Consumer Staples Select Sector SPDR® ETF

Latest Consumer Staples Select Sector SPDR® ETF News and Updates

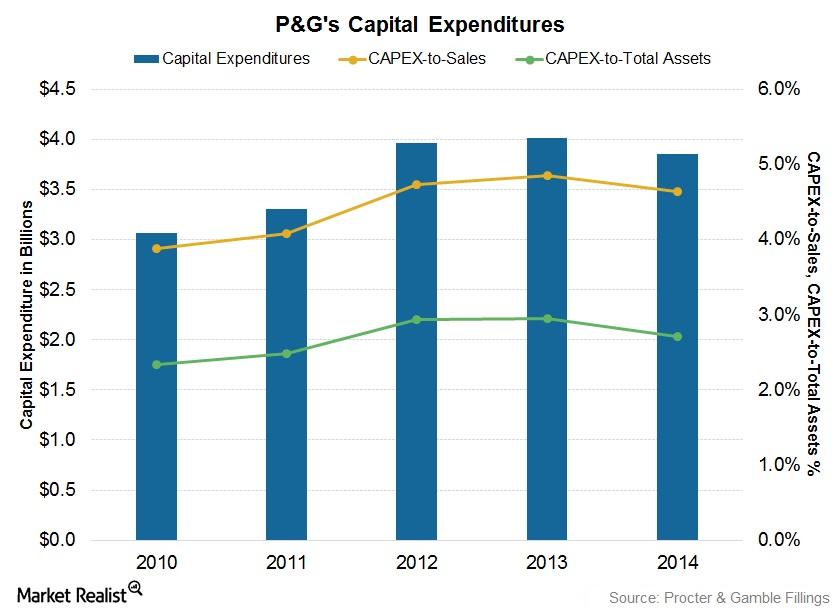

Procter & Gamble’s Efforts to Reduce Capex

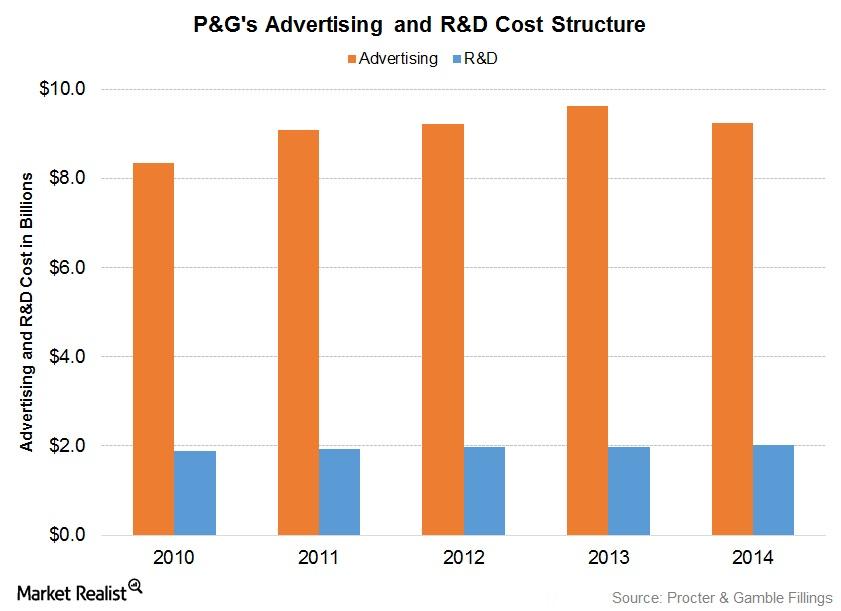

Less capex has been required since P&G reduced the number of brands as well as the research and development, marketing, and innovation costs associated with them.

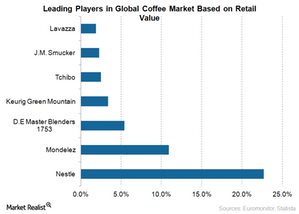

Jacobs Douwe Egberts: Its Impact on Coffee Industry Rivals

Jacobs Douwe Egberts will be a leading player in the coffee industry with powerful brands like Jacobs, Maxwell House, and Pilão. It will have a strong presence in emerging countries like China.

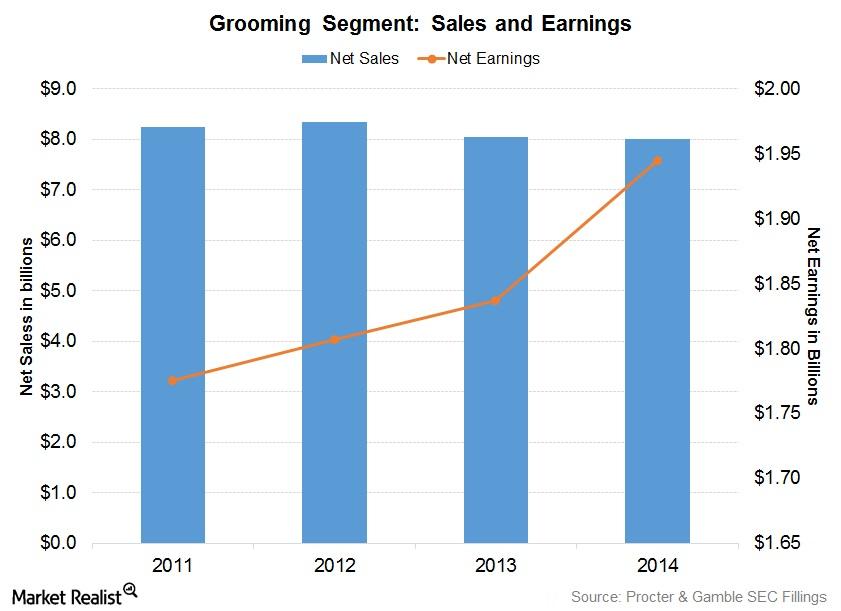

Why Procter & Gamble Dominates in Grooming Products

In the six months ending December 31, 2014, P&G’s net sales stood at $40.3 billion. Of this, 9.6% came from the Grooming segment.

