BHP Billiton Limited

Latest BHP Billiton Limited News and Updates

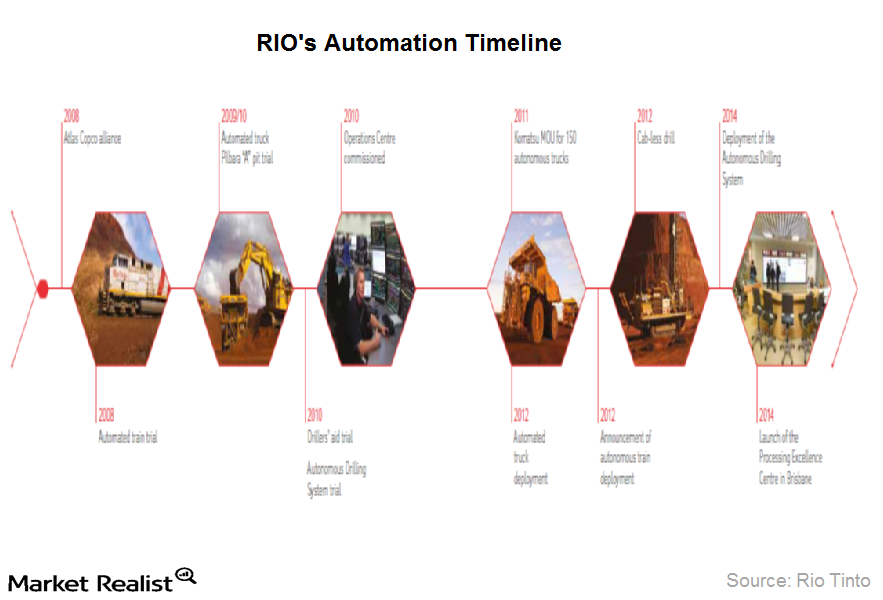

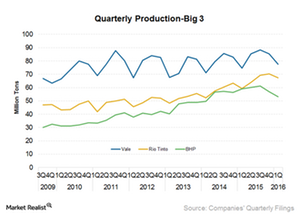

Why Rio Tinto has key advantages over its peers

Rio is the largest owner and operator of autonomous—driverless—trucks in the world. These initiatives are part of Rio’s “Mine of the Future” program.

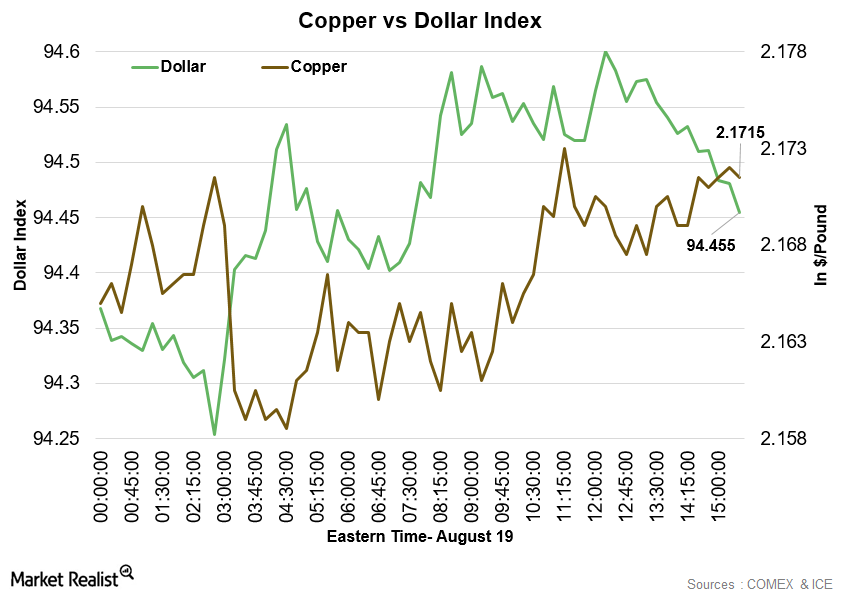

Copper Weaker on August 19 Due to Weaker Demand Signs

After starting the day with decreased momentum, copper prices remains mixed on Friday, August 19. At 1:50 PM EDT on August 19, the COMEX copper futures contract for September delivery was trading at ~$2.17 per pound, a gain of ~0.16%.

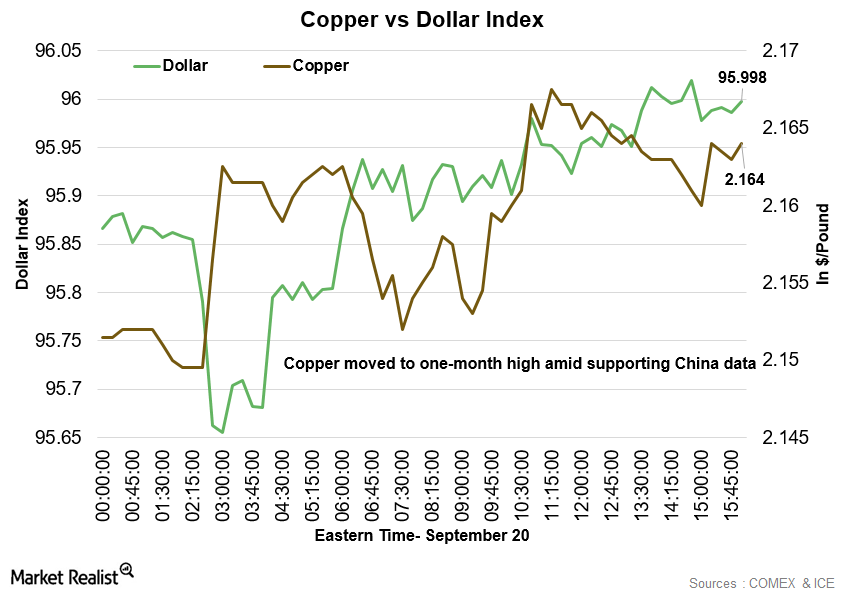

Copper Rose to 1-Month High Price Levels on September 20

At 1:15 PM EST on September 20, the COMEX copper futures contract for December delivery rose ~0.35%. It was trading at $2.16 per pound.

