BHP Billiton Limited

Latest BHP Billiton Limited News and Updates

Why Alcoa Did the Obvious and Is Splitting Its Value-Add Business

On September 28, Alcoa (AA) announced that it would split into two independent companies. The transaction is expected to be completed in the second half of 2016.

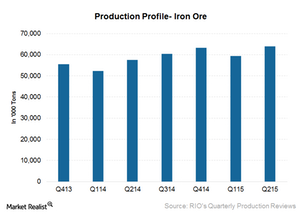

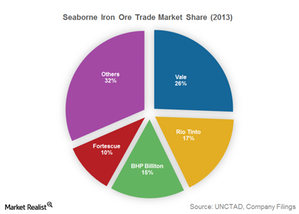

Why Rio Tinto May Not Pull Back Its Iron Ore Volume Growth

Iron ore volumes are key to Rio Tinto’s (RIO) iron ore segment’s revenue. The other factor, seaborne iron ore prices, is determined by demand and supply dynamics.

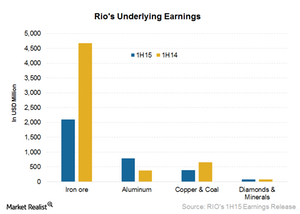

Will the Slide in Rio Tinto’s Underlying Earnings Continue?

Rio Tinto’s (RIO) underlying EBITDA (earnings before interest, taxes, depreciation, and amortization) was $7.3 billion for 1H15.

After 1H15, Rio Tinto Looks Forward to Further Cost Cuts

Within four trading days of its 1H15 results, Rio Tinto’s stock price rose 3%. This is despite a 1.7% fall in benchmark seaborne iron ore prices.

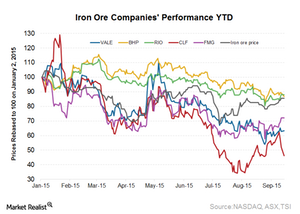

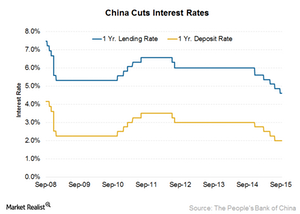

Will China’s Monetary Easing Impact Iron Ore Miners Favorably?

Chinese credit easing measures should positively impact the steel industry. This will help iron ore companies like Rio Tinto and BHP Billiton.

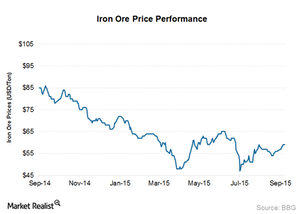

Iron Ore Prices Are Holding Steady Thus Far

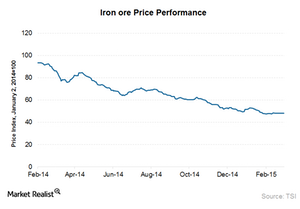

Since the end of July, benchmark iron ore prices have been holding steady near $55–$57 per ton. This is despite the continuing slide in other commodities amid China slowdown worries.

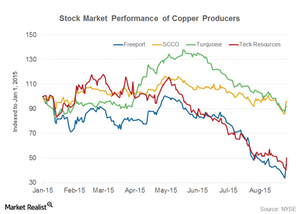

Is Freeport-McMoRan Worth a Look for Investors?

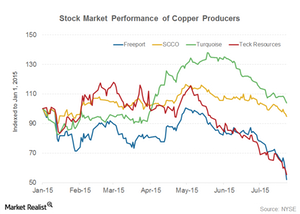

With the recent news of activist investor Carl Icahn taking an 8.5% stake in the company coupled with Freeport’s lower capital expenditure guidance, the stock has seen a smart up move.

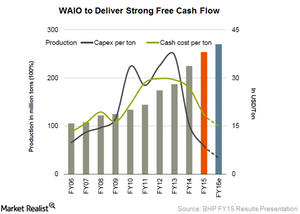

How Much Lower Can BHP’s Unit Iron Ore Costs Go?

Iron ore costs are key to determining BHP’s iron ore segment’s profitability, which ultimately impacts its stock price and relative performance.

