BTC iShares MSCI United Kingdom ETF

Latest BTC iShares MSCI United Kingdom ETF News and Updates

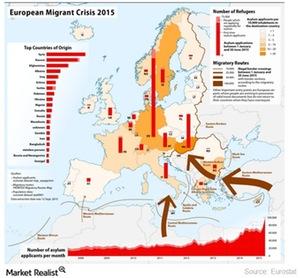

What Does the UK Really Have to Gain from Exiting the EU?

The EU’s light immigration laws allow young talent to work across the EU, but with more immigrants entering the UK, local citizens have less access to jobs.

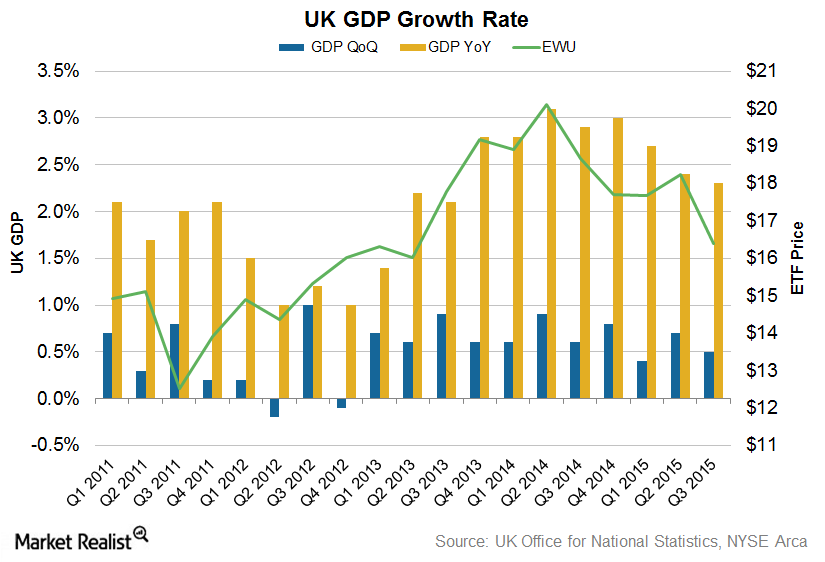

Rise in Household Spending Provided Respite for UK Economic Growth

With household spending gathering pace, it could be an important growth driver for the United Kingdom’s economic growth.

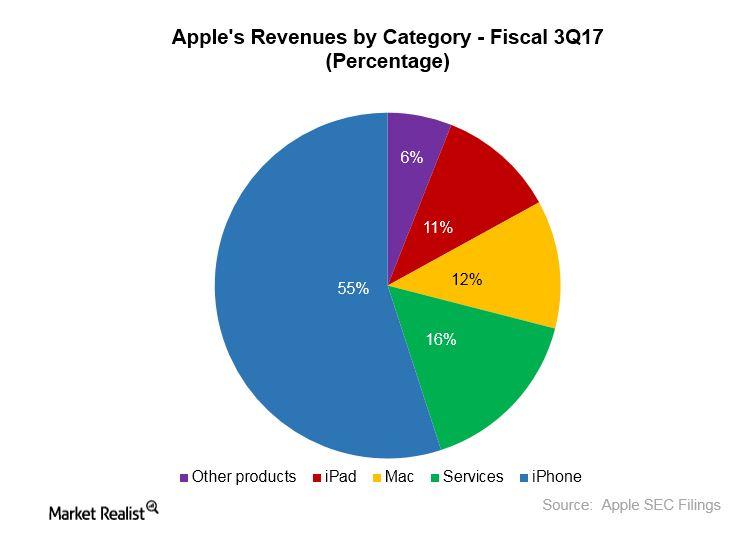

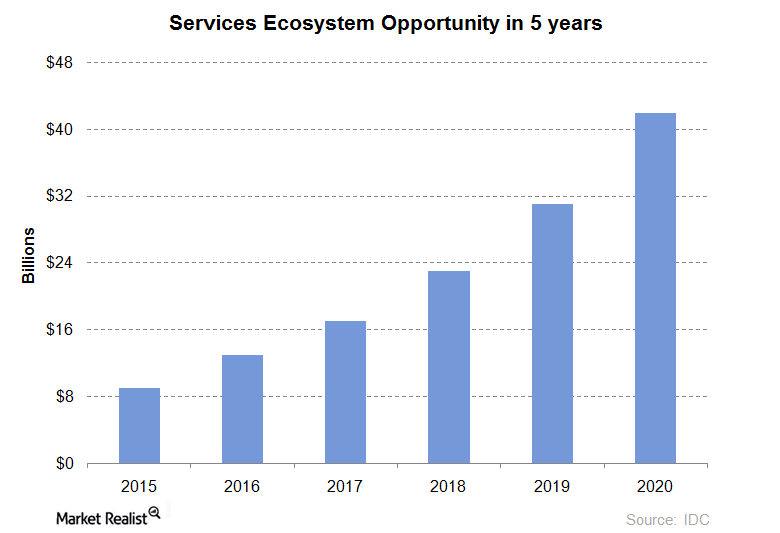

Putting Apple’s $1 Billion Content Budget into Perspective

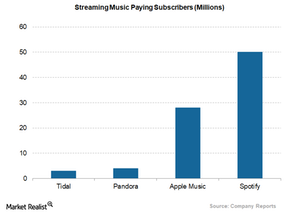

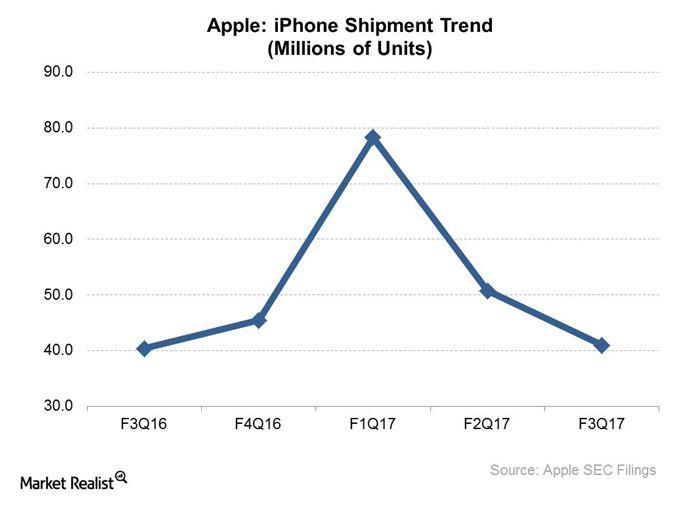

Services contributed 16% of revenue Apple (AAPL) generated $24 billion from its Services business in fiscal 2016, and aims to double the revenue in four years. In fiscal 3Q17, Apple’s Services division contributed $7.3 billion in revenue, up 22% from a year earlier, and making up 16.1% of the quarter’s total revenue. Apple’s Services business consists of offerings […]

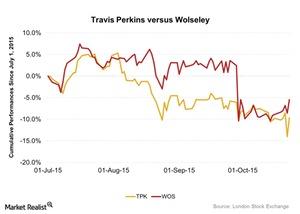

Travis Perkins Rebounded, Led EWU by 5.09%

Travis Perkins was at the top of the iShares MSCI United Kingdom ETF on October 23, 2015, as analysts showed positivity toward the construction industry.

Once Again, Soros Makes Money off the UK’s Woes

Four days before the UK (EWU) decided to leave the European Union (VGK), Soros warned the markets of a “Black Friday” and a crash in the pound.

