Simon Property Group Inc

Latest Simon Property Group Inc News and Updates

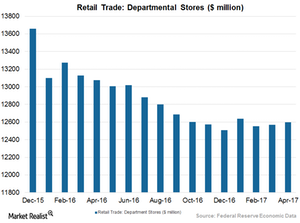

GGP and Other Retail REITs Struggle to Exist in Digital Era

During 1Q17, General Growth Properties’ (GGP) occupancy rate (same-store leased percentage) fell to 95.9% from 96.6% in 1Q16.

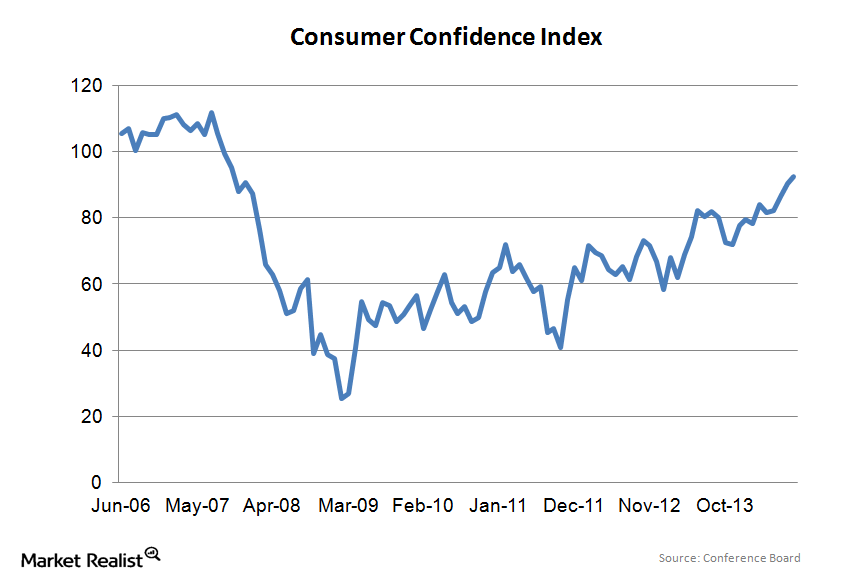

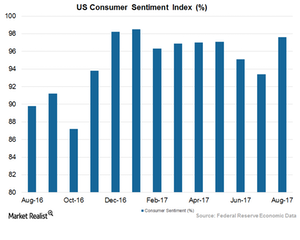

Why rising asset prices are driving consumer confidence higher

The CCI is one of the oldest consumer surveys, originally started as a mail-in survey in 1967. It asks respondents whether certain conditions are positive, negative, or neutral.

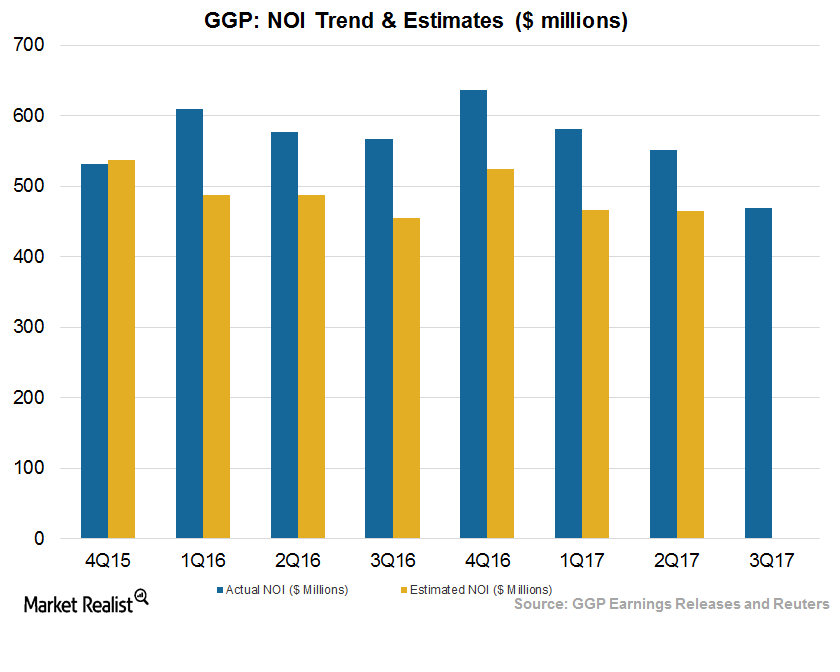

How GGP Managed Its Expenses in 2Q17

In 2Q17, GGP (GGP) reported NOI (net operating income) of $551.0 million, which came in higher than the previous year at $554.0 million.

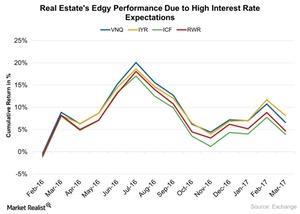

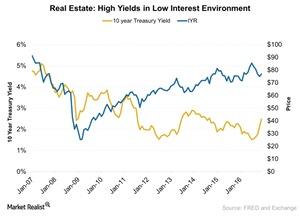

The Real Estate Reaction: Gauging the Impact of the Fed’s Rate Hikes

The rising interest rate is expected to boost the economy in the long run, but it could severely impact sectors like real estate.

Simon Property Group’s Key Business Segments

Simon Property is the only REIT in the S&P 100 Index and has heavy asset concentration on the US east coast and in the central US.

