BHP Billiton Limited

Latest BHP Billiton Limited News and Updates

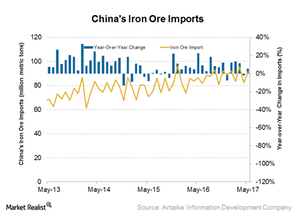

Why China’s June Iron Ore Import Outlook Is Strong

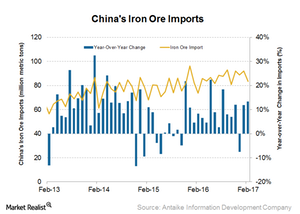

China’s iron ore imports recovered from a six-month low in April by importing 91.5 million tons in May 2017.

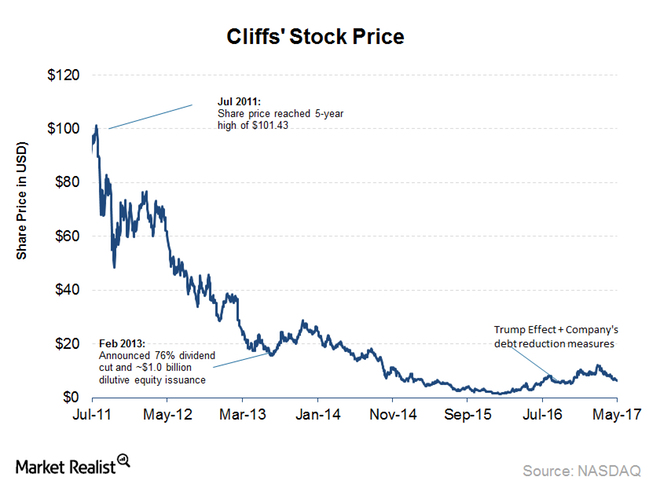

Cliffs Natural Resources’ First HBI Plant: What You Need to Know

The estimated investment needed for Cliffs Natural Resources’ (CLF) HBI (hot briquetted iron) plant is ~$700 million.

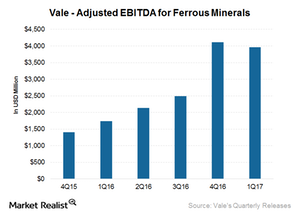

What Will Drive Vale SA’s Iron Ore Division Going Forward?

In 1Q17, Vale’s (VALE) ferrous division accounted for ~89.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization).

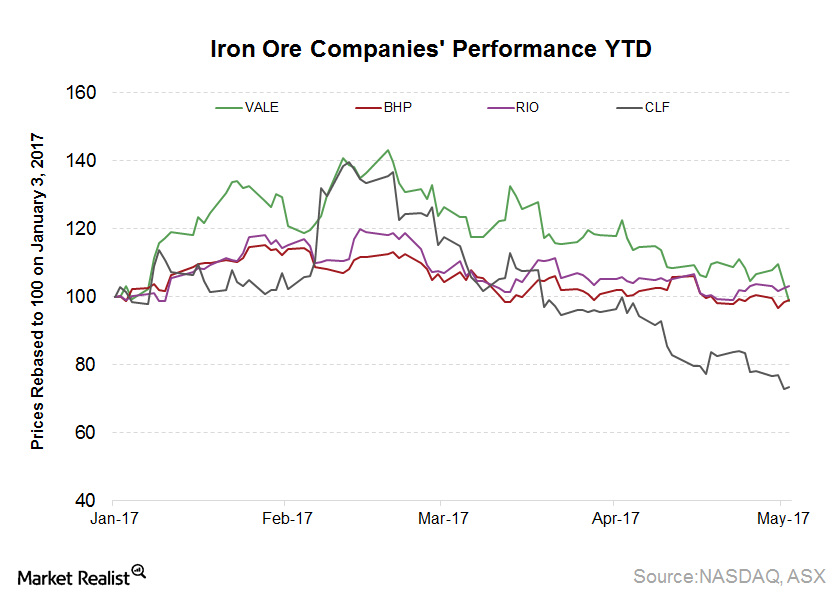

These Factors Led to Weakness in Vale Stock after 1Q17

In 1Q17, Vale (VALE) significantly outperformed its major peers with a rise of ~25%.

China’s Iron Ore Imports Remain Strong: What’s the Outlook?

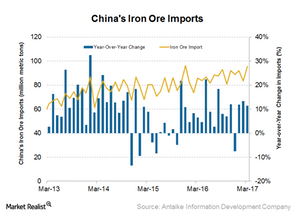

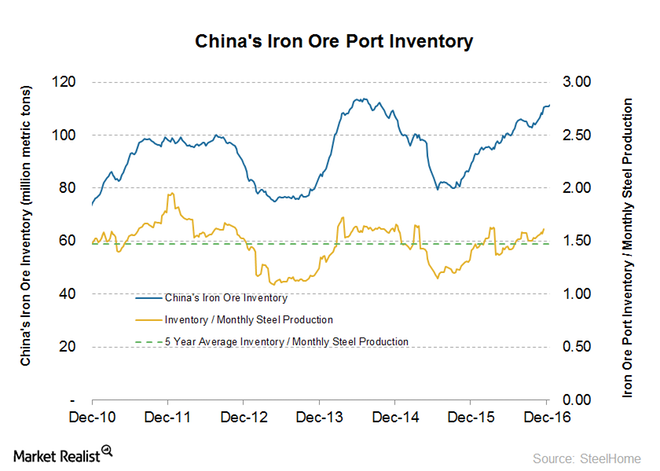

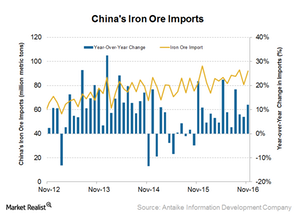

Strong Chinese iron ore imports China imported 95.6 million tons of iron ore in March, compared with 83.5 million tons in February 2017. This figure implies a strong growth of 11% year-over-year (or YoY). This number is also the second-highest monthly amount on record. China imported 96.3 million tons of iron ore in December 2015. […]