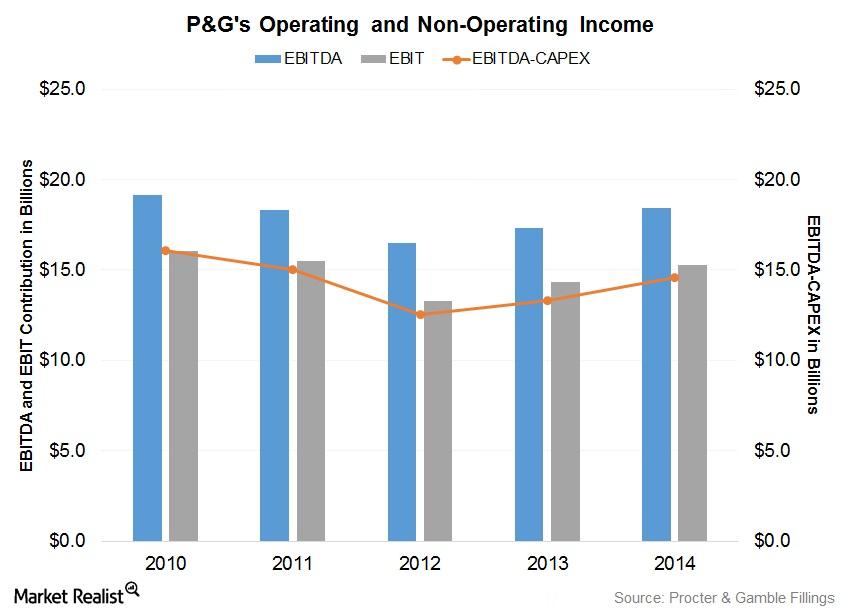

How Innovation is Helping Procter & Gamble Develop Premium Brands

In 2001, P&G established an innovation strategy program called “Connect and Develop.” The program has allowed the company to better understand consumer behaviour.

Procter & Gamble: A Brand Marketing Pioneer

P&G is one of the world’s biggest advertisers. The company has defined many of the marketing strategies used globally.

Procter & Gamble: Global Leader in Fabric Care and Home Care

P&G’s Fabric Care and Home Care segment’s annual revenue was reported to be $26.1 billion in fiscal 2014. It contributed 31.7% of the company’s total net sales.

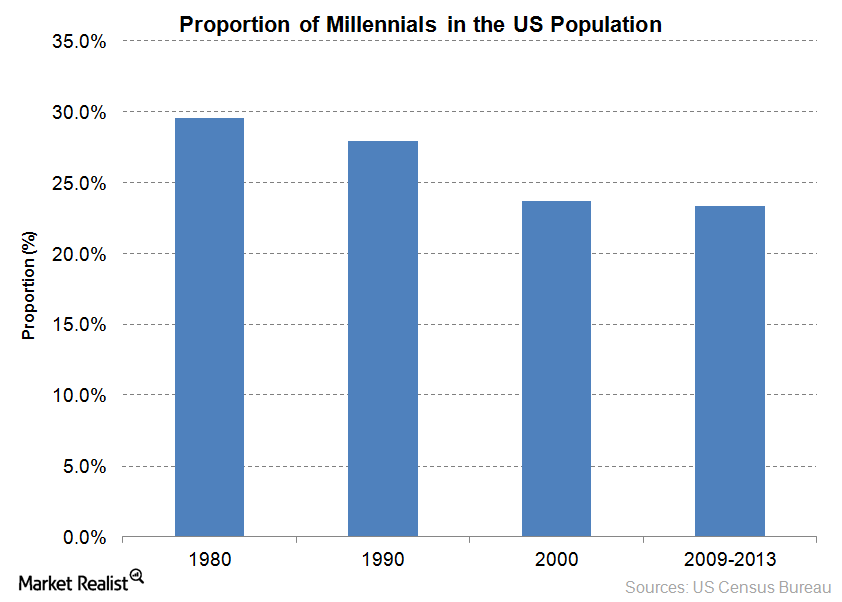

Why Are Millennials a Key Demographic for Monster Beverage?

Millennials are the key consumers of energy drinks and shots. Monster Beverage specifically targets this tech-savvy demographic in its advertisements.

Energy Drinks Continue to Thrive despite Controversies

Two-thirds of energy drink consumers are concerned about the negative effects of energy drinks and shots, but this doesn’t stop them from consuming the drinks.

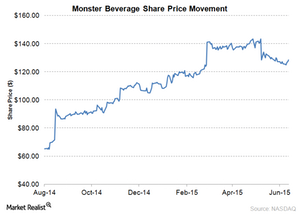

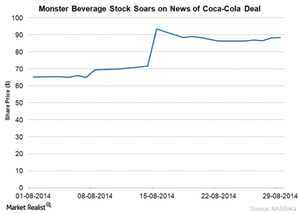

Monster Gets More Energy in Strategic Partnership with Coca-Cola

On June 12, Coca-Cola and Monster Beverage completed a strategic partnership. Coca-Cola purchased 16.7% in Monster for $2.2 billion. That day, Monster Beverage shares rose 1.0%, and Coca-Cola’s fell 0.3%.

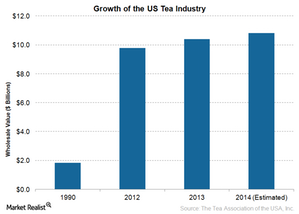

The Growing Demand for Tea in the US

Though the per capita consumption of tea in the US is low compared to other countries, the growth in tea consumption in recent years has been impressive.