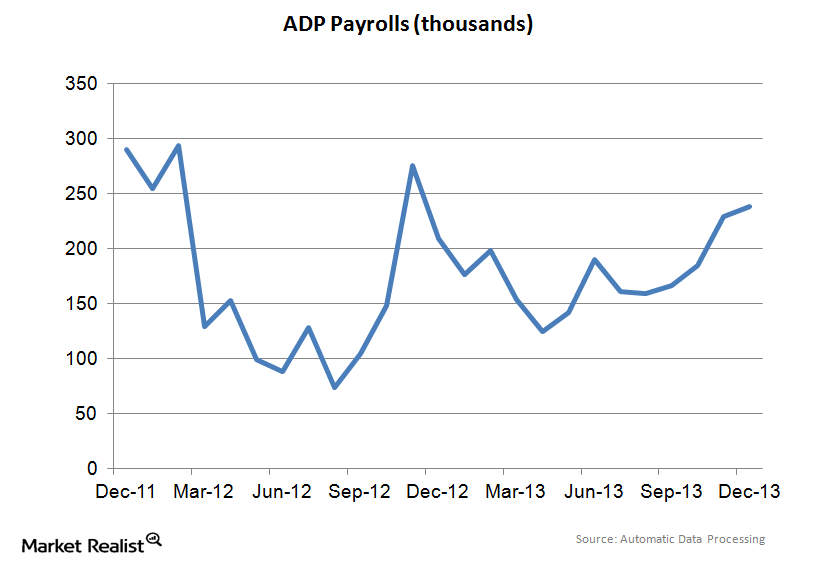

Jobs report shows hiring is picking up—good for commercial REITs

Private sector employment increased by 238,000 in December, while November’s numbers were revised upward from 215,000 to 229,000.

Simon Property Group faces competition from online retailers

Simon Property Group is by far the biggest shopping center REIT in the U.S., with a market capitalization of $53 billion. The next biggest REITs are less than half Simon’s size.

Simon Property Group and Amazon in Talks on Fulfillment Centers

Simon Property Group, the biggest mall owner, is in talks with Amazon to transform some empty spaces into Amazon fulfillment centers.

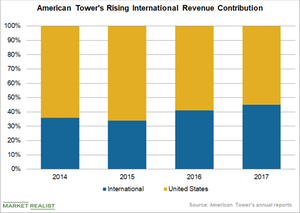

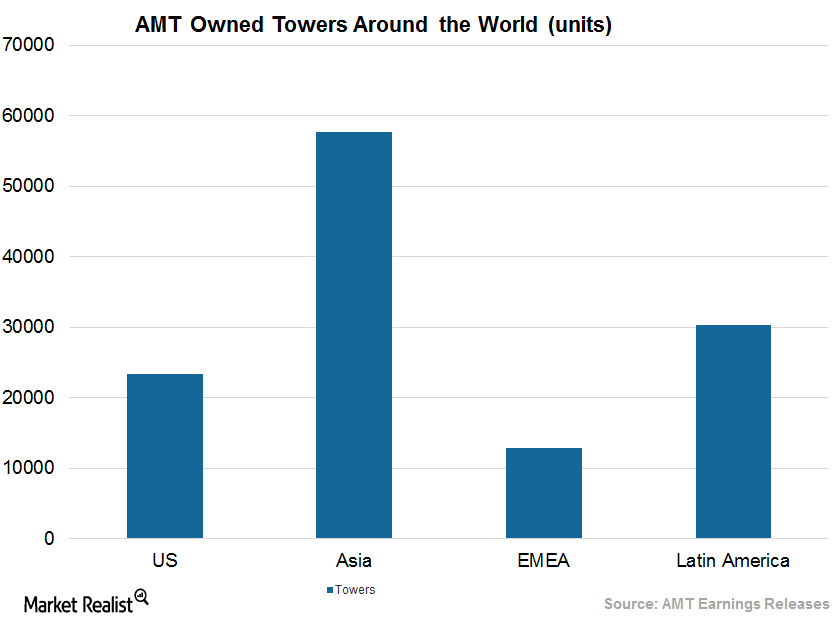

What American Tower’s Global Expansion Strategy Indicates

American Tower’s (AMT) global expansion strategy, which includes acquisitions and joint ventures in several countries (mainly in developing nations), is likely to continue supporting its top line.

American Tower’s Disciplined Capital Allocation

American Tower (AMT) deployed $600 million of capital in 3Q17, bringing its year-to-date amount to $3.6 billion.

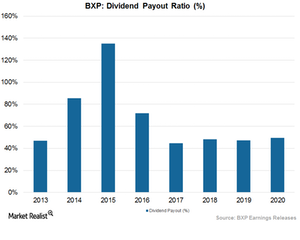

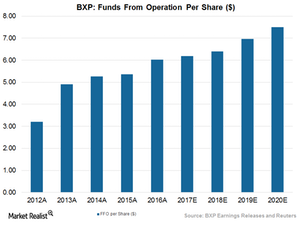

How Boston Properties Returns Value to Shareholders

In order to qualify as REITs (real estate investment trusts), companies usually have to pay 90% of their profits (excluding capital gains) as dividends.

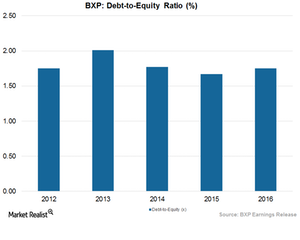

What’s Boston Properties’ Balance Sheet Position?

REITs depend on equity and debt for their working capital.