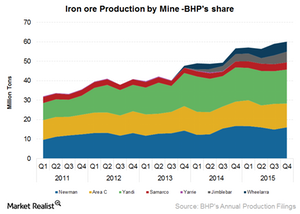

Why BHP Delivered Record Iron Ore Production in Fiscal 2015

BHP Billiton’s iron ore production for fiscal 2015 was a record 233 million tons, a growth of 14% year-over-year.

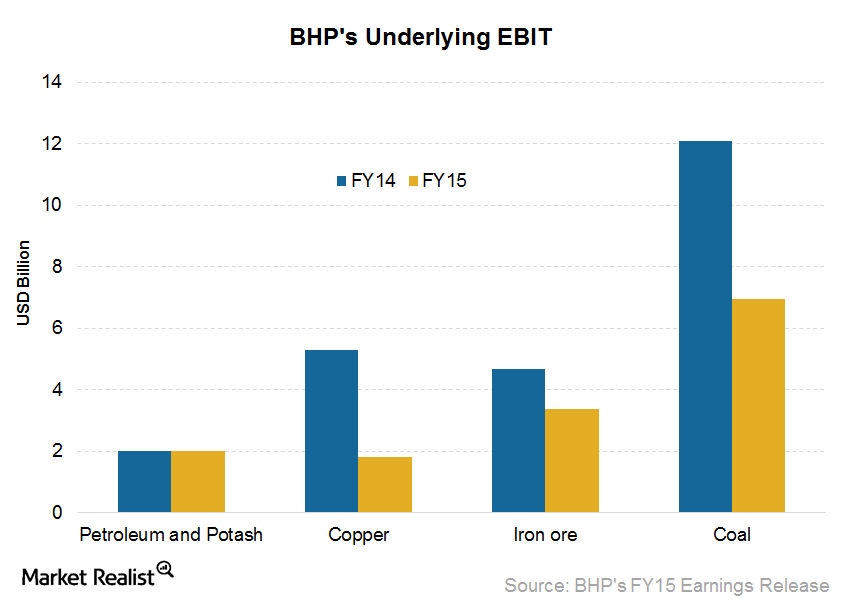

Why BHP’s Operating Income Fell in Fiscal 2015

BHP Billiton’s (BHP) (BBL) underlying EBITDA was $21.9 billion for fiscal 2015. This is a fall of 28% year-over-year (or YOY). Operating income also fell 46% YoY in fiscal 2015.

Is Everything Going According to Plan for BHP Billiton?

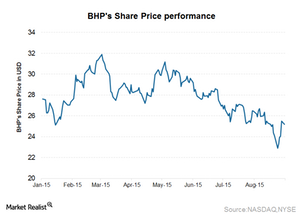

BHP Billiton (BHP) (BBL), the world’s largest miner by market capitalization, reported its fiscal 2015 results on August 25. The results were mostly in line with market expectations.

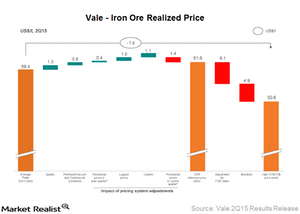

What Led to Vale’s Increased Realized Iron Ore Prices in 2Q15?

Vale’s (VALE) average CFR (cost and freight) realized price for iron ore fines increased by $3.30 per ton, from $58.20 per metric ton in 1Q15 to $61.50 in 2Q15.

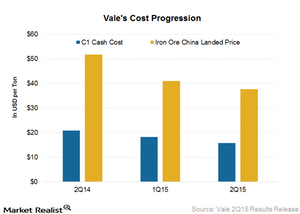

Vale’s 2Q15 Profitability Gets Boost from Iron Ore Cost Control

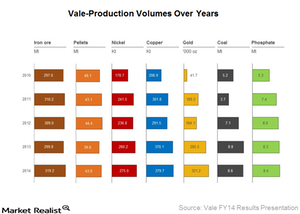

Vale’s (VALE) iron ore production for 1H15 was a record 159.8 million tons, 9.3 million tons higher than 1H14. For 2Q15, production was the second highest on record at 85.3 million tons.