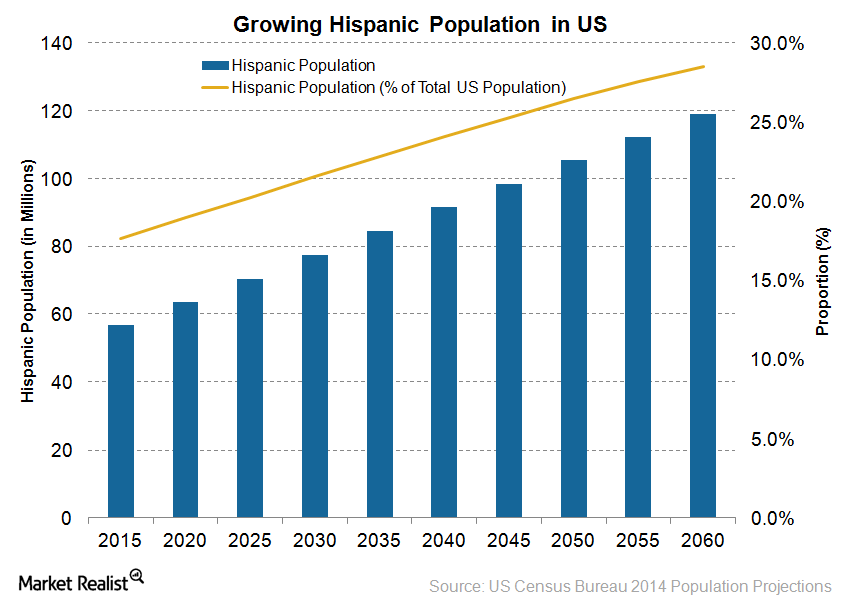

Why PepsiCo and Its Peers Are Focusing on Hispanics in 2015

PepsiCo (PEP) and peers like Coca-Cola and Dr Pepper Snapple have been developing several products based on the tastes and preferences of Hispanics.

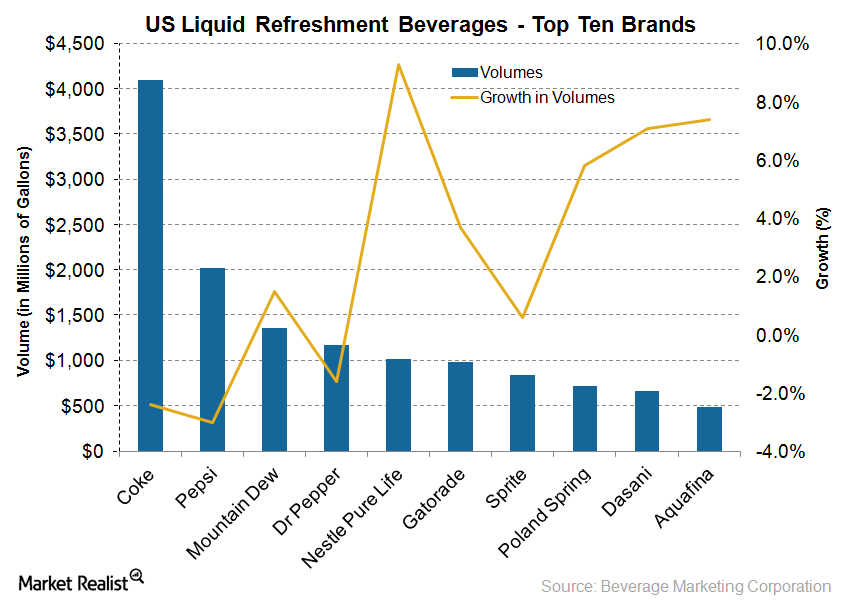

Gatorade by PepsiCo: Still Athletic at 50

Gatorade is celebrating its 50th anniversary this year. It’s one of PepsiCo’s $22-billion brands, generating more than $1.0 billion in annual retail sales.