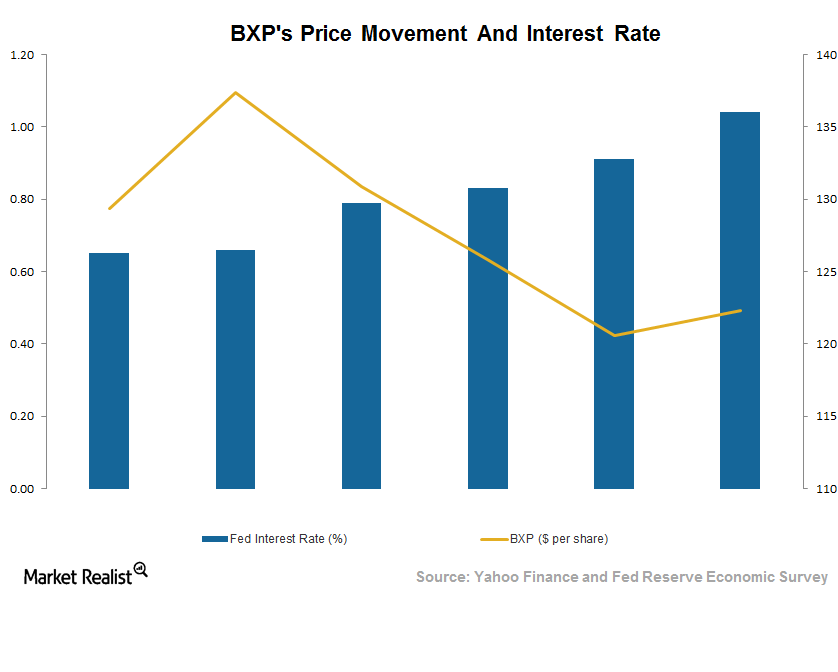

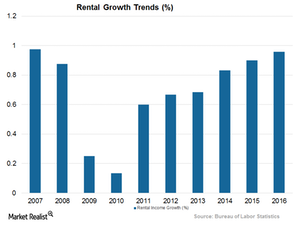

How Boston Property Is Flourishing despite Rising Interest Rates

Although it is a common belief that high interest rates are usually bad for REITs like Boston Properties (BXP), Simon Property (SPG), Prologis (PLD), and Vornado Realty Trust (VNO), we find that REITs have continued in their growth trajectory in the past few months.

Can Boston Properties Flourish amid Higher Interest Rates?

REITs have flourished for a considerable period in a record-low-interest-rate environment because they depend on debt and equity for their working capital.

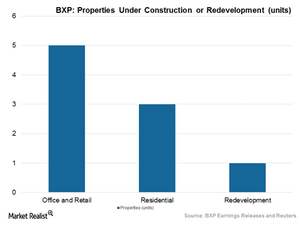

Boston Properties Maintained Profitability with Development Projects

BXP leased properties with a total area of 926,000 square feet in 2Q17.

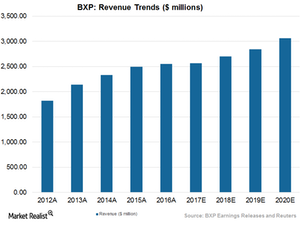

What Lies Ahead for Boston Properties in 2017?

Boston Properties raised its EPS (earnings per share) outlook for 2017 to a range of $2.72 to $2.77 per share.

How Did Boston Properties Fare in 1H17?

The growing economy has acted as a boon to REITs, and with the help of their strategic initiatives, these REITs have been able to take advantage of the opportunity and report higher revenue and profits.

Why Boston Properties Could Be Strong Enough to Combat Headwinds

Boston Properties’ recent upbeat results came on the back of higher leasing activity as well as strong occupancy levels, which led to revenue growth.