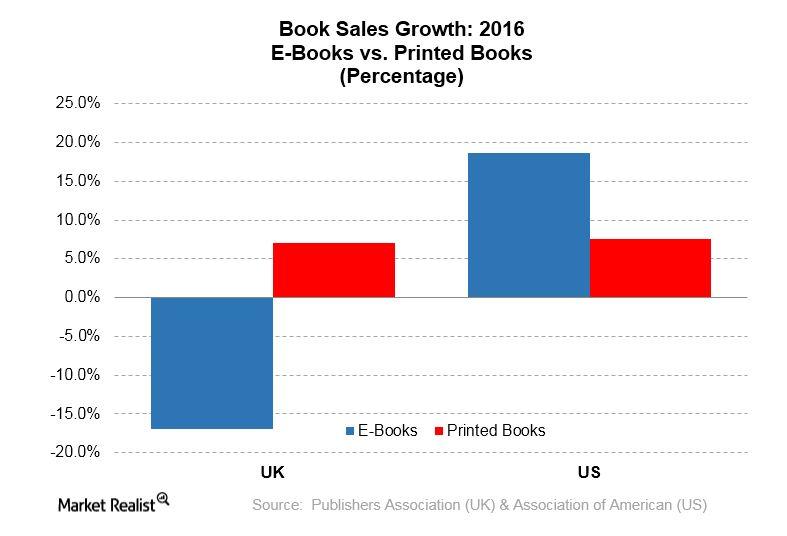

Why Is Amazon Opening Physical Bookstores?

According to PricewaterhouseCoopers, the global book market could grow to $121.1 billion by 2020, up from $114.8 billion in 2016.

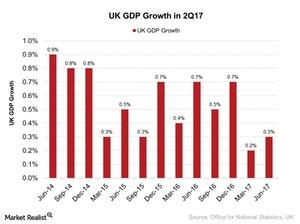

Will UK’s 2Q17 Growth Strengthen Investor Sentiment?

The UK’s 2Q17 economic growth surprised the market with a rise of 0.3% as compared to a 0.2% rise in the first quarter of 2017.

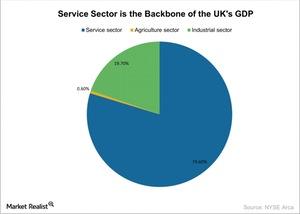

Which Sectors in the UK Will the ‘Brexit’ Decision Affect Most?

The financial sector has contributed heavily to the UK economy. Financial institutions like HSBC and Barclays will face challenges doing business in the EU.

How ArcelorMittal Fared in 1Q18

ArcelorMittal (MT), the world’s largest steel producer, reported revenues of $19.2 billion for 1Q18, the highest since 3Q14.

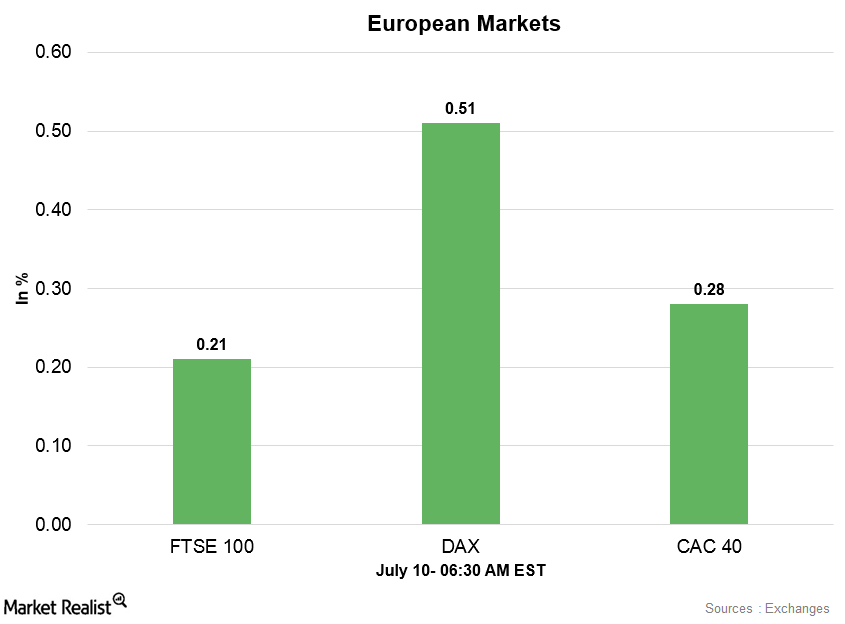

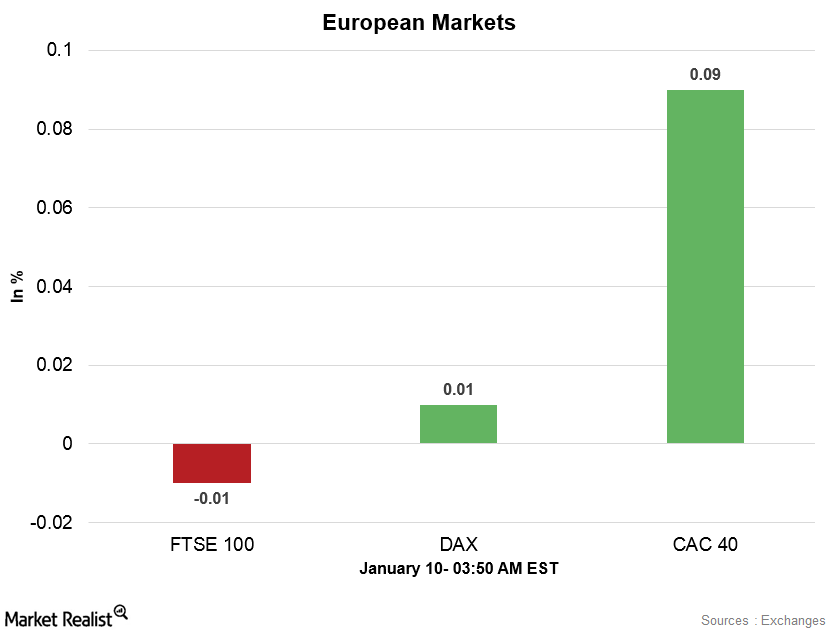

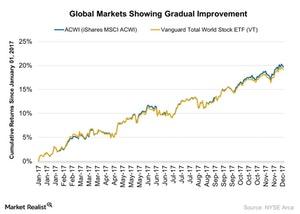

European Markets Opened Higher amid Improved Global Sentiment

France’s CAC 40 Index quit falling last week and traded in a range of 5,200–5,100. This week, it opened higher amid improved global sentiment.

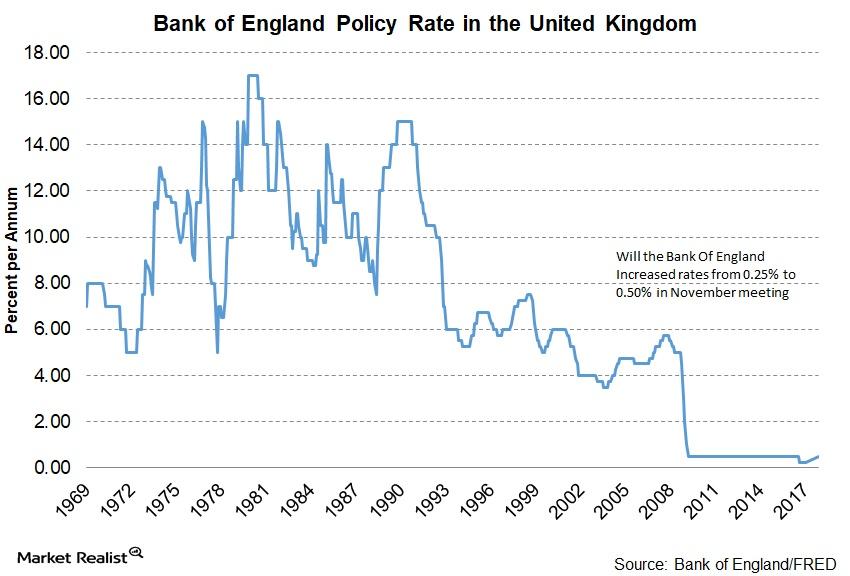

Bank of England Raises Interest Rate to 0.50%

The BOE (Bank of England) in its November meeting increased its benchmark interest rates from 0.25% to 0.50%.