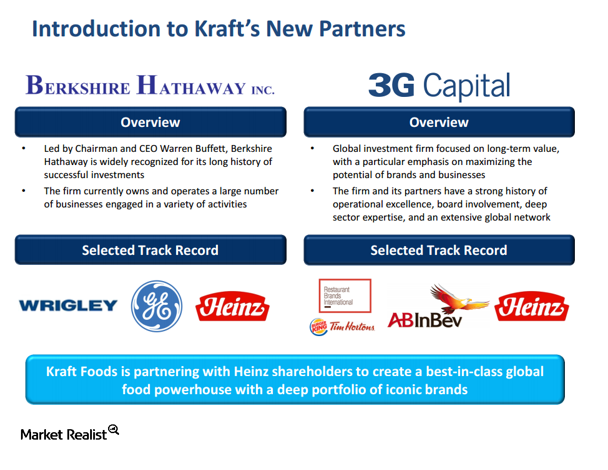

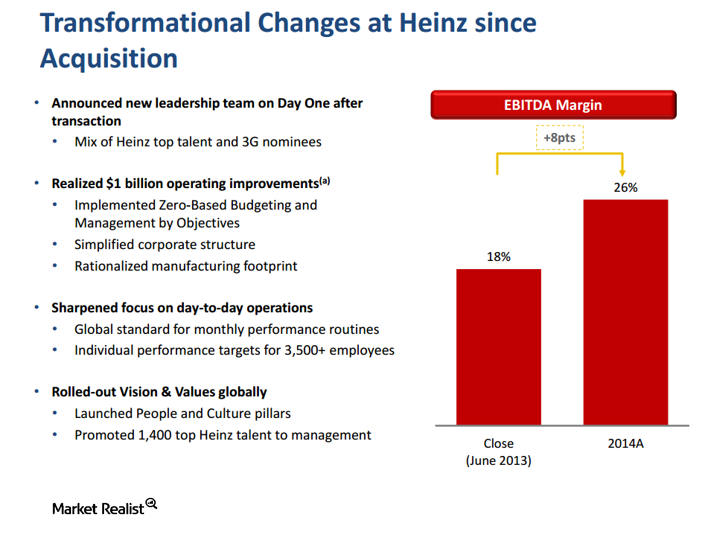

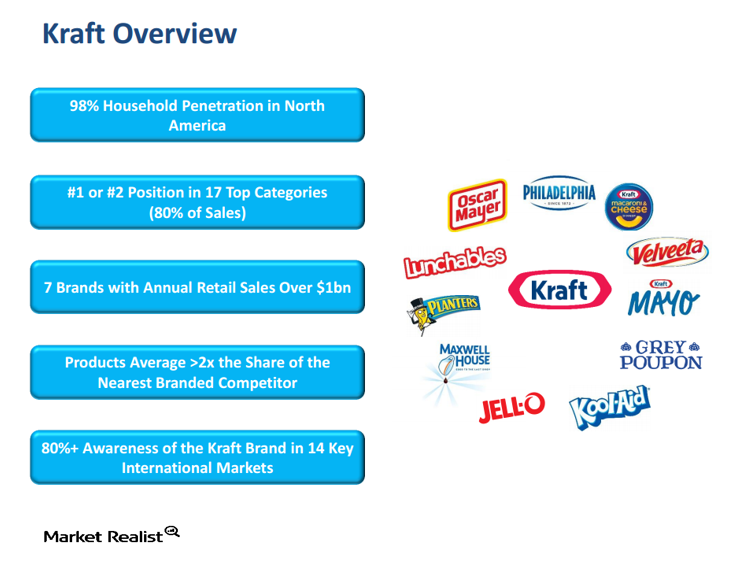

The Kraft–Heinz merger: Overview of Heinz

Kraft’s (KRFT) and Heinz’s portfolio of brands are highly complementary, which is a big reason for the Kraft–Heinz merger.

The Kraft–Heinz Merger: What If the Deal Breaks?

The Kraft–Heinz merger isn’t a typical risk arbitrage deal because you can’t arbitrage a spread. Before the deal, Kraft was trading at $62.40 a share.

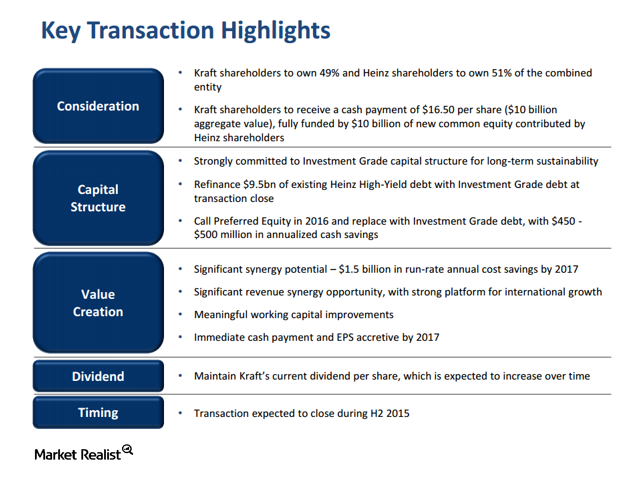

The Kraft–Heinz Merger: Transaction Rationale

The Kraft–Heinz merger entity will maintain Kraft’s current dividend, and management anticipates it will grow.

Is Antitrust an Issue in the Kraft–Heinz Merger?

The first place arbitrageurs look to get a handle on antitrust risk is the 10-K, where companies often disclose the names of competitors.

The Kraft–Heinz Merger and Material Adverse Change, Part 3

Other important merger spreads include the deal between Time Warner Cable and Comcast as well as the merger between Pharmacyclics and AbbVie.

The Kraft–Heinz Merger: Transaction Benefits for Kraft Investors

Kraft has a non-solicitation agreement with a fiduciary out. This means that Kraft could discuss another merger if approached by another suitor.

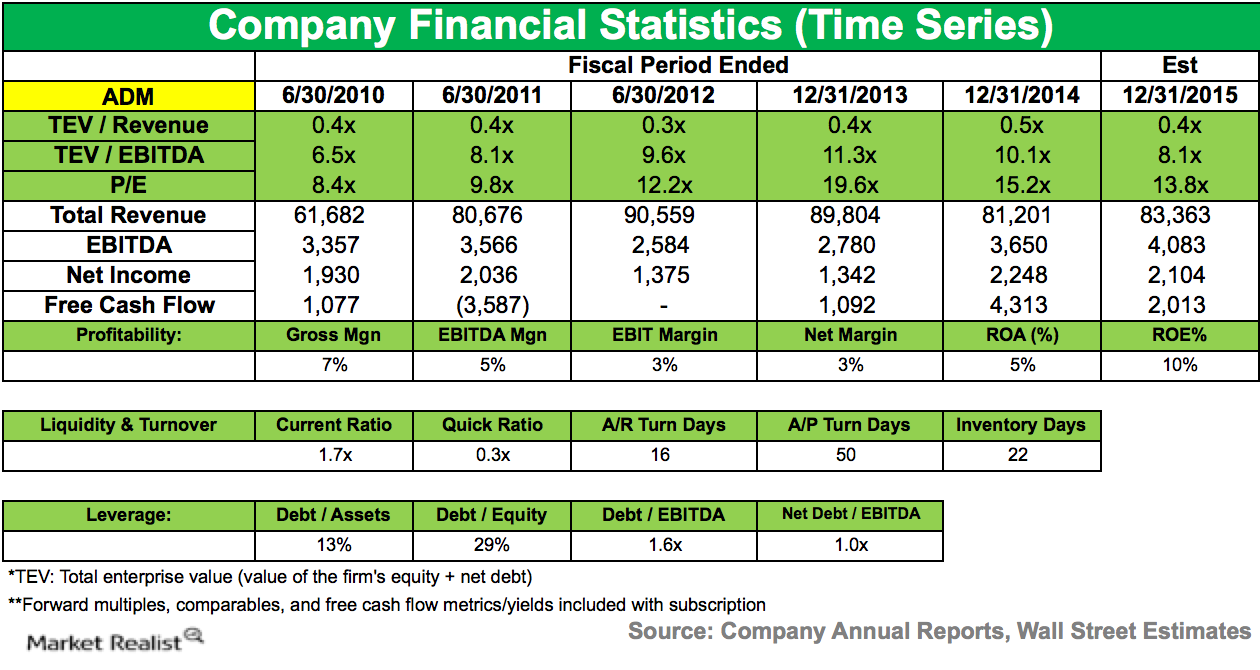

Citadel Advisors Reduces Position in Archer Daniels Midland

The Archer Daniels Midland Company is a processor of oilseeds, corn, wheat, cocoa, and other agricultural commodities.