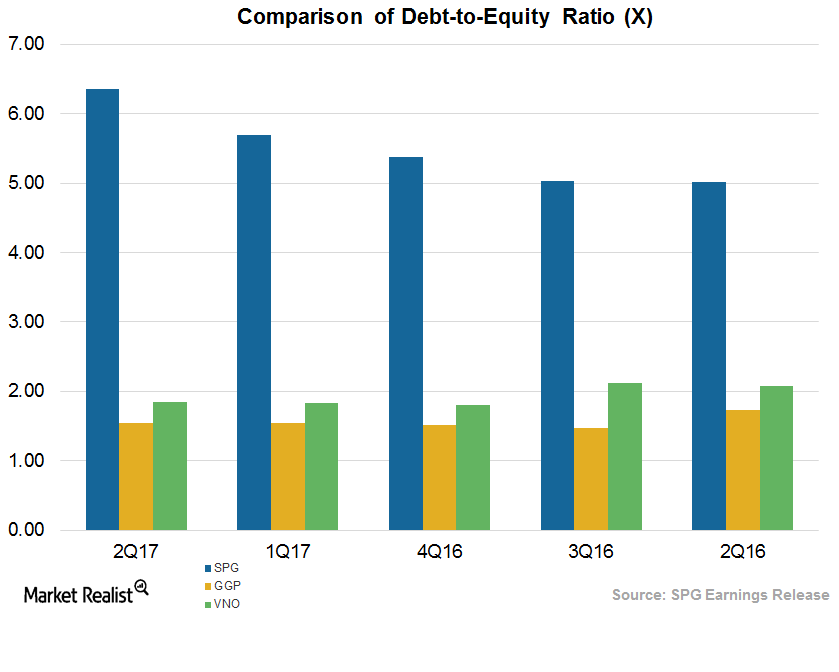

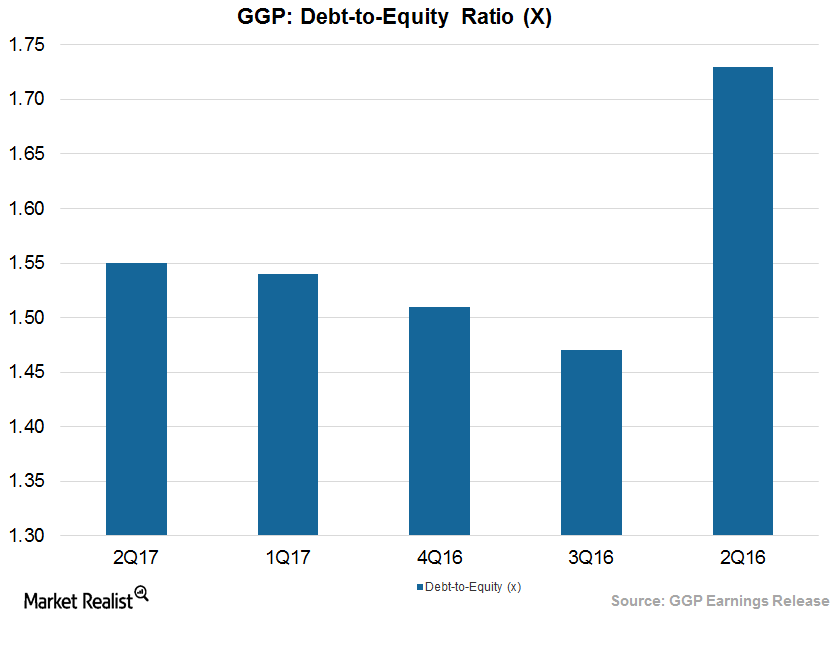

Commercial REITs Have Higher Debt-to-Equity Ratios

GGP’s (GGP) debt-to-equity was 1.55x for 2Q17, which was higher than the industrial mean of 1.07x. As of 2Q17, GGP had $2.0 billion of liquidity.

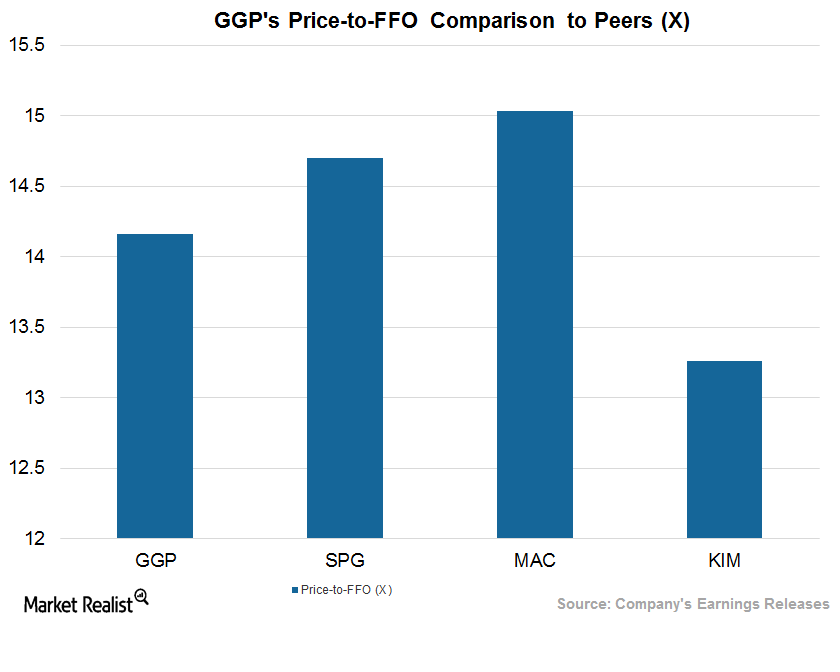

How GGP Stacks Up against Its Peers after 2Q17

GGP’s estimated price-to-FFO multiple for fiscal 2018 is 14.2x, which is at a premium compared to its peers.

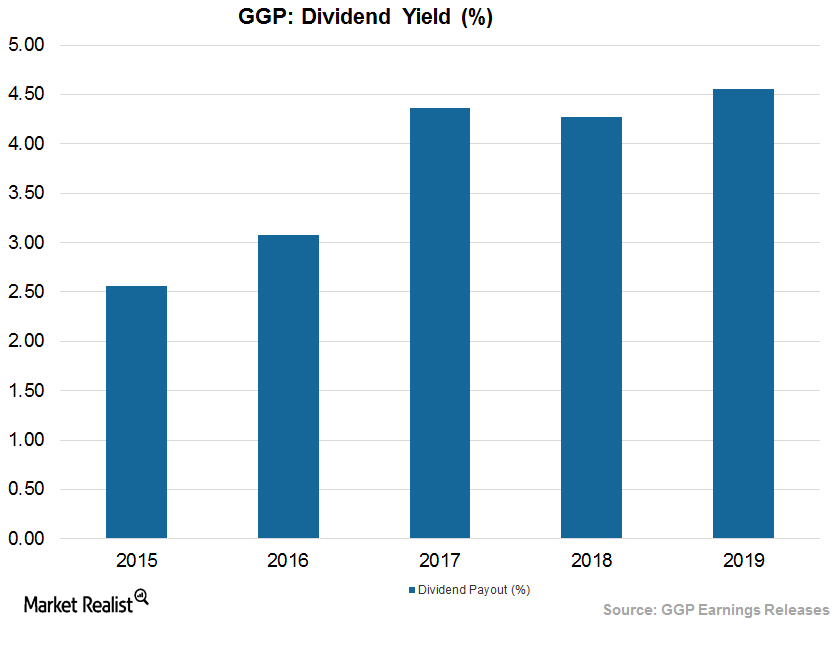

GGP’s Generous Return to Stockholders in 2Q17

In 2Q17, GGP (GGP) paid $17.5 million in dividends to its shareholders. That was higher than $13.3 million paid a year ago.

GGP Has High Debt-to-Equity Ratio as of 2Q17: Can It Be Lowered?

GGP maintained a debt-to-equity ratio of 1.55x for 2Q17. That was higher than the industrial mean of 1.07x.

