BHP Billiton Limited

Latest BHP Billiton Limited News and Updates

How NZ50, ASX, Singapore, KOSPI Indexes Fared Today

Australia’s ASX200 lost marginally today. Although the index was trading higher until noon, it erased those gains afterward. 70 stocks gained, while 118 fell. BHP Group (BHP) outperformed the index with marginal gains, while Rio Tinto (RIO) gained 0.64%.

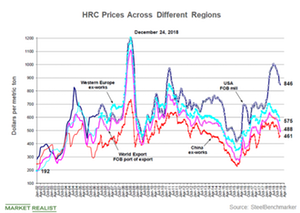

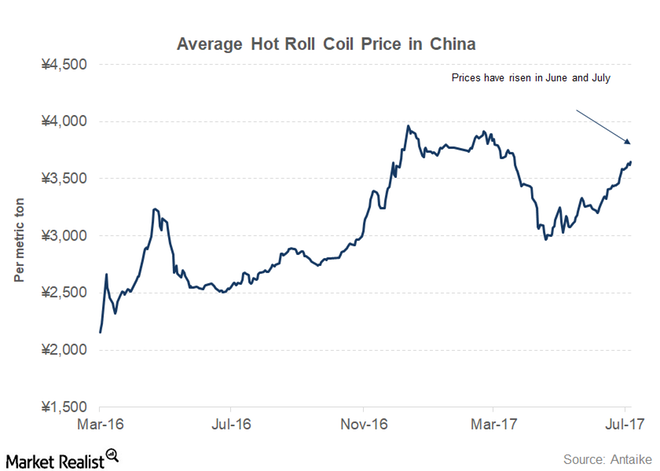

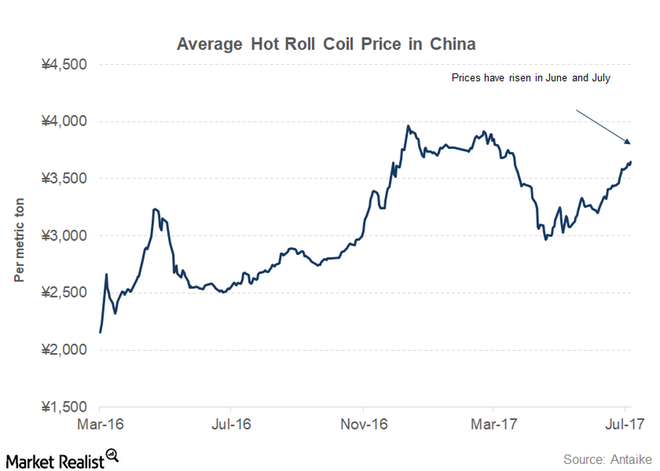

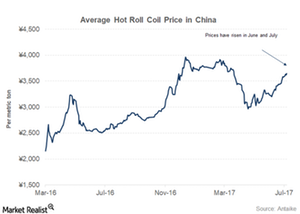

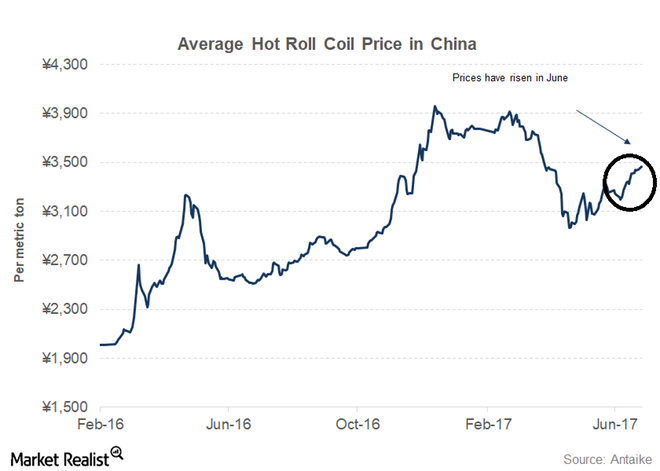

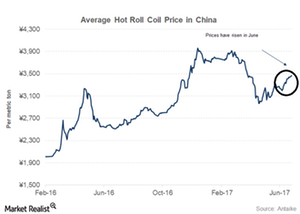

What China’s Steel Price Trends Could Mean for Iron Ore Miners

Bumper margins prompted Chinese steel mills to continue increasing their output.

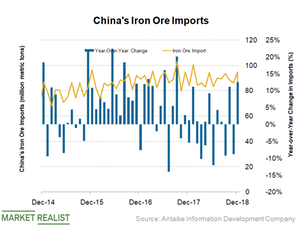

Why China’s Iron Ore Demand Could Soon Weaken

As China consumes more than 70% of seaborne-traded iron ore, it’s imperative for iron ore investors to track the country’s demand and outlook.