Why Did Vale Report a Beat on Market Expectations in 2Q15?

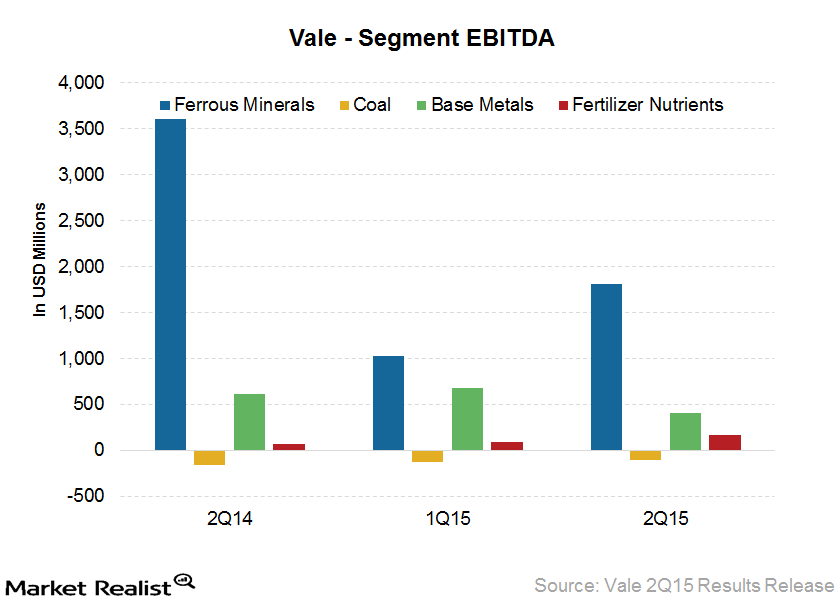

In this article, we’ll look at Vale’s (VALE) 2Q15 results and why they’re a beat on market expectations. Vale reported adjusted EPS of $0.19, which was 55% above consensus.

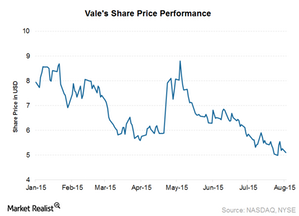

Vale Reports a Beat in 2Q15 Results, but Stock Falls

Vale S.A. (VALE) reported its 2Q15 results on July 30, 2015. Overall results were a beat on market expectations. However, Vale’s stock price fell 6.5% after Vale announced its results.

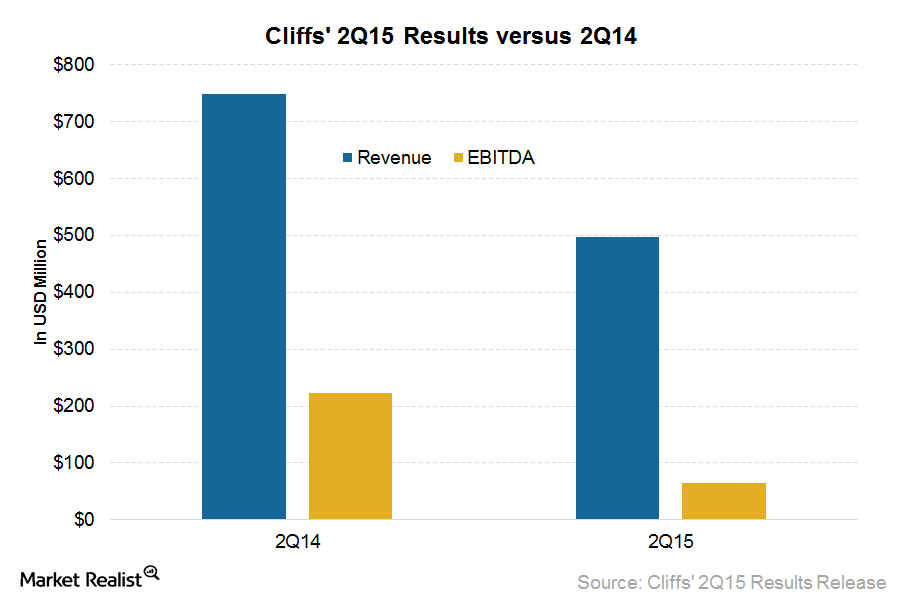

Key Highlights of Cliffs Natural Resources’ 2Q15 Earnings

Cliffs Natural Resources reported revenues of $498 million for 2Q15, a decline of 33% year-over-year.