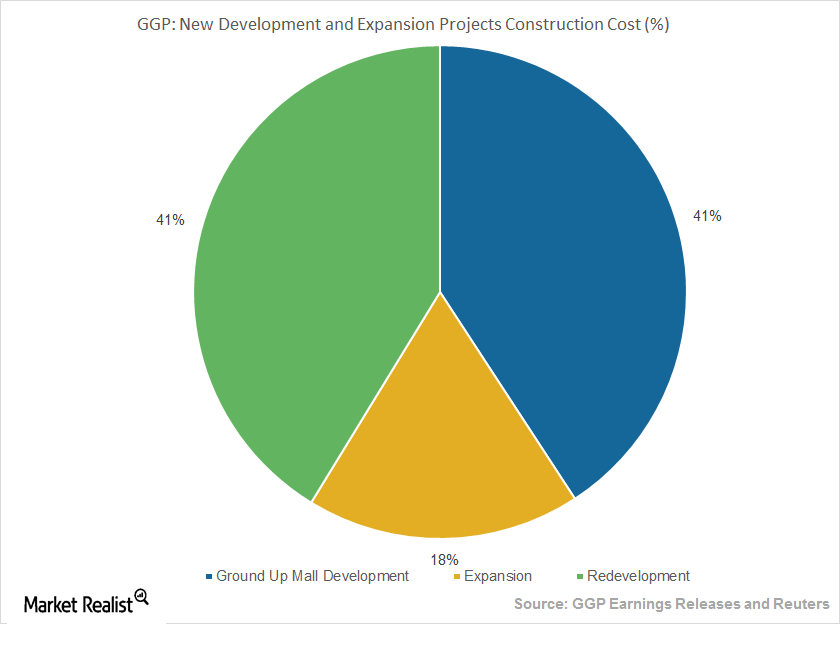

GGP Grew in 2Q17 Due to Development and Redevelopment

GGP has redeveloped its vacant spaces for non-retail uses such as restaurants, entertainment zones, fitness centers, and grocery stores.

What Caused GGP’s Soft Rent Growth in 2Q17?

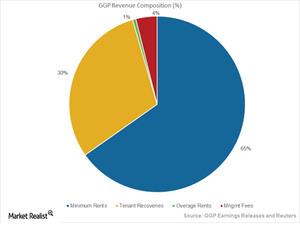

GGP’s (GGP) minimum rent fell by $17.0 million in 2Q17, mainly because of dilution resulting from the sale of an interest in the Fashion Show Mall in Las Vegas n 2016.

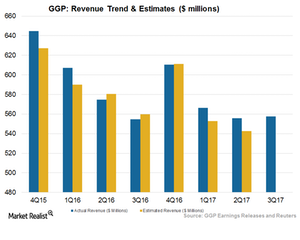

GGP’s Revenue Rode High in 2Q17, Backed by New Leases

GGP’s minimum rent fell 3.9% to $349.2 million, and tenant recoveries fell 4.6% to $161.9 million. Overage rent fell 25.0% to $3.3 million.

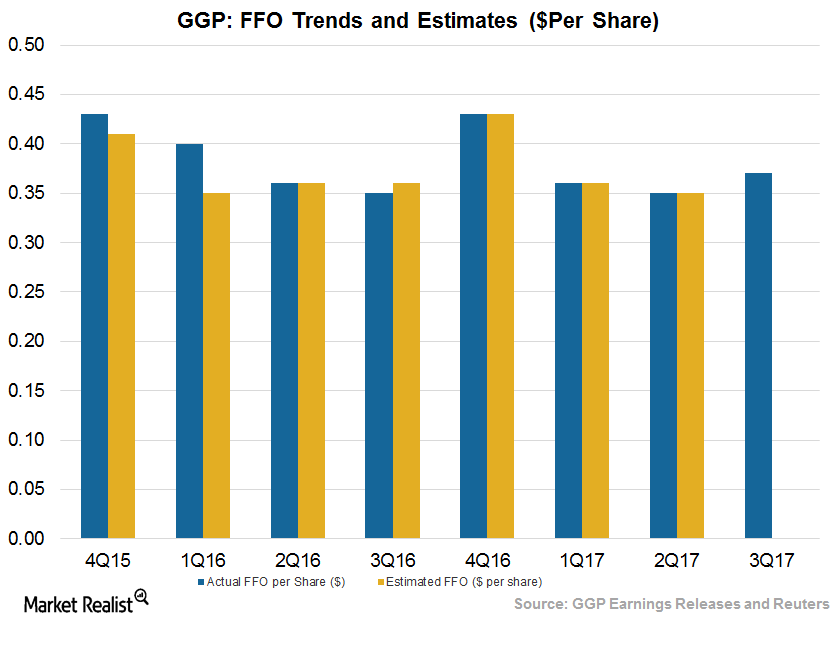

GGP’s 2Q17 Results from an Investor’s Perspective

GGP (GGP) reported funds from operations (or FFO) of $0.35 per share, which was in line with Wall Street estimates. Adjusted FFO remained flat year-over-year.