Cyclical Nature of BHP’s Business and Mechanistic Share Buybacks

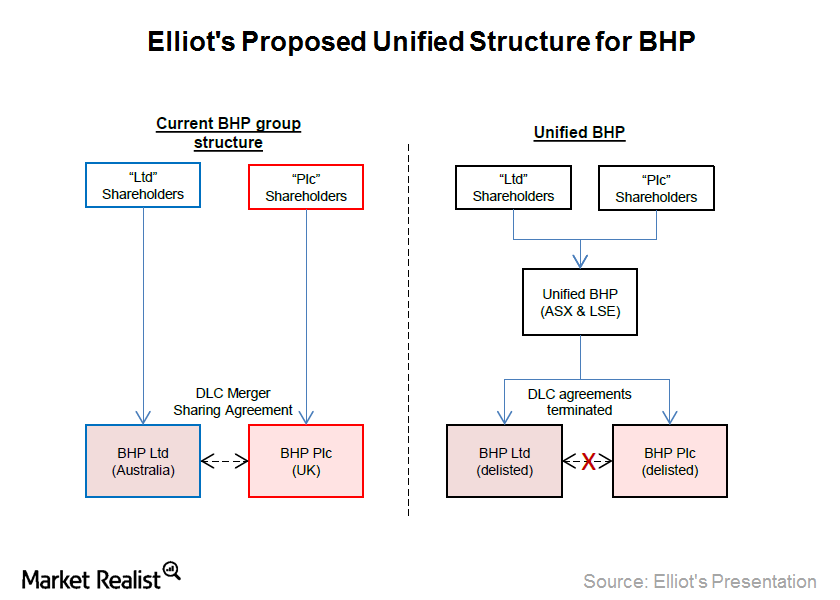

The third element of Elliott Funds’ “value unlock” plan for BHP Billiton (BHP) (BBL) is the adoption of a policy of consistent and optimized capital returns to shareholders.

A Unified Structure for BHP: Do the Costs Outweigh the Benefits?

Elliott Funds has proposed unifying BHP Billiton’s (BHP) (BBL) dual-listing structure into a single Australian-headquartered and Australian tax resident–listed company.

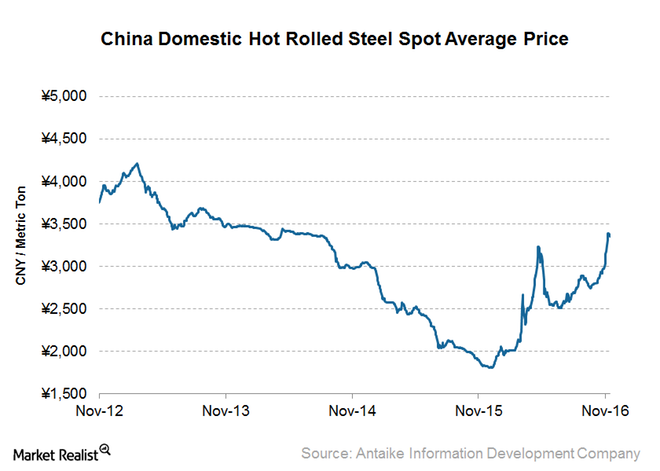

Should Cliffs Worry about Chinese Steel Price Trends?

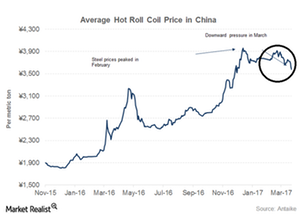

Among the most dominant factors driving the recent iron ore price rally are higher steel production and the rise of steel prices in China (FXI).

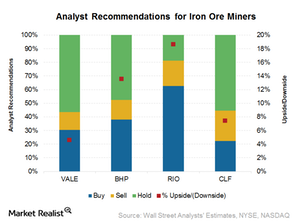

Inside Iron Ore Miners’ Price Targets: Gauging Their Upside Potential

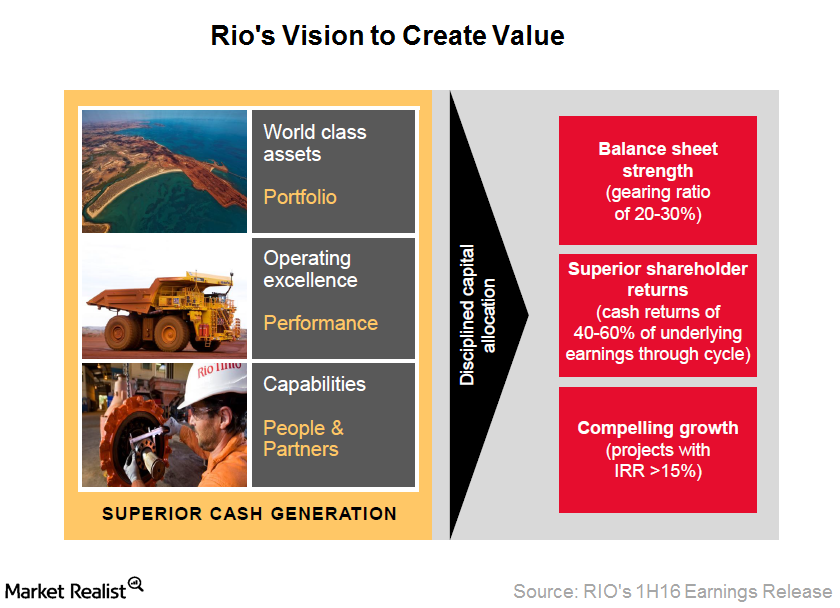

Among the iron ore miners (PICK), analysts are most bullish on Rio Tinto (RIO), with 63% “buy” and 19% “hold” ratings.