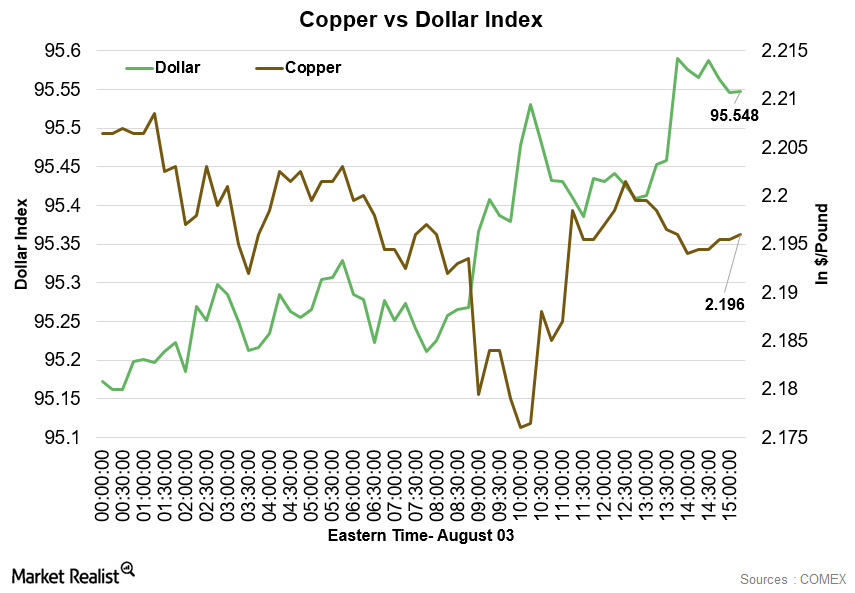

Copper Weakened amid Recovery in Dollar on August 3

After starting the day on a weaker note on Wednesday, August 3, copper maintained the same sentiment throughout the day and declined lower.Materials Why the demerger of non-core assets makes sense for BHP

BHP had been contemplating whether to sell the non-core assets or go for a demerger. Finally, the company decided in favor of a demerger on August 15. The proposed company will likely have assets in the range of $12–$20 billion.Materials Why Alcoa is improving its competitive position

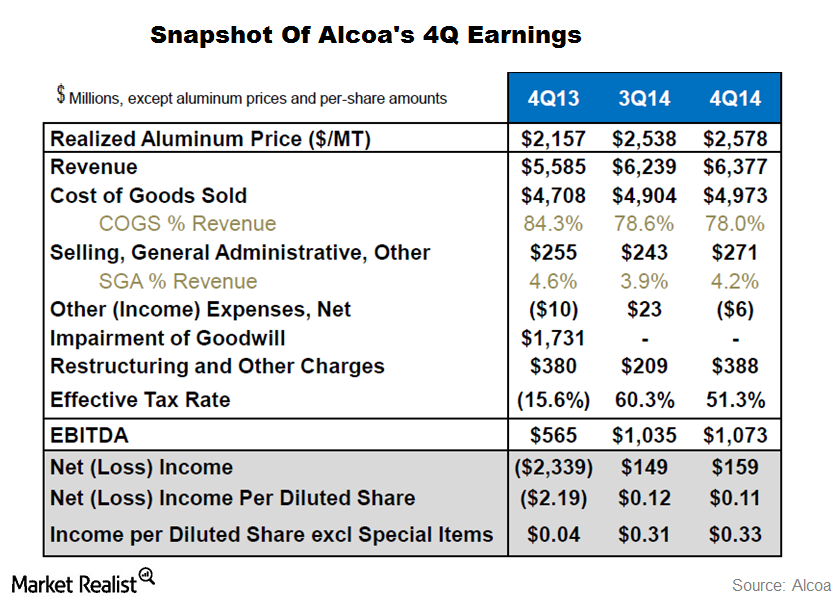

Alcoa idled several smelting plants since 2007. Its aluminum smelting capacity has come down by 28% over the period. Most of these smelters had high unit production costs.

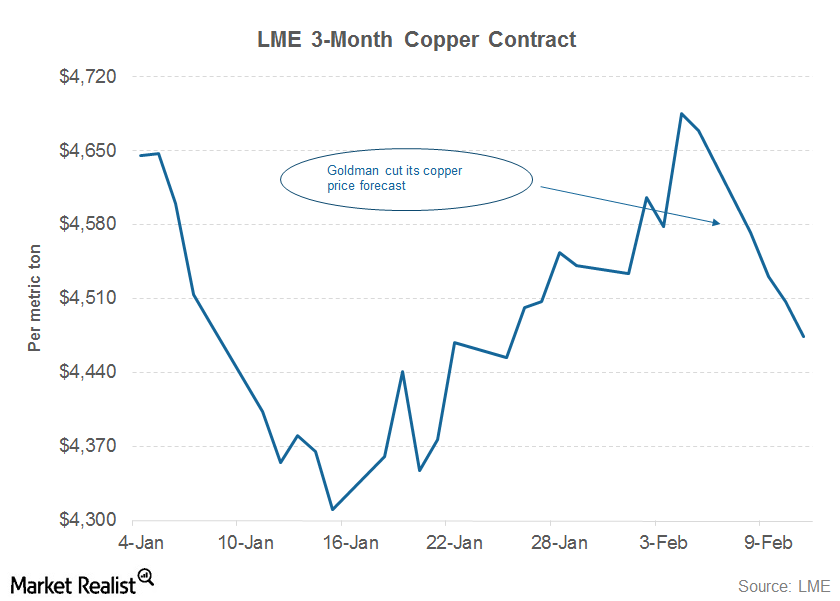

Must Know: Goldman Provided Fodder to Copper Bears

Goldman Sachs (GS) now expects copper prices to fall to $4,000 per metric ton this year. In its previous guidance, Goldman had expected copper to fall to $4,500 per metric ton in 2016.Materials Why did the Cliff’s share price rally?

Iron ore prices are down 19% year-over-year (or YoY) and coal prices are down 30% YoY—volumes were also down YoY, but the stock rallied 7% in a single trading session the next day of the earnings call and up 3% the subsequent trading day.

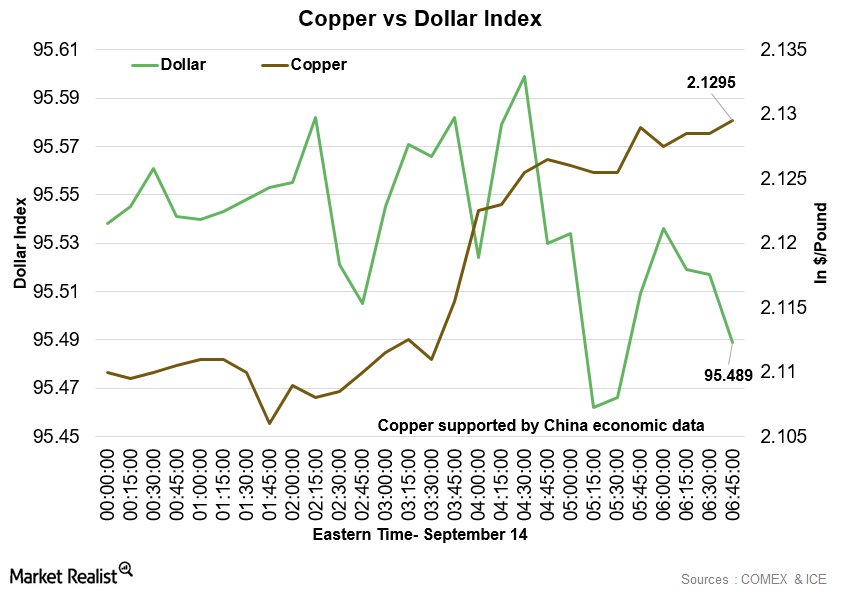

Why Is Copper Trading High in the Early Hours on September 14?