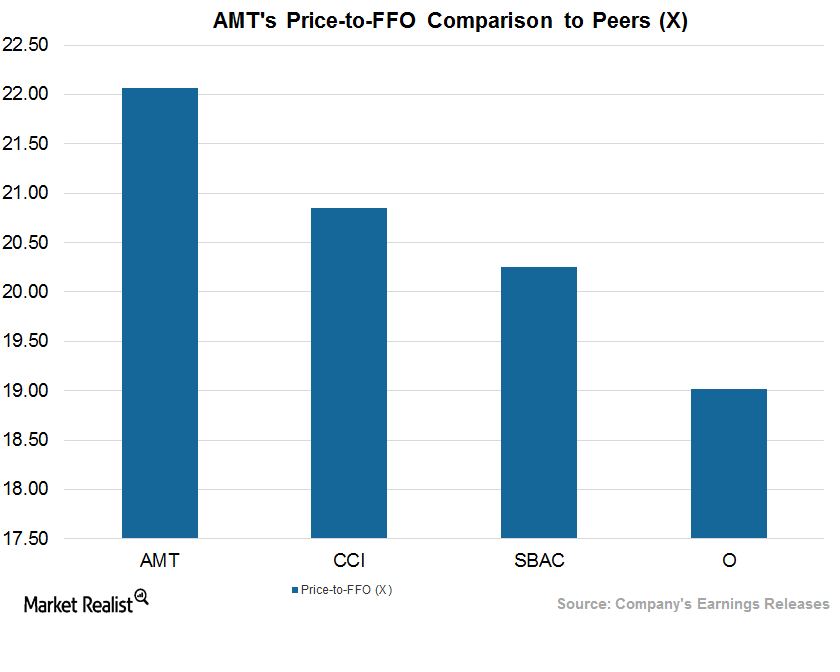

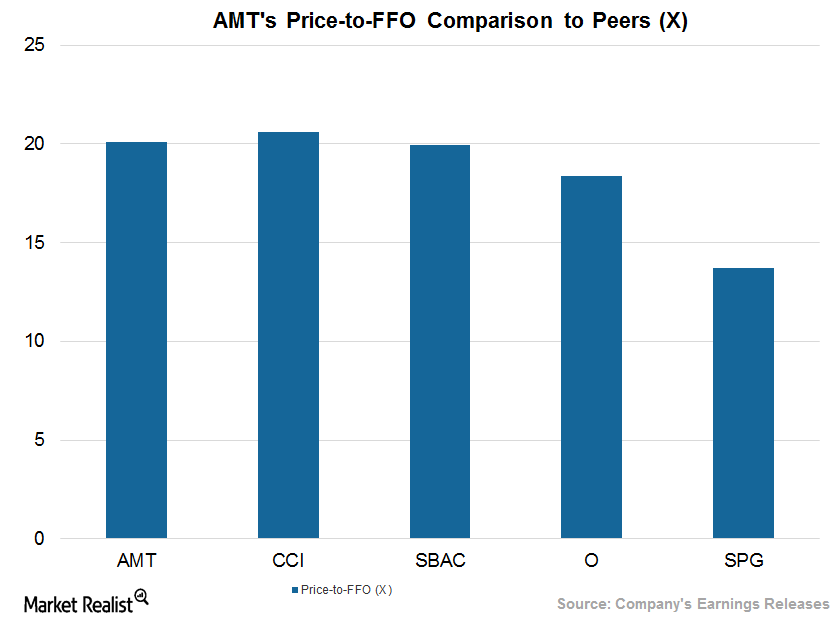

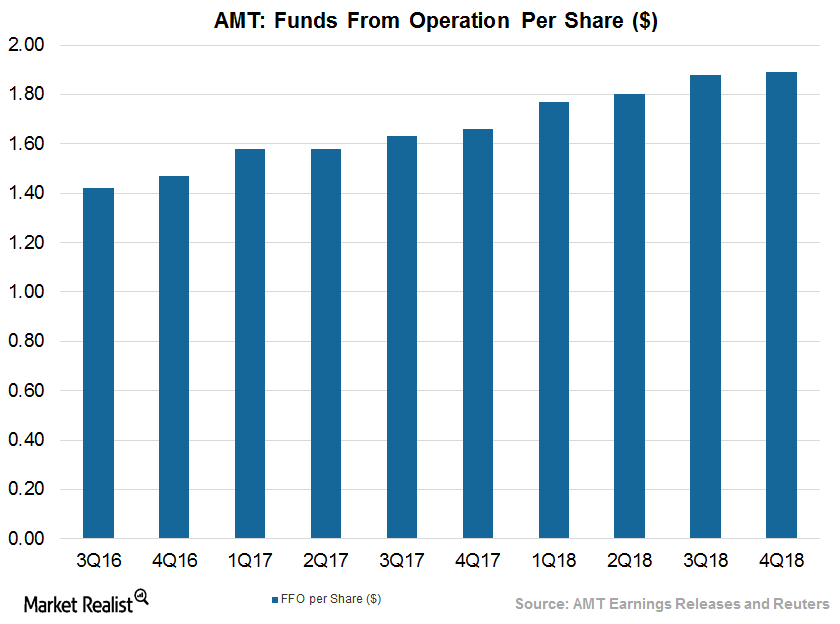

American Tower’s Place among Peers after 2Q17

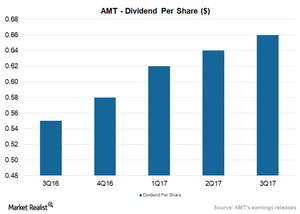

AMT’s current price-to-FFO multiple stands at ~22.1x. After 2Q17, American Tower offers a next-12-month dividend yield of 1.9%.