What China’s Resilient Iron Ore Imports Mean for Miners

China imported a total of 83.5 million tons of iron ore in February 2017, which represents a growth of 13% YoY (year-over-year) and -9.2% month-over-month.

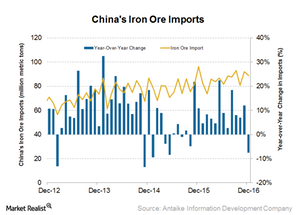

China Imported Record Iron Ore in 2016: How’s the 2017 Outlook?

China’s iron ore imports were robust in 2016. While the country’s imports fell 7.6% year-over-year (or YoY) in December 2016, they hit a yearly record in 2016.

What Could Impact Chinese Steel Prices in 2017?

Since China is the world’s largest steel producer and exporter, it’s important for investors to keep track of Chinese steel prices.

What Could Affect Iron Ore Prices in 2017?

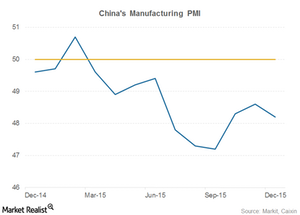

Chinese demand is the key driver of iron ore prices, as the country accounts for more than two-thirds of seaborne demand (CLF) (BHP).

What’s the Outlook for Chinese Iron Ore Imports?

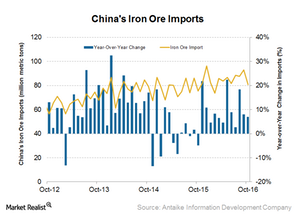

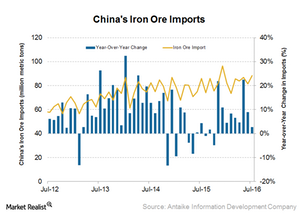

Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In November, imports were 92.0 million tons.

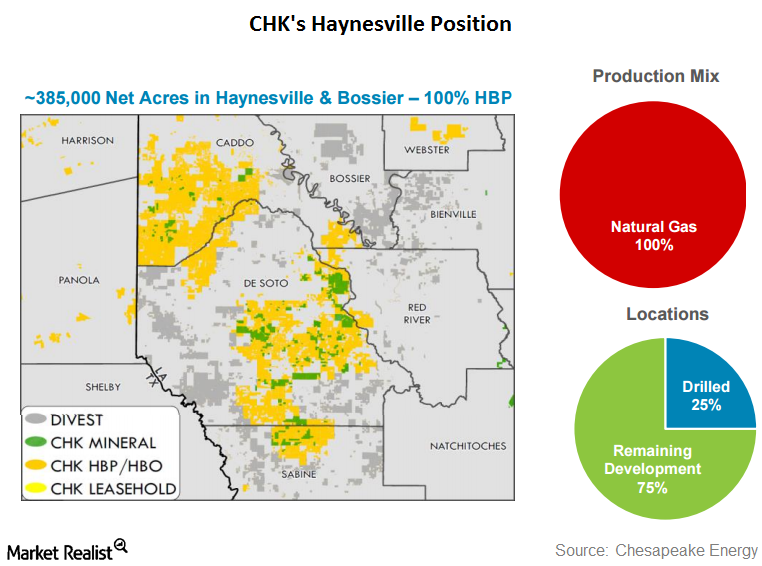

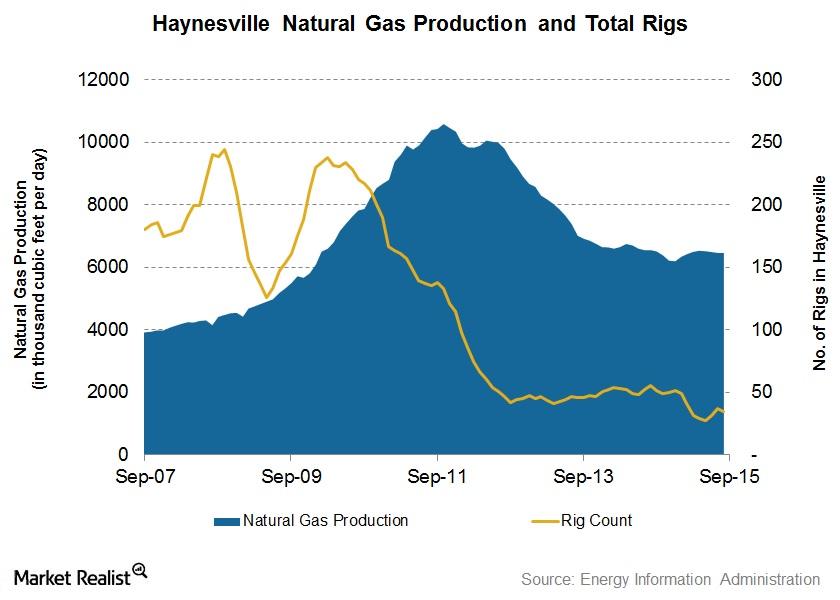

Chesapeake Energy Announces Haynesville Asset Divestiture

Chesapeake Energy (CHK) announced on December 5 that it had agreed to sell 78,000 net acres in Louisiana’s Haynesville Shale for $450 million. The buyer is an undisclosed private player.

Higher Commodity Prices Impact Glencore’s Business Operations

While trading activities account for more than 70% of Glencore’s consolidated revenues, most of its earnings come from the industrial business.