At 6:20 AM EST on September 14, the COMEX copper futures contract for December delivery was trading at $2.13 per pound—a gain of ~1.2%.

Civeo impacted by customers’ plans to trim capital spending

Civeo said the demand for its services depends on its customers’ capital spending programs. As a result, it’s one of the first to suffer losses when oil drillers pare back exploration.

Understanding Glencore’s Metals and Mining Business

Glencore’s metals and mining segment was the second-biggest contributor to its 1H15 revenues.

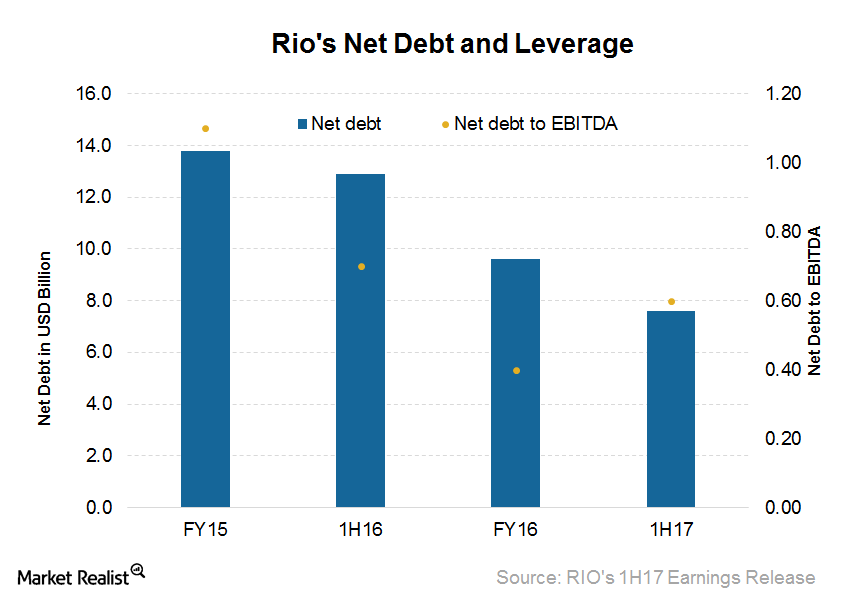

What Rio Tinto’s Balance Sheet Means for Future Growth

Rio Tinto’s (RIO) net debt at the end of 1H17 was $7.6 billion, compared with $12.9 billion at the end of 1H16 and $9.6 billion at the end of December 2016.

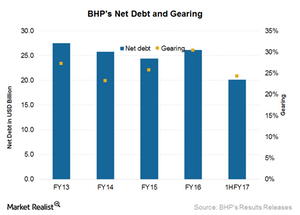

BHP’s Balance Sheet: The 2017 Outlook

BHP’s net debt was $20.1 billion at the end of December 2016, as compared to $26.1 billion on June 30, 2016.

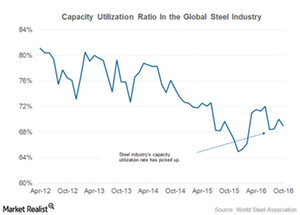

Do Steel Capacity Cuts in China Bode Well for Iron Ore Miners?

China has been reeling under its overcapacity in the steel industry. In 2016, China planned to cut 45 million tons but wound up cutting 80 million tons.

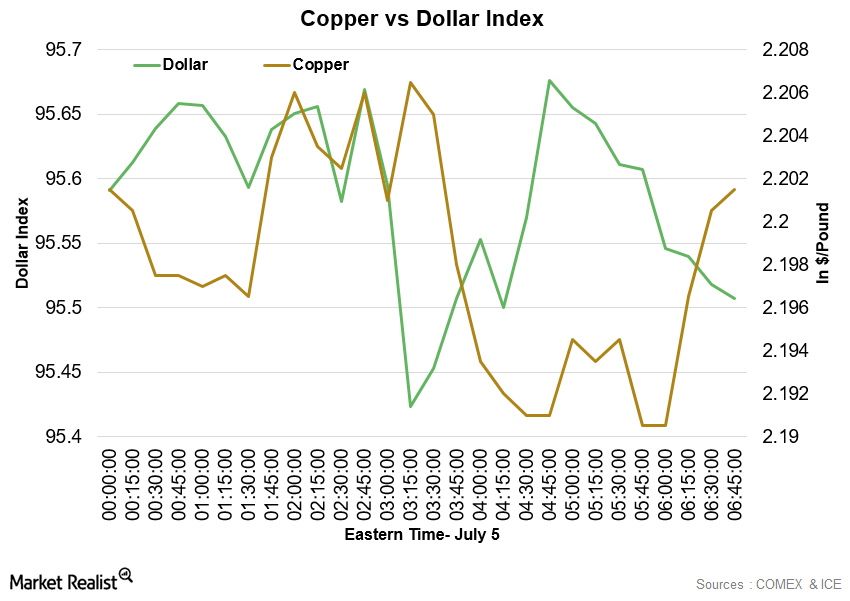

Copper Fell and Gold Stabilized on July 5

At 6:40 AM EST on July 5, the COMEX Copper futures contract for September delivery was trading at $2.2 per pound—a drop of 0.81%.

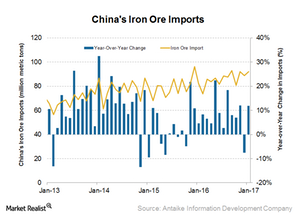

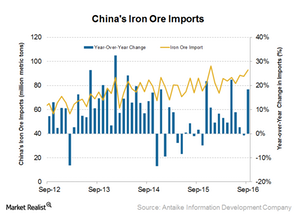

What China’s High Iron Ore Imports Suggest

China imported 92 million tons of iron ore in January 2017—a growth of 12.0% YoY and 3.4% month-over-month.

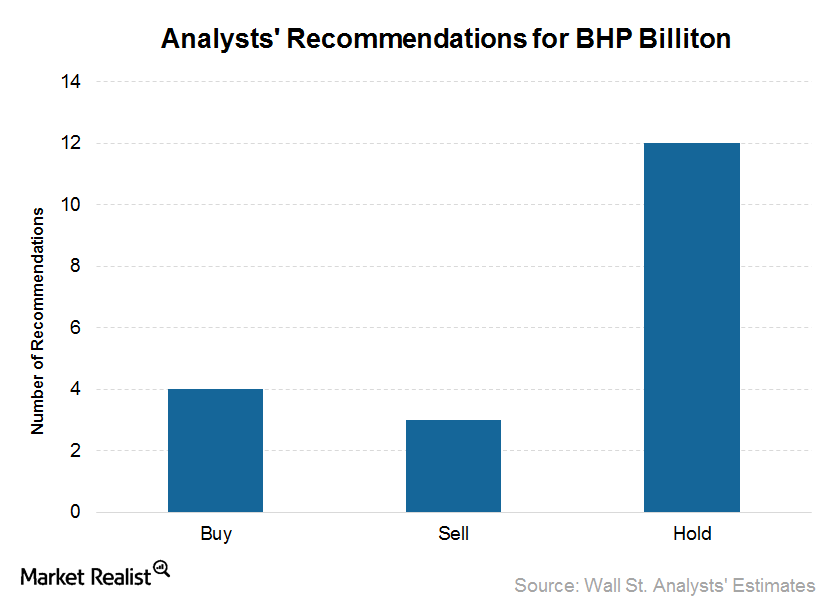

Inside BHP Billiton’s Recent Upgrades and Downgrades

Of the 19 analysts covering BHP Billiton (BHP), four analysts issued “buy” recommendations, while 12 issued “holds,” and three issued “sells.”