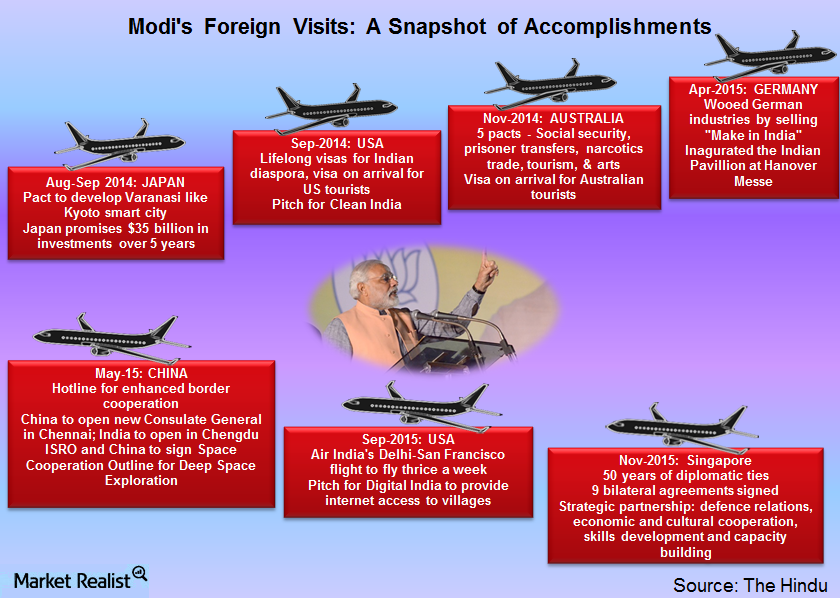

Modi’s Moment: Promises and Accomplishments

India (PIN) has strengthened its ties with Asian powerhouses (GRR) like Japan (JEQ) (EWJ) and Singapore (SGF).

European Markets Are Mixed Early on January 11

At 3:45 AM EST on January 11, the DAX Index was trading at 13,275.50—a fall of 0.04%. The iShares MSCI Germany (EWG) fell 0.88% on January 10.

How IBM’s iX Unit Could Get a Big Boost from Bluewolf Group

After the Bluewolf acquisition is finalized, the company will become part of IBM’s iX, or Interactive Experience, unit.

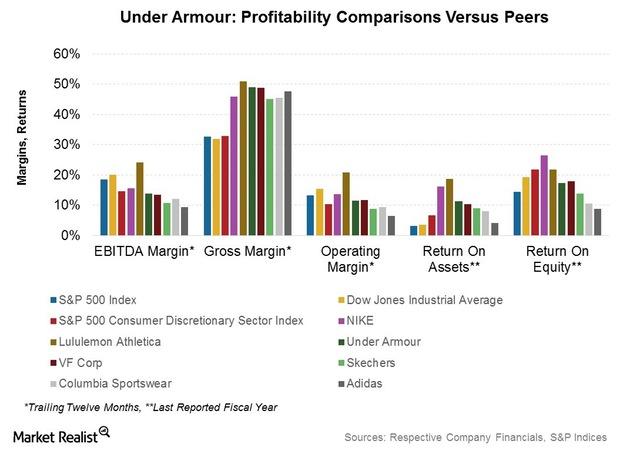

Key Drivers Impacting Under Armour’s Future Financial Performance

The impact of adverse forex movements on UA’s financial performance may be mitigated somewhat by the stronger retail environment in Europe.

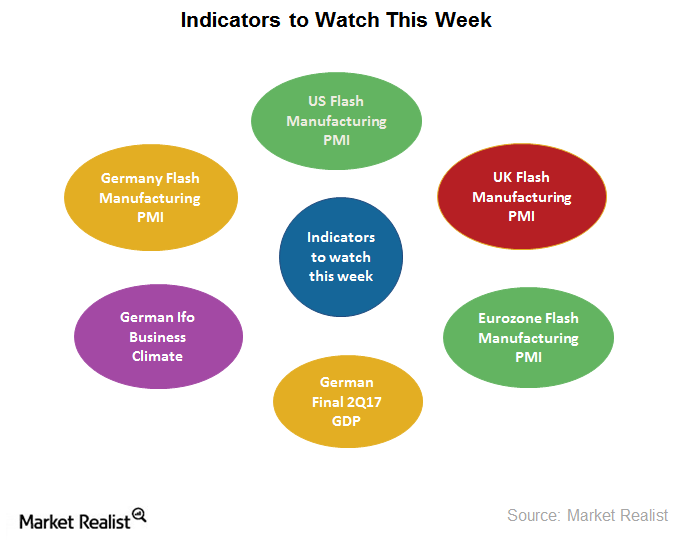

Important Economic Indicators to Watch Next Week

The most important indicators next week are the global flash manufacturing PMIs. Manufacturing PMIs are important indicators for the economy.

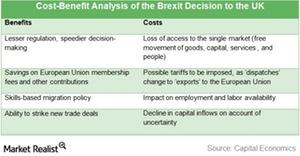

A Cost-Benefit Analysis of the Brexit Decision

To understand how the Brexit result stands to impact your portfolio or your willingness to invest in the United Kingdom, a cost-benefit analysis is pertinent.

Will Brexit Weaken the UK’s Competitive Advantage over the US?

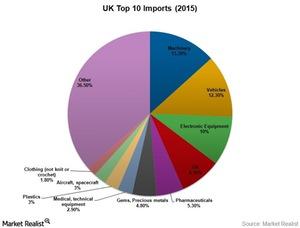

On Brexit, import restrictions and tariff quotas currently applicable to importers in the UK and foreign businesses that export to the UK are set to change.

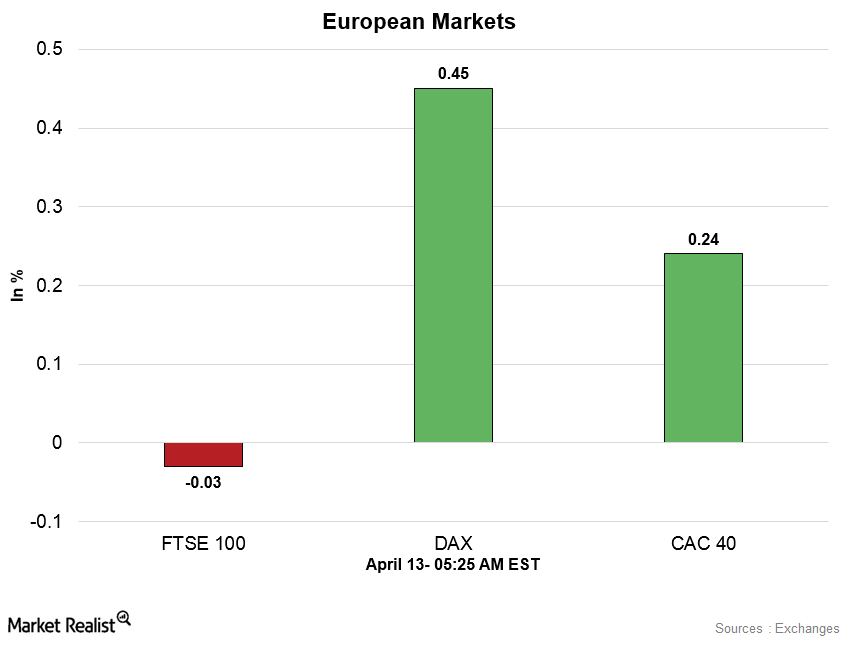

European Markets Are Stable Early on April 13

At 5:25 AM EST on Friday, the CAC 40 Index was trading at 5,322.22—a gain of 0.24%. The iShares MSCI France (EWQ) gained 0.47% on April 12.

