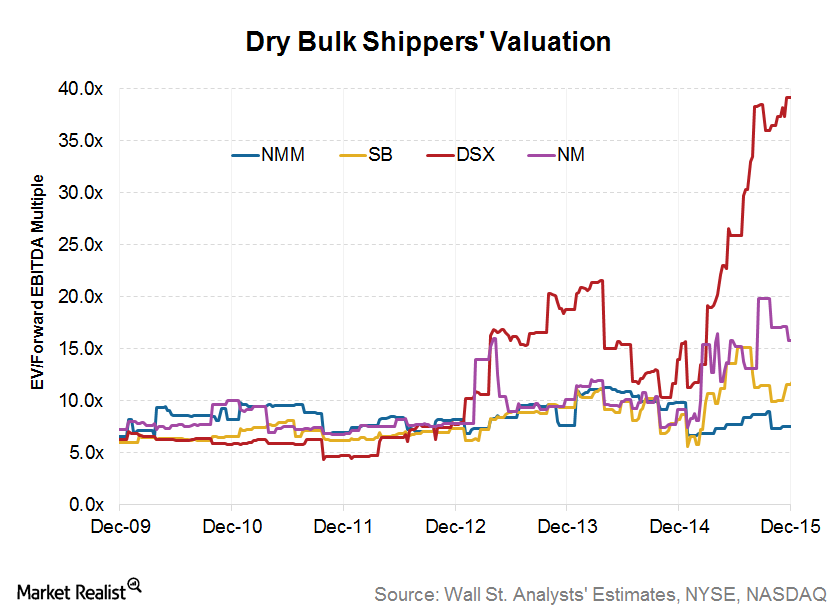

The Relative Valuation of Dry Bulk Companies

Diana Shipping is proactively investing in vessels to take advantage of the current low point for vessel valuation, and it can most likely outlast a prolonged downturn. So its valuation appears more or less full.

Copper Industry Gets a Lift in 1H2015

In this series, we’ll discuss recent copper industry indicators. We’ll see how copper prices have done in 2015. We’ll also discuss copper supply trends and demand.

Do Steel Capacity Cuts in China Bode Well for Iron Ore Miners?

China has been reeling under its overcapacity in the steel industry. In 2016, China planned to cut 45 million tons but wound up cutting 80 million tons.

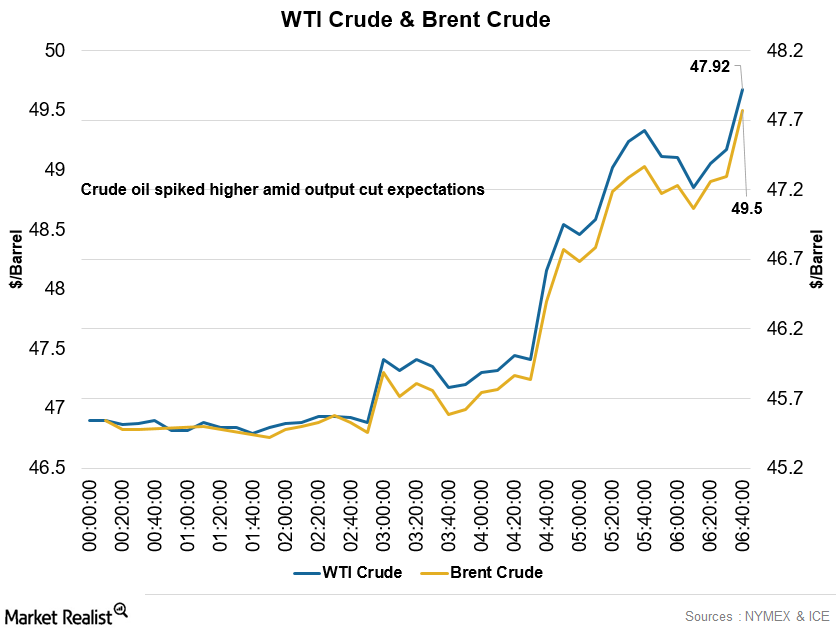

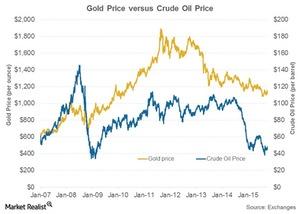

Crude Oil Rose, Copper and Gold Were Weaker in the Early Hours

At 5:35 AM EST, the West Texas Intermediate crude oil futures contract for January 2017 delivery was trading at $47.91 per barrel—a rise of ~5.9%.