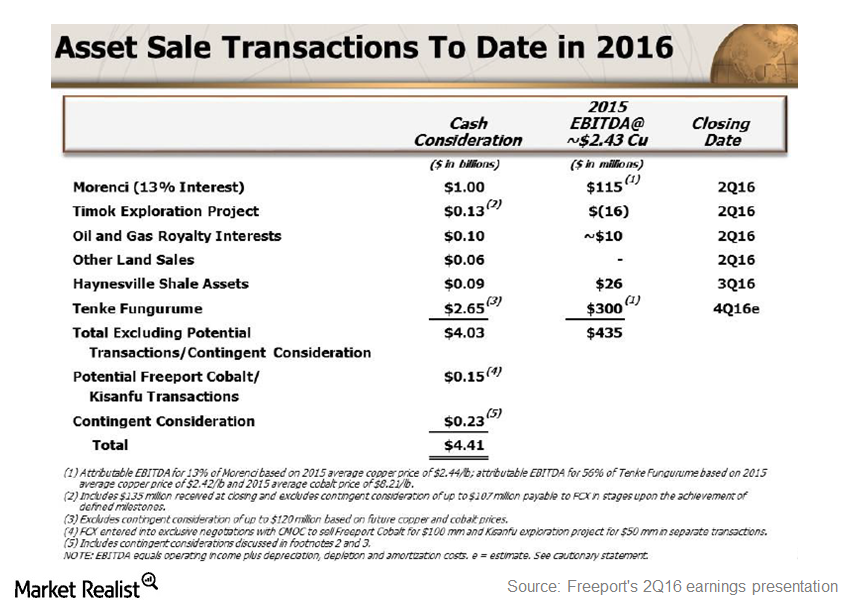

Freeport-McMoRan’s Debt Reduction Plan: Key Takeaways

During its 4Q15 earnings conference call, Freeport-McMoRan (FCX) mentioned a debt reduction program to raise $5 billion–$10 billion to shore up its balance sheet.

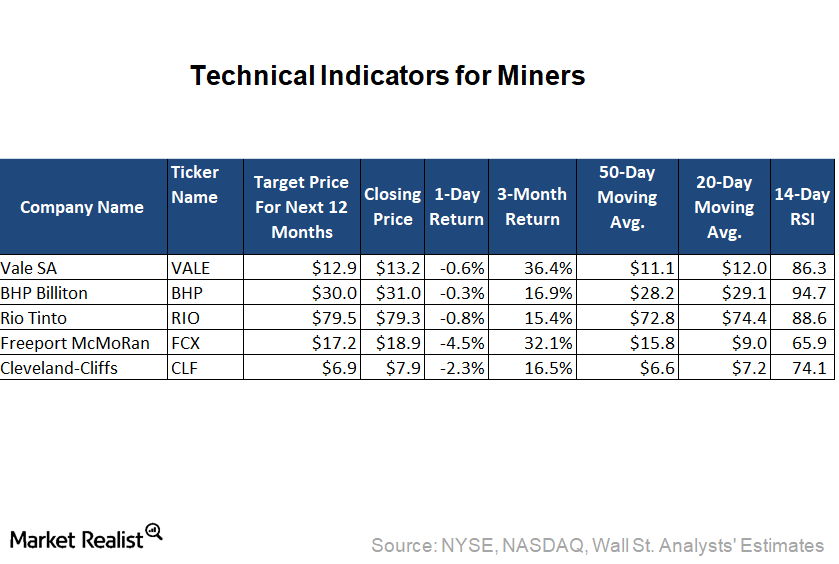

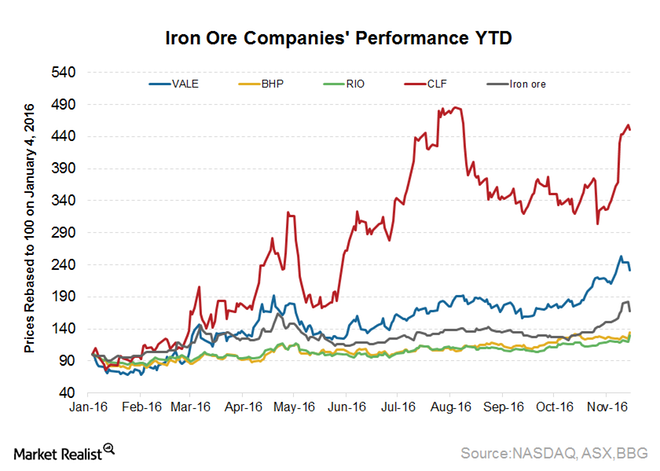

Is the Pullback in Iron Ore Miners Based on Technical Indicators?

Among the stocks under review in this series, Vale SA (VALE) has given the highest trailing-three-month return of 36.4%, while Rio Tinto (RIO) has generated the lowest return of 15.4%.

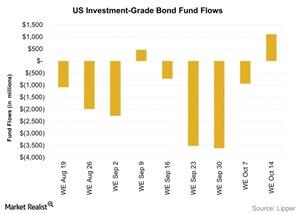

Investment-Grade Bond Funds Witness Inflows

Flows into investment-grade bond funds were positive for the week ending on October 14 after witnessing four consecutive weeks of outflows.

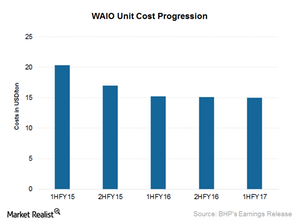

This Could Lead BHP’s Cost-Reduction Efforts in Iron Ore

Iron ore makes up 38% of BHP Billiton’s (BHP) revenues and 42% of its EBITDA.

Why Rio Tinto Believes Iron Ore Prices Can Sustain

According to Bloomberg, Rio Tinto CFO Chris Lynch has suggested that iron ore prices will not collapse, as many expect.