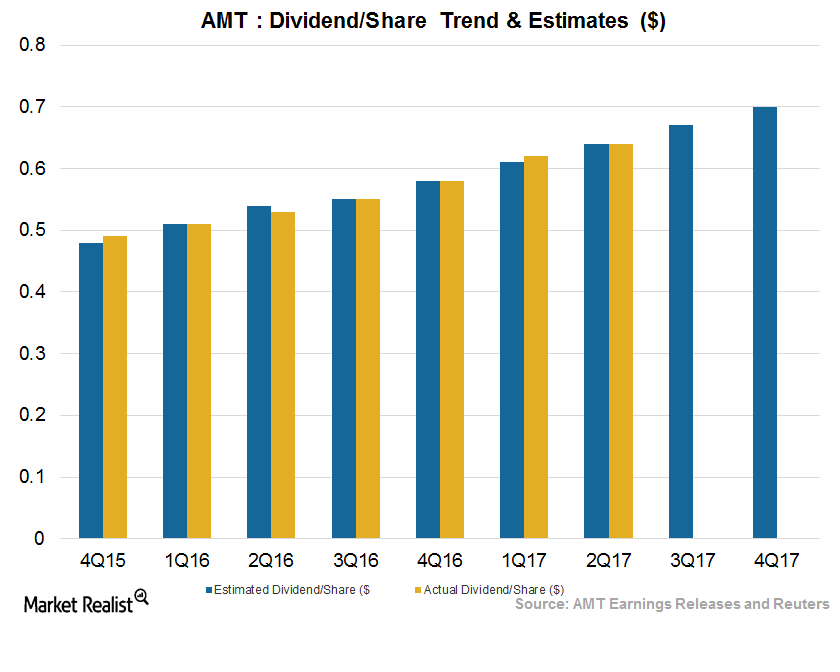

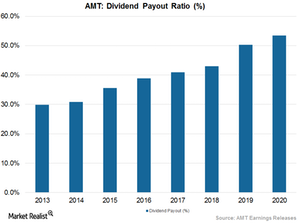

How American Tower Rewarded Stockholders in 2Q17

In 2Q17, American Tower distributed cash worth $275 million among its common stockholders and paid preferred stock dividends totaling $27 million.

Will American Tower Boost Its Shareholders’ Returns in 2Q17?

American Tower has paid dividends to its shareholders in every quarter since it became a public company. On June 1, AMT hiked its quarterly dividend by 3.2%.

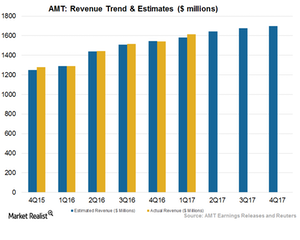

Will American Tower Ride High on Its Top Line in 2Q17?

Analysts expect wireless tower operator American Tower (AMT) to report revenue of $1.6 billion in its 2Q17 earnings call on July 27, 2017.

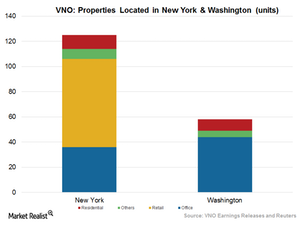

Vornado Realty Trust—Development, Redevelopment, and Occupancy

Vornado Realty Trust (VNO) invested in developing a high-demand office property in Highline at 512 West 22nd Street in Manhattan, which covers 173,000 square feet.

Comparing American Tower with Retail REITs in Its Industry

AMT’s current price-to-FFO multiple is ~20.1x.

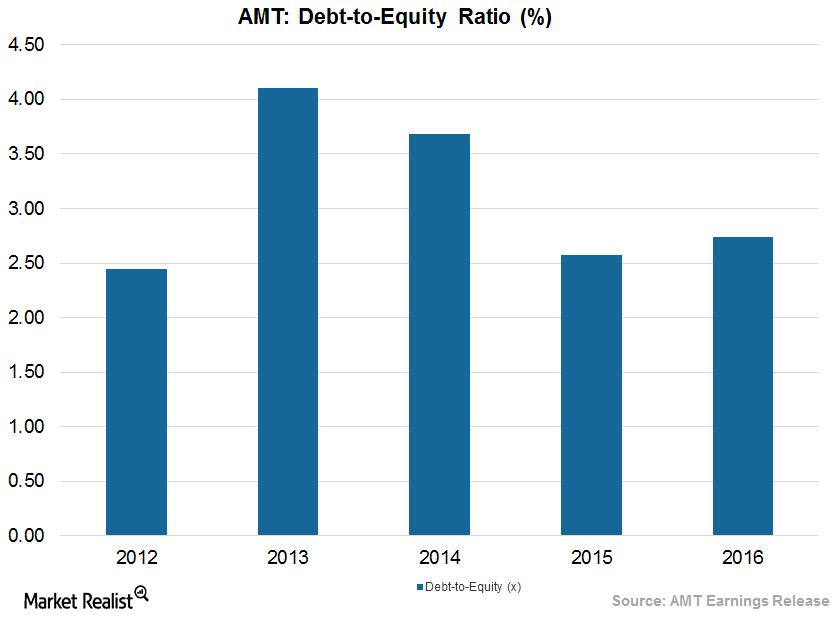

How Well Does American Tower Manage Its Balance Sheet?

AMT reported a debt-to-equity ratio of ~2.8x in 1Q17. The industry median debt-to-equity ratio is ~1.1x.

American Tower: A Rewarding Stock for Shareholders

AMT has maintained a consistent dividend yield over the last two years. Its dividend yield was ~1.8% in 2015 and ~2.0% in 2016.

5G Is the Future of Internet Data—Is It a Threat to AMT?

More than 95% of AMT’s towers are located in suburban and rural areas, where the majority of the US population resides.

American Tower’s Business Model Seeks Consistent Profitability

AMT maintains non-cancellable long-term leases with an initial term of ten years. Almost 50% of the company’s leases have a renewal date of 2022 or beyond.

American Tower’s Enhanced Fiscal 2017 Outlook on Growth Opportunities

American Tower’s (AMT) revenues rose ~26% in 1Q17, driven by 22% growth in its Tenant Billings business and 8.6% growth in its Organic Tenant Billings business.