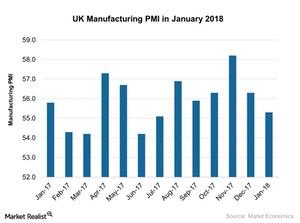

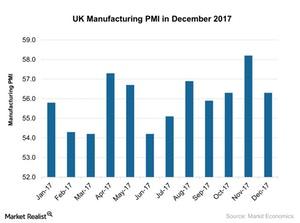

Why UK Manufacturing PMI Is Gradually Falling

The UK Manufacturing PMI showed a weaker rise in January 2018. It was 55.3 in January 2018 compared to 56.3 in December 2017.

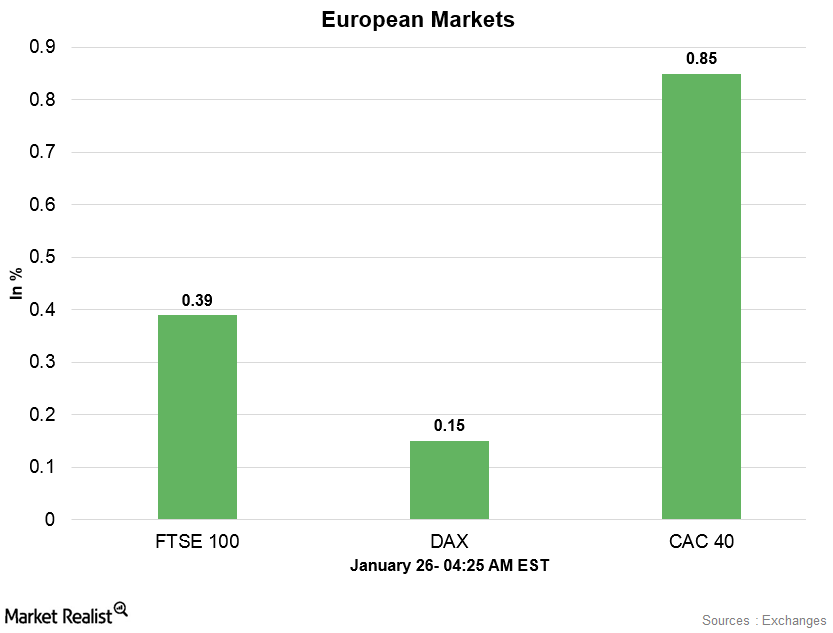

European Markets Are Mixed in the Morning Session on January 26

At 4:25 AM EST on January 26, the DAX Index was trading at 13,306.50—a gain of 0.06%. The iShares MSCI Germany (EWG) fell 0.7% on January 25.

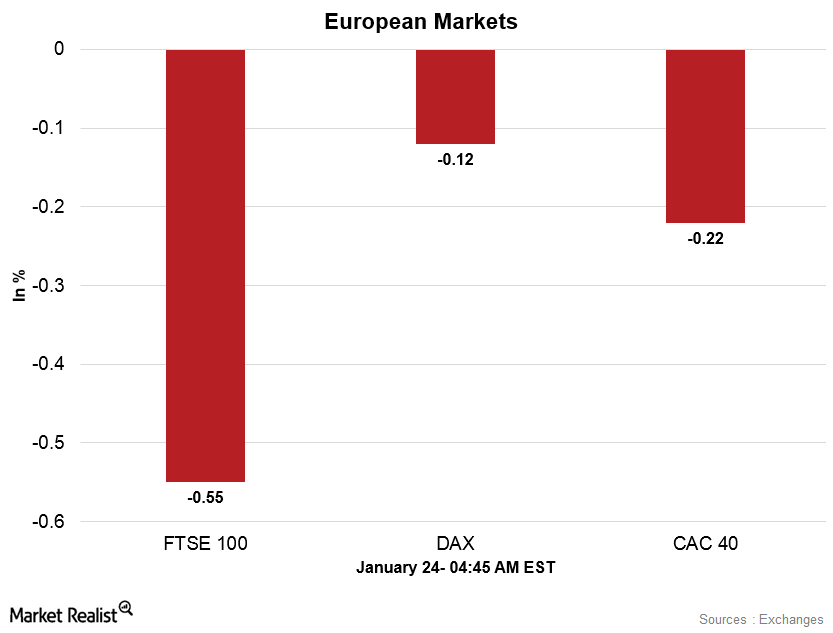

Analyzing European Markets Early on January 24

At 4:40 AM EST on January 24, the DAX Index was trading at 13,536.50—a fall of 0.17%. The iShares MSCI Germany (EWG) rose 0.54% on January 23.

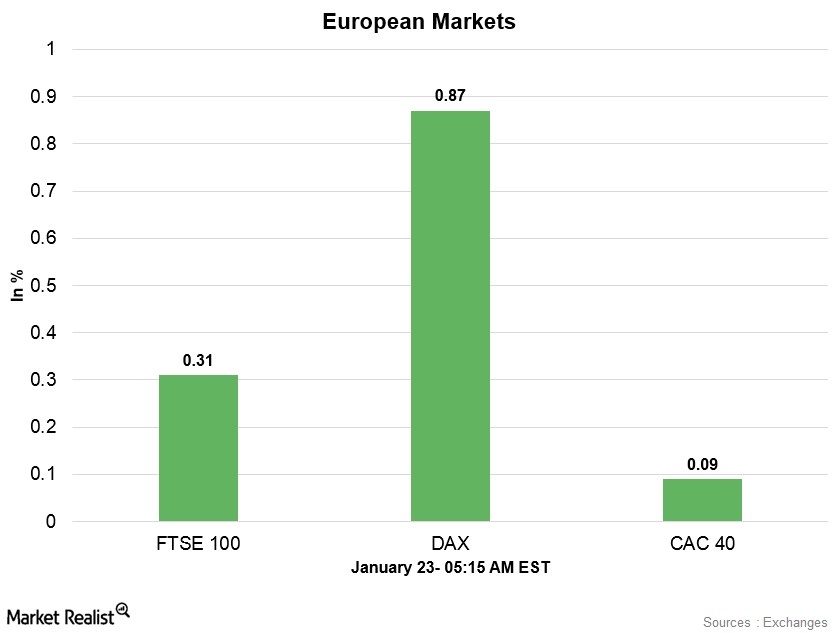

European Markets Were Stronger Early on January 23

At 5:05 AM EST on January 23, the DAX Index was trading at 13,574.50—a rise of 0.82%. The iShares MSCI Germany (EWG) rose 0.62% on January 22.