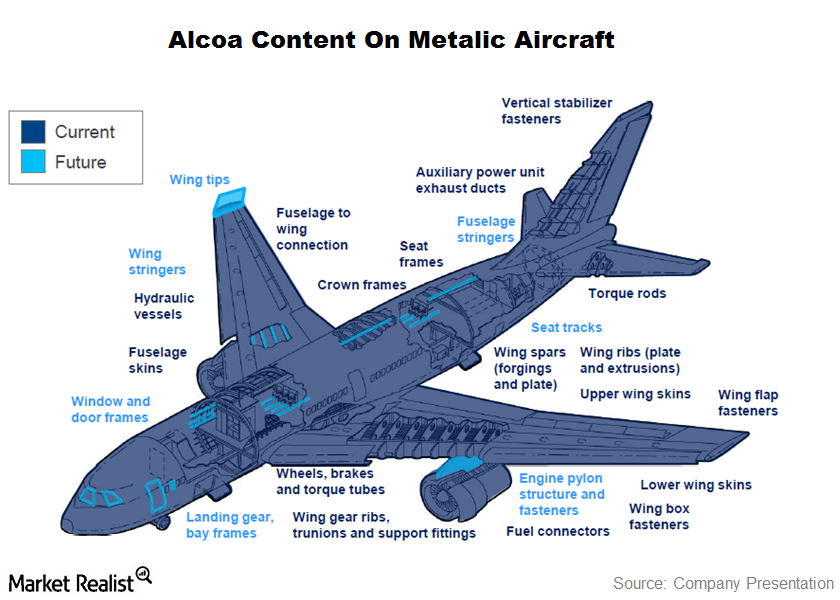

Must-know: Alcoa’s Aerospace Segment Is Important

The aerospace segment is the one of the biggest aluminum consumers in the world. Alcoa (AA) got $4 billion in revenue from aerospace companies last year.

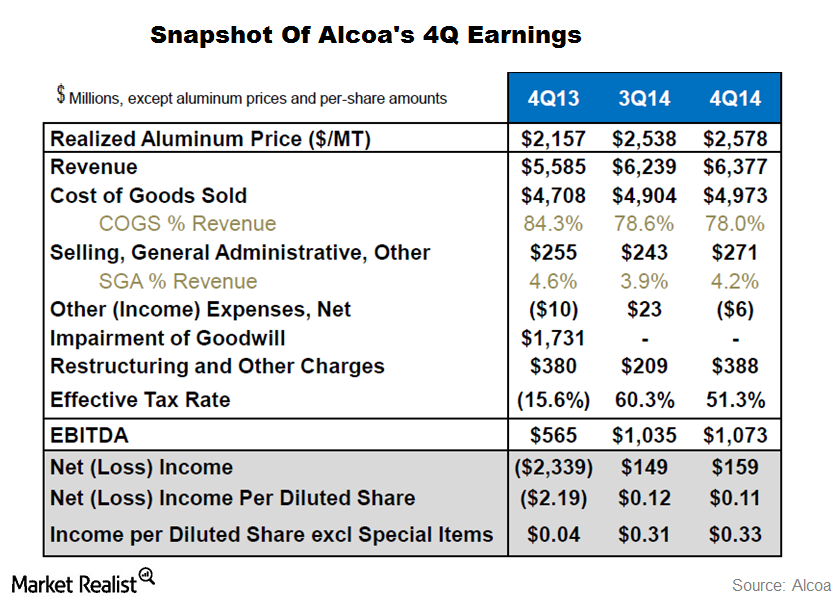

How Alcoa Looked In 2014

In this series, we’ll pay special attention to Alcoa’s 2014 performance and to how investors can play Alcoa and other aluminum companies in 2015.

Different Steel Types Have Distinct End Use

Steel producers manufacture steel in several shapes according to demand from end consumers.

Why Did Crude Oil Prices Hit a 16-Month High?