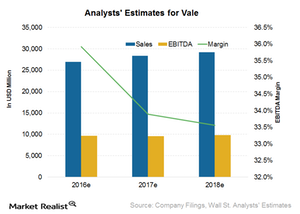

Why Analysts Significantly Raised Vale’s Earnings Estimates

Wall Street analysts covering Vale are projecting sales of $27.0 billion for 2016. That implies a revenue change of 4.4% year-over-year.

Why Were Chinese Iron Ore Imports Weak in October?

China’s weaker iron ore imports Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In October, however, the imports were at their lowest since February, at 80.8 million tons, down 13% month-over-month. On a year-over-year basis, the imports rose 7%. In the first ten months of […]

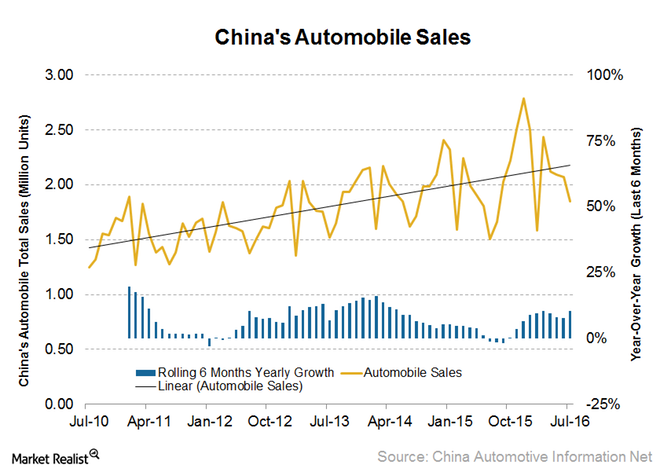

The Outlook for China’s Automobile Sales and Why It Matters

China’s passenger car sales rose 26% year-over-year in August. This is the fourth consecutive month that car sales have risen in the double digits.

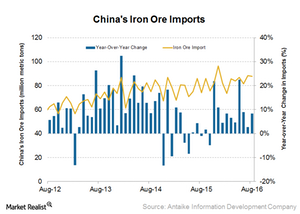

Could China’s Iron Ore Imports Pull Back in the Near Term?

In August 2016, China’s iron ore imports came in at 87.7 million tons, a rise of 18.3% compared to 74.1 million tons in August 2015 but a slight fall of 0.8% compared to July 2016.

How Do Chinese Copper Demand Indicators Look This Month?

It’s important for investors in companies such as Freeport-McMoRan, BHP Billiton, and Rio Tinto to track Chinese copper demand indicators.

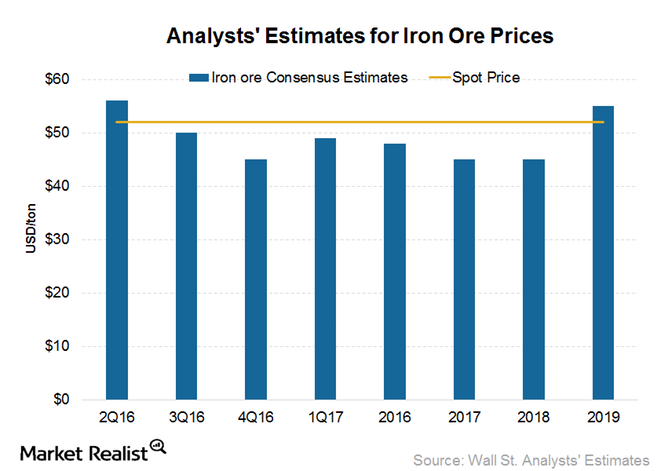

Morgan Stanley, Citibank Doubt Longevity of Iron Ore Price Rally

Morgan Stanley is bearish on the future prospects of iron ore prices. The broker estimates that the iron ore prices will fall to $40 per ton in 2H16 and $35 per ton in 4Q16.

Why China’s Iron Ore Imports May See a Near-Term Pullback

In July 2016, China’s iron ore imports came in at 88.4 million tons. This was a rise of 2.7% compared to 86.1 million tons in July 2015 and 81.6 million tons in June 2016.

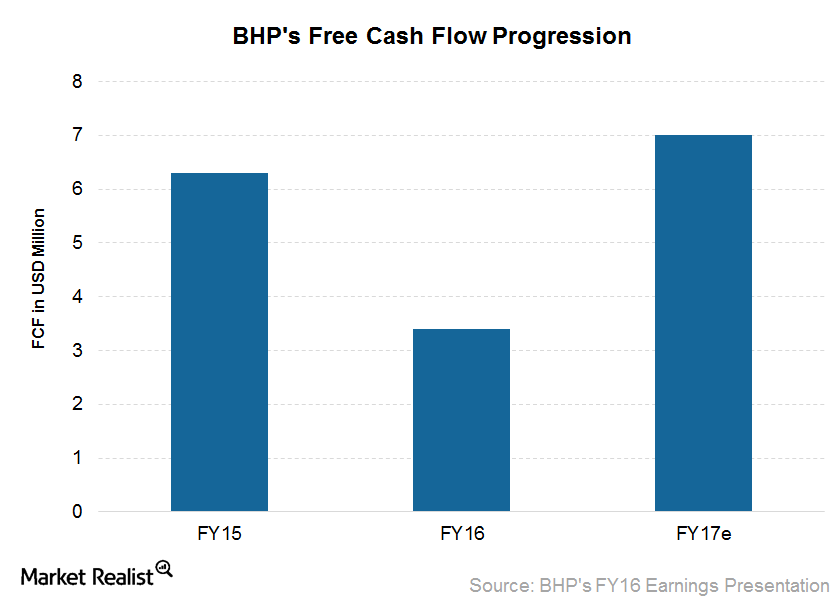

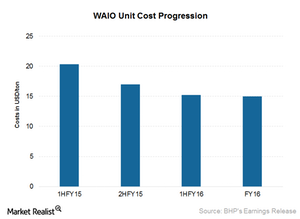

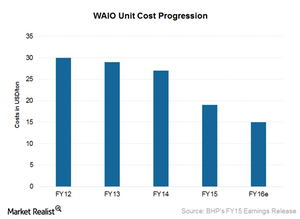

What Could Drive BHP Billiton’s Free Cash Flows for Fiscal 2017?