Why is Beer Losing Ground to Wine and Spirits?

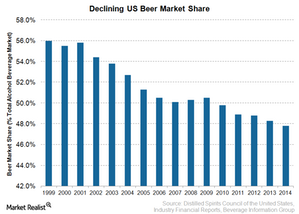

The beer market share in terms of supplier revenues has fallen from 56.0% in 1999 to 47.8% in 2014. The decline is more evident in the light beer category.

Beer Brands That Make a Difference in the US Market

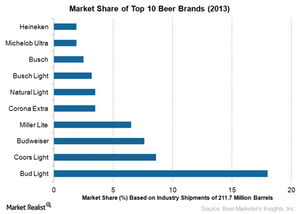

Bud Light is the leader among major beer brands, with 18% share of the beer market based on the 2013 total beer industry shipments of 211.7 million barrels.

Competitive Forces: Who Rules the US Beer Industry?

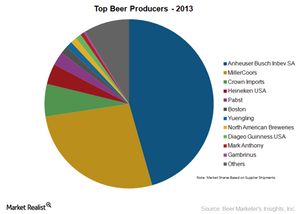

Based on the US beer industry shipments of 211.7 million barrels, Anheuser-Busch InBev led the beer industry in 2013 with a 45.6% market share.

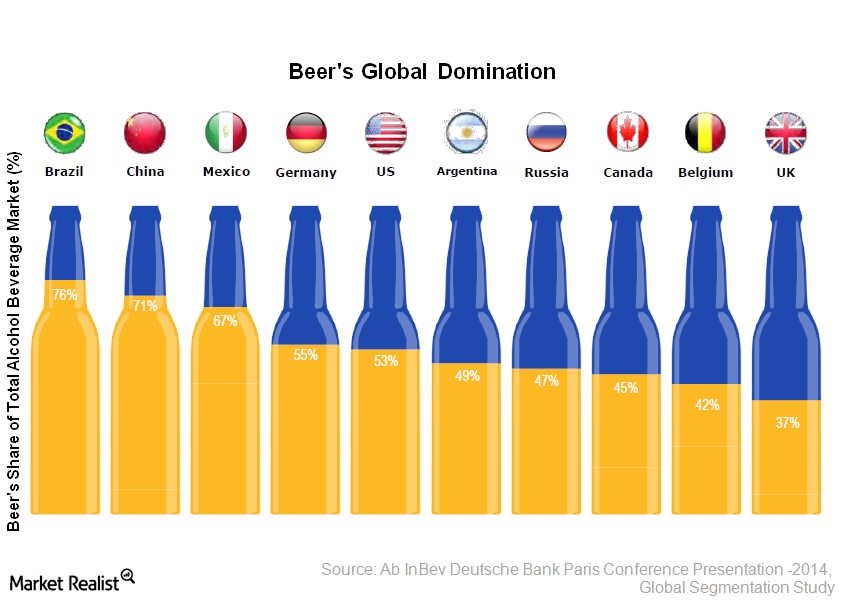

Beer Dominates Alcoholic Beverage Market

Beer is the dominant category in the alcoholic beverage industry with a 47.8% market share of the gross supplier revenue figures for 2014.

Highlights of Citadel Advisors’ 4Q14 Portfolio

Citadel Advisors’ 4Q14 portfolio increased by 3.63% to $82.66 billion from $76.77 billion in 3Q14.

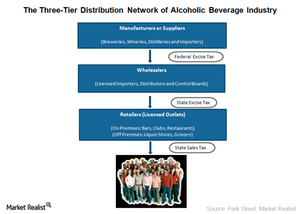

The Three-Tier Distribution of the US Alcoholic Beverage Industry

The three-tier distribution system ensures collection of taxes and prevents control of production, distribution, and selling by a single entity.

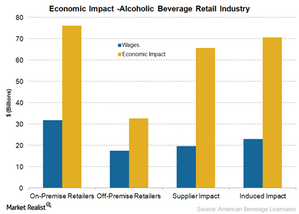

How Important Is the Alcoholic Beverage Industry to the Economy?

In an economic study, the American Beverage Licensees estimated the economic impact of the alcoholic beverage industry in 2014 to be more than $245 billion.

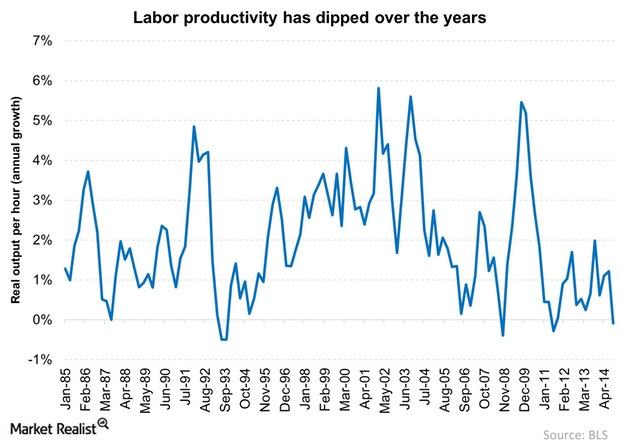

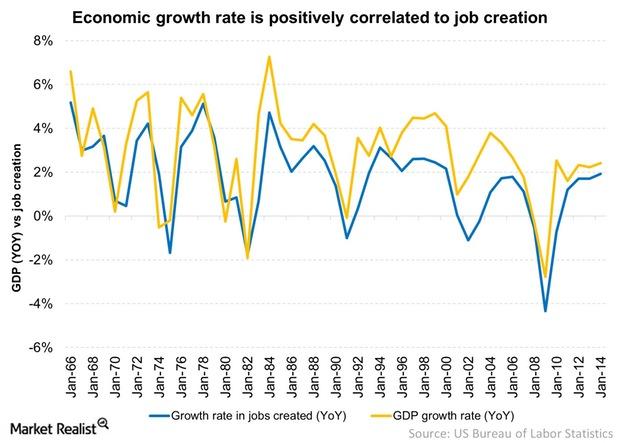

Why Low Labor Productivity Could Affect GDP Growth

Labor productivity growth has slumped to a negative. The 30-year average is 2%. However, this average has been quite volatile.