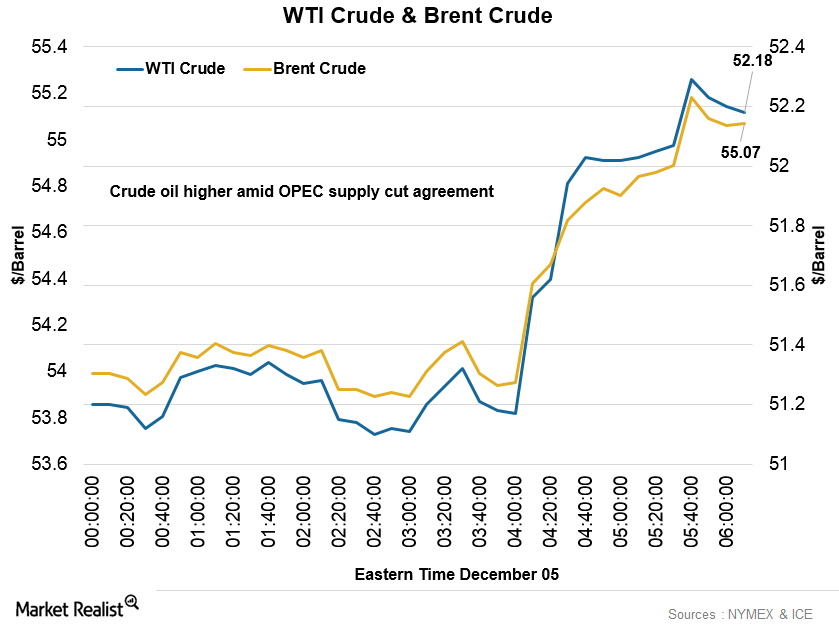

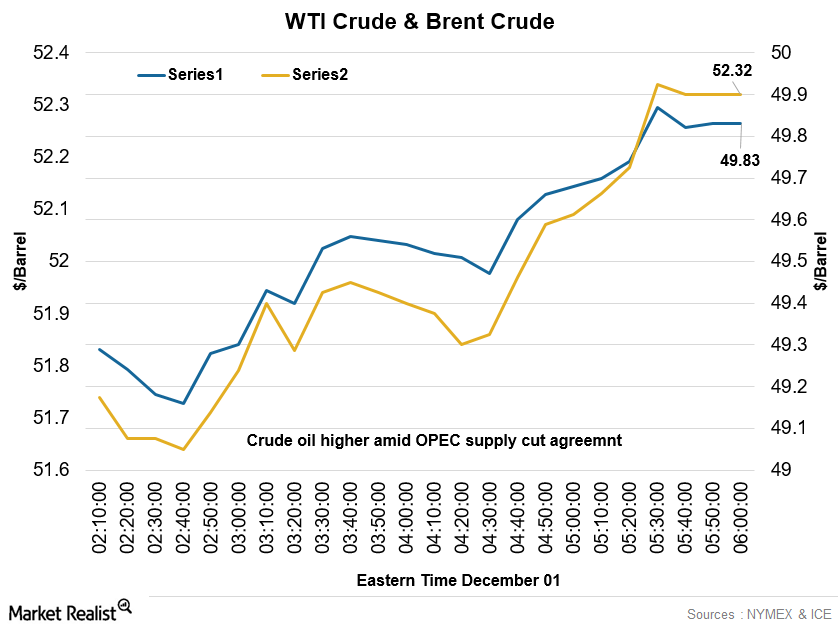

At 5:45 AM EST on December 5, the WTI crude oil futures contract for January 2017 delivery was trading at $52.18 per barrel—a rise of ~0.97%.