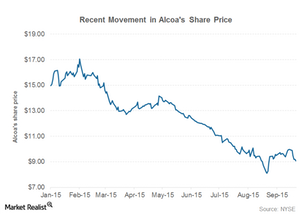

Alcoa at a 52-Week Low: What Should Investors Do?

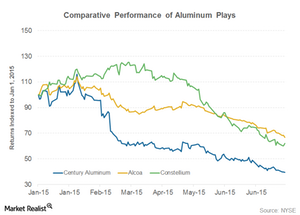

Alcoa was trading at its 52-week low on July 23 and closed at $9.96—breaching the psychologically crucial level of $10 per share for two consecutive days.

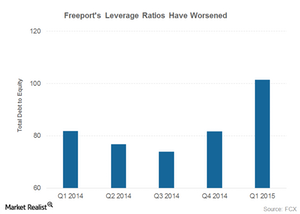

Freeport-McMoRan: 2Q15 Earnings, Outlook Fail to Cheer Investors

Freeport-McMoRan (FCX) released its 2Q15 earnings on July 23. It reported a net loss of $1.85 billion, which was largely attributable to the $2 billion write-down of its oil and gas assets.

Alcoa Continues to Sag as Aluminum Prices Fall Further

Aluminum prices have been in a downtrend for more than a month.

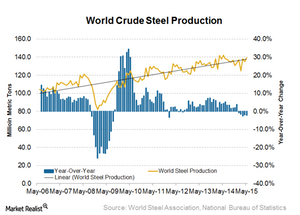

World Steel Production Falls for Five Straight Months

According to data released on June 22 by the WSA, world crude steel production totaled 139 million tons in May. This is a 2.1% decline year-over-year.

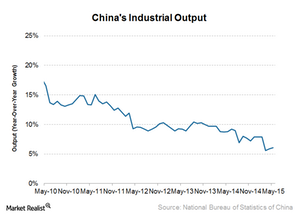

China’s Investment Data Down, Industrial Production Up in May

China’s industrial production grew by 6.1% year-over-year in May. Economists were expecting an increase of 6.0%. May’s growth is higher than the 5.9% year-over-year growth in April.

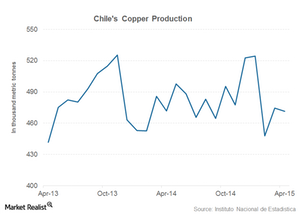

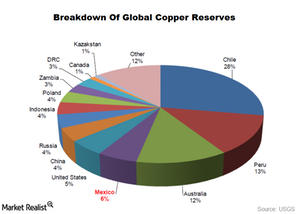

Copper Production in Peru, Chile Falls in First 3 Months of 2015

According to the World Bureau of Metal Statistics, Peru’s refined copper production declined in the first three months of the current year.