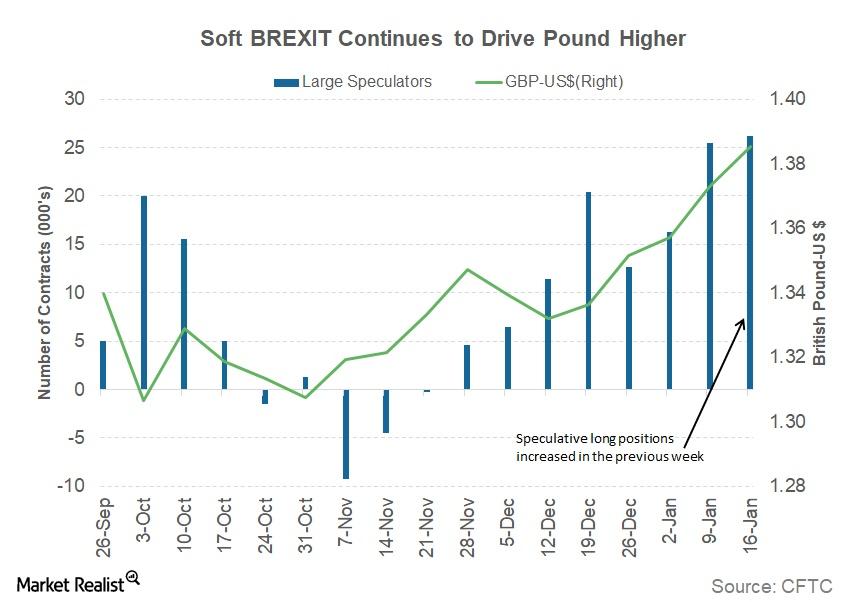

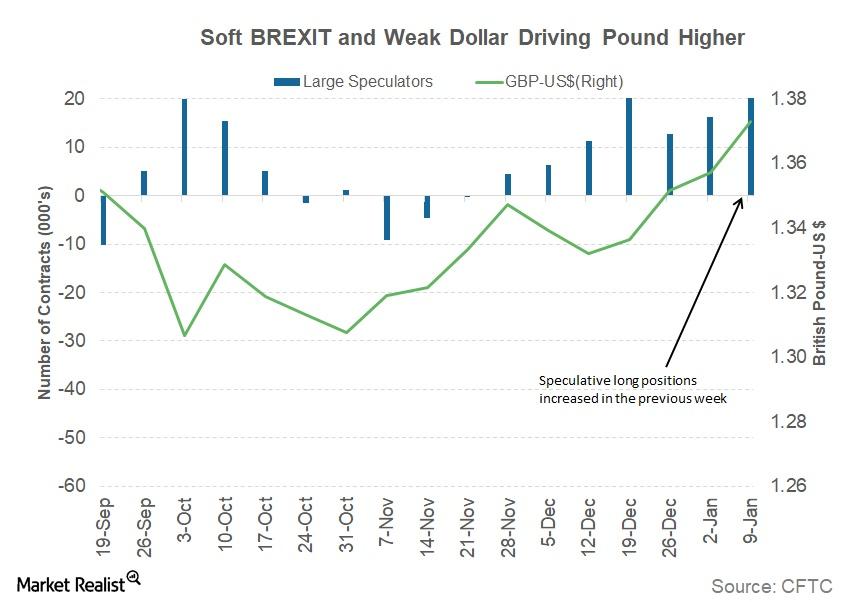

Factors that Drove the British Pound over 1.38 against the Dollar

During the week ended January 29, 2018, British equity markets (BWX) were supported by the prospect of a soft Brexit.

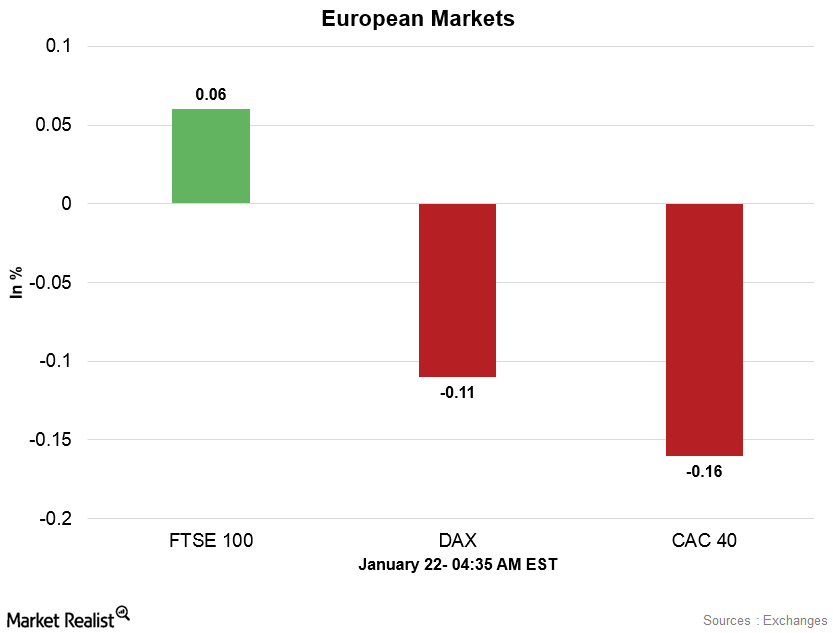

European Markets in the Morning Session on January 22

At 4:30 AM EST on January 22, the DAX Index was trading at 13,419.50—a fall of 0.1%. The iShares MSCI Germany (EWG) rose 1.1% on January 19.

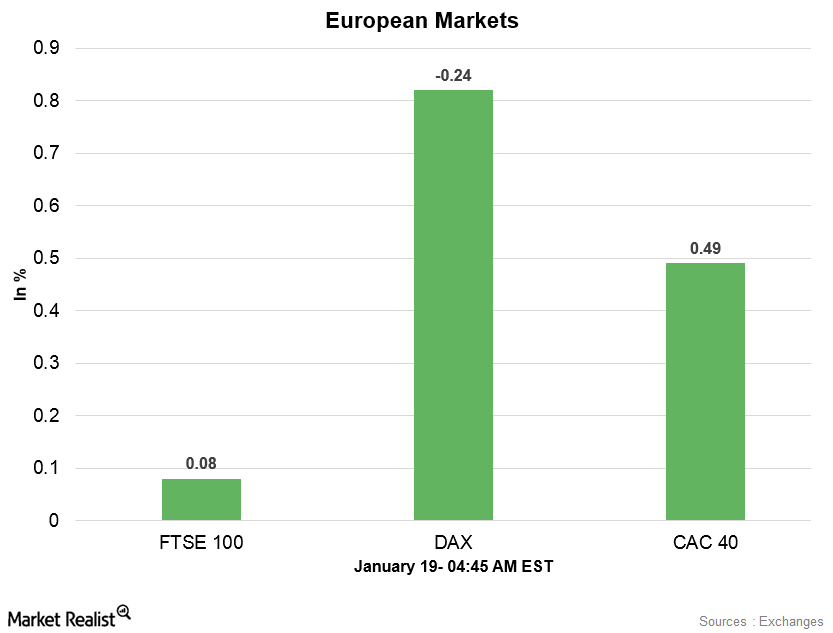

European Markets Are Strong Early on January 19

At 4:45 AM EST on January 19, the DAX Index was trading at 13,387.50—a gain of 0.8%. The iShares MSCI Germany (EWG) rose 0.58% on January 18.

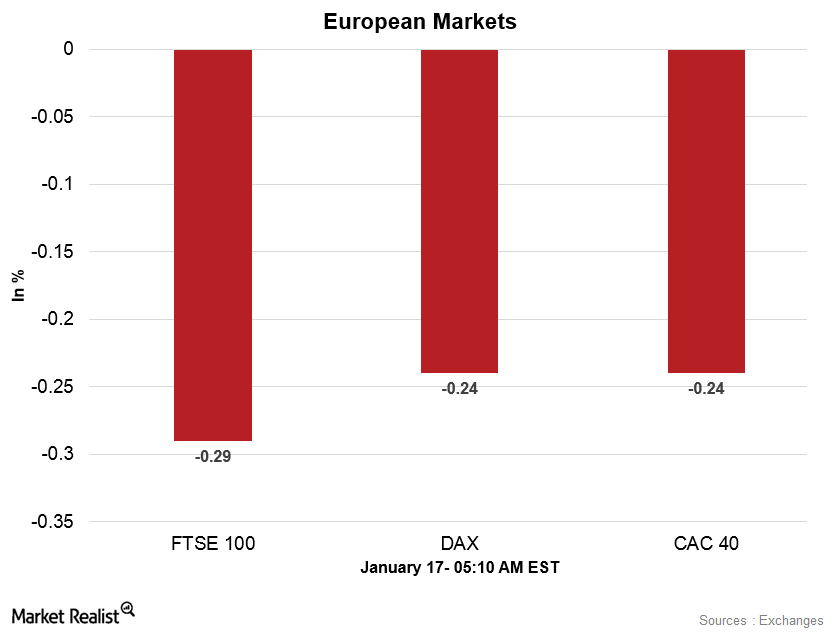

Analyzing European Markets in the Morning Session on January 17

At 4:55 AM EST on January 17, the DAX Index was trading at 13,224.50—a drop of 0.16%. The iShares MSCI Germany (EWG) rose 0.14% on January 16.