Monster Beverage and Coca-Cola: A landmark partnership

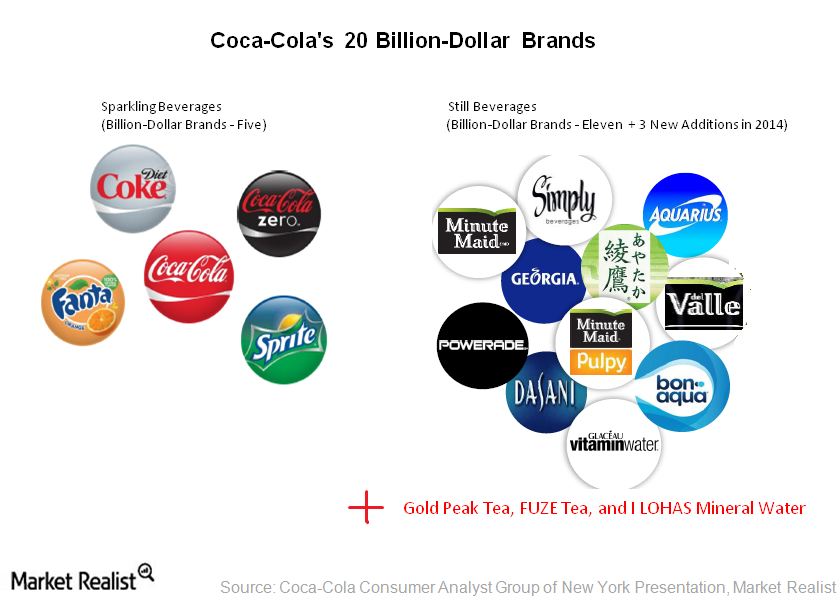

Under their strategic partnership, Coca-Cola will acquire 16.7% of Monster Beverage for $2.15 billion and transfer its energy business to Monster Beverage.

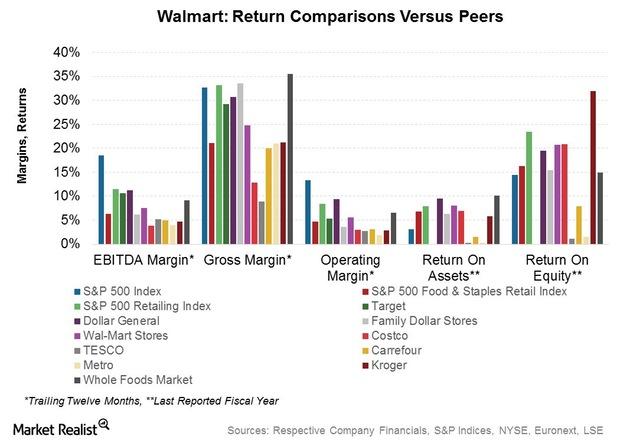

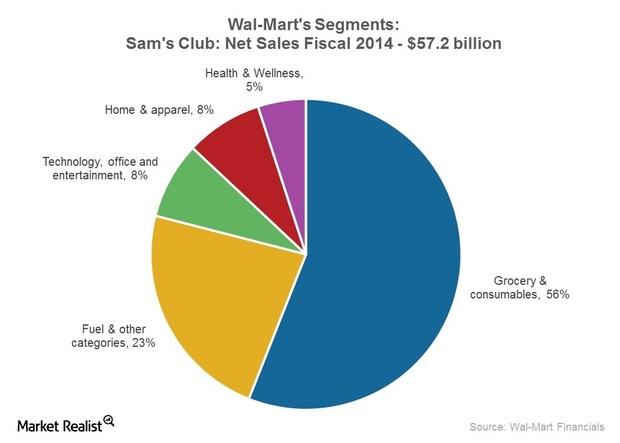

Analyzing Walmart’s Profitability And Margins Versus Peers

Despite its sales growth, the gross profit rate declined for Walmart’s US operations, consisting of the Walmart US and Sam’s Club segments.

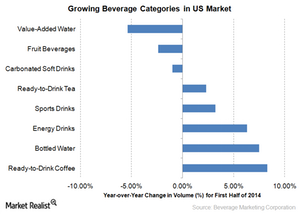

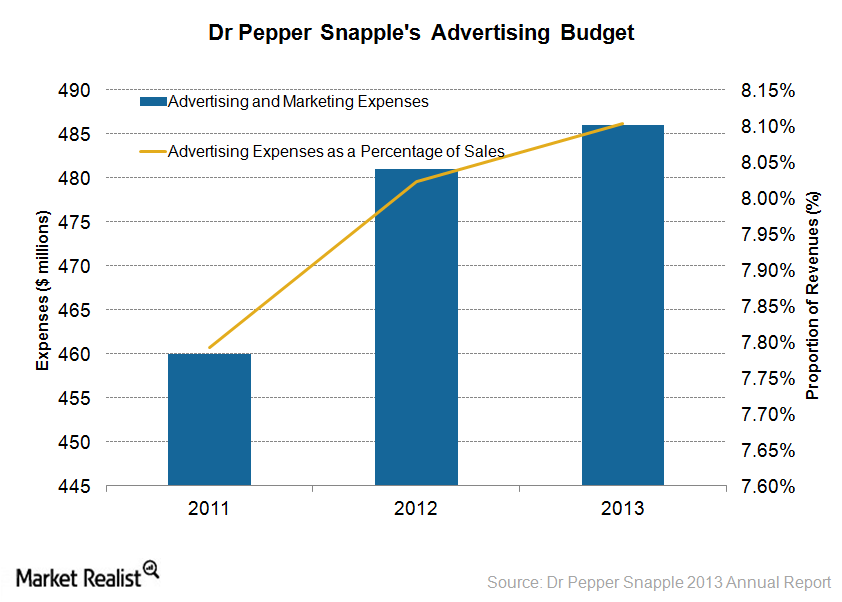

Dr Pepper Snapple pursues non-carbonated beverage growth

Keeping in view declining soda volumes, Dr Pepper Snapple is focusing on expanding its non-carbonated beverage line.