BHP Billiton’s (BHP) (BBL) unit costs declined by 16% in fiscal 2016, supported by increased capital efficiency. This helped BHP generate strong free cash flow.

How Do Freeport McMoRan’s Fundamentals Compare to Its Peers?

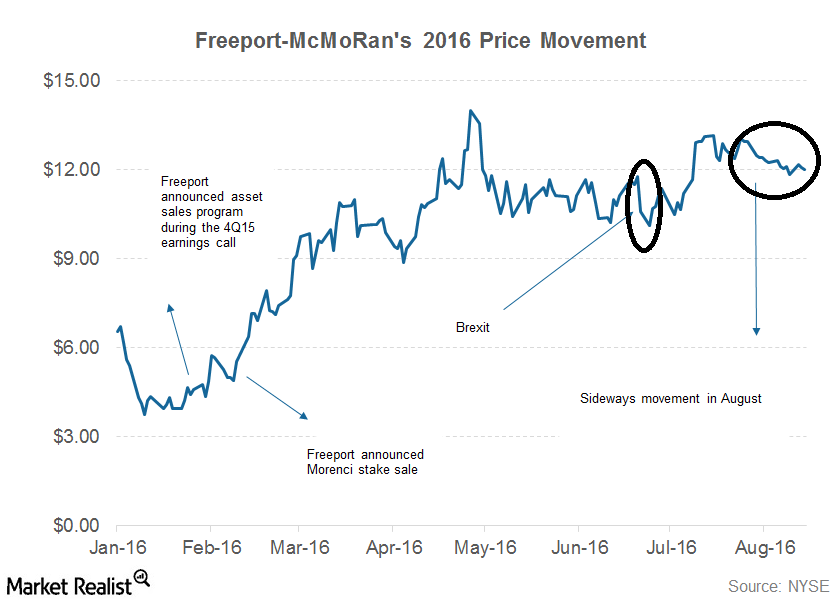

Freeport-McMoRan (FCX) has been trading largely sideways around the $12 price level for almost a month. August has been a dull month for most companies in the metals and mining space.

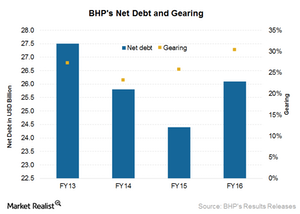

A Look at BHP Billiton’s Balance Sheet after Fiscal 2016

BHP has a strong balance sheet in this depressed commodity environment. Standard & Poor’s cut its rating by one notch from A+ to A in February 2016.

How Much Lower Can BHP Billiton Push Its Costs in Iron Ore?

BHP’s total iron ore production increased by 2% in fiscal 2016 to a record 227 million tons.

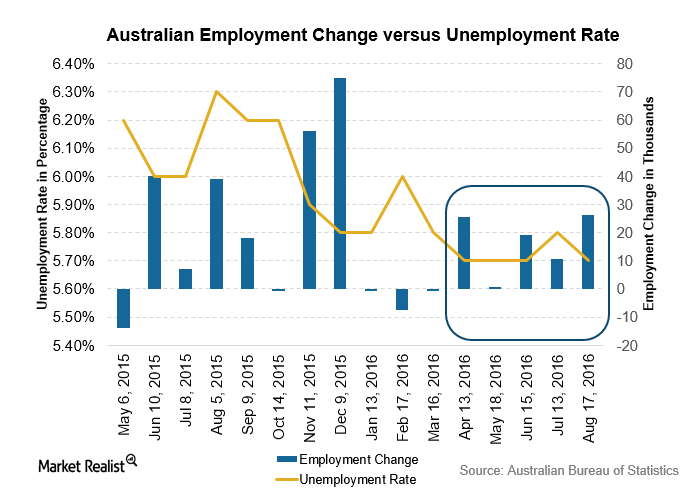

Australian Unemployment Fell: Is More Easing Needed?

The Australian Bureau of Statistics published the employment report for July on August 18, 2016. The unemployment rate fell by 0.1% to 5.7%.

Rio Tinto’s Earnings during 1H16 Were Driven by This

Rio Tinto reported its 1H16 results on August 3, 2016. Its underlying earnings came in at $1.6 billion, 7% ahead of consensus expectations of $1.5 billion.