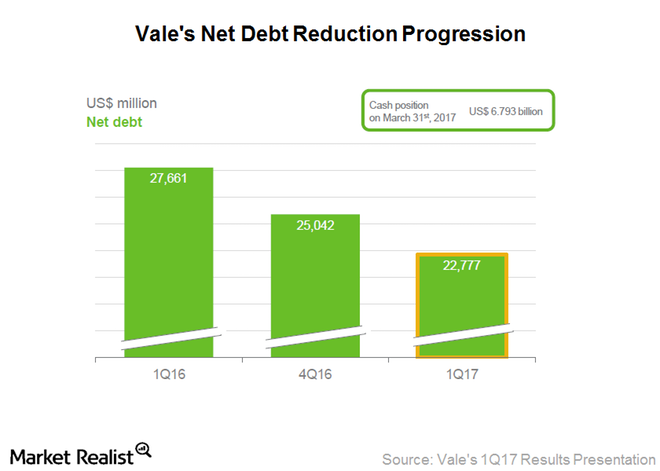

Can Vale SA Reverse Its 2Q17 Performance in 2017?

While Vale SA outperformed peers including Rio Tinto (RIO) and BHP Billiton by rising 24.7% in 1Q17, its performance deteriorated significantly in 2Q17.

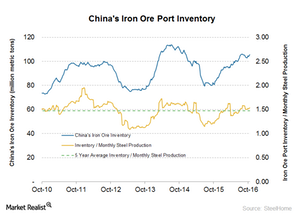

How Price Impacts Iron Ore Inventory

China’s (MCHI) iron ore port inventory is a key indicator that reflects the commodity’s supply-and-demand balance.

Alcoa Beats Wall Street Expectations Again

Aluminum premiums more than doubled in 2014, which benefited primary producers like Rio Tinto and BHP Billiton.

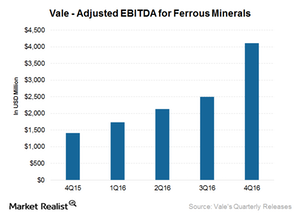

How Vale Reacted to Higher Iron Ore Prices in 4Q16

Iron ore price realization In 4Q16, Vale’s (VALE) ferrous division accounted for ~85.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization). The company’s EBITDA for ferrous minerals came in at $4.1 billion, which was $1.6 billion higher than 3Q16. Higher realized prices and higher sales volumes led to these rises. The CFR […]Materials Why are iron ore futures downward sloping?

“Backwardation” occurs when futures contracts trade below the spot price, and the futures curve begins to downward slope. This means that the market expects further decline in iron ore prices based on current indicators and fundamentals.

Understanding BHP Billiton’s Earnings Beat in Fiscal 2H17

BHP’s underlying net profit of $3.2 million was a solid improvement, as compared to the profit of $412 million in 4Q15.

What Led Robust Chinese Iron Ore Imports despite Contrary Views

Contrary to what was suggested by many market participants, the iron ore imports by China increased in September 2016 instead of declining.

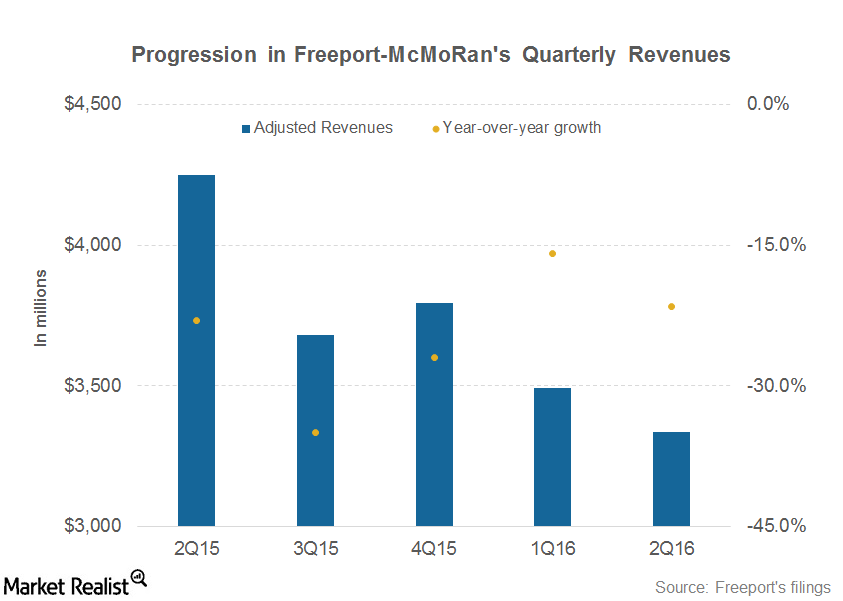

Why Freeport-McMoRan Missed Q2 Revenue Estimates

Freeport-McMoRan (FCX) posted revenues of $3.3 billion in 2Q16. In contrast, Freeport posted revenues of nearly ~$4.2 billion in 2Q15.

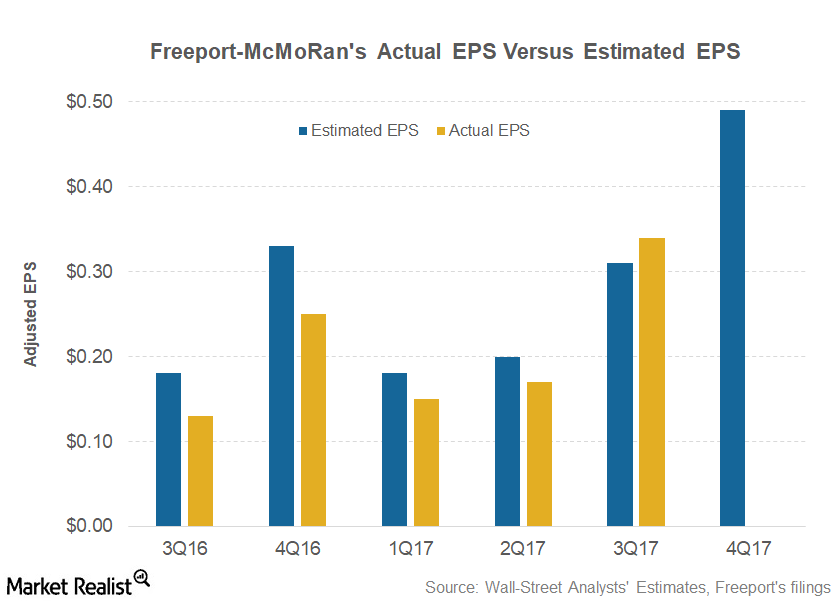

Can Freeport’s 4Q17 Earnings Keep Investor Optimism Alive?

Freeport-McMoRan (FCX), the leading US-based copper miner (XME), is scheduled to release its 4Q17 earnings on January 25.

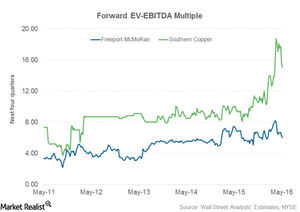

Why Southern Copper Is Trading at a Premium to Freeport-McMoRan

Southern Copper has historically traded at a premium to Freeport.

The Love-Hate Relationship between Freeport and Indonesia

According to Freeport-McMoRan’s agreement with Indonesia’s government, it must divest an additional 20.6% stake in its Indonesian operations to the government or its citizens.