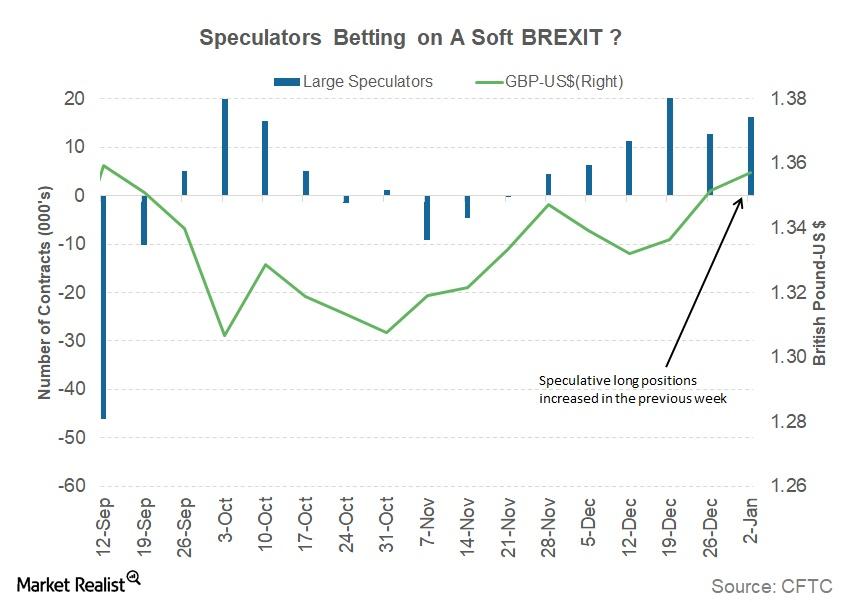

Why a Soft Brexit Possibility Is Driving the British Pound Higher

The gains in the British pound were driven by the higher chances of a soft Brexit deal, which could see economic relations between the UK and the EU remain mostly unchanged.

What UK Manufacturing Activity Indicates for the Economy

UK manufacturing activity in December Between November and December 2017, the UK manufacturing PMI (purchasing managers’ index) fell to 56.3 from 58.2 and missed the market expectation of 58. The index was mainly affected by the following: production output and volume improved at a slower rate new and export orders rose at a slower pace employment in the manufacturing sector slowed In […]

What Key Economic Indicators Say about the Economy

In this series, we’ll take a look at December 2017 manufacturing PMI reports for major developed regions, namely the United States (SPX-INDEX), Germany (DAX-INDEX), France, Spain, Europe, Japan, and the United Kingdom (UKX-INDEX).

Will the Pound Gain with Signs of a Soft Brexit?

The British pound (FXB) (GBB) continued to appreciate against the US dollar in the first week of 2018, rising 0.41% against the dollar (UUP).

How Acquisition of Shazam Could Benefit Apple

Apple (AAPL) has finally decided to purchase UK-based (EWU) music recognition app Shazam Entertainment.

November Services PMIs: What They Say about Developed Markets

In this series, we’ll analyze the November performances of the services PMIs for developed economies, including the United States, the United Kingdom, the Eurozone, Germany, France, Spain, and Japan.

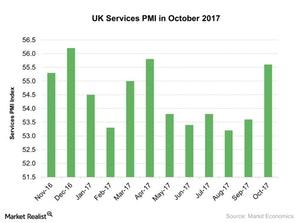

The UK’s Services PMI Rose Strongly: How Could Its Impact the Economy?

The final UK services PMI (purchasing managers’ index) rose strongly in October 2017. It stood at 55.6 in October 2017 compared to 53.6 in September 2017.

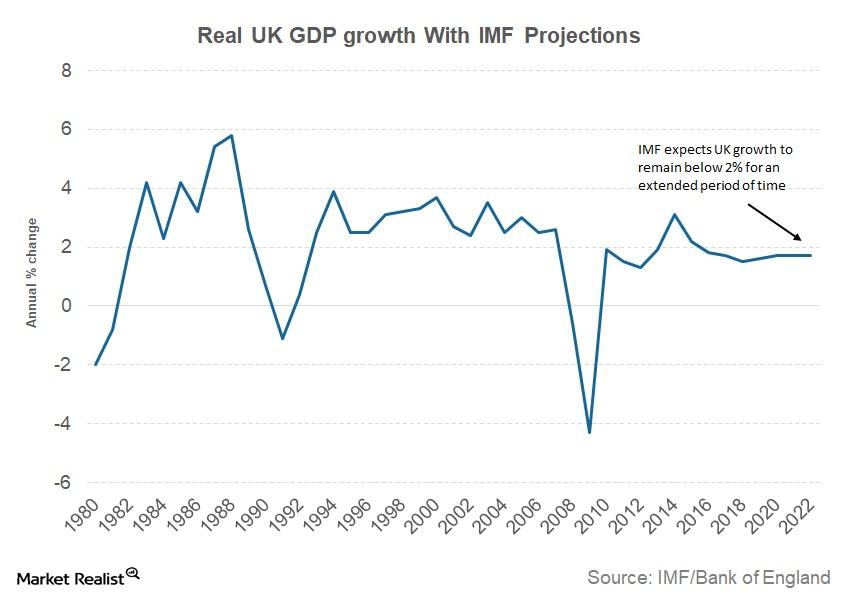

Why the IMF Sees Continued Uncertainty in the UK

The International Monetary Fund (or IMF), in its October world economic outlook, downgraded its growth outlook for the United Kingdom.

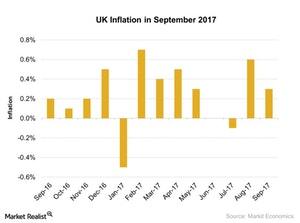

UK’s Inflation Was at 0.3%: How Will It Affect the Economy?

According to the report provided by the Office for National Statistics, on a monthly basis, the United Kingdom’s inflation index stood at 0.3% in September 2017 as compared to a 0.6% improvement in August 2017.

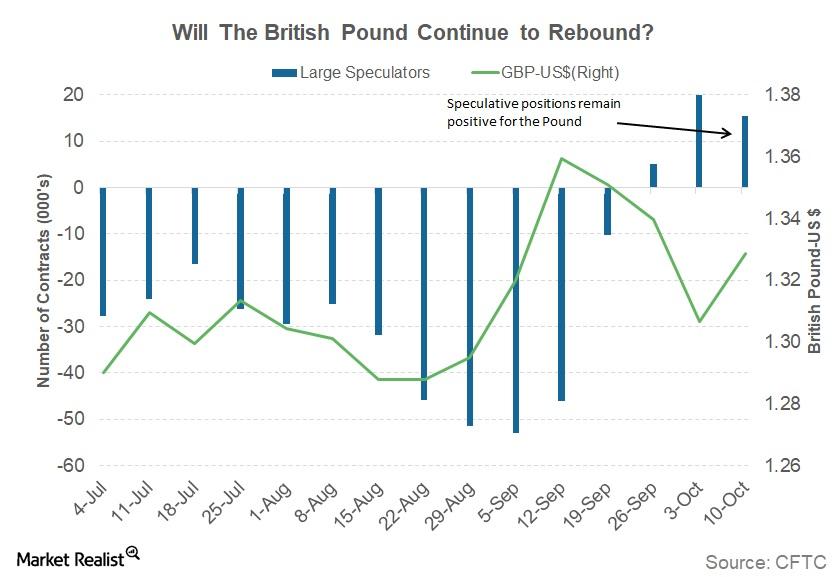

Why the British Pound Appreciated by 1.5% Last Week

The British Pound (FXB) appreciated by more than 2% against the US dollar last week. The pound (GBB) closed for the week at 1.3288, appreciating by 1.69% against the US dollar (UUP).

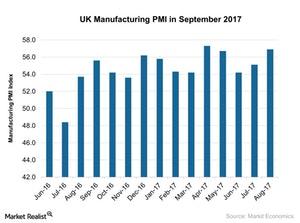

How Will Weaker UK Manufacturing Affect the Markets?