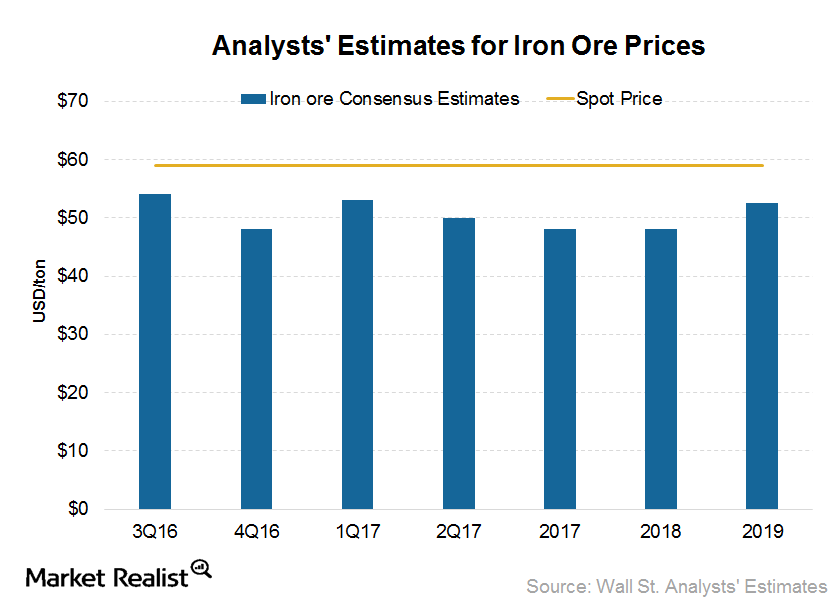

What Analysts Have to Say about Iron Ore Prices

Analysts have increased their short-term iron ore price forecasts due to stronger-than-expected temporary factors.

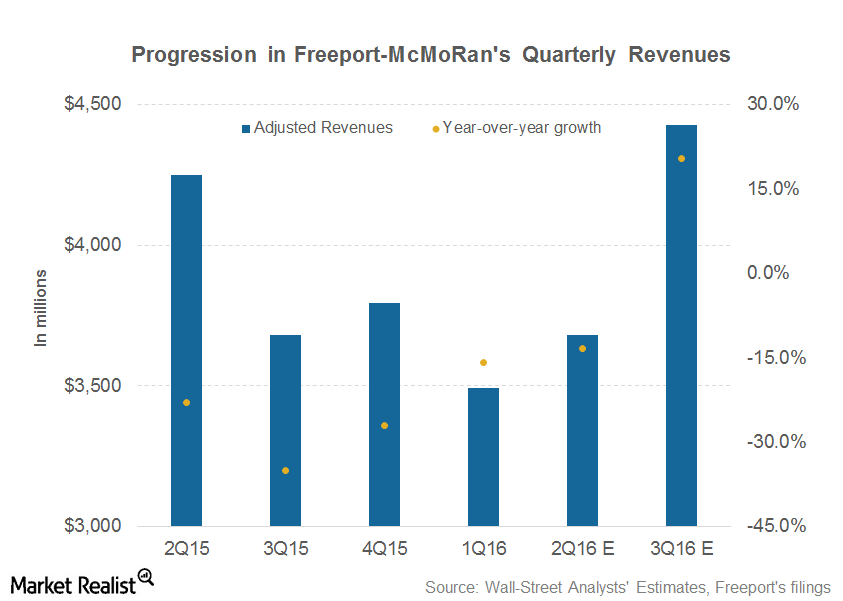

Can 2Q16 Mark a Turnaround for Freeport-McMoRan’s Revenues?

Analysts expect Freeport-McMoRan (FCX) to post revenues of ~$3.7 billion in 2Q16 and $4.4 billion in 3Q16.

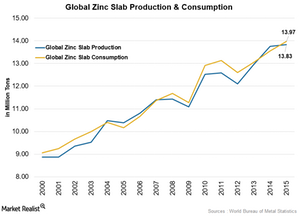

Why Zinc Demand Could Pick Up in 2016–2017

Zinc has gained more than 15% in 2016 so far, outperforming other base metals in the same category.

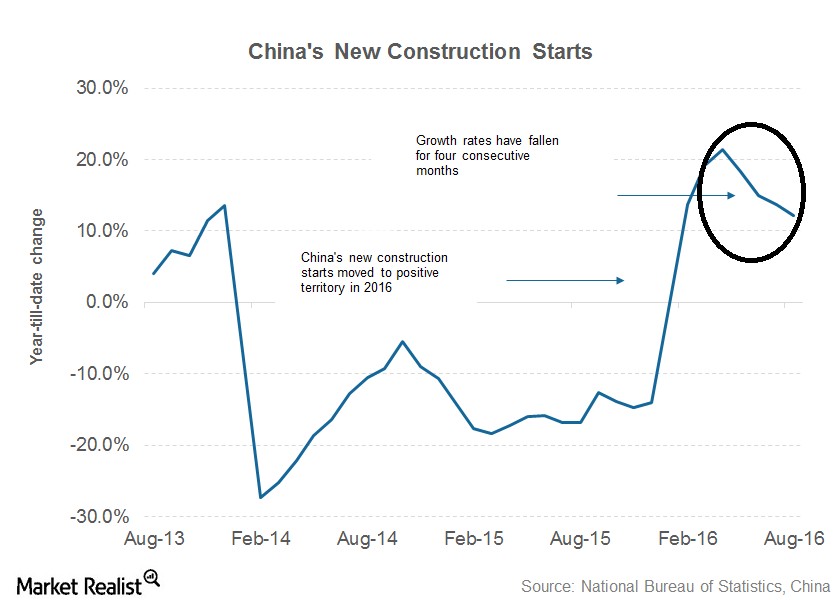

Why Is the Iron Ore Price Rally Losing Steam?

In this series, we’ll analyze the demand-supply fundamentals for iron ore and see whether the recent surge was a one-off phenomenon or the start of a more sustained uptick in prices.

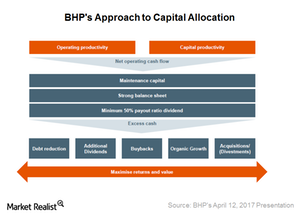

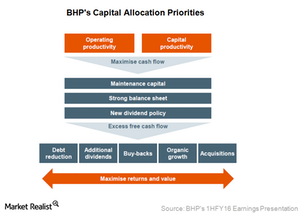

A Look at BHP Billiton’s Capital Allocation Priorities

BHP Billiton (BHP) (BBL) has reframed its capital allocation priorities, including sustaining capex, maintaining balance sheet strength, and cutting dividends.