Walmart’s Stock Performance Has Been Below Par

Stock price movement affected Walmart’s stock performance. Walmart’s stock is only up by 8.8% since the start of 2014.

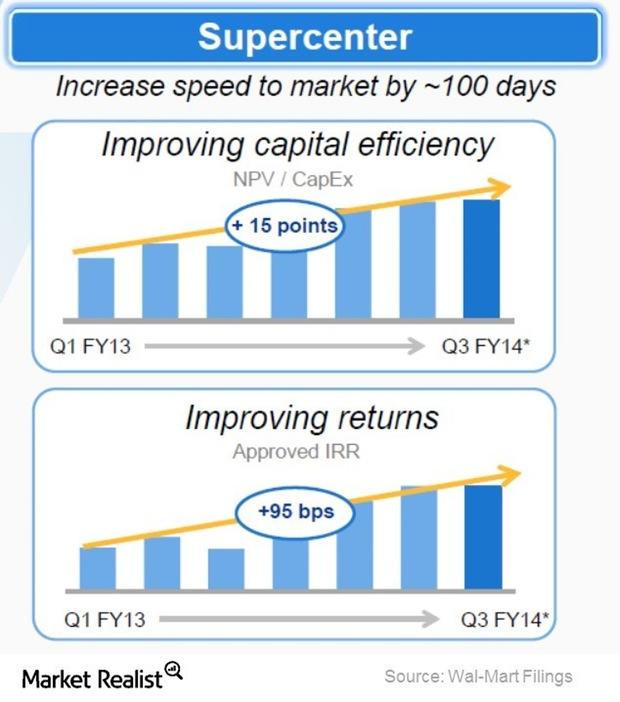

Walmart’s Capital Strategy – Smaller Stores And Supercenters

Walmart embarked to aggressively minimize the capital cost per square foot of retail space with the aim of faster payback on investment.

How PepsiCo is benefitting from complementary businesses

PepsiCo’s snack and beverage businesses are complementary in nature and derive a lot of synergies.

How PepsiCo’s focus on innovation is reaping rewards

PepsiCo’s focus on innovation includes Pepsi Spire 5.0 equipment, which allows consumers to create about 1,000 beverage combinations using a 32-inch touchscreen.

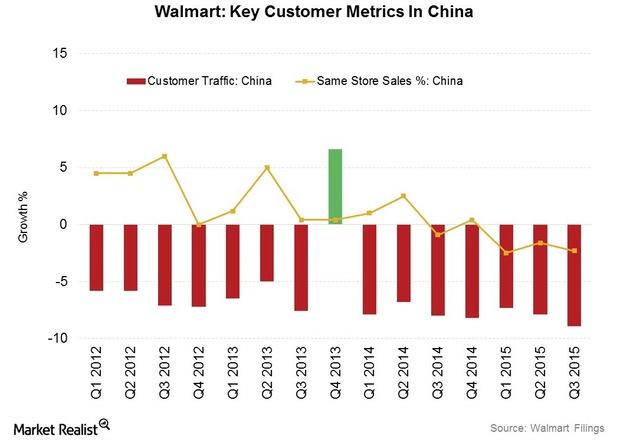

Why Walmart Isn’t A Heavyweight In China

In 2013, Walmart closed 29 underperforming stores in China. It also announced a revamp. It planned to open 110 new stores in focused geographies.

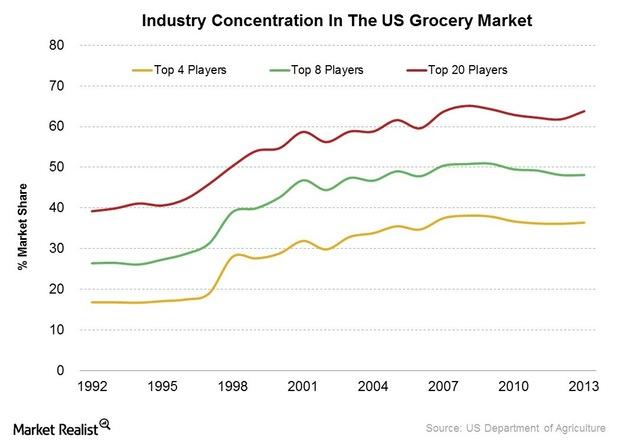

Competitive Forces: Why Walmart Dominates The Grocery Industry

Walmart’s largest merchandising category is groceries. According to the USDA, Walmart was the largest seller of grocery items in the US in 2013.

Coca-Cola’s still beverages brands meet growing demand

In 2014, Coca-Cola added three still beverage brands. Coca-Cola’s still beverages now include Gold Peak Tea, FUZE Tea, and I LOHAS mineral water.

Walmart’s Sam’s Club Segment: Positioning For The Next Level

Walmart’s Sam’s Club segment consists of membership-only club warehouse retail operations. Members include both business owners and individual consumers.

Why Job Creation And GDP Growth Go Hand-In-Hand

Job creation and GDP growth go hand-in-hand. The job markets and the economy tend to move in a similar pattern.