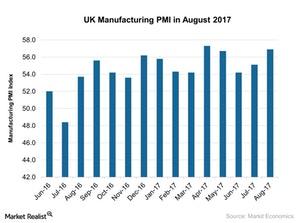

The United Kingdom’s manufacturing PMI stood at 55.9 in September 2017, compared to 56.9 in the previous month. The PMI figure was below the preliminary market expectation of 56.4.

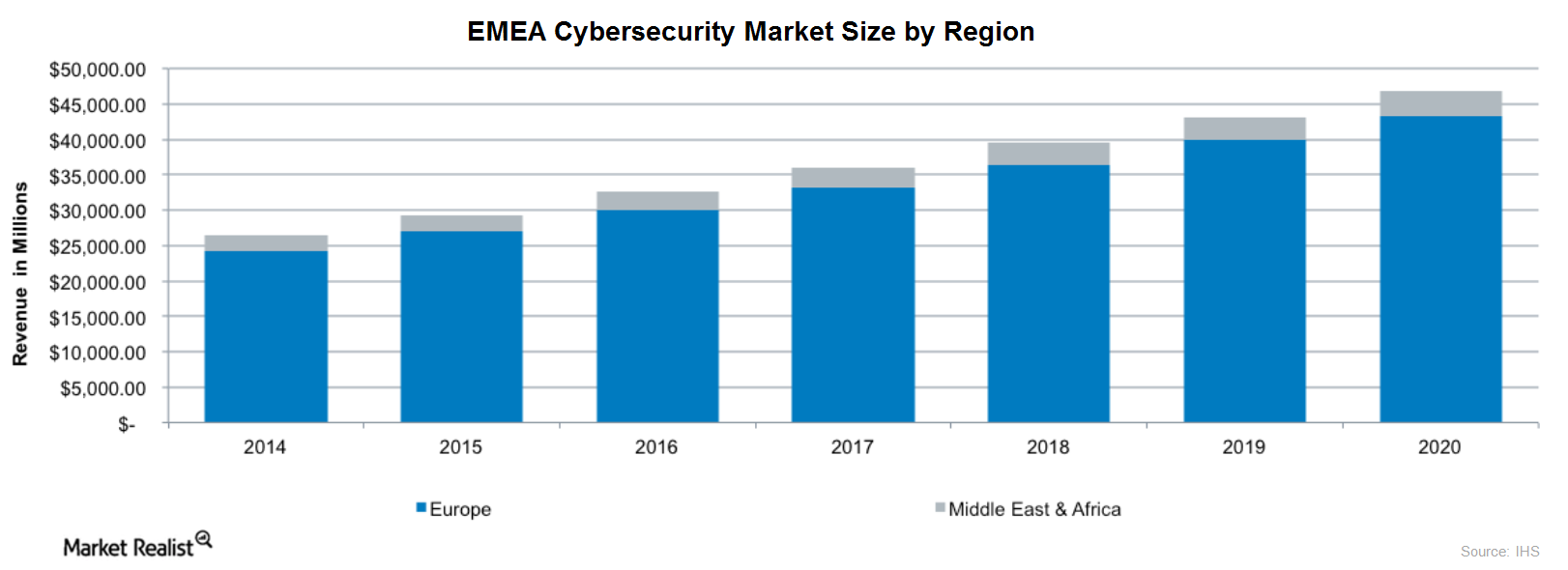

Why Europe’s Increased Focus on Cybersecurity Is Good News for FireEye

Last year, more than 4,000 ransomware attacks happened on a daily basis in the EU (EFA).

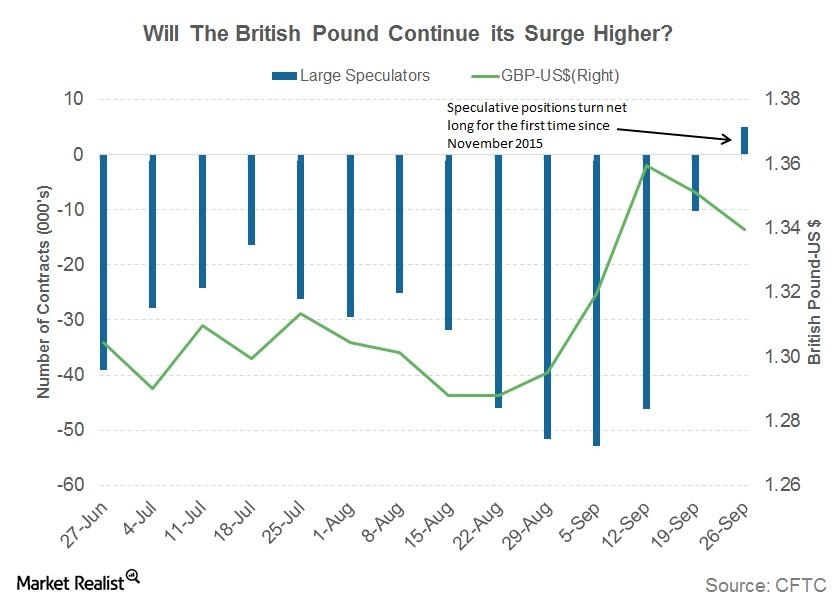

Why British Pound Speculators Turned Bullish after 22 Months

The British pound (FXB) depreciated against the US dollar for the week ended September 29. The pound (GBB) posted a weekly close of 1.3397, depreciating by 0.71% against the US dollar (UUP).

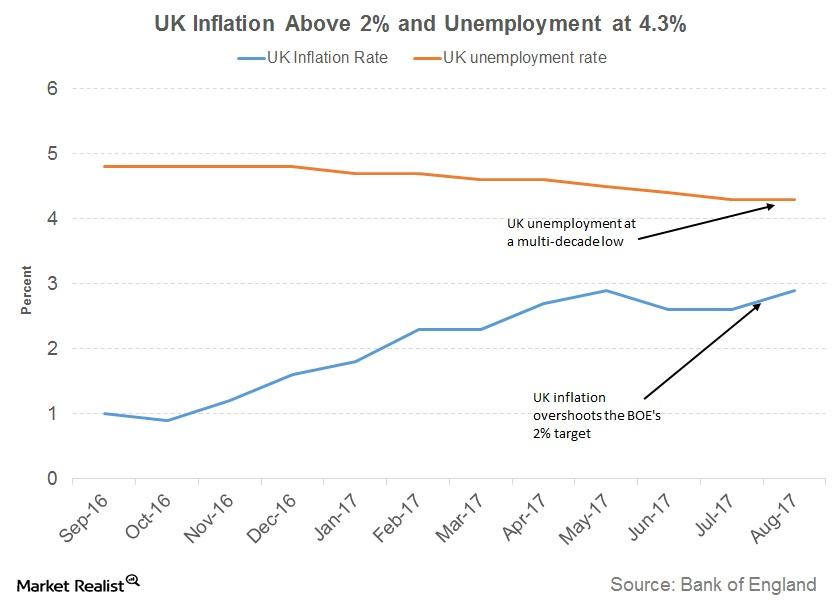

Will Inflation and Unemployment Push the BOE to Raise Rates?

Inflation in the United Kingdom has been on a higher trajectory with consumer prices in the United Kingdom rising 2.9% in August year-over-year.