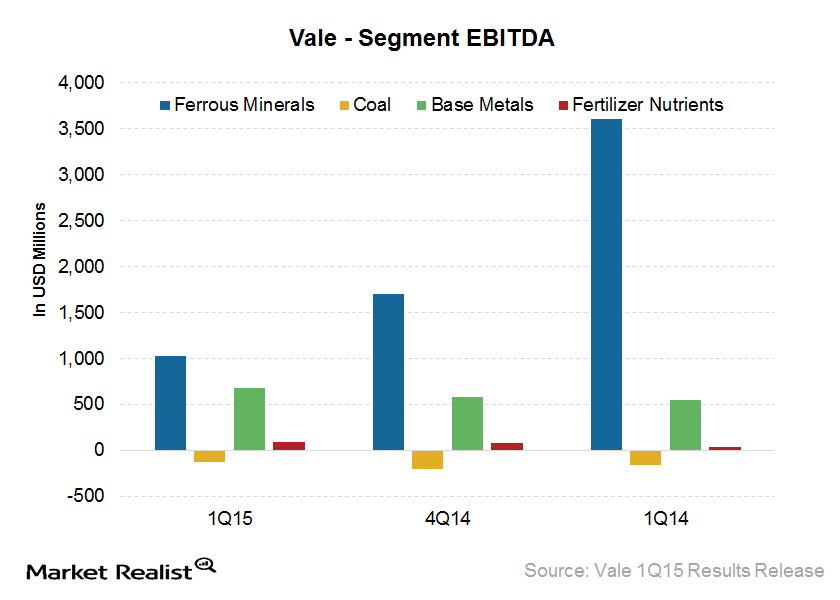

Vale’s 1Q15 Earnings Take a Hit

Vale S.A. (VALE) reported revenues of $6.4 billion in 1Q15, a decline of $2.9 billion compared to 4Q14. Most of the decline is due to seasonally lower sales volumes and lower commodity prices.

Cash-Starved Freeport Looks at IPO of Energy Business

On April 23, Freeport said it might look at selling a minority stake in its energy business and come out with an IPO of its oil and gas subsidiary later in the year.

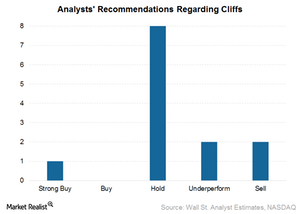

What’s the Current Market Sentiment for Cliffs Natural Resources?

As for market sentiment, Cliffs (CLF) seems to be on the receiving end. Most of it is due to the worsening current and future outlook for iron ore prices.

A Business Overview of Cliffs Natural Resources

Cliffs Natural Resources’ (CLF) key driver is global demand for the raw materials used to make steel.

Cliffs Natural Resources stock prices in a changing environment

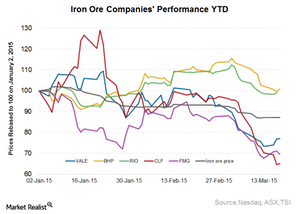

Cliffs’ (CLF) stock prices fell to a fresh 52-week low of $4.24 on March 19, mostly due to an iron ore supply glut coupled with slowing Chinese demand.

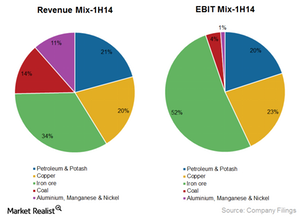

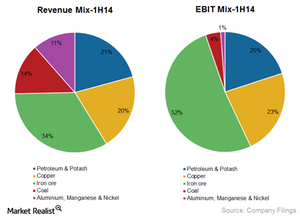

BHP Billiton: A critical business overview

BHP Billiton (BHP) is a leading global diversified resources company and is one of the world’s largest major commodity producers.

Why Vale’s Results Are a Miss on Expectations

Vale’s results were a miss on expectations with a reported adjusted EPS loss of $0.05 per share. This is below the consensus of $0.19 per share.