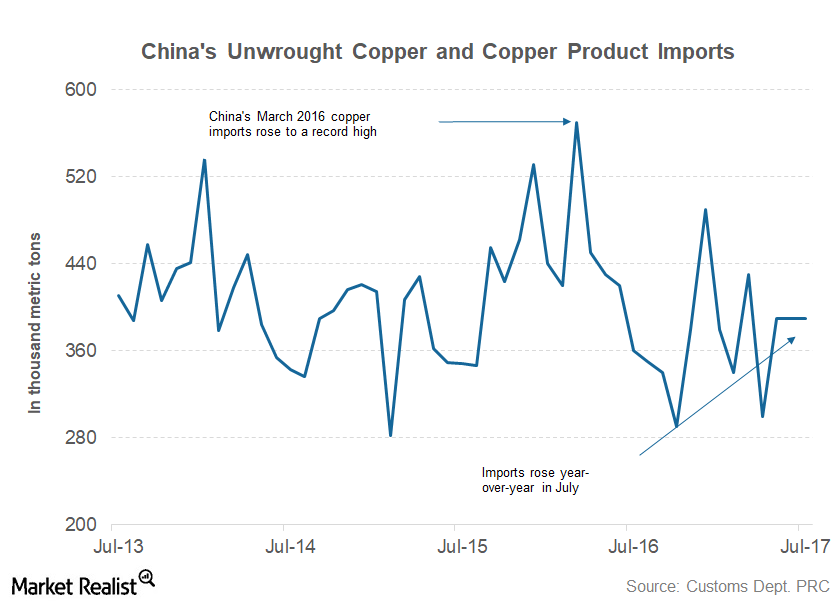

Chinese Copper Imports: Can Freeport’s Good Run Continue?

Previously in this series, we’ve looked at China’s July steel and aluminum exports. In this final part of the series, we’ll look at Chinese copper imports.

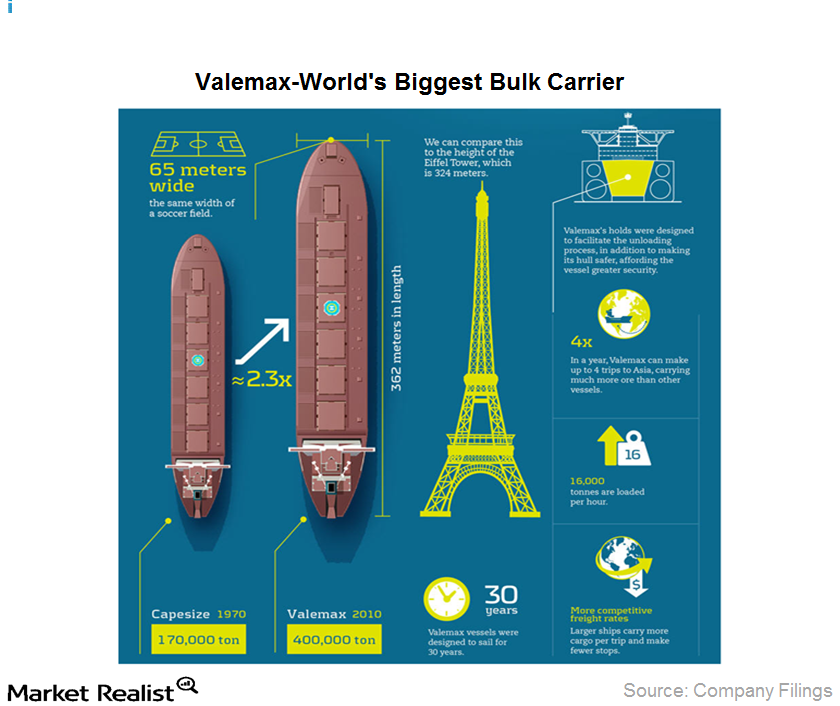

Valemax ships sail Vale SA to cost-effective distribution

Valemax ships are ultra-large vessels, capable of carrying 400,000 dwt (dead weight tons) each. That’s 2.3 times more than traditional Capesize ships. They also emit 35% less CO2 per ton of ore transported.

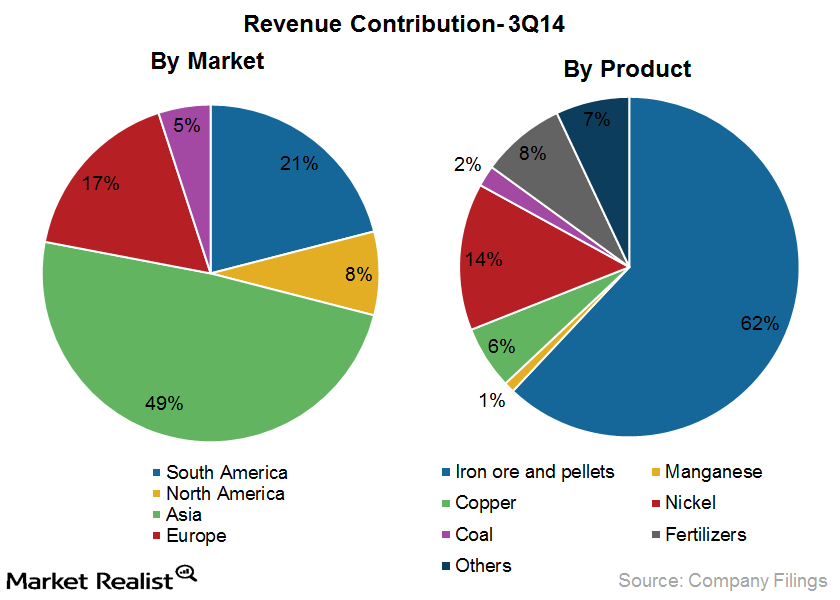

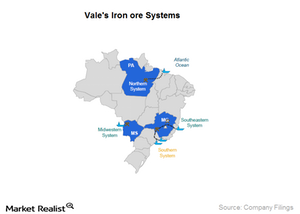

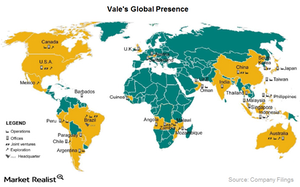

Vale SA: Overview of the world’s largest iron ore company

Vale SA (VALE) is a Brazilian multinational diversified metals and mining company. It is the world’s largest producer of iron ore and iron ore pellets and the world’s second-largest producer of nickel.