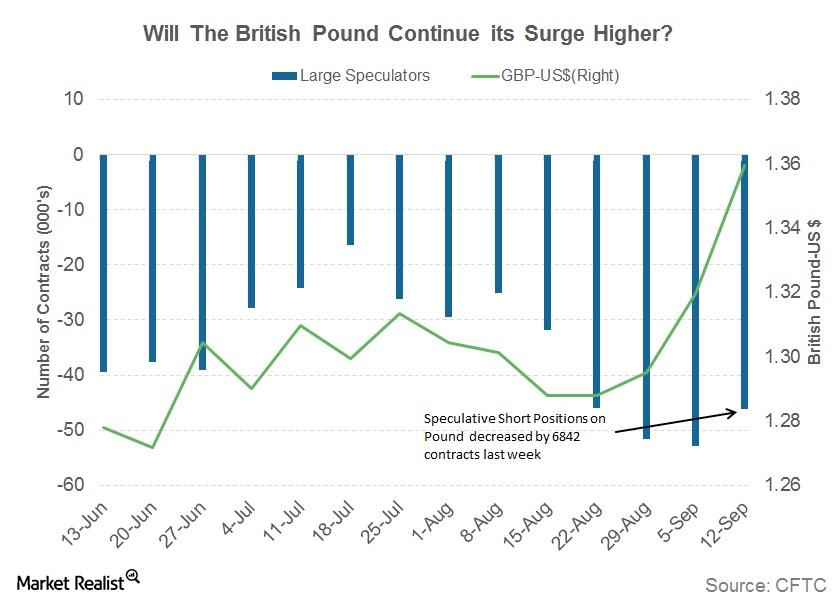

Why the British Pound Rallied to 15-Month High

The British pound (FXB) appreciated against the US dollar for the week ending September 15.

Behind the iPhone X: Breaking Down Apple’s Price Discrimination

Apple has stuck to its tradition of releasing its new iPhone models in September, but it veered away from a pricing culture that it has practiced for years.

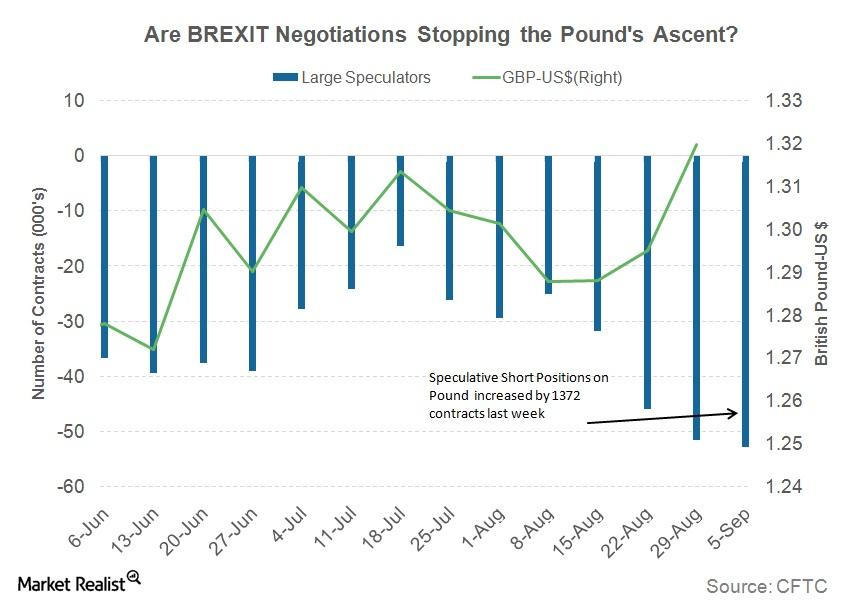

The Reason behind the Sharp Gains in the British Pound

The British pound (FXB) appreciated against the US dollar for the week ended September 8, 2017. The pound closed at 1.32, appreciating 1.9% against the US dollar.

UK’s Manufacturing PMI Rose Sharply: Is It a Turning Point?

The UK’s manufacturing PMI stood at 56.9 in August 2017 as compared to 55.3 in the previous month.

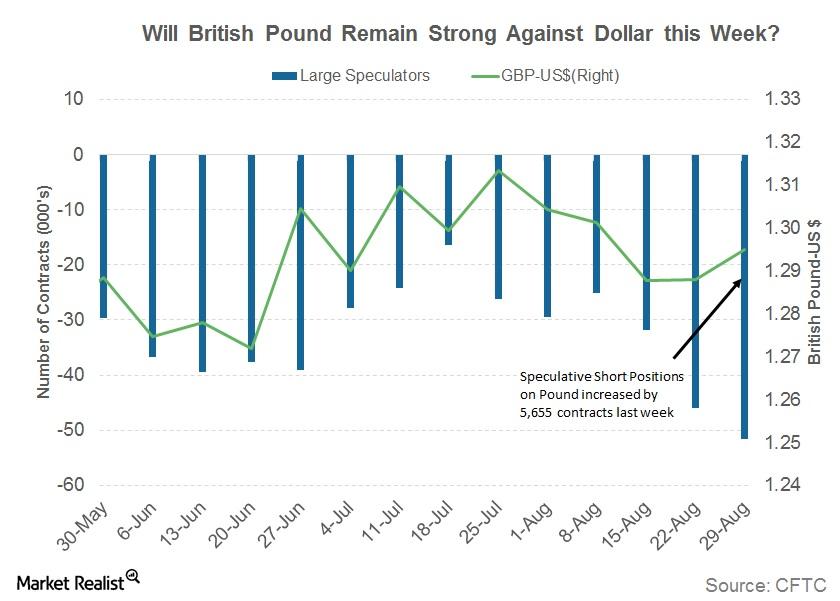

Can the British Pound Continue to Remain Strong This Week?

The British pound (FXB) appreciated marginally against the US dollar for the week ended September 1, 2017.

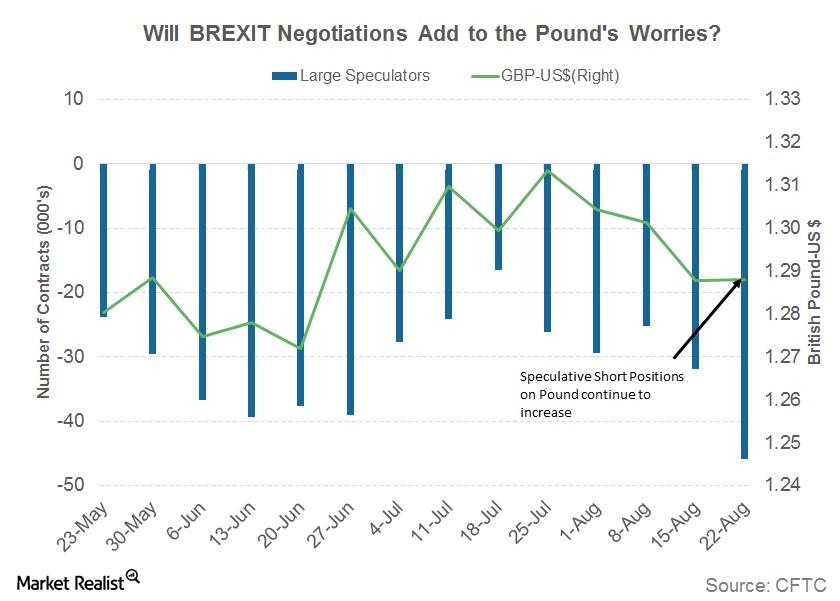

Round 3: Will Brexit Negotiations Help the British Pound?

The British pound (FXB) remained unchanged against the US dollar for the week ending August 25. The pound (GBB) closed the week at 1.2887.

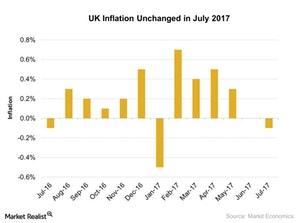

UK Inflation Fell: Possible Rough Path Ahead

According to a report by the Office for National Statistics, on a monthly basis, the United Kingdom’s inflation fell 0.1 in July 2017.

The Latest Key Economic Indicators from Developed Nations

In this series, we’ll analyze the services PMIs for major developed nations including the US, France, Germany, Spain, the Eurozone, Japan, and the UK.

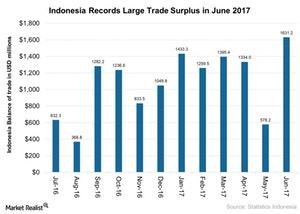

Here’s Why Indonesia’s Trade Surplus Rose in June 2017

Indonesia’s (EIDO) trade surplus in June 2017 stood at $1.6 billion as compared to $1.1 billion in the corresponding period last year and $0.57 billion in the previous month.