American Tower Rises above Uncertainty in Wireless Tower Sector

For fiscal 2017, American Tower (AMT) expects to report adjusted funds from operations exceeding $2.8 billion. This figure is $55 million, or ~2%, higher than expected by the company.

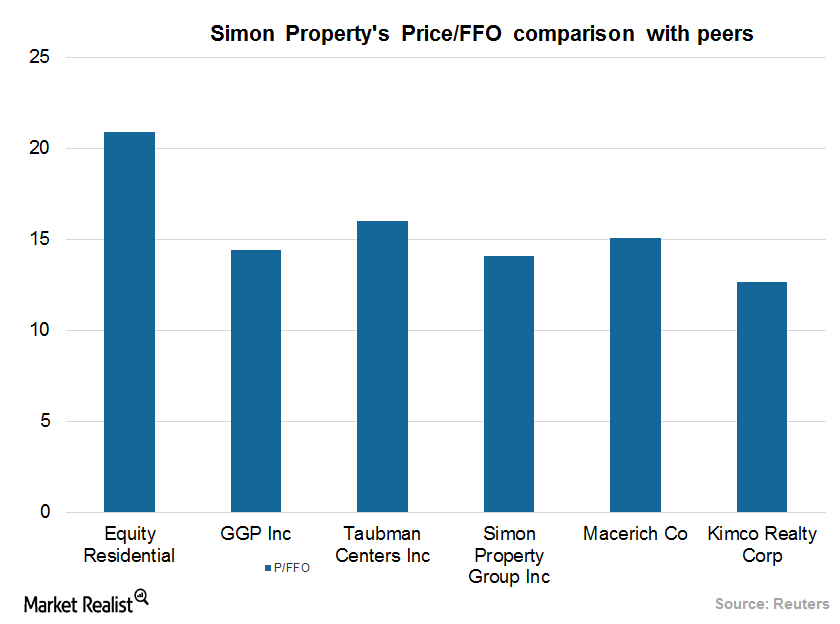

Investing in Simon Property Group: Relative Valuation

Simon Property Group’s current price-to-FFO multiple is ~14.1x.

How Would an Interest Rate Hike Affect Real Estate Valuations?

The real estate sector’s (VNQ) (IYR) performance was subdued in 2016 due to its supply-demand dynamics.

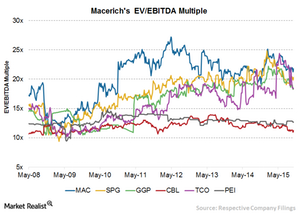

Macerich’s Highest EV-to-EBITDA Multiple Compared to Peers

Over the past eight years, Macerich’s EV-to-EBITDA has ranged between 11.9x–27.2x, with a current EV-to-EBITDA multiple of around 21.8x.

Investing in Macerich: a Must-Know Company Overview

Macerich is a self-managed REIT headquartered in Santa Monica, California. The company was founded in New York in 1964.

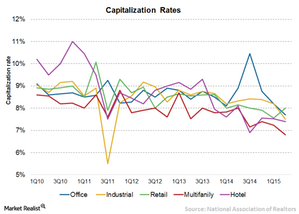

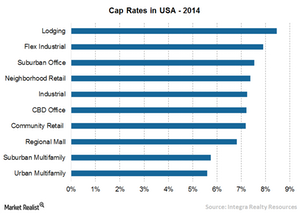

REIT Capitalization Rates Fall as Prices Surge

Average capitalization rates in 2Q15 fell to 7.5% across all the property types compared to 8.35% in 2Q14.

General Growth Properties’ Top Tenants in Retail

The malls in GGP’s portfolio receive a smaller percentage of their operating income from anchor tenants than from specialty retailers who lease space.

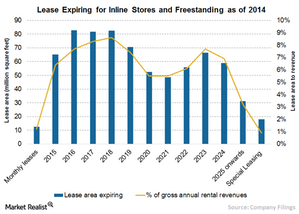

Simon Property Group’s Lease Length Exposure

Only 1.2% of Simon Property’s gross annual revenues from inline or freestanding stores comes from month-to-month leases. 6.5% of leases will expire in 2015.

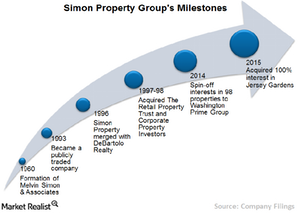

Simon Property Group’s Acquisition Growth Strategy

Simon Property has a strong track record of aggressive acquisitions. Since its IPO in 1993, the company has completed acquisitions worth $40 billion.

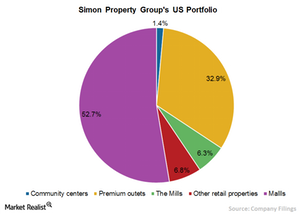

Simon Property Group’s Retail Mall Business

Simon Property’s US properties consist of malls, premium outlets, community centers, and retail properties that make up ~182 million square feet of GLA.

Introducing Simon Property Group: A Must-Know Company Overview

Headquartered in Indianapolis, Simon Property Group formed in 1993 when the shopping center division of Melvin Simon & Associates became publicly-traded.

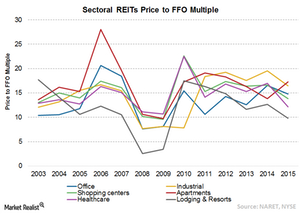

Most of the REITs Are Trading near Historic Multiples

The most common way of calculating the relative value of a REIT is the price-to-FFO multiple. FFO is widely used because it’s the main earnings metric for REITs.

Why Are Capitalization Rates Important for Investors?

The capitalization rate, or cap rate, is an important concept in the commercial real estate industry. It’s defined as an initial yield on a real estate investment.