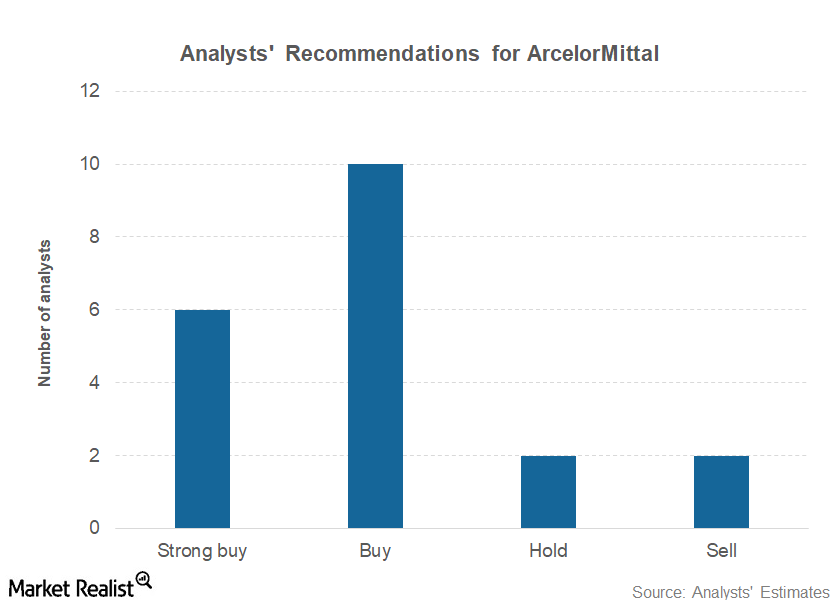

ArcelorMittal Could Keep Outperforming US Steel Stocks

ArcelorMittal (MT), the world’s largest steel producer, outperformed its US-based peers including U.S. Steel Corporation (X) and AK Steel (AKS) last year.Materials Must-know: Playing the aluminum value chain

Bauxite is the most abundant metal in the earth’s crust. Because of the many impurities in bauxite, it must be refined to produce alumina.

Alcoa Beats Wall Street Expectations Again

Aluminum premiums more than doubled in 2014, which benefited primary producers like Rio Tinto and BHP Billiton.Materials Why investors need to understand the cost curve

Primary aluminum and alumina are commodity products. Producers don’t have much control over their pricing. The prices are decided by market dynamics.Consumer Overview: Ambre Energy—a coal and oil shale export company

Ambre Energy was founded in June 2005. It’s an Australian-American coal and oil shale company. The company’s Australian headquarters are located at Brisbane. The head American office is located at Salt Lake City, Utah. The company operates in three business lines—U.S. coal export infrastructure, international coal marketing and trading, and U.S. thermal coal production.Materials Why are iron ore futures downward sloping?

“Backwardation” occurs when futures contracts trade below the spot price, and the futures curve begins to downward slope. This means that the market expects further decline in iron ore prices based on current indicators and fundamentals.

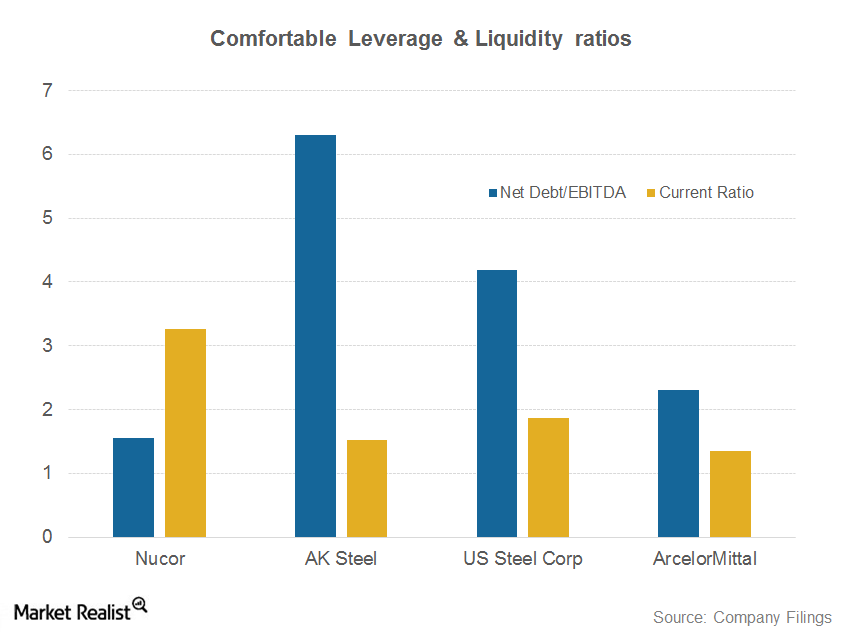

Why Nucor might acquire mining assets

Nucor is the only North American steel producer to hold investment-grade credit ratings due to its comfortable liquidity and leverage ratios.