Vale SA – World’s Largest Iron Ore Company

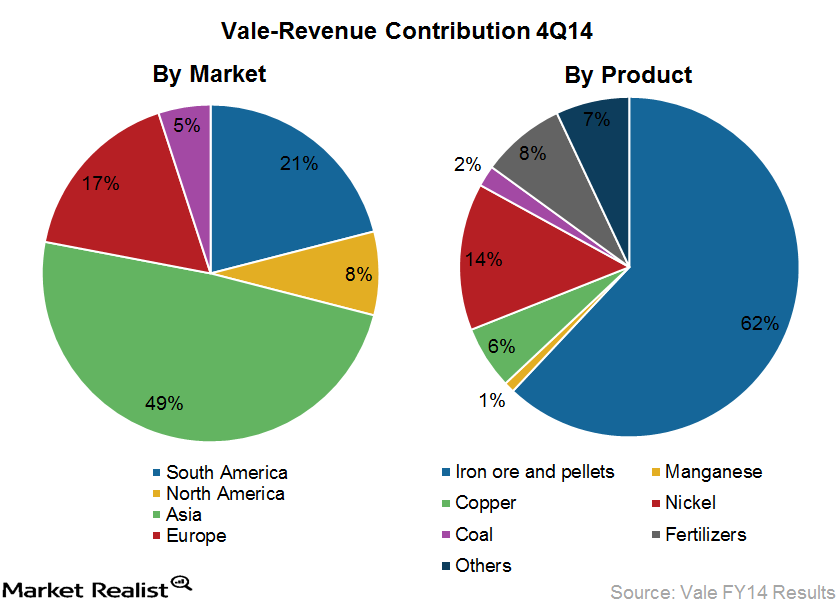

Vale is the world’s largest producer of iron ore and iron ore pellets. It’s the second largest nickel producer.

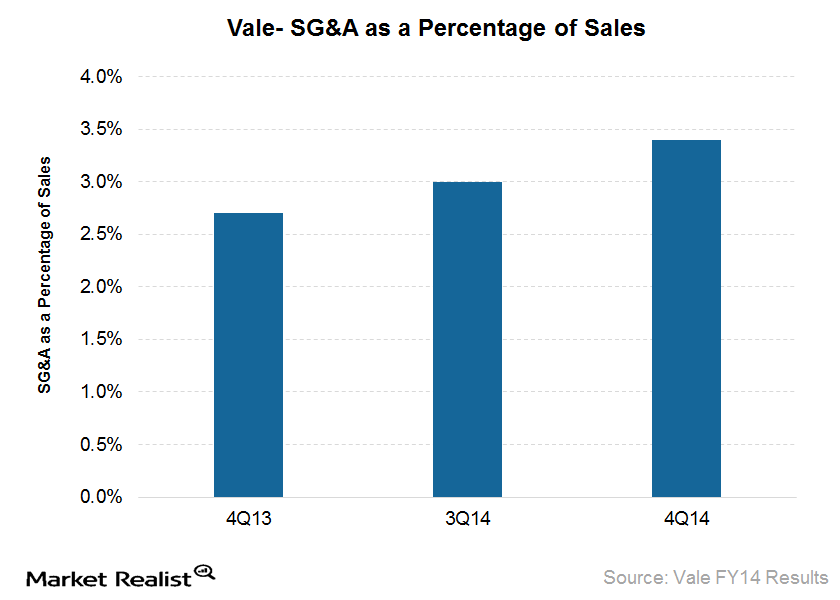

Key Earnings Takeaways from Vale’s FY14 Results

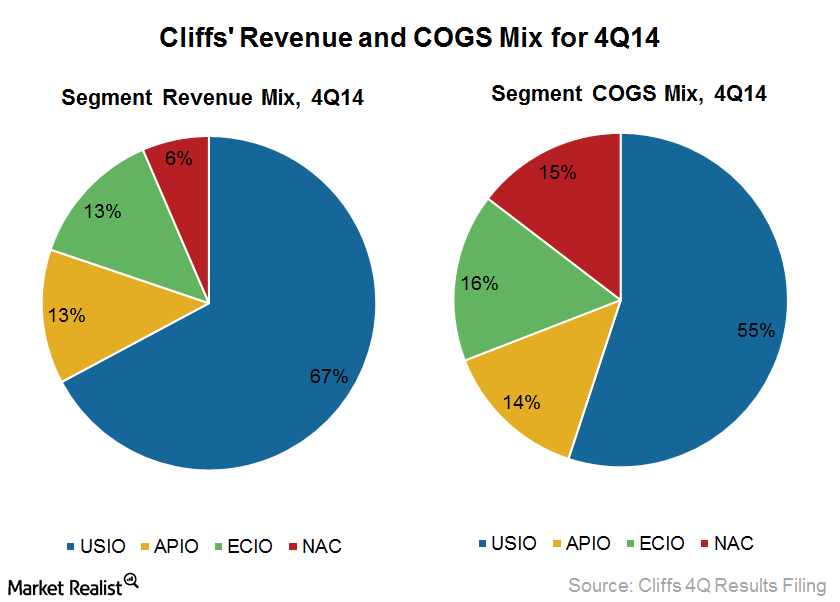

Key earnings takeaways from Vale’s results show cost of goods sold amounted to $25.1 billion in 2014, an increase of $819 million from 2013.