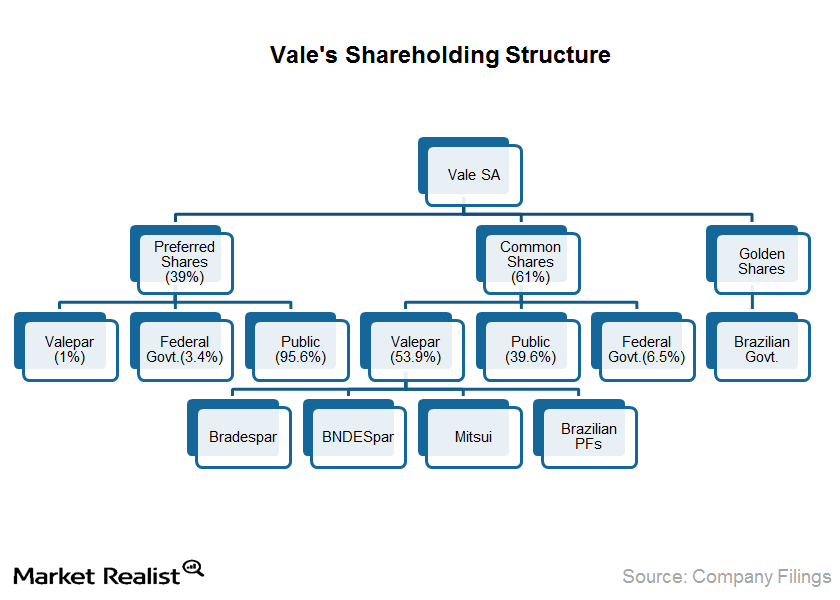

The implications of the Vale SA ownership structure

Although there hasn’t been any recent cause for concern, and the government doesn’t interfere in the day-to-day workings of Vale, there’s always a risk that the company could be pushed into pursuing objectives that aren’t in the best interests of all shareholders.

Vale SA: Top-quality iron ore and pellets

Vale SA (VALE) is the world’s largest producer of iron ore and pellets. Pellets are manufactured by gathering together the powder generated during the ore extraction process.

How Vale SA values its iron ore customers

Vale SA offers technical assistance to its customers and operates sales support offices in several cities. These offices monitor customer requirements and ensure timely deliveries.

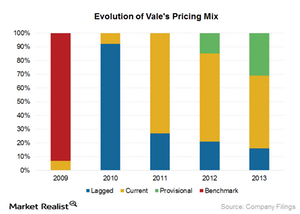

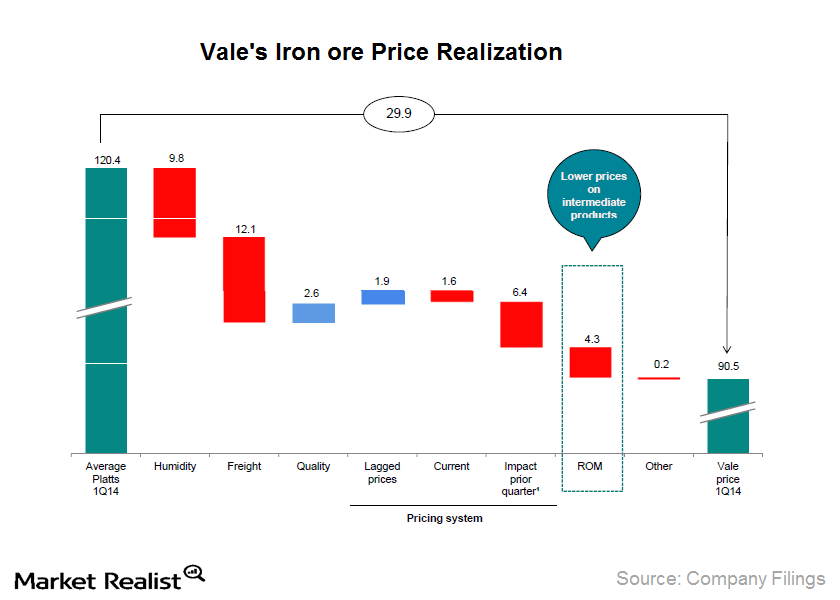

Realized price: The factors impacting Vale SA iron ore

Realized prices for iron ore vary depending on quality, moisture content, freight costs, and pricing mechanisms. ROM sales reduced Vale’s realized price by about $6 per ton in 2013.

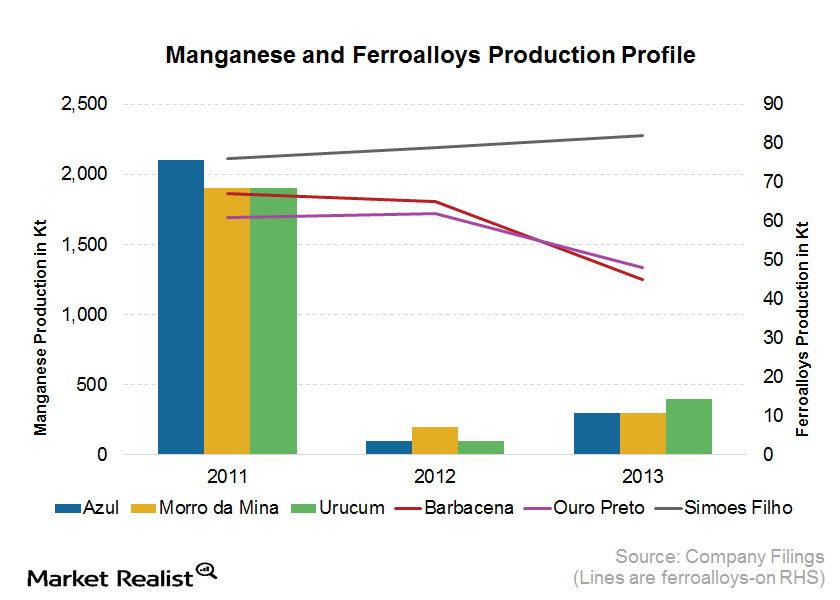

Vale SA in the manganese and ferroalloys business

Vale SA is the largest manganese producer in Brazil, accounting for roughly 70% of the country’s market. The Azul Mine in Para is responsible for 80% of its output.

Why Aluminum Is An Important Metal For Investors

Investors like aluminum. They can play the aluminum industry by trading aluminum on commodity exchanges. Investors can also investment in aluminum plays.

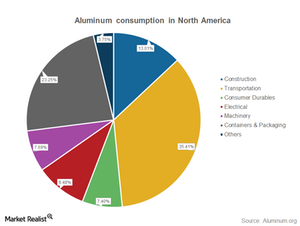

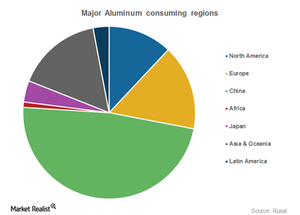

What Are The Major Regions That Consume Aluminum?

China is the biggest consumer. It consumes almost half of the aluminum that’s produced globally. However, this isn’t surprising. China is the biggest consumer of most industrial commodities.