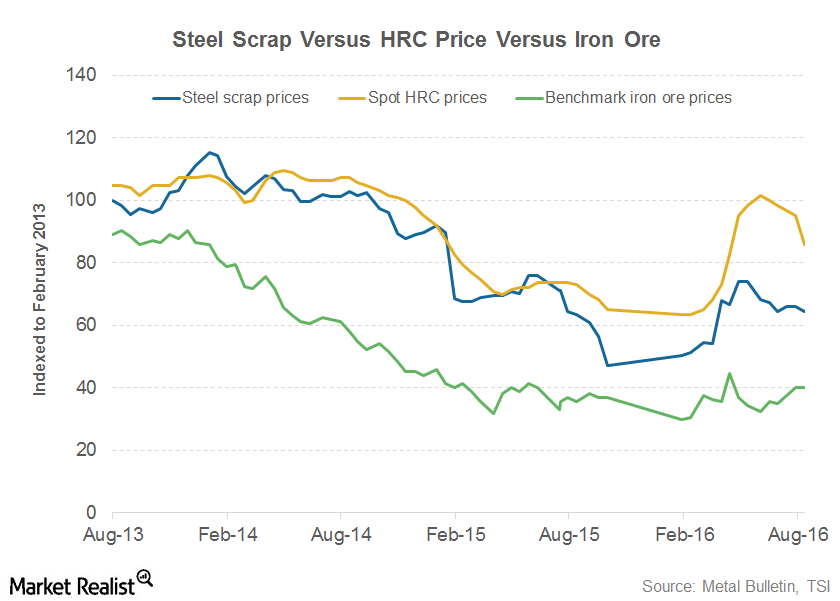

Could Steel Scrap Prices Follow Steel Prices Lower?

Steel scrap prices could follow steel prices lower. Steel mills might negotiate hard with scrap suppliers as steel prices pare some of their 2016 gains.

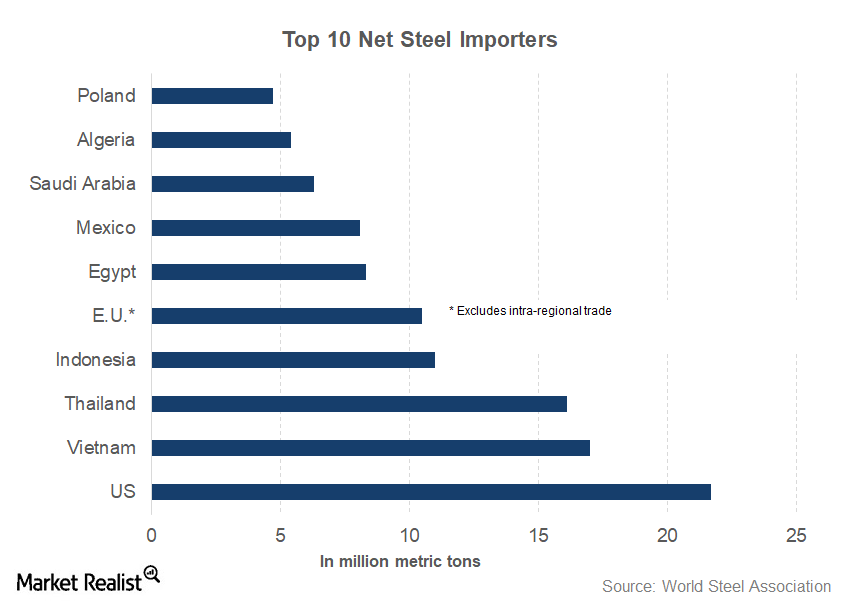

Top 10 Steel Importers: Is US Steel Industry Justified?

The United States is the world’s largest net steel importer. The country’s net steel imports totaled 21.7 million metric tons last year.

Crude Oil Continued to Rise, OPEC Agreed to the Supply Cut

At 5:45 AM EST, the WTI crude oil futures contract for January 2017 delivery was trading at $49.88 per barrel—a rise of ~0.89%.