Key iron ore indicators to consider

It’s important to look at iron ore indicators collectively because they give clues about the direction of iron ore prices.

Why It’s Important To Understand Global Copper Reserves

Copper mining is concentrated in Latin America, while the major copper consumers are in Asia. More than 60% of global copper consumption comes from Asia.

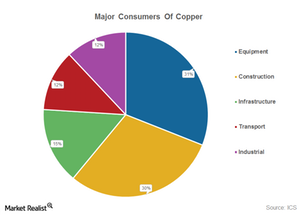

Must Know: Major Consumers Of Copper

Because of its excellent heat transfer capabilities, copper is also widely used in producing heat exchange equipment and other uses in extreme environments.

Operations overview for BHP Billiton

Headquartered in Melbourne, Australia, BHP Billiton operates 100 locations in 25 countries. A merger between BHP and Billiton created the company in June 2001.

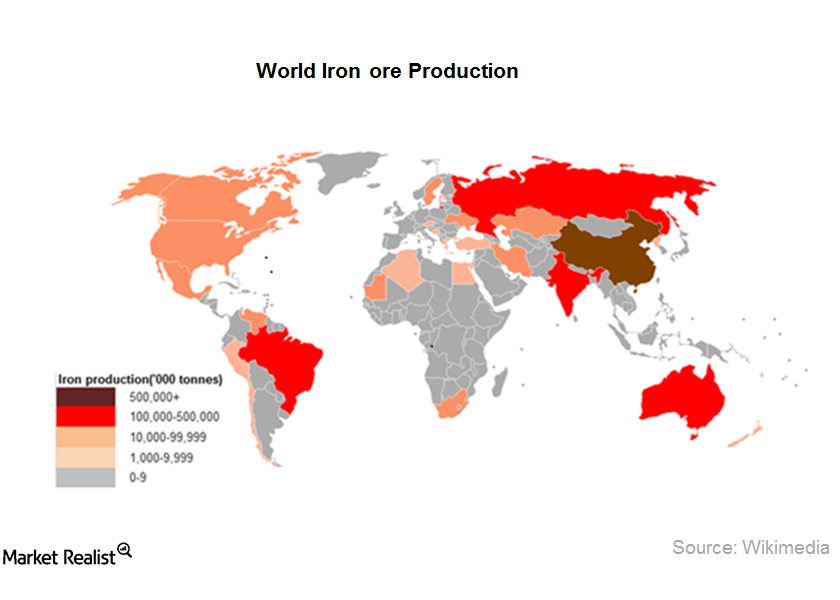

VALE, RIO, and BHP can swing the global iron ore prices

With over 65% exports going to China, China is the real swinger in global iron ore prices. A slowdown in China caused panic among all major commodity exporters.

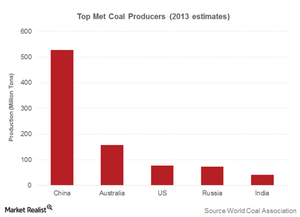

Who are the swing met coal producers in the global market?

In the seaborne met coal market, the swing producers are clearly the Australian producers. Australia is the second largest of the met coal producers. It’s the largest met coal exporter.Materials Must-know: The financial gains in iron ore companies

With the emergence of China’s demand, prices moved to quarterly contracts from annual private negotiations in 2010.Materials Must-know: The basics of the cost curve for miners

The cost curve also sets the floor for the price because if price falls below the cost of production of some players, those players will be out of the market.Materials Must-know: Why capital intensity makes a difference

Capital intensity is a measure used to determine the efficiency of production.

Why the quality spread on iron ore products is widening

Chinese environmental protection and pollution control measures will necessitate the use of higher content.Materials Overview: Mineral extraction from mining to metal

Surface mining is done when the deposits of commercially useful minerals are found near the surface.

Must-know: The basics of iron ore

Prior to the industrial revolution, most of the iron ore was mined directly from hematite deposits.