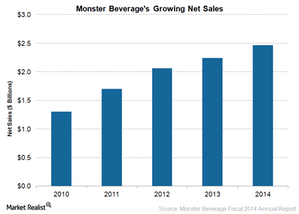

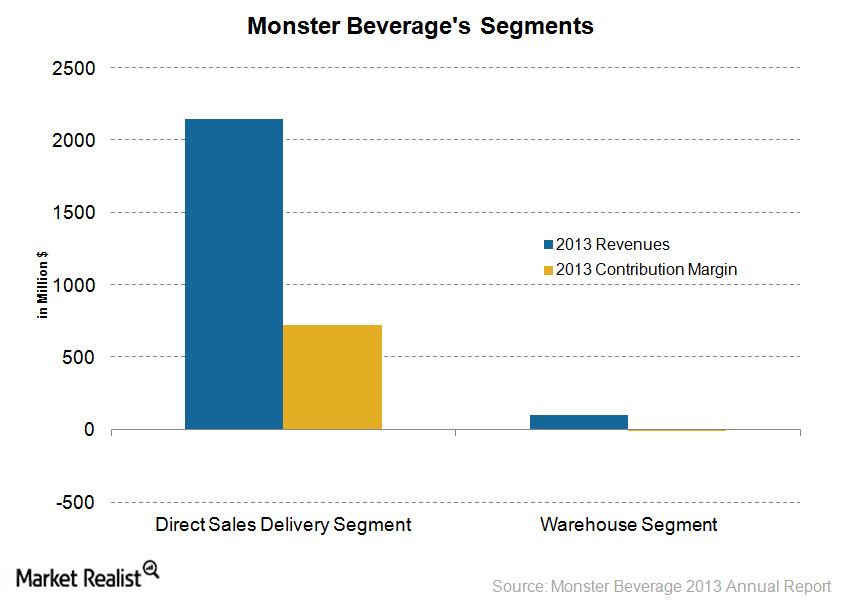

Analyzing Monster Beverage’s segments

Monster Beverage Corporation (MNST) conducts its business through two business segments—Direct Store Delivery, or DSD, and Warehouse. The DSD segment mainly sells energy drinks.

Monster Beverage’s bold marketing approach

Monster Beverage’s advertising and marketing efforts are associated with adventure sports and sports personalities. It sponsors extreme sporting events—like Motocross.

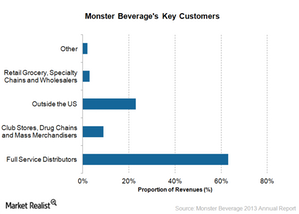

Monster Beverage’s distribution network

Coca-Cola purchased a 16.7% stake in Monster Beverage. Monster Beverage will be able to leverage Coca-Cola’s strong distribution network.

An overview of Monster Beverage Corporation

Monster Beverage Corporation (MNST) is based in California. It manufactures alternative beverages. It sold over 10 billion energy drinks in the past 12 years.

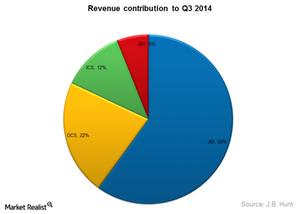

An overview of J.B. Hunt Transport Services

J.B. Hunt Transport Services, Inc. (JBHT) is one of the leading transport and logistics companies in North America. The company operates a huge fleet of semi-trailer trucks.

What are Dr Pepper Snapple’s growth strategies?

Dr Pepper Snapple plans to grow into new categories by leveraging its distribution agreements for third-party brands such as Vita Coco coconut water.

What are Dr Pepper Snapple’s major risks?

Dr Pepper Snapple faces major risks like significant reliance on carbonated soft drinks, limited international growth, and excessive reliance on third-party distribution.

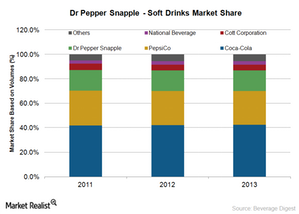

Dr Pepper Snapple is pitted against the soda behemoths

In 2013, Coca-Cola had 42.4% of the market share in the US carbonated soft drink category. PepsiCo had 27.7% and Dr Pepper Snapple 16.9% of the market share.

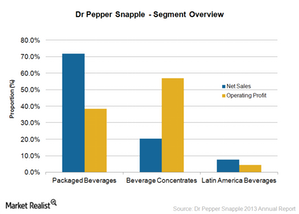

Understanding Dr Pepper Snapple’s revenue streams

Dr Pepper Snapple derives its revenues from the sale of carbonated soft drinks and noncarbonated beverages like ready-to-drink tea, juices, and mixers.

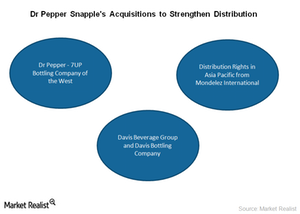

Dr Pepper Snapple strengthens its distribution network

Dr Pepper Snapple is continually strengthening its position as a major beverage company by acquiring regional bottling companies and distribution rights.

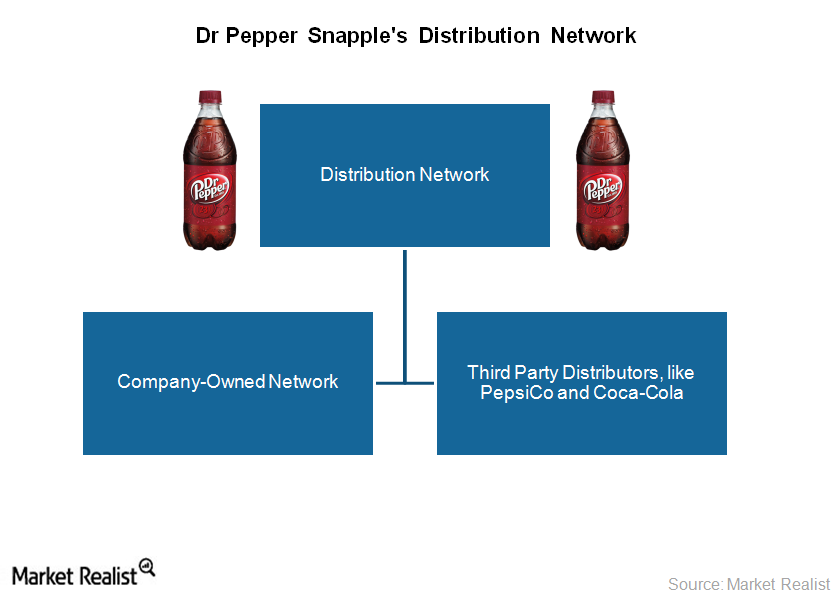

Understanding Dr Pepper Snapple’s route to market

Dr Pepper Snapple’ beverages reach consumers through the company’s own distribution network, third-party distributors, and direct delivery to customers’ warehouses.