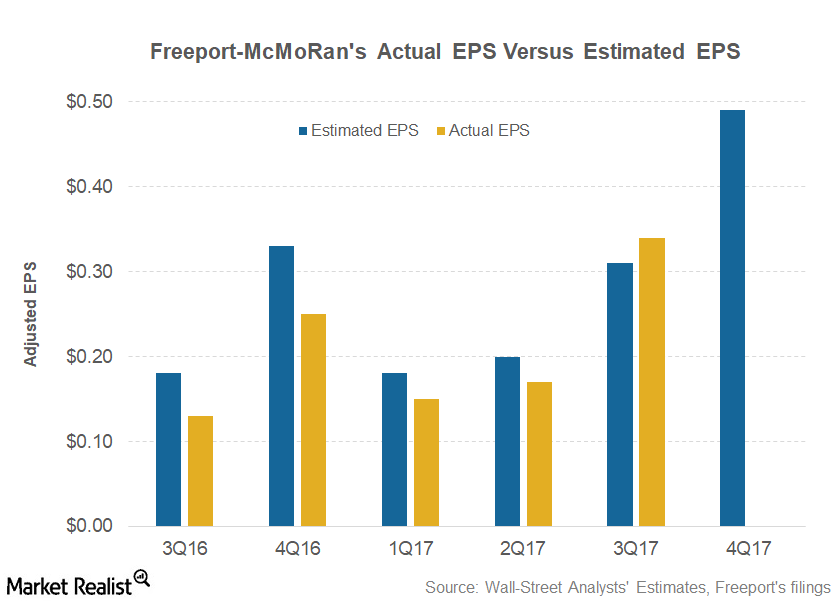

Can Freeport’s 4Q17 Earnings Keep Investor Optimism Alive?

Freeport-McMoRan (FCX), the leading US-based copper miner (XME), is scheduled to release its 4Q17 earnings on January 25.Materials Must-know: An investor’s guide to Nucor’s supply chain

To fulfill its iron ore requirements, Nucor has a DRI plant in Trinidad.

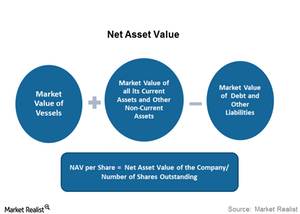

How Does Net Asset Value Measure Navios Maritime’s Valuation?

NAV (net asset value) is a valuation method under which a company’s value is equal to the difference between its assets and liabilities.

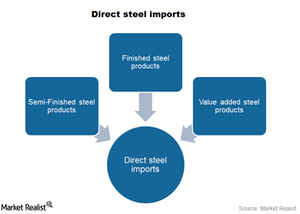

What Are Direct And Indirect Steel Imports?

We’re analyzing the surging steel imports in the United States. But first, investors should understand about various types of steel imports.

Must-know: 3 risks that aluminum company investors face

Litigations can be a big blow for aluminum producers. Litigations are expected to decrease aluminum prices and premiums. This will be negative for aluminum companies like Alcoa Inc. (AA), Century Aluminum (CENX), Kaiser Aluminum Corp. (KALU), and Constellium (CSTM).Materials Why metal service centers are important for U.S. Steel

Metal service centers account for about one-fifth of U.S. Steel’s total revenues. This makes these centers an important customer segment for the company.Materials Why Alcoa is positioned well to serve the automotive industry

Alcoa is working to expand its capacity in Tennessee. It’s a $275 million investment. Alcoa expects that the facility will be operational by mid-2015.

Steel Industry’s Capacity Utilization Ratio Is At A 1-Year Low

The capacity utilization ratio is a key determinant of steel companies’ profitability. As a result, it’s a key metric that steel play investors should actively track.

Challenges that aluminum faces as a steel replacement

Using aluminum, instead of steel, increases the vehicles’ manufacturing costs. With lower energy prices, analysts’ doubt that consumers will pay extra to purchase an all-aluminum body vehicle.Materials Why steel production has slowed down in China, affecting stocks

The steel industry in China has witnessed a slowdown, largely as a result of a slowdown in the real estate industry in China.

Will a Rate Hike Pull the Lid off Gold?

Though an increase in rates may initially dim the luster of the metal, after the hike, gold may soar, uninterrupted by looming fears.

A Look at Analysts’ Top 5 US Steel Stocks

In this overview article, we’ll see how analysts are rating the leading steel stocks, and we’ll also compare performance from the top five steel companies.

Important End Consumers Of Steel

The automobile industry is on of the biggest end consumers of steel. It accounts for a quarter of steel consumption in the US.