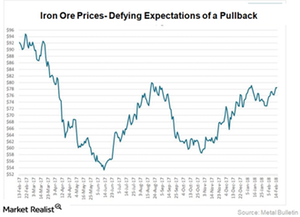

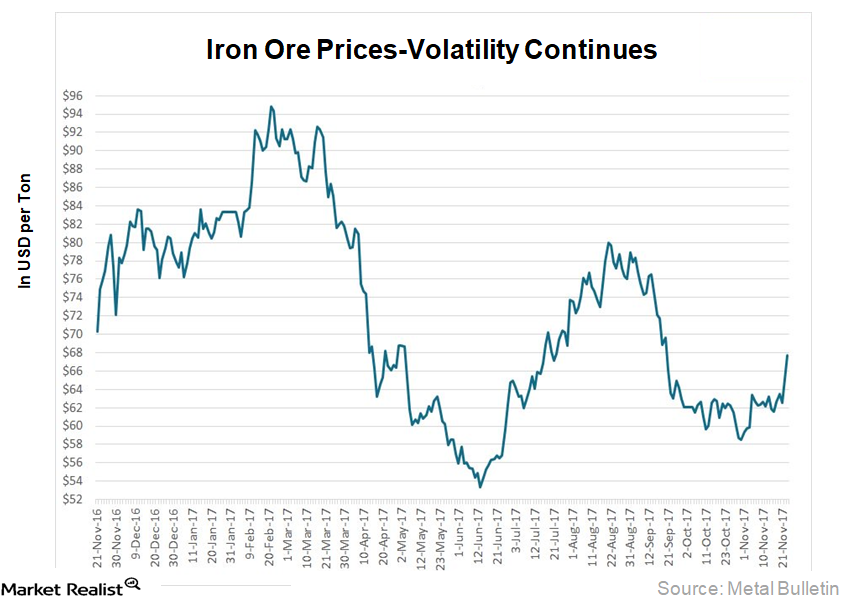

Why Seaborne Iron Ore Prices Might Not Impact Cleveland-Cliffs Much

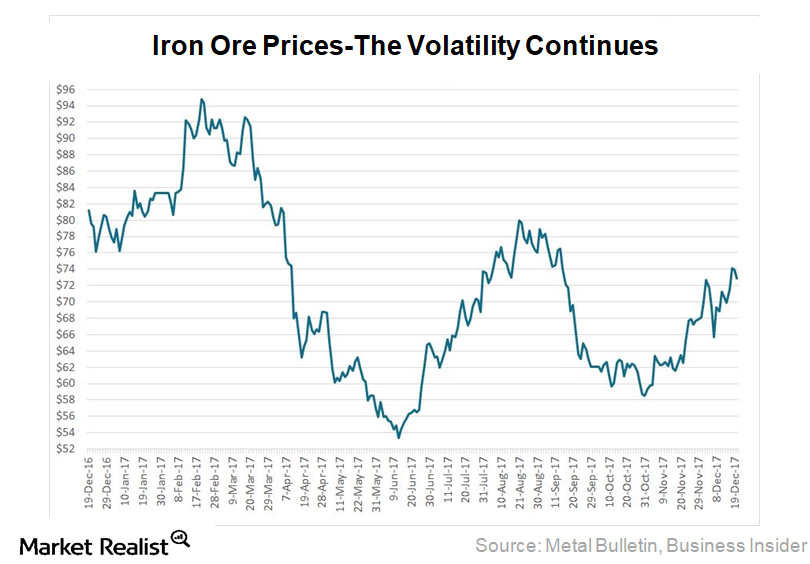

Iron ore prices showed a lot of volatility in 2017, which is continuing well into 2018.

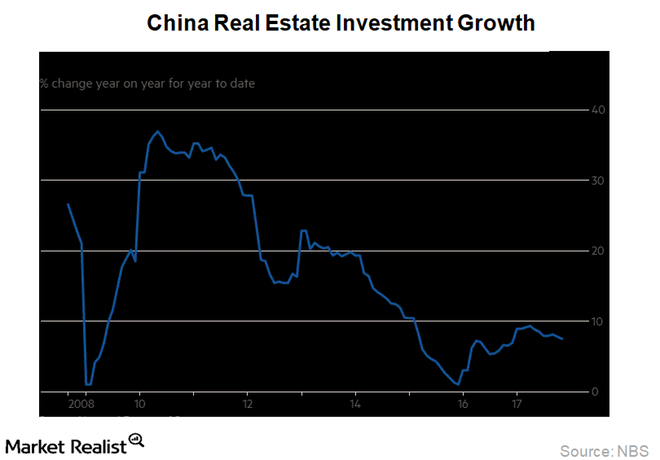

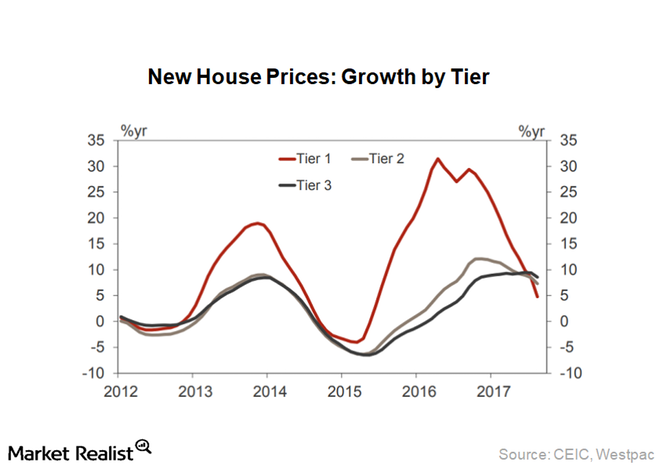

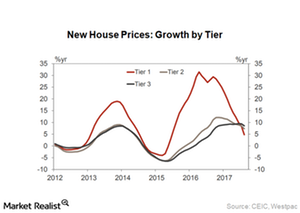

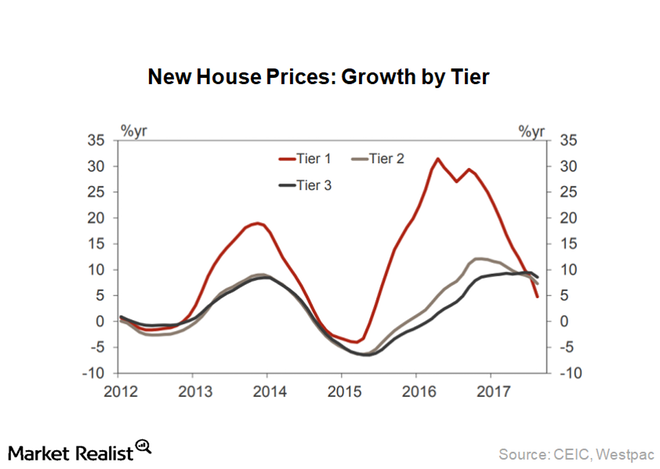

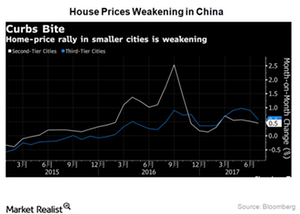

Iron Ore: China’s Property Market Shows Signs of Weakness

It’s vital for iron ore investors to track movements in the Chinese real estate market (TAO). This sector constitutes more than 50% of the total steel consumed in the country.

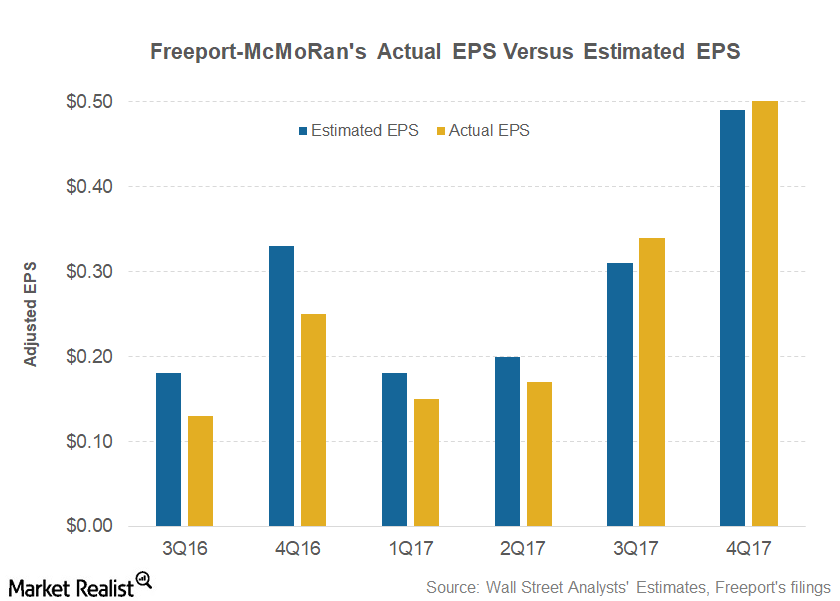

Freeport-McMoRan’s 4Q17 Earnings: What You Need to Know

Freeport-McMoRan (FCX) reported its 4Q17 earnings on January 25, 2018. The company reported an adjusted net income of $750 million.

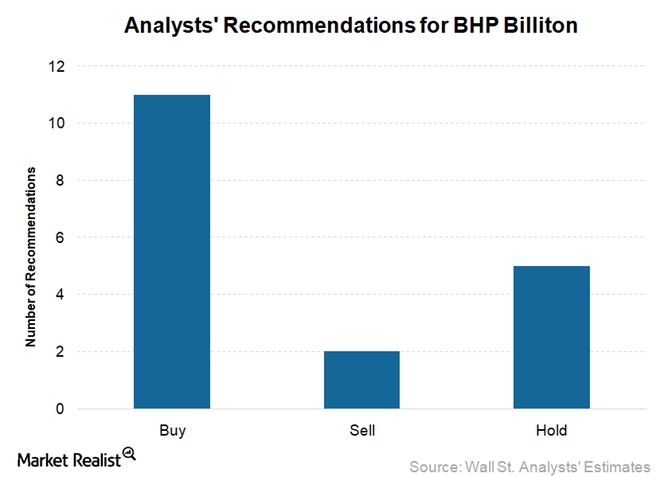

BHP Billiton: Recent Wall Street Upgrades and Downgrades

Of the 18 Wall Street analysts currently covering the BHP Billiton’s (BHP) stock, 61% rate it as a “buy,” 28% recommend a “hold,” and the remaining 11% have a “sell” recommendation on the stock.

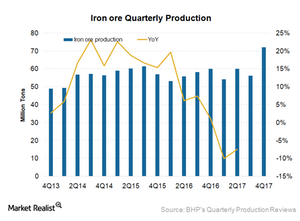

BHP Billiton Outlook: Iron Ore Volumes Flat

Iron ore (PICK) volumes are key to BHP Billiton’s (BHP) revenues and earnings as iron ore is the single largest commodity produced by the company.

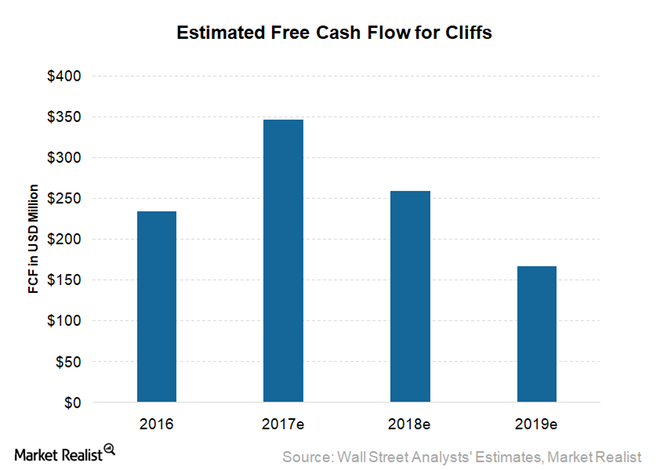

These Factors Could Lead to Upside to CLF’s Free Cash Flow

Cleveland-Cliffs (CLF) had accumulated debt over a number of years.

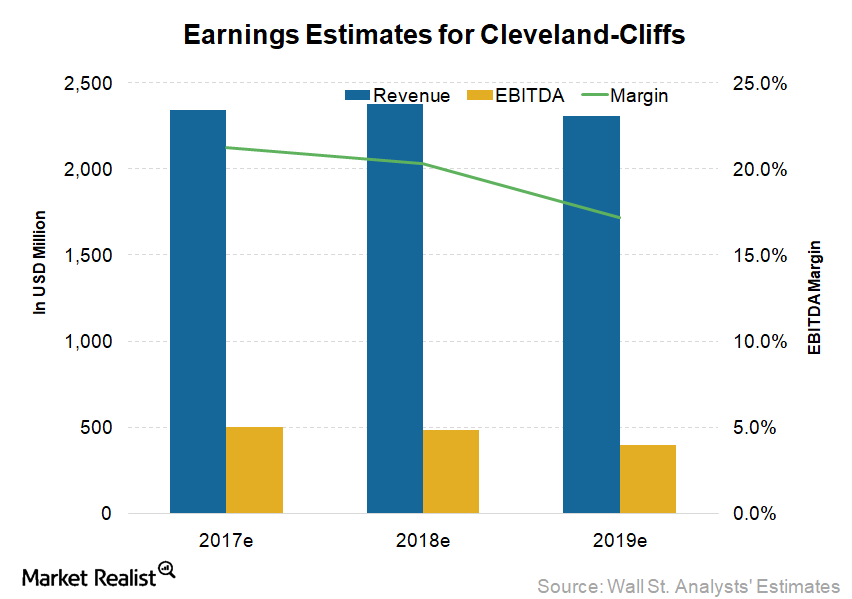

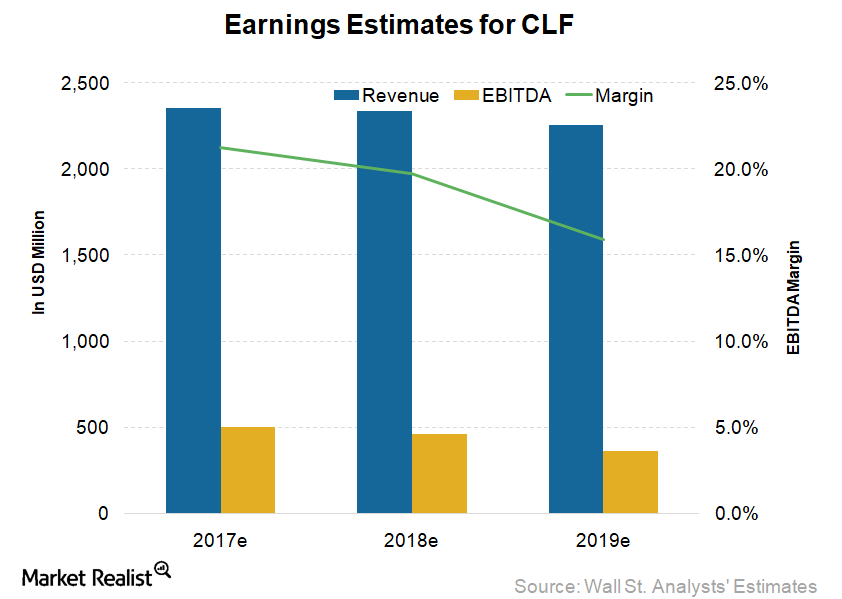

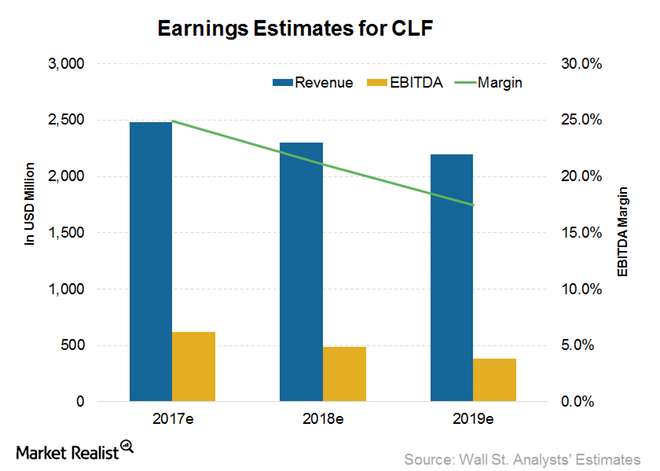

How Analysts View Cleveland-Cliffs’ Earnings for 2017 and Beyond

In this article, we’ll discuss analysts’ projections for Cleveland-Cliffs (CLF). Investors should note that drivers for CLF are quite different from those of its seaborne peers.

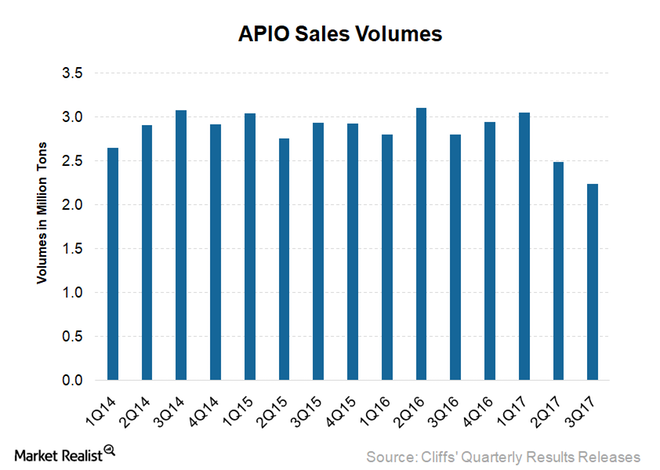

What to Expect from Cleveland-Cliffs’ Asia-Pacific Segment

Iron ore prices have been very volatile lately. While the prices fell substantially in September 2017, they picked up after that.

China’s Steel Demand Indicators: A Slower 2018?

China’s property sector is a steel-intensive market—consuming approximately 50% of overall steel in the country—followed by the automotive industry.

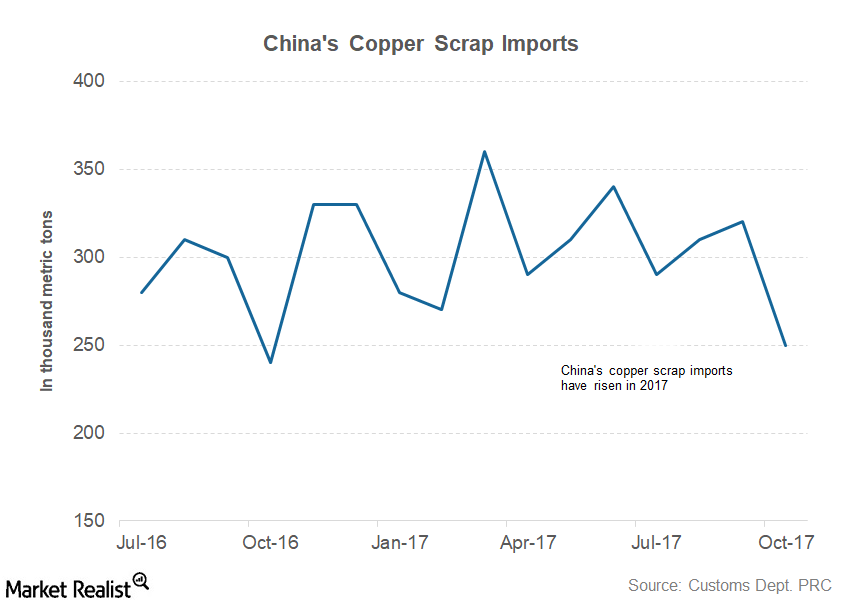

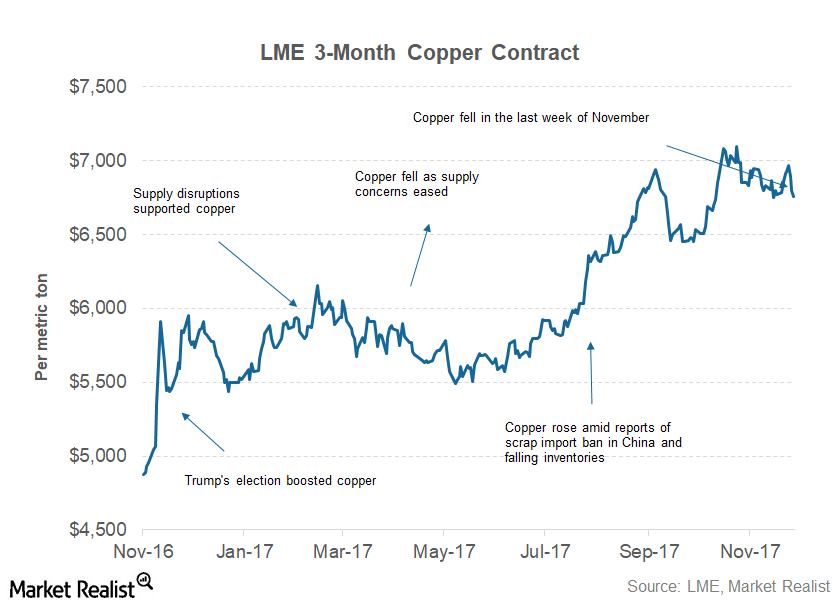

How the Secondary Market Could Impact Copper Prices in 2018

Copper, like other metals, is widely recycled. Last year, we saw improved scrap flows as copper prices moved to higher price levels.

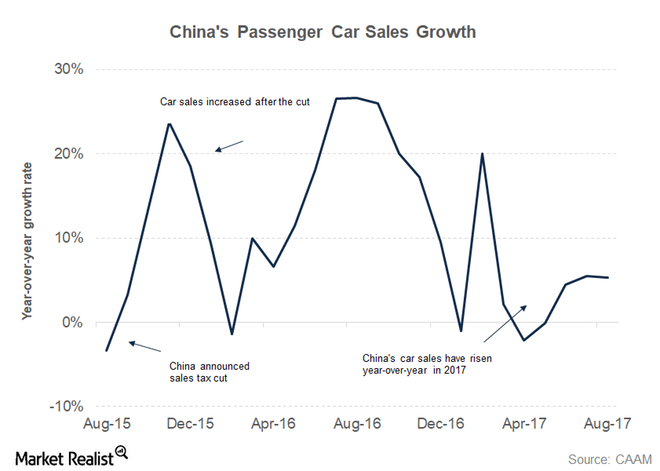

Iron Ore: Could China’s Auto Sales Hit a Rough Patch in 2018?

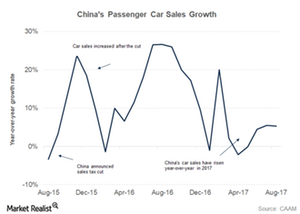

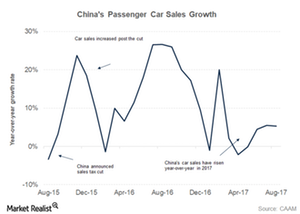

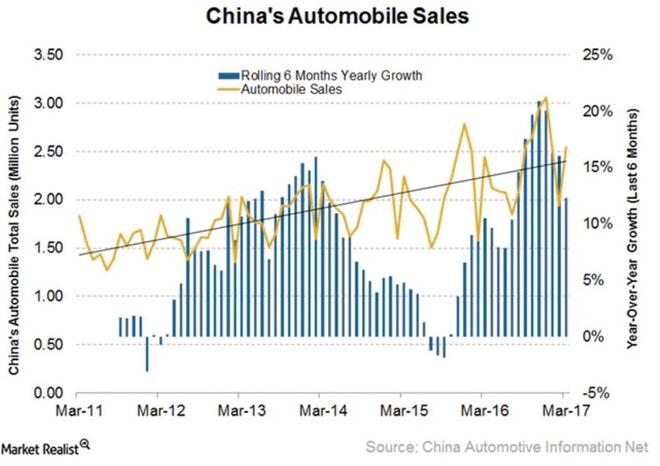

The China Association of Automobile Manufacturers originally forecast 5.0% growth in total vehicle sales for 2017.

How China’s Steel Prices Can Support Iron Ore in 2018

Due to the government’s efforts to fight pollution in winter months, steel prices in China have hit a nine-year high in the first week of December 2017.

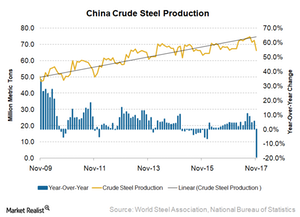

Can China’s Steel Production Pick Up after March 2018 on Pent-Up Demand?

Overall, China’s steel production in 2017 was strong, which was mostly supported by higher steel prices and firm demand.

What Are Analysts Predicting for Iron Ore Prices in 2018?

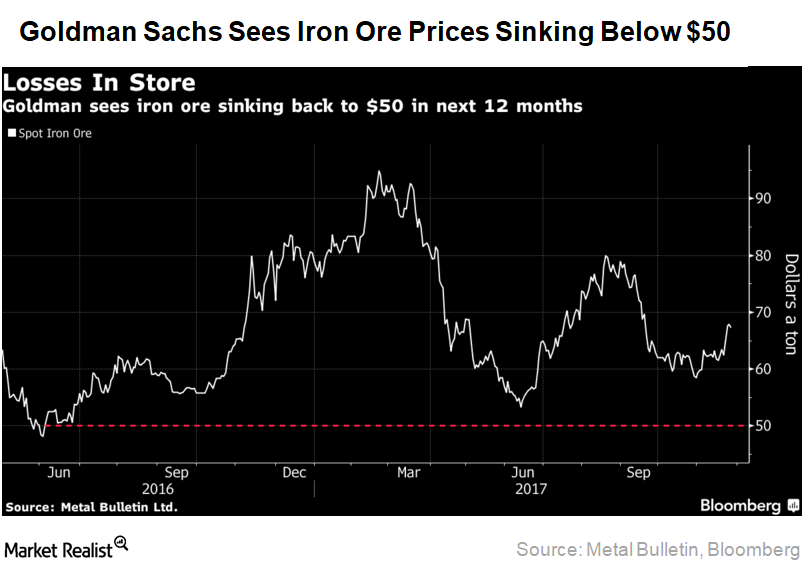

Goldman Sachs (GS) believes that iron ore prices should sink back to $50 per ton in 2018.

Iron Ore Investors Could Anticipate These Factors in 2018

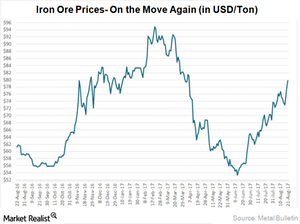

Iron ore prices were tumultuous throughout 2017. There is a 44% difference between the peak of $95 per ton in February and the trough of $53 per ton experienced in July.

China’s Steel Demand Indicator Slowdown—How Will Iron Ore React?

China’s property sector is one of the most steel-intensive sectors, consuming approximately 50% of overall steel in the country.

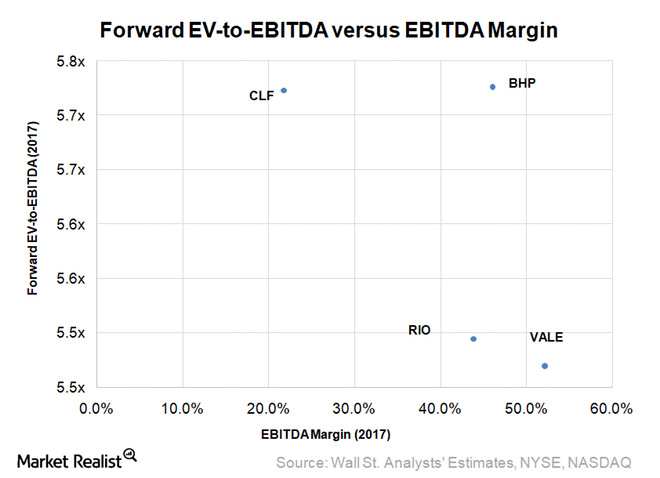

Does Vale Deserve a Rerating of Its Valuation Multiple?

Vale’s CFO (chief financial officer) Luciano Siani Pires said during Vale Day on December 6, 2017, that the company deserves a rerating of its valuation.

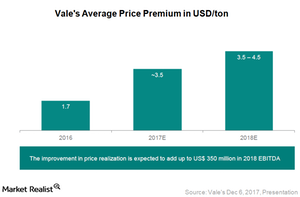

How Vale Could Benefit from a Move to Quality in Iron Ore

Vale has changed its product portfolio and quality in iron ore according to market demand. In 2017, it’s more focused on selling high-quality ore.

Copper Bulls Took a Back Seat in November

Copper bulls had a nice run since July. Copper underperformed several industrial metals in 1H17. However, copper has been on an uptrend in 2H17.

Why Analysts Downgraded Cleveland-Cliffs’s Earnings Estimates

The drivers for Cleveland-Cliffs’ (CLF) top and bottom lines are quite different from the miners we’ve discussed in the previous parts of this series such as Rio Tinto (RIO), BHP (BHP), and Vale (VALE).

China’s Auto Sales Might Have a Surprise Impact on Iron Ore

The Chinese automobile industry comes second, after the real estate sector, in consuming the most steel. In this article, we’ll look at the recent developments in this industry to track the associated iron ore demand.

Can China’s Steel Prices Keep Supporting Iron Ore Prices?

In the previous part of this series, we discussed how the momentum in Chinese steel production in 2017 has come on the back of strong steel prices.

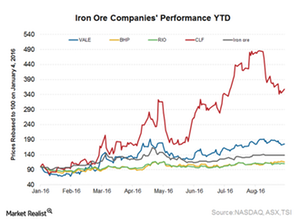

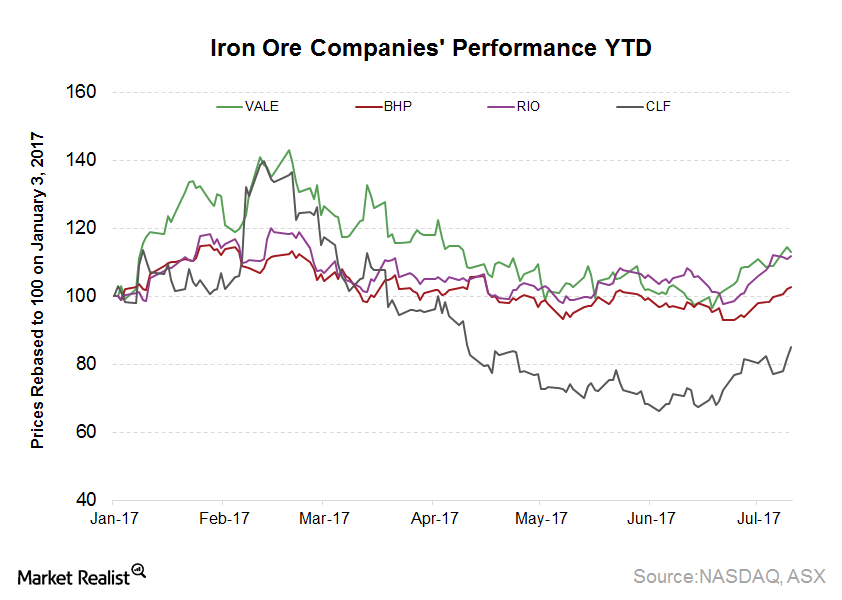

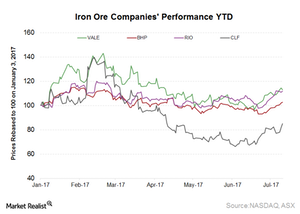

Iron Ore Rebound: How Analyst Ratings for Miners Are Changing

Iron ore prices in 2017 so far have been a roller coaster ride. Prices reached a peak of $95 per ton in February only to slump to a low of $53 per ton in July and take off soon after.

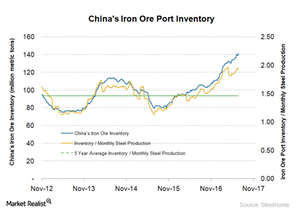

China’s Ever-Rising Iron Ore Port Inventory

It’s important for investors to keep tabs on iron ore port inventories in China. Inventory levels show the balance between demand and supply for iron ore.

Cleveland-Cliffs: Tracking China’s Steel Demand

China’s total vehicle sales rose 2.0% in October 2017 compared to October 2016.

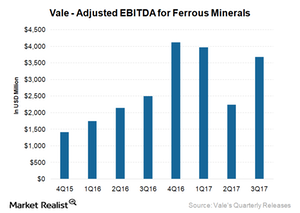

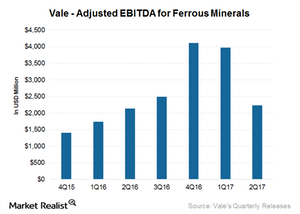

Why Vale Believes the Iron Ore Market Is in Balance

Vale’s (VALE) Ferrous division accounted for ~87.6% of its adjusted EBITDA in 3Q17, compared with ~82.0% in 2Q17.

How China’s Steel Demand Could Affect Iron Ore Demand

China’s property sector China’s property sector is one of its most steel-hungry sectors, accounting for close to 50% of overall steel demand. Therefore, it is important for steel investors to keep tabs on the sector to gauge the steel demand outlook in China. China’s property sector once again appeared to be under stress in August. […]

How Owning the Tilden Mine Fits Into Cleveland-Cliffs’s Strategy

Cleveland-Cliffs now fully owns Tilden On October 2, 2017, Cleveland-Cliffs (CLF) announced its acquisition of U.S. Steel Corporation’s (X) 15% equity interest in the Tilden mine for $105 million. Cleveland-Cliffs already owned the other 85% of the joint venture. This transaction will provide 1.2 million tons of annual pellet production capacity to Cleveland-Cliffs, taking its capacity to ~20 million […]

How Did China’s Auto Sales Trend in August?

China’s automobile industry is the second-largest steel consumer after the real estate sector.

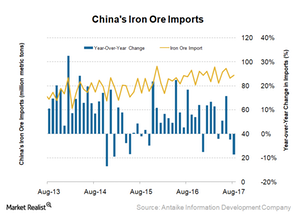

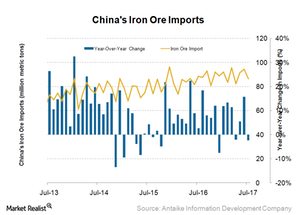

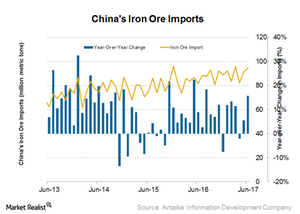

Can China’s Iron Ore Imports Support Prices?

China is the world’s largest consumer of iron ore. Therefore, to gauge the outlook for iron ore demand, it’s important to track China’s iron ore import data.

Understanding Changes in Analyst Estimates for CLF

Wall Street analysts covering Cleveland-Cliffs estimate revenues of ~$2.4 billion in 2017. This implies growth of 14.7% year-over-year.

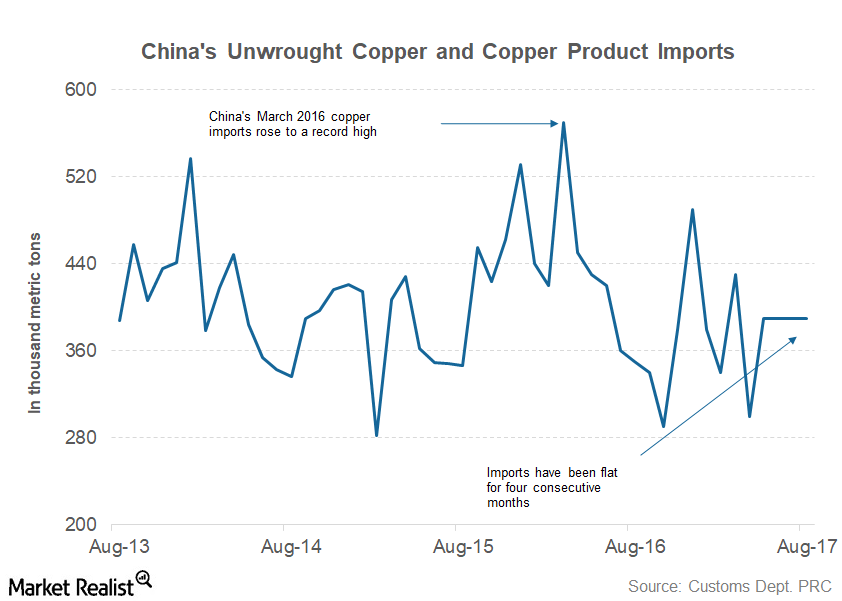

China’s Copper Imports: Did Data Spoil Freeport’s Party?

China imported 390,000 metric tons of unwrought copper and copper products in August 2017—compared to 350,000 metric tons in August 2016.

Inside China’s Steel Demand Indicators and Outlook for Iron Ore

To gauge the steel demand outlook in China, it’s important to keep an eye on the property sector.

China Steel Prices Are Touching Higher Highs: Impact on Iron Ore

According to Reuters, the September 2017 steel rebar futures contract on the Shanghai Futures Exchange has risen 40% year-to-date.

Why China’s Lower Iron Ore Imports in July Could Be a One-Off

China’s iron ore imports for July 2017 fell 2.4% over July 2016 to 86.3 million tons.

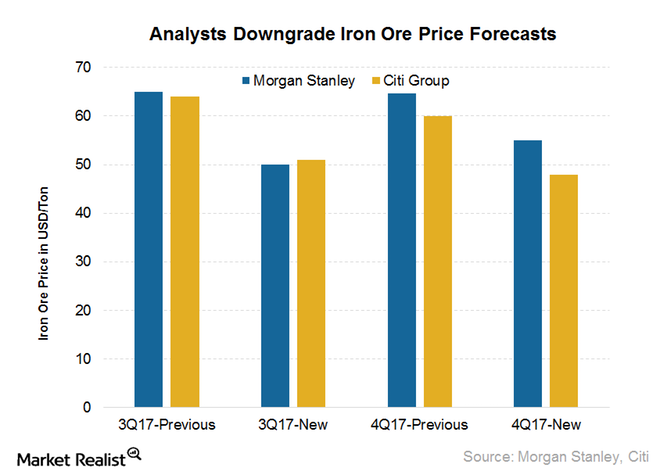

Why Analysts Are Rethinking Their Near-Term Iron Ore Price Forecasts

Goldman Sachs is bullish Although Goldman Sachs (GS) is bullish on the near-term price forecasts for iron ore, it believes that the pressure could return in the long run. In the near term, it believes that prices could be supported by the better-than-expected demand in China. Goldman Sachs believes that the supply pressure could build […]

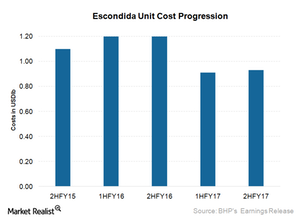

What Could Drive BHP Billiton’s Copper Costs in Fiscal 2018?

BHP Billiton’s (BHP) copper production fell 16.0% in fiscal 2017 to 1.3 million tons.

Does BHP Billiton Expect to Sustain Iron Ore Price Momentum?

BHP Billiton (BHP) attributed the rise in iron ore prices to higher pig iron production in China, the preference for higher grade materials, and improved steel margins.

What’s the Outlook for Vale’s Iron Ore Division?

Vale’s (VALE) ferrous division accounted for ~82%.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) in 2Q17.

These Factors Could Affect Vale Stock in 2H17

After significantly outperforming its peers in 1Q17, Vale’s (VALE) performance deteriorated in 2Q17.

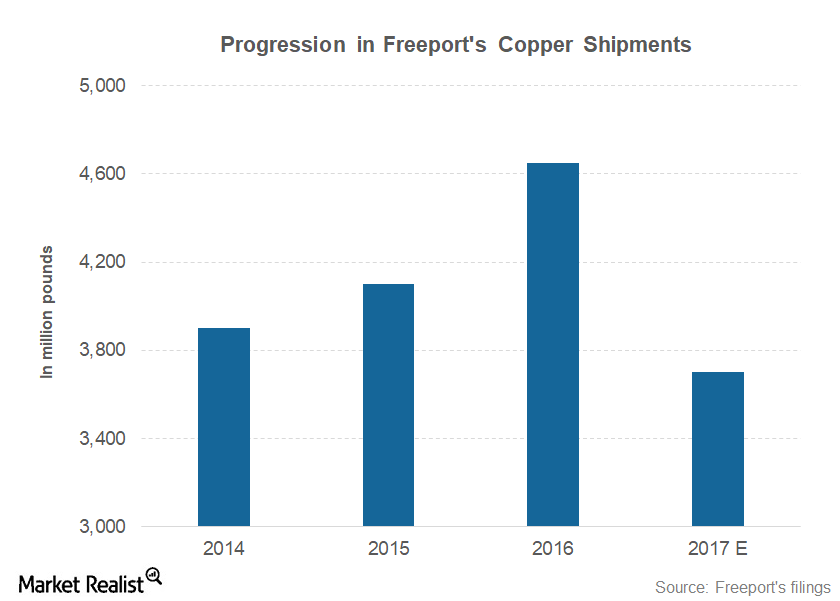

Analyzing Copper Miners’ 2017 Production Plans

During its 2Q17 earnings call, Freeport-McMoRan (FCX) lowered its 2017 copper production guidance to 3.7 billion pounds.

Chinese Steel Prices Are Surging—Can They Keep the Momentum?

Chinese steel production has been hitting one record after another. This renewed vigor in the Chinese steel industry is due to higher steel prices.

China’s Iron Ore Imports Surged in June—Where Will They Go Next?

It’s important for investors to keep track of China’s iron ore import data because they provide a clue regarding the demand patterns for imported iron ore among Chinese mills and traders.

Can Iron Ore Miners’ Supply Discipline Lead to a Price Upside?

Rio Tinto (RIO) released its operational update for 1H17 on July 18, 2017. Rio’s iron ore shipments fell 6% year-over-year (or YoY) to 77.7 million tons in 2Q17.

China’s Auto Sales Rebounded in June: Gauging Iron Ore’s Impact

Since China’s automobile industry is the second-largest consumer of steel after the real estate sector, it’s important to track its developments.

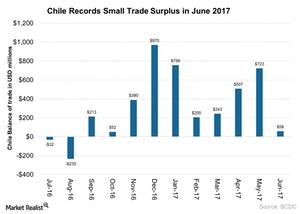

Sluggish Mining Sector and Chile’s Trade Surplus in June

Chile’s economy is highly dependent on copper mining activities. The recent long strike at BHP Billiton’s Escondida copper mine continues to impact Chile.

Can the Rebound in Chinese Steel Prices Support Iron Ore Miners?

One of the major factors that led to the iron ore price rally in 2016 and 1Q17 was stronger-than-expected Chinese steel prices.