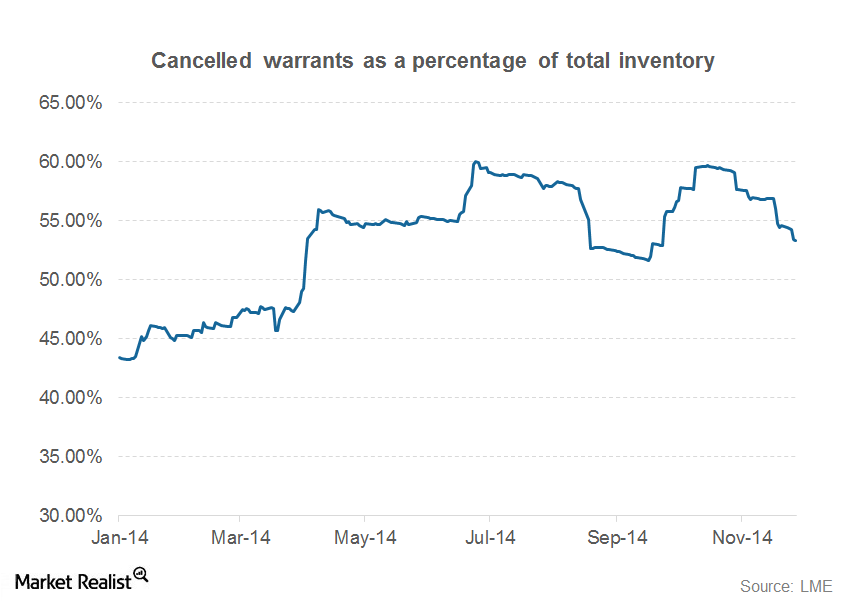

What Investors Need to Know About Aluminum Warrants

Analysts expect that most of the metal has been moving away from LME registered warehouses to non-LME registered warehouses, which typically charge less rent than registered warehouses.Materials Why investors should understand Alcoa’s business model

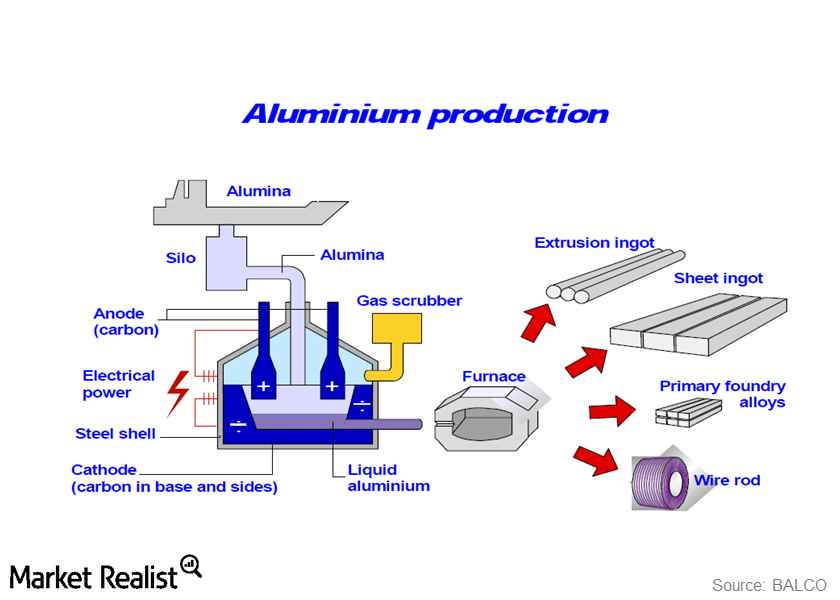

Alcoa is an integrated player in the aluminum value chain. This means its operations extend from bauxite refining to aluminum fabrication.

Where Vale SA operates and why

Currently, the the private sector is leading significant expansion and major rehabilitation of Mozambique’s infrastructure. Vale itself is investing in the development of the Nacala infrastructure project.

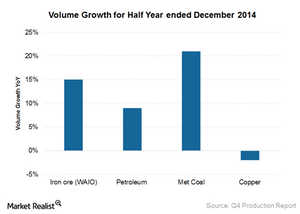

BHP reports mixed production results and maintains its guidance

Overall, BHP reported mixed 2Q15 results. It recorded a 9% production increase during the December 2014 half-year.

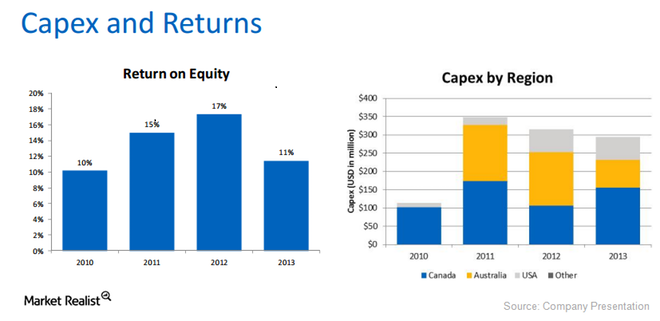

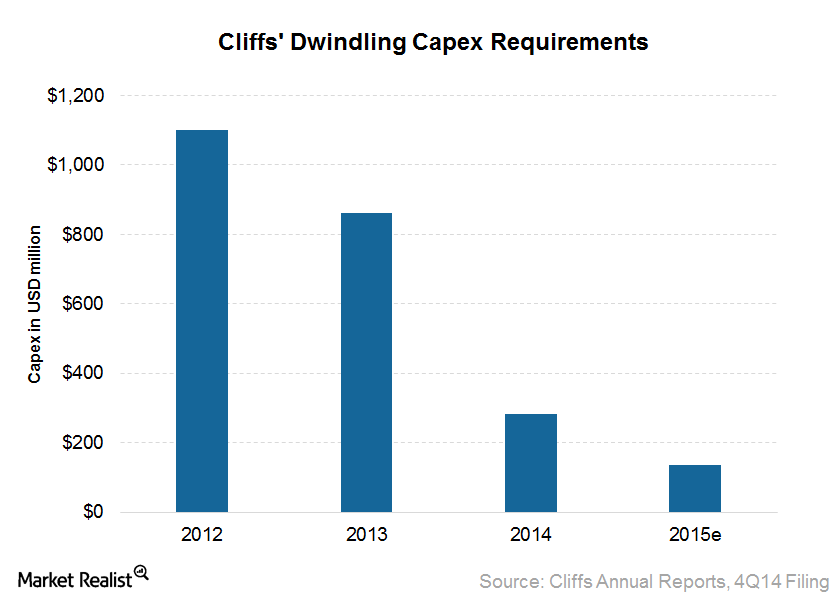

Why Cliffs plans to reduce its capex going forward

Cliffs Natural Resources’ (CLF) estimation for the 2015 annual capital expenditure, or capex, is $125–$150 million.

Must-know: Understanding aluminum’s value chain

The aluminum industry has a value chain that consists of both upstream and downstream companies. Upstream companies are engaged in the mining and refining operations.

China’s Iron Ore Imports Drop, Will Prices Stay Elevated?

Falling iron ore imports China consumes more than 70% of seaborne-traded iron ore. As a result, iron ore investors should track China’s demand and outlook. Today, China released its trade data for June. China’s iron ore imports were 75.18 million tons in June—9.7% lower YoY (year-over-year) and 10.2% lower month-over-month. In June, China’s imports fell […]