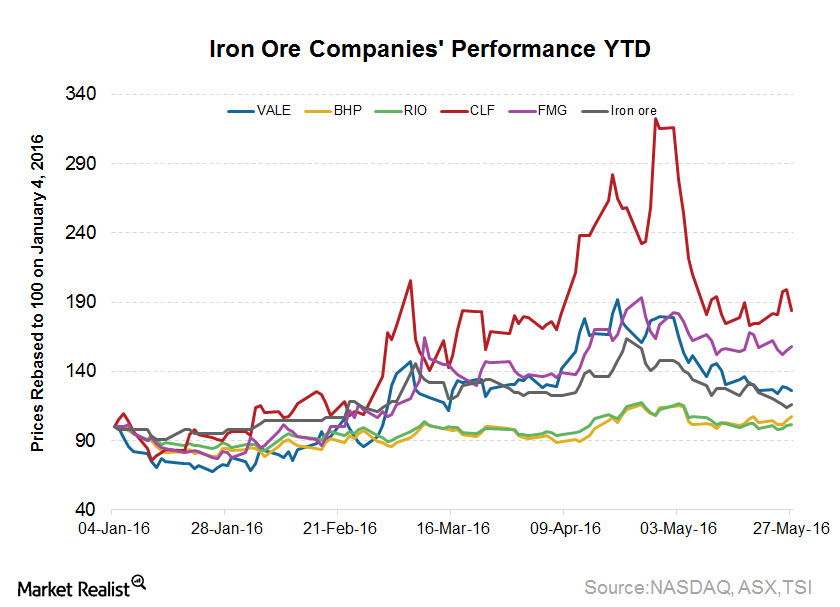

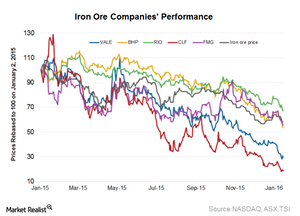

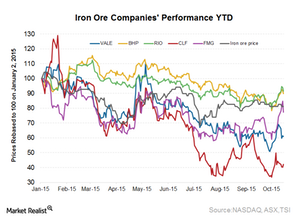

So Far, 2016 Has Been an Unhappy New Year for Iron Ore Stocks

Just a few weeks old, 2016 started where 2015 left off for the iron ore industry. The benchmark seaborne iron ore prices were trading at $40 levels as of January 14, 2016, down 9% for the year.Company & Industry Overviews The Energy and Materials Sectors Pulled VEURX into the Red in 2015

The Vanguard European Stock Index Fund was the worst performer for 2015 among the ten funds in this review.

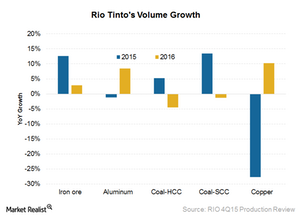

Rio Tinto Reported Overall Strong Production Results for 4Q15

Rio Tinto’s copper production was a slight miss, falling short ~1% of the fiscal 2015 guidance. This was mainly due to weaker throughput at Escondida.

Cliffs Natural Resources’ Woes Continued in the Fourth Quarter

In 2015, Fortescue Metals Group (FSUGY) and Cliffs Natural Resources (CLF) fell 35% and 78%, respectively.

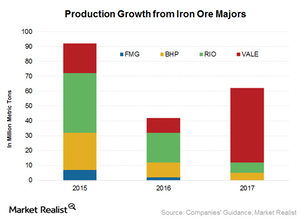

Are Curtailments Enough to Offset New Capacity in Iron Ore?

The Nullagine joint venture, where BC Iron owns 75% and Fortescue Metals (FSUGY) owns 25%, will cease production in 2016 due to weak iron ore prices.

Depressed Iron Ore Prices Will Strain BHP Billiton’s Cash Flows

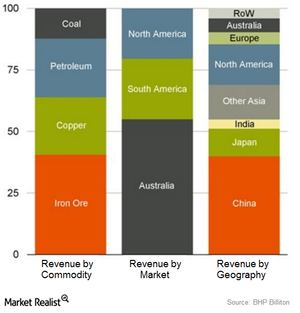

Iron ore forms the biggest chunk of BHP Billiton’s revenues and earnings. For its latest quarter, the company delivered 7% year-over-year growth.

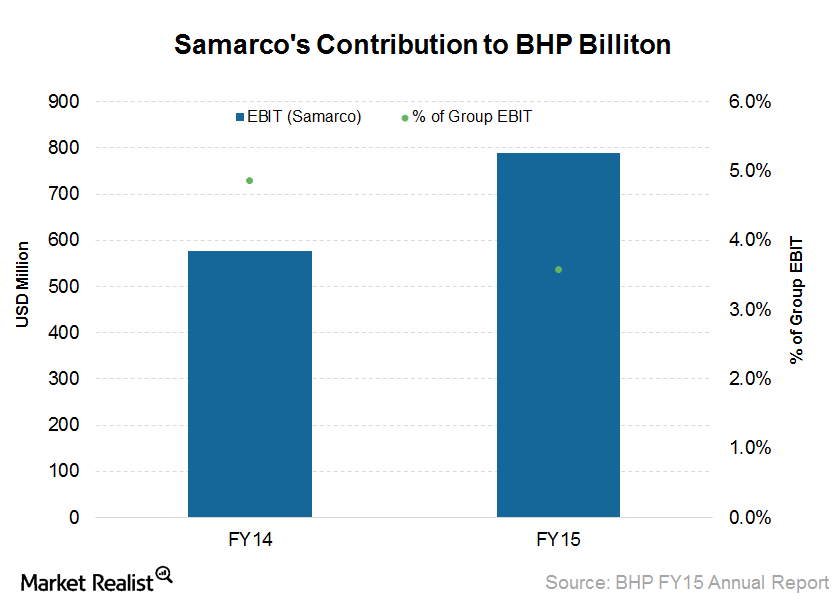

How Could the Samarco Dam Failure Impact BHP Billiton?

Brazil’s government has announced that it intends to start legal proceedings against Samarco, Vale, and BHP Billiton for Samarco’s tailings dam failure.

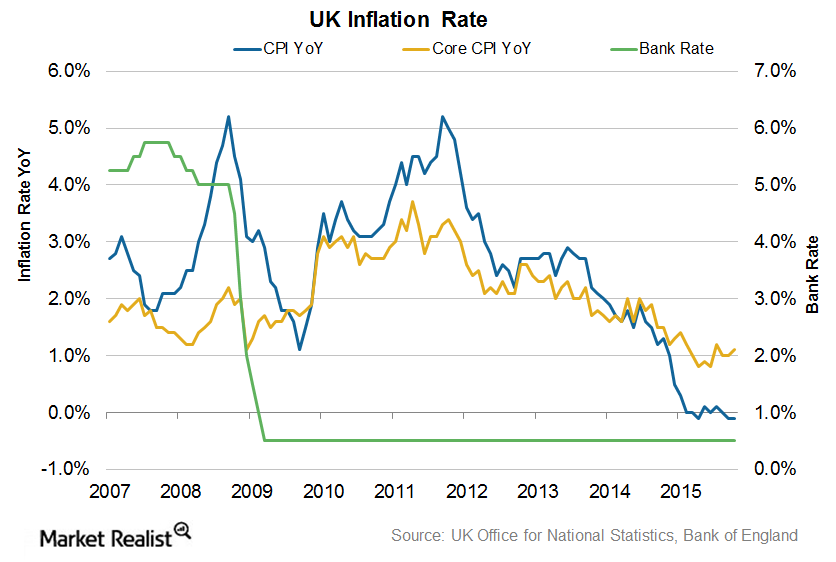

Falling Crude Oil Prices Keep UK Inflation in Check

The Bank of England or BoE is targeting an inflation rate at 2.0% in order to attain economic growth in the United Kingdom.

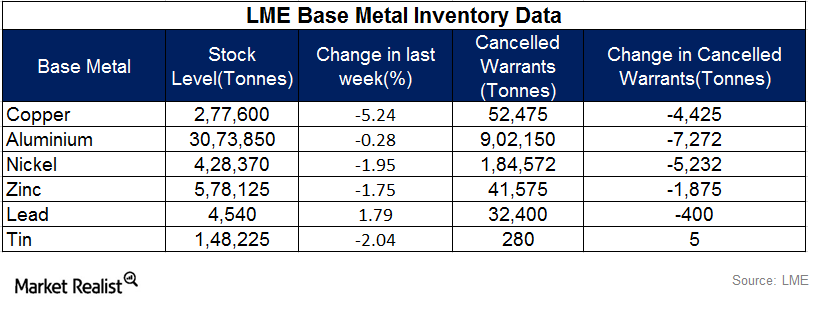

LME Warehouse Data Indicating Support For Metal Prices, But XME Collapses

Analysis of base metal inventories helps us understand the price and usage trends of the respective base metal, as well the price trends of base metal mining companies.

Why Aren’t BHP and RIO Cutting Copper Production?

While major mining companies like Freeport-McMoRan and Glencore are declaring copper production cuts, BHP Billiton says it is reluctant to decrease its copper production.

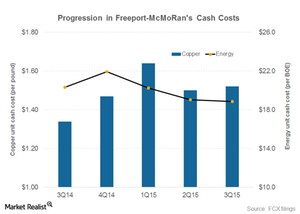

Is Freeport-McMoRan Doing Enough to Contain Its Costs?

In this part of ours series, we’ll explore the trend in Freeport-McMoRan’s unit production costs.

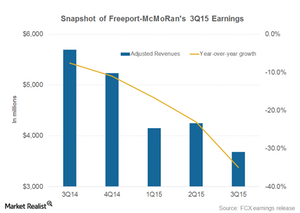

Why Freeport-McMoRan’s 3Q15 Revenues Fell Off a Cliff

In this part of the series, we’ll explore the trend in Freeport-McMoRan’s (FCX) revenues.

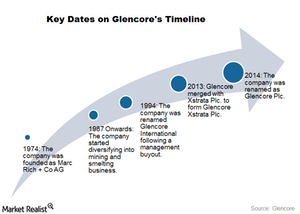

Must Know: How Did Glencore Take Shape?

Glencore (GLNCY) is a relatively new entrant in the metals and mining industry. The company was founded in 1974.

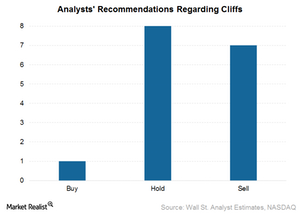

Cliffs Natural Resources: 3Q15 Market Expectations

Market expectations for Cliffs Natural Resources (CLF) are varied. Of the analysts covering Cliffs, one has a “buy” recommendation, eight have a “hold,” and seven have a “sell.”

Cliffs Natural Resources Has Underperformed Iron Ore Peers So Far

The third quarter of 2015 hasn’t been good for iron ore equities. Most of them lost significant value during the quarter.

Haynesville Shale Natural Gas Production Fell in September

The Haynesville Shale’s natural gas production in September was 0.1% lower than August. On a YoY basis, it was 1.4% less. The drop marked the fourth straight month-over